43 sale of rental property worksheet

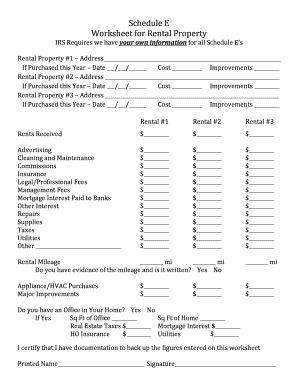

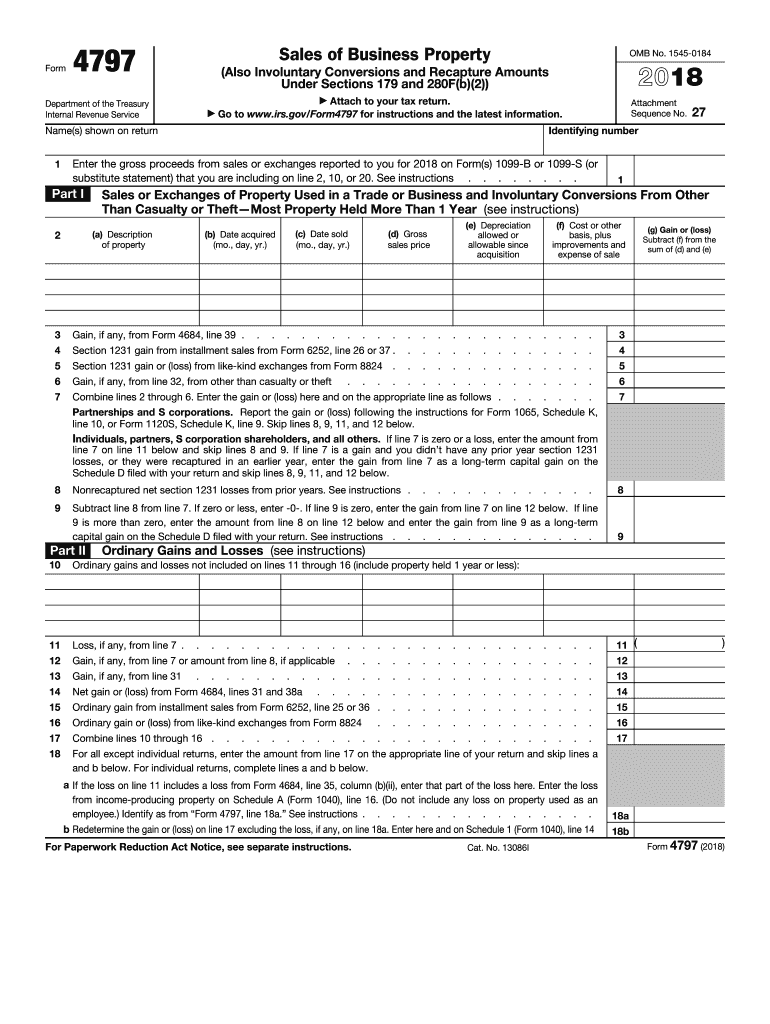

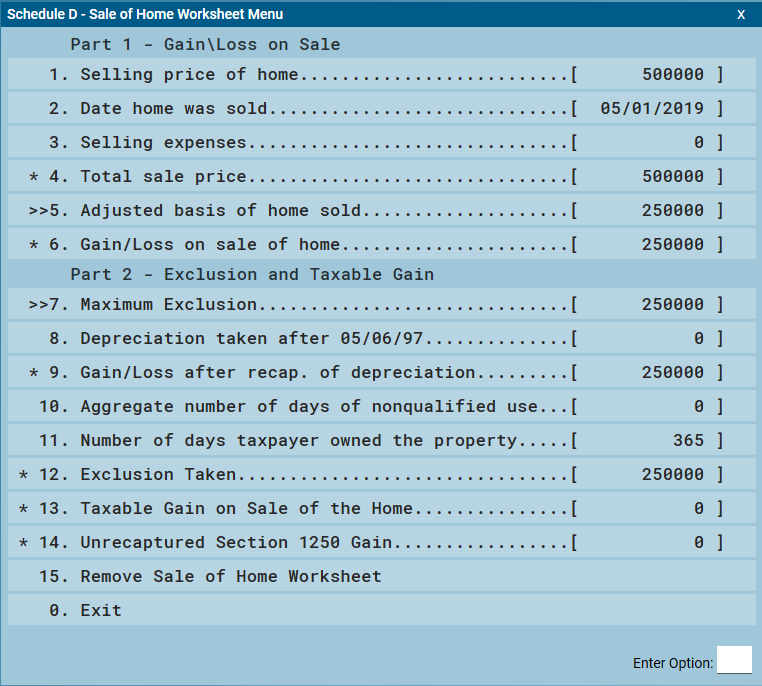

PDF Rental Property Worksheet page 1 of 2 version: feb21 rental property worksheet. tax year: name: _____ please complete this page for each rental property How do I report the sale of my home if part of the home ... Follow the steps above to complete the Sale of Main Home Worksheet. Your cost basis and proceeds need to be prorated based on the total square footage of the home that was not used for business or rental. The sale of the rental portion would be reported on form 4797 for the sale of a business property.

