42 same day tax payment worksheet

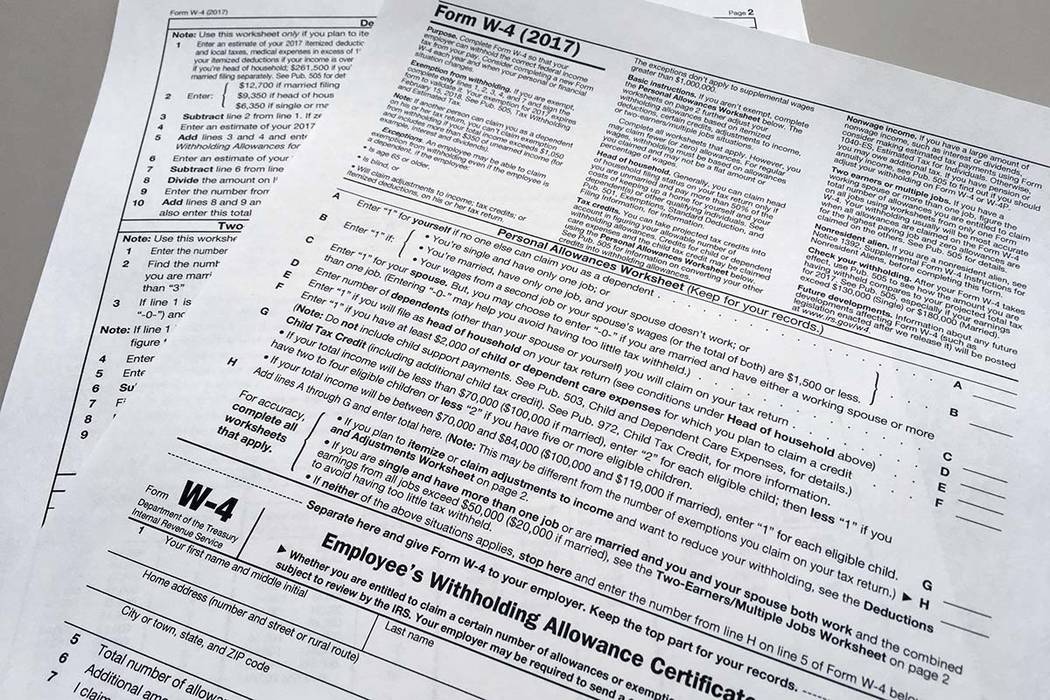

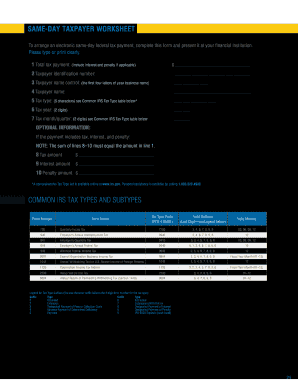

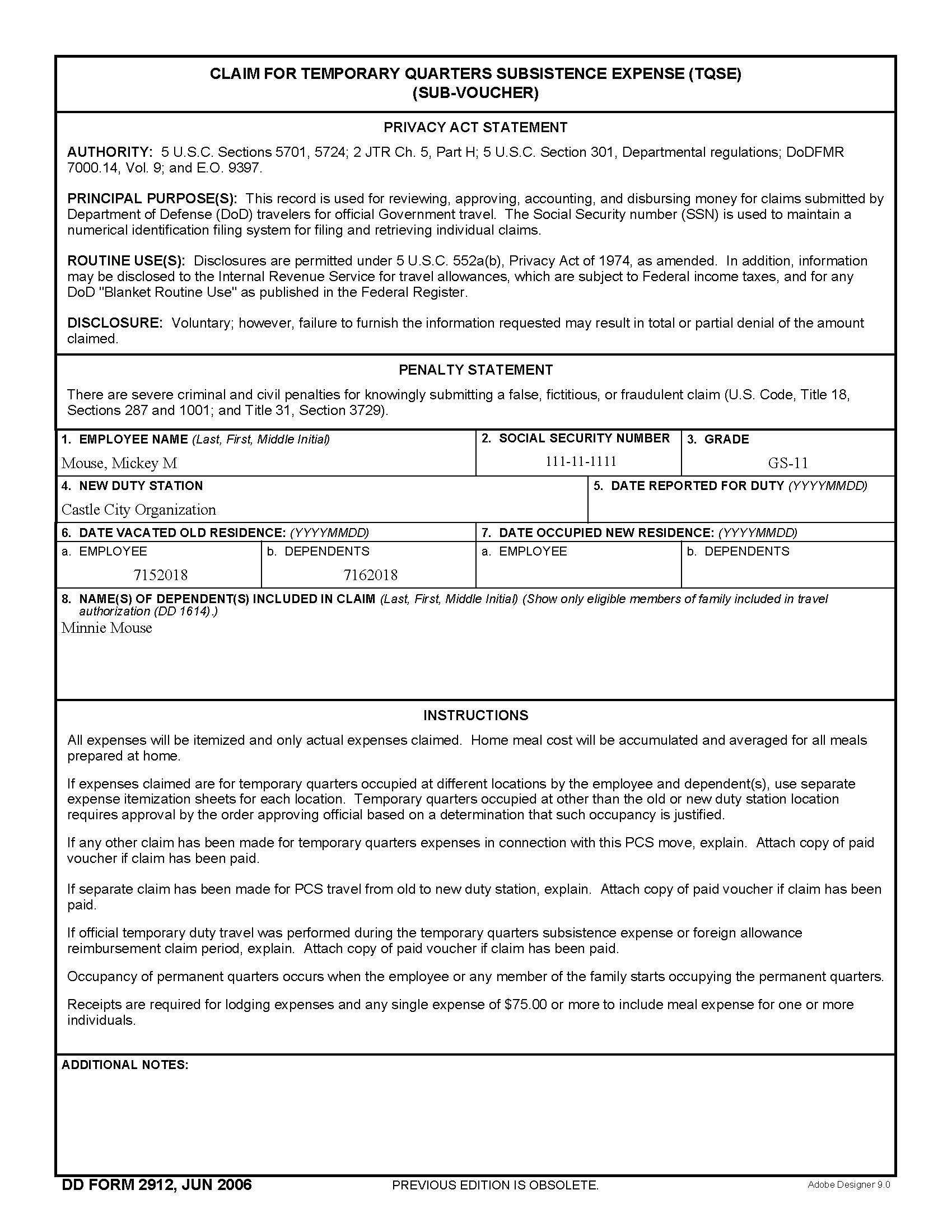

PDF SAME-DAY TAXPAYER WORKSHEET - Bureau of the Fiscal Service SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identification number: Same Day Taxpayer Worksheet - Fill Out and Sign Printable ... Follow the step-by-step instructions below to eSign your same day payment worksheet irs: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

