38 form 886 a worksheet

8.17.5 Special Computation Formats, Forms and Worksheets | Internal ... Form, Worksheet or Spreadsheet Technical Support Sharepoint Site RGS Web Site; Form 5403 Worksheet (fillable) X: ... 5403 generated by RGS will only show an entry for Reference Number 888, and no entry is required for Reference Number 886 on the Form 5403 Worksheet. 8.17.5.2.5 (09-24-2013) Forms and Instructions (PDF) - IRS tax forms Additional Child Tax Credit Worksheet 0321 03/22/2021 Form 15110 (sp) Additional Child Tax Credit Worksheet (Spanish Version) 0122 06/02/2022 Form 1040 (Schedule 3) ... Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 1040 (Schedule EIC) ...

Forms and Instructions (PDF) - IRS tax forms Earned Income Credit Worksheet (CP 27) (Spanish Version) 0722 08/18/2022 Form 15112: Earned Income Credit Worksheet (CP 27) 0722 08/17/2022 Form 13588 (sp) ... Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 ...

Form 886 a worksheet

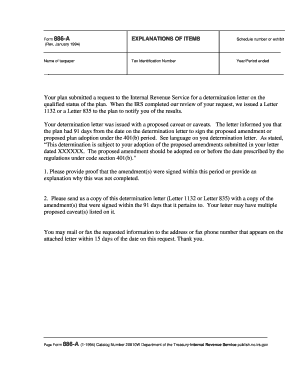

PDF Form 886-H-HOH - IRS tax forms Form . 886-H-HOH (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. › irm › part44.8.9 Statutory Notices of Deficiency | Internal Revenue Service Jul 04, 2015 · Form 3615-A, Gift Tax. This form is used to show the adjustments and how the deficiency was determined. Form 886-A, Explanation of Items. This form is used to explain each adjustment made. Certain standard language may be found in IRM Exhibit 4.10.10-2, Standard Paragraphs. Recd a Form 886-A worksheet re Qualified Loan limit and Ded. - JustAnswer Rec'd a Form 886-A worksheet pre Qualified Loan limit and Ded. Mort Interest - Answered by a verified Tax Professional. We use cookies to give you the best possible experience on our website. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Form 886 a worksheet. Form 886 A - Fill Out and Sign Printable PDF Template | signNow Follow the step-by-step instructions below to design your 886a form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. After that, your 886 an is ready. PDF P936 (PDF) - IRS tax forms P936 (PDF) - IRS tax forms Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank - pdfFiller Сomplete the form 886 a worksheet for free Use Form 886-H-FTHBC-LTR, First-Time Homebuyer Credit or Special Rule for Long-Time Resident Supporting Documents, when requesting documentation for ... Most often, Form 886A is used to request information from you during an audit or explain proposed adjustments in an audit. form 8863 worksheet Form 886 A Worksheet - Worksheet List nofisunthi.blogspot.com. form worksheet irs fill fillable forms pdf. Education Credit 4 : Form 8863 - Lifetime Learning Credit blog.daum.net. Form 592 Instructions - 2017 Printable Pdf Download . instructions form pdf. 31 Form 1023 Ez Eligibility Worksheet - Support Worksheet martindxmguide ...

› credits-deductions › individualsLetter or Audit for EITC | Internal Revenue Service Mar 28, 2022 · See the Form 886-H-EIC PDF for information on when you should use one or more of these templates to obtain statements on letterheads from one of the following. School; Healthcare provider; Childcare provider Using the Form 886-H-EIC Toolkit to help you identify what documents you need to provide to prove you can claim the EITC with a qualifying ... Forms 886 Can Assist You | Earned Income Tax Credit - IRS tax forms Forms 886 Can Assist You Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the due diligence knowledge requirement. Consider using the forms IRS uses to request documentation during audits. Tell your clients here's what you need to support your claim if you are audited by IRS. Form 886 A Worksheet - Fill and Sign Printable Template Online Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one. Make sure that each field has been filled in properly. form 886a: Fill out & sign online | DocHub Add a document. Click on New Document and choose the file importing option: upload form 886 a worksheet from your device, the cloud, or a protected link. Make changes to the template. Use the upper and left-side panel tools to change form 886 a worksheet.

