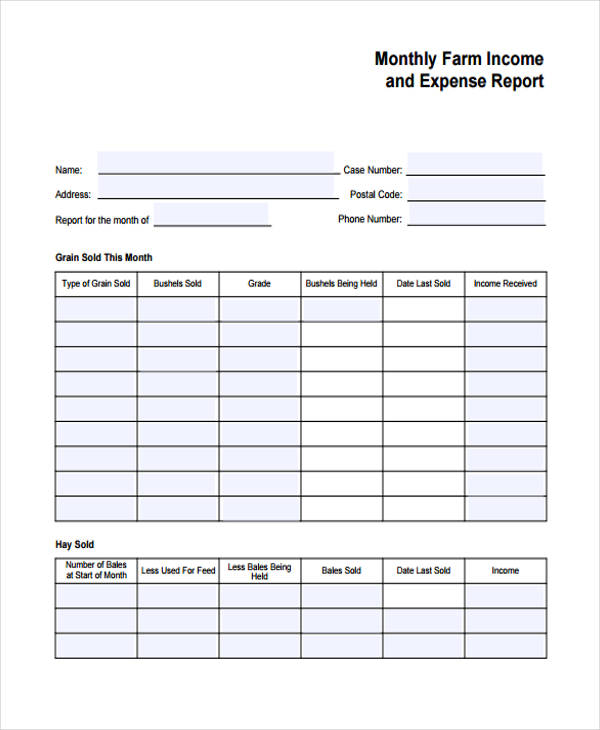

40 farm income and expense worksheet

A management programs geared specifically for farmers. Surrounded by farm management, farm policy, agricultural finance and marketing experts, and a group of your peers, the conference will stimulate your thinking about agriculture's future and how you can position your farm to be successful in the years ahead.

Operating a farm often involves several different income sources and expenses, deductions and credits, all of which can complicate things when it's time to file your taxes. While the average age for farmers as of 2012 was 58.3, first-time farmers are still entering the business — including millennials.

