38 income tax worksheet excel

How to Do Taxes in Excel - Free Template Included You can add up all of your income and expenses in one place and be well prepared to drop your final numbers into your tax prep software. While a basic budget spreadsheet is great, it is a rather manual process to prepare. Either you are adding multiple numbers in one cell and triple checking you keyed them in correctly, or you are creating a ... Tax expense journal - templates.office.com Tax expense journal. Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet.

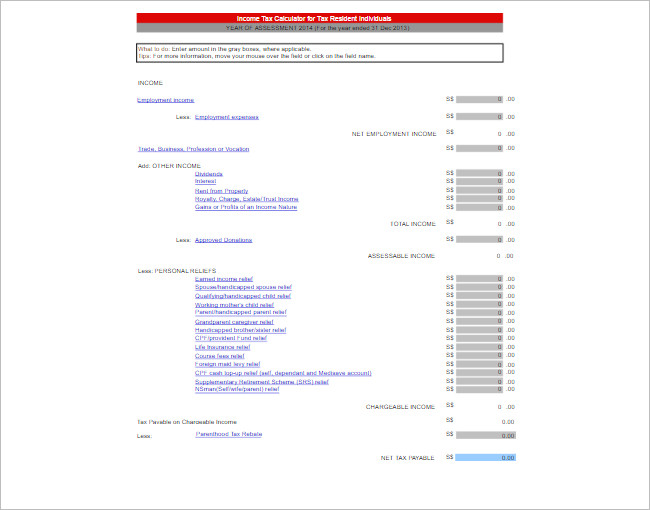

Federal Income Tax Form 1040 (Excel Spreadsheet) Income ... Download - Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator.

Income tax worksheet excel

Income Tax Calculator India In Excel★ (FY 2021-22) (AY ... Download Income Tax Calculator Excel India (FY 2021-22) How to Calculate Income Tax in India? In case you want to calculate your income tax without using the Income Tax India calculator, it's not very difficult. You need to follow following steps using the below example. Amit is salaried employee with following salary structure. Estimated Income Tax Spreadsheet - Mike Sandrik Now the spreadsheet can calculate your effective tax rate based on the estimated amount of income you expect to make. The tax rates calculated depend on the tax tables on the right side of the sheet, which define the income tax brackets. You'll need to update the data in yellow each year for the new brackets and for your filing status. Income Tax Withholding Assistant for Employers | Internal ... Save a copy of the spreadsheet with the employee's name in the file name. Each pay period, open each employee's Tax Withholding Assistant spreadsheet and enter the wage or salary amount for that period. The spreadsheet will then display the correct amount of federal income tax to withhold.

