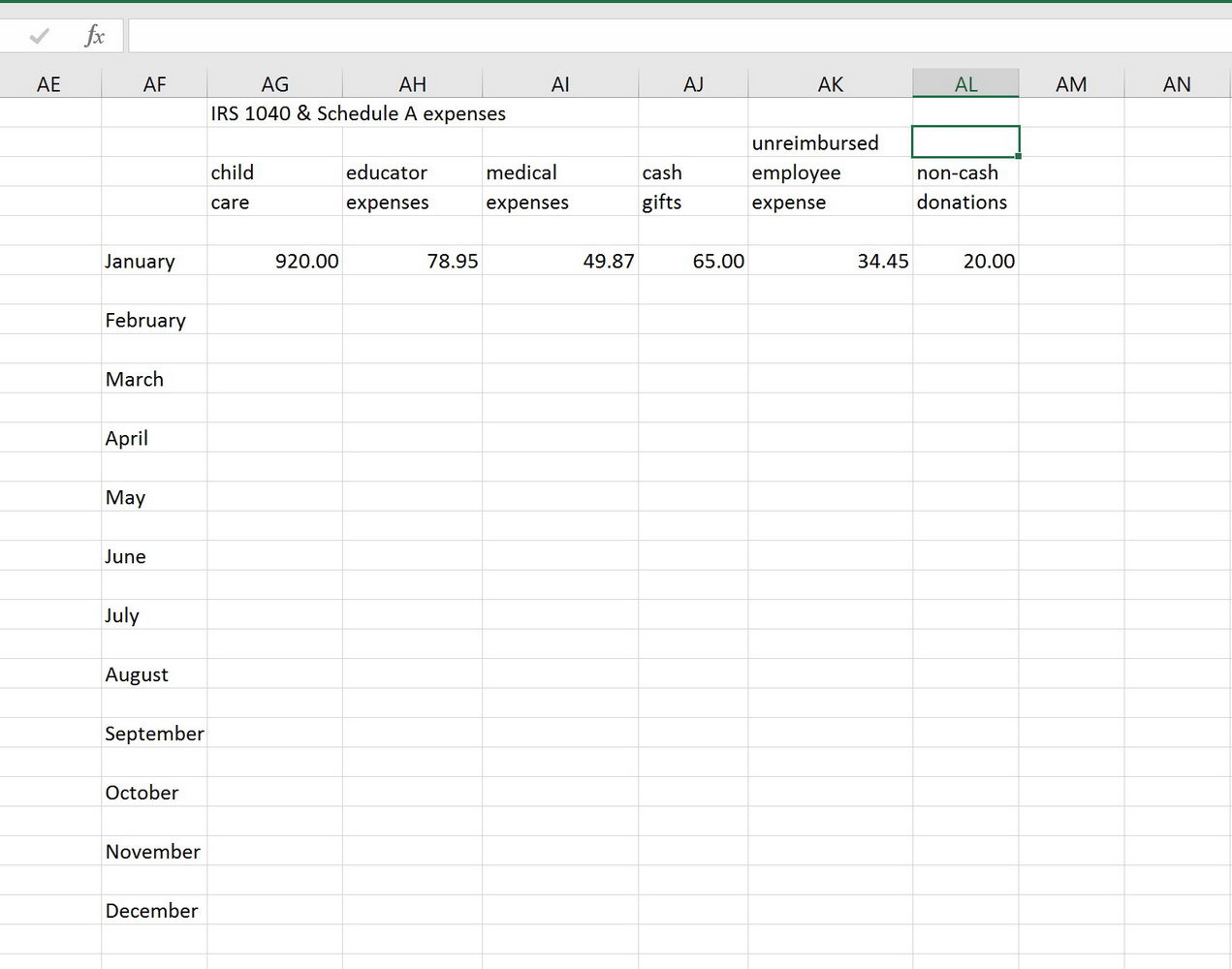

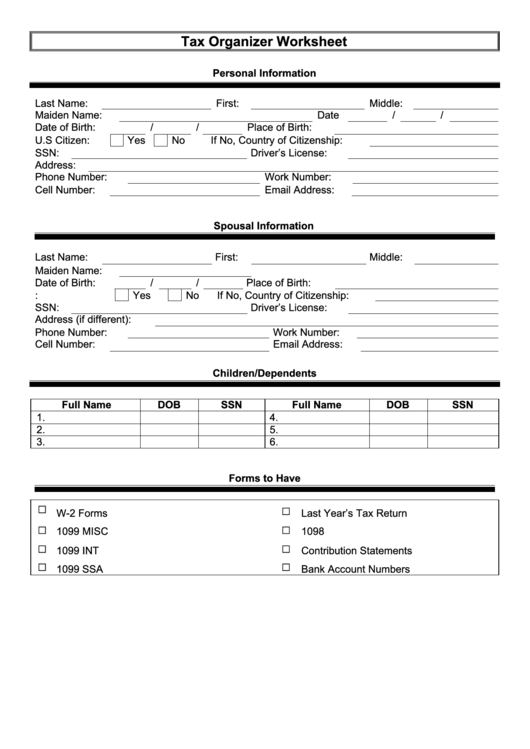

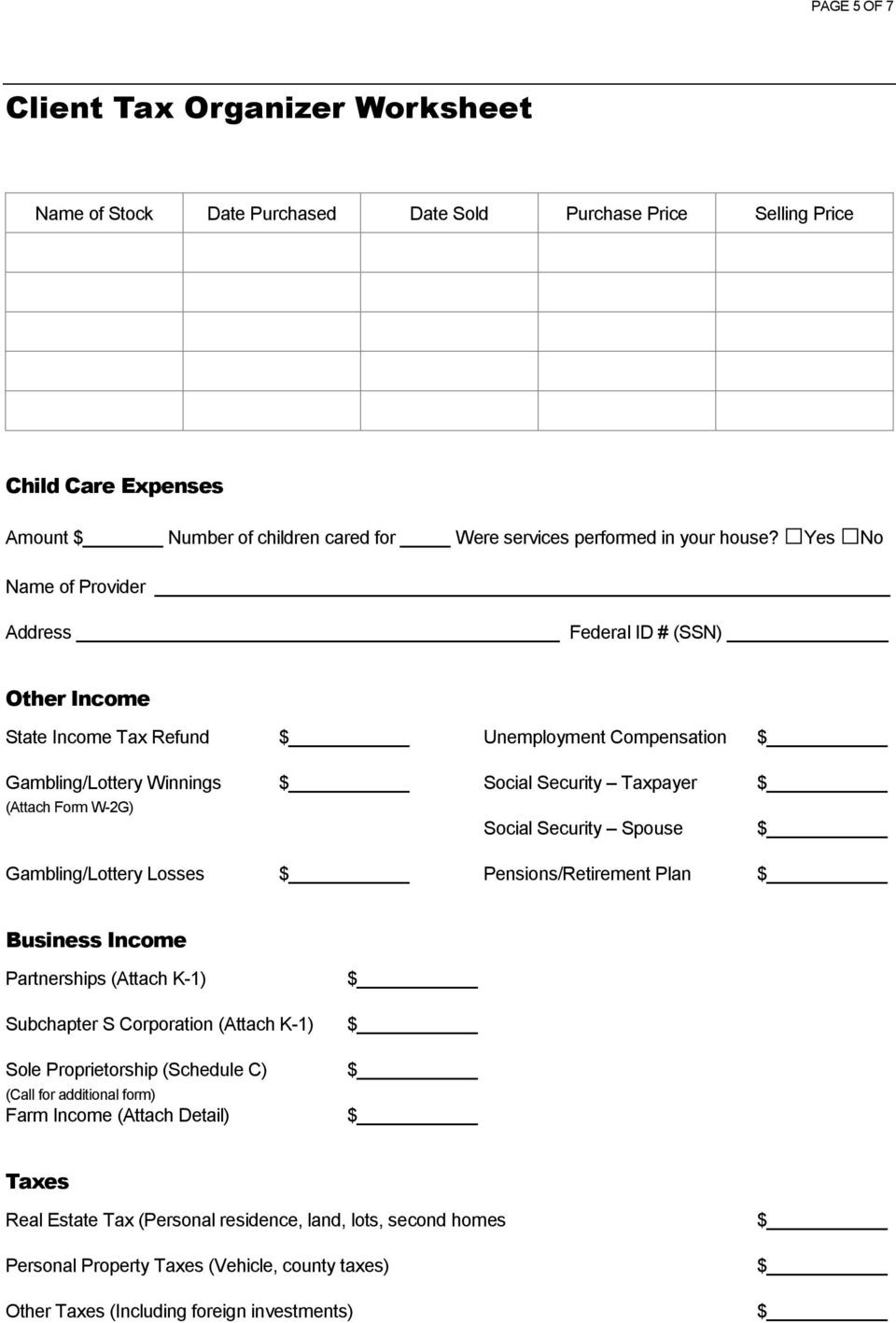

come tax organizer worksheet

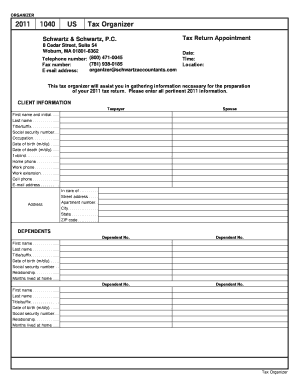

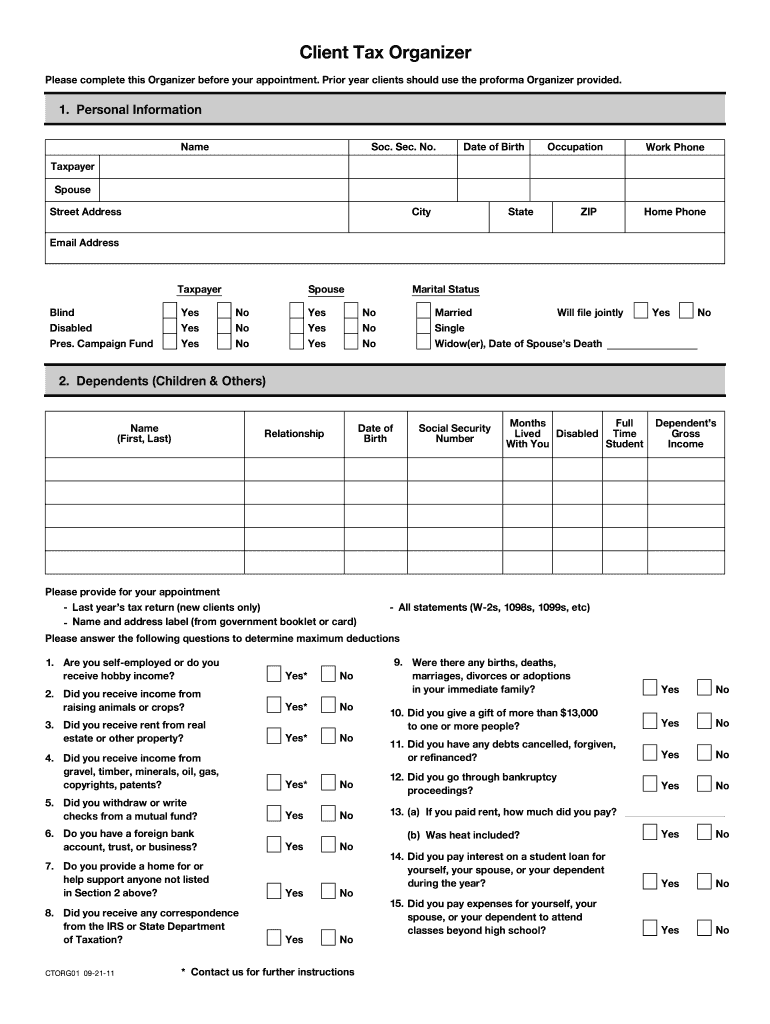

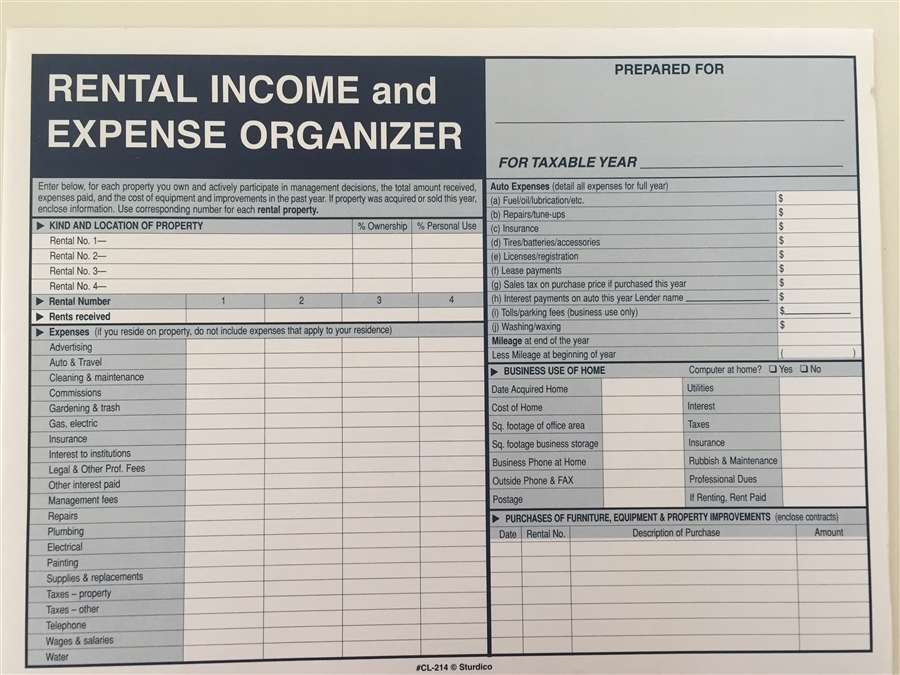