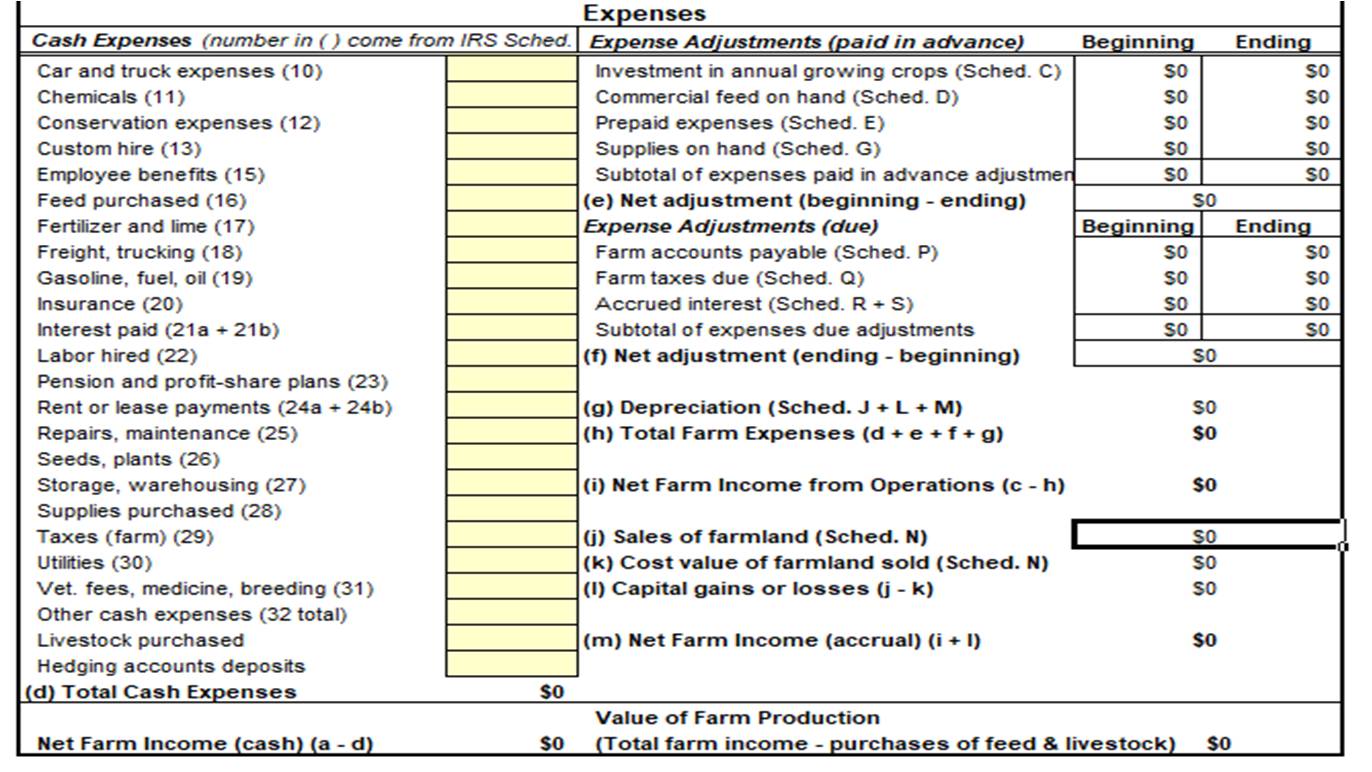

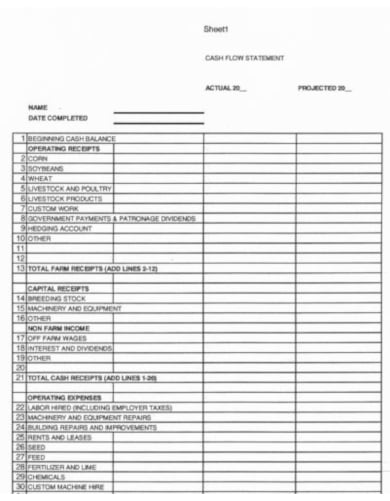

FARM INCOME AND EXPENSE WORKSHEET. Did you materially participate in the operation or management of the farm on a regular, continuous, and.1 page

