40 self employed business expenses worksheet

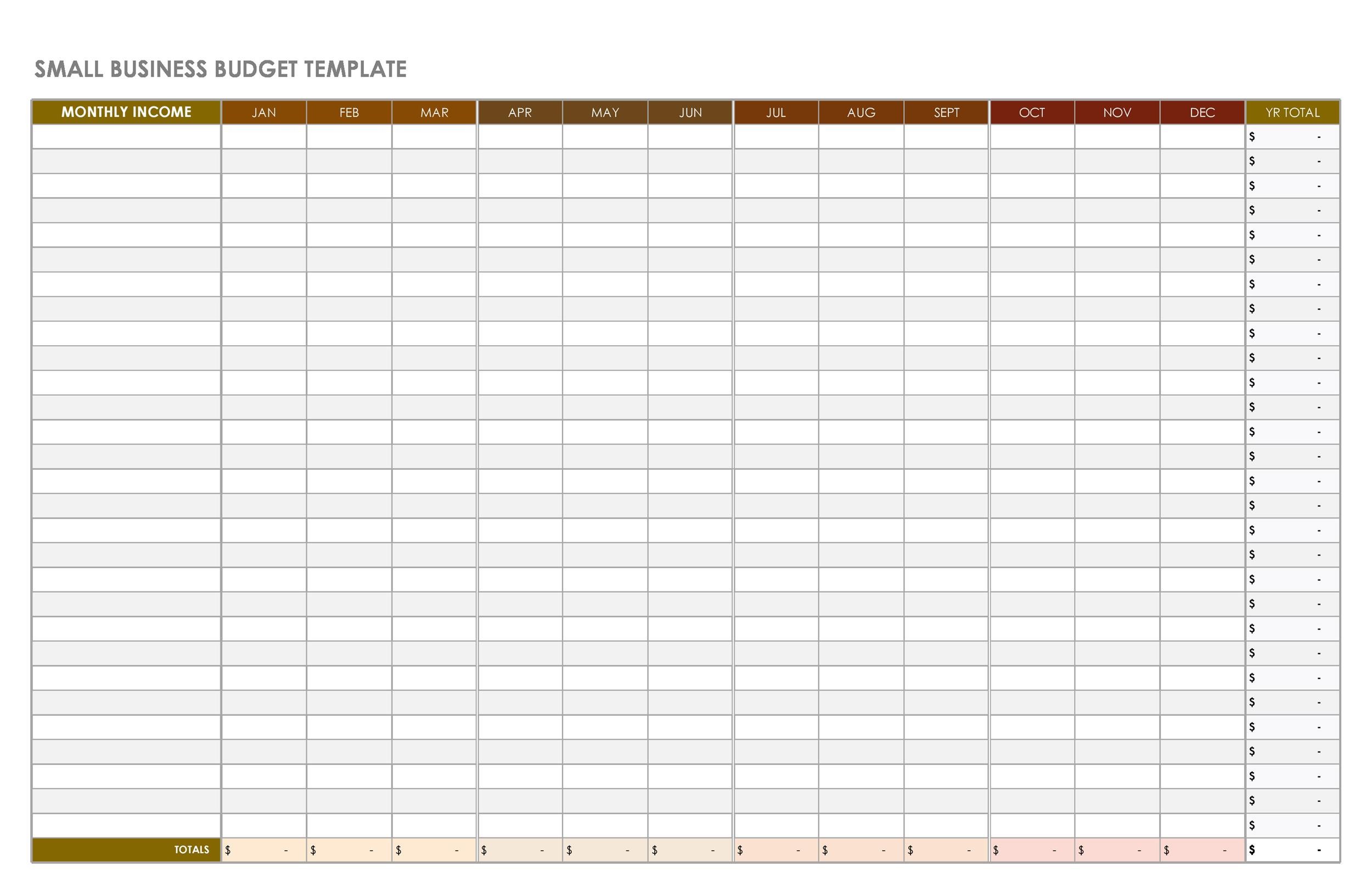

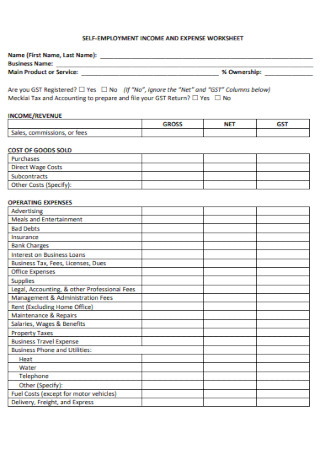

PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising PDF 2021 Self-Employed (Sch C) Worksheet 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: _____ If you checked any of the above, please stop here and speak with one of our Counselors. If you checked none of these above, please continue by completing the worksheet below for each business.

PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here,

Self employed business expenses worksheet

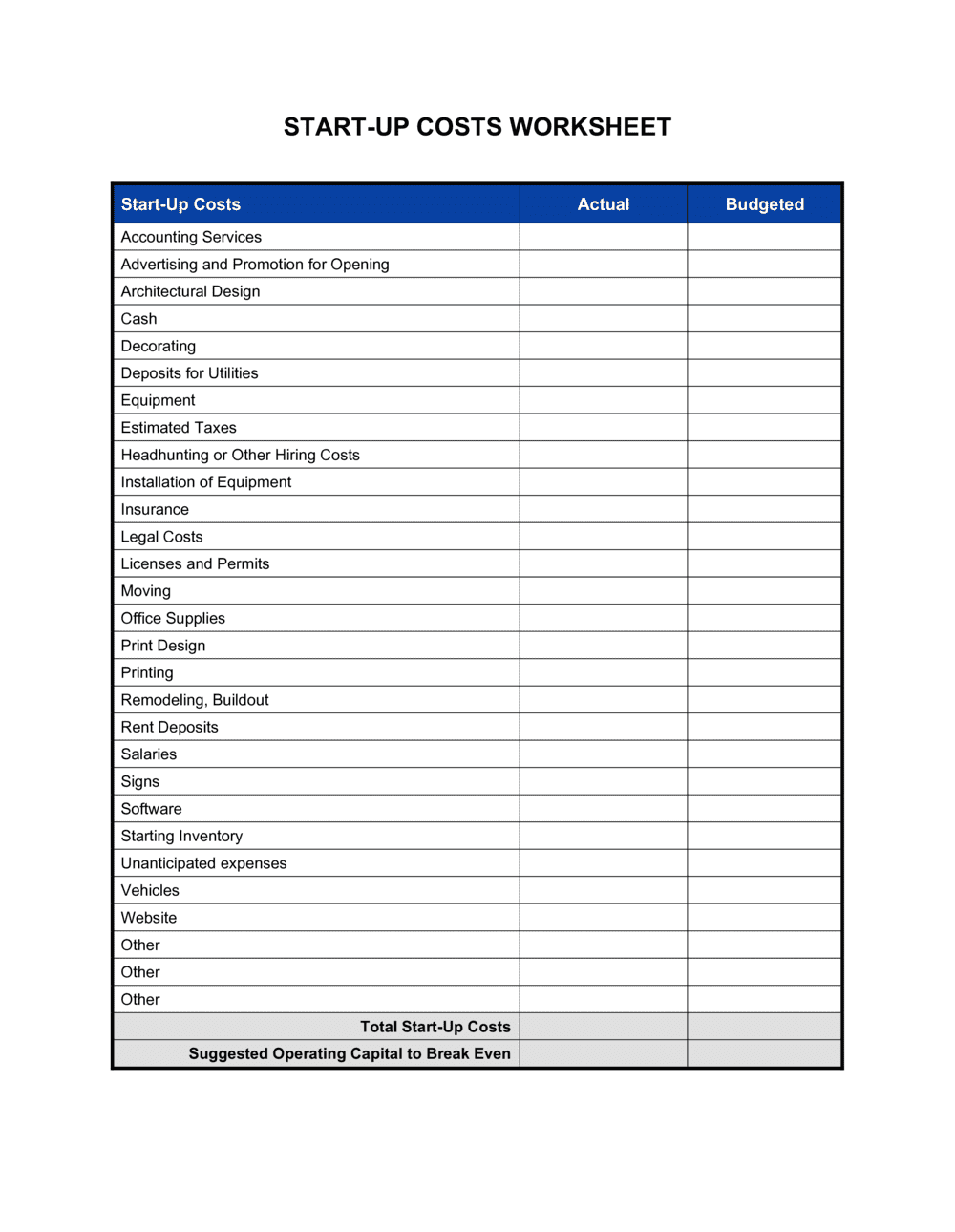

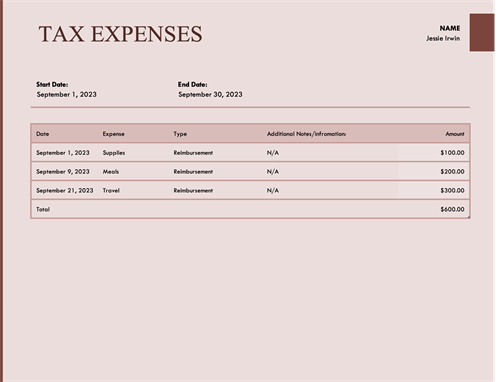

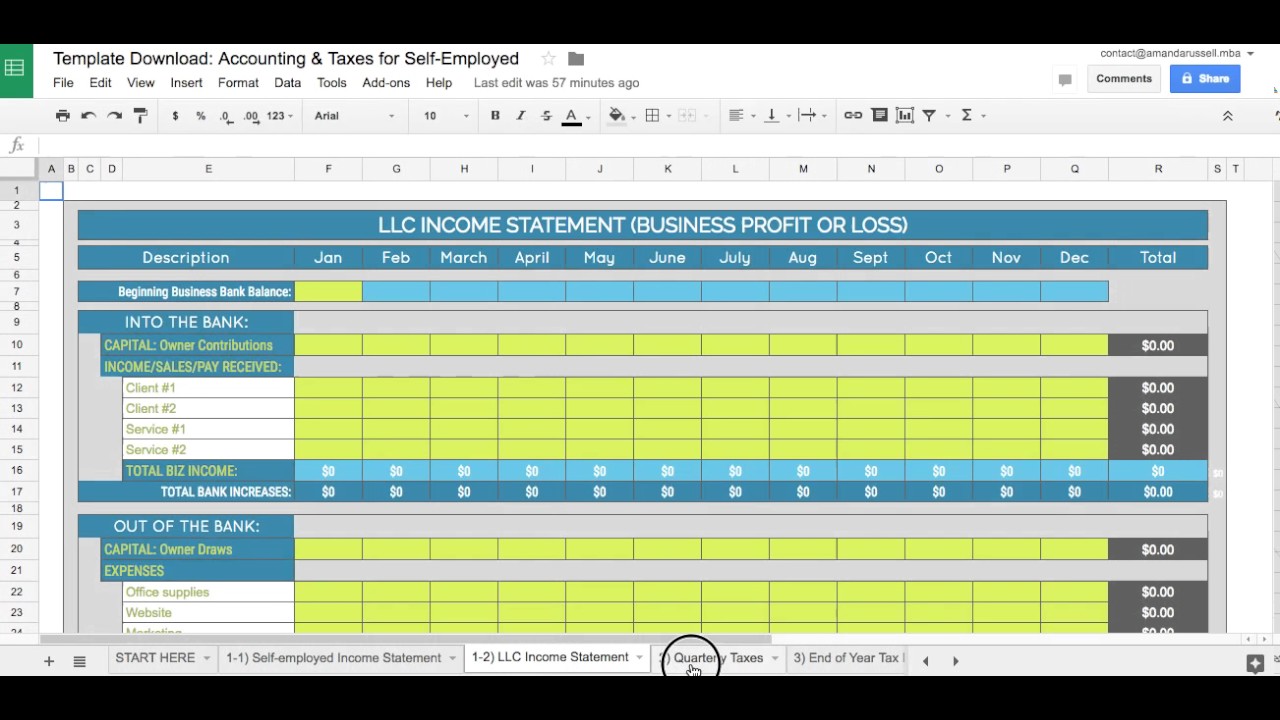

Self-Employed Business Expense Worksheet Business Cards Bank Char es CD, DVD Blanks Client Gifts BUSINESS SUPPLIES WORKSHEET LLC TAX YEAR The purpase of this worksheet is to help you organize your tax deductible business expenses. In order for expense to be deductible, it must be considered an *ordinary and necessary- expense. You may include other applicable expenses. PDF (Schedule C) Self-Employed Business Expenses Worksheet for ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... PDF SELF-EMPLOYED TAX ORGANIZER - GetNetSet.com Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit.

