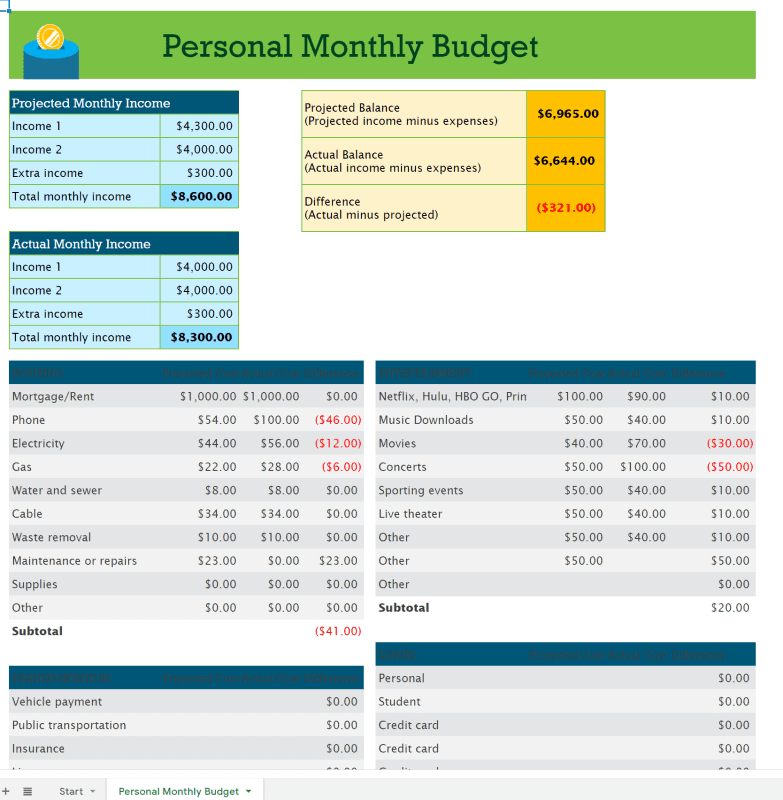

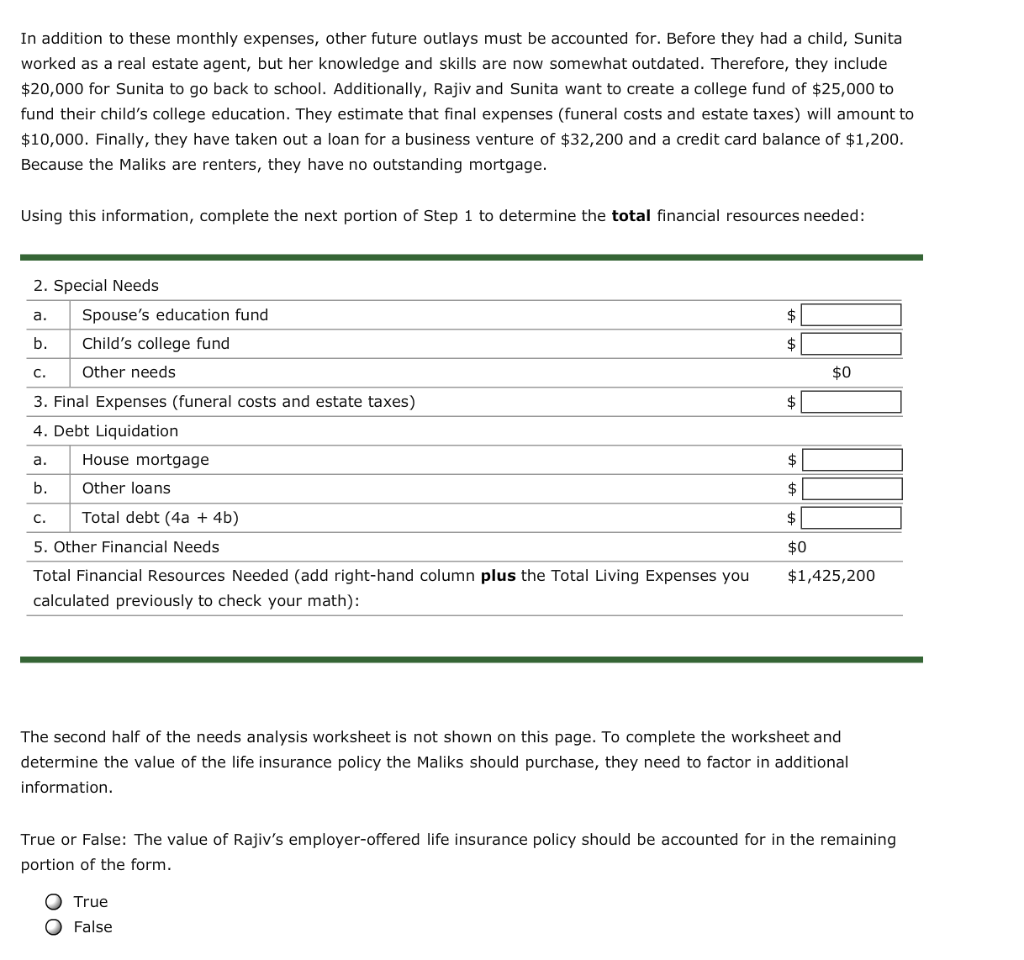

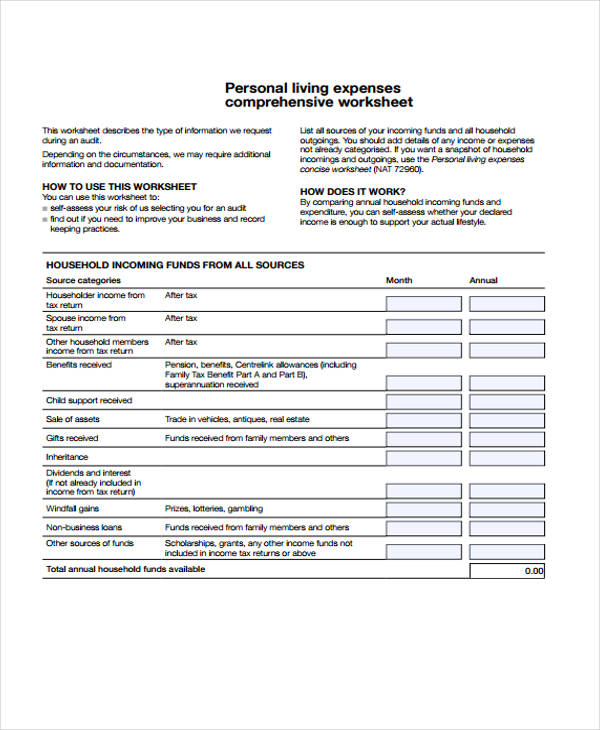

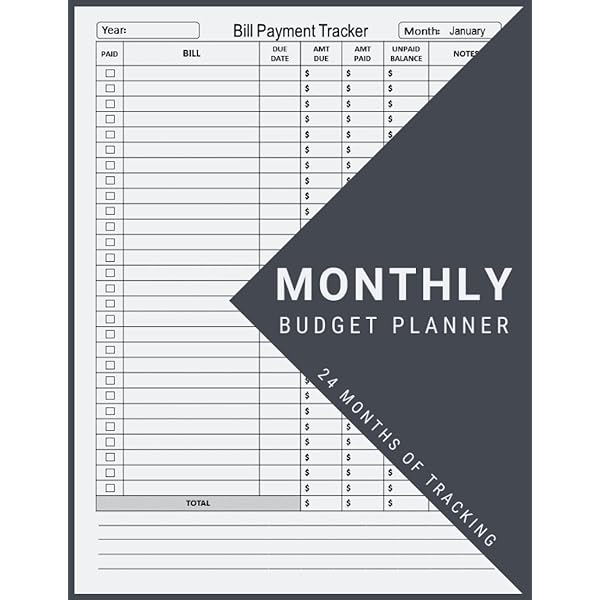

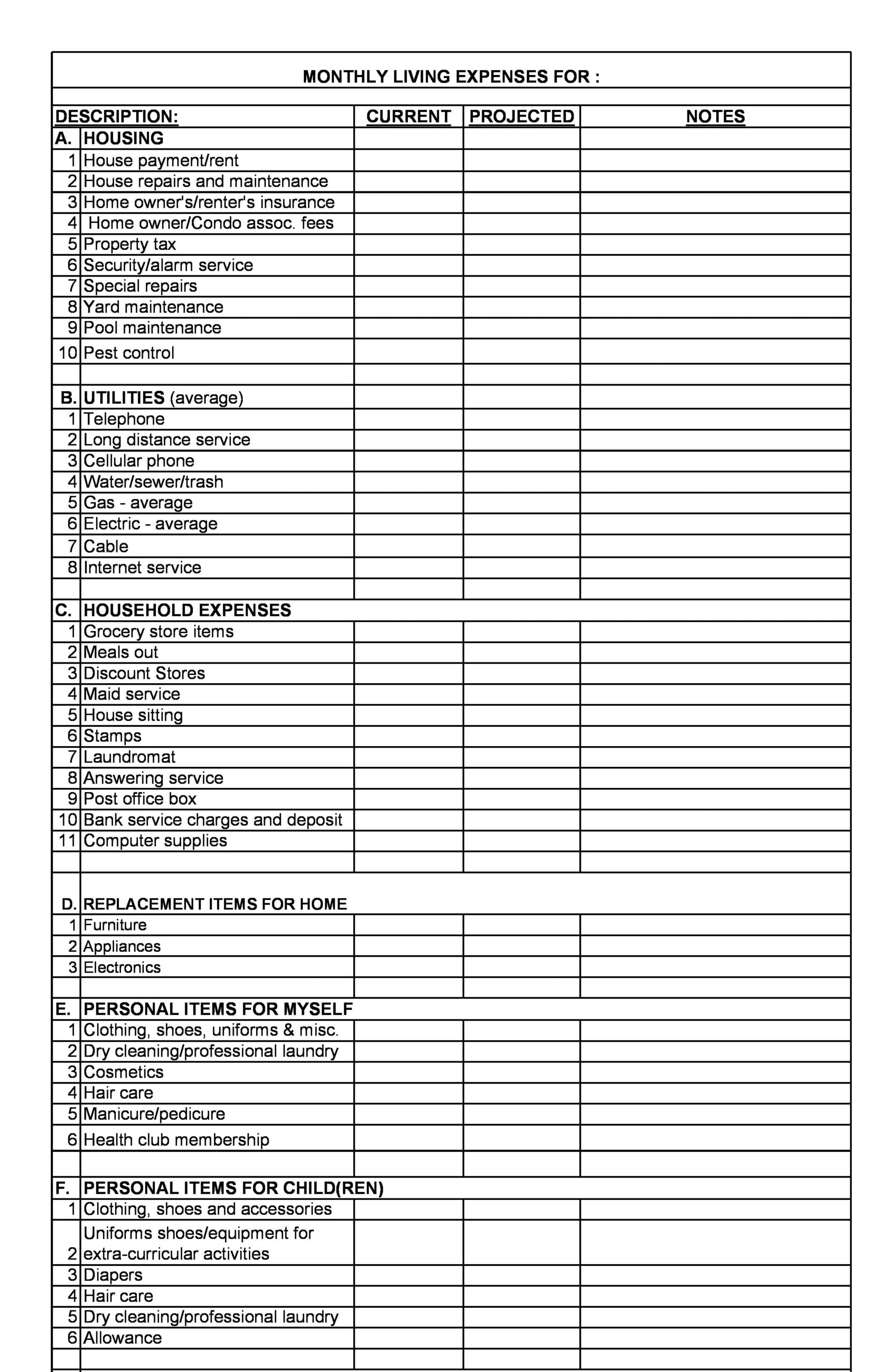