Farm income and expense worksheet

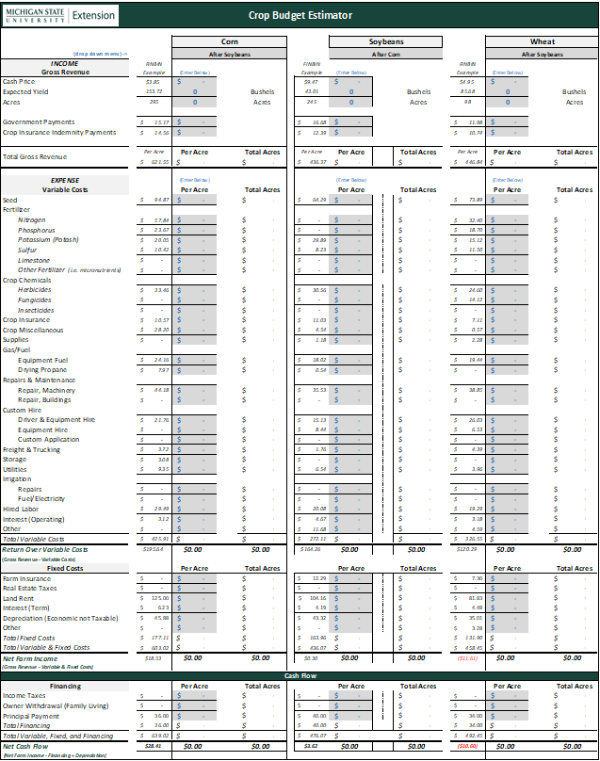

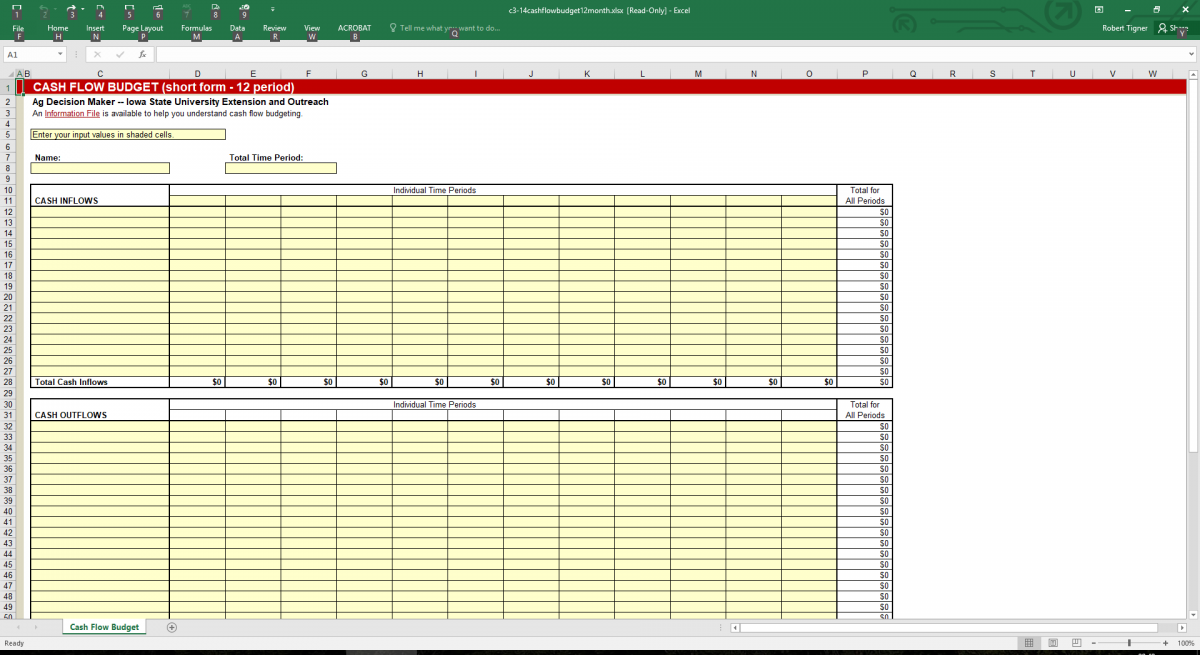

Mar 22, 2019 — Electronic spreadsheets are designed to enter and total farm income and expenses easily. Spreadsheets can be set up in many different ways for ...

