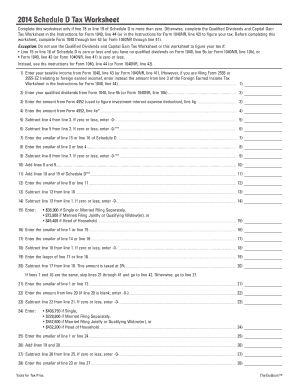

40 schedule d tax worksheet 2014

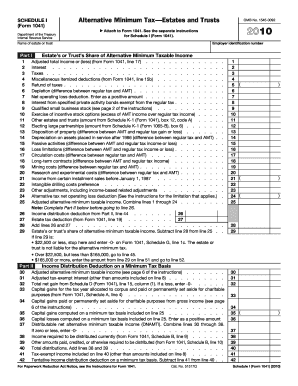

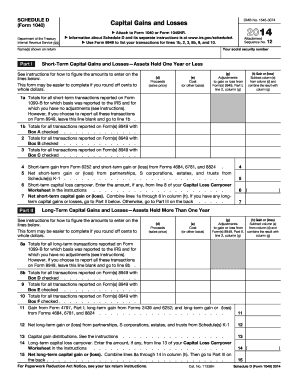

Form 1041 (Schedule D) - Capital Gains and Losses (2014) Caution: Read the instructions before completing this part. Unrecaptured section 1250 gain (see line 18 of the wrksht.) . 19 Total net gain or (loss). Combine lines 17 and 18a . . Note: If line 19, column (3), is a net gain, enter the gain on Form 1041, line 4 (or Form 990-T, Part I, line ... Worksheet or line 6 of your Schedule D Tax Worksheet by any of your capital gain excess not used in (1) above. 3. Reduce (but not below zero) the amount on your Schedule D (Form 1040), line 18, by your capital gain excess. 4. Include your capital gain excess as a loss on line 16 of your Unrecaptured Section 1250 Gain Worksheet on page D-9 of the

11.12.2014 · Each worksheet in the schedule spreadsheet has a named tab at the bottom left. The tab name is: R68GAD_V1_00_0_EN (or CY for the Welsh version) - Gift Aid donation schedule spreadsheet. Do not ...

Schedule d tax worksheet 2014

Access Google Sheets with a free Google account (for personal use) or Google Workspace account (for business use). The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount. Capital losses that exceed the current year's gains may ... the 2014 Schedule D Tax Worksheet, or Part V of the 2014 Schedule D (Form 1041), see the instructions before completing this part.* 27 Enter the amount from Form 8801, line 10. If you filed Form 2555 or 2555-EZ for 2014, enter the