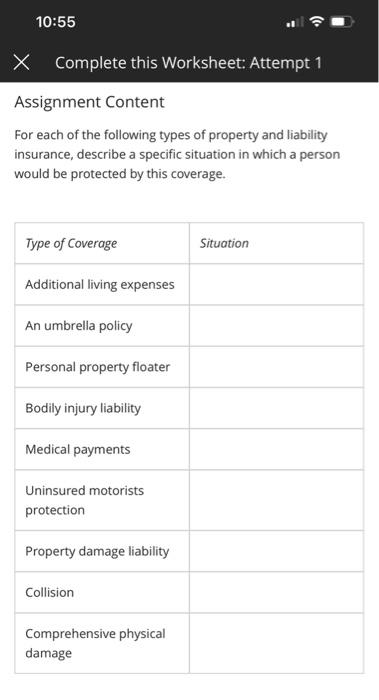

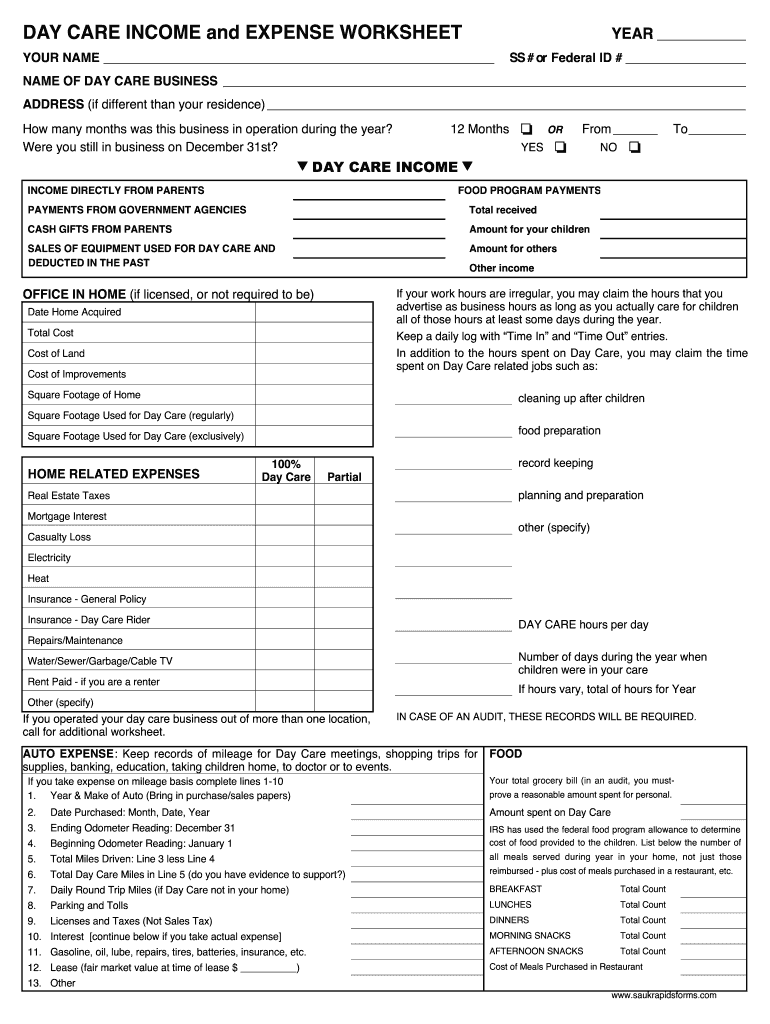

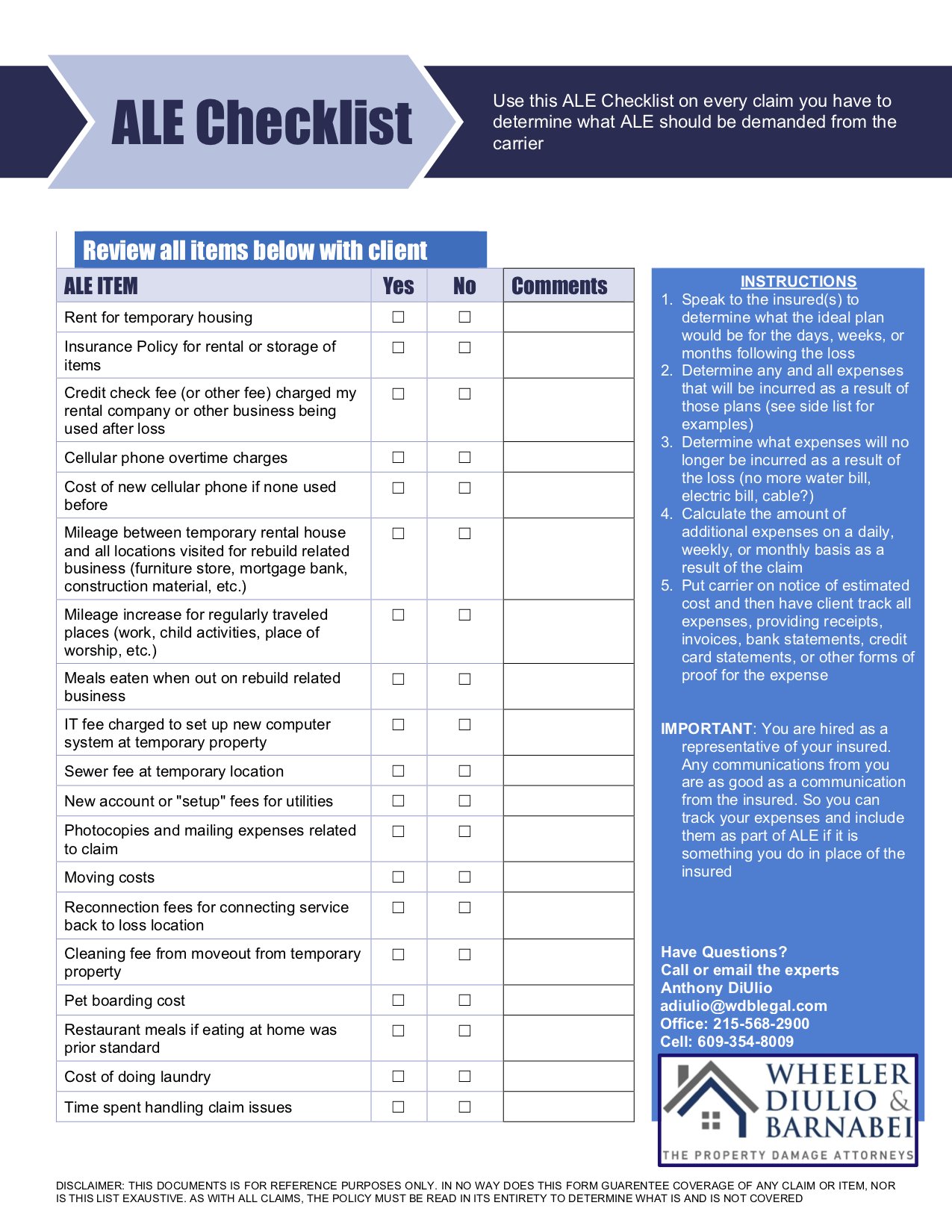

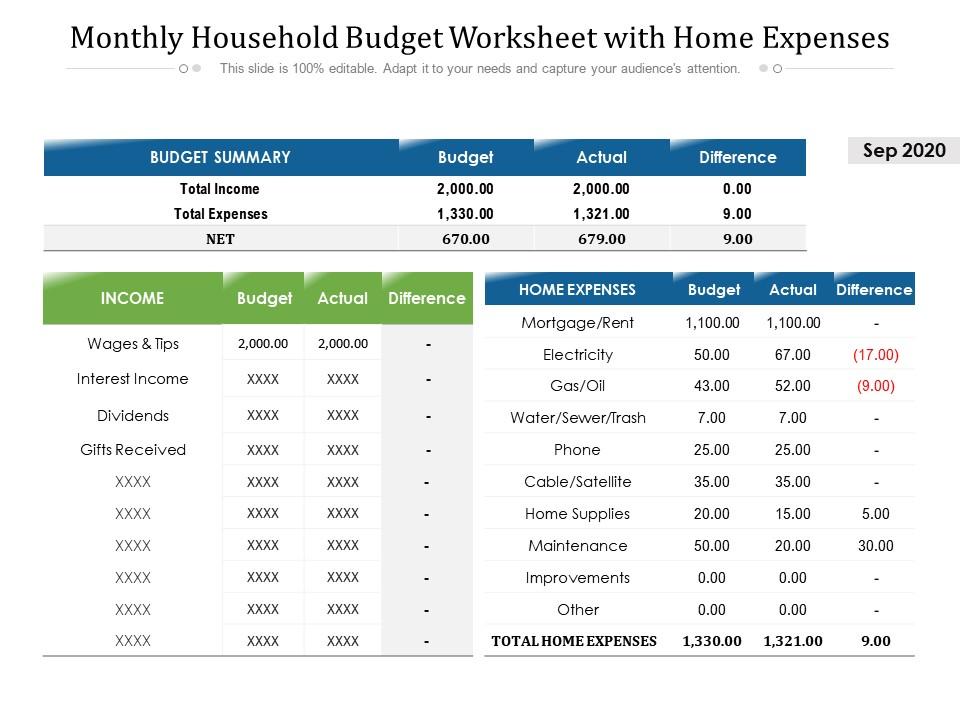

43 additional living expenses worksheet

45 CFR 46 | HHS.gov The HHS regulations for the protection of human subjects in research at 45CFR 46 include five subparts. Subpart A, also known as the Common Rule, provides a robust set of protections for research subjects; subparts B, C, and D provide additional protections for certain populations in research; and subpart E provides requirements for IRB registration. M&IE Breakdown | GSA Aug 16, 2022 · M&IE Breakdown; M&IE Total 1 Continental Breakfast/ Breakfast 2 Lunch 2 Dinner 2 Incidental Expenses First & Last Day of Travel 3; $59: $13: $15: $26: $5: $44.25: $64: $14: $16: $29

Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia.

