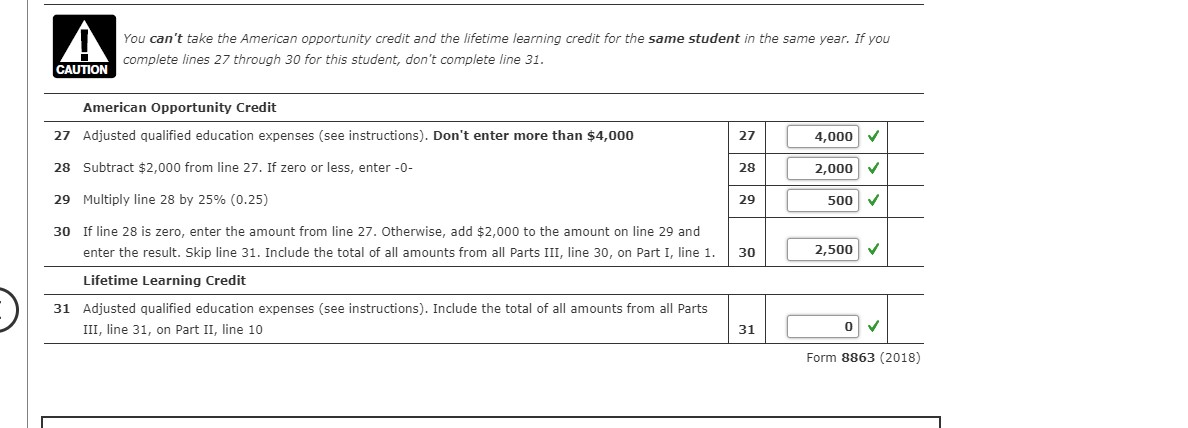

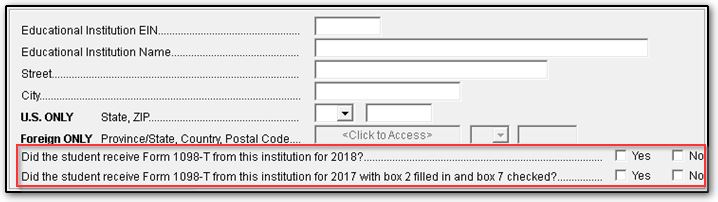

40 qualified education expenses worksheet

› publications › p526Publication 526 (2021), Charitable Contributions | Internal ... Qualified cash contributions for 2021 plus qualified contributions for relief efforts in a qualified disaster area, declared prior to February 26, 2021, subject to the limit based on 100% of AGI. Deduct the contributions that don't exceed 100% of your AGI minus all your other deductible contributions. › publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022

› publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Qualified education expenses worksheet