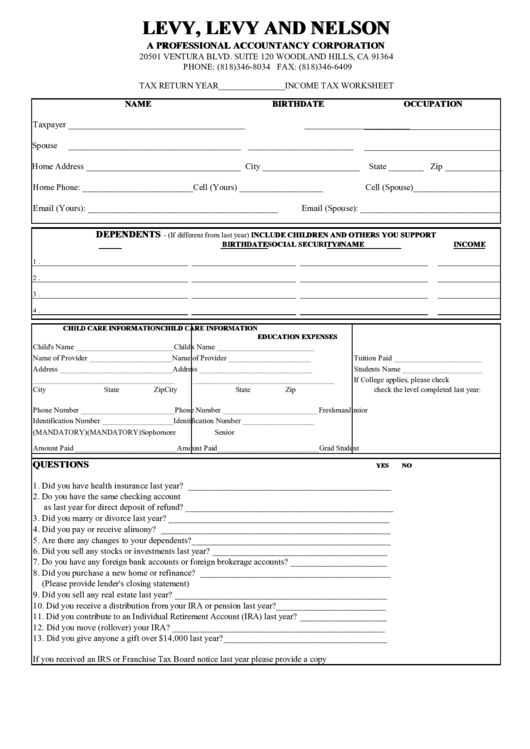

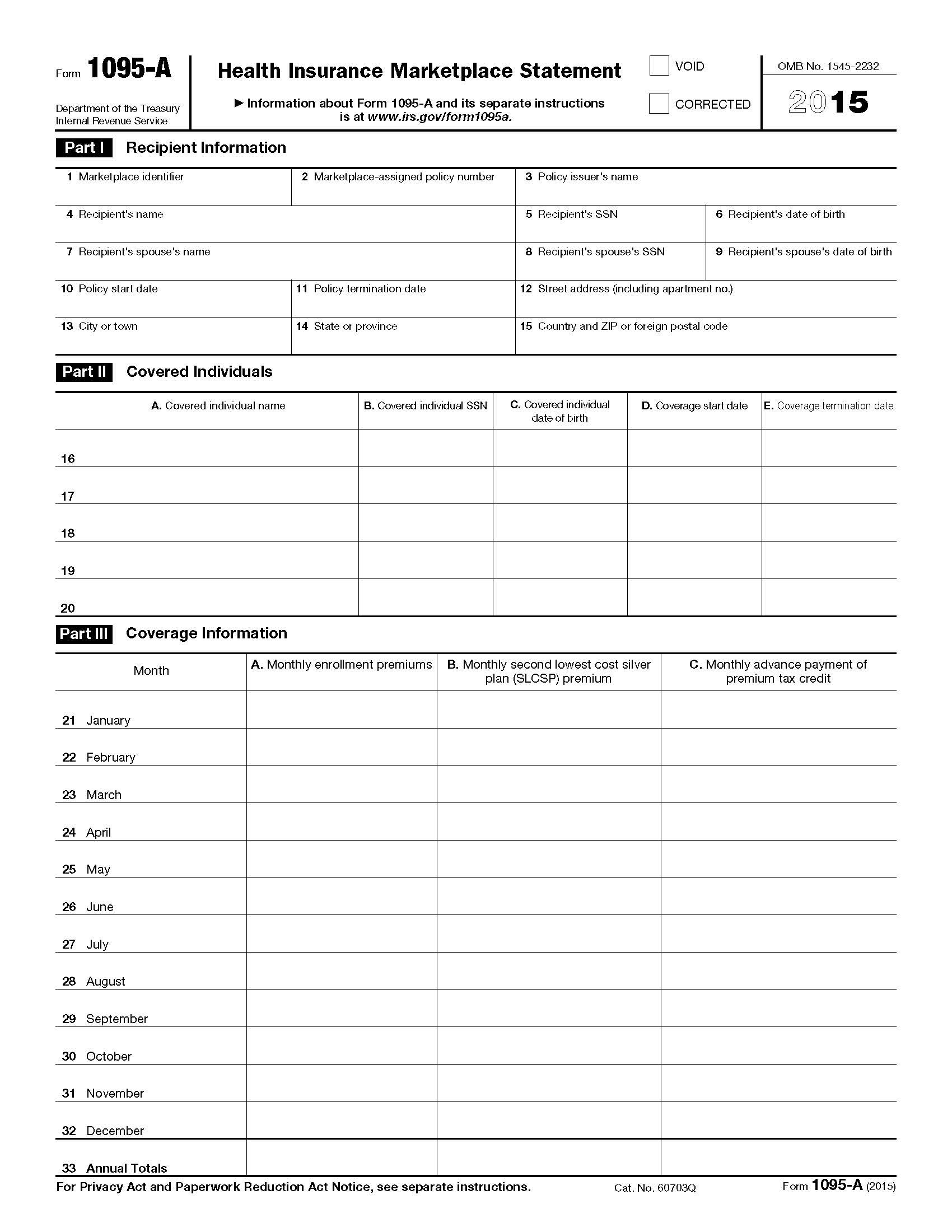

Tax Form 1040 is used to report an individual's income tax return. The form contains two pages. The first page contains information about the taxpayer, his or her dependents, and his or her filing status. The second page of the form contains a worksheet with instructions for calculating the income tax. A Tax Guide for U.S. Immigrants Filing 2020 Taxes: Your Go-To Guide How to File an Amended Tax Return with the IRS Video: IRS Tax Return Retention Requirements Video: How to Get All the Tax Deductions Possible When Filing Video: Documents Needed to File Income Taxes The W-4 Form Changed in Major Ways — Here's What's Different 5 Tips for How to File Taxes for the First Time Tax Counseling for ...

