42 qualified dividends and capital gain tax worksheet 2015

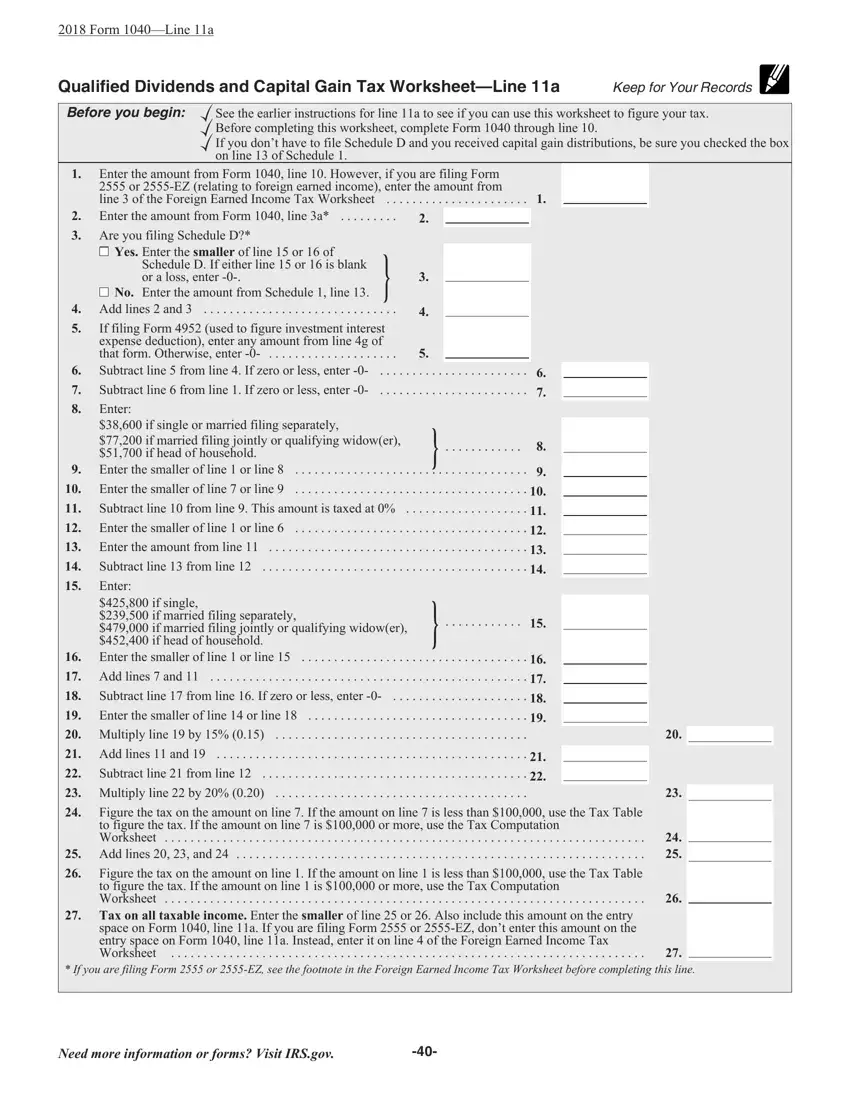

Form Dividends Capital Tax Worksheet And Qualified Gain ... Search: Form Qualified Dividends And Capital Gain Tax Worksheet 2014 Qualified Dividends and Capital Gain Tax Worksheet ... Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Before you begin: 1. Enter the amount from Form 1040, line 43.

Free Microsoft Excel-based 1040 form available ... Line 44 - Qualified Dividends and Capital Gain Tax Worksheet; Line 52 - Child Tax Credit Worksheet; Lines 64a and 64b - Earned Income Credit (EIC) Six additional worksheets round out the tool: W-2 input forms that support up to 4 employers for each spouse; 1099-R Retirement input forms for up to 4 payers for each spouse; SSA-1099 input ...

