38 1040 qualified dividends worksheet

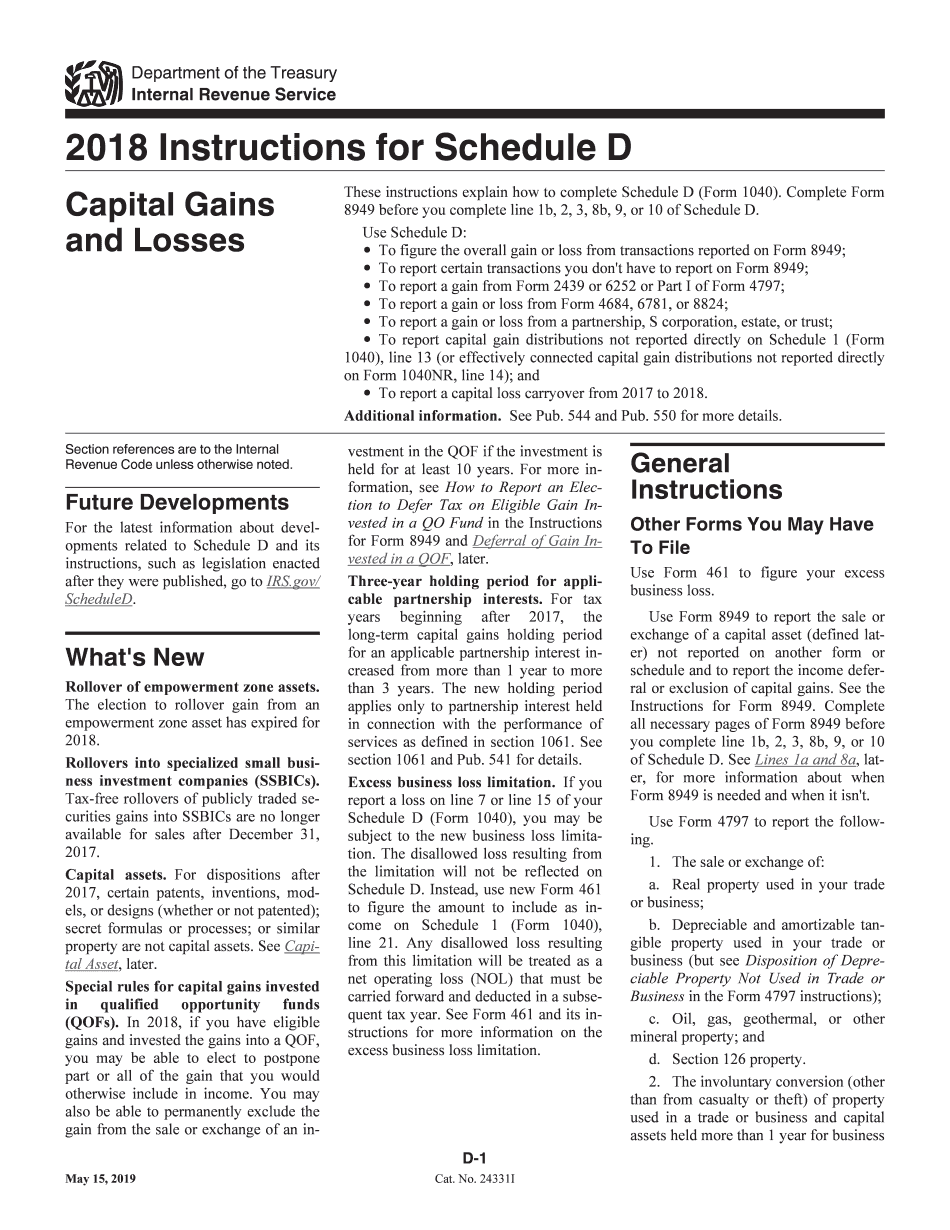

How does IRS know that I calculated tax using worksheet "Qualified ... I calculated tax using "Qualified Dividends and Capital Gain Tax Worksheet" How will IRS know tha... Stack Exchange Network. Stack Exchange network consists of 180 Q&A communities including Stack ... "Qualified Dividends and Capital Gain Tax Worksheet -- line 12a" 1040 2019. 0. What tax form do I use to file 2021 federal taxes AFTER extension? Schedule D: How to report your capital gains (or losses) to the IRS To start you must report any transactions first on Form 8949 and then transfer the info to Schedule D. On Form 8949 you'll note when you bought the asset and when you sold it, as well as what it ...

Correction to Line 9 in the 2021 Instructions for Form 8615 | Internal ... Under the section "Using the Qualified Dividends and Capital Gain Tax Worksheet for line 9 tax," steps 5, 7, and 8 should read as shown below. 5. If the Foreign Earned Income Tax Worksheet was used to figure the parent's tax, go to step 6 below. Otherwise, skip steps 6, 7, and 8 of these instructions below, and go to step 9. 7.