E-filing is rapidly becoming the most popular way to file taxes. People mailing in the forms are in the minority as people opt for the quicker and easier way to handle their taxes. The IRS encourages people to e-file and even offers several...

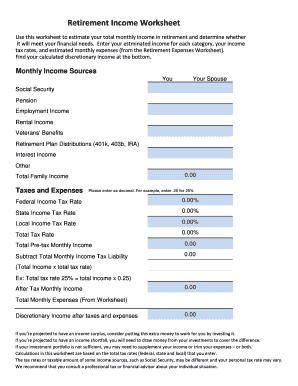

Income tax organizer worksheet

If you expect to make quarterly estimated tax payments, use Form 1040-ES, Estimated Tax for Individuals, which contains a worksheet similar to Form 1040. Keep your return - you will need the ... Taxes may not be the most exciting financial topic, but they’re definitely important. In the United States, federal and state governments need money to provide certain services and benefits that we wouldn’t otherwise have access to, from So... An overview of some basics about personal income taxes that every taxpayer should know. An overview of some basics about personal income taxes that every taxpayer should know. Can I Avoid State Sales Tax by Using a Montana LLC? This may sou...

Income tax organizer worksheet. State income tax is different from the federal income tax. This is the amount you pay to the state government based on the income you make, as opposed to federal income tax that goes to the federal government. That said, 50 states income ta... Hello Veterans, Please note that this is an aliased account, as I prefer to remain anonymous on this subject due to sensitive information I'm releasing. Regardless of how you interpret my words, I want you to understand that I am doing my very best and being the greatest father I can be with the resources, time, and love I have - I'm involved in a weekly parenting class at the VA and I am 100% involved in my Son's life. My Son and I have an incredible relationship together and my only hope t... **IMPORTANT INFORMATION** * YSK: Many states consider [a significant reduction in pay](https://www.reddit.com/r/YouShouldKnow/comments/fqm1w1/ysk_many_states_consider_a_significant_reduction/) a "constructive dismissal" - if your employer reduces your wages due to the stimulus, you may be able to file under unemployment insurance. - [u/Acctingner](https://www.reddit.com/u/Acctingner/) * You should know that most disinfectant sprays need to be left on the surface you're spraying for 5 to 10 min... Lacerte 2020 Organizer and Proforma release is now available. ... Your Tax Year 2021 order will process on October 20th. If you need to update your auto renew products or change the auto renew preference, this can be done any ... read more. DebH Employee. Lacerte Tax . posted Oct 15, 2021.

Budget Binder for 2021 (with FREE Printables!) This free printable budget binder and budget planner can help you save more money and spend less! Get ready to crush debt and start saving! The 2021 Budget Binder is here! I've been getting dozens of emails requesting the 2021 version, and today is the day! I share a budget planner each year in ... This 1099 expense tracker is a mobile app that is a small business owner's dream. The app can automatically scan your credit card or bank statements for tax-write deductions and create expense reports. Yes, you don't need business cards to track your write-offs any more. Stop hoarding all of your paper receipts for tax deductions. 21-16 Annual Income Tax Update Seminar - 12/13/21-12/14/21. Bob is a nationally renowned author and speaker, presenting continuing education classes to over 100,000 tax professionals over the last 20 years all over the world. Form 1040 is the tax form you will out every year when you do your federal income taxes. Prior to the 2018 tax year, there were multiple versions of the 1040, but for 2019 and beyond, the form has been consolidated into one version. While people with more complicated tax situations may need more ...

* **If you find your book in the thread below, send the number of the book via** **reddit chat or via** [**telegram**](https://t.me/textbooks4cheap) **.** * **Almost all the books are in their latest editions and some of them are available in multiple editions too** * **Books (pdf) are delivered through Google-Drive link** * **You can also send requests via reddit chat or by** [**telegram**](https://t.me/textbooks4cheap) **.** * **Also, upvote the post if you found it useful** Please find the l... The American tax system isn’t known for being the most straightforward set of laws and processes to follow, and being responsible for determining what you owe each year can seem confusing — if not a little anxiety-inducing, too. Fortunately... Quickbooks is a popular choice for accounts management. Quickbooks is easy to use with awesome features. You can handle most of the accounting tasks such as invoicing, payroll, budgeting and reconciliation in QB. It requires a little bit of time to learn the software functionality but it’s worth it. I have given few tips on restaurant accounting with QuickBooks. It is based on my 10 years of accounting experience. You will get an idea of most of the elements of Quickbooks. **QuickBooks setu... **IMPORTANT INFORMATION** * There are predators taking advantage of the CoVid-19 outbreak to [scam](https://wlos.com/news/local/scam-alert-better-business-bureau-releases-list-of-top-coronavirus-scams) people. Don't be fooled. [Here](https://www.consumer.ftc.gov/features/coronavirus-scams-what-ftc-doing) is what the FTC is suggesting you watch out for and what they are doing to protect you. * [What to do](https://www.nbcchicago.com/news/coronavirus/steps-to-take-if-you-cant-make-ends-meet-becau...