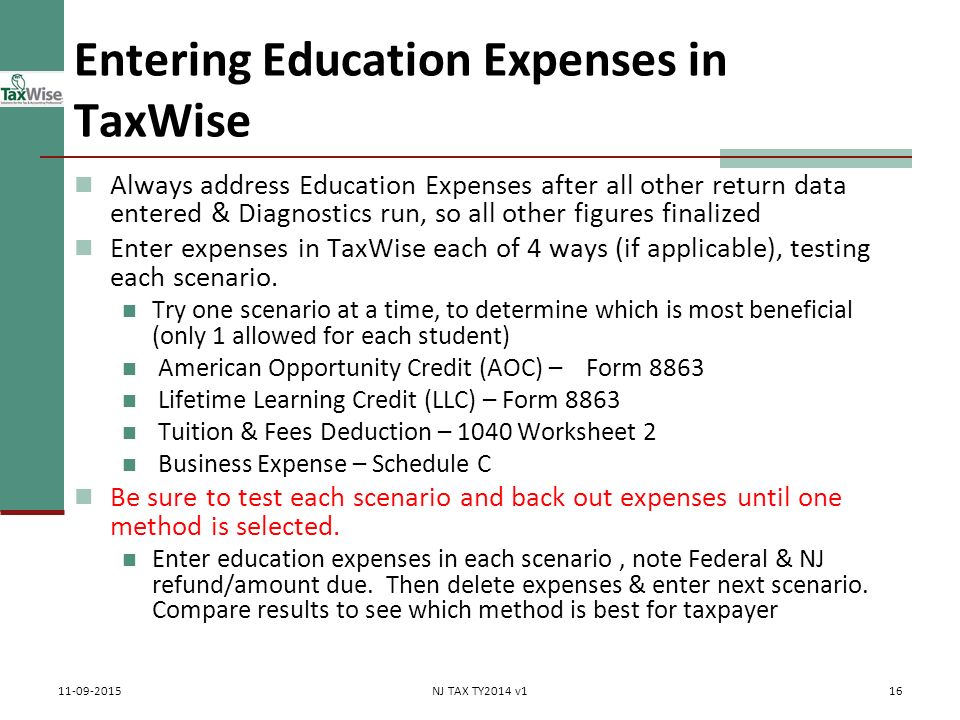

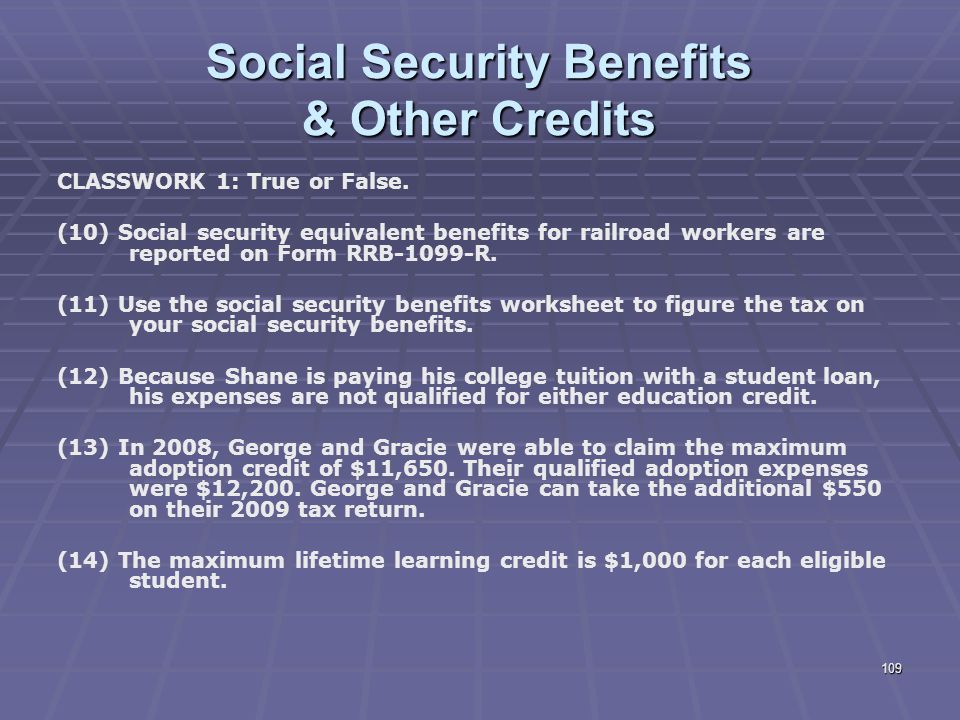

› publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2022 instead of reducing your expenses for 2021.. › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... • Student loan repayment from programs, such as the Department of Defense Educational Loan Repayment Program, to the extent that qualified higher education expenses exceed $5,250 annually • Certain payments made by an employer after March 27, 2020, and before January 1, 2026, of principal or interest on certain qualified education loans › pub › irs-pdfFuture Developments What's New - IRS tax forms expenses by check, the day you mail or deliver the check is generally the date of payment. If you use a “pay-by-phone” or “online” account to pay your medical expenses, the date reported on the statement of the finan-cial institution showing when payment was made is the date of payment. If you use a credit card, include medical

Qualified education expenses worksheet. › publications › p502Publication 502 (2021), Medical and Dental Expenses If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure your deduction. If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. › pub › irs-pdfFuture Developments What's New - IRS tax forms expenses by check, the day you mail or deliver the check is generally the date of payment. If you use a “pay-by-phone” or “online” account to pay your medical expenses, the date reported on the statement of the finan-cial institution showing when payment was made is the date of payment. If you use a credit card, include medical › publications › p3Publication 3 (2021), Armed Forces' Tax Guide | Internal ... • Student loan repayment from programs, such as the Department of Defense Educational Loan Repayment Program, to the extent that qualified higher education expenses exceed $5,250 annually • Certain payments made by an employer after March 27, 2020, and before January 1, 2026, of principal or interest on certain qualified education loans › publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2022 instead of reducing your expenses for 2021..

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "40 qualified education expenses worksheet"

Post a Comment