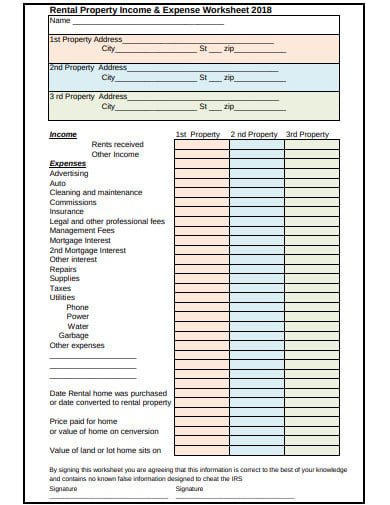

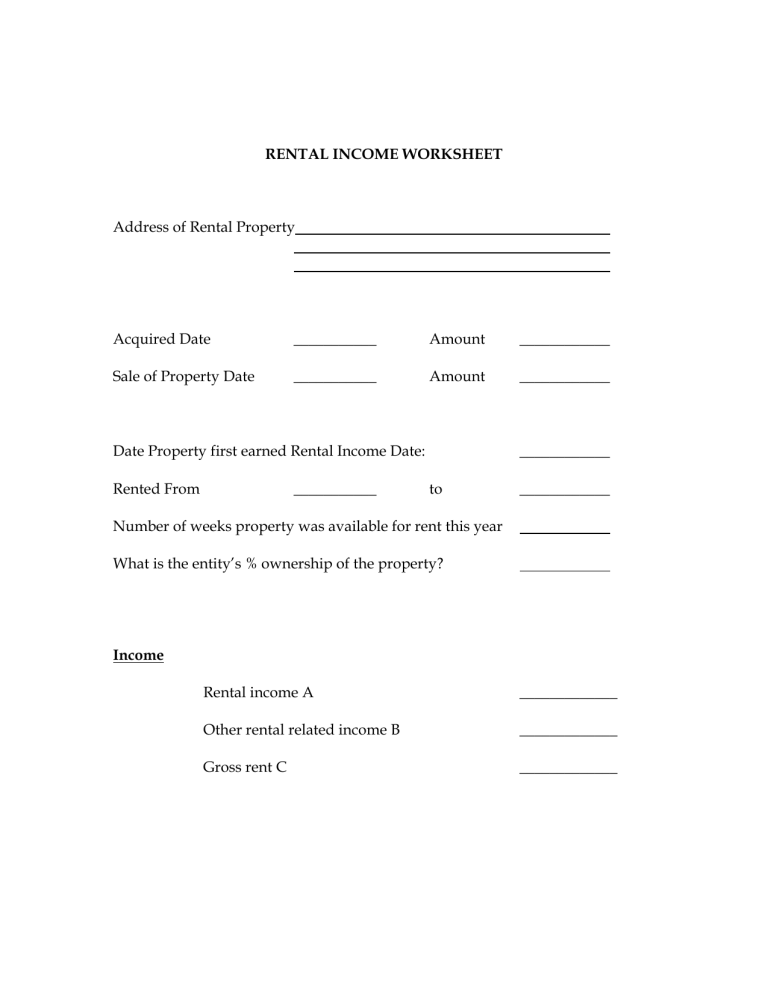

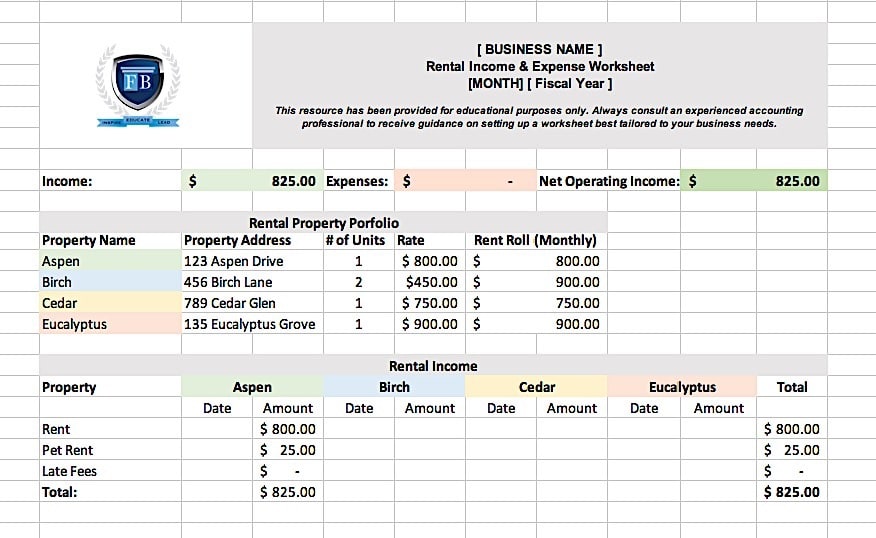

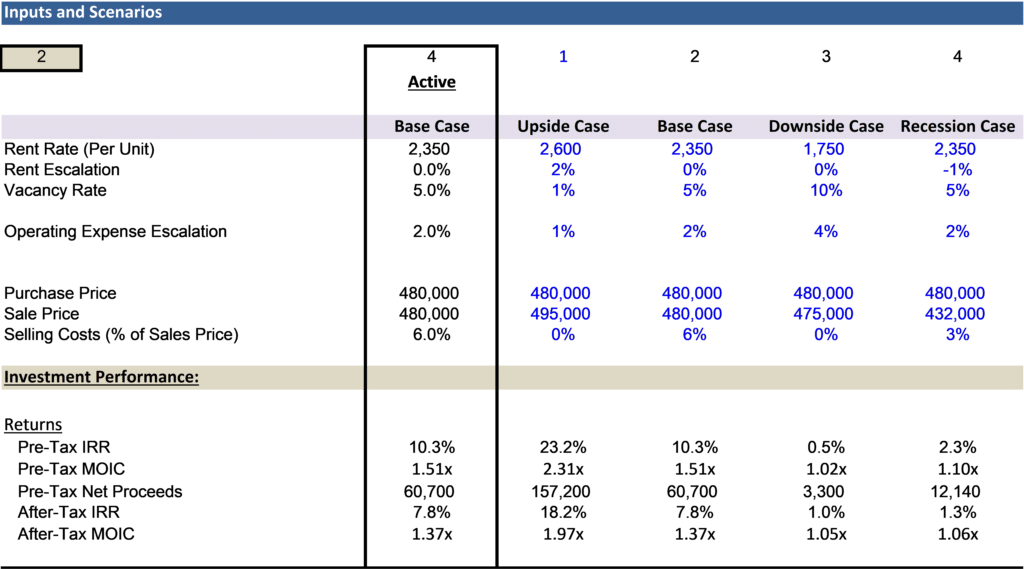

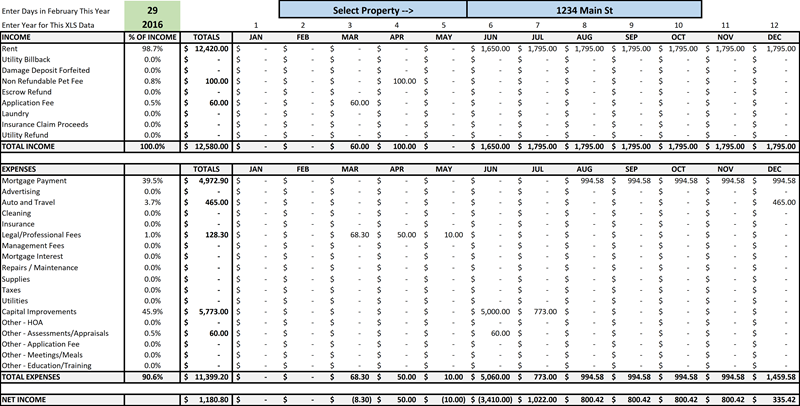

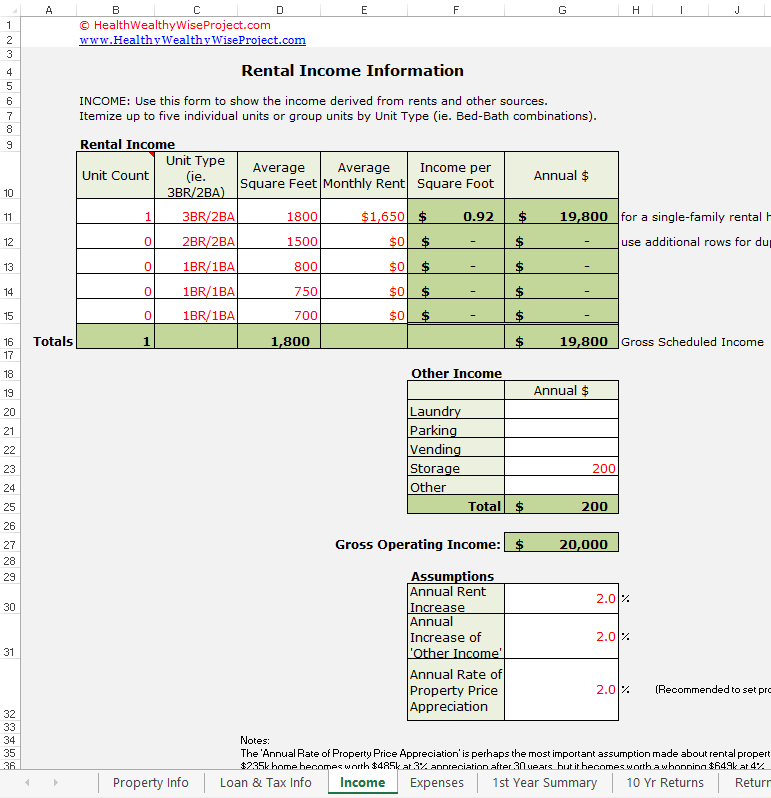

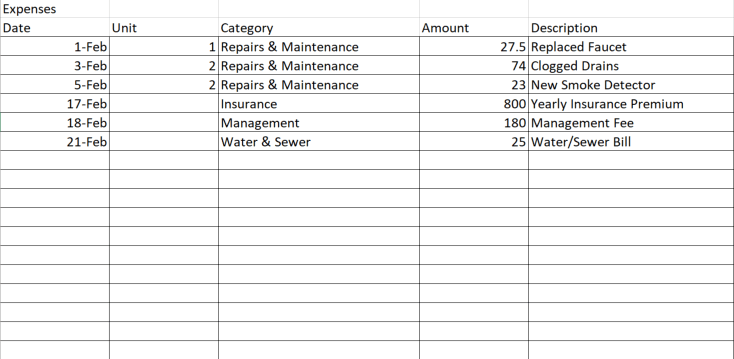

18+ Rental Property Worksheet Templates in PDF | Free ... The Rental Property Worksheet is to keep the record of the rent including the expenses. And if you have included new assets in the property or