Schedule Nj Coj Download Fillable Pdf Or Fill Online Credit For Income Or Wage Taxes Paid To Other Jurisdiction 2019 New Jersey Templateroller Gross Income Tax Depreciation Adjustment Worksheet. Nj worksheet h 2019 .

Federal income tax rates and withholding often seem opaque to both employees and employers. As an employee, you are surprised to see that your paycheck is well below what you might expect from the monthly salary agreed to with your employer...

If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. A tax appraisal influences the amount of your property taxes. Here’s what you need to know about getting a tax appraisal. Your city u...

As the old adage goes, taxes are a fact of life. And the more we know about them as adults the easier our finances become. There are many things to learn to become an expert (this is why we have accountants), but the essentials actually are...

Lacerte Tax Discussions. Lacerte 2020 Organizer and Proforma release is now available. An update for Lacerte 2020 is now available to enable you to create organiz... Read more. New field in "My settings". There is now a place to add your CAN (Customer Account Number) under "My se... Read more. E-file start and stop dates for federal returns.

Going back to our example of $100,000 adjusted gross income, let's assume you paid yourself a salary of $40,000 and took $60,000 in dividends. In this scenario, you'd only pay the 15.3% SE tax on the $40,000. In this example, your self-employment tax is $6,120, effectively lowering your tax burden by nearly $9,000. A Few Things To Keep In Mind

Preparing your own income tax return can be a task that leaves you with more questions than answers. According to a study released by the US Government's General Accounting Office last year, most taxpayers (77% of 71 million taxpayers) believe they benefited from using a professional tax preparer.

Step 2: Select the right tax forms. Whether you're an independent contractor or an employee, you'll use Form 1040 to file your tax return as a delivery driver. If you're an employee, the wages from your W-2 go on line 1 of Form 1040, and the federal income taxes your employer withheld go on line 17. If you use tax filing software like TurboTax ...

**IMPORTANT INFORMATION** * YSK: Many states consider [a significant reduction in pay](https://www.reddit.com/r/YouShouldKnow/comments/fqm1w1/ysk_many_states_consider_a_significant_reduction/) a "constructive dismissal" - if your employer reduces your wages due to the stimulus, you may be able to file under unemployment insurance. - [u/Acctingner](https://www.reddit.com/u/Acctingner/) * You should know that most disinfectant sprays need to be left on the surface you're spraying for 5 to 10 min...

For all those posting gain/loss porn today, this is literally for you (both losers and winners). Quick edit: It is OK if you don't know this stuff. This post is to help you get started. To those who want to spew insults in the comments because a surprising number of folks don't know the basic information in this post, try teaching our members instead of shaming them. Take some responsibility to better this community. What is a 1099? Where am I supposed to find that? I switched platforms five t...

312-50 Certified Ethical Hacker Practice Exam-1 https://impodays.com/courses/312-50-certified-ethical-hacker-practice-exam-1/ Accounting, Financial Accounting https://impodays.com/courses/accounting-financial-accounting/ AI-900 : Microsoft Azure AI Fundamentals Exam->Practice Test https://impodays.com/courses/ai-900-microsoft-azure-ai-fundamentals-exam-practice-test/ Aplos Not for Profit Accounting Software https://impodays.com/courses/aplos-not-for-profit-accounting-software/ AZ-220...

**IMPORTANT INFORMATION** * Nursing 101: [Caring for your loved ones at home](https://www.reddit.com/r/Coronavirus/comments/f513zm/nursing_101_caring_for_your_loved_ones_at_home/?utm_medium=android_app&utm_source=share) * [These](https://www.washingtonpost.com/graphics/business/coronavirus-stimulus-check-calculator/) [three](https://www.nytimes.com/article/coronavirus-stimulus-package-questions-answers.html) [articles](https://militarybenefits.info/stimulus-checks/) will probably answer any...

In the United States, every working person who earns more than a certain amount of money each year needs to pay income taxes to the federal government. Not everyone pays the same amount, though; the U.S. uses a progressive tax system, which...

**IMPORTANT INFORMATION** * There are predators taking advantage of the CoVid-19 outbreak to [scam](https://wlos.com/news/local/scam-alert-better-business-bureau-releases-list-of-top-coronavirus-scams) people. Don't be fooled. [Here](https://www.consumer.ftc.gov/features/coronavirus-scams-what-ftc-doing) is what the FTC is suggesting you watch out for and what they are doing to protect you. * [What to do](https://www.nbcchicago.com/news/coronavirus/steps-to-take-if-you-cant-make-ends-meet-beca...

