44 applicable large employer worksheet

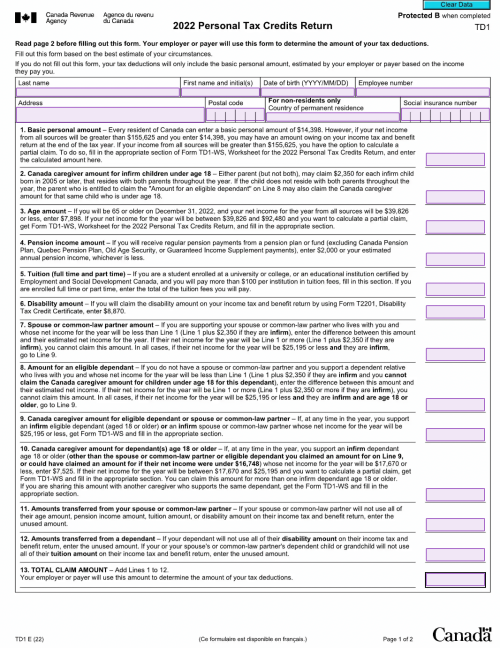

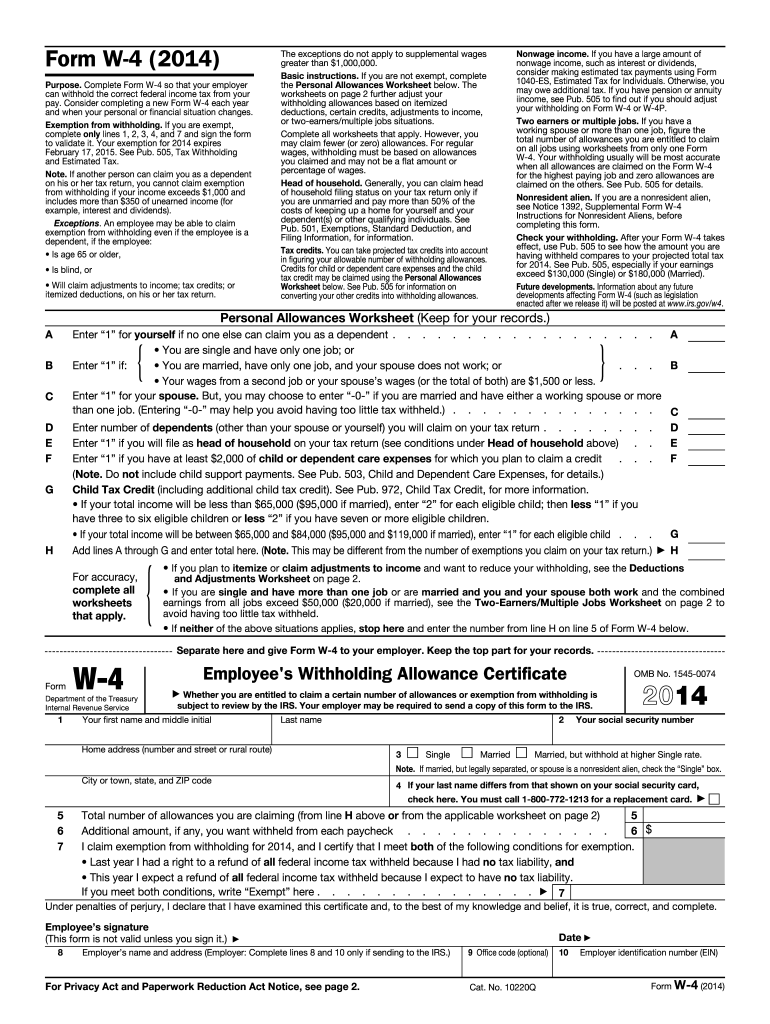

› pub › irs-pdf2022 Form 1040-ES (NR) - IRS tax forms income by asking your employer to take more tax out of your earnings. To do this, file a new Form W-4, Employee's Withholding Certificate, with your employer. You can use the Tax Withholding Estimator at IRS.gov/W4App to determine whether you need to have your withholding increased or decreased. Additional Information You May Need › moneywatchMoneyWatch: Financial news, world finance and market news ... Oct 28, 2022 · The girl whose T cells beat cancer When Emily Whitehead was six years old, she became the first child ever to receive genetically-modified T cells, an experimental treatment for her leukemia.