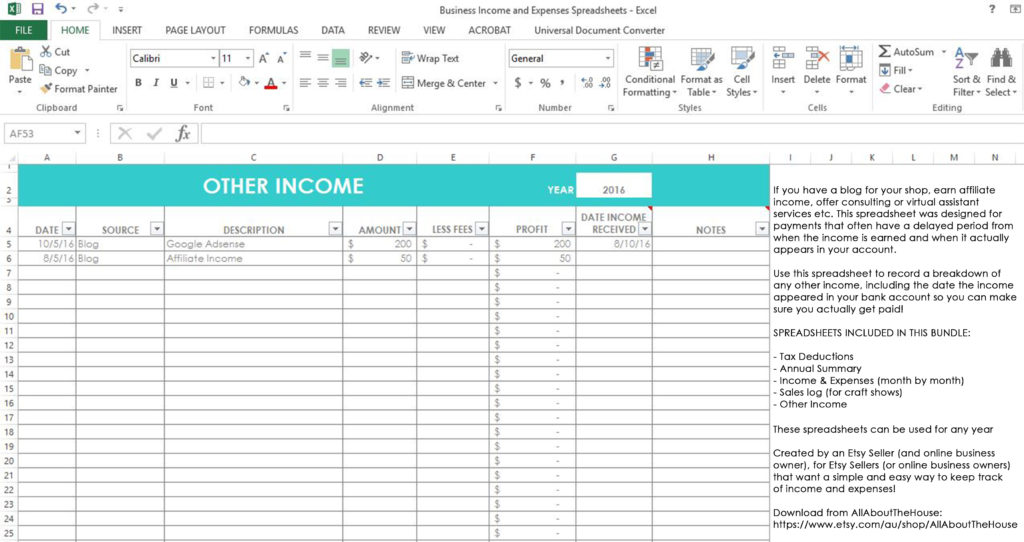

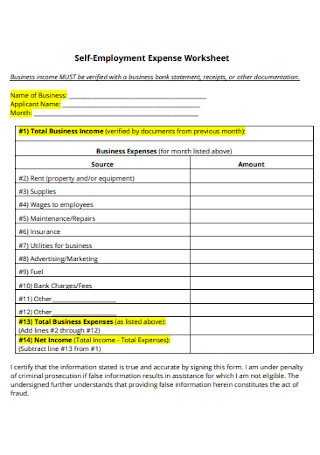

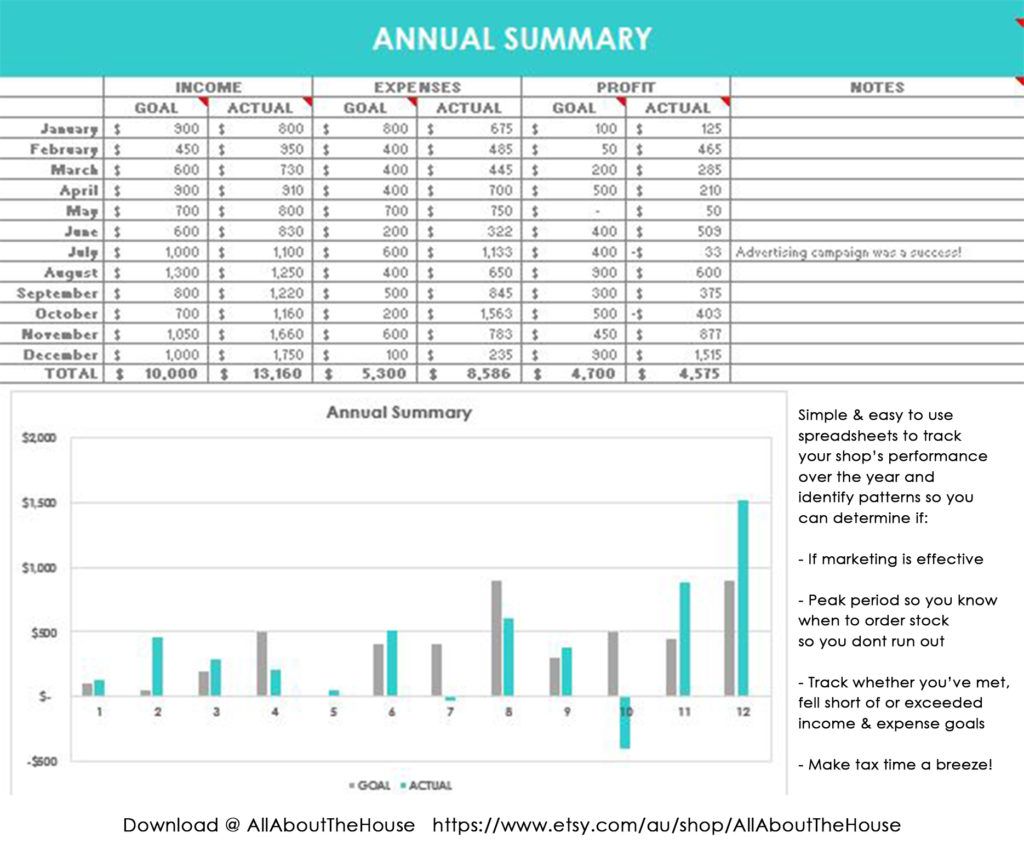

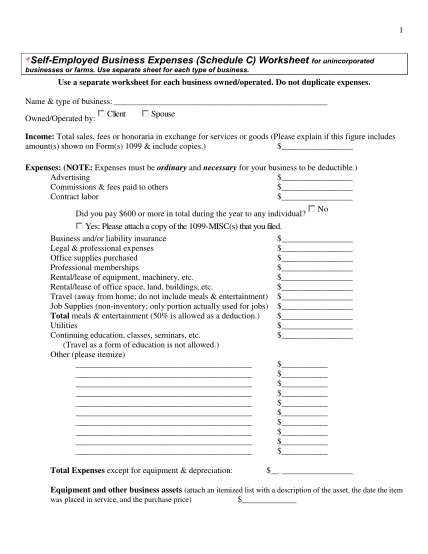

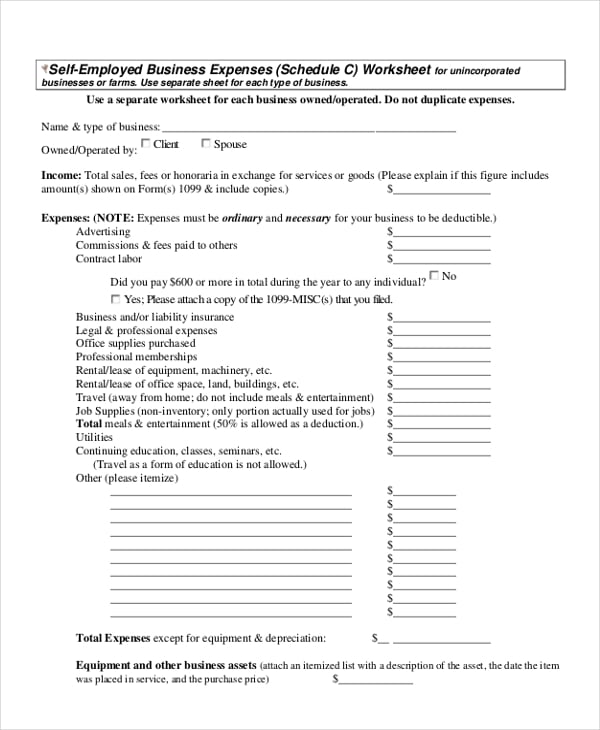

Self employed business expenses worksheet. PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other: Title: Self Employed Income & Expense Sheet.xlsx Author: Assistant ... Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your ... 12+ Business Expenses Worksheet in PDF | DOC | Free ... self-employed business expenses worksheet. The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair. The related expenditure can be ...

