39 Cancellation Of Debt Worksheet

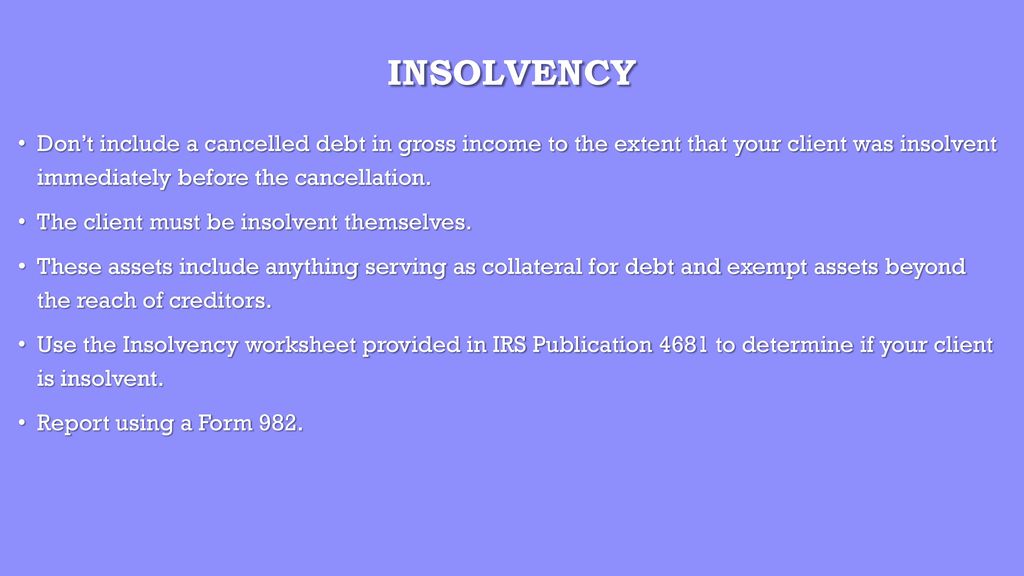

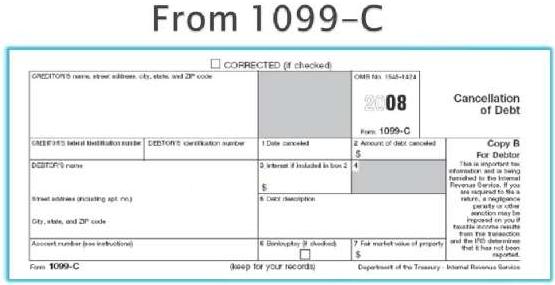

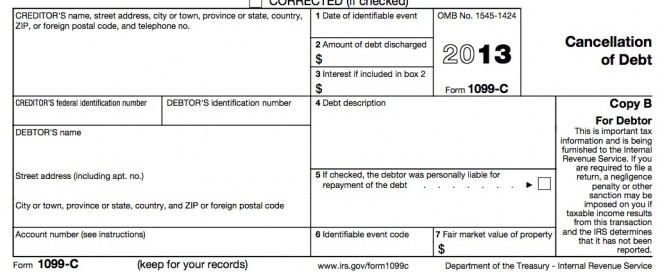

2020 Cancellation of Debt Insolvency - Tax Happens cancellation of debt, in addition to any gain or loss from the sale. Cancelled debt is intended as gift.Amount cancelled is not income.* * Gift tax may apply. Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing Cancellation of Debt - Mike Parisi Tax Consultants You can only exclude cancellation of debt income to the extent that you are considered insolvent. By applying this method you will not be taxed on the cancelled debt. Please fill out the Insolvency Worksheet provided below. Insolvency Worksheet Bankruptcy If your debt was cancelled in conjunction with Title 11 bankruptcy proceeding Chapter 7 or ...