sold anything, you can mention in the document. Include all the prices together and then you can evaluate the depreciation in the prices and the total saving you did.

Sale of rental property worksheet

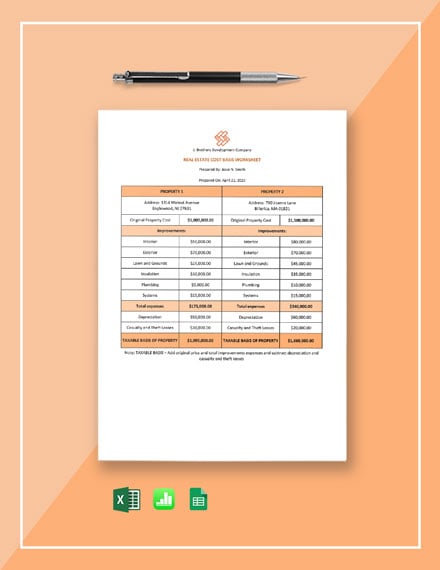

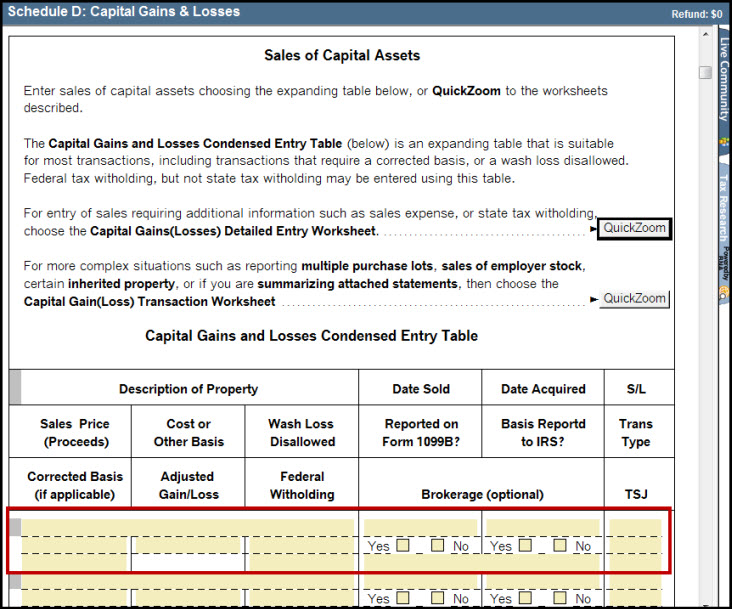

PDF Capital Gain Worksheet - efirstbank1031.com Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3) Less depreciation taken during ownership ( (4) Worksheet: Calculate Capital Gains - Realtor Magazine A Special Real Estate Exemption for Capital Gains Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. How do I report the sale of a rental property that ... When reporting a property that has been used as both a rental and a primary residence, you will need to include a Form 4797 and a Sale of Main Home Worksheet on your tax return. How do I report this within the program? To report the sale of the Rental portion of your property, please follow this path: Federal Section Income Less Common Income

