40 ira deduction worksheet 2014

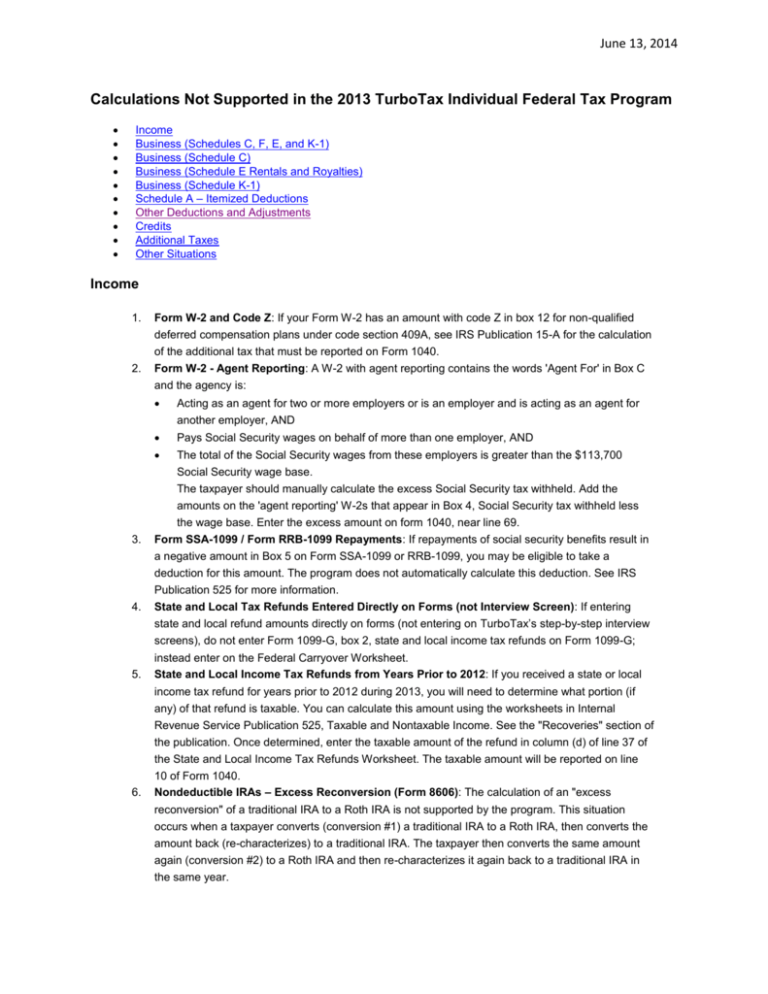

Employees’s Withholding Allowance Certificate which you expect your estimated deductions for the year to exceed your allowable standard deduction. Worksheet B . Estimated Deductions. Use this worksheet . only. if you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage income not subject to . withholding. 1. Enter an estimate of your itemized deductions for … Should You Contribute to a Non-Deductible IRA? 02.12.2021 · For a deductible IRA, filing as single or head of household eligibility phases out between $66,000 and $76,000 of modified adjusted gross income (MAGI) for 2021. In 2022 it goes up to $68,000 and ...

English ESL deduction worksheets - Most downloaded (19 Results) A collection of English ESL worksheets for home learning, online practice, distance learning and English classes to teach about deduction, deduction. Grammar guide for advanced students to learn how to use modal verbs of deduction and speculation in the present and in the past.