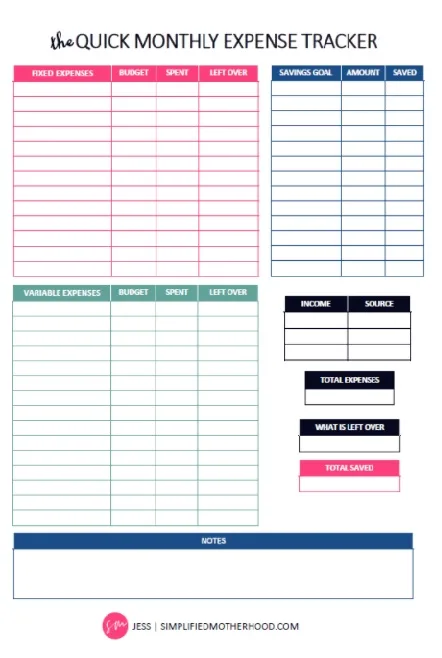

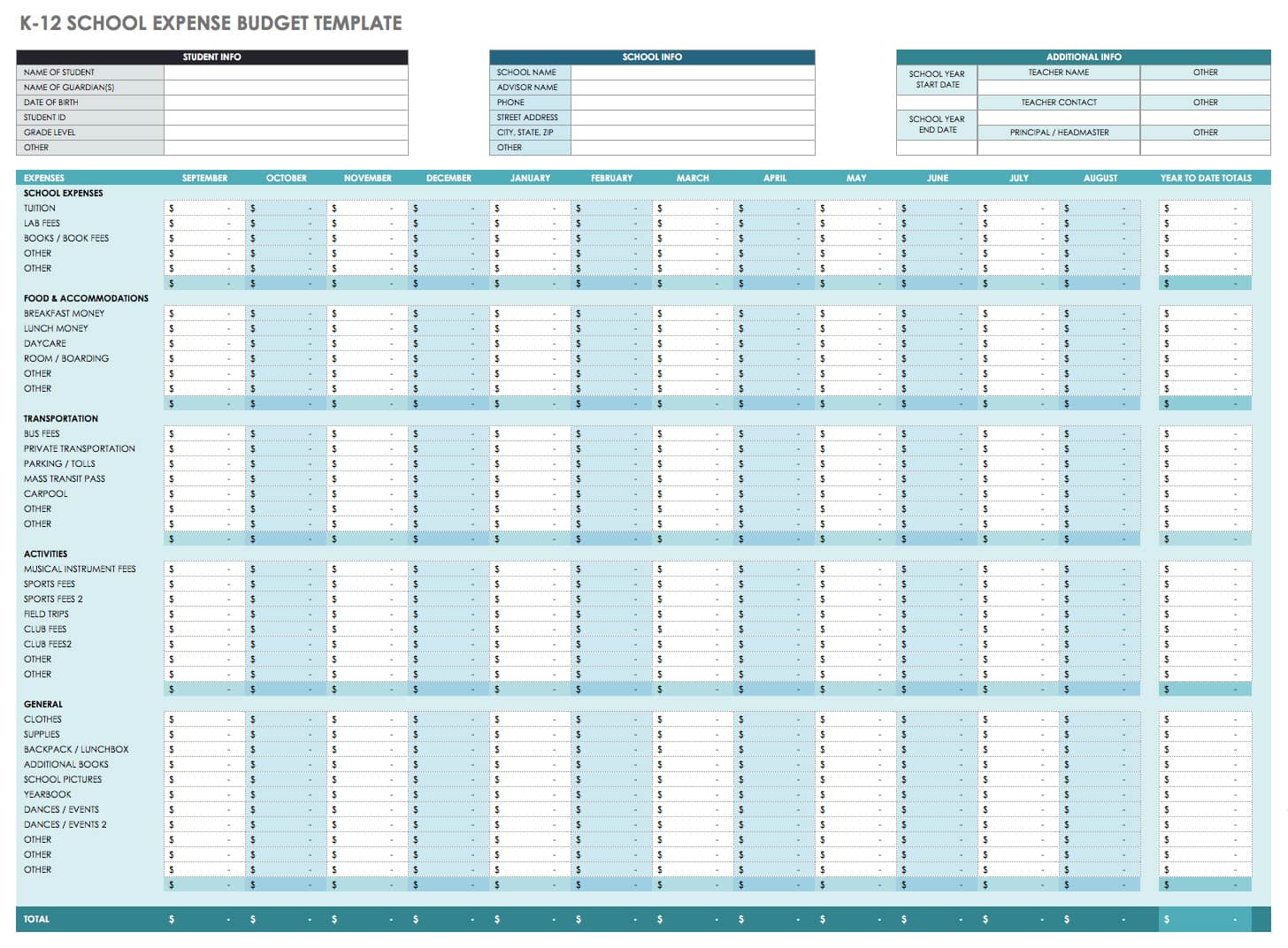

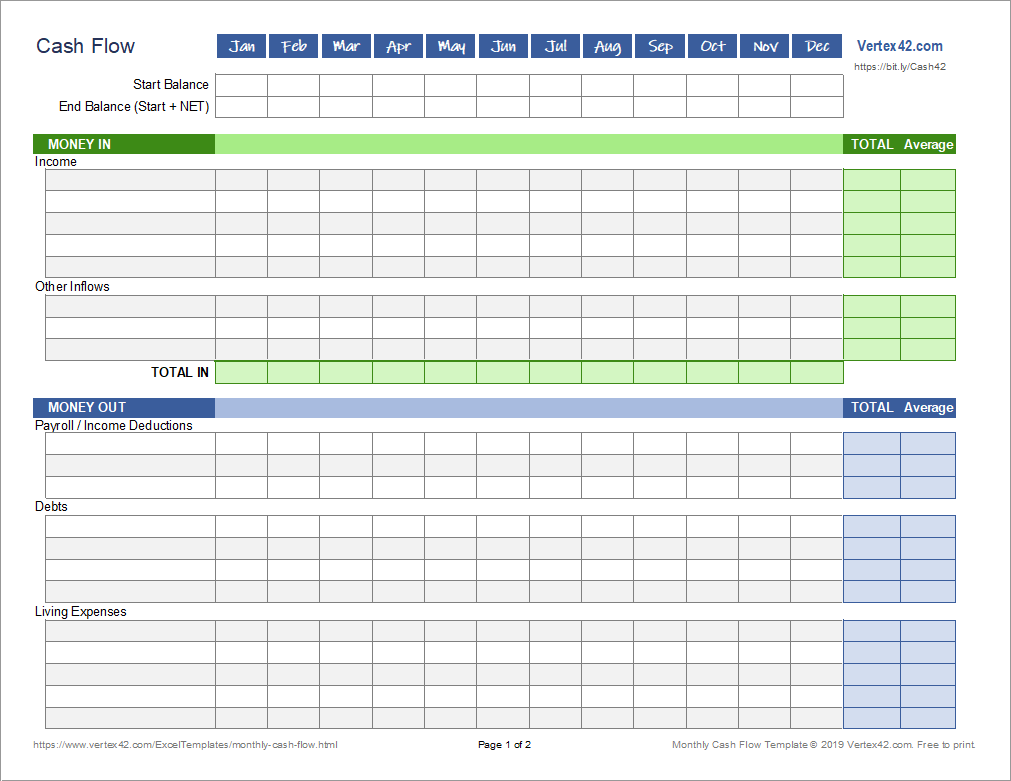

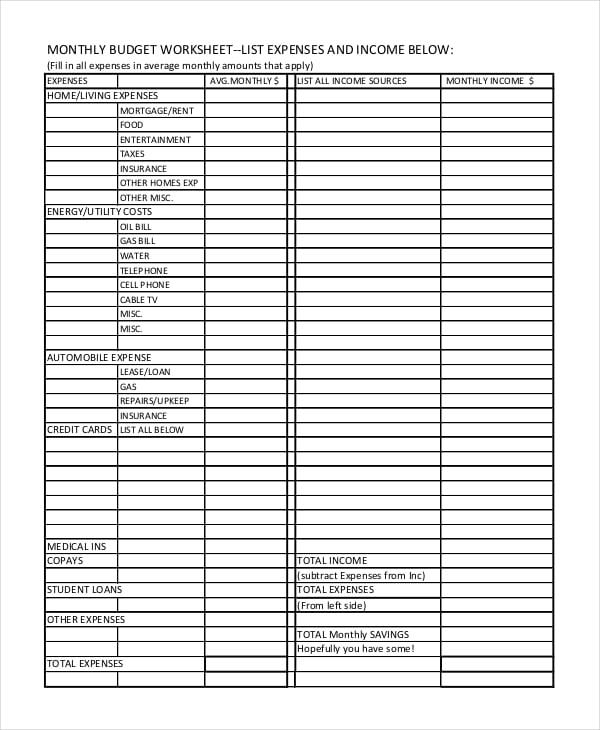

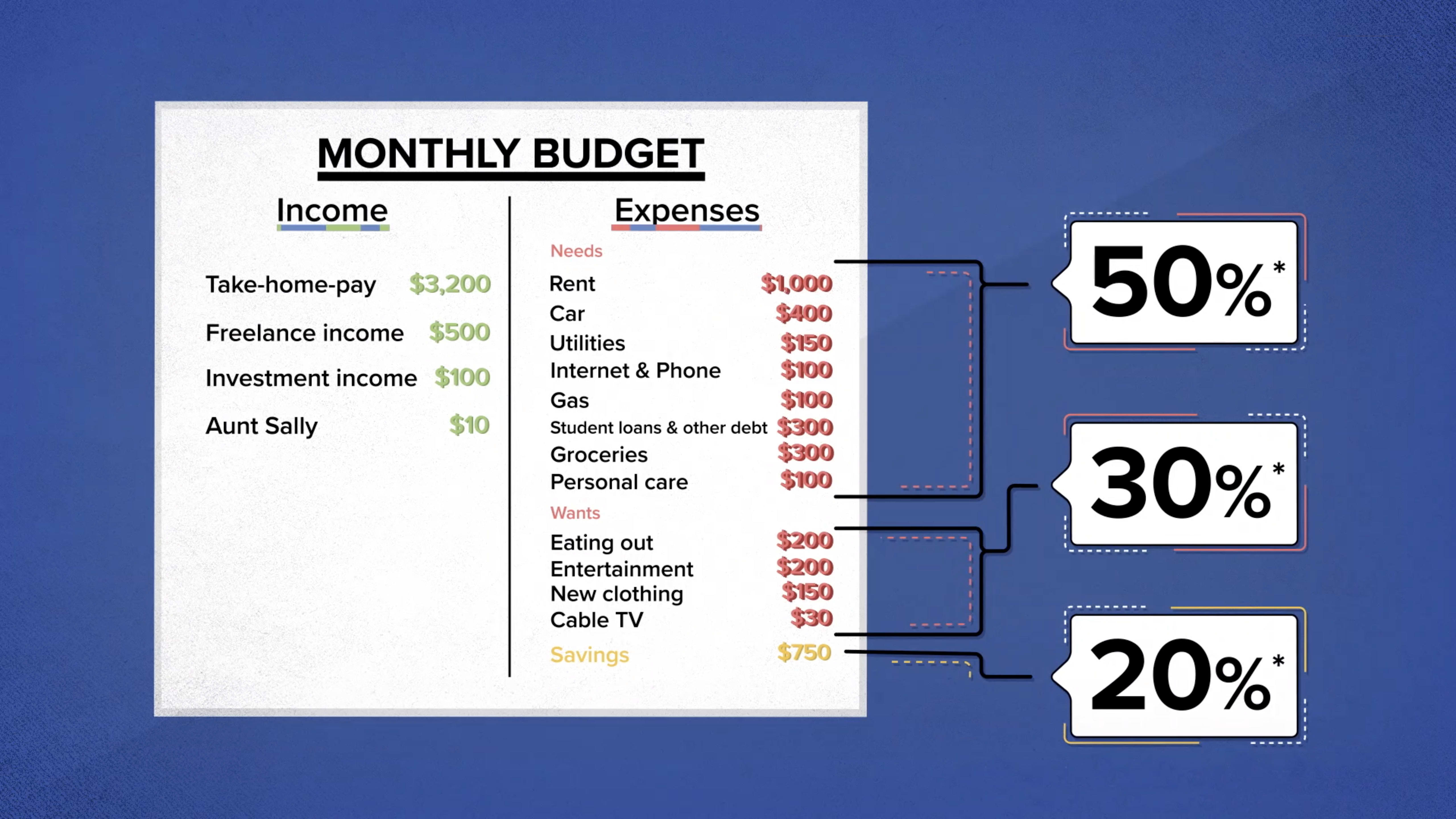

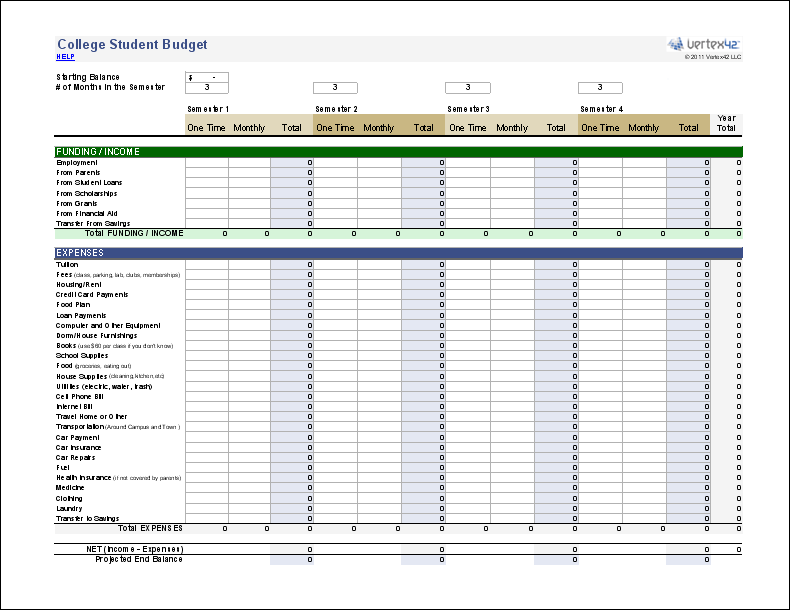

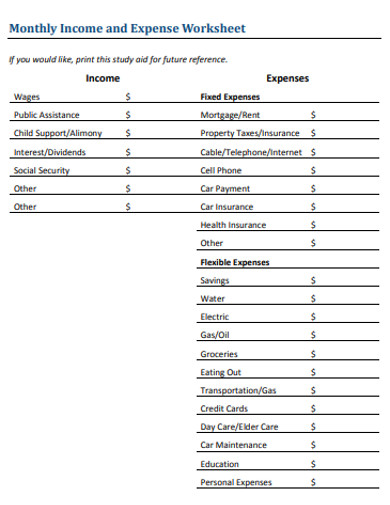

Additional living expenses worksheet

Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure your deduction. If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Publication 17 (2021), Your Federal Income Tax | Internal ... For 2021, the dollar limit on qualifying expenses increases to $8,000 for one qualifying person and $16,000 for two or more qualifying persons. The rules for calculating the credit have also changed; the percentage of qualifying expenses eligible for the credit has increased, along with the income limit at which the credit begins phasing out. Income Limits | HUD USER The Department