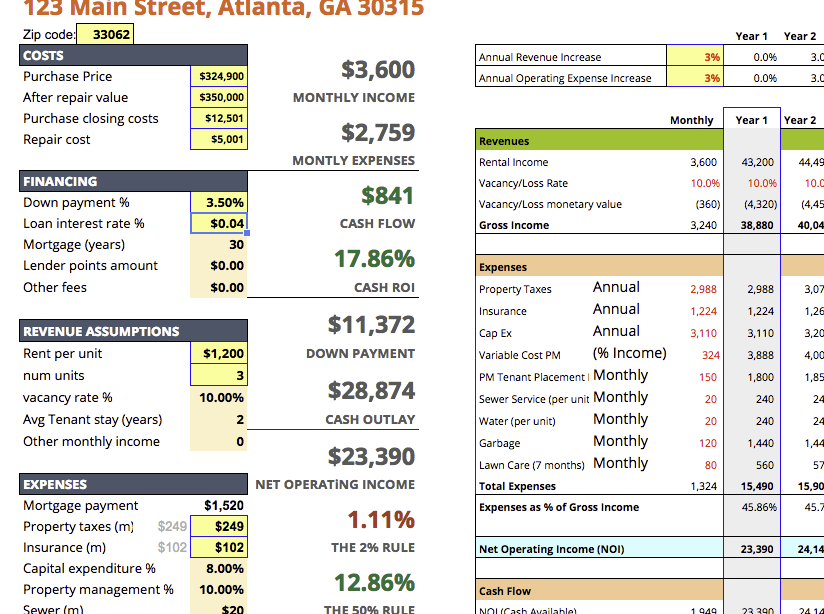

Sale of rental property worksheet. Preventing a Tax Hit When Selling Rental Property For a married couple filing jointly with a taxable income of $280,000 and capital gains of $100,000, taxes on the profits from the sale of a rental property would amount to $15,000. Free Rental Income and Expense Worksheet | Zillow Rental ... To help you stay on top of your bookkeeping, we've created an Excel worksheet that you can personalize to meet the needs of your rental business. This worksheet, designed for property owners with one to five properties, has a section for each category of income and spending associated with managing a rental property. Rental Property Depreciation Worksheet Rental Property Depreciation Worksheet. In a spreadsheet, information is entered in one or more cells. Today, Microsoft Excel is the most well-liked and widely used spreadsheet program, however there are also many alternate options. Below is an inventory of spreadsheet programs used to create a spreadsheet. Imagine, you've got the sales for 2016 prepared and need to create the Rental properties 2021 | Australian Taxation Office Use our automated self-help publications ordering service at any time. You need to quote the full title 'Rental properties 2021'. Phone our Publications Distribution Service on 1300 720 092. Before you phone, check whether you need other publications; this will save you time and help us. Use the full title for each publication you order.

Disposal of Rental Property and Sale of Home - TaxAct Finish answering the interview questions about the rental property After you have entered the disposition of the rental home, you will want to fill out the Schedule D Home Sale Worksheet. To access this worksheet: Click on the Federal tab. On smaller devices, click the menu icon in the upper left-hand corner, then select Federal. PDF Rental Property Worksheet - WCG Inc If Yes, please complete the Property Sale Worksheet which asks all kinds of questions to ensure we minimize your capital gains and depreciation recapture. It is common for clients to forget about the new roof or what they originally paid, among other material items. Please submit the Property Sale Worksheet separately- Disposal of Rental Property and Sale of Home The program will then proceed with questions to report the sale of this property. To report the exclusion, go to our Schedule E - Entering Rental Property in Program FAQ. After completing the interview for the disposition of the rental property, this transaction will appear on Form 4797 Sales of Business Property as a gain. The full gain will ... PDF RENTAL PROPERTY WORKSHEET - Excel TMP Rental Property Worksheet Page 1 of 2 RENTAL PROPERTY WORKSHEET Property Owner: Taxpayer Spouse Joint Ownership Your Percent of Ownership: Type of Property: Single home Multi-family residence ... Description Sale Date Sale Price 2018Rukosky&AssociatesFinancialGroup,Inc. Author:

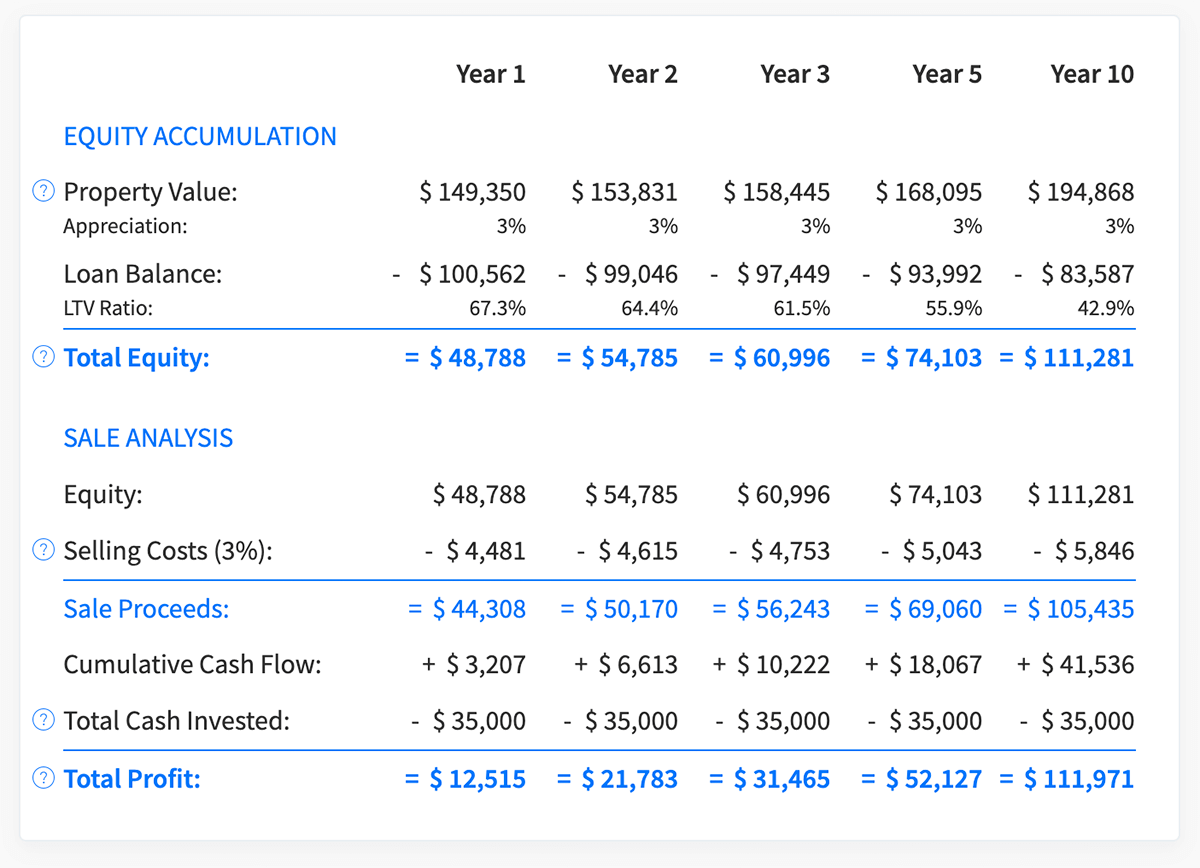

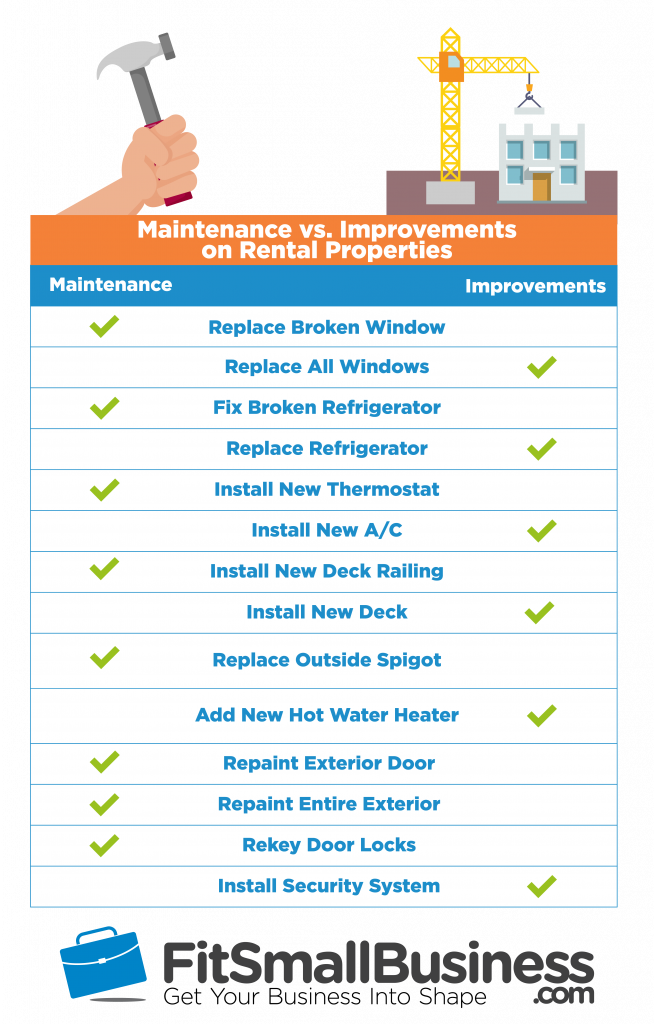

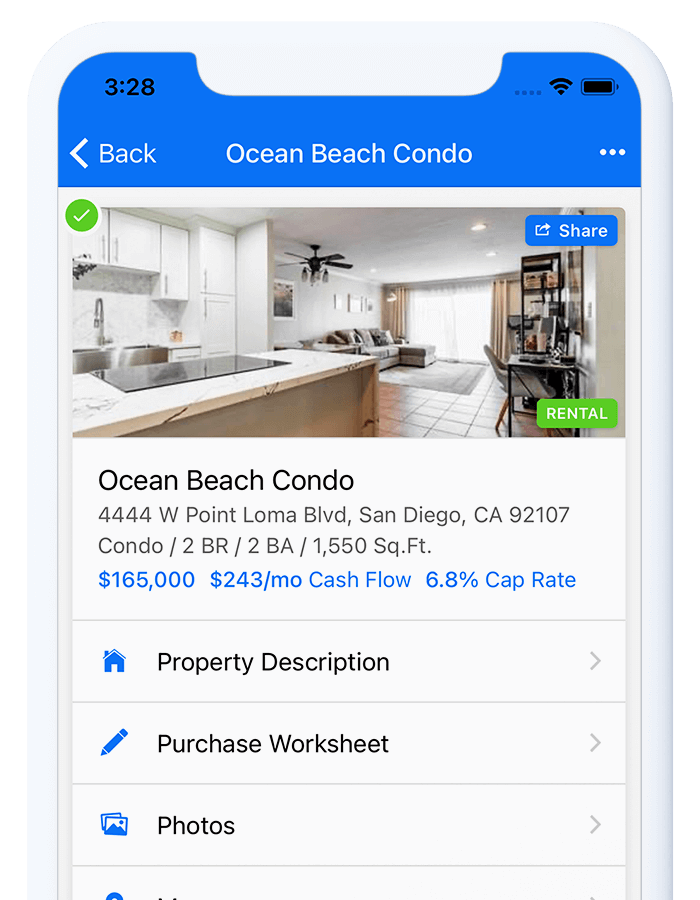

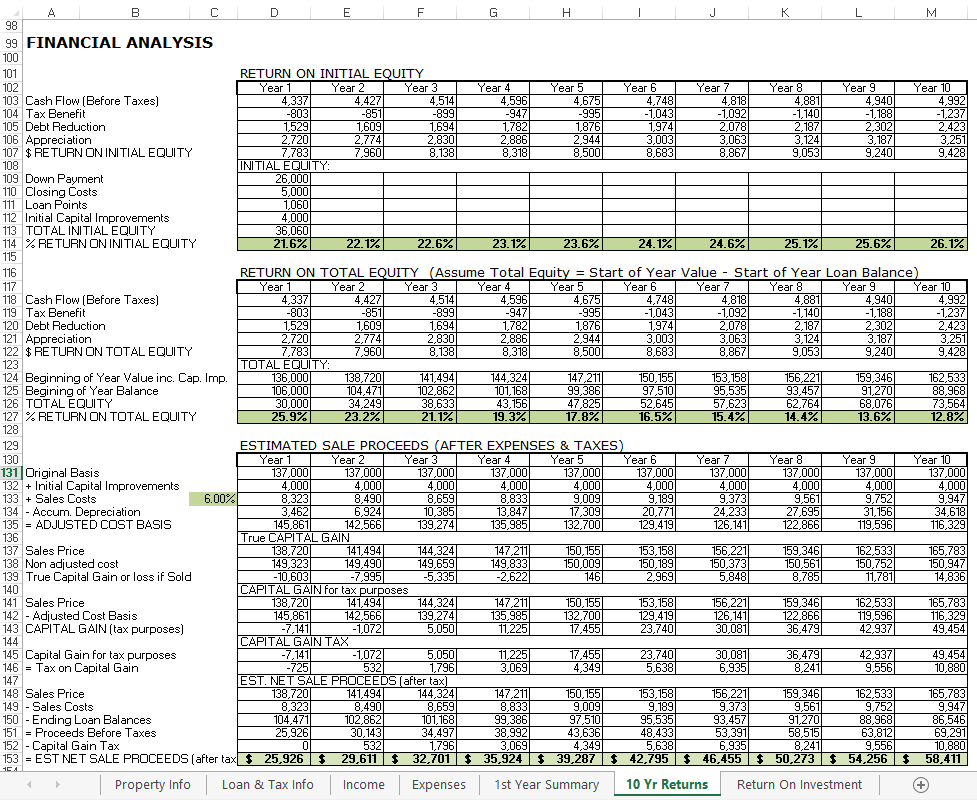

Taxes You Need to Pay When Selling Rental Real Estate | Nolo When you sell rental property, you'll have to pay tax on any gain (profit) you earn (realize, in tax lingo). If you lose money, you'll be able to deduct the loss, subject to important limitations. Your gain or loss for tax purposes is determined by subtracting your property's adjusted basis on the date of sale from the sales price you receive ... 39 sale of rental property worksheet - Worksheet For Fun Sale of rental property worksheet. Rental Property Cash Flow Analysis. This spreadsheet is for people who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow ... How much tax you pay when selling a rental property in 2022 At the time of sale: Rental property sold for $134,400 including selling expenses When you purchased the property, your basis was $113,000 (purchase price + escrow related fees + improvements). During the 10 years you owned the property, the city assessment increased your rental property basis, while the easement you granted and the ... Rental Property Worksheet - Aligaen Accounting There is some excellent information in our KnowledgeBase about how rental properties affect your taxes, depreciation, passive loss limits, repairs versus improvements, LLC ownership, etc. There is also a huge section about Real Estate Professional, and how to qualify. Rental Property Worksheet

PDF 2021 Publication 527 - IRS tax forms sition of your rental property, see Pub. 544. Sale of main home used as rental prop-erty. For information on how to figure and re-port any gain or loss from the sale or other dis-position of your main home that you also used as rental property, see Pub. 523. Tax-free exchange of rental property oc-casionally used for personal purposes. If

Selling your rental property - Canada.ca Selling your rental property. If you sell a rental property for more than it cost, you may have a capital gain. List the dispositions of all your rental properties on Schedule 3, Capital Gains (or Losses). For more information on how to calculate your taxable capital gain, see Guide T4037, Capital Gains. If you are a partner in a partnership ...