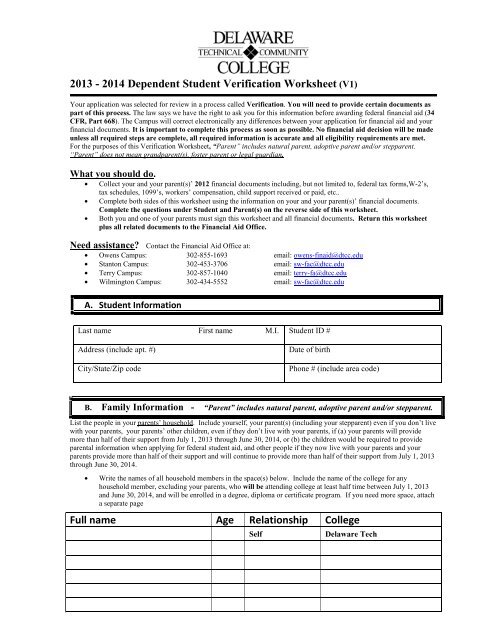

Ira deduction worksheet 2014

Traditional IRA Deductibility Limits | Deducting Your IRA Contribution A single filer with no employer-sponsored retirement plan can deduct the full amount of a traditional IRA contribution. However, if you are covered by a retirement plan at work Couples who are married filing jointly can take the full IRA deduction if neither spouse is covered by a retirement plan at work. Why an IRA Deduction Is the Same Thing As Free... | The Motley Fool How IRAs work for you The basics of the deduction work like this: Every year, you're entitled to reduce your taxable income by up to $5,500 so long as you contribute the money to a By contrast, now let's assume that Robert contributes $5,500 to a traditional IRA, which is equal to the limit for 2014. Ira Deduction Worksheet — excelguider.com A Ira Deduction Worksheet is several short questionnaires on a certain topic. Ira Deduction Worksheet need to be child friendly. The particular issue level to a worksheet must be minimum. Worksheet should've clarity in questioning avoiding any ambiguity.

Ira deduction worksheet 2014. Roth IRA - Wikipedia A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan … PDF 2016-HQFO-00116 - A-File Record -Redacted.pdf Part Ill - IRA Deduction Worksheet Computation. 47 , 977. You can make a 2013 IRA contribution until the April 15, 2014 tax filing deadline. If you'll'l3 retired, or changed jobs, Union. Bank can also help you transfer your employer sponsored retirument plan with a Rollover IRA. Deductions Allowed for Contributions to a Traditional IRA - TheStreet Traditional individual retirement accounts, or IRAs, are tax-deferred, meaning that you don't have to pay tax on any interest or other gains the account earns until you withdraw the For purposes of the IRA deduction, earned income excludes interest, dividends, and similar types of investment income. Taxes - 2021 Retirement & Pension Information The deduction is $20,000 for a return filed as single or married, filing separately, or $40,000 for a return filed as married, filing jointly. If you checked either SSA Exempt box 22C or 22G from Schedule 1, your deduction is increased by $15,000. If you checked both boxes 22C and 22G your deduction is increased by $30,000.

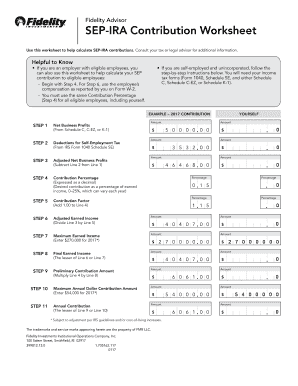

PDF 2014 DRAFT FORM F-1040 08282014.xlsx Flint IRA deduction based upon individual's earned income. Amount individual's federal IRA 5. deduction exceeds individual's. NONRESIDENT: Nonresidents use the nonresident deduction column of this worksheet to calculate their deduction. Form 1040, Schedule 1, IRA deduction in ProConnect Tax ProConnect Tax will generate a worksheet titled IRA Deduction Worksheet (Schedule 1, Line 19) showing how the deduction was calculated based on taxpayer age, employer retirement plan coverage, modified adjusted gross income threshold (if applicable), and earned income. IRS Publication 721: Tax Guide To U.S. Civil Service ... 30.11.2020 · IRS Publication 721 is the tax guide to civil service retirement benefits. The Internal Revenue Services publishes Publication 721 annually and details information about tax information for ... PDF Simplified Employee Pension Plans (SEP IRAs) | Contribution... Sep ira contribution worksheet. This worksheet will assist you with calculating your For self-employed individu-als, earned income refers to net business profits derived from the business, reduced by a deduction of one-half of your self-employment tax, less your SEP IRA contribution.

