45 payroll reconciliation excel worksheet

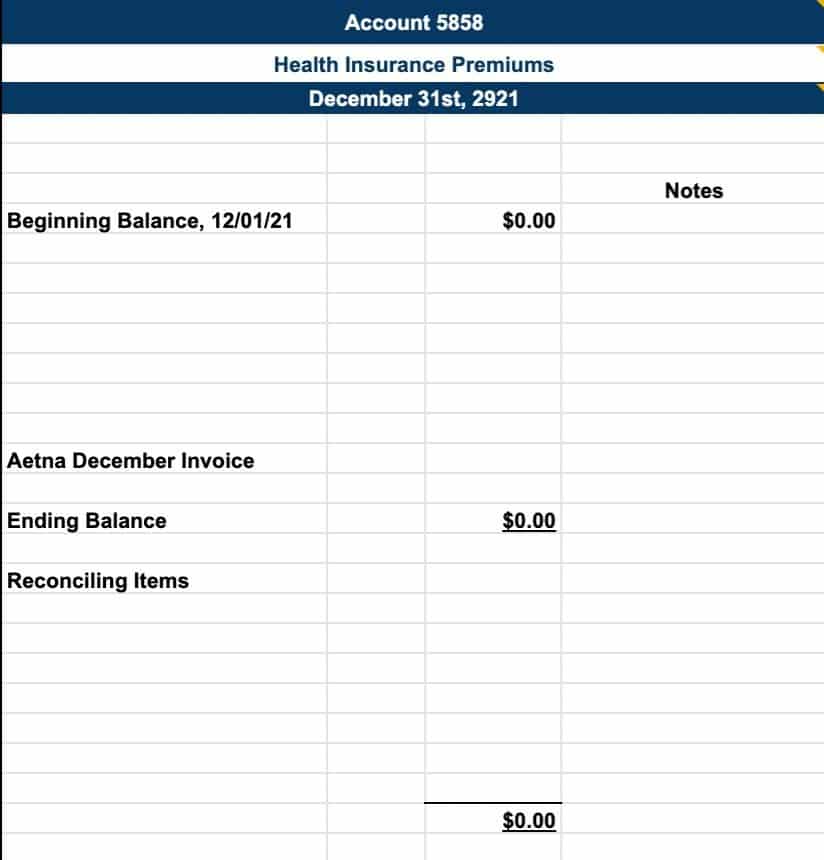

Payroll Reconciliation Spreadsheet | Etsy Sweden Check out our payroll reconciliation spreadsheet selection for the very best in unique or custom, handmade pieces from our shops. Reconciliation | Office of Financial Management - Washington Below are instructions and worksheets to help agencies reconcile the state payroll revolving account and federal tax deposits. Account 035 - State payroll revolving account Health insurance sample reconciliation and instructions Health insurance mid-period transfer template Reconciliation template Rapid reference guide