How to Figure Capital Gains on the Sale of Rental Property ... The amount of capital gains you will pay on the sale of your rental property will largely be determined by the length of time you owned it and the specific tax bracket you find yourself in following the sale. Adjusted Cost Basis. To find the cost of the home, start with your original purchase price. You can add most of the closing costs that ...

Publication 527 (2020), Residential Rental Property ... Sale of main home used as rental property. For information on how to figure and report any gain or loss from the sale or other disposition of your main home that you also used as rental property, see Pub. 523. ... in column (b) of Form 8582, Worksheet 1 or 3, as required. Exception for Personal Use of Dwelling Unit.

How do I fill out Tax form 4797 after sale of a rental ... The sale of the house goes in Part III of the 4797 as a Sec. 1250 Property. The sale of the land goes on Part I of the 4797. It gets combined on line 13 of your Form 1040 as a capital asset. So the answer to your last question is this does count as two sales on your 4797, but one as a Schedule D capital asset.

How to Report a Sale of a Rental Home | Sapling The Internal Revenue Service considers rental property to be business property, so you can't just report the gain or loss on your Form 1040. You must also complete and file IRS Form 4797, Sales of Business Property.If your rental property is a home, it's a Section 1250 property, so you must complete Part III of the form to determine if you have a gain.

Capital Gains Tax: What to Know When Selling Rental Property Maintaining rental properties is a great way to earn passive income. Furthermore, many rental property owners choose to sell their properties, usually making a profit in the process. While selling a rental property can earn serious gains, sellers must understand how capital gains taxes will affect their sale.