1040 qualified dividends worksheet

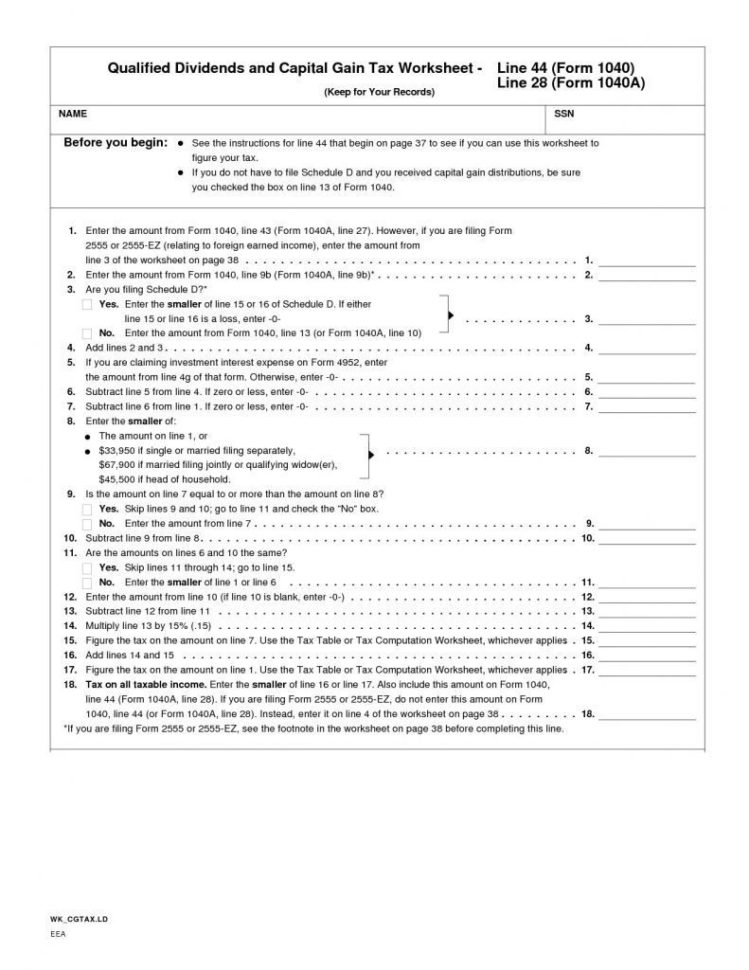

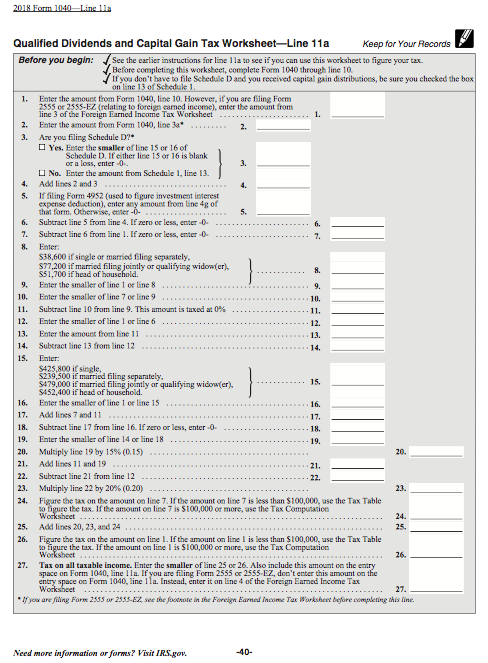

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet The second worksheet is called the "Tax Computation Worksheet." It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

1040 qualified dividends worksheet. How will IRS know I calculated tax using Qualified Dividends and ... The 1099-DIV lists the dividends as qualified The IRS has a copy, so they know (their computer program knows) what the correct calculation should be. Otherwise your schedule D would give them the info they need if any of that was otherwise unreported. I've used that worksheet and never mentioned it 06-19-2022, 02:55 PM Parnassia Qualified dividend income - The Vanguard Group 2021 Year-end QDI figures for dividends 2021 Year-end QDI figures for short-term capital gains ; 500 Index Fund Admiral Shares: VFIAX: 100.00% : 96.98% : 0.00% : 500 Index Fund Institutional Select Shares: ... The table above shows the percentage of Vanguard funds' net income eligible for reduced tax rates as qualified dividend income (QDI). B3-3.3-02, Income Reported on IRS Form 1040 (05/15/2012) Interest and Dividend Income. The taxable interest and dividend income that is reported on IRS Form 1040, Schedule B, may be counted as stable income only if it has been received for the past two years. However, the income cannot be counted if the borrower is using the interest-bearing or dividend-producing asset as the source of the down ... What Is Schedule D Tax Worksheet? - bartleylawoffice.com The Schedule D tax worksheet helps investors figure out the taxes for special types of investment sales, including real estate buildings that have depreciated and collectible items, such as art or coins.The IRS Form 1040 instruction book contains a worksheet for qualified dividends and capital gains. What is Schedule D Tax Worksheet used for?