PDF Schedule C - Self Employed Business Expenses Schedule C - Self Employed Business Expenses Client Name: Income Prior year Current Year Gross Receipts/Sales Other: Total - Expenses Prior year Current Year Advertising Commissions & Fees Contract Labor Employee Health Ins Liability Ins (not vehicle) Interest - Mortgage - Other Legal & Professional Office expense Pension/Simple IRA etc Free expenses spreadsheet for self-employed Expenses Spreadsheet for Self-Employed. Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes.We've built it to help you get peace of mind and get on with your work. PDF Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C's Business Name (if any)_____ Address (if any) _____ Is this your first year in business? Yes PDF Schedule C -- Self Employed Business Income and Expense ... Schedule C -- Self Employed Business Income and Expense Worksheet. Complete this form if you were self-employed during this tax year. A Small Business Questionnaire and a 1099 and Sales Tax Questionnaire is required in addition to this worksheet. Additional worksheets may be required to report home office and vehicle expenses.

PDF TAX YEAR 2021 SMALL BUSINESS CHECKLIST - Tim Kelly self-employed health insurance premiums outside services (paid to other businesses) postage printing and copy expense professional memberships retirement contributions for employees retirement contributions for owner(s) rental of vehicles, machinery or equipment rental of space or property repairs security email to lynn@timkelly.com or fax to ... Self-Employed Individuals Tax Center | Internal Revenue ... Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax ... Self Employment Worksheet - First Choice Tax Service Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person. Self-Employed Tax Deductions Worksheet (Download FREE) The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

Tax Worksheets - Brent Financial Employee Business Expenses: For employees with unreimbursed job-related expenses. (Self-employed individuals should use the Self Employment Worksheet instead.) Educator Expenses: For teachers, aides, instructors, counselors, or principals. You must be employed at a grade school or high school, work at least 900 hours during the school year, and ...

39 self employed business expenses worksheet - Worksheet ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

PDF Trucker'S Income & Expense Worksheet TRUCKER'S INCOME & EXPENSE WORKSHEET ... business, require information returns to be filed by payer. Due date of return is January 31. Nonfiling penalty can be $150 per recipient. If recipient does not furnish you with his/her Social Security Number, you are required to withhold 31% of the payment(s).

PDF Self-Employed/Business Monthly Worksheet - OA Tax Partners Self-Employed/Business Name of Proprietor. Social Security Number: Monthly Worksheet: ... Auto & Truck Expense Bank Charges Business Contributions; Business Taxes Commissions; Delivery & Freight Dues & Subscriptions; Equipment Rental Gifts; Insurance Interest.

Publication 535 (2021), Business Expenses | Internal ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. ... This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. ... If you are self-employed ...