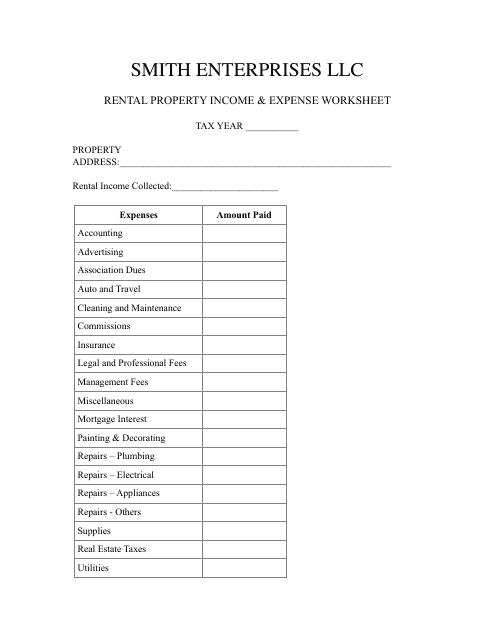

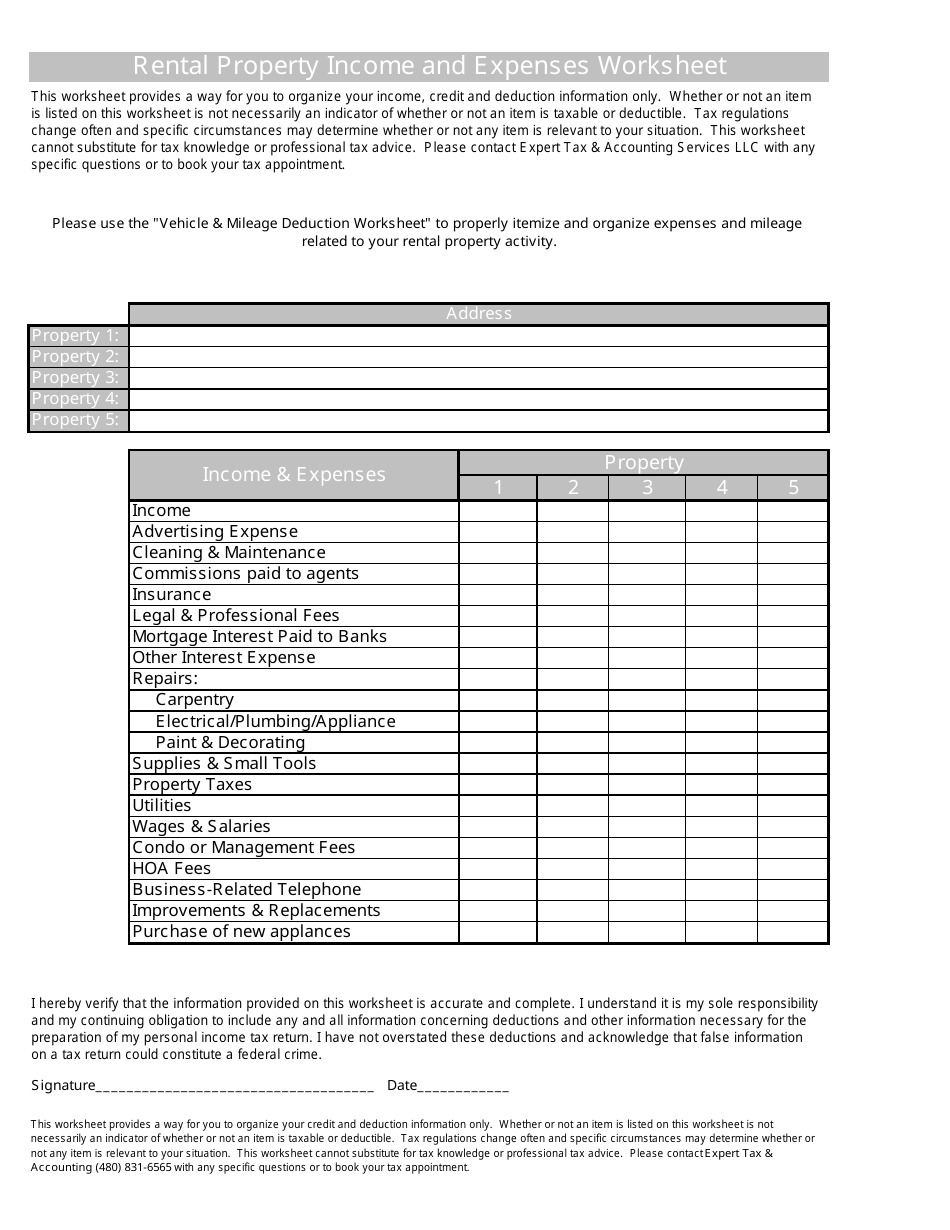

To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

For expense tracking, you could use my Income and Expense Worksheet, Checkbook Register, or the newer Money Manager. A budget is almost useless without tracking what you are spending. I started out using Excel to do everything, but I began using Quicken after a friend showed me how easy it was to keep track of checks and credit card charges and ...

Farm income and expense worksheet.

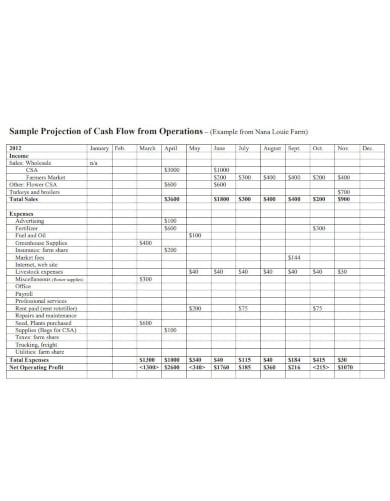

This spreadsheet uses projected inventories, crop sales and expenses, and non-farm income and expense to create pro-forma income and sources and uses of ...