**IMPORTANT INFORMATION** * YSK: Many states consider [a significant reduction in pay](https://www.reddit.com/r/YouShouldKnow/comments/fqm1w1/ysk_many_states_consider_a_significant_reduction/) a "constructive dismissal" - if your employer reduces your wages due to the stimulus, you may be able to file under unemployment insurance. - [u/Acctingner](https://www.reddit.com/u/Acctingner/) * Nursing 101: [Caring for your loved ones at home](https://www.reddit.com/r/Coronavirus/comments/f513zm/nursi...

Quickbooks is a popular choice for accounts management. Quickbooks is easy to use with awesome features. You can handle most of the accounting tasks such as invoicing, payroll, budgeting and reconciliation in QB. It requires a little bit of time to learn the software functionality but it’s worth it. I have given few tips on restaurant accounting with QuickBooks. ( Most of the points are applicable to other businesses as well. So keep reading.) It is based on my 10 years of accounting experie...

We built two E. Howard Number 70-24 Regulator clocks. These clocks made of oak have a 24 inch painted wooden dial, stand a massive 59 inches tall and weight around 150 pounds. 26 Brighton Street. Belmont, MA 02478. ph: 617-484-1816. fax: 617-484-3467. russ @russkcpa .com.

Schedule A is an IRS form used to claim itemized deductions on a tax return (Form 1040). See how to fill it out, how to itemize tax deductions and helpful tips.

I have two 1065 K-1s and one 1099-DIV with foreign taxes paid ($4,583, $1, and $3, respectively).I have all linked to Form 1116 on the K-1. davetodd11 Level 4. ProSeries Professional. posted Jan 4, 2022. Last activity Jan 5, 2022 by jeffmcpa2010.

[baby, let's talk about T20](https://www.youtube.com/watch?v=ydrtF45-y-g)\~ Let's talk aboooout debt! Let's talk about debt! (yes it is a link to Salt-n-Pepa) This is an admittedly biased resource for people choosing between a T14 at sticker and a T20 with $$+, but it can be adapted for anyone choosing between a top choice with less money and a target or safety with more money. Just be aware when adapting it across lower tiers what employment scores and median salaries look like for the school...

**IMPORTANT INFORMATION** * There are predators taking advantage of the CoVid-19 outbreak to [scam](https://wlos.com/news/local/scam-alert-better-business-bureau-releases-list-of-top-coronavirus-scams) people. Don't be fooled. [Here](https://www.consumer.ftc.gov/features/coronavirus-scams-what-ftc-doing) is what the FTC is suggesting you watch out for and what they are doing to protect you. **EMERGENCY ASSISTANCE** * [IF YOU ARE EXPERIENCING LOSS OF JOB OR INCOME](https://www.nytimes.com/arti...

312-50 Certified Ethical Hacker Practice Exam-1 https://impodays.com/courses/312-50-certified-ethical-hacker-practice-exam-1/ Accounting, Financial Accounting https://impodays.com/courses/accounting-financial-accounting/ AI-900 : Microsoft Azure AI Fundamentals Exam->Practice Test https://impodays.com/courses/ai-900-microsoft-azure-ai-fundamentals-exam-practice-test/ Aplos Not for Profit Accounting Software https://impodays.com/courses/aplos-not-for-profit-accounting-software/ AZ-220 ...

**IMPORTANT INFORMATION** * There are predators taking advantage of the CoVid-19 outbreak to [scam](https://wlos.com/news/local/scam-alert-better-business-bureau-releases-list-of-top-coronavirus-scams) people. Don't be fooled. [Here](https://www.consumer.ftc.gov/features/coronavirus-scams-what-ftc-doing) is what the FTC is suggesting you watch out for and what they are doing to protect you. * [What to do](https://www.nbcchicago.com/news/coronavirus/steps-to-take-if-you-cant-make-ends-meet-becau...

Please join & Support [r/eBooksDeals](https://www.reddit.com/r/eBooksDeals/) 🙏& keep me awake with Coffee [https://ko-fi.com/vm007](https://ko-fi.com/vm007) 🤘☕️ \[English\] 11h 54m Lead Generation MASTERY with Facebook Lead & Messenger Ads [https://www.udemy.com/course/facebook-lead-ads-course/?couponCode=SEPTGOODNESS99](https://www.udemy.com/course/facebook-lead-ads-course/?couponCode=SEPTGOODNESS99) 2 Days left at this price! \[English\] 1h 27m Learn MySQL - For Beginners [http...

**How to Get a Cheap Separation** Lots of people obtain mentally as well as economically stressed when they file divorce papers. It's even more difficult for pairs with children. Most spouses have a dirty understanding of Family members Legislation in the United States. They aren't knowledgeable about the various types of divorce you can submit in some states. It is important to get in touch with a family members attorney to understand what separation involves. Right here are 8 suggestions t...

Quickbooks is a popular choice for accounts management. Quickbooks is easy to use with awesome features. You can handle most of the accounting tasks such as invoicing, payroll, budgeting and reconciliation in QB. It requires a little bit of time to learn the software functionality but it’s worth it. I have given few tips on restaurant accounting with QuickBooks. It is based on my 10 years of accounting experience. You will get an idea of most of the elements of Quickbooks. **QuickBooks setu...

