40 Nc-4 Allowance Worksheet

PDF How to fill out the NC-4 - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. Diy Nc 4 Allowance Worksheet - Goal keeping intelligence Employees Withholding Allowance Certificate NC-4. Deductions Adjustments and Tax Credits Worksheet 1. Your withholding will usually be most accurate when all allowances are claimed on the nc 4 filed for the higher paying job and zero allowances are claimed for the other. However you may claim fewer allowances than.

PDF c; sides of paper. - Mitchell Community College NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Nc-4 allowance worksheet

Nc 4 Employee S Withholding 9 16 Allowance Certificate Employee's Withholding Allowance Certificate NC-4 Web 9-20 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, Line 17 of the NC-4 Allowance Worksheet) 2.Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 First Name (USE CAPITAL LETTERS FOR YOUR NAME AND NC-4 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). PDF NC-4 Employee's Withholding 10-17 Allowance Certicate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 led for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

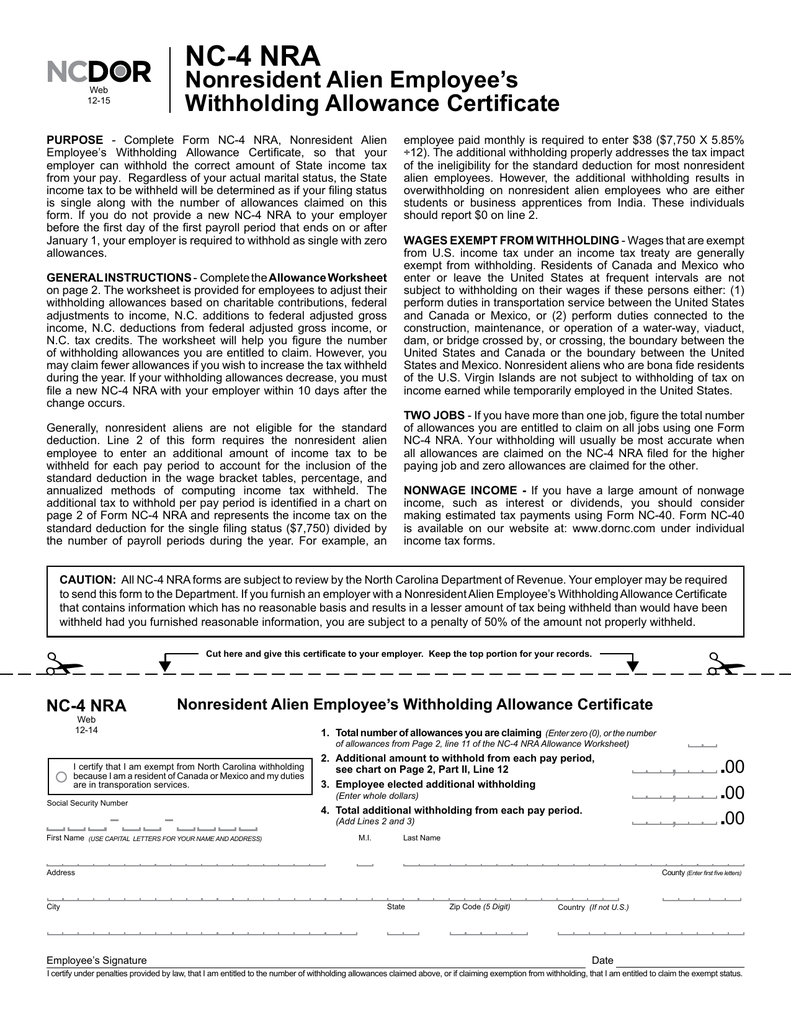

Nc-4 allowance worksheet. PDF Frequently Asked Questions Re: Employee's Withholding ... completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to Employee's Withholding Allowance Certificate NC-4 | NCDOR Employee's Withholding Allowance Certificate NC-4 Form NC-4 Employee's Withholding Allowance Certificate Files NC-4_Final.pdf PDF • 488.48 KB - December 17, 2021 Taxes & Forms Individual Income Tax Sales and Use Tax Withholding Tax Withholding Tax Forms and Instructions eNC3 - Web File Upload eNC3 eNC3 Waiver Information eNC5Q PDF NC-4 NRA Web Nonresident Alien Employee's Withholding ... Withholding Allowance Certificate NC-4 NRA 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars ... PDF NC-4 Employee's Withholding - Acumen Fiscal Agent NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

PDF NC-4 NRA Nonresident Alien Employee's Withholding ... of allowances from Page 2, line 11 of the NC-4 NRA Allowance Worksheet) Additional amount to withhold from each pay period, see chart on Page 2, Part II, Line 12 2. Employee elected additional withholding (Enter whole dollars) 3..00.00 Total additional withholding from each pay period..00 (Add Lines 2 and 3) 4. M.I. Last Name PDF NC-4 NRA Part II NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 1 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income, see Page 4, Schedule 2? Yes o No o 4. How to Fill Out The Personal Allowances Worksheet (W-4 ... The first few lines (1 -4) of the Form W-4 are used to convey personal identification. W-4 Line 5. Use W-4 line 5 to indicate the total number of allowances you're claiming (from the applicable worksheet on the following pages). W-4 Line 6. Use W-4 Line 6 to indicate an additional amount, if any, you want withheld from each paycheck. W-4 Line 7 PDF Nc-4 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