For example, the household expenses budget automatically adds up income and expenses. Free Printable Budget Worksheets: Household Expenses. This free blank budget worksheet printable is perfect for those that are brand new to budgeting, but not so basic as to be useless to those who are serious about their budgeting.

FARM INCOME AND EXPENSE WORKSHEET. 1. Livestock (Gross sales) $. 1. Car/Truck Expenses. $. 2. Crops. 2. Chemicals. 3. Patronage Dividends.2 pages

The Home Income and Expense Worksheet, is a financial tracking tool that does a 'deep dive' into how your money is spent. It follows the money management system described in the eBook 'Simple Life Dollars and Sense', with categories such as: Priority One - mortgage, food, utilities, etc. Priority Two - Child care, loans, savings, insurance, etc.

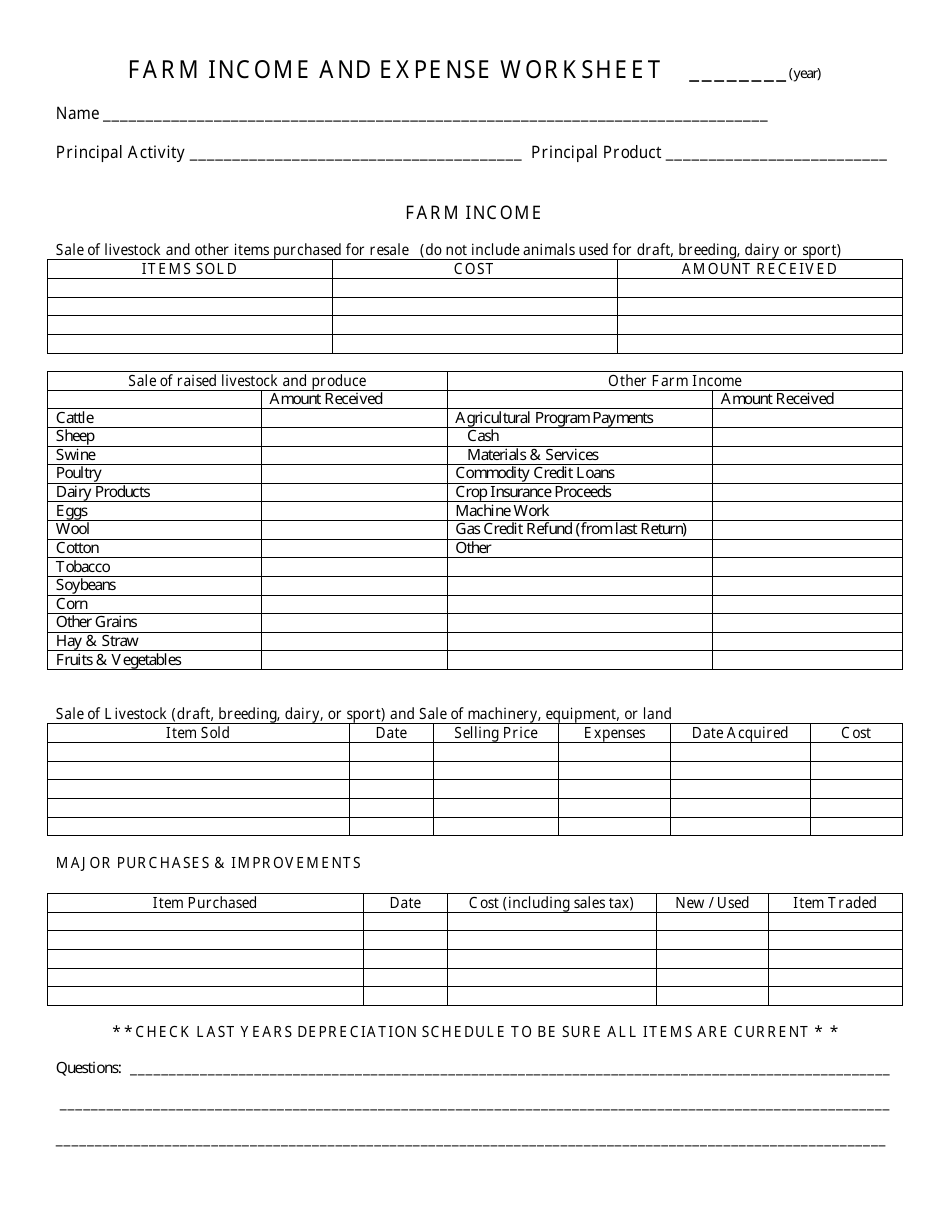

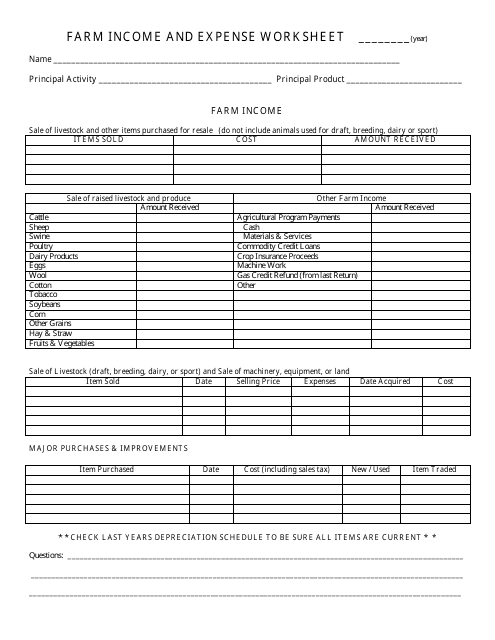

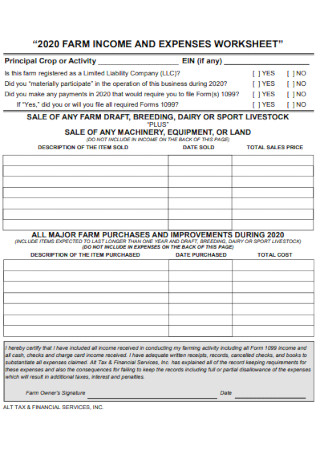

FARM INCOME AND EXPENSE WORKSHEET ______(year) ... Agricultural Program Payments ... Expenses. Date Acquired. Cost. MAJOR PURCHASES & IMPROVEMENTS.2 pages