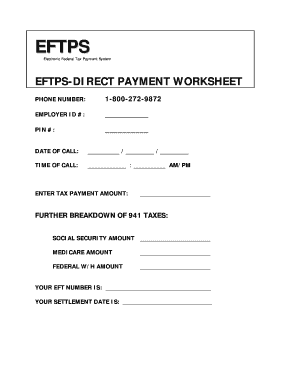

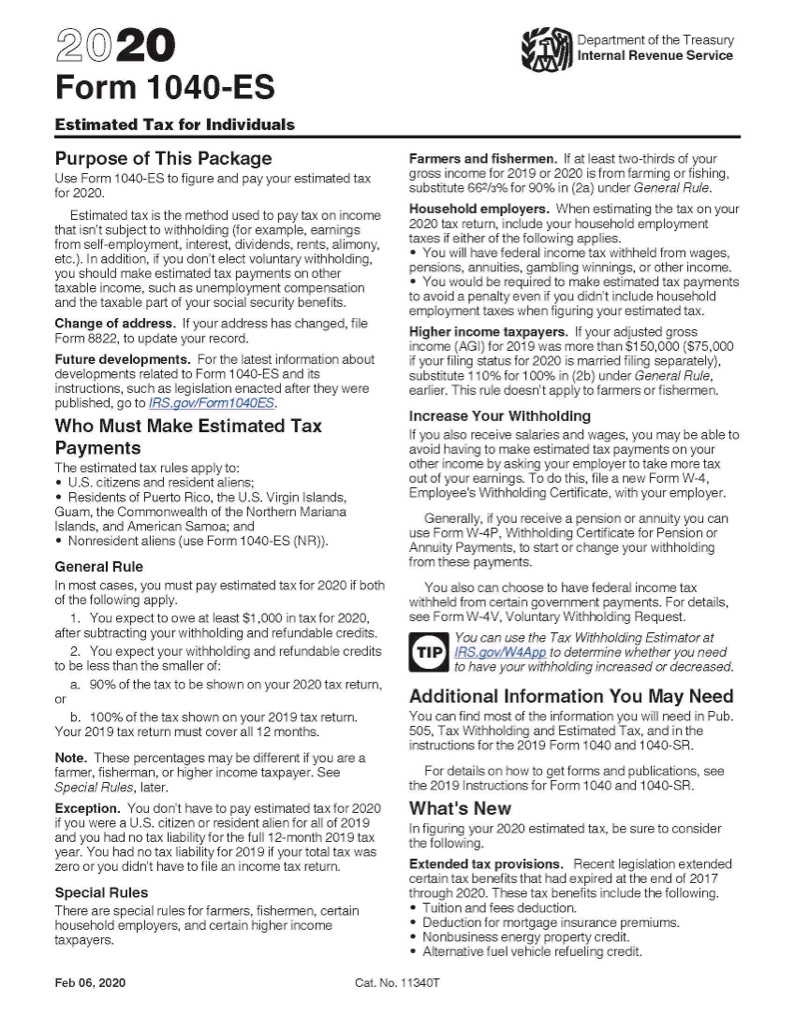

Instructions for Form 1120-W (2022) - IRS tax forms Enter the 15th day of the 4th, 6th, 9th, and 12th months of your tax year in columns (a) through (d). If the due date falls on a Saturday, Sunday, or legal holiday, enter the next business day. Line 11. Required Installments Payments of estimated tax should reflect any 2021 overpayment that the corporation chose to credit against its 2022 tax.