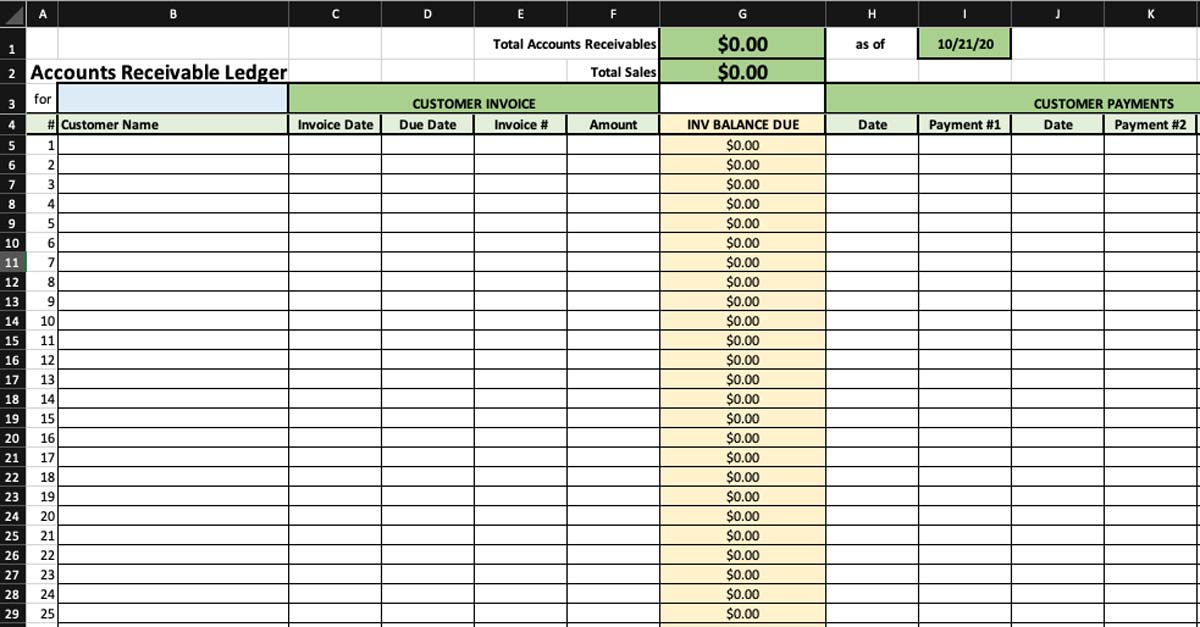

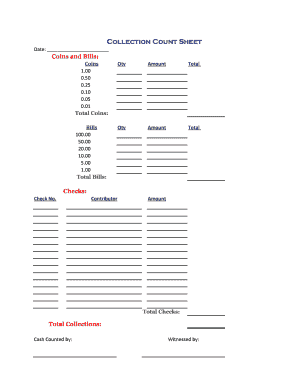

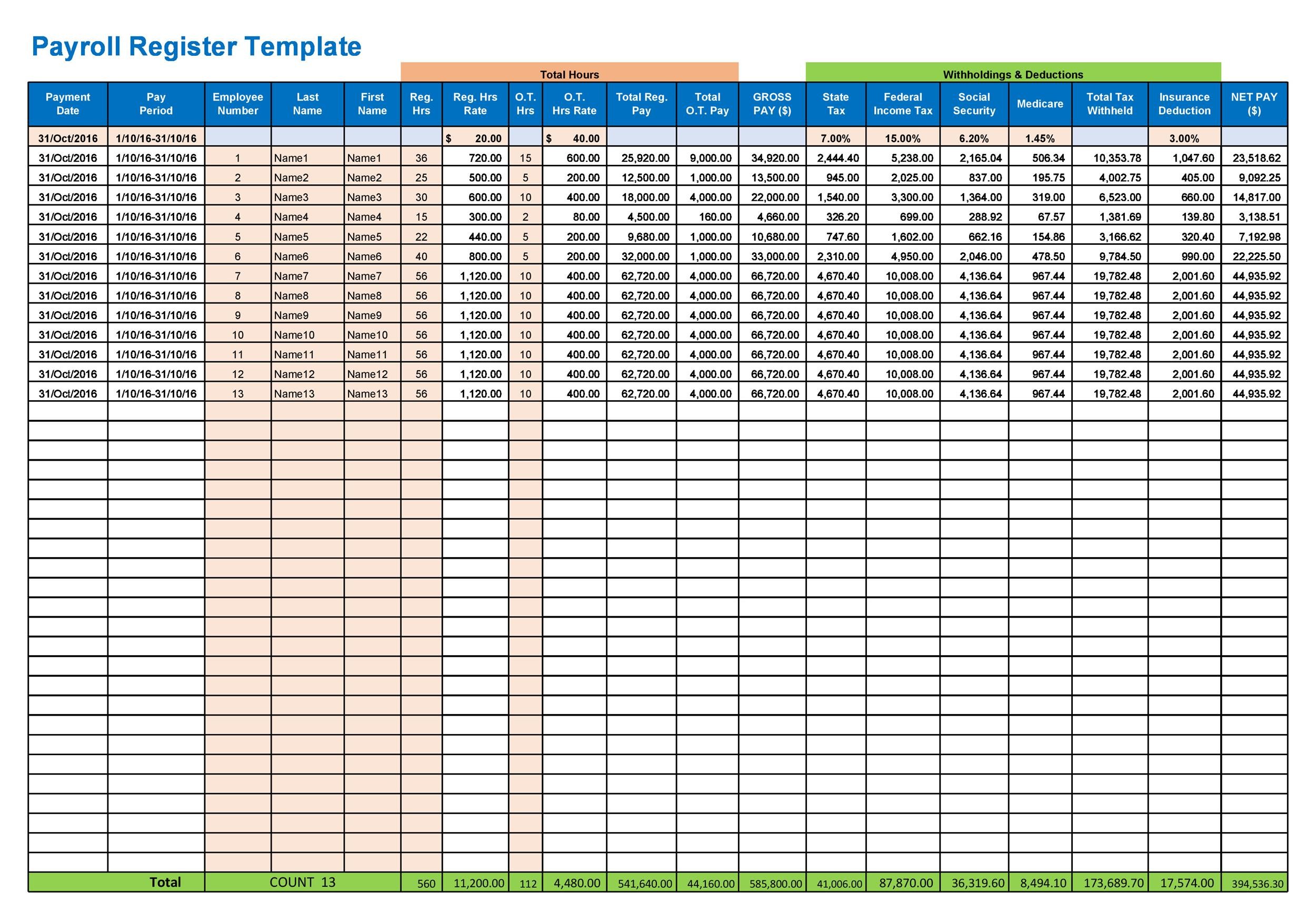

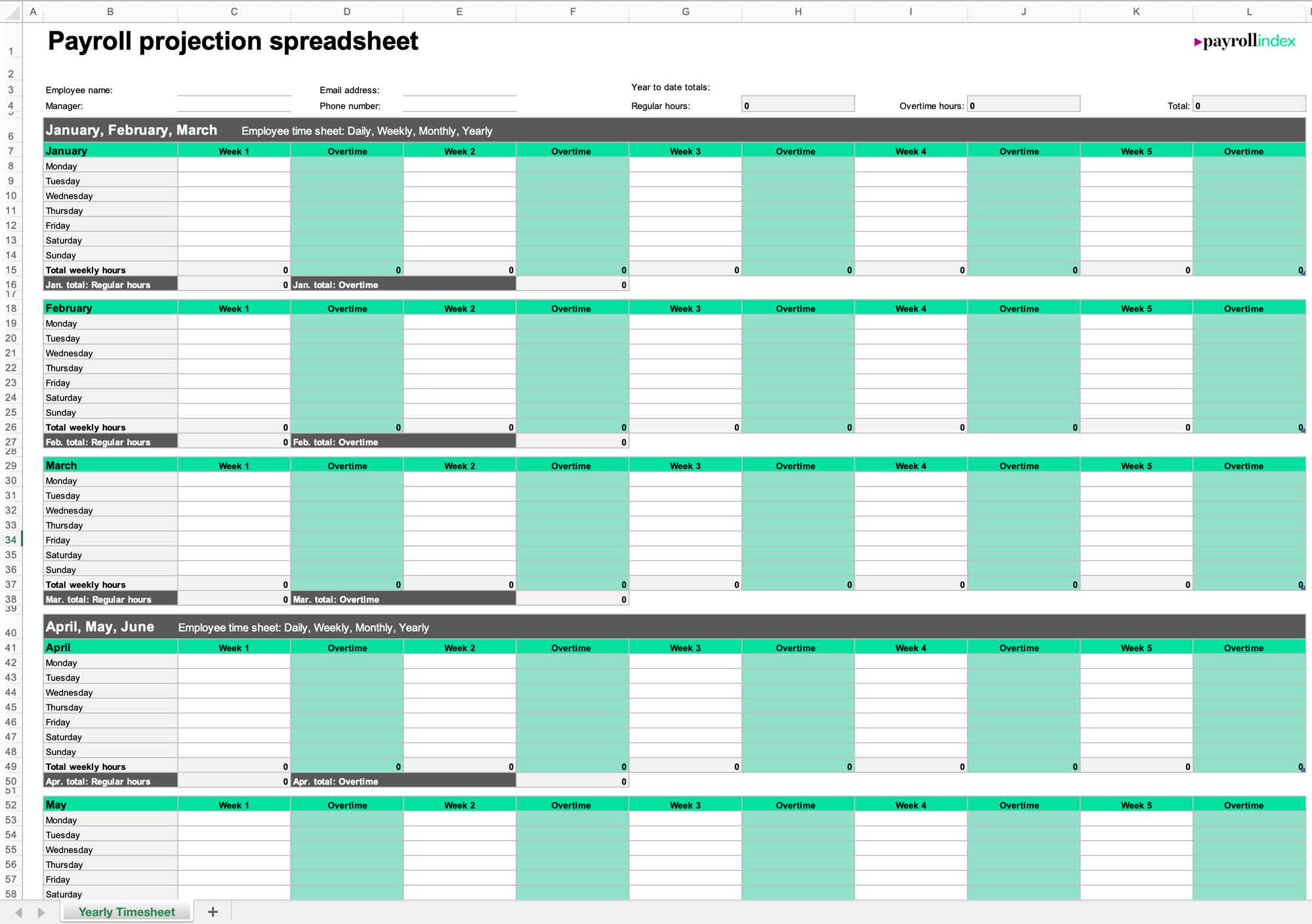

Payroll spreadsheet templates for Excel - free UK downloads Payroll reconciliation template - Excel A payroll reconciliation template is a type of spreadsheet that is used to help businesses reconcile their payroll expenses. This type of template can be used to track employee pay rates, hours worked, and other payroll-related information. Download Employee absence tracker spreadsheet template

