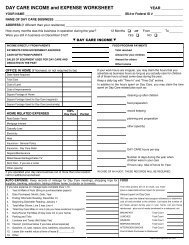

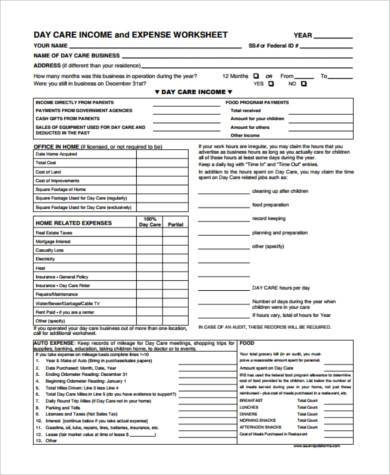

37 daycare income and expense worksheet

Listed below are the most common reoccurring monthly expenses most providers are likely to incur. MONTHLY INCOME. Parent fees. ______. Food Program ...2 pages

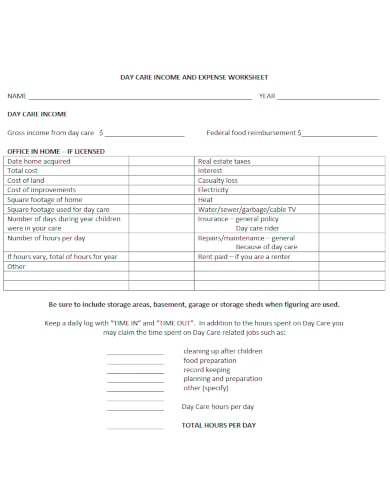

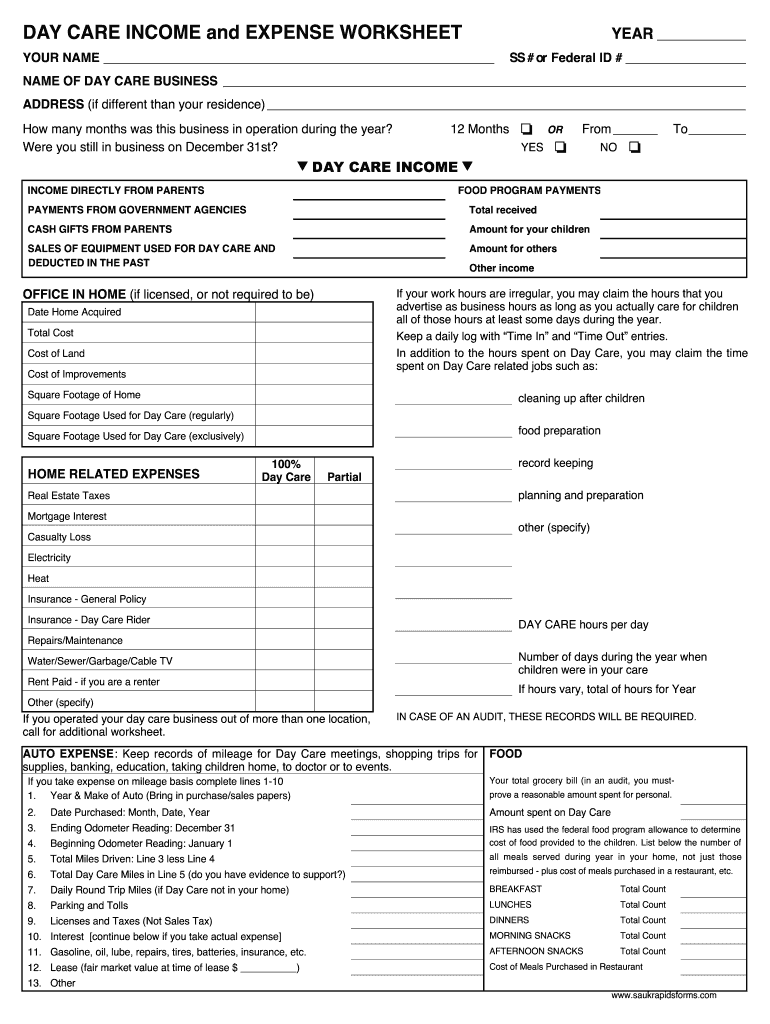

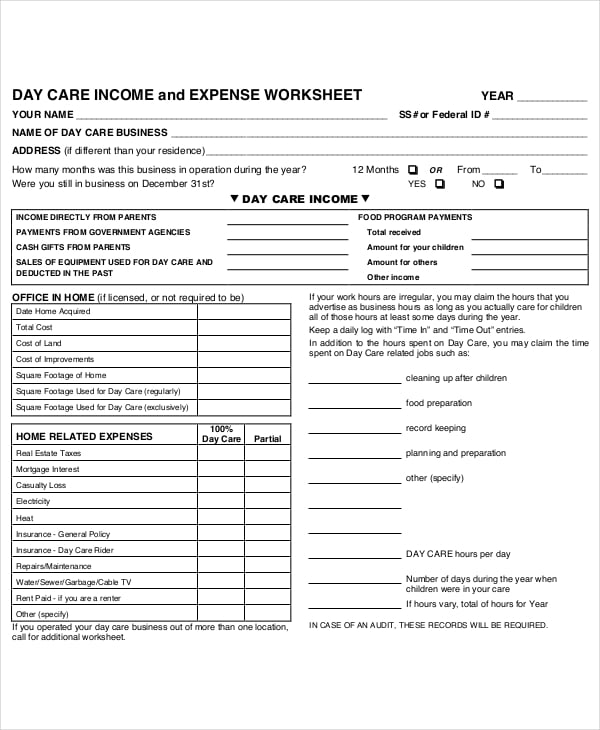

100% Day Care Use-Notice the left side of Page 2 of the daycare sheet is for items that are used exclusively for daycare. 6. Shared Expenses-Notice the right side of Page 2 lists those items you share with daycare. If you do not separate items like household supplies, cleaning supplies, kitchen supplies, bottle water,

Day Care Statement of Income And Expenses Client Name: TPC/ClientForms/Daycare Page 1 of 1 Langley Office: 604-882-9148 Maple Ridge Office: 604-476-9555. Title: Daycare Income & Expense sheet.xls Author: lwatts Created Date:

Daycare income and expense worksheet

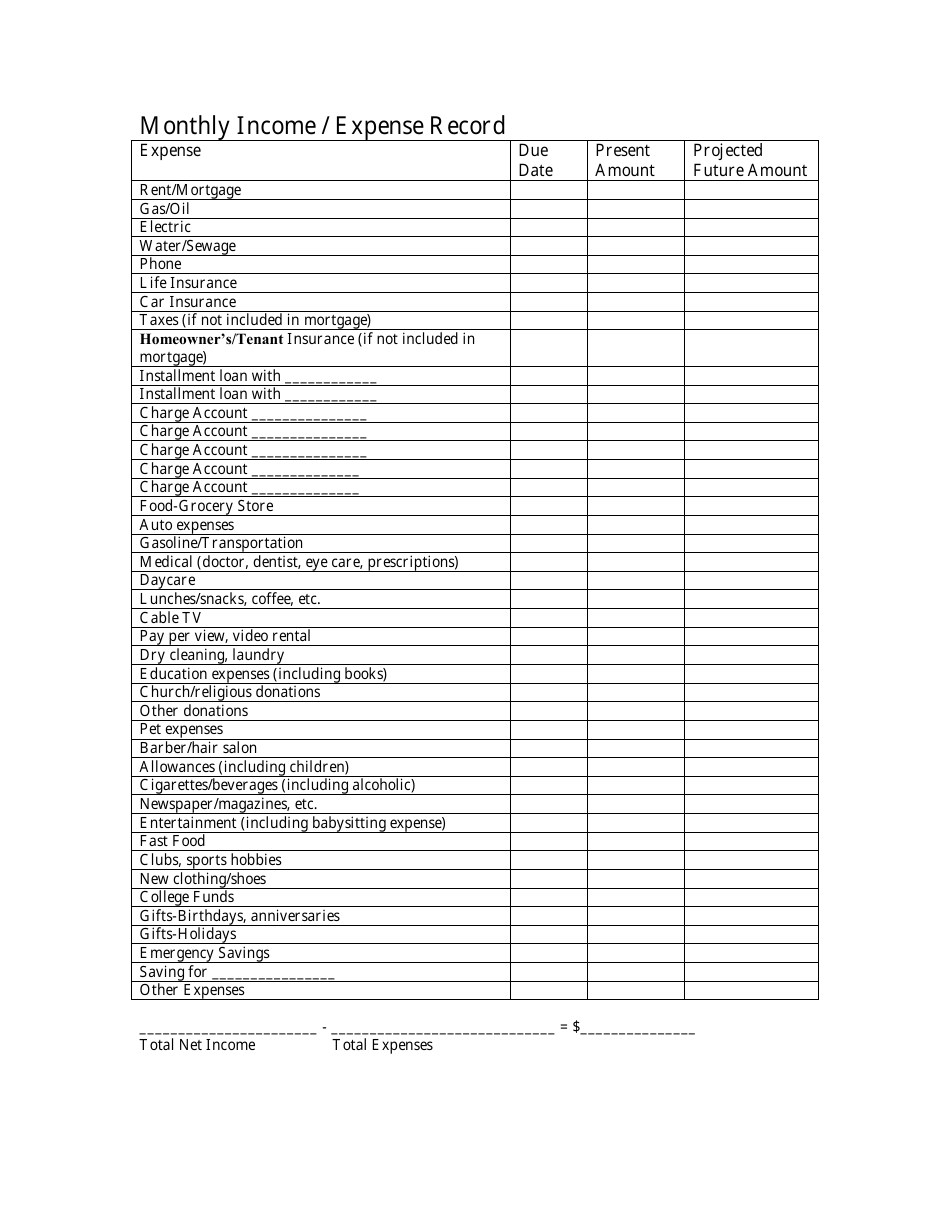

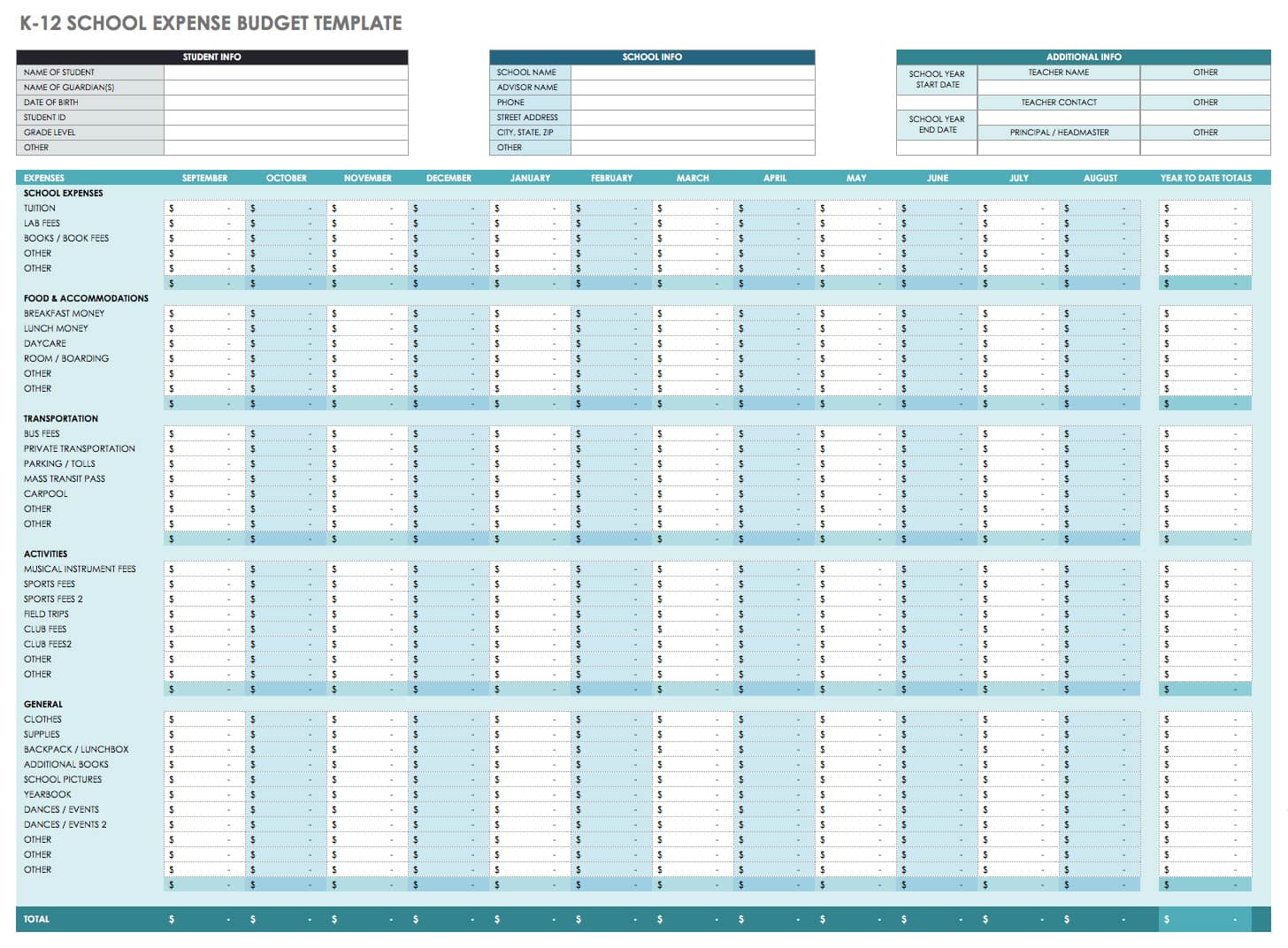

Child Care Expenses Vacations Child Care. School Tuition Hobbies. Personal Grooming Lunch Money Newspaper/Magazines School Supplies Disability Insurance Lessons, Sports Life Insurance New Clothing Legal Expenses Other Fixed Debts With Payments Balance Mo. Pmt SUBTOTAL EXPENSES PLUS MONTHLY DEBT. TOTAL EXPENSES TOTAL INCOME

List of Daycare Income And Expense Worksheet. A good director for a day care center will command a salary equal to teachers in your public schools plus fringe benefit allowances such as free enrollment for their children and perhaps medical and dental insurance if you choose to provide group coverage.

OTHER EXPENSES NOT LISTED *The IRS may allow other expenses in certain circumstances. For example, if the expenses are necessar for the health and welfare of the taxpayer or family, or for the production of income. Specify the expense and list the minimum monthly payment you are billed. Description Lawn Care Furniture Payments Cleaning Supplies

Daycare income and expense worksheet.