Same day tax payment worksheet

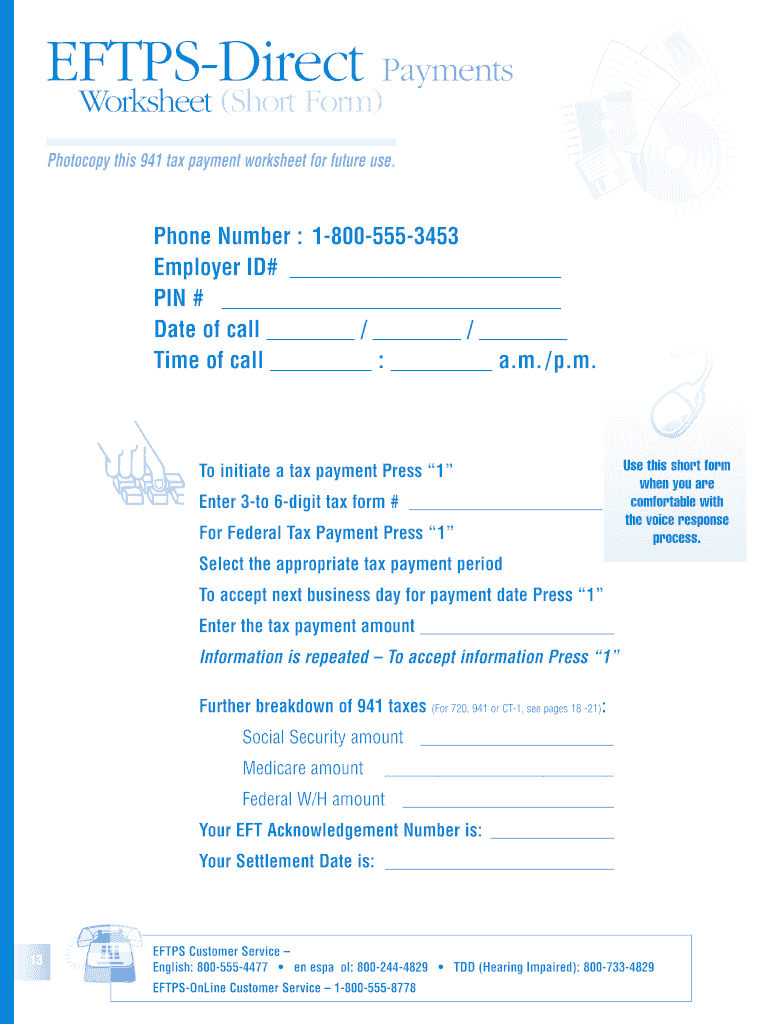

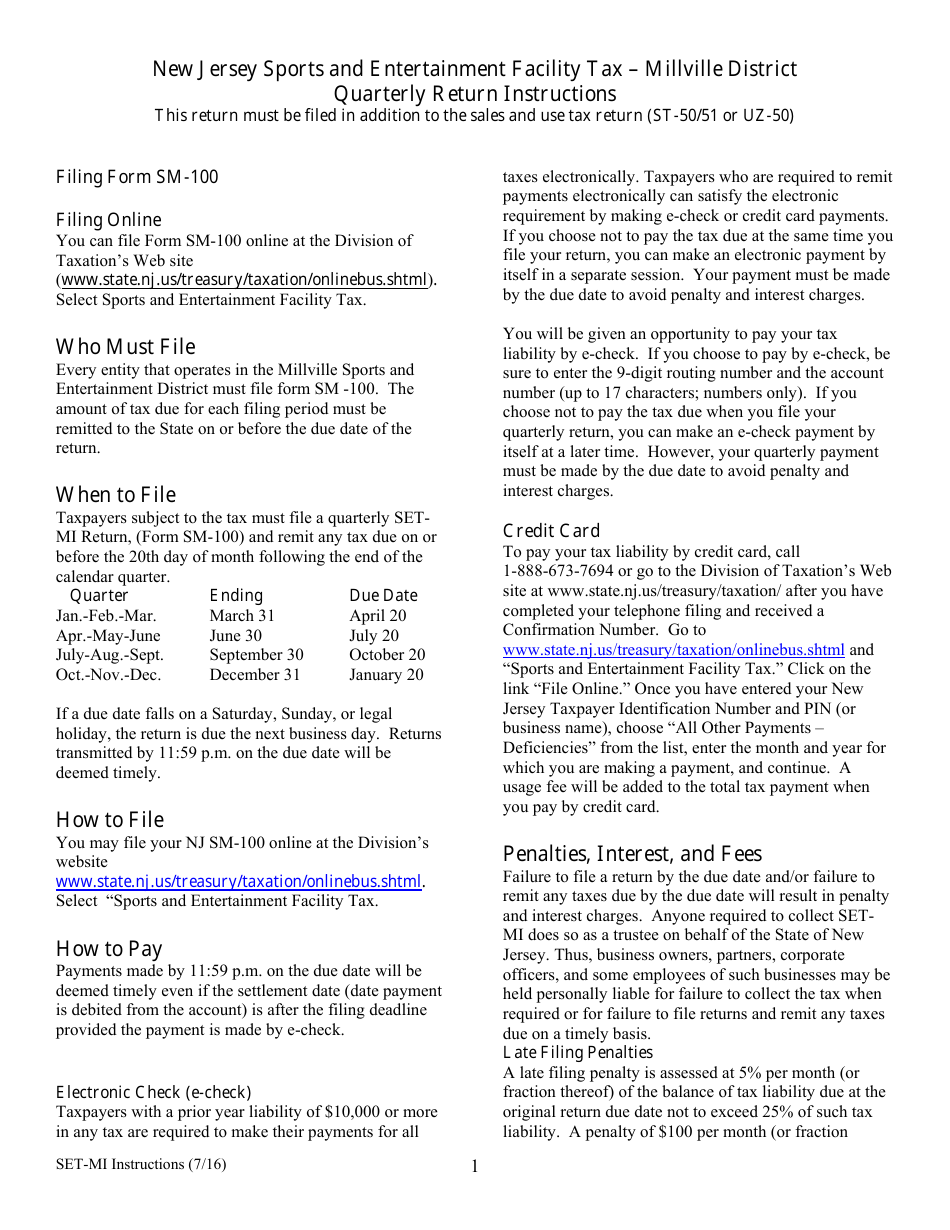

Welcome To Eftps Online - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to eSign your eftps direct payment worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. Fill - Free fillable Same- Day Taxpayer Worksheet PDF form Fillable Same- Day Taxpayer Worksheet Fill Online, Printable, Fillable, Blank Same- Day Taxpayer Worksheet Form Use Fill to complete blank online OTHERS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Same- Day Taxpayer Worksheet PDF FAE - Estimated Tax Payments Worksheet - Tennessee When to Make Payments: Quarterly payments of the estimated franchise and excise taxes are to be made as follows: Payment Due Date 1st Payment The 15th day of the 4th month of the current taxable year 2nd Payment The 15th day of the 6th month of the current taxable year 3rd Payment The 15th day of the 9th month of the current taxable year

