44 rental income calculation worksheet

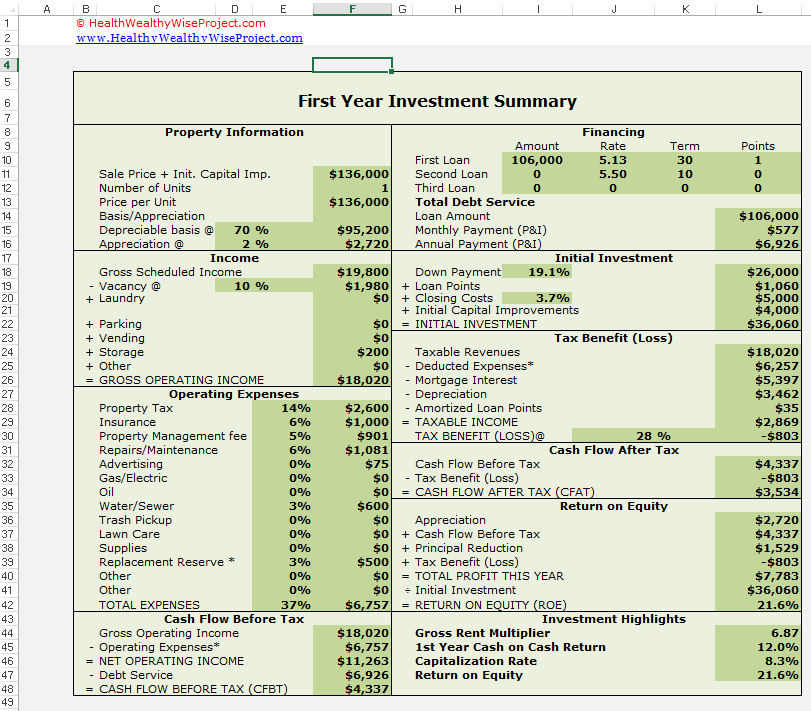

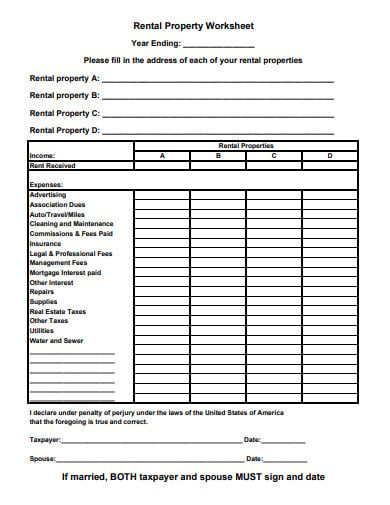

Rental Income and Expense Worksheet: Free Resources A good rental income and expense worksheet makes analyzing the current performance of property and additional investments much easier. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: B3-3.1-08, Rental Income (05/04/2022) Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

Form 92 - Guide 1 Refer to Section 5306.1(c)(i) for net rental Income calculation requirements 2 Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825, regardless of Borrower's percentage of ownership interest in the business or whether the Borrower is

Rental income calculation worksheet

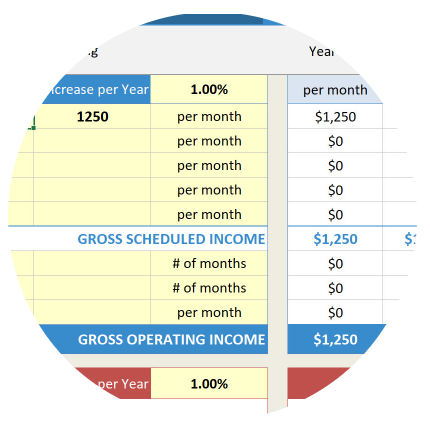