Payroll reconciliation excel worksheet

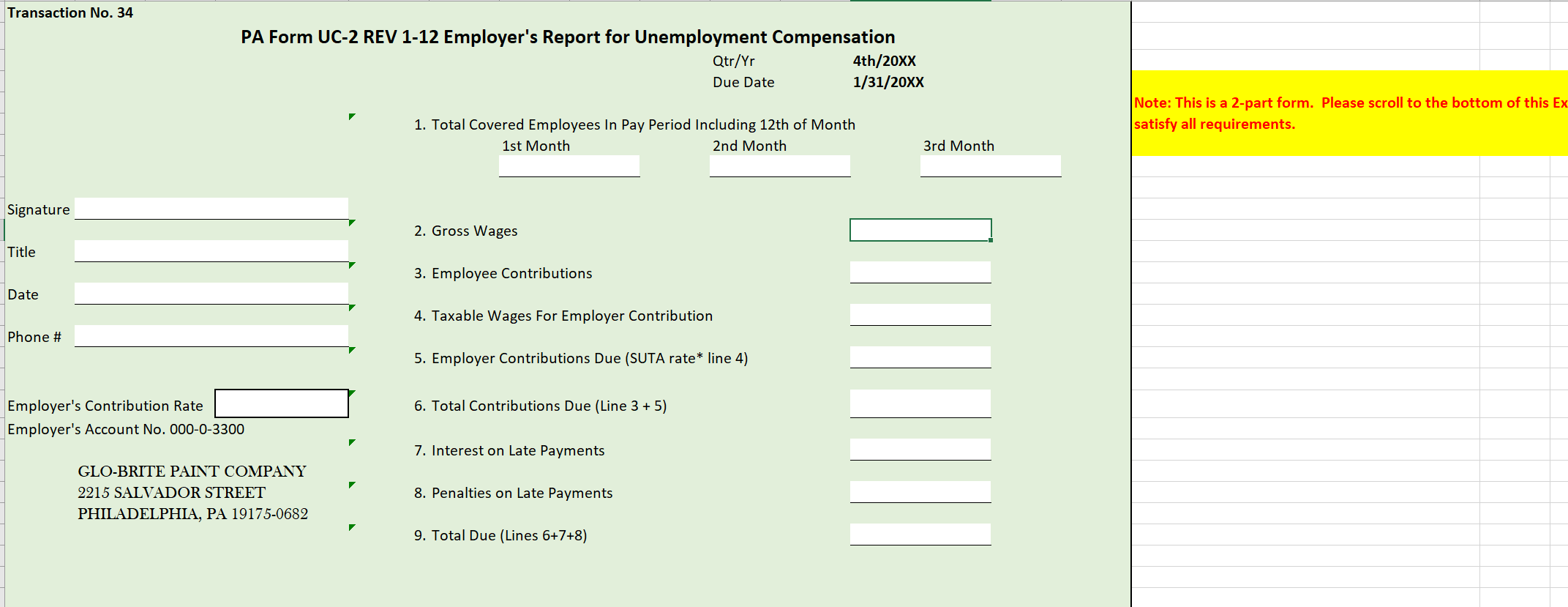

Quick Guide: Spot-Checking the Payroll Reconciliation Report Click on column "A" at the very top (where the "A" is) and hold down the mouse through "S" Right-click and select "Delete" Add a filter to the report. Go to the "Data" tab at the top and click on "Filter" Spot-Check the Payroll Reconciliation Sort and Spot-Check by Name Go to the "Data" tab at the top and click on "Sort" What to Know About Form 941 Reconciliation | Steps - Patriot Software Steps to reconciling Form 941. Follow these five simple steps to reconcile Form 941. 1. Gather payroll registers from the current quarter. Whether you track payroll taxes and wages in a spreadsheet or software, the first step in reconciling Form 941 is printing or reviewing your payroll registers. Payroll registers consist of reports or ... State Accounting Office of Georgia EXAMPLE SPREADSHEET FOR RECONCILING PAYROLL TOTALS TO W-2 TOTALS GTW=Gross Taxable Wages W/H=Withholding Pay Cycle 1/15/20xx 1/31/20xx 2/15/20xx 2/28/20xx 3/15/20xx 3/31/20xx 1st Qtr Totals (Box 1) (Box 2) (Box 3) (Box 4) (Box 5) (Box 6) (Box 9) (Box 10) (Box 12c) (Box 12d) (Box 12e) (Box 12g) (Box 12p) (Box 14y) (Box 14z) (Box 16) (Box 17)

Payroll reconciliation excel worksheet. assignmentessays.comAssignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. 55+ SAMPLE Payroll Deduction Forms in PDF | MS Word | Excel When you set up a payroll deduction program for your employees, a payroll deduction form is a must-have. Through this document, the employees may grant you the authority to execute various deductions on their payroll. Creating a payroll deduction authorization form adds up to the pile of paperwork you need to do. We will help you with the process. Provided below is a step-by-step … 15 Free Payroll Templates | Smartsheet Download Corporate Payroll Check Template - Excel Designed for corporate settings, this payroll check template provides traditional pay stub formatting and covers current and year-to-date payroll data. Fields are included for an employee ID number and check number for reference and easy tracking. 5+ Payroll Worksheet Templates - Free Excel Documents Download Payroll Worksheet Template Pdf Download Download You are getting ready made payroll spreadsheet here covering all needed points featured on a standard payroll worksheet- like name, address, ID, sex, salary amount etc. You are saved from the labour and hassle of creating an entire payroll spreadsheet right from the beginning.

