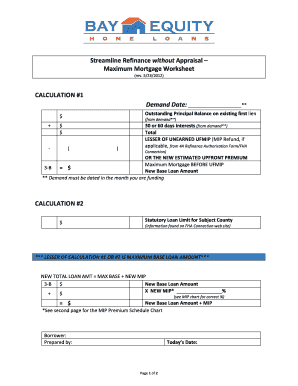

41 fha streamline refinance worksheet

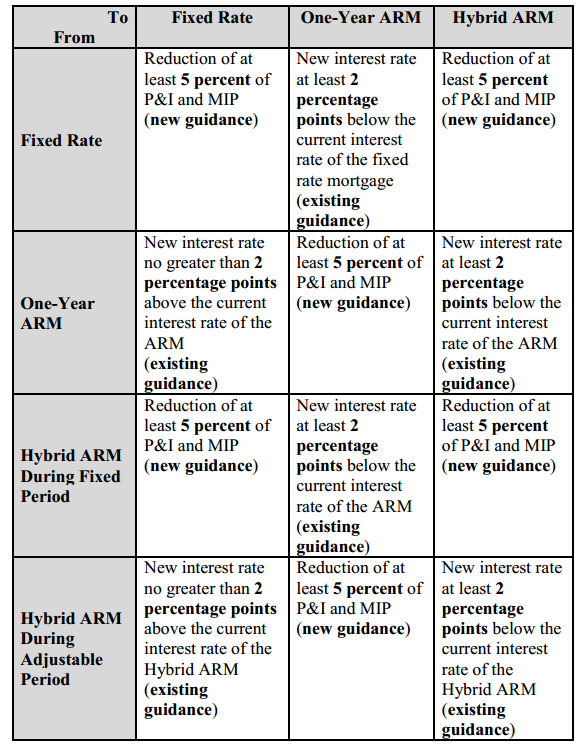

› overwatch-2-reaches-25-millionOverwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc › housing › sfhStreamline Refinance Your Mortgage | HUD.gov / U.S ... Cash in excess of $500 may not be taken out on mortgages refinanced using the streamline refinance process. Investment Properties are only eligible for FHA insurance if the borrower is a HUD-approved Nonprofit Borrower, or a state and local government agency, or an Instrumentality of Government.

The EU Mission for the Support of Palestinian Police and Rule of Law EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Fha streamline refinance worksheet