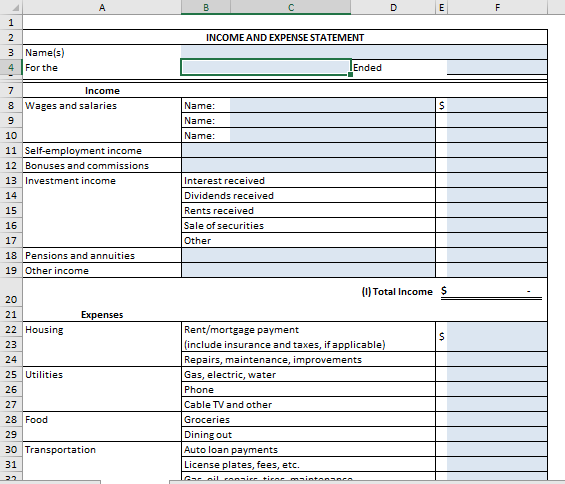

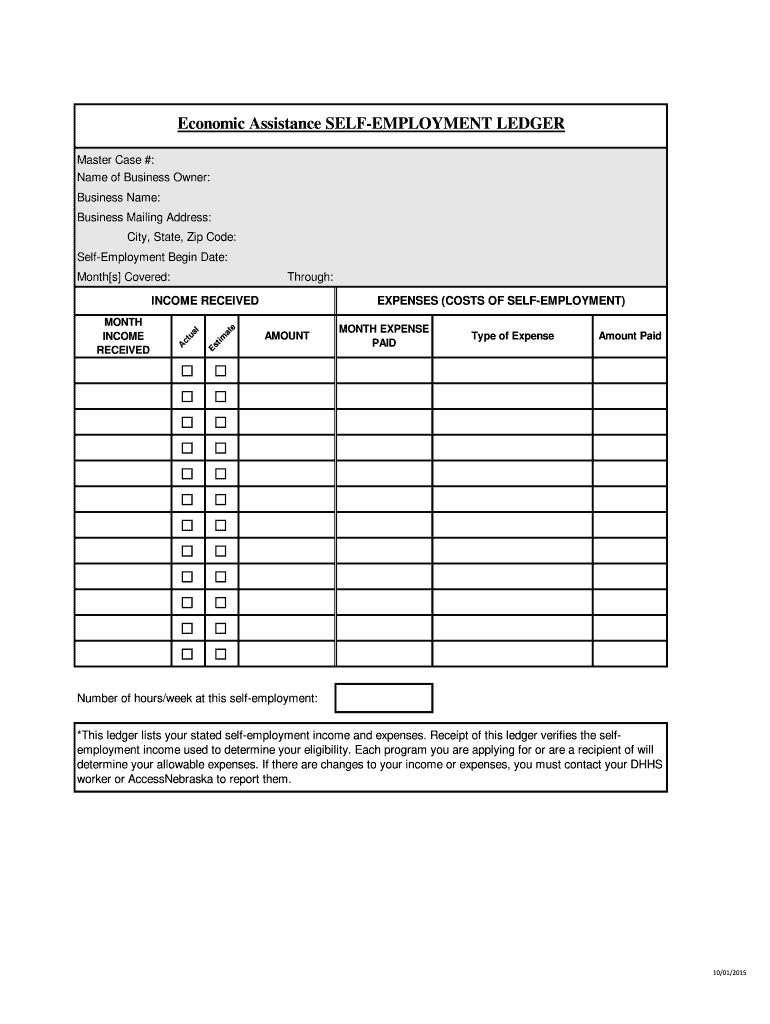

PDF Self-employed Income and Expense Worksheet self-employed income and expense worksheet taxpayer name ssn principal business or profession business name employer id number business address business entity (circle one) individual spouse joint business city, state, zip code income expenses $ gross receipts or sales ...

Home Office Deduction Worksheet (Excel) - Keeper Tax Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it is usually better for them to choose the actual expense method. Our worksheet assumes that you will be filing using the actual expense method because the simplified method bases the size of the home office deduction on the amount of space in ...

PDF 2020 Sched C Worksheet - Alternatives Schedule C Worksheet for Self-Employed Filers and Contractors - tax year 2020 This document will list and explain the information and documentation that we will need in order to file a tax return for a self-employed person, a contract worker, or a sole-proprietor of a business.

15 Tax Deductions and Benefits for the Self-Employed IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

PDF SELF-EMPLOYED Worksheet - tax29.com Business Miles Accrued Other expenses necessary for the running of or promotion of the business Gross receipts or sales ... Expenses Cost of Goods Sold Income SELF-EMPLOYED Business Name Business EIN Services Offered Worksheet.

PDF Self Employment Income Worksheet Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS. Income: Months:

PDF SELF-EMPLOYED TAX ORGANIZER - GetNetSet.com Part 12: SELF-EMPLOYED BUSINESS EXPENSES A deductible business expense is one that is ordinary (commonly accepted in your industry) and necessary (helpful and appropriate even if not indispensable) for a particular business. Keep bank and credit card statements, but note these are not enough to verify expenses in case of audit.

PDF (Schedule C) Self-Employed Business Expenses Worksheet for ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

Self-Employed Business Expense Worksheet Business Cards Bank Char es CD, DVD Blanks Client Gifts BUSINESS SUPPLIES WORKSHEET LLC TAX YEAR The purpase of this worksheet is to help you organize your tax deductible business expenses. In order for expense to be deductible, it must be considered an *ordinary and necessary- expense. You may include other applicable expenses.

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "40 self employed business expenses worksheet"

Post a Comment