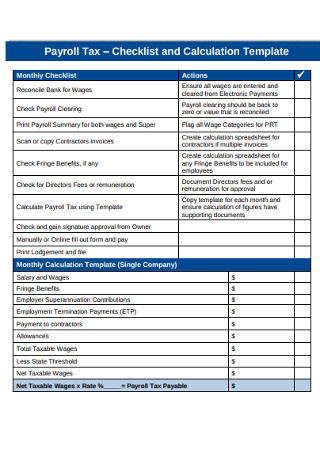

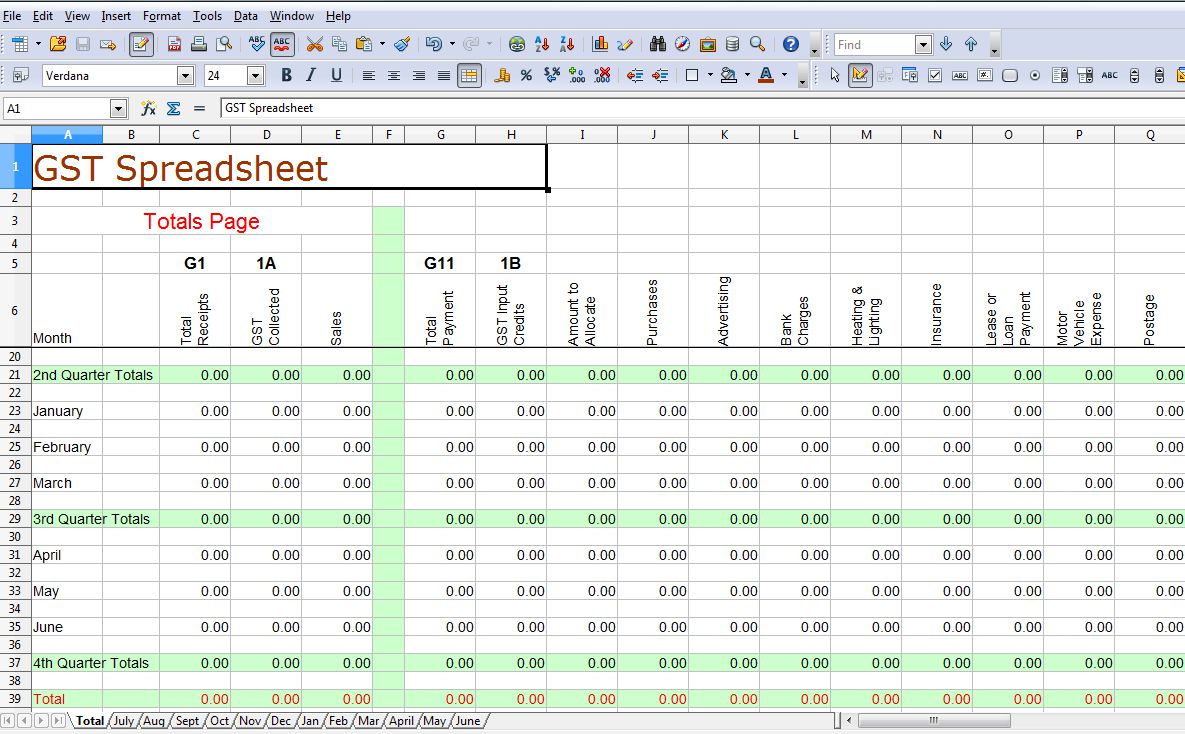

PPIC Statewide Survey: Californians and Their Government 26.10.2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and … › hr › payroll-checklist47+ SAMPLE Payroll Checklists in PDF | MS Word | Excel With the various payroll templates available for you to utilize, a payroll checklist is one of the few tools you can benefit from the most. So before processing your payroll, here are a few things to remember to help streamline your system. Step 1: Make the Adjustments in Employee Records › business › payroll25+ Payroll Templates - PDF, Word, Excel | Free & Premium ... Payroll Reconciliation Template. Numerous day-to-day transactions are happening in a firm and verifying them with precision is tough work. The payroll reconciliation template helps you to check and cross-check the accounts without any mistakes using digital software. Pick any template like PDF, PSD, MS Word, and more that are available. help.tallysolutions.com › article › TallyCreate, Alter, Delete Ledgers - TallyHelp Bank Reconciliation. Manual Bank Reconciliation; Auto Bank Reconciliation - View and import or re-import Bank Statement; Removing Opening BRS after Splitting the Company Data; FAQ on Banking; Configure Bank Ledgers and Print Cheques; Statutory and Taxation. Taxation - India. GST. Upgrade to Tally.ERP 9 Release 6.6.3; Activate GST for Your ...