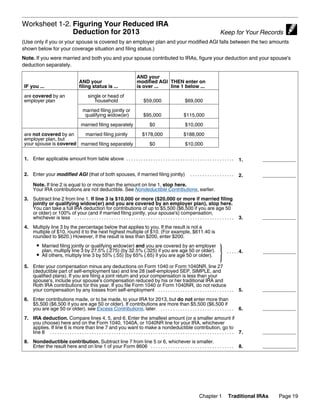

2014 Traditional IRA Deductions | Ed Slott and Company, LLC 2014 Traditional IRA Deductions. If you are covered by a retirement plan at work, use this IRS table to determine if you can deduct your 2014 Traditional IRA contribution Ira Deduction Worksheet — db-excel.com Ira Deduction Worksheet in a learning medium may be used to try students capabilities and understanding by addressing questions. Since in the Student Worksheet about 90% of the articles of the complete guide are issues, both numerous decision and solution questions which are not available. Remind students that this topic covers traditional IRA... | Course Hero Visuals: Form 1040 Instructions IRA Deduction Worksheet Form 1040 , line 32 Pub 17 , Individual Retirement Arrangements chapter Pub 4012, Adjustments tab: Adjustments to Income Form 1099-R Internet: Roth IRA Contributions. PDF Merrill Edge® Self-Directed Inherited IRA Account How IRA contributions affect Roth IRA contributions [64] Your IRA contributions for a year will reduce the amount you can contribute to a Roth IRA IRA. We'll use the Uniform Lifetime Table to determine your distribution period, unless our records show that you qualify for the Joint and Last Survivor Table.

PDF Drake-produced PDF | Spouse's IRA IRA Deduction Worksheet - Line 32. (Keep for your records). You may not be able to use this worksheet. Figure any write-in adjustments to be entered on the dotted line next to line 36 (see instructions for line 36).

2022 IRA Contribution and Deduction Limitations IRA Contribution Limits. Deadlines for Making Contributions. Where to Claim the Tax Deduction. If you are covered by a retirement plan at work, how much of your contributions you can deduct is based on your filing status and MAGI.

Publication 536 (2020), Net Operating Losses (NOLs) for ... USE YOUR 2020 FORM 1040, 1040-SR, 1040-NR, OR 1041 TO COMPLETE THIS WORKSHEET: 1. Enter as a positive number your NOL deduction for the NOL year entered above from Schedule 1 (Form 1040) or Form 1040-NR, line 8; or Form 1041, line 15b _____ 2. Enter your taxable income without the NOL deduction for 2020. See instructions _____ 3.

Ira Deduction Worksheet 2014 - Nidecmege Ira deduction worksheet 2014. Your deduction is phased out if your magi is more than 189000 but less than 199000 if youre married and your spouse Examples worksheet for reduced ira deduction for 2014. 50000 from schedule c c ez or k 1 step 2deduction for self employment tax 2. An individual...

Sales Tax Deduction Worksheet Sales Tax Deduction Worksheet (for use with IRS Sales Tax Calculator). Clear and reset calculator. + Tax-exempt Interest. Form 1040. + Total IRA Distributions SUBTRACT any rollover amounts included in the line above.1,2 SUBTRACT Taxable IRA Distributions2.

PDF Tax deposition questions: 1. liability Adjustments to Income 451 Individual retirement. arrangements (IRAs) 452 Alimony paid 453 Bad debt deduction 454 Tax shelters 455 Moving expenses 456 Student loan interest deduction 457 Deduction for higher education. IRA Deduction Worksheet—Line 23.