Insolvency Worksheet - Fillable - GetNetSet.com Insolvency Worksheet Liabilities (Debts) Amount Owed on the Day Before the Cancellation 1 Credit Card Debt 2 Mortgages(s) on real property (including first & second mortgages and home equity loans) mortgages(s) can be on personal residence, additional residence, or property held for investment or used in a trade or business 3 Car and Other Vehicle Loans 4 Medical Bills 5 …

Cancellation of debt worksheet

Activity #4—Create A Debt Payoff Plan - Summit Credit Union Activity #4—Create A Debt Payoff Plan Now that you have tracked your expenses, started to create a budget and reallocated some of your money to meet your priorities, you’ll want to focus on paying off your debt systematically with our Debt Payoff Plan Worksheet. Although you may have already created debt pay-off goals in Activity #1, you may end up changing your goals as … Insolvency Worksheet Canceled Debts - Fill and Sign ... Ensure the data you add to the Insolvency Worksheet Canceled Debts is up-to-date and correct. Include the date to the document using the Date tool. Select the Sign tool and make an electronic signature. Feel free to use three available alternatives; typing, drawing, or capturing one. Make sure that each field has been filled in correctly. Insolvency Determination Worksheet Insolvency (Out of ... Cancellation of Debt (COD) 1-21 Cancellation of Debt – Nonbusiness Credit Card Debt Cancellation Generally, if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent immediately before the debt was canceled, all the canceled debt will be included on Form 1040, line 21, Other Income. No additional supporting forms or schedules are needed to …

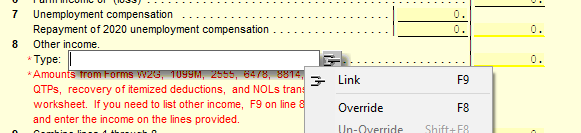

Cancellation of debt worksheet. Publication 4681 (2021), Canceled Debts, Foreclosures ... By completing the Insolvency Worksheet, James determines that, immediately before the cancellation of the debt, he was insolvent to the extent of $5,000 ($15,000 total liabilities minus $10,000 FMV of his total assets). He can exclude $5,000 of his $7,500 canceled debt. Robin completes a separate Insolvency Worksheet and determines she was insolvent to the extent … Entering canceled debt in ProSeries - Intuit Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental PDF Cancellation of Debt - Tax Season Resources 1. Consumer Credit Card Debt Cancellation of non-business credit card debt may be non-taxable if at the time of the cancellation the taxpayer was insolvent or had filed bankruptcy. The screening sheet for cancellation of credit card debt is found of page D-58 of Publication 4012. To determine insolvency, use the worksheet on page D-59 of PDF Abandonments and Repossessions, Canceled Debts, Nonbusiness credit card debt cancellation. If you had a nonbusiness credit card debt can-celed, you may be able to exclude the canceled debt from income if the cancellation occurred in a title 11 bankruptcy case or you were insolvent immediately before the cancellation. You should read Bankruptcy or Insolvency under

Topic No. 431 Canceled Debt – Is It Taxable or Not ... In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must pay, the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs. The canceled debt isn't taxable, however, if the law specifically allows you to exclude it from … Which cancellation of debt exclusion requires Form 982 ... Cancellation of debt (COD) is the forgiveness of debt obligations by a creditor. Debt relief can be achieved through direct negotiations,debt relief programs,or bankruptcy. Canceled debt must be reported as taxable income and filed through Form 1099-C. If the canceled amount is$600 or more,then an individual is required to file with the IRS. Cancellation of Debt - Taxpayer Advocate Service 21.12.2021 · Assess the debt. Review any IRS Form 1099-C, Cancellation of Debt, you received for the year.If you believe the information on the form is wrong, contact the lender to correct it. If the payer (lender) won’t correct the IRS Form 1099-C document, report the amount on your tax return but include an explanation as to why the payer’s information is incorrect. PDF 2018 Cancellation of Debt Insol vency cancellation of debt, in addition to any gain or loss from the sale. Cancelled debt is intended as gift. Amount cancelled is not income.* * Gift tax may apply. Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing