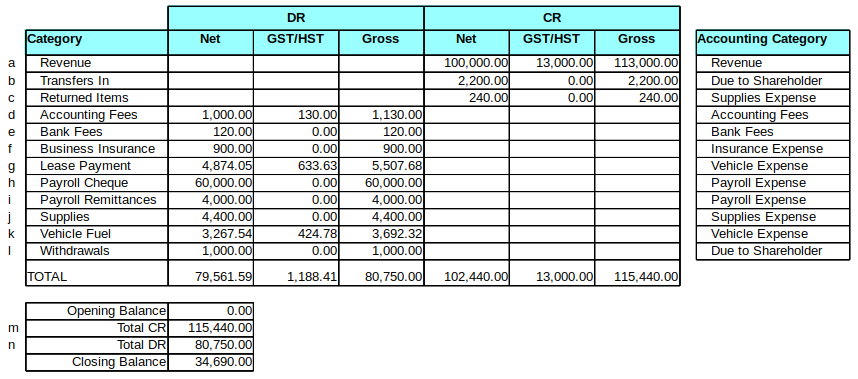

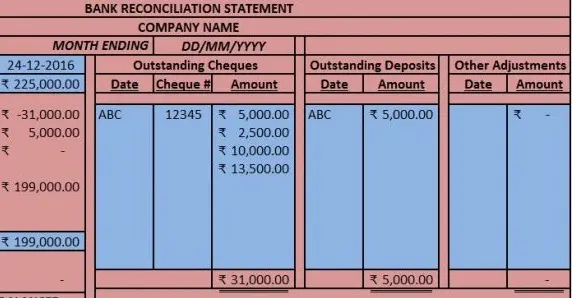

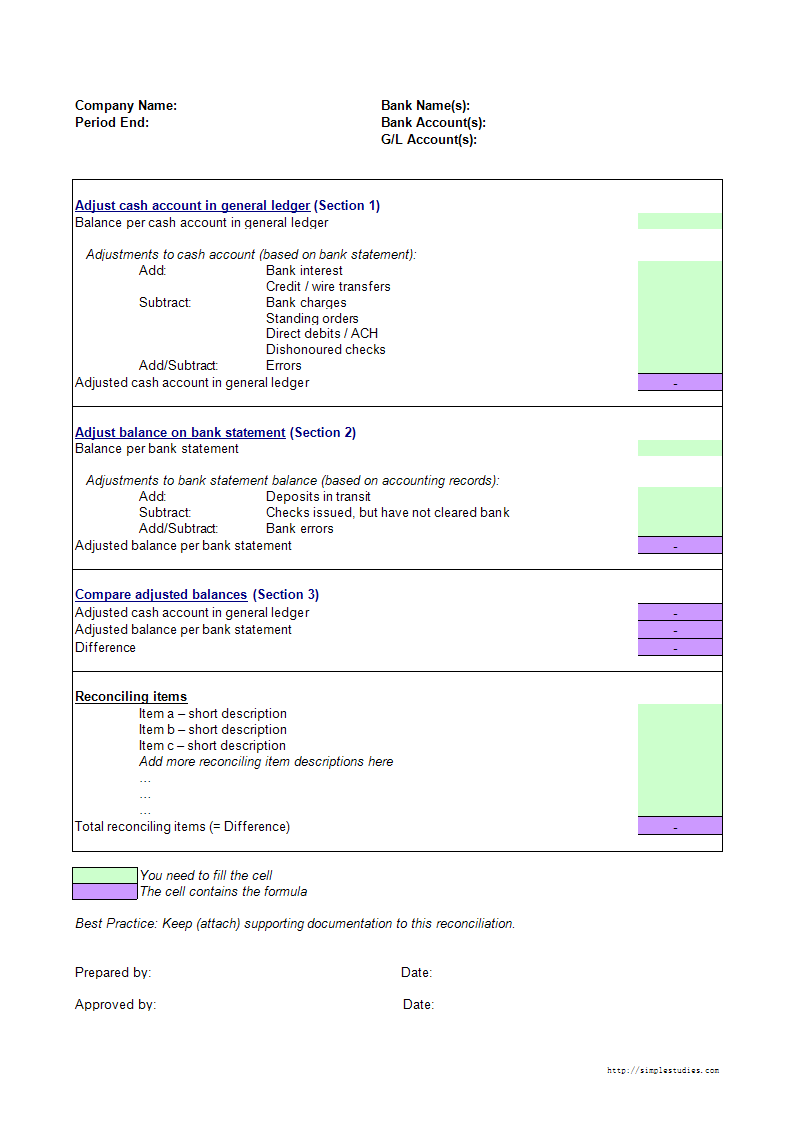

Monthly bank reconciliation - templates.office.com Monthly bank reconciliation Monthly bank reconciliation This monthly bank reconciliation template allows the user to reconcile a bank statement with current checking account records. Use this bank reconciliation example template to help rectify any errors in your financial statement. This is an accessible template. Excel Download Open in browser General Ledger - Dynamics GP | Microsoft Learn For example, all accounts assigned to the Cash category—Petty Cash, Cash-Operating, Cash Payroll—will appear under the Cash category when financial statements are printed. You also can choose whether to print descriptions for the first account in the category or print the category description. General Ledger includes 48 predefined account categories. The account … Payroll Reconciliation Spreadsheet - Etsy Payroll Reconciliation Spreadsheet (1 - 1 of 1 results) Price ($) Shipping Summary Payroll Report, Easy to Use Employee Payroll Tracker, Summarize Each Payroll Check into One Report, Excel Payroll Spreadsheet TheBusinessMogulHQ (6) $7.99 1 Common Questions Free Weekly Payroll Tax Worksheet - Excel Spreadsheet File The Payroll/Income Tax Worksheet is an spreadsheet that is designed to help you calculate Federal Income Tax 941 payment based on your weekly payroll totals. You can simply enter the information and the spreadsheet will calculate the totals for you. This spreadsheet does not automatically calculate the % of payroll tax that you need to pay. You ...

Unbanked American households hit record low numbers in 2021 25.10.2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

Could Call of Duty doom the Activision Blizzard deal? - Protocol 14.10.2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

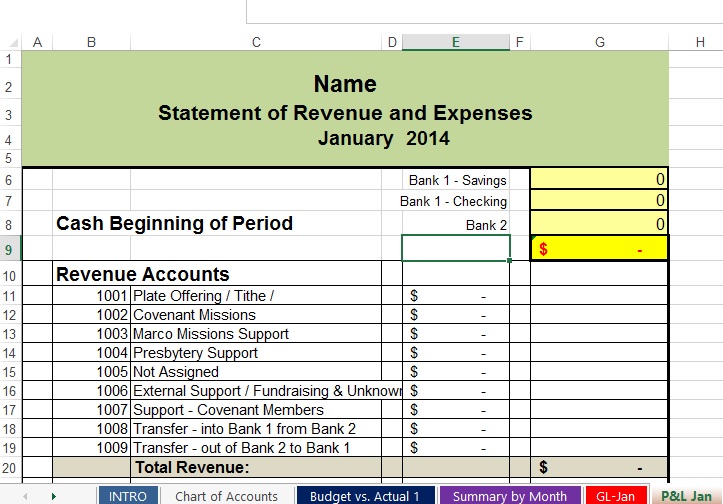

exceldatapro.com › download-profit-loss-templateDownload Profit and Loss Account Excel Template - ExcelDataPro Dec 08, 2016 · Excel Google Sheets Open Office Calc Apple Numbers. Click here to Download All Financial Statement Excel Templates for ₹299. Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Top 10 payroll spreadsheet template Excel download 2022 Payroll spreadsheet template Excel provide a simple solution for tracking employee data, scheduling employees, calculating payroll costs and presenting detailed profit and loss statements. Below are the best free online top 10 payroll spreadsheet template Excel. ... The payroll reconciliation table is used to increase or decrease an employee's ...

Create, Alter, Delete Ledgers - TallyHelp Create Ledgers one-by-one 1. Go to Gateway of Tally > Accounts Info. > Ledgers > Create (Single Ledger) . The Ledger Creation screen appears as shown below: 2. Enter the Name of the ledger account. Duplicate names are not allowed. 3. Enter the alias of the ledger account, if required. . You can access the ledgers using the original name or the alias na

Free Account Reconciliation Templates | Smartsheet 23.10.2018 · This simple bank reconciliation template is designed for personal or business use, and you can download it as an Excel file or Google Sheets template. Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled. To create an ongoing record, copy and paste …

Payrolls - Office.com Excel payroll templates help you to quickly calculate your employees' income, withholdings, and payroll taxes. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats.