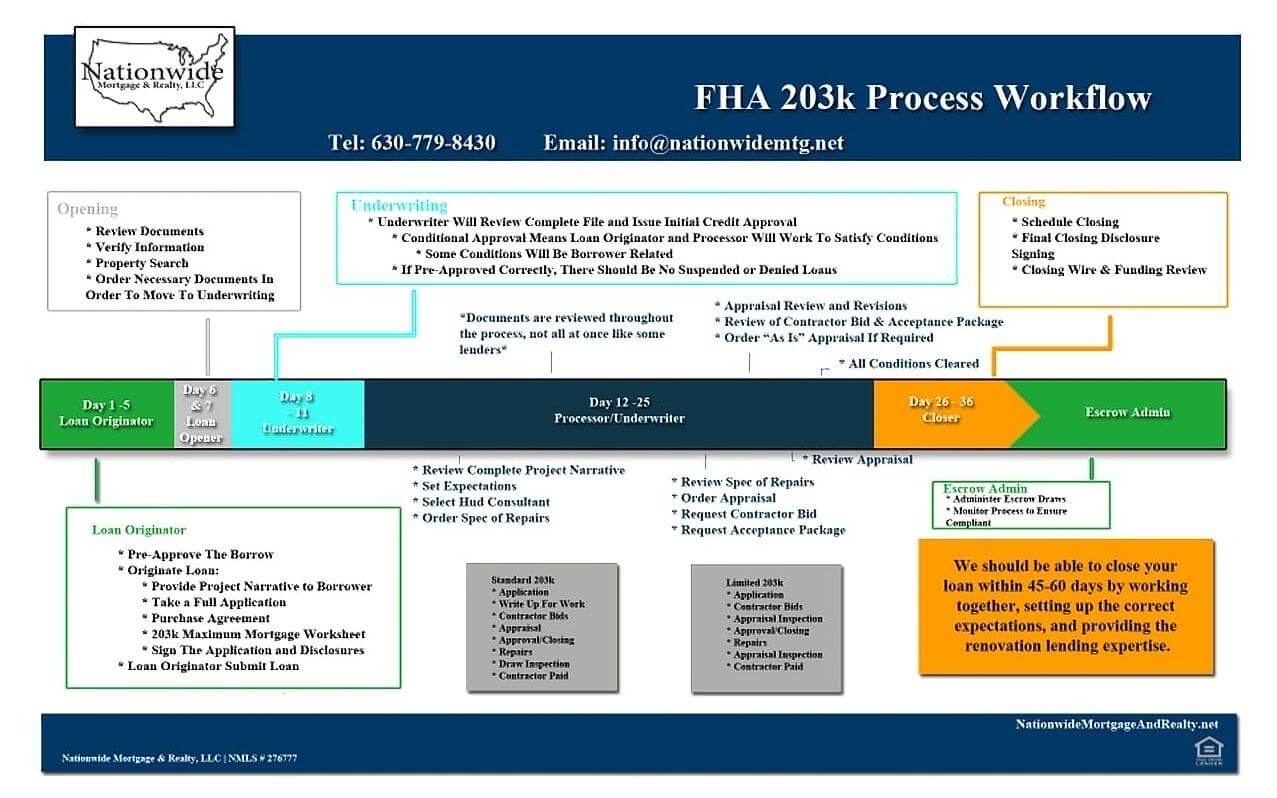

News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more VA Loan Closing Costs - Complete List of Fees to Expect Who pays what in closing costs and concessions is always up for negotiation. Seller concessions on VA loans are limited to 4% of the purchase price, but it’s important to understand that sellers aren’t obliged to pay any costs on your behalf. But you can always request that the sellers pay a portion, or all, of the closing costs when you’re making a formal offer on a home. FHA 203k Loans: How Does It Work? | Requirements 2022 Two Types of FHA 203k Loans. It’s important to note that there are two sub-types of 203k loan program: the full 203k, and the Streamline 203k. In this article, we will focus mainly on the Streamline 203k loan, since it is the most popular type, and will suit most homeowners who are looking to buy a fixer-upper. Additionally, many more lenders ...

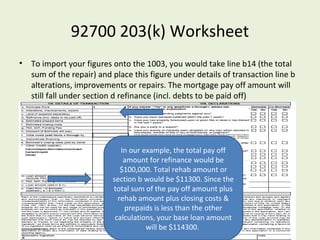

Fha streamline refinance worksheet. › fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. PPIC Statewide Survey: Californians and Their Government 26/10/2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and … mymortgageinsider.com › fha-streamline-203k-rehab-loanFHA 203k Loans: How Does It Work? | Requirements 2022 The HUD-92700 “203k Worksheet” As part of the 203k process, you will need to sign the FHA 203k Worksheet, also called the HUD-92700. This form is a breakdown of all loan costs, 203k fees, purchase price, repair bid amount, final loan amount, etc. Your lender will provide you with this form. › news-and-insightsNews and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

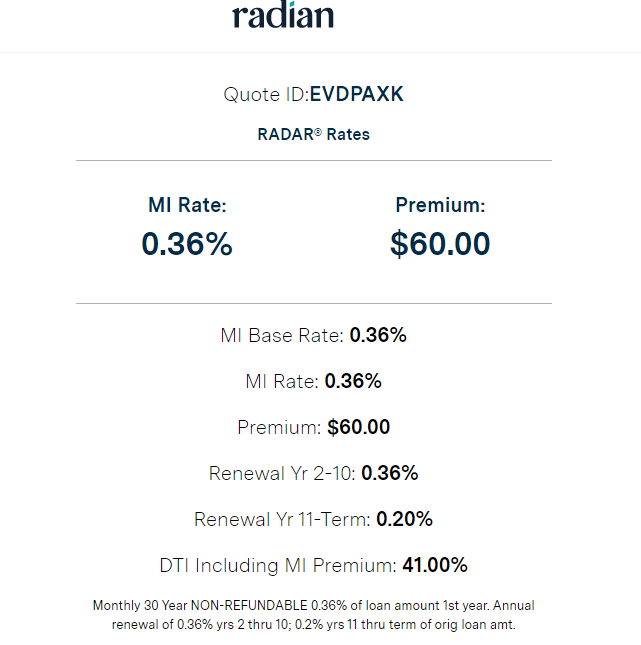

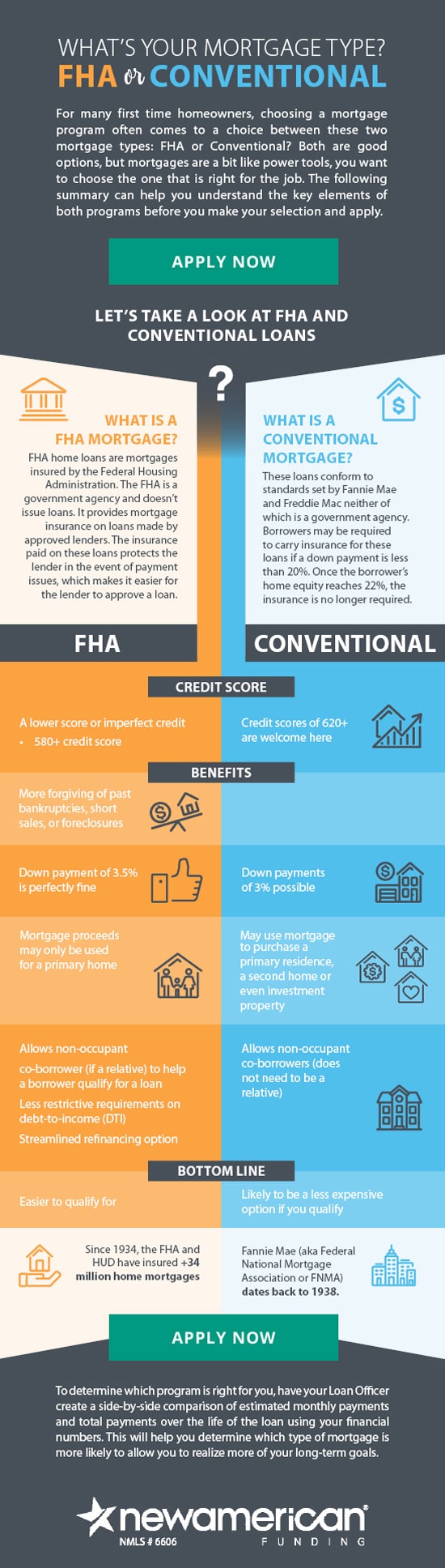

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Loan Modification Vs. Refinance | Rocket Mortgage 16/09/2022 · However, you can cancel private mortgage insurance on a conventional loan as soon as you reach 20% equity. Many homeowners refinance their FHA loan to a conventional loan after they achieve 20% equity for this same reason. Take a cash-out refinance. A cash-out refinance allows you to draw money from your home equity to cover outside expenses ... Is PMI Mortgage Insurance Tax Deductible in 2022? - RefiGuide 02/01/2018 · You will not need to pay for PMI any more once you have 20% of equity in the property. The only exception to that is recent FHA loans; if you put 3.5% down, you cannot cancel PMI. FHA loans with at least 10% down can cancel PMI after 11 years. For others, you should verify if you have hit at least 20% equity in your home. It would be unusual ... › newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

› pmi-mortgage-insurance-taxIs PMI Mortgage Insurance Tax Deductible in 2022? - RefiGuide Jan 02, 2018 · You will not need to pay for PMI any more once you have 20% of equity in the property. The only exception to that is recent FHA loans; if you put 3.5% down, you cannot cancel PMI. FHA loans with at least 10% down can cancel PMI after 11 years. For others, you should verify if you have hit at least 20% equity in your home. Unbanked American households hit record low numbers in 2021 25/10/2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ... Could Call of Duty doom the Activision Blizzard deal? - Protocol 14/10/2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. FHA 203k Loans: How Does It Work? | Requirements 2022 Two Types of FHA 203k Loans. It’s important to note that there are two sub-types of 203k loan program: the full 203k, and the Streamline 203k. In this article, we will focus mainly on the Streamline 203k loan, since it is the most popular type, and will suit most homeowners who are looking to buy a fixer-upper. Additionally, many more lenders ...

VA Loan Closing Costs - Complete List of Fees to Expect Who pays what in closing costs and concessions is always up for negotiation. Seller concessions on VA loans are limited to 4% of the purchase price, but it’s important to understand that sellers aren’t obliged to pay any costs on your behalf. But you can always request that the sellers pay a portion, or all, of the closing costs when you’re making a formal offer on a home.

News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

0 Response to "41 fha streamline refinance worksheet"

Post a Comment