37 debt snowball worksheet excel

The debt-snowball method is a debt repayment strategy, in which one pays off the accounts starting with the smallest balances first, while paying the minimum payment on larger debts. This is different from the traditional wisdom of paying the debt with the largest interest rate first.

Debt Snowball Worksheet For Excel Debt snowball, Debt . Credit Card Snowball Calculator Excel in 2020 Printable . credit card tracker creditcard Looks like this would work . Debt Snowball Calculator Debt Reduction Services Debt . best free debt snowball calculator program excel Debt . Budget Spreadsheet, Excel Budget Template + Dave Ramsey ...

This Spreadsheet Calculates When You'll Pay Off Debt With the Snowball Method The snowball method is the best way to pay down your debt. If you're skeptical and want to see how it will work, this spreadsheet will calculate exactly how long it will take to be debt free. A Aimee McGrath Money SAVING Tips, Hacks & Ideas | budget, savings

Debt snowball worksheet excel

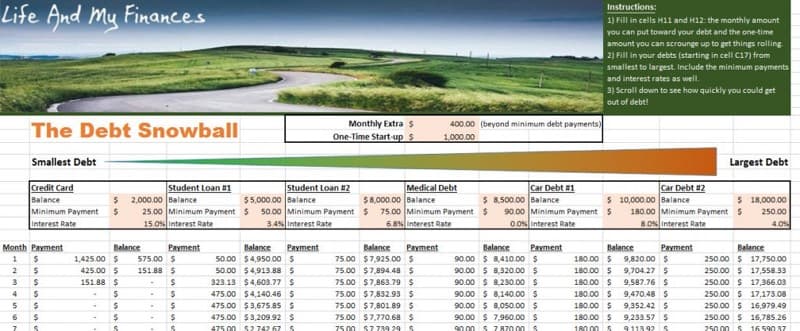

You can set up your debt snowball spreadsheet in Excel or Google Sheets. Both systems will get you the same results, it's all a matter of preference. I love Google Sheets and will be demonstrating with that. But like I said, you can make a debt snowball excel too. Download your free debt snowball spreadsheet here to get the template.