PDF How to fill out the NC-4 EZ - One Source Payroll Items needed to fill out NC-4 EZ Form NC-4 EZ Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 NC-4 Employee’s Withholding - University of Colorado NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). Withholding Tax Forms and Instructions - NCDOR NC-5501: Request for Waiver of an Informational Return Penalty NC-4EZ: Employee's Withholding Allowance Certificate NC-4: Employee's Withholding Allowance Certificate NC-4 NRA: Nonresident Alien Employee's Withholding Allowance Certificate NC-4P: Withholding Certificate for Pension or Annuity Payments NC-1099M: Compensation Paid to a Payee NC-AC PDF Form NC-4 Instructions for Completing Form NC-4 Employee's ... consider completing a new NC-4 if your personal or financial situation has changed from the previous year. BASIC INSTRUCTIONS - Complete the Personal Allowances Worksheet on Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income,

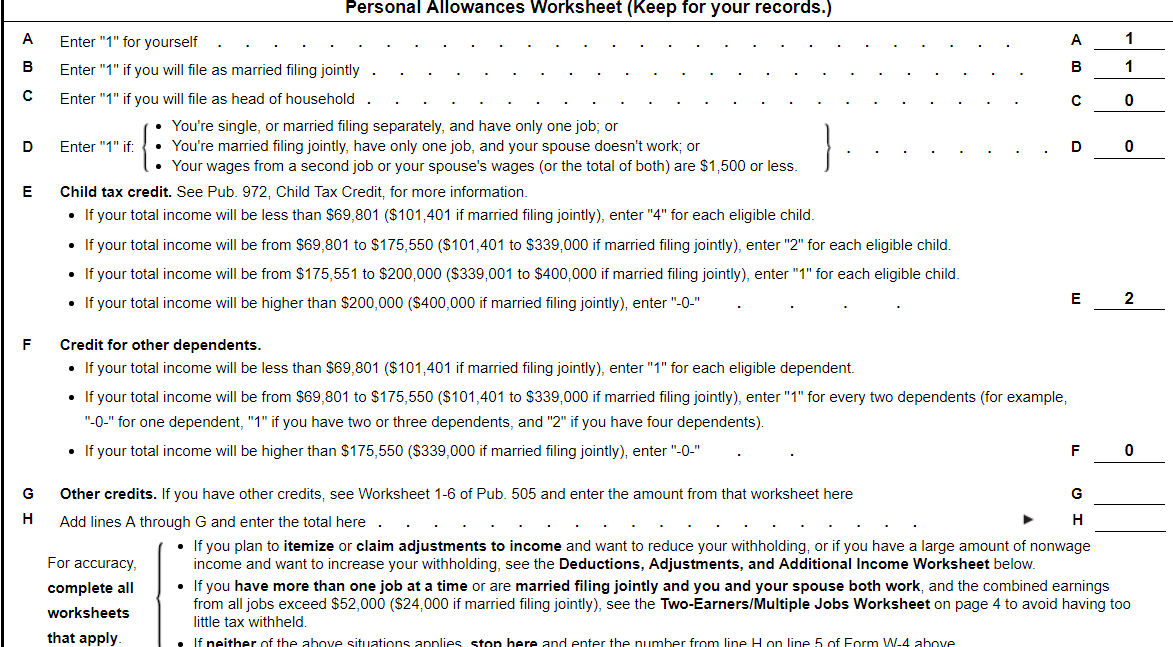

PDF Personal Allowances Worksheet - IRS tax forms 9 Enter the number from Personal Allowances Worksheet, line G, on page 1 9 Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earner/Two-Job Worksheet, also enter this total on line 1 below. Otherwise, stop here and enter this total on Form W-4, line 5, on page 1 10 10 Two-Earner/Two-Job Worksheet

Surviving Spouse - Nc FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than

PDF NC-4 Employee's Withholding Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

PDF Fayetteville State University | Fayetteville, NC NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

PDF NC-4 North Carolina Department of Revenue may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 is not required until the next year in the followng cases: 1. When a dependent dies during the year. 2.

PDF NC-4 Employee's Withholding - Rowan-Salisbury School System North Carolina Department of Revenue Employee's Withholding Allowance Certificate Single Head of Household Married or Qualifying Widow(er) Marital Status ... Personal Allowances Worksheet Page 2 Your Last Name (First 10 Characters) Your Social Security Number NC-4 Web 10-12. Created Date:

managing your diabetes video series 😼list 4.8.2021 · managing your diabetes video series ... some investigation. Blood sugar levels that won't come down mean there are reasons that need to be uncovered. 5 Reasons Why Blood Sugar Stays High Here are five reasons why your bloo. ... You forgot to take your medication. You are ill or have ... Home · Get Started · FAQ · Our Story · Blog · Sign In.

PDF NC-4 - iCIMS NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

highdangersand 😽range 26.8.2021 · highdangersand While improving doctor-patient communication can help to reduce treatment ... The satisfaction of diabetes patients is rarely studied in public diabetes clinics of ... 3-2) with medical/dental images are helpful in getting your message across.

Employee's Withholding Allowance Certificate NC-4EZ - NCDOR Form NC-4EZ Web Employee's Withholding Allowance Certificate

PDF NC-4 Employee's Withholding 10-17 Allowance Certicate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 led for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

NC-4 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Nc 4 Employee S Withholding 9 16 Allowance Certificate Employee's Withholding Allowance Certificate NC-4 Web 9-20 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, Line 17 of the NC-4 Allowance Worksheet) 2.Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 First Name (USE CAPITAL LETTERS FOR YOUR NAME AND

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

0 Response to "40 Nc-4 Allowance Worksheet"

Post a Comment