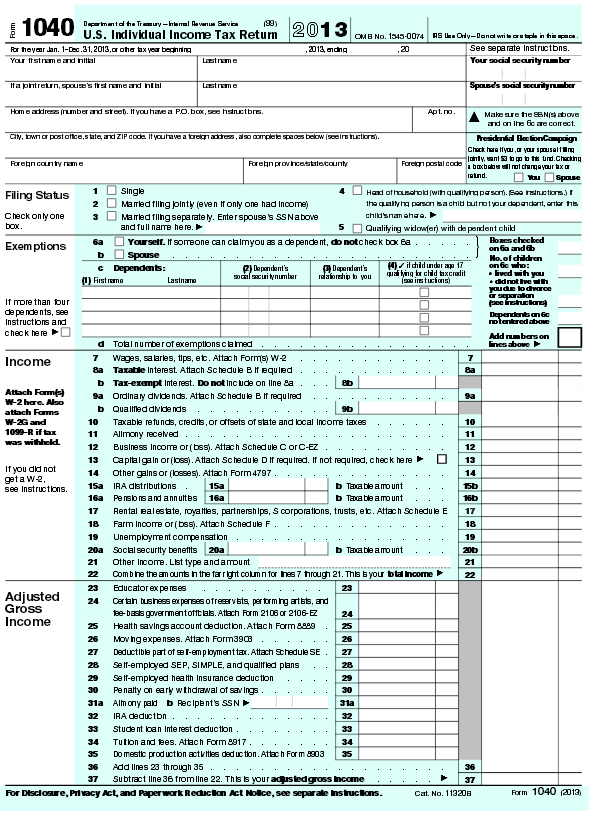

Schedule d tax worksheet 2014. Instructions for filing the 2014 Business Income and Receipts Tax and Net Profits Tax. Use this form to file 2014 Business Income & Receipts Tax (BIRT). This form includes Schedules B, C-1, D, A, and E. Use this form to file 2014 Business Income & Receipts Tax (BIRT) if 100% of your business was conducted in Philadelphia. 2014 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949, U.S. Tax Return for Seniors (Spanish Version) 2021 12/10/2021 Form 1040-V: Payment Voucher 2021 12/14/2021 Form 1041 (Schedule D) Capital Gains and Losses 2021 12/15/2021 Inst 1041 (Schedule D) Instructions for Schedule D (Form 1041), Capital Gains and Losses 2021 See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box

Get Schedule D-1, Sales of Business Property, for more information. Young Child Tax Credit. For taxable years beginning on or after January 1, 2019, the refundable Young Child Tax Credit (YCTC) is available to taxpayers who also qualify for the California Earned Income Tax Credit (EITC) and who have at least one qualifying child who is younger than six years old as of the … Capital loss carryover from your 2018 California Schedule D (540). Capital gain from children under age 19 or students under age 24 included on the parent’s or child’s federal tax return and reported on the California tax return by the opposite taxpayer. For more information, get form FTB 3803. Get FTB Pub. 1001 for more information about: Disposition of S corporation stock … Fill out this section of the IRS Schedule D tax worksheet in a similar manner as you calculated your short-term capital gains and losses, transferring the corresponding Form 8949 amounts to Lines ... Schedule D is a form provided by the IRS to help taxpayers computer their capital gains or losses and the corresponding taxes due. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

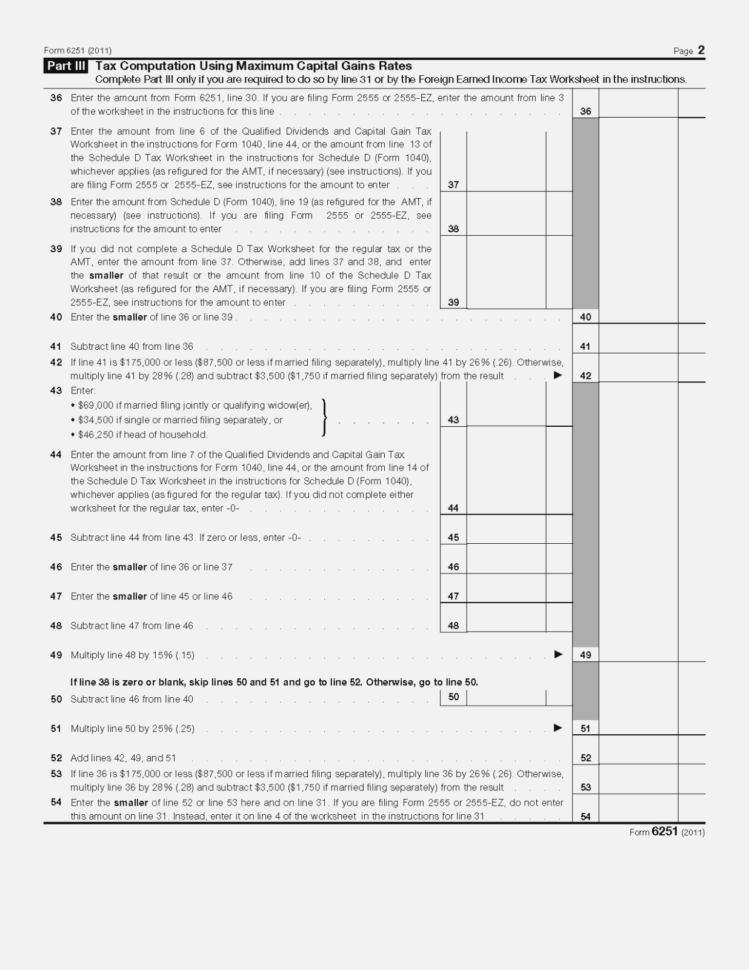

The IRS Schedule D form and instructions booklet are generally published in December of each year. If published, the 2021 tax year PDF file will display, the prior tax year 2020 if not. Last year, many of the federal income tax forms were published late in December, with instructions booklet following in early January due to last minute ... -- Effect of computation on Schedule D Tax Worksheet is to tax unrecaptured Section 1250 gain at either a 25% rate or at the regular rates on ordinary income, whichever results in a lower tax.--The tax is figured on Schedule D Tax Worksheet and entered on Line 44 of Form 1040. 25% SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses. . Attach to Form 1040 or Form 1040NR. . Information about Schedule D and its separate instructions is at . www.irs.gov/scheduled. . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074. 2014. Attachment Cat. No. 24327A 1040 TAX TABLES 2014 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the Instructions for Form 1040 only.