**IMPORTANT INFORMATION** * There are predators taking advantage of the CoVid-19 outbreak to [scam](https://wlos.com/news/local/scam-alert-better-business-bureau-releases-list-of-top-coronavirus-scams) people. Don't be fooled. [Here](https://www.consumer.ftc.gov/features/coronavirus-scams-what-ftc-doing) is what the FTC is suggesting you watch out for and what they are doing to protect you. * [What to do](https://www.nbcchicago.com/news/coronavirus/steps-to-take-if-you-cant-make-ends-meet-becau...

America's #1 tax preparation provider: As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2020, tax year 2019. Self-Employed defined as a return with a Schedule C/C-EZ tax form.

The other night a good friend of mine came into the studio to get some portraits done. We did some really good work and I believe this is the best one.

Getting back on the budgeting bandwagon. I haven't been here since YNAB 4, and I didn't use it a lot after YNAB 2. I'm pretty bad at budgeting. So I pulled out all my Financial Peace University worksheets from 2k12 I never actually used for a start... I should probably take a class again once we're allowed to leave our homes. I'd like to work in tandem with YNAB, ideally without double entry. I have my Special Ordered System (tm) all figured out but there are some things/forms I want to use wit...

Don't forget to make your quarterly tax payments to avoid any fines as well. Try Keeper Tax's estimated tax calculator to see how much you need to pay. {email_capture} Get your 1099 Excel template. I encourage you to utilize this CSV excel template to get you more organized when filling out your 1099 forms and ready for tax time.

If you’re a working American citizen, you most likely have to pay your taxes. And if you’re reading this article, you’re probably curious to know what exactly you’re paying for. We’ll break down everything you need to know about paying taxe...

**I know this is text heavy. Dont let it daunt you. Print and read in chunks. I think it's worth it and will get you benefits fastest, if you cant get a lawyer** The RFC & worksheets from PDS are really easy, and the Nolo Guide is a For Dummies that walks you through the process & answers legal questions. **SSDI Basics of filing and Residual RFC (Helps for SSI & RFC & worksheets work for Employers/ private disability too)** This is not just for Sleep disorders, though I hav...

**IMPORTANT INFORMATION** * YSK: Many states consider [a significant reduction in pay](https://www.reddit.com/r/YouShouldKnow/comments/fqm1w1/ysk_many_states_consider_a_significant_reduction/) a "constructive dismissal" - if your employer reduces your wages due to the stimulus, you may be able to file under unemployment insurance. - u/Acctingner * Nursing 101: [Caring for your loved ones at home](https://www.reddit.com/r/Coronavirus/comments/f513zm/nursing_101_caring_for_your_loved_ones_at_hom...

This article will assist you with generating Form 6781, Gains and Losses From Section 1256 Contracts and Straddles, in ProSeries Professional and ProSeries Basi... read more. Intuit Help Intuit. ProSeries Basic ProSeries Professional. posted Dec 10, 2021.

Hi everyone, so recently because of the covid-19 situation (and because of time as I'm getting old) I think it's a good idea to get all of my admin things figured out. This is what I have so far: \- made a will (using a paid will service with unlimited revisions). I have to get it signed which will be tricky \- will print off a 140 page worksheet (not all of it applies to me) with my biographical info, employment, business interests, durable power of attorney, health card, memberships, organ d...

Hi, My total income in 2019 was less than $300 before any deductions or expenses. After deductions (I started a small business which was destroyed by the pandemic). After expenses (approximately $1,200 to start the business), my total income was negative. I am (and was) an independent contractor essentially; I worked for myself, and picked clients for myself and did not work for any company or agency. I used an online tax preparer and it had me do the following forms: 1040 1040 Schedule 1 Fo...

Keeping the over 9 million words of constantly changing tax code straight is a daunting task. New Tax Law, Revenue Rulings, Filing Requirements, Phase-Outs, Dependency Rules; it's a lot to remember! Our authors take this massive amount of information and place it in a fast-answer format that makes finding your answer easy.

A tax collector may not be a friend to all but someone has to do the job. Their duties ensure that individuals and businesses are paying the correct amount of taxes on time. A tax collector works for various government agencies, whether at ...

An overview of some basics about personal income taxes that every taxpayer should know. An overview of some basics about personal income taxes that every taxpayer should know. Can I Avoid State Sales Tax by Using a Montana LLC? This may sou...

Taxes may not be the most exciting financial topic, but they’re definitely important. In the United States, federal and state governments need money to provide certain services and benefits that we wouldn’t otherwise have access to, from So...

If you expect to make quarterly estimated tax payments, use Form 1040-ES, Estimated Tax for Individuals, which contains a worksheet similar to Form 1040. Keep your return - you will need the ...

0 Response to "come tax organizer worksheet"

Post a Comment