Itemized Deduction Worksheet printable pdf download View, download and print Itemized Deduction Worksheet pdf template or form online. For traditional IRAs. Roth IRAs are not deductible. Some contributions for last year may be made this

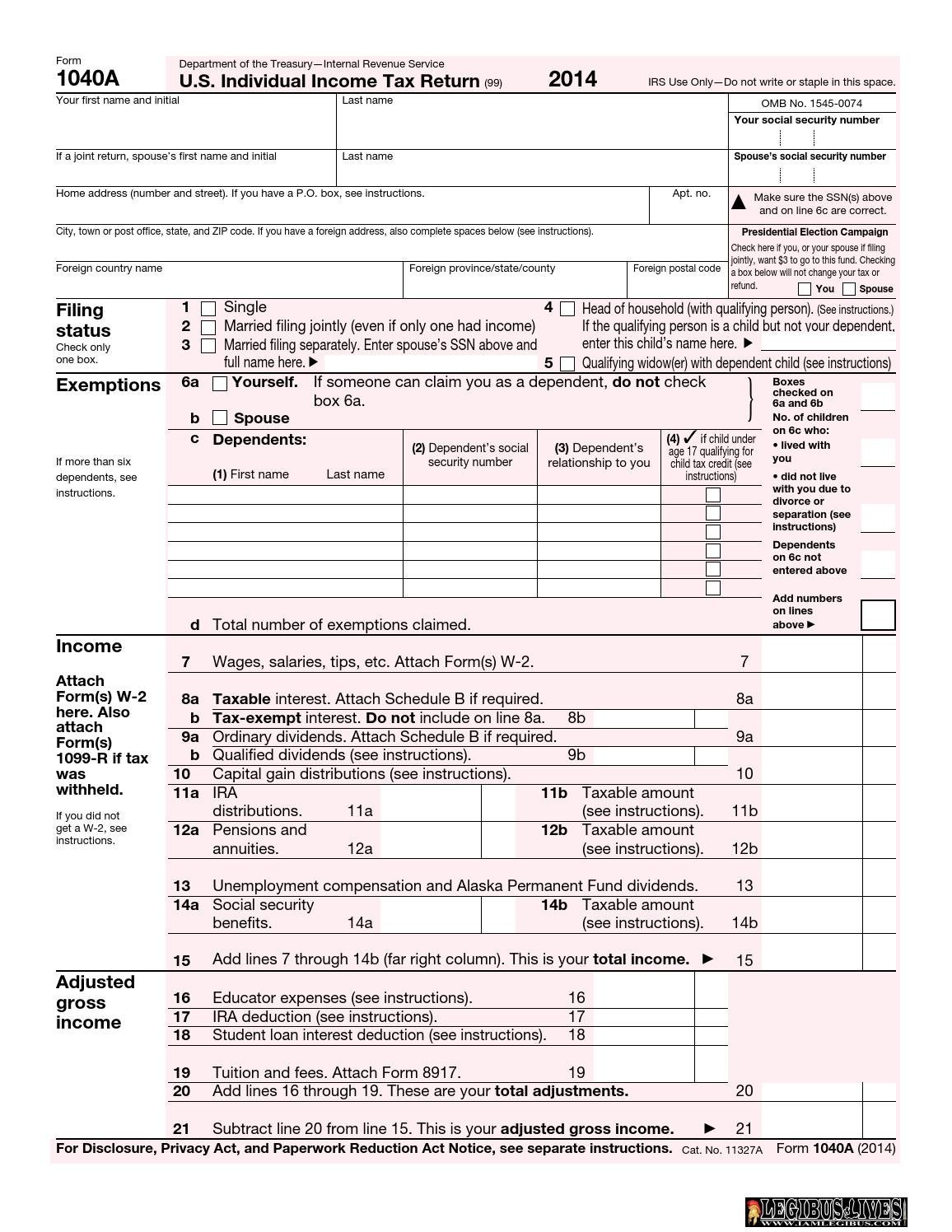

e-filing Use the IRA Deduction Worksheet in these instructions to figure the amount, if any, of your IRA deduction. But read the following 11-item list before you fill in the worksheet. 1. If you were age 701 2 or older at the end of 2014, you cannot deduct any contributions made to your traditional IRA for...