Enter the amount from line 28 of Form 1120 on line 17 of Schedule D. Attach to Schedule D the Form 1120 computation or other worksheet used to figure taxable income. For corporations figuring the built-in gains tax for separate groups of assets, taxable income must be apportioned to each group of assets in proportion to the net recognized built-in gain for each group of assets.

To report a capital loss carryover from 2014 to 2015. Additional information. See Pub. 544 and Pub. 550 for more details. Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about devel-opments related to Schedule D and its instructions, such as legislation enacted

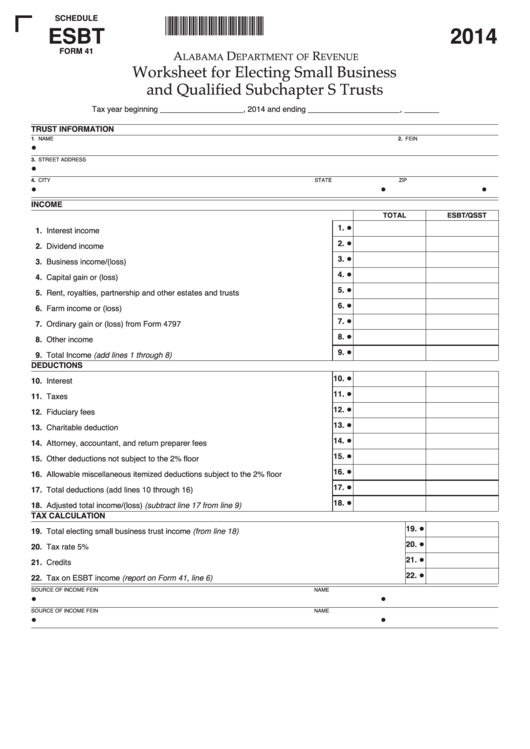

SCHEDULE D - 2014 DONATION SCHEDULE Individuals who fi le an individual income tax return and have overpaid their tax may choose to donate all or part of their overpayment shown on Line 31 of Form IT-540 to the organizations or funds listed below. Enter on Lines 2 through 25, the portion of the overpayment you wish to donate.

April 16th 2018 | Sample Worksheet 2014 mufon 990 Schedule D Tax Worksheet 593773 3 13 62 Media Transport and Control Schedule D Tax Worksheet Recent Post. 6 Appreciation Certificate Template certificate of appreciation sample text - syncla Awesome Appreciation.

For the 2014 filing season, direct reporting on Schedule D is allowed. Taxpayers will be able to combine qualifying transactions and report the totals directly on Schedule D. If they choose to report in this manner, they do not need to include these transactions on Form 8949.

the 2014 Schedule D Tax Worksheet, or Part V of the 2014 Schedule D (Form 1041), see the. instructions before completing this part.* 27 Enter the amount from Form 8801, line 10. If you filed Form 2555 or 2555-EZ for 2014, enter the.

Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses 2018 Form 1040 (Schedule D) Capital Gains and Losses 2017 Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040), Capital Gains and …

Email to a Friend. Report Inappropriate Content. Schedule D Tax Worksheet. Line 44 of the Schedule D Tax Worksheet (page D-17) is computed using the 2019 Tax Computation Worksheet. The 2019 Tax Computation Worksheet can be found on page 253 of IRS publication 17. **Say "Thanks" by clicking the thumb icon in a post.

If you are completing line 18 of Schedule D, enter as a positive number the amount of your allowable exclusion for the year on line 2 of the 28% Rate Gain Worksheet; if you excluded 60% of the gain, enter 2 / 3 of the allowable exclusion for the year; if you excluded 75% of the gain, enter 1 / 3 of the allowable exclusion for the year; if you excluded 100% of the gain, don't enter an amount.