Same day tax payment worksheet. Electronic Same-Day Federal Tax Payment - 2290Tax.com To make a same-day federal tax payment you need to fill out the Same Day Payment Worksheet and present it to your bank. Electronic Same-Day Worksheet Things to know: Must schedule your payment before 5 p.m. ET otherwise your payment will be rejected. Errors in the worksheet will be cause for your payment to be rejected. M Form 1-ES Massachusetts Estimated Income Tax Revenue Estimated Tax Worksheet. Explanations of your deductions, exemptions and credits appear in the tax form instructions. Note: If first voucher is due on April 15, 2022, June 15, 2022, September 15, 2022, or January 15, 2023, enter 25%, 33%, 50% or 100%, respectively, PDF Common Irs Tax Types and Subtypes - Eftps SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) 2 Taxpayer identification number: 3 Taxpayer name control: (the first four letters of your business ... PDF SAME-DAY TAXPAYER WORKSHEET - PHD Tax SAME-DAY TAXPAYER WORKSHEET To arrange an electronic same-day federal tax payment, complete this form and present it at your inancial institution. Please type or print clearly. 1 Total tax payment: (Include interest and penalty if applicable) $ 2 Taxpayer identiication number: 3 Taxpayer name control: (the irst four letters of your business ...

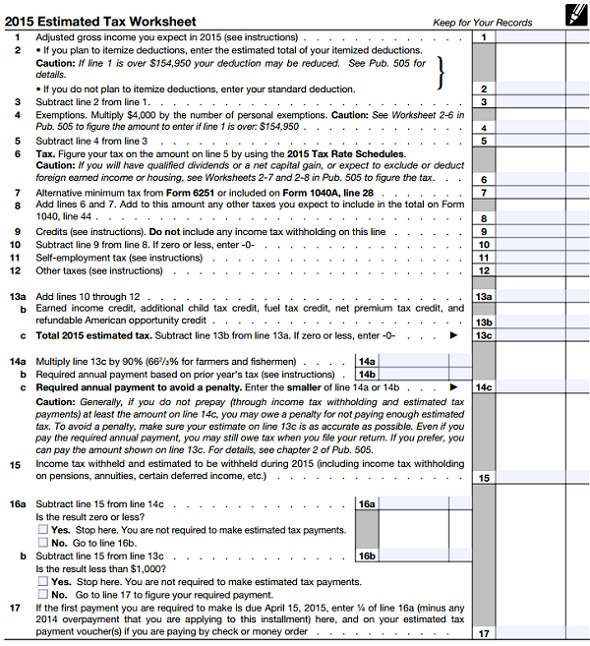

PDF Same-day Taxpayer Worksheet To arrange an electronic same-day federal tax payment, complete this form and present it at your financial institution. Please type or print clearly. Legend for Tax Type Suffixes (the one character suffix follows the 4-digit form number for the tax type): Suffix Type Suffix Type 0 Amended 6 Estimated PDF Individual Estimated Income Tax first estimated tax payment due for this tax period. Calculating the Payment Estimated tax payments can be made on a quarterly basis. Use the worksheet provided on the following page to calculate the amount of estimated tax owed. Reference the previous year Colorado income tax return and instructions for help determining taxable income. PDF Electronic Federal Tax Payment System. Financial ... HOW EFTPS MAKES TAX PAYMENTS EASIER 1 Business customers can schedule payments up to 365 days in advance 2 Individuals can schedule payments up to 365 days in advance 3 Up to sixteen months of payment history can be viewed online 4 U.S.-based, live support is available 24/7 at: 1.800.555.4477 (English) 1.800.244.4829 (Spanish) PDF EFTPS-Direct Payment Worksheet VRS EFTPS-Direct Payment Worksheet - long form (continued) Further breakout for the following tax forms: For Tax Form 720, you are requested to report IRS numbers and amounts, and the IRS number amounts must balance to the Tax Form 720 payment amount. For Tax Form 941 and CT-1, you are requested to report