Guide to Debt Cancellation and Your Taxes - TurboTax Tax ... A number of exceptions and exemptions can eliminate your obligations to pay tax on the canceled debt. If you receive a Form 1099-C this year, it's because one of your creditors canceled a debt you owe, meaning the company writes it off and you no longer have to pay it back. In some cases, you may need to include the amount of debt your 1099-C ... How do I enter cancellation of debt in a 1040 return using ... Knowledge Base Solution - How do I enter cancellation of debt in a 1040 return using worksheet view? There is not a specific IRS 1099-C input form to fill in. Instead, depending how the cancellation of debt is to be treated, there are a few methods to get this to flow correctly to your return. Cancellation of Debt Insolvency Worksheet - RH Tax Services Cancellation of Debt ... Worksheet by: William Roos, EA, roos@bigsky.net Revised 11-27-12 NOTE: Do not use a spouse's separately owned assets in computing the taxpayer's insolvency. If any assets or liabilities are separately owned, use a separate worksheet for each spouse. Insolvency Worksheet - SOLVABLE An insolvency worksheet is a useful tool and an integral part of a debt cancellation process. Not only can it help you lower your overall debt, but it is also an important document in your communication with the IRS.

Qualified Principal Residence Indebtedness Exclusion ... 20.12.2019 · If the debt is cancelled as part of a bankruptcy filing, the bankruptcy exclusion applies to exclude the forgiven debt from income, instead of the QPRI exclusion. The taxpayer can opt to exclude the cancelled debt from income under the insolvency exclusion, but only if the taxpayer was insolvent immediately before and after the cancellation of debt. The extension …

Form 1099-C - Cancellation of Debt: What it Means and What ... 08.04.2020 · Student loan cancellation of debt often comes with tax consequences and a Form 1099-C. When you receive word that your student loans have been forgiven — all or in part — it can be a huge relief. However, in many cases, you might still owe taxes on the amount forgiven. Let’s look at some key facts about Form 1099-C and the cancellation of your student loan …

1099-C frequently asked questions - CreditCards.com 25.02.2021 · Q: I was struggling financially when the debt was forgiven. Does that mean I was insolvent? The IRS requires you to total up the fair market value of everything you owned at the time and compare it to the total amount of money that you owed. (You can use the insolvency worksheet in IRS Publication 4681, but it may be best to work with a tax ...

Cancellation Of Debt: What To Know About Taxes When You ... If you were insolvent just before your debt was canceled, you can exclude the debt from income. Use the insolvency worksheet (found in Pub 4681, Canceled Debts, Foreclosures, Repossessions, and...

PDF Cancellation of debt - Iowa State University 5/26/2016 4 Foreclosure Worksheet #1 Figuring Cancellation of Debt Income The amount on line 3 will generally equal the amount shown in box 2 of Form 1099‐C.

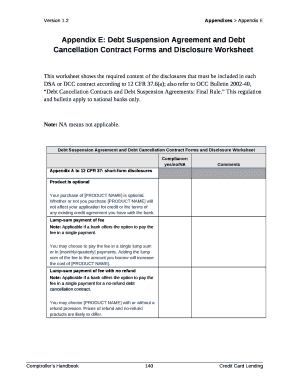

Cancellation of Debt Insolvency Worksheet - Thomson Reuters Cancellation of Debt Insolvency Worksheet This tax worksheet calculates a taxpayer's insolvency for purposes of excluding cancellation of debt income under IRC Sec. 108. A debt includes any indebtedness whether a taxpayer is personally liable or liable only to the extent of the property securing the debt.

Cancellation of Debt - Qualified Real Property Business ... Cancellation of Debt - Qualified Real Property Business Debt Worksheet This tax worksheet determines if a taxpayer is qualified to exclude income from the discharge of qualified real property business debt and to calculate the amount of excludable income. For further assistance:

Cancellation of Debt Insolvency Worksheet - Asheville Tax Insolvency Worksheet Keep for Your Records Date debt was canceled (mm/dd/yy) Part I. Total liabilities immediately before the cancellation (do not include the same liability in more than one category) Amount Owed Liabilities (debts) Immediately Before the Cancellation 1. Credit card debt $ 2.