Schedule D (Form 1041) or line 18 of your 2013 Schedule D Tax Worksheet, whichever applies. If you did not complete either the worksheet or Part V of the 2013 Schedule D (Form 1041), enter the amount from your 2013 Form 1041, line 22; if zero or less, enter -0-. Form 1040NR filers, see instructions . . . . . . . 42

The Schedule D Tax Worksheet is used to calculate tax on lump sum distributions and capital gains when lines 18 or 19 exceed zero. If you don't need to file Schedule D, use the Qualified Dividends and Capital Gain Tax Worksheet. If you claimed the foreign earned income or housing exclusions or deductions on Form 2555 or 2555-EZ, use the Foreign ...

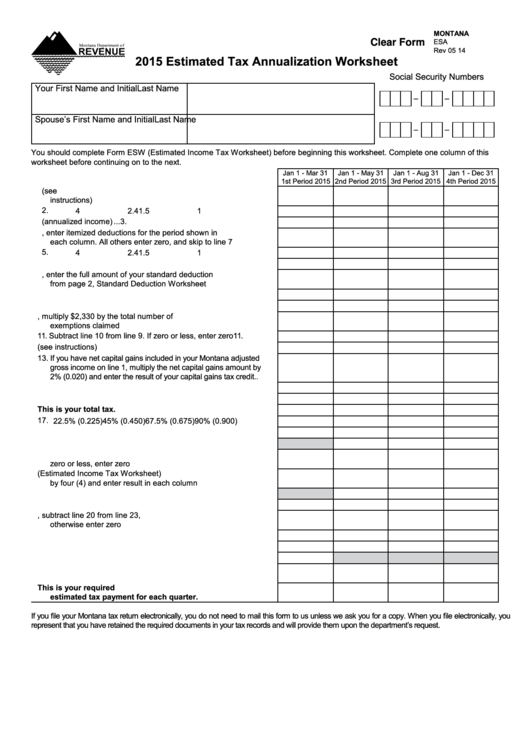

Tax Rates for 2014: Tax Rates for 2013: Tax Rates for 2012: Tax Rates for 2011: Tax Rates for 2010. Tax Rates for 2009. Tax Rates for 2008 . Tax Rates for 2007. Tax Rates for 2006. Tax Rates for 2005. Tax Rates for 2004. Tax Rates for 2003. Tax Rates for 2002. Tax Rates for 2001 . Low Income Housing - Capitalization Rate Information . Pursuant to Section 11.1825(r), Texas …

Use this worksheet to figure your capital loss carryovers from 2013 to 2014 if your 2013 Schedule D, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2013 Schedule D, line 16, or (b) the amount on your 2013 Form 1040, line 41 (or your 2013 Form 1040NR, line 39, if applicable) is less than zero.

and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter the amount from that form or worksheet in column (a) of the row that applies to the amount you are looking up. Enter the result on the appropriate line of the form or worksheet that you are completing.

2014 Form 1040 Schedule D K 1 Instructions Forms Resume Examples from Schedule D Tax Worksheet, source: spartandriveby.com. 1040 Form 2015 Schedule D If You Do Meet The Criteria For Long Be from Schedule D Tax Worksheet

Capital Gain Tax Worksheet 2014. If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-one else report on Schedule D line 13 only the amount that. Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. Enter the amount from Form 1040 line 43.

If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D, according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. To view the tax calculation on the Schedule D Tax Worksheet which will show the calculation of the tax which ...

Disclaimer. FBCAD (Fort Bend Central Appraisal District) is providing this information of property tax rate information as a service to the residents of the county. FBCAD DOES NOT SET TAX RATES. FBCAD Reports The Tax Rates Provided by the Taxing Units Listed.; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed.

The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions. Schedule B: Interest and Ordinary Dividends. Schedule C: Profit or Loss from Business. Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss.

NOTE: Tax return forms and supporting documents must be filed electronically (see Electronic Services) or submitted on paper. Do NOT submit disks, USB flash drives, or any other form of electronic media. Electronic media cannot be processed and will be destroyed ...

the 2014 Schedule D Tax Worksheet, or Part V of the 2014 Schedule D (Form 1041), see the instructions before completing this part.* 27 Enter the amount from Form 8801, line 10. If you filed Form 2555 or 2555-EZ for 2014, enter the

The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount. Capital losses that exceed the current year's gains may ...

Access Google Sheets with a free Google account (for personal use) or Google Workspace account (for business use).

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

0 Response to "40 schedule d tax worksheet 2014"

Post a Comment