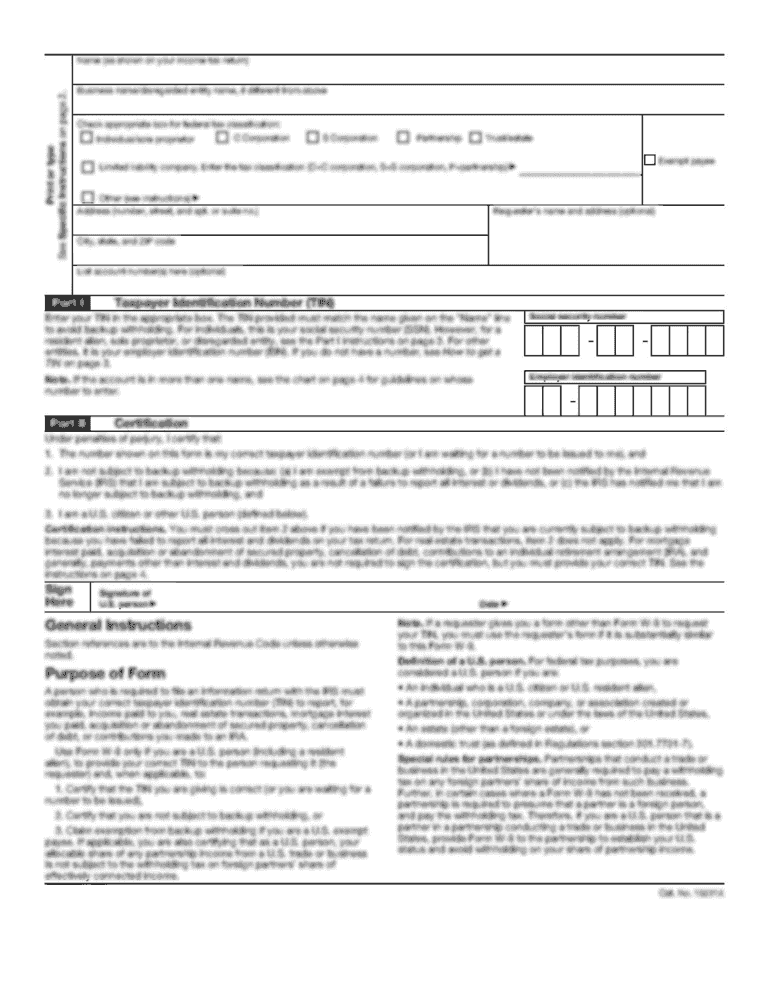

your child care business income and expenses in a way that will make sense to you and your tax preparer when the time comes to file your tax returns. Why Family Child Care Providers Should File Tax Returns • It is the law: anyone who takes home net earnings of at least $400 in a year from self-employment must file a tax return.

hello welcome to the first video for the accounting spreadsheet so when you go into your spreadsheet you'll see one — one sole proprietor income statement ...

Supplies and miscellaneous expenses (may include personal expenses). Income Issues . Introduction . Whether the child care provider is a babysitter, "Kith & Kin" type provider, a family day care operator or a child care center, the income from the activity is taxable income. The

The easy Home Income and Expense Worksheet can help with that by showing you at a glance exactly where every penny is spent. This Worksheet is an Excel spreadsheet that comes complete with calculation formulas already done for you, and a Pie Chart to see what percentages of your income each one consumes.

First off, I strongly recommend reading Tom Copeland's books, especially the Family Child Care Record-Keeping Guide.. The more detailed records you record, the better. The Redleaf Calendar-Keeper 2021 or the software KidKare are two great ways of doing that. To help you prepare your information for your tax return AND to thoroughly understand your daycare tax return (either if you do your ...

You can make an effective home daycare income worksheet by connecting the student's expenses with the family's income. Include all related expenses, both personal and household, as well as any other miscellaneous expenses. Include all sources of income such as alimony, commissions, bonuses, and rent.

Daycare Income & Expense Worksheet Year ... Daycare Income. Income from Parents &/or State Aide $ ... Interest Expense – on daycare loans only.

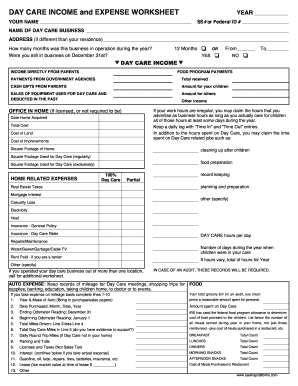

Showing top 8 worksheets in the category - Monthly Daycare Expence. Some of the worksheets displayed are Day care income and expense work, Day care providers work, Day care income and expense work year, Monthly income expense work early, Family child care provider or child care center owner, Monthly budgeting work, Day care providers work, Family child care net income work.