Description. This version was created specifically for printing and completing by hand. This worksheet can be the first step in your journey to control your personal finances. Step 1: Track your Income and Expenses. Step 2: Use that information to create a budget. Step 3: Continue tracking to help you stick to your budget.

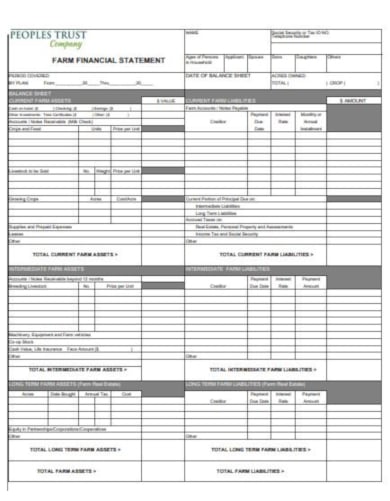

This form is used by self-employed farmer or member of farming partnerships to help to calculate the farming income and expenses for income tax purposes.

6. iMom's Save, Spend, Share Printable for Kids. Youth Budget Templates - Budgeting Worksheets for Students. 1. Learn in Color's Share Spend Give Budget Sheet for Kids. 2. Queen of Free's Christmas Gift Budget Template. 3. Penney Lane's Christmas Budget Worksheet. Sample Budget Template for Teenagers.

Total sale value/ income from the chicken @ Rs 90/kg: Rs 21, 60,000.00. The total profit on the investment is around: Rs 4, 44,000.00 (annually). The sale of other by-products of the farms like manure and gunny bags can bring in an extra income of around Rs 20,000. Broiler chicken farming project report - loans and subsidies