Same-Day Wire Federal Tax Payments - IRS tax forms Download the Same-Day Taxpayer Worksheet PDF. Complete it and take it to your financial institution. If you are paying for more than one tax form or tax period, complete a separate worksheet for each payment. Financial institutions can refer to the Financial Institution Handbook PDF for help with formatting and processing information. PDF 52882 2022 D-40es 12.14.21 Spread Columbia (DC) income tax return and, you expect to owe $100 or more in taxes. See Worksheet to Estimate DC Tax Payments on page 8. _____ What must be filed? If you plan to file jointly on your 2021 D-40 return, you should file joint 2022 D-40ES vouchers to ensure that you receive credit for any esti-mated income tax you pay. PDF 2022 D-101a Form 1-ES Instructions - Estimated Income Tax ... The estimated tax payments may be divided between you and your spouse in any manner you choose. If separate payments are ... your due dates are the 15th day of the 4th, 6th, and 9th months of your current fiscal year, ... 2022 Estimated Income Tax Worksheet - Keep for your records - Do not file 2022 Tax Rate Schedules for Full-Year Residents* TEXNET and Electronic Payment of Taxes and Fees Questions For questions regarding electronic payment, please contact the Electronic Reporting Section or call 800-531-5441, ext. 3-3630. For questions regarding TEXNET payments, please call the TEXNET Hotline at 800-531-5441, ext. 3-3010.

Treasurer Online Payment Full Year payments accepted through December 31st interest-free on current year taxes. A convenience fee of 2.25% for credit card transactions and a convenience fee of 1.85% for debit card transactions will be charged by FIS. Only one credit card can be used per transaction. Please allow 1-3 business days for your payment to post.

Can I make my Federal payroll tax payments the day they're ... To make a same-day wire transfer, fill out the Same-Day Taxpayer Worksheet and take it to your bank. If you are depositing for multiple tax forms or tax periods, then you will have to complete a separate form for each payment.

PDF *210158-I19999* Denver CO 80261-0008 (0019) Tax.Colorado ... DR 0158-I (06/03/21)Tax Payment Worksheet- Photocopy for your records before returning 1. Income tax you expect to owe 2. Tax payments and credits: a. Colorado income tax withheld b. Colorado estimated income tax payments c. Other payments and credits d. Total tax payments and credits - Add lines 2a through 2c 3.

DOC IRS Wire Transfer Instructions - ncpe Fellowship The IRS asks that you fill out the Same-Day Taxpayer Worksheet and bring it to your financial institution to assist in making the transfer. You'll document your total tax payment, your taxpayer identification number, the first four letters of your business name -- if applicable -- and your name or the full business name.

What do I put on the Same-Day Taxpayer Worksheet u... What do I put on the Same-Day Taxpayer Worksheet under tax/month quarter for a 1040X What do I put on the Same-Day Taxpayer Worksheet under tax/month quarter for a 1040X. My preparer told me to use 10 and I did but now I'm thinking it may have been wrong?

Session Expired - Electronic Federal Tax Payment System To begin a new session, click the 'back' button on your browser and then press the 'shift' key and click the 'refresh' icon. Click here to begin a new session. For assistance call Customer service at 1 800 555-8778.

Same Day Wire Federal Tax Payments | Internal Revenue Service Information about making same-day wire federal tax payments via the EFTPS website. You may be able to do a same-day wire from your financial institution. Contact your financial institution for availability, cost, and cut-off times. Download the Same-Day Taxpayer Worksheet. Complete it and take it to your financial institution.

PDF 2022 Instructions for Estimating PA Personal Income Tax ... the tax rate for both tax years is the same and the taxpayer ... shown or the next business day if the due date falls on a Saturday, PAYMENT DUE DATES TABLE 2022 PA ESTIMATED TAX PAYMENT WORKSHEET 2022 ESTIMATED INCOME Enter the expected PA-taxable income for 2022. Do not

Welcome to EFTPS online If you are required to make deposits electronically but do not wish to use the EFTPS® tax payment service yourself, ask your financial institution about ACH Credit or same-day wire payments, or consult a tax professional or payroll provider about making payments for you. Please note: These options may result in fees from the providers.