of Housing and Urban Development (HUD) sets income limits that determine eligibility for assisted housing programs including the Public Housing, Section 8 project-based, Section 8 Housing Choice Voucher, Section 202 housing for the elderly, and Section 811 housing for persons with disabilities programs.

Additional living expenses worksheet. Personal Finance Advice and Information | Bankrate.com Nov 22, 2022 · Control your personal finances. Bankrate has the advice, information and tools to help make all of your personal finance decisions. Income Limits | HUD USER The Department of Housing and Urban Development (HUD) sets income limits that determine eligibility for assisted housing programs including the Public Housing, Section 8 project-based, Section 8 Housing Choice Voucher, Section 202 housing for the elderly, and Section 811 housing for persons with disabilities programs. Publication 17 (2021), Your Federal Income Tax | Internal ... For 2021, the dollar limit on qualifying expenses increases to $8,000 for one qualifying person and $16,000 for two or more qualifying persons. The rules for calculating the credit have also changed; the percentage of qualifying expenses eligible for the credit has increased, along with the income limit at which the credit begins phasing out. Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure your deduction. If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet.

![28 Best Household Budget Templates [Family Budget Worksheets]](https://templatearchive.com/wp-content/uploads/2020/08/household-budget-template-03-scaled.jpg)

![28 Best Household Budget Templates [Family Budget Worksheets]](https://templatearchive.com/wp-content/uploads/2020/08/household-budget-template-20.jpg)

0 Response to "43 additional living expenses worksheet"

Post a Comment