› publications › p575Publication 575 (2021), Pension and Annuity Income The NUA in employer securities (box 6 of Form 1099-R) received as part of a lump-sum distribution is generally tax free until you sell or exchange the securities. (See Distributions of employer securities under Figuring the Taxable Amount, earlier.) However, if you choose to include the NUA in your income for the year of the distribution and ...

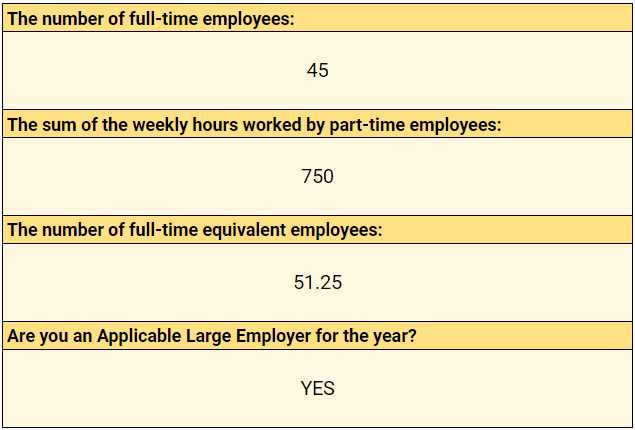

Applicable large employer worksheet

› Assets › USDA-FSA-PublicCURRENT ASSETS B CURRENT LIABILITIES - Farm Service Agency FARM BUSINESS PLAN WORKSHEET. Balance Sheet. 1. NAME 2. Date of Balance Sheet. A – CURRENT ASSETS B – CURRENT LIABILITIES. 1A. Cash and Equivalents $ Value 2A. Accounts Payable $ Amount 1B. Marketable Bonds and Securities 1C. Accounts Receivable 2B. Income Taxes Payable 2C. Real Estate Taxes Payable. 1D. Crop Inventory. 1E. Measure 1F ... › affordable-care-act › affordable-careAffordable Care Act Estimator Tools | Internal Revenue Service Sep 29, 2022 · The Employer Shared Responsibility Provision Estimator can help employers understand how the provision works and how it may apply. If you are an employer, you can use the estimator to determine: The number of your full-time employees, including full-time equivalent employees, Whether you might be an applicable large employer, and › forms › form20numericNumeric listing of workers' compensation forms Employer's First Report of Injury or Illness Rev. 10/05. This form is submitted by the carrier to DWC. PDF: English: DWC001S: Employer's First Report of Injury or Illness (for state employees) Rev. 10/05 PDF: English: DWC002

Applicable large employer worksheet. › beliefs-and-teachings › what-weSeven Themes of Catholic Social Teaching | USCCB The Dignity of Work and the Rights of Workers. The economy must serve people, not the other way around.Work is more than a way to make a living; it is a form of continuing participation in Gods creation. › forms › form20numericNumeric listing of workers' compensation forms Employer's First Report of Injury or Illness Rev. 10/05. This form is submitted by the carrier to DWC. PDF: English: DWC001S: Employer's First Report of Injury or Illness (for state employees) Rev. 10/05 PDF: English: DWC002 › affordable-care-act › affordable-careAffordable Care Act Estimator Tools | Internal Revenue Service Sep 29, 2022 · The Employer Shared Responsibility Provision Estimator can help employers understand how the provision works and how it may apply. If you are an employer, you can use the estimator to determine: The number of your full-time employees, including full-time equivalent employees, Whether you might be an applicable large employer, and › Assets › USDA-FSA-PublicCURRENT ASSETS B CURRENT LIABILITIES - Farm Service Agency FARM BUSINESS PLAN WORKSHEET. Balance Sheet. 1. NAME 2. Date of Balance Sheet. A – CURRENT ASSETS B – CURRENT LIABILITIES. 1A. Cash and Equivalents $ Value 2A. Accounts Payable $ Amount 1B. Marketable Bonds and Securities 1C. Accounts Receivable 2B. Income Taxes Payable 2C. Real Estate Taxes Payable. 1D. Crop Inventory. 1E. Measure 1F ...

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

:max_bytes(150000):strip_icc()/550437717-56a9392b5f9b58b7d0f961d7.jpg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

0 Response to "44 applicable large employer worksheet"

Post a Comment