IRS Wire Transfer Instructions - sapling The IRS asks that you fill out the Same-Day Taxpayer Worksheet and bring it to your financial institution to assist in making the transfer. You'll document your total tax payment, your taxpayer identification number, the first four letters of your business name -- if applicable -- and your name or the full business name.

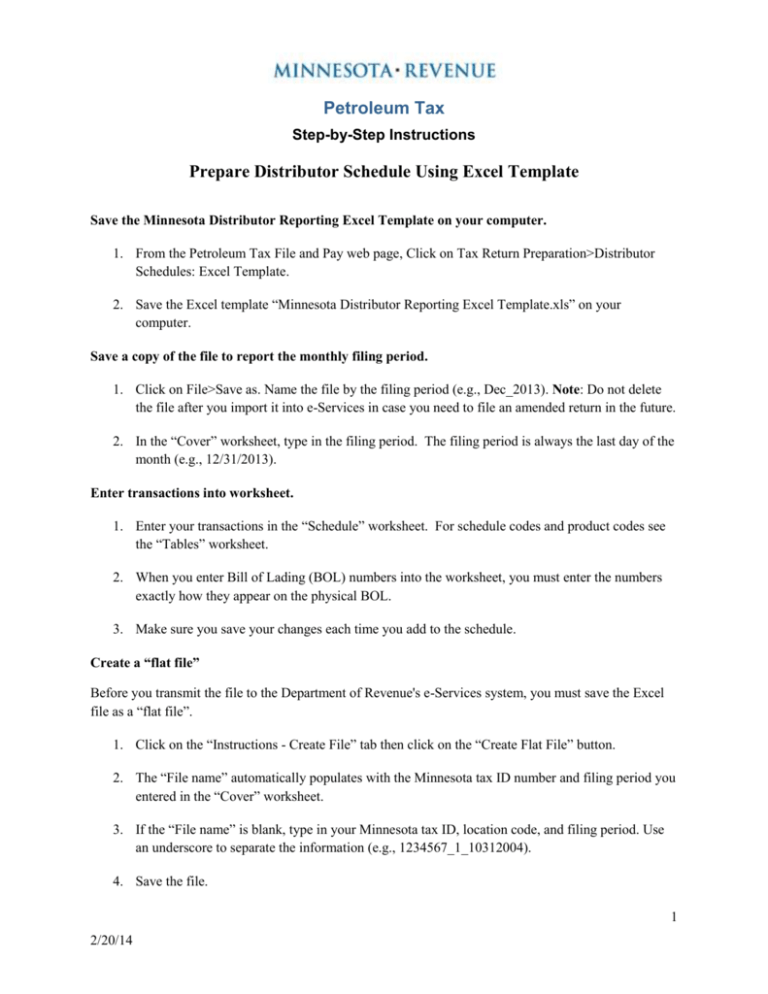

Federal Tax Collection - Resources The Federal Tax-Wire Assistant is designed to assist taxpayers and financial institutions with the proper formatting of same day IRS tax Fedwires. The use of this spreadsheet is OPTIONAL. Taxpayers are not required to use this tool. Before opening the Federal Tax-Wire Assistant, close all other Excel spreadsheets.

PDF FAE - Estimated Tax Payments Worksheet - Tennessee When to Make Payments: Quarterly payments of the estimated franchise and excise taxes are to be made as follows: Payment Due Date 1st Payment The 15th day of the 4th month of the current taxable year 2nd Payment The 15th day of the 6th month of the current taxable year 3rd Payment The 15th day of the 9th month of the current taxable year

Fill - Free fillable Same- Day Taxpayer Worksheet PDF form Fillable Same- Day Taxpayer Worksheet Fill Online, Printable, Fillable, Blank Same- Day Taxpayer Worksheet Form Use Fill to complete blank online OTHERS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Same- Day Taxpayer Worksheet

Welcome To Eftps Online - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to eSign your eftps direct payment worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "42 same day tax payment worksheet"

Post a Comment