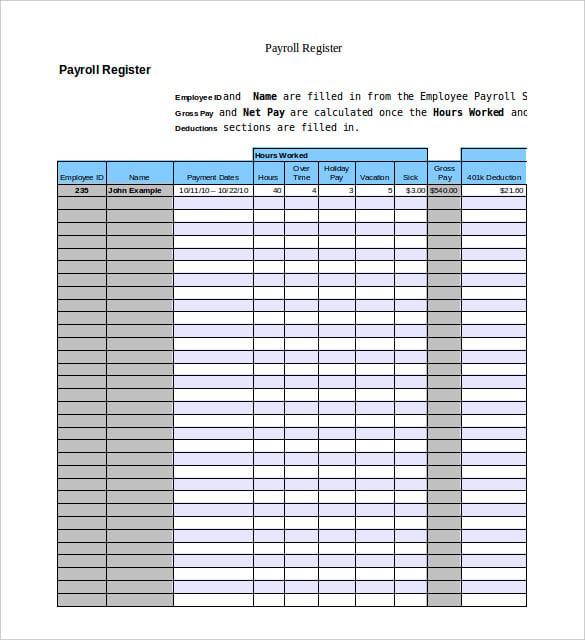

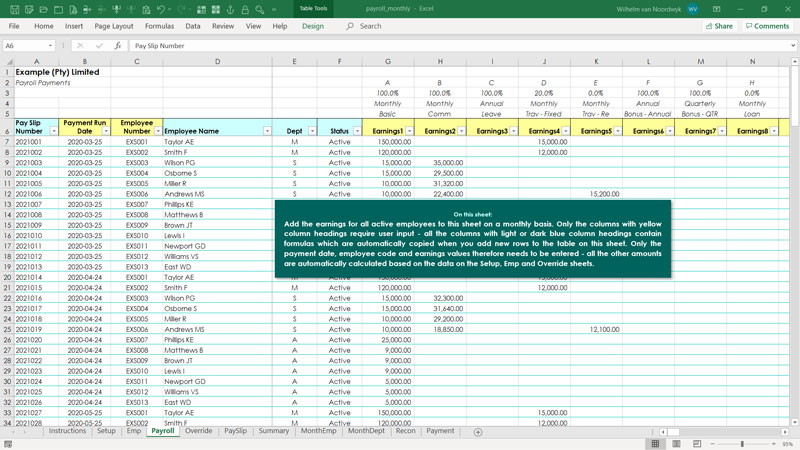

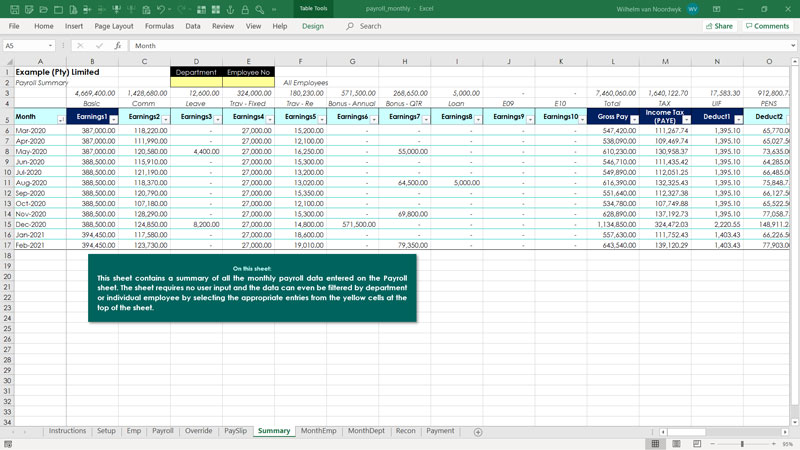

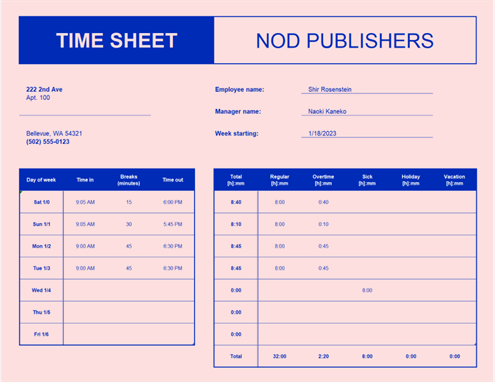

Payroll Template - Free Employee Payroll Template for Excel - Vertex42.com The Payroll Register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, FICA taxes, and other deductions. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it.