Forms to Download - Florida Atlantic University Direct Loan Comparison Worksheet; Request For Private Loan In Place of FAFSA Aid; Parent Notification Of PLUS Abandonment; PLUS Loan No Borrower Match; Loan Cancellation Form; 2021-22 Other Financial Aid Forms. Federal Title IV Authorization (form located online via FAU Self-Service) Short Term Advance Application (SPRING 2022)

39 cancellation of debt worksheet - Worksheet For You Cancellation of debt worksheet. Cancellation of Debt - Insolvency It includes a worksheet for a taxpayer to determine if he or she is insolvent and it explains the tax implications of cancelled debt. HIGHLIGHTS: Tax treatment of cancelled debt. Form 1099-C, Cancellation of Debt. Taxpayer insolvency and insolvency worksheet.

How do I enter a cancellation of debt in a 1040 ... - CCH If the cancellation of debt should be reported as a Gain, enter information the appropriate D-Series Interview form (D-1/D-1A for capital transactions or D-2 for 4797 gains/losses). Click here if you need to fill out the Form 982 - Reduction of Tax Attributes Due to Discharge of Indebtedness.

Cancellation of Debt: What does it mean and how does ... Second, the debt that was canceled may be excludable from taxable income to the extent that you are considered "insolvent" immediately prior to the cancellation of the debt. The Internal Revenue Service has provided an Insolvency Worksheet to assist taxpayers in determining whether they are considered insolvent.

1099-C Cancellation of Debt | H&R Block 1099-C cancellation of debt. May 12, 2021 : H&R Block. Debts, in some cases, debt can be forgiven. If your credit card debt, car loans, student loans, or mortgage is forgiven (or you go into foreclosure), you might get an unexpected tax form - the 1099-C. In this post, we'll walk through the definition of a 1099-C, what to do when you get ...

Cancellation of Debt - Insolvency — 1 Tax Financial Cancellation of Debt - Insolvency It includes a worksheet for a taxpayer to determine if he or she is insolvent and it explains the tax implications of cancelled debt. HIGHLIGHTS: Tax treatment of cancelled debt. Form 1099-C, Cancellation of Debt. Taxpayer insolvency and insolvency worksheet. Reduction of tax attributes due to discharge of debt.

The Best Free Debt-Reduction Spreadsheets Squawkfox Debt-Reduction Spreadsheet . The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet.. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest paid.

How To Avoid Income Taxes on Canceled Credit Card Debt ... The creditor may then send you to form 1099-C, Cancellation of Debt. Cases Where a 1099-C Does Not Apply. Note that this only applies to the canceled debt. If there is an ongoing attempt to collect the debt, such as selling the debt to a third-party collection agency, the debt is not canceled.

Insolvency Determination Worksheet Insolvency (Out of ... Cancellation of Debt (COD) 1-21 Cancellation of Debt – Nonbusiness Credit Card Debt Cancellation Generally, if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent immediately before the debt was canceled, all the canceled debt will be included on Form 1040, line 21, Other Income. No additional supporting forms or schedules are needed to …

Insolvency Worksheet Canceled Debts - Fill and Sign ... Ensure the data you add to the Insolvency Worksheet Canceled Debts is up-to-date and correct. Include the date to the document using the Date tool. Select the Sign tool and make an electronic signature. Feel free to use three available alternatives; typing, drawing, or capturing one. Make sure that each field has been filled in correctly.

Activity #4—Create A Debt Payoff Plan - Summit Credit Union Activity #4—Create A Debt Payoff Plan Now that you have tracked your expenses, started to create a budget and reallocated some of your money to meet your priorities, you’ll want to focus on paying off your debt systematically with our Debt Payoff Plan Worksheet. Although you may have already created debt pay-off goals in Activity #1, you may end up changing your goals as …

0 Response to "39 Cancellation Of Debt Worksheet"

Post a Comment