PDF Examples — Worksheet for Reduced IRA Deduction for 2013 Traditional IRA contribution and deduction limit. For 2014, if you are covered by a retirement plan at work, your deduction for contributions to a tradi-tional IRA is reduced (phased out) if your modified AGI is

Publication 590-B (2020), Distributions from Individual ... After you complete Worksheet 1-2 in chapter 1 of Pub. 590-A or the IRA Deduction Worksheet in the form instructions, enter your nondeductible contributions to traditional IRAs on line 1 of Form 8606. Complete lines 2 through 5 of Form 8606. If line 5 of Form 8606 is less than line 8 of Worksheet 1-1, complete lines 6 through 15c of Form 8606 and stop here. If line 5 of Form …

PDF Arkansas 2014 Arkansas 2014 Individual Income Tax. Forms and Instructions. Your traditional IRA distribution may be adjusted for nondeduct-ible IRA contributions, if any, by completing Federal Self-employed health insurance deduction worksheet. 1. Enter the amount you paid in 2014 for health...

Session 9 IRAs-Traditional Deductions and Roth Contributions Session Details. IRA Statutory Requirements. Traditional IRA Deduction Phaseout Amounts (2014). Calculation of Deductible IRA Contribution • Determine the deductible percentage • Multiply by the maximum contribution amount • The result is the maximum dollar amount that can be deducted...

Fill - Free fillable 2018 Form 1040 IRA Deduction Worksheet PDF form Fill Online, Printable, Fillable, Blank 2018 Form 1040 IRA Deduction Worksheet Form. Use Fill to complete blank online IRS pdf forms for free. All forms are printable and downloadable. 2018 Form 1040 IRA Deduction Worksheet (Schedule 1, Line 32). On average this form takes 6 minutes to...

2014 TaxReturn | PDF | Tax Refund | Tax Deduction Health Insurance Coverage for Individuals - This form may be used to report health insurance coverage information for each individual whose health coverage is NOT reported on a Form QuickZoom to the IRA Information Worksheet for IRA information. Excess Contributions 2013 2014.

Ira Deduction Worksheet | Homeschooldressage.com Publication 590 Individual Retirement Arrangements IRAs from Ira Deduction Worksheet, source:webapp1.dlib.indiana.edu. Traditional IRA Contribution and Deduction Limitations from Ira Deduction Worksheet, source:thebalance.com. Publication 536 2016 Net Operating Losses NOLs...

How to Figure IRA Deduction 1040 | Pocketsense You can figure your individual retirement account deduction on the IRA Deduction Worksheet in the Internal Revenue Service Instructions for Form 1040, the Individual Tax Return. The amount you can deduct depends on your contributions, your age, your income and the type of IRA you use.

Roth vs. Traditional IRA: Which Is Right For You? - NerdWallet Traditional IRA contributions can be tax-deductible; retirement withdrawals are taxable. These income limits apply only if you (or your spouse) has a retirement plan at work. The limits are based on modified adjusted gross income, which is your adjusted gross income with some deductions added...

PDF Microsoft Word - 2013 CF-1040 TABLE OF CONTENTS R 11062013.doc Page 11 IRA Deduction Worksheet Page 12 Self-employed SEP, SIMPLE, and Qualified Retirement Plan Deduction. Other than the rollover of the dates to 2014, there are few changes to the forms, schedules and worksheets. A listing of the changes is attached as page xx of these instructions.

Ira Deduction Worksheet — excelguider.com A Ira Deduction Worksheet is several short questionnaires on a certain topic. Ira Deduction Worksheet need to be child friendly. The particular issue level to a worksheet must be minimum. Worksheet should've clarity in questioning avoiding any ambiguity.

Why an IRA Deduction Is the Same Thing As Free... | The Motley Fool How IRAs work for you The basics of the deduction work like this: Every year, you're entitled to reduce your taxable income by up to $5,500 so long as you contribute the money to a By contrast, now let's assume that Robert contributes $5,500 to a traditional IRA, which is equal to the limit for 2014.

Traditional IRA Deductibility Limits | Deducting Your IRA Contribution A single filer with no employer-sponsored retirement plan can deduct the full amount of a traditional IRA contribution. However, if you are covered by a retirement plan at work Couples who are married filing jointly can take the full IRA deduction if neither spouse is covered by a retirement plan at work.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

0 Response to "40 ira deduction worksheet 2014"

Post a Comment