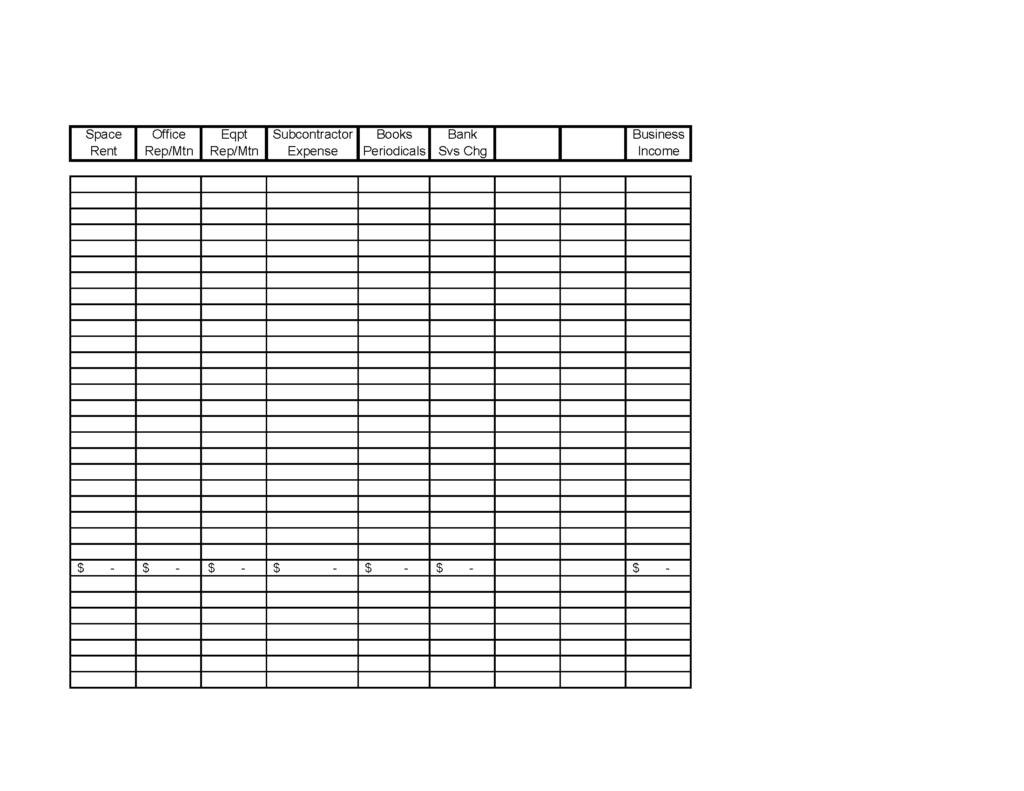

Income tax worksheet excel. Independent Contractor Expenses Spreadsheet ... - Keeper Tax The sheet will take this and automatically calculate your total tax deduction in Column E. (Leave the business-use percentage column blank for a purchase, and you'll get your gross expense amount counted as your total tax deduction.) Making sure your deduction amount is correct Microsoft Excel tax spreadsheet template - cours-gratuit.com The file to download presents tow Microsoft Excel tax spreadsheet template. Income tax calculator sample template; This template enables users to perform annual income tax & monthly salary calculations based on multiple tax brackets (also referred to as a sliding income scale) and a number of other income tax & salary calculation variables. Downloadable tax organizer worksheets This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. business.pdf Estimated Tax Worksheet - Colorado Tax-Aide Resources Estimated Payments Needed:by:JointTPSP. 90% of estimated total tax ( 66 2/3% for farmers and fishermen) 0. Enter 100% of 2021 's income tax ( Check if 2021 's AGI was > $ 150 K) Choose which to use... Smaller of above or ... Use 100 % of 2021 's amount from the line above. Use 100% of the 2022 estimated total tax.

PDF Free Rental Income and Expense Worksheet - Excel Tmp of rental income, allowable expenses and their tax treatment. The worksheet on the reverse side should help you document your rental income and identify deductible expenses from rental activities. Rental Property Tax Law Special tax laws have been created within the Tax Code to address rental income and losses. Generally, rental income is deemed Download Excel based - Income Tax Calculator for FY 2020 ... This excel-based Income tax calculator can be used for computing income tax on income from salary, pension, gifts, fixed deposit, and bank interest and you will get the result accordingly to your tax regime selection. Highlights of Changes in FY 2020-21 in Income Tax Income and Expenses Excel Spreadsheet for Income and Expenses Best Income and Expenses Management Excel Template. Tracking your expenses and income is one of the important steps in handling your money. This spreadsheet is designed for personal finance and printable benefits and it is also modified as an editable worksheet. Download Income Tax Calculator FY 2021-22 (AY 2022-23) Download Income Tax Calculator FY 2021-22 (AY 2022-23) in Excel Format. It is simple and user-friendly income tax calculator for salaried individuals. This calculator will work for both old and new tax slab rate which were released in 2020. You can calculate your tax liability and decide tax ...

Income Tax Calculator Excel : AY 2021-22 - Karvitt Download Excel file to Calculate and compare Taxable Income and Income Tax Liability as per the Existing and New Regimes (Tax Provisions & Tax Rates) for AY 2021-22 (FY 2020-21). Save your calculations on your computer for future reference. Download Income Tax Calculator AY 2021-22 | 2022-23 in Excel Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge. Computation Of Income Tax In Excel - Excel Skills TaxCalc - this sheet contains the annual income tax, monthly salary and annual bonus calculations. Only the cells with yellow cell backgrounds require user input and all calculations are automated. Monthly - this sheet enables users to perform monthly income tax calculations based on variable monthly earnings and annual bonus amounts. Income Tax Calculator FY 2020-21 (AY 2021-22) - Excel Download Download Income Tax Calculator FY 2020-21 (AY 2021-22) in Excel Format. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. You can calculate your tax liabilities as per old and new tax slab. It will help you to make an informed decision to opt for a suitable tax structure.

Business worksheets - free - GE | SOLUTIONS Tax Solutions Please feel free to use our Business Income and Expenses Worksheet to compile your business income and expenses for the year. Once you've entered your information, the Excel spreadsheet can easily be sent to us to help us prepare your personal tax return which includes your business. . If you are a GST/HST Registrant, these worksheets will help ...

How to calculate income tax in Excel? - ExtendOffice Actually, you can apply the SUMPRODUCT function to quickly figure out the income tax for a certain income in Excel. Please do as follows. 1. In the tax table, right click the first data row and select Insert from the context menu to add a blank row. See screenshot: 2.

Excel formula: Income tax bracket calculation | Exceljet To calculate total income tax based on multiple tax brackets, you can use VLOOKUP and a rate table structured as shown in the example. The formula in G5 is: = VLOOKUP( inc, rates,3,1) + ( inc - VLOOKUP( inc, rates,1,1)) * VLOOKUP( inc, rates,2,1)

Download Free Federal Income Tax Templates In Excel Prepare your Federal Income Tax Return with the help of these free to download and ready to use ready to use Federal Income Tax Excel Templates. These templates include Simple Tax Estimator, Itemized Deduction Calculator, Schedule B Calculator, Section 179 Deduction Calculator and much more. All excel templates are free to download and use.

Income Statement Template for Excel - Vertex42.com The first is a simple single-step income statement with all revenues and expenses lumped together. The second worksheet, shown on the right, is a multi-step income statement that calculates Gross Profit and Operating Income. Income Statement Essentials Net Income = Total Revenue - Total Expenses Revenues

Excel Income tax calculator for FY 2021-22 (AY 22-23) and ... Rest leave all to this excel calculator, which will show you the tax amount in old regime, tax amount in new regime and their difference indicating which one is suitable for filing the income tax return for the financial year FY21-22 (AY 22-23) and FY 22-23 (AY 23-24). Tax rate changed and the Finance Minister has given us the 2 options, either ...

13 Best Images of Monthly Income Expense Worksheet Template - Income and Expense Statement ...

Income Analysis Worksheet | Essent Guaranty Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Tax & Adjusting Entry Year-End Accounting Excel Worksheet ... An Excel worksheet can be used to show the difference between net income on the unadjusted trial balance, the adjusted trial balance, and tax trial balance in an easy visual way. A worksheet can be used as a reference to communicate to supervisors, clients, and as a reference for us to look back at in the future.

0 Response to "38 income tax worksheet excel"

Post a Comment