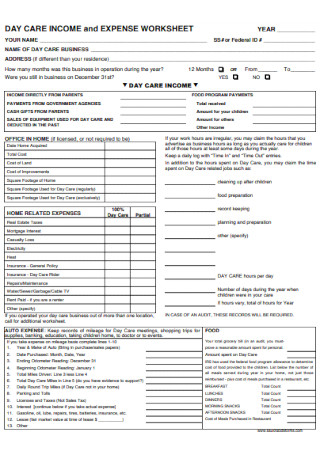

DAY CARE INCOME and EXPENSE WORKSHEET YEAR _____ YOUR ... DAY CARE BUSINESS EXPENSES (continued) MAJOR PURCHASES and IMPROVEMENTS (Computers, office equipment, furnishings) Item Purchased Date Purchased Cost Item Purchased Date of Purchase Cost CHECK LAST YEAR'S DEPRECIATION FORM TO SEE IF ALL ITEMS ARE CURRENT

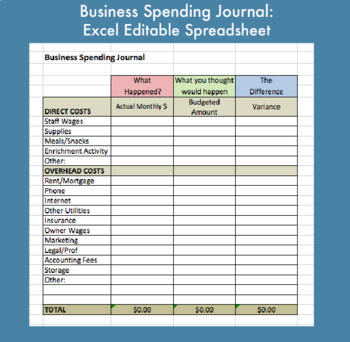

Title the first worksheet as "income" and the second one as "expenses" by right-clicking the tab at the bottom of each worksheet, then selecting the "rename" option, and entering the name. Add the headings for columns. You have to do this for all of the columns located in the top row of your daily worksheet.

Monthly Income & Expenses Worksheet: This sheet helps us determine your monthly earnings from your child care home. Use figures from last month to answer each question. If last month does not reflect an average month, use the most recent month which does.

Income and expenses listed are supported by receipts and/or other appropriate documentation which I retain on file. My signature certifies that this is an ...2 pages

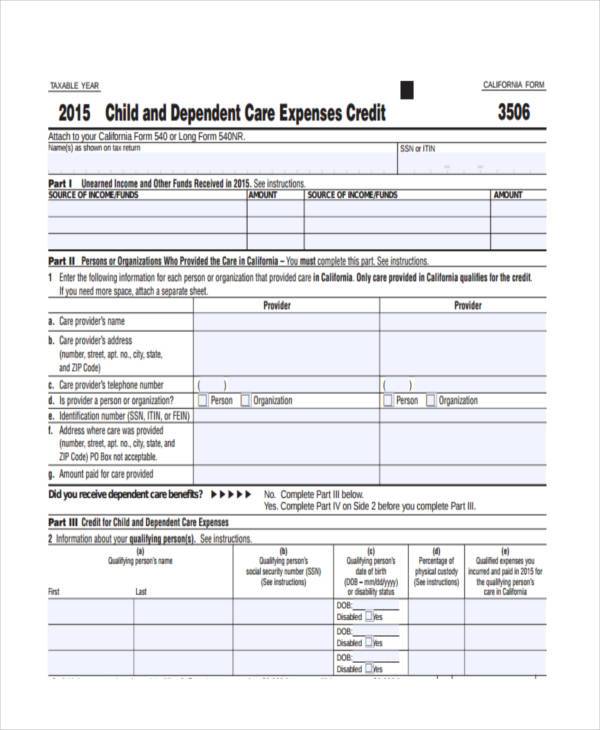

Dependent Care Tax Credit Worksheet. Use the worksheet below to determine whether a Dependent Care FSA or Dependent Care Tax Credit works best for your specific tax situation. Once you have completed the worksheet, compare your Spendable Income (line 12) in each column to determine which method will benefit you most. This worksheet does not

In 2019, Sam and Kate had childcare expenses of $2,600 for their 12-year-old child. Of the $2,600, they paid $2,000 in 2019 and $600 in 2020. Their adjusted gross income for 2019 was $30,000. Sam's earned income of $14,000 was less than Kate's earned income.

TOTAL CHILD-RELATED EXPENSES $_____ $_____ * Not Covered by Insurance TOTAL EXPENSES (Including Children) $_____ $_____ NOTE: Make two copies of this budget, one for "Pre-Divorce" and one for "Post-Divorce" expenses. Monthly Annual Expenses Expenses Monthly Annual Expenses Expenses q Pre-Divorce Expense Worksheet q Post-Divorce

YoungStar - Tools to Help Family Child Care Programs Create Budgets - Page 3 of 7 YoungStar requires that providers can show at least one area where the actual income and expenses from the previous year informs the annual budget for the current year.