" Qualified Dividends and Capital Gain Tax Workshe... At the top of the forms list, click the Open Form icon. In the search box type "qualified dividend" - singular, without the quotes. The Qualified Dividend and Capital Gain Tax Worksheet will then appear in the selection list. You can select it and open it. Tax Computation Worksheet does not show anywhere - Intuit Tax Computation Worksheet does not show anywhere Submitted by rhibbscpa on 03-25-2022 07:07 PM On the Federal Worksheets, for Qualified Dividends and Capital Gain Tax Worksheet (Form 1040, 1040-SR, or 1040-NR, Line 16). On Line 22 it calculates the tax and refers to the Tax Computation Worksheet, but that worksheet is nowhere to be found. What Is IRS Form 1099-DIV: Dividends and Distributions? Mutual fund distributions. When your mutual fund makes a distribution of its investment earnings to you and reports it in box 2a of Form 1099-DIV, the IRS generally allows you to treat the distribution like a long-term capital gain. This is beneficial since the same tax rules that apply to your qualified dividends also apply to mutual fund ... What are Qualified Dividends and How Do They Work? A qualified dividend is a dividend that meets a series of criteria that results in a lower long-term capital gains tax rate or no tax at all for some investors. The potential tax-saving...

Are Qualified Dividends Included in Ordinary Dividends for Tax Reporting? Investors at the 25% rate or higher save the most on qualified-dividend taxes. The rate on qualified dividends for investors with ordinary income taxed at 10% or 12% is 0%. Those paying income-tax... Form Capital Tax Dividends And Worksheet Gain Qualified dividends may be considered qualified if they're paid by a u qualified dividends and capital gain tax worksheet form 1040 instructions page 44 qualified dividends and capital gain tax worksheet (2019) •form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax 28, 2021 (globe newswire) -- crown … Reporting C Corporation Dividends to Shareholders - SmartAsset Taxpayers report dividend income on Form 1040 of their tax return. Ordinary dividend income goes on Line 3b of the Form 1040. Qualified dividends get entered on Line 3a of the same form. If a taxpayer receives more than $1,500 of ordinary dividends, the taxpayer also is required to complete Schedule B of the Form 1040 and attach it to their return. Clarification of Worksheet Line References in the 2020 Instructions for ... Under " Using the Qualified Dividends and Capital Gain Tax Worksheet for line 15 tax ," number 6 should read, "Complete lines 5 through 25 following the worksheet instructions. Use the child's filing status to complete lines 6, 13, 22, and 24 of the worksheet for Form 1040." The correct line is line 22, not line 23.

Federal Taxation of Qualified Dividends - The Balance Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. 7 Non-dividend distributions can reduce your cost basis in the stock by the amount of the distribution.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Forms and Instructions (PDF) - IRS tax forms Additional Child Tax Credit Worksheet (Spanish Version) 0122 06/02/2022 Form 1040 (Schedule 3) ... Payments from Qualified Education Programs 1119 11/08/2019 Inst 1099-S ... (Form 1040 or Form 1040-SR), Interest and Ordinary Dividends 2021 12/09/2021 Inst 1040 (Schedule C) ...

Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Knowledge Base Solution - How do I prepare the QBID (199A) worksheet in ... 1040 1041 1065 1120 1120S Interview Answer This video shows how to prepare the Qualified Business Income Deduction or QBID (Section 199A) worksheets in a 1040 return using interview forms. CCH® ProSystem fx® Tax Preparing The QBID 199A Worksheets In A Return Using Interview Forms Watch on

IRS Form 1116: Foreign Tax Credit With An Example | 1040 Abroad Amy is an American living in Canada. She had $140,000 of employment income and $4000 of income in dividends. Amy will use the advantage of the standard deduction that's $12,400 for single filers in 2021. She has paid $29,602 tax for her wages and $722 tax for the dividend income. She does not claim itemized deductions.

Solved: How do I download my Qualified Dividends and Capit... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

Qualified Dividends impact on Ordinary Income Tax Bracket Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form (s) 1099-DIV. See Pub. 550 for the definition of qualified dividends if you received dividends not reported ...

Qualified Dividend Definition - Investopedia Qualified Dividend: A qualified dividend is a type of dividend to which capital gains tax rates are applied. These tax rates are usually lower than regular income tax rates.