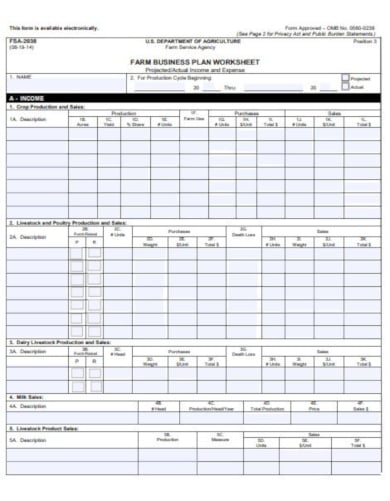

Payroll Expense Calculation Worksheets Complete ONE worksheet based on your business type. Business Type ... those who report their net farm profit on IRS Form 1040 Schedule F), use IRS Form 1040 Schedule F in lieu of Schedule C above. ... farmer's or rancher's gross income to avoid double-counting amounts that represent pay to the

Sole proprietors must file Schedule C with their tax returns, and self-employed farmers report their income and expenses from their farming businesses on Schedule F . Completing Schedule F involves some calculations. You must accurately report your income, then subtract your expenses from your revenues.

An enterprise budget is a list of income and expenses, based on a set of assumptions. Enterprise budgets estimate profitability for agricultural enterprises. They are useful for performing breakeven analyses and can be used to select the mix of enterprises on a farm. Below is a sample budget for a sheep enterprise with 100 ewes lambing annually.

An entity refers to a discrete taxable unit, such as a single rental property, farm, or business with its own income and expenses. Usually, entity income and expenses are entered in a series or group of worksheets that are added to the main tax return. A tax return can include multiple, separate entities of the same type. Adding Entities

RC4060 Farming Income and the AgriStability and AgriInvest Programs Guide - Joint Forms and Guide RC322 AgriInvest Adjustment Request T1164 Statement B - AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Additional Farming Operations T1175 Farming - Calculation of Capital Cost Allowance (CCA) and Business ...

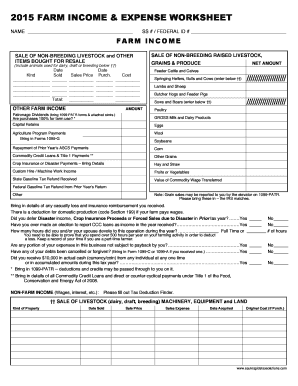

FARM INCOME & EXPENSE WORKSHEET. NAME. SS # / FEDERAL ID #. FARM INCOME. SALE OF NON-BREEDING LIVESTOCK AND OTHER. SALE OF NON-BREEDING RAISED LIVESTOCK,.4 pages

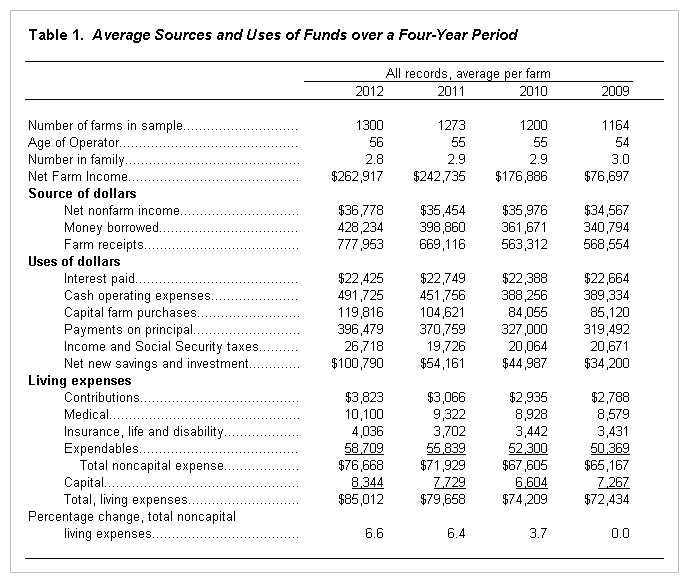

When you take total family living expenses minus net nonfarm income this equals $40 per acre in 2020 and was $48 per acre for the five-year average. This would be the part of family living that is covered by the farm income. In addition, there is another $29 per acre in social security and income taxes to be covered by the farm in 2020.