Working on your income and expenses worksheet is always a great idea. Doing so will help you in planning out your budget for the next month. You can also estimate the amount of money you can spend for the whole month by calculating your expenses at the end of each day. It can also help you track where your expenses have gone to and how much money you withdrew.

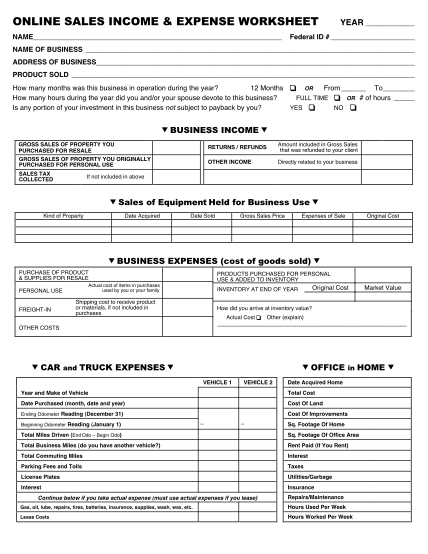

Day Care Income and Expense Worksheet mer-tax.com Details File Format PDF Size: 191 KB Download This is a professionally designed budget template which gives detailed information about the income expenditure, costs of purchases and improvements made during the year.

Printable Forms Available: Day Care Income and Expense Worksheet. January 31, 2011. In Money Tips, Tax Preparation. To make tax preparation a little easier for our clients, we have placed some popular forms on our website. Our clients who are daycare providers will find the Day Care Income and Expense Worksheet invaluable for recording their ...

DAY CARE INCOME AND EXPENSE WORKSHEET . ... DAY CARE INCOME . Gross income from day care $ _____ Federal food reimbursement $ _____ OFFICE IN HOME - IF LICENSED ... AUTO EXPENSE . Keep records of mileage for day care meetings, shopping for supplies, groceries, or to events, etc.

your child care business. For each question, use the amount you made or spent in one month, or estimate for an average month based on the last six months. In addition to this completed sheet, you must send a copy of your most recent Profit/Loss statement (Schedule C) from your last income tax form for the application to be complete. 1.

Ensure the details you add to the Daycare Income And Expense Worksheet is updated and accurate. Include the date to the sample with the Date option. Select the Sign tool and make an electronic signature. You can find 3 available choices; typing, drawing, or capturing one. Make sure that each area has been filled in properly.

Day Care/Elder Care $ Car Maintenance $ Education $ Personal Expenses $ Donations $ Total Income $ Total Expenses $ Title: Monthly Income and Expense Worksheet Author: Federal Deposit Insurance Corporation Subject: FDIC Money Smart Financial Recovery Keywords: FDIC, Money Smart, Financial Recovery

No, I haven't been closed so far this year; Yes, I was closed for a week or less; Yes, I was closed for one-four weeks; Yes, I was closed for 1-2 months

Home daycare monthly budget worksheet | tax preparation records | expense reporting | childcare | income | profit | pdf printable | editable

SUN CREST TAX SERVICE LLC. 3112 SOUTHWAY DR. ST. CLOUD, MN 56301. (320)253-3160. DAY CARE INCOME and EXPENSE WORKSHEET. Tax Year ______. PROVIDERS NAME ...2 pages

Sq. Ft of Residency Sq. Ft of Daycare PROVIDER MONTHLY INCOME WORKSHEET To Determine Income Qualification Last Month's Gross Household Income: Parent Fees For Day Care (provide copy of payment records) $ Salary received from Outside Employment (provide copy of last paystub) $ Child Support (provide copy of court decree) $ Other Household Income

![Free Household Budget Worksheet [Excel, Word, PDF] - Best ...](https://www.bestcollections.org/wp-content/uploads/2021/04/household-budget-worksheet-for-wisconsin-works.jpg)

0 Response to "37 daycare income and expense worksheet"

Post a Comment