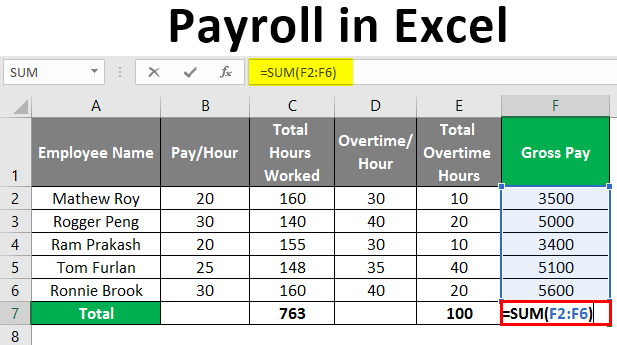

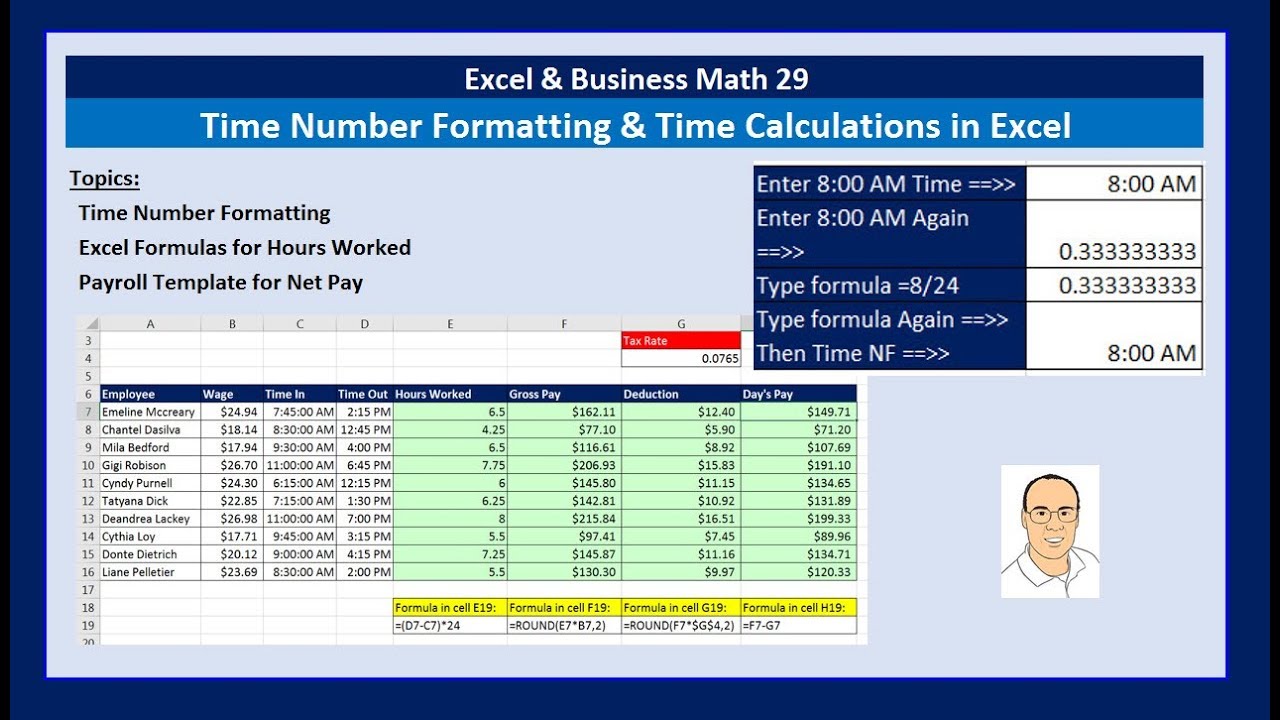

How to Prepare Payroll in Excel: A Step-by-Step Guide - CareerAddict Check out our step-by-step guide below and learn how to prepare your payroll in Excel. 1. Build a payroll template. To start a successful business, you'll need a good productivity software suite including a word processor, presentation programme and a spreadsheet for calculations. To create your payroll, open a new spreadsheet in Excel.

Payroll in Excel | How to Create Payroll in Excel (With Steps) - EDUCBA Step 1: Open a new blank excel spreadsheet. Go to Search Box. Type "Excel" and double click on the match found under the search box to open a blank excel file. Step 2: Save the file on the location you want your payroll to be saved so that it does not get lost, and you will always have it with you.

Payroll Spreadsheets | Excel Templates The first step to filling out an excel payroll worksheet template is assembling all pertinent data. Things like hours worked per employee, tax rate information, and each employee's individual scheduling needs are all things that may need to be used depending on what kind of template is being used. 2.

25+ Payroll Templates - PDF, Word, Excel | Free & Premium … Payroll Reconciliation Template. Numerous day-to-day transactions are happening in a firm and verifying them with precision is tough work. The payroll reconciliation template helps you to check and cross-check the accounts without any mistakes using digital software. Pick any template like PDF, PSD, MS Word, and more that are available.

6 Best Microsoft Excel Templates for Payroll Management - Guiding Tech The payroll management template spreads across three worksheets. There is one each for employee wage and taxes, payroll based on employees' clocked hours, and last to create pay stubs. The...

› article › 3-ways-to-reconcile3 ways to reconcile transactions using Excel 2016 - TechRepublic Jun 18, 2018 · Click New Worksheet if necessary and click OK. Using the PivotTable Field pane, drag Customers to the Rows list and drag Order Total to the Values list. Next, drag Date to the Rows list.

PDF Year-end Reconciliation Worksheet for Forms 941, W-2, and W-3 Annual amounts from payroll records should match the total amounts reported on all Forms 941 for the year. ... Year-end Reconciliation Worksheet for Forms 941, W-2, and W-3 Author: Internal Revenue Service Created Date: 10/3/2011 11:31:08 AM ...

State of Oregon: Forms - Forms and publications library Form OR-OTC-V, Oregon Combined Payroll Tax Payment Voucher: 150-211-053: General: Form: Form OR-PA, Oregon Professional Athletic Team Annual Reconciliation Tax Report: 150-206-015: 2021: Form: Form OR-PA, Oregon Professional Athletic Team Annual Reconciliation Tax Report Instructions : 150-206-015-1: 2021: Publication: Form OR-SOA, Settlement ...

› newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

DOC GL-Payroll Reconciliation Adjustments to the General Ledger (Spreadsheet Journals (SSJs), etc.) are not reflected in either HRMS or the EPM Detailed Payroll or HR Accounting Line tables. ... Earnings (Embedded Excel Worksheet of Earnings Codes) Report 2 - In Core Financials, you can: ... Sample page of EPM Detail Payroll Reconciliation Report Query 4 - In Core EPM, you can:

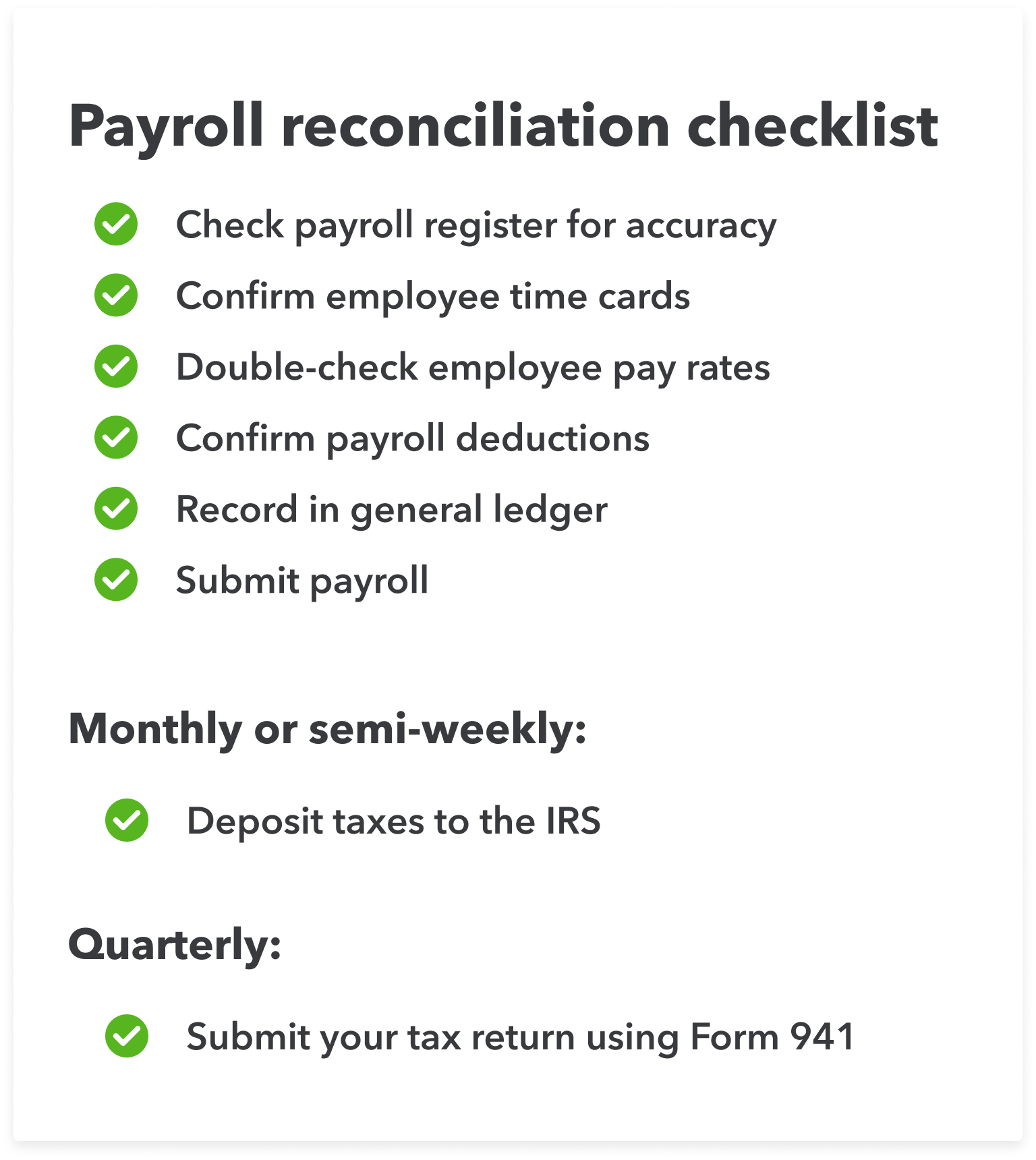

Payroll Reconciliation: How to Do It in 6 Easy Steps Step 1: Make sure your payroll register accurately reflects wages and hours You need to reconcile payroll each pay period before checks actually go out, as it's much harder to correct any mistakes once people have gotten paid. The first step is to make sure everyone is getting paid the right amount.

Top 10 payroll reconciliation template Excel download 2022 Below are the best free online top 10 payroll reconciliation template Excel. 1. Employee Payroll Calculator With payroll templates, you can record your employees' salaries and calculate hourly rates. With this free downloadable payroll template, you can calculate wages based on regular hours and overtime. 2. Employee Payroll Calculator

The Beginners Guide to Payroll Reconciliation - QuickSprout Performing this crucial task every pay period ensures you won't be overwhelmed during the quarterly and annual reconciliation. Here are a few excellent tips to incorporate into reconciliation to make it quick, efficient, and accurate. 1. Reconcile Payroll Before Payday It's much harder to fix payroll errors after you've paid employees.

How to Do a Bank Reconciliation: Step-By-Step Process 16.06.2022 · To do this, a reconciliation statement known as the bank reconciliation statement is prepared. Bank Reconciliation: A Step-by-Step Guide. You receive a bank statement, typically at the end of each month, from the bank. The statement itemizes the cash and other deposits made into the checking account of the business. The statement also includes ...

Payroll Reconciliation and Maintaining Accurate Accounting Books Use the following steps to reconcile payroll. 1. Print out your payroll register. The payroll register summarizes each employee's wages and deductions for the pay period. 2. Match each hourly employee's time card to the pay register. Confirm that you entered the hours for each employee correctly.

Excel Payroll Software Template - Excel Skills Recon - This sheet contains a reconciliation between the monthly payroll calculations and monthly payments which need to be entered on the Payments sheet. The sheet has 3 sections which display net pay (only differences), salary deductions and company contributions separately.

How to reconcile payroll: A step-by-step process - Article - QuickBooks Step #1: Check your payroll register Your payroll register lists all of the details about an employee's payroll during a pay period. It should include basic information about the employee, including: Name Birthdate Social security number Employee number

GL Payroll Reconciliation Tool - University of California, Los Angeles The tool is locked so that formulas and layout cannot be altered How to Use the GL Payroll Reconciliation Tool Download the Excel Template. Run reports in CDW. Copy and Paste data in predefined formats and spaces. Review the "Difference" column. Rows that have a non-zero value has a variance between the General Ledger and the UCPath Labor Ledgers.

Free Account Reconciliation Templates | Smartsheet This simple bank reconciliation template is designed for personal or business use, and you can download it as an Excel file or Google Sheets template. Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled.

State Accounting Office of Georgia EXAMPLE SPREADSHEET FOR RECONCILING PAYROLL TOTALS TO W-2 TOTALS GTW=Gross Taxable Wages W/H=Withholding Pay Cycle 1/15/20xx 1/31/20xx 2/15/20xx 2/28/20xx 3/15/20xx 3/31/20xx 1st Qtr Totals (Box 1) (Box 2) (Box 3) (Box 4) (Box 5) (Box 6) (Box 9) (Box 10) (Box 12c) (Box 12d) (Box 12e) (Box 12g) (Box 12p) (Box 14y) (Box 14z) (Box 16) (Box 17)

What to Know About Form 941 Reconciliation | Steps - Patriot Software Steps to reconciling Form 941. Follow these five simple steps to reconcile Form 941. 1. Gather payroll registers from the current quarter. Whether you track payroll taxes and wages in a spreadsheet or software, the first step in reconciling Form 941 is printing or reviewing your payroll registers. Payroll registers consist of reports or ...

Quick Guide: Spot-Checking the Payroll Reconciliation Report Click on column "A" at the very top (where the "A" is) and hold down the mouse through "S" Right-click and select "Delete" Add a filter to the report. Go to the "Data" tab at the top and click on "Filter" Spot-Check the Payroll Reconciliation Sort and Spot-Check by Name Go to the "Data" tab at the top and click on "Sort"

0 Response to "45 payroll reconciliation excel worksheet"

Post a Comment