42 income tax deduction worksheet

Salary Paycheck Calculator · Payroll Calculator · PaycheckCity Hint: Check which jurisdictions, if any, from which your deduction is exempt. You can use this method for calculating pre-tax deductions. For instance, cafeteria plans (section 125) and 401k deductions are exempt from certain taxes. Check with the administrator of the tax jurisdiction for further information › forms-pubs › about-form-1099-miscAbout Form 1099-MISC, Miscellaneous Income - IRS tax forms Sep 28, 2022 · At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. At least $600 in: Rents. Prizes and awards. Other income payments. Medical and health care payments. Crop insurance proceeds. Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

Retirement Income Exclusion | Georgia Department of Revenue See Form IT-511 for the Retirement Income Exclusion Worksheet to calculate the maximum allowable adjustment for this year. Taxpayers who are 62 or older, or permanently and totally disabled regardless of age, may be eligible for a retirement income adjustment on their Georgia tax return. Retirement income includes: Income from pensions and ...

Income tax deduction worksheet

› credits-deductions › individualsEarned Income Tax Credit (EITC) | Internal Revenue Service Oct 31, 2022 · The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about the EITC? Find out what to do. Who Qualifies. You may claim the EITC if your income is low- to ... › qualified-business-income-deductionQualified Business Income Deduction | Internal Revenue Service The deduction is available, regardless of whether taxpayers itemize deductions on Schedule A or take the standard deduction. Eligible taxpayers can claim it for the first time on the 2018 federal income tax return they file in 2019. The deduction has two components. QBI Component. Earned Income Tax Credit (EITC) | Internal Revenue Service Oct 31, 2022 · The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about the EITC? Find out what to do. Who Qualifies. You may claim the EITC if your income is low- to ...

Income tax deduction worksheet. Calculators and tools - ird.govt.nz Business and organisations Ngā pakihi me ngā whakahaere. Income tax Tāke moni whiwhi mō ngā pakihi; Employing staff Te tuku mahi ki ngā kaimahi; KiwiSaver for employers Te KiwiSaver mō ngā kaituku mahi; Goods and services tax (GST) Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha; IRD numbers Ngā tau … › blog › postHow the Qualified Business Income Deduction is Calculated Oct 31, 2022 · The specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the QBID). For taxpayers below the income threshold of $157,500 (or $315,000 for Married Filing Jointly), the QBID will be calculated on the “Simplified Worksheet.” › calculator › salarySalary Paycheck Calculator · Payroll Calculator · PaycheckCity Hint: Check which jurisdictions, if any, from which your deduction is exempt. You can use this method for calculating pre-tax deductions. For instance, cafeteria plans (section 125) and 401k deductions are exempt from certain taxes. Check with the administrator of the tax jurisdiction for further information Topic No. 456 Student Loan Interest Deduction - IRS tax forms Oct 05, 2022 · If you file a Form 2555, Foreign Earned Income, Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, or if you exclude income from sources inside Puerto Rico, refer to Worksheet 4-1, Student Loan Interest Deduction Worksheet in Publication 970 instead of the worksheet in the Instructions for Form 1040 (and Form 1040-SR).

Qualified Business Income Deduction | Internal Revenue Service The qualified business income (QBI) deduction allows you to deduct up to 20 percent of your QBI. Learn more. Many owners of sole proprietorships, partnerships, S corporations and some trusts and estates may be eligible for a qualified business income (QBI) deduction – also called Section 199A – for tax years beginning after December 31 ... How the Qualified Business Income Deduction is Calculated Oct 31, 2022 · The specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the QBID). For taxpayers below the income threshold of $157,500 (or $315,000 for Married Filing Jointly), the QBID will be calculated on the “Simplified Worksheet.” › taxtopics › tc456Topic No. 456 Student Loan Interest Deduction - IRS tax forms Oct 05, 2022 · If you file a Form 2555, Foreign Earned Income, Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, or if you exclude income from sources inside Puerto Rico, refer to Worksheet 4-1, Student Loan Interest Deduction Worksheet in Publication 970 instead of the worksheet in the Instructions for Form 1040 (and Form 1040-SR). dor.georgia.gov › retirement-income-exclusionRetirement Income Exclusion | Georgia Department of Revenue See Form IT-511 for the Retirement Income Exclusion Worksheet to calculate the maximum allowable adjustment for this year. Taxpayers who are 62 or older, or permanently and totally disabled regardless of age, may be eligible for a retirement income adjustment on their Georgia tax return. Retirement income includes: Income from pensions and ...

About Form 1099-MISC, Miscellaneous Income - IRS tax forms Sep 28, 2022 · At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. At least $600 in: Rents. Prizes and awards. Other income payments. Medical and health care payments. Crop insurance proceeds. Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish. Individual Income Tax - Louisiana Department of Revenue Jan 01, 2009 · Nonresident professional athlete taxpayers use Schedules NRPA-1 and NRPA-2 to calculate their Louisiana taxable income and Tax Computation Worksheet to calculate the amount of Louisiana tax due based on the amount of their Louisiana taxable income. The Tax Computation Worksheet allows a deduction for a Personal Exemption based on filing status. Income Tax Folio S1-F3-C2, Principal Residence - Canada.ca Mar 19, 2019 · When the sale of a property results in business income. 2.6 Where the gain from the sale of a taxpayer’s personal residence results in business income (as opposed to a capital gain), the gain cannot be exempt from income tax as a result of the principal residence exemption under paragraph 40(2)(b). An individual does not have to be involved in the housing … Earned Income Tax Credit (EITC) | Internal Revenue Service Oct 31, 2022 · The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about the EITC? Find out what to do. Who Qualifies. You may claim the EITC if your income is low- to ...