“2020 FARM INCOME AND EXPENSES WORKSHEET”. Principal Crop or Activity. EIN (if any). Is this farm registered as a Limited Liability Company (LLC)?.2 pages

Federal Income Tax Spreadsheet Form 1040 (Excel . Sites.google.comDA: 16 PA: 40 MOZ Rank: 56. Updated Form 1040, Schedule A, medical threshold from 10% to 7.5%; Significant revision to Form 1040, Schedule SE; Versions from previous tax years are available below; If you are unable to download any spreadsheet, don't hesitate to send an e-mail to ...

Because it is used for the purpose of tracking income and expenses, the Income and Expenses Spreadsheet Small Business is always running. Any changes made are automatically saved, and any files are completely safe, so it should be the first spreadsheet you choose if you have a large client base.

SNAP allows expenses that are also allowed by Internal Revenue Code unless specifically listed in 0017.15.33.15 (Self-Employment Expenses Not Allowed). Divide the expenses by 12 (months) to find the monthly average expense for the business. Subtract allowable business expenses from gross income.

This income and expenditure template has cell references that point to my exported file, however, the attached version does not contain these links. If you decide to use this template, enter your amounts manually or develop a system of linking to your own exported reports. Note: for the last three columns (YTD 2021, YTD 2022, and YTD 2023) to ...

If you have a profit or a loss, it gets combined with the other non-farming income reported on your return and increases or reduces your taxable income. When you suffer a net operating loss—meaning you paid more in expenses than you earned for all of your income sources including non-farm income—you can use it to offset future farming profit.

Farm Expenses Worksheet 2021. September 15, 2021. Farm Income Worksheet 2021. September 15, 2021. Expense Reimbursements for Employees 2021. September 14, 2021. Extending Your Individual Income Tax Return 2021. September 14, 2021. Estimated Taxes 2021. September 13, 2021. Estate Tax (Form 706) 2021.

Finally, it is important to note that the case farm has strong labor benchmarks. Gross revenue per worker is approximately $1,060,000 for the case farm. In addition, the ratio of total labor expense (hired labor plus family and operator labor) as a percentage of value of farm production is only 5.9 percent.

This spreadsheet's key components include your total monthly income, total monthly must-have expenses, total monthly nice-to-have expenses, and allowance, or the leftovers. If you want a simple approach to tracking your expenses, this is a good option. 20. RegPaq Google Sheets Budgeting Template.

Enter losses reported on Line 32 of Form 4835, Farm Rental Income and Expenses, on Form 4835, Line 34c. To force Form 8582 for one client only: Go to Screen 14.1, SS Benefits, Alimony, Miscellaneous Income. Scroll down to the Passive Activity Overrides (8582) section. Enter a 2 in Form 8582: 1=when applicable, 2=force (code 27).

Income. Amount. Gross sales/receipts. Sales of Livestock Raised. Sales of produce, milk, eggs, grain, plants, syrup ... FARM WORKSHEET - INCOME AND EXPENSES.2 pages

The Monthly Budget Sheet is split into 4 handy sections. Income, one-off monthly expenses, fixed monthly expenses, and variable monthly expenses. Recording your expenses in this way makes it much easier to spot problematic spending. If you have lots of one-off expenses you may need to check this to see if it was necessary!

Like T2042, these forms also request your farming income and expenses, but they contain an authorization form so the CRA can share your information with these farm support programs to determine your eligibility. If you have additional farming operations, fill out forms T1164 or T1274, and submit a form for each farm. Partnerships

Download, Fill In And Print Farm Income And Expense Worksheet Pdf Online Here For Free. Farm Income And Expense Worksheet Is Often Used In Income Expense ... Rating: 4.7 · 30 votes

FAST (Farm Analysis Solution Tools) are a suite of Microsoft Excel spreadsheets designed to assist those in agriculture make better decisions via user-friendly computer programs. FAST aids users in performing financial analysis, assessing investment decisions, and evaluating the impacts of various management decisions. Featured Tools

At the end of the insurance period and after you have filed your farm income taxes for the policy year, a loss adjuster will complete an Allowable Revenue and Allowable Expense Worksheet for the policy year using your farm tax forms. First, the allowable expenses will be compared to your approved expenses to determine if you incurred at least ...

0 Response to "40 farm income and expense worksheet"

Post a Comment