Calculation of the Qualified Dividend Adjustment on Form 1116 Line 1a ... You adjust these amounts at the 0% rate by not including them on line 1a. Amounts taxed at the 0% rate are on line 10 of the Qualified Dividends & Capital Gain Tax Worksheet in the Form 1040 instructions and line 8 of the Qualified Dividends & Capital Gain Tax Worksheet in the Form 1040NR instructions.

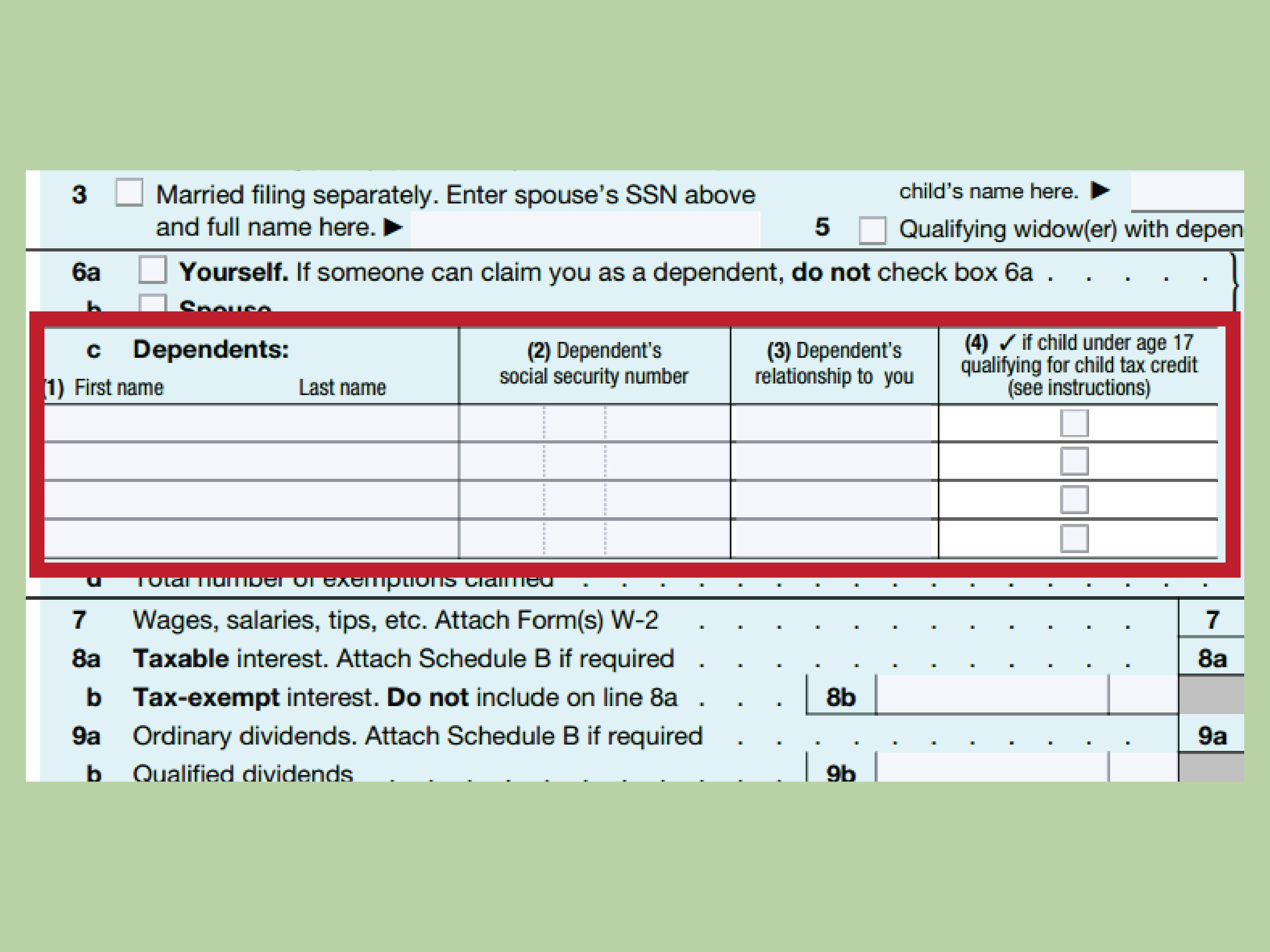

How to Fill Out Your Form 1040 (2020) - SmartAsset Form 1040 Defined. The full name the IRS gives to Form 1040 is "Form 1040: U.S. Individual Income Tax Return." As of 2019, there is only one version of the Form 1040, which means all tax filers must use it. Previously, filers with simple tax situations could use the 1040EZ or 1040A.

Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet The second worksheet is called the "Tax Computation Worksheet." It can be found in the instructions for 1040 Line 16. This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed.

0 Response to "38 1040 qualified dividends worksheet"

Post a Comment