› qualified-business-income-deductionQualified Business Income Deduction | Internal Revenue Service The deduction is available, regardless of whether taxpayers itemize deductions on Schedule A or take the standard deduction. Eligible taxpayers can claim it for the first time on the 2018 federal income tax return they file in 2019. The deduction has two components. QBI Component.

› credits-deductions › individualsEarned Income Tax Credit (EITC) | Internal Revenue Service Oct 31, 2022 · The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund. Did you receive a letter from the IRS about the EITC? Find out what to do. Who Qualifies. You may claim the EITC if your income is low- to ...

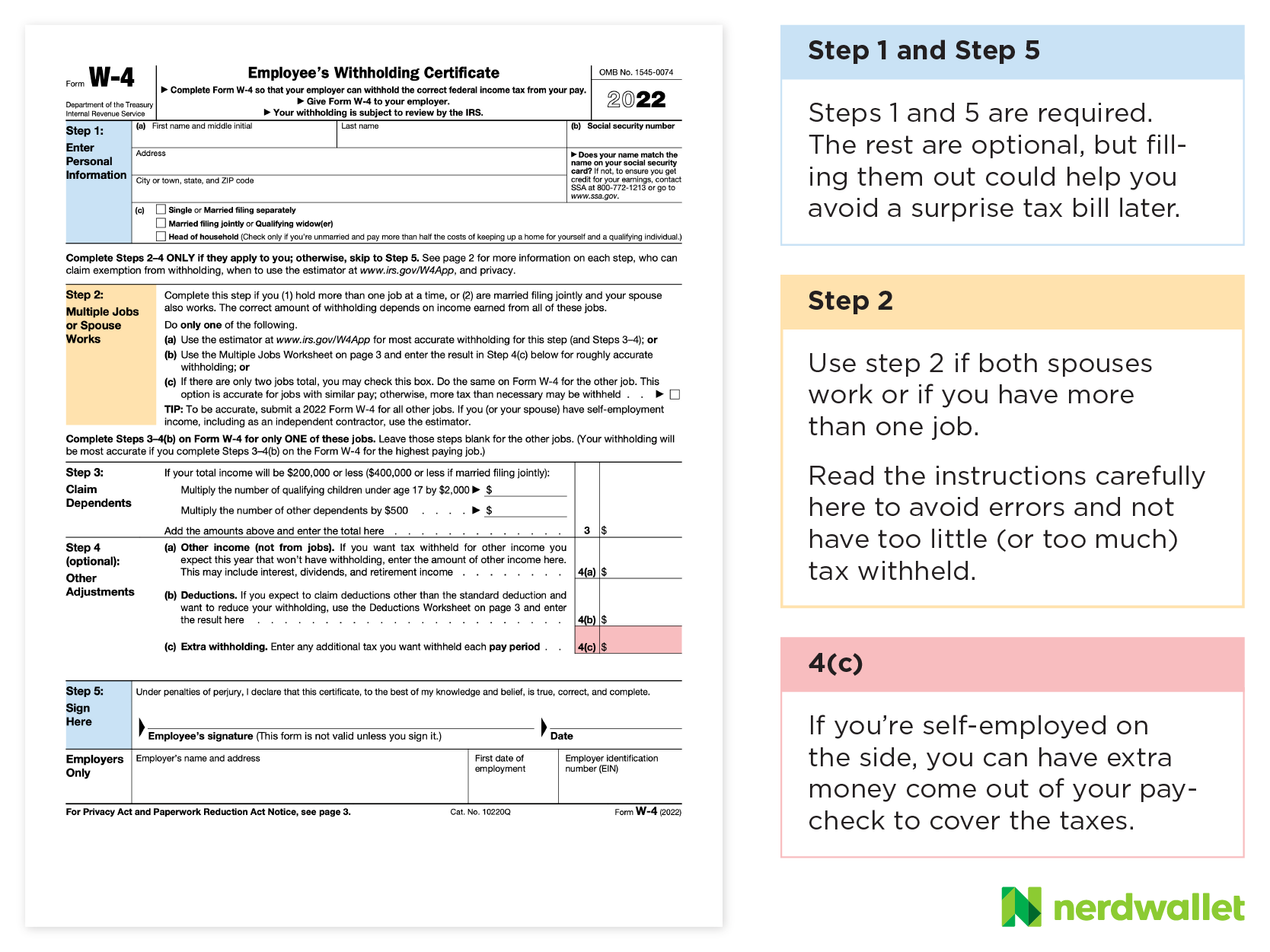

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

0 Response to "42 income tax deduction worksheet"

Post a Comment