Qualified dividends and capital gain tax worksheet 2015

Qualified Dividends and Capital Gains Worksheet - ACC330 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

Qualified dividends and capital gain tax worksheet 2015. PDF 2015 Form 8615 - IRS tax forms Enter the tax on the amount on line 14 based on the . child's. filing status (see instructions). If the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or Schedule J (Form 1040) is used to figure the tax, check here . . . . . . . . . 15 16 35+ Ideas For Qualified Capital Gains Worksheet 2015 30 Qualified Dividends And Capital Gain Tax Worksheet Calculator Worksheet Resource Plans. Dean Lance And Wanda 2015 Acc 321 Tax Accounting I Msu Studocu. Form 1040 Schedule J Income Averaging Form For Farmers And Fishermen 2015 Free Download. Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. Qualified Dividends And Capital Gain Worksheet Figure The Tax On The Amount On Line 7 If The Amount On Line 7 Is Less Than 100 000 Use The Tax Table To Figure The Tax If The Amount On Line 7 Course Hero Qualified Dividends And Capital Gain Tax Worksheet Line 44 Capital Gain Tax Worksheet 1040 Com

Solved: How can I view and print a copy of the "Qualified ... Scroll down to the bottom of the screen and Click on Add a state Click on Tax Tools on the left side of the online program screen. Then click on Print Center . Then click on Print, save or preview this year's return . Choose the option Include government and TurboTax worksheets View solution in original post 0 Reply 1 Reply DoninGA Level 15 irs capital gains worksheet 2021 - cubecrystal.com It may not account for specific scenarios that could affect your tax liability. For example, a single . Fill in all of the requested fields they are marked in yellow. Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form. Short-term gains and losses. Instructions for Form 8615 (2021) - IRS tax forms If line 14 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. However, if the child has to file Schedule D and line 18 or line 19 of the child's Schedule D is more than zero, use the Schedule D Tax Worksheet to figure this tax instead. 2021 Instructions for Schedule D (2021) - IRS tax forms Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset Most property you own and use for personal purposes or investment is a capital asset. For example, your house, furniture, car, stocks, and bonds are capital assets.

How to Figure the Qualified Dividends on a Tax Return ... Treat qualified dividends (found in box 1b of your 1099-DIV) as ordinary dividends, which are subject to the zero to 15 percent tax rate that applies to capital gains. Subject qualified dividends... 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Capital gains tax in the United States - Wikipedia The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table. Qualifieed Dividends Amnd Capital Gain Worksheets - K12 ... Displaying all worksheets related to - Qualifieed Dividends Amnd Capital Gain. Worksheets are 44 of 107, 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work line, Qualified dividends and capital gain tax work an, Qualified dividends and capital gain tax work, Schedule d tax work 2016, The need to simplify the tax treatment of capital gains, 2017 ...

Qualified Dividends and Capital Gain Tax Worksheet Form ... Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021 Edit & sign 2021 qualified dividends and capital gain tax worksheet from anywhere Save your changes and share capital gains worksheet 2021

PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts.

How to Dismantle an Ugly IRS Worksheet | Tax Foundation One of these is on most kinds of income, and another of these is on qualified corporate dividends and capital gains. There are seven and three brackets for each of these kinds of income, but the cutoffs for the brackets are based on the combination of both kinds of income.

Publication 550 (2021), Investment Income ... - IRS tax forms Capital Gain Tax Rates. Table 4-4. What Is Your Maximum Capital Gain Rate? Investment interest deducted. 28% rate gain. Collectibles gain or loss. Gain on qualified small business stock. Unrecaptured section 1250 gain. Tax computation using maximum capital gain rates. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet.

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

PDF and Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

Qualified Dividends and Capital Gain Tax - TaxAct Qualified Dividends and Capital Gain Tax With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate.

2020 S Corporation Tax Booklet | FTB.ca.gov Line 4 – Net capital gain. Enter on this line any net capital gain subject to the 1.5% tax rate (3.5% for financial S corporations) shown on Schedule D (100S), Section B, line 10, and any gains subject to the 8.84% tax rate (10.84% for financial S corporations) shown on Schedule D (100S), Section A, line 13.

capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43.

PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR

Qualified Dividends and Capital Gains Worksheet - ACC330 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

0 Response to "42 qualified dividends and capital gain tax worksheet 2015"

Post a Comment