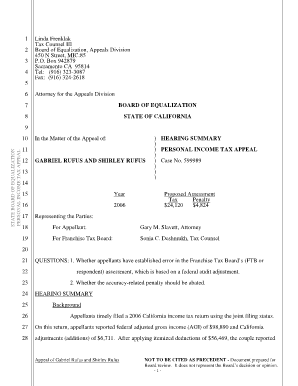

PDF 886-A EXPLANATIONS OF ITEMS - IRS tax forms Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended N/A Please check the appropriate boxes and answer the following questions: 1. Please specify the reason for filing the form 5310-A, see instructions for appropriate codes for line 1. › instructions › i1040sca2021 Instructions for Schedule A (2021) | Internal Revenue ... See the instructions for line 1 of the worksheet to figure your 2021 income. The family size column refers to the number of dependents listed on page 1 of Form 1040 or Form 1040-SR (and any continuation sheets) plus you and, if you are filing a joint return, your spouse. Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. More from H&R Block In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted. ️Form 886 A Worksheet Instructions Free Download| Qstion.co Form 886a may include the facts, tax law, your. You may qualify for head of household filing. The american opportunity credit, part of which may be refundable. Form 886 a worksheet instructions 12) 13) enter the total amount of interest paid. Click the sign tool and create an electronic signature.

Is there a downloadable/fillable version of Schedule C-7 (Form 886-A ... Seek local help if needed so you can understand what you need to do ( there is no such thing as a form Sch C-7). IRS Notices - Audit Form 886A. The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit.

Get Form 886 A Worksheet Fillable - US Legal Forms Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details.

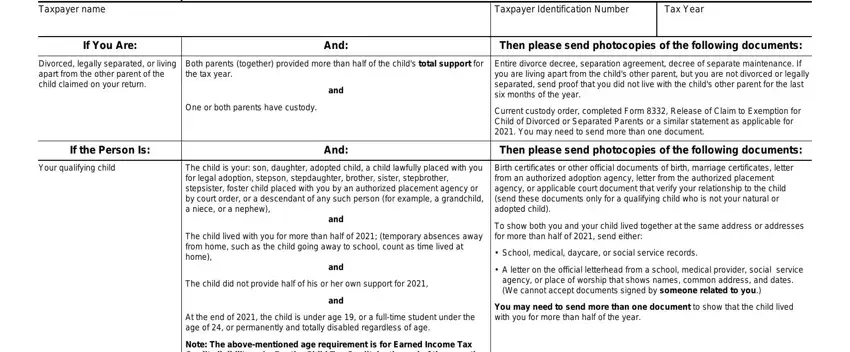

PDF Form 886-H-DEP Supporting Documents for Dependents - IRS tax forms Form 886-H-DEP (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents for Dependents Taxpayer name. Taxpayer Identification Number. Tax YearIf You Are: And: Then please send photocopies of the following documents: Divorced, legally separated, or living

Recd a Form 886-A worksheet re Qualified Loan limit and Ded. - JustAnswer Rec'd a Form 886-A worksheet pre Qualified Loan limit and Ded. Mort Interest - Answered by a verified Tax Professional. We use cookies to give you the best possible experience on our website. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

› irm › part44.8.9 Statutory Notices of Deficiency | Internal Revenue Service Jul 04, 2015 · Form 3615-A, Gift Tax. This form is used to show the adjustments and how the deficiency was determined. Form 886-A, Explanation of Items. This form is used to explain each adjustment made. Certain standard language may be found in IRM Exhibit 4.10.10-2, Standard Paragraphs.

PDF Form 886-H-HOH - IRS tax forms Form . 886-H-HOH (October 2019) Department of the Treasury-Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test.

0 Response to "38 form 886 a worksheet"

Post a Comment