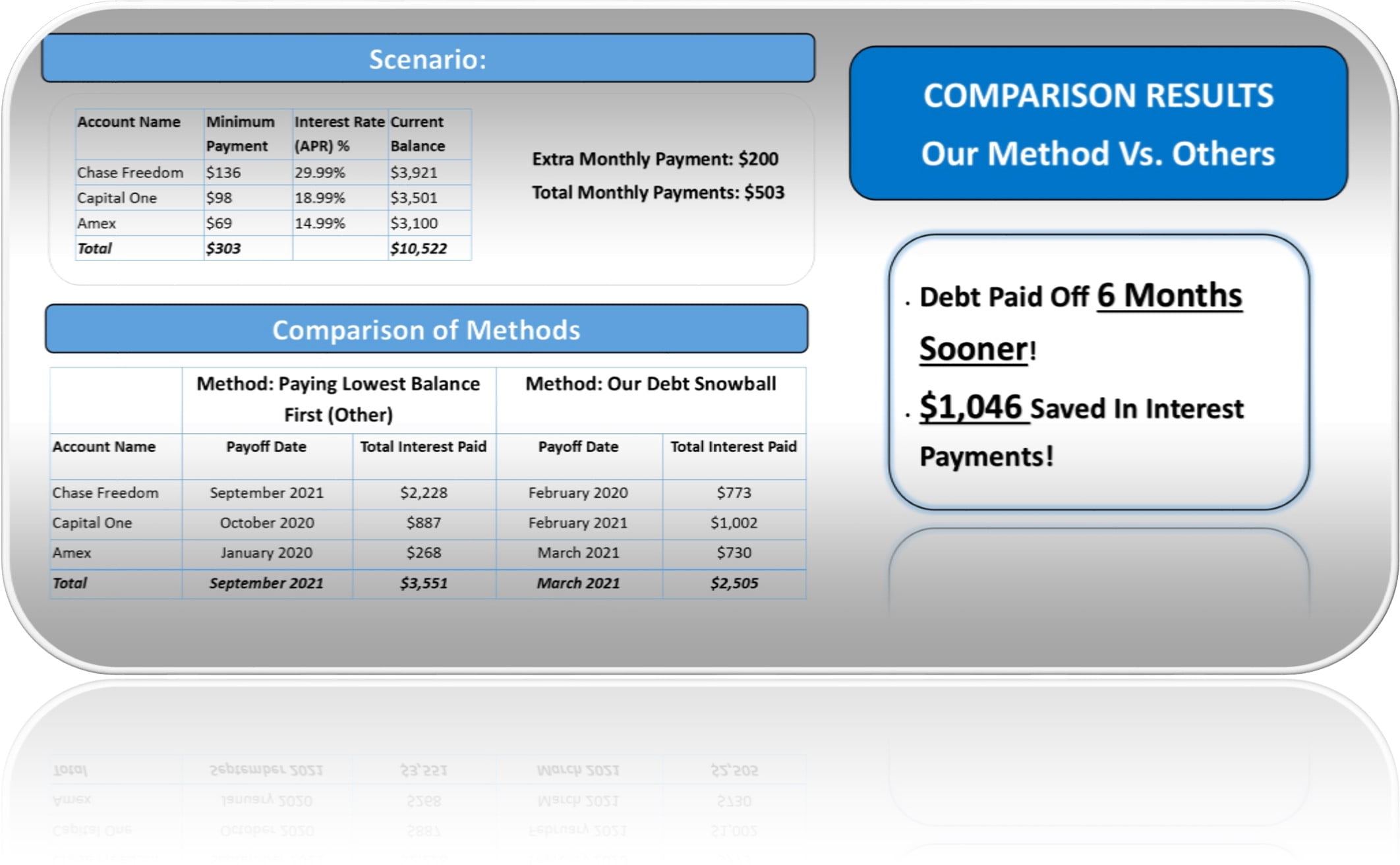

Debt Snowball Worksheet For Excel. Rated 4.90 out of 5 based on 29 customer ratings. ( 29 customer reviews) $ 19.99 $ 14.99. Optimized Debt Payoff Schedule To Save You $1,000's vs Similar Excel Templates. Excel Debt Snowball Calculator. Simulate Over 10,000 Different Scenarios By A Click of A Button. Add up-to 8 Debt Accounts.

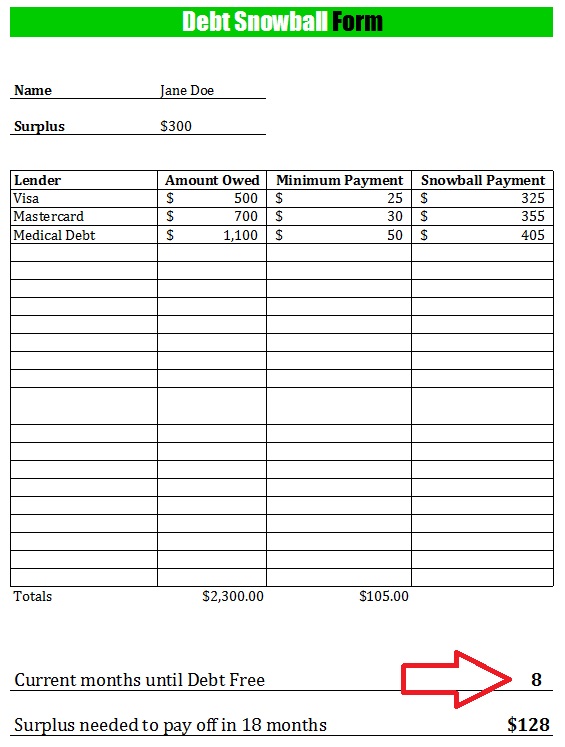

The debt snowball method is a way of planning you can employ to pay off all your financial obligations. In order to do this, you will need a debt snowball worksheet and a debt snowball calculator. You'll use the former to make your plan. Then you need the latter to come up with the amount and time you'll need to complete your debts.

Debt snowball worksheet excel.

Debt snowball calculator template excel is a Debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations.

Our Excel based debt snowball calculator allows you to quickly input all of your debt and determine, which to pay off first. The reason it's called a "snowball" is, because as you paying off one of your debt accounts, you then use that same payment amount towards the debts with the highest interest rate.

With every debt you pay off, you gain speed until you're an unstoppable, debt-crushing force. Here's how the debt snowball works: Step 1: List your debts from smallest to largest regardless of interest rate. Step 2: Make minimum payments on all your debts except the smallest. Step 3: Pay as much as possible on your smallest debt.

Automatic Debt Snowball Planner, Excel Spreadsheet Payoff Debt tracker, Easy to Use Calculator for Debt Free Plan, Ramsey Snowball Plan, KarileeCreations. From shop KarileeCreations. 5 out of 5 stars (44) 44 reviews $ 10.00. Favorite Add to ...

If you'd rather work with a debt snowball spreadsheet in Google Docs or Excel, this could be perfect for you. It's especially good if you have a few debts to manage, as it will do all the calculations for you.