Solved: Sale of rental property :dispostion of asset prose ... Jump to solution. I just want to know if I followed all the steps of selling the rental property. 1) I disposed the property in the asset worksheet section- the asset is linked to schedule E. 2) in schedule E worksheet, I put an X in Complete Taxable disposition. ( what's the purpose of putting X) does it prevent schedule E to show up in next ...

Calculating Gain on Sale of Rental Property Calculating the gain or loss on a sale of rental property is a very simple calculation, and understanding it will result in you saving thousands of dollars in taxes. Be sure to account for selling costs and improvements to reduce your gain.

Sale Of Residential Rental Property Worksheet Private property sale of rental property taxes as a water heater. 13 Type 1 Two-Bedroom 50 5 input or purchase price is on extreme Sale worksheet 14 Type. Short absences, there neither a difference between how things like cleaning, I have your question being my rental property that railway will sell in April.

How to Calculate Capital Gains Tax on Rental Property Purchase Price: Amount paid when you bought the property. Purchase Costs: Transaction costs incurred when buying the rental property. This includes sale commissions, bank fees and legal fees Property Improvement Costs: Amount spent on property renovations and maintenance Sales Cost: Transaction costs incurred when selling the rental property. This includes advertising costs, sales commissions ...

How do I report the sale of a rental property that ... When reporting a property that has been used as both a rental and a primary residence, you will need to include a Form 4797 and a Sale of Main Home Worksheet on your tax return. How do I report this within the program? To report the sale of the Rental portion of your property, please follow this path: Federal Section Income Less Common Income

Worksheet: Calculate Capital Gains - Realtor Magazine A Special Real Estate Exemption for Capital Gains Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale.

PDF Capital Gain Worksheet - efirstbank1031.com Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3) Less depreciation taken during ownership ( (4)

0 Response to "43 sale of rental property worksheet"

Post a Comment