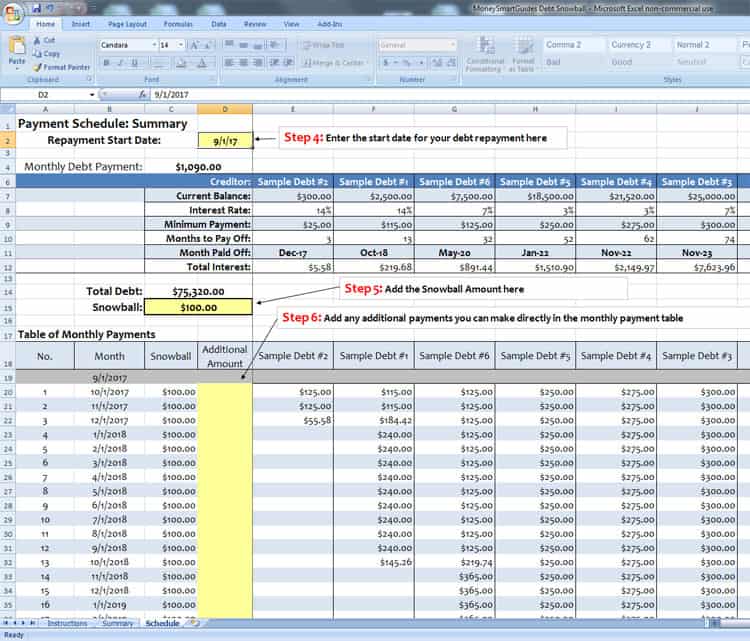

How to use the Debt Snowball Worksheet Choose whether you want the spreadsheet in Excel or Google Sheets format Select the appropriate link from the download section below Enter your debt repayment plan start date on the first tab of the worksheet Enter your list of debts in the table on the first tab of the worksheet (order does not matter)

Snowball Debt Payoff Spreadsheet excel will allow you to easily calculate and determine exactly how much you need to pay on which debt and when. It will allow you to forecast exactly how much longer it will take for you to achieve your goals. It is also incredibly easy to use thanks to the brilliant software Microsoft Excel.

As you can see below it has a lot of pretty helpful features and I wish I had a spreadsheet this cool when we were using the Snowball method to pay off our debt. You can download the Debt Snowball Excel (XLS) file or find more out at the creators website. Click here to get the spreadsheet for Google Docs (or Google Sheets)

Excel Debt Snowball Spreadsheet. Rated 4.89 out of 5 based on 83 customer ratings. ( 83 customer reviews) $ 20.99 $ 14.99.

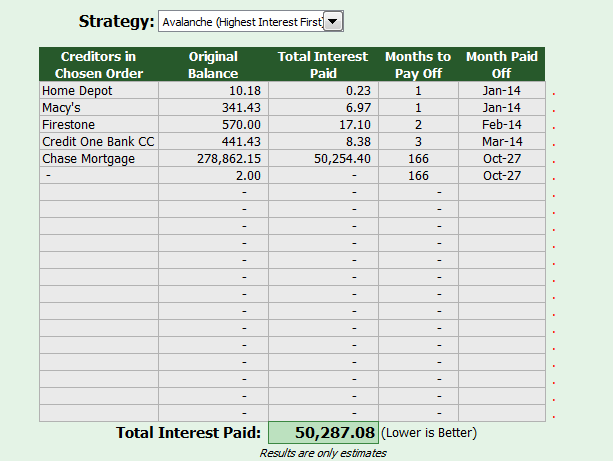

Debt Snowball Spreadsheet from Wise Woman Wallet This Excel sheet from Wise Woman Wallet allows you to use not just the debt snowball and avalanche methods, but also what the creator calls the 'debt volcano' method. This method sorts your debt payoff ranking by your frustration and emotions towards each individual debt.

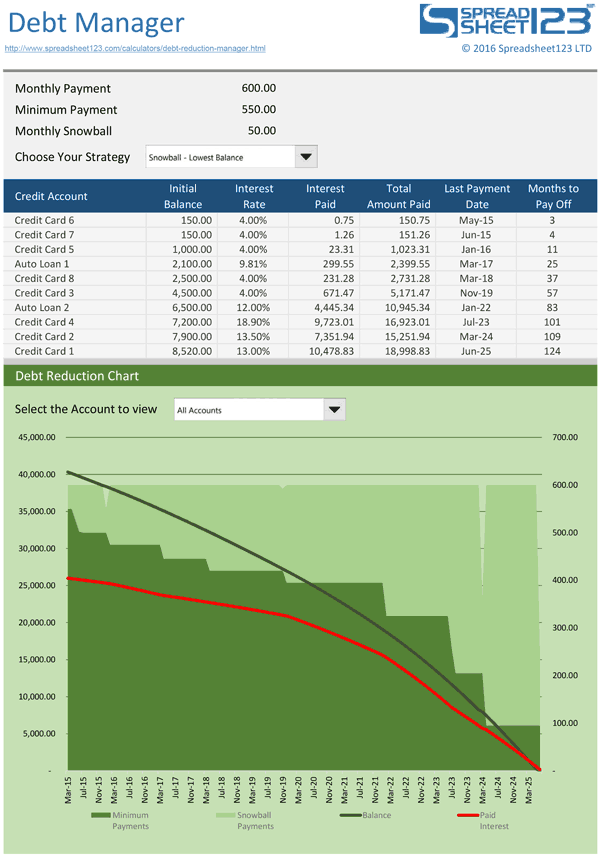

Debt Snowball Workbook Dashboard After entering your debt accounts into the excel spreadsheet you can see a summary of when all of your debts will be paid off. You also have the ability to quickly see the impact of making additional payments will have on the total interest paid and the dates you become debt free.

SNOWBALL WORKSHEET DEBT List all your debts below starting from the smallest to the largest balance. Pay the minimum payment for all your debts except for the smallest one. Put any extra dollar amount into your smallest debt until it is paid off. Do the same for the second smallest debt untill that one is paid off as well.

The debt snowball calculator is a simple spreadsheet available for Microsoft Excel® and Google Sheets that helps you come up with a plan. It uses the debt roll-up approach, also known as the debt snowball, to create a payment schedule that shows how you can most effectively pay off your debts. Advertisement

Debt Snowball Spreadsheet Free Download! Once you click the link, you should see the download at the bottom of your screen. Just click it to open it, then be sure to enable the sheet so you can use it and start updating the default debt snowball numbers with your own! Debt Snowball Spreadsheet for Google Sheets. Don't have Excel?

Debt Payoff Calculator Spreadsheet - Debt Snowball, Excel, Student Loan and Credit Card Debt Tracker. YourFrugalFriend. 5 out of 5 stars. (253) $5.99. Bestseller. Add to Favorites.

The advanced sorting is helpful if you're using a particular debt-payoff plan, such as the debt snowball. The DebtTracker includes seven worksheets, including a Paydown worksheet with a graph for tracking the results of paying off a debt over time. Debt Prioritization Worksheet from Wise Woman Wallet

With the printable debt-reduction free downloadable samples and templates that we have gathered in the previous section, you can now create your Debt Snowball Spreadsheet, but before you use them, because, just like executing an outstanding online marketing strategy, to ensure that you can utilize this strategy properly, there are certain steps ...

The strategy of paying the small amount or lowest balance first and the highest interest rate first is used in making and maintaining the spread sheets of the snowball debts. Debt snowball excel spreadsheet is designed in a way that you simply add your debts in it and the final accumulated result shown to you in a bit of second in the end sections of the spread sheet.

Debt Payoff Spreadsheet Snowball Debt Payoff Spreadsheet Snowball Debt Payoff Template Snowball Debt Payoff SpreadsheetThere have been many studies that have shown one of the most stressful factors of a person's life is their financial health.

Our basic or advanced finance document templates are intuitive and available in several kinds of formats (such as PDF, WORD, PPT, XLS. The Excel spreadsheets include the necessary formulas as well. Therefore, we recommend you to download this example debt snowball XLSX worksheet excel template now. Using this debt snowball XLSX worksheet excel template guarantees that you will save time, cost and efforts and enables you to reach the next level of success in your project, education, work, and ...

On the last page of the form is a Debt Snowball Worksheet. List your debt from the smallest to the largest and enter relevant information as required by the form. Some of the information they'll require from you include your stipulated monthly payment and the extra payment you've made for the month.

1) Enter all your debts into the debt snowball template First things first - enter all your debts into the debt snowball template. Start with your smallest debt and insert it on the far left. Change "Debt 1" to your debt title - like "Amex credit card" or "Payday loan" or something like that, so you know what it is Enter the current balance

debt snowball calculator template excel is a debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations.once the littlest obligation is paid off, one continues to the following somewhat bigger little …

Automatic debt snowball planner, excel spreadsheet payoff debt tracker, easy to use calculator for debt free plan, ramsey snowball plan,

Debt payoff calculator spreadsheet - debt snowball, excel, student loan and credit card debt tracker

![Free Debt Snowball Spreadsheet [+ Video]](https://www.roadmapmoney.com/wp-content/uploads/2019/10/Debt-Snowball-Spreadsheet.jpg)

0 Response to "37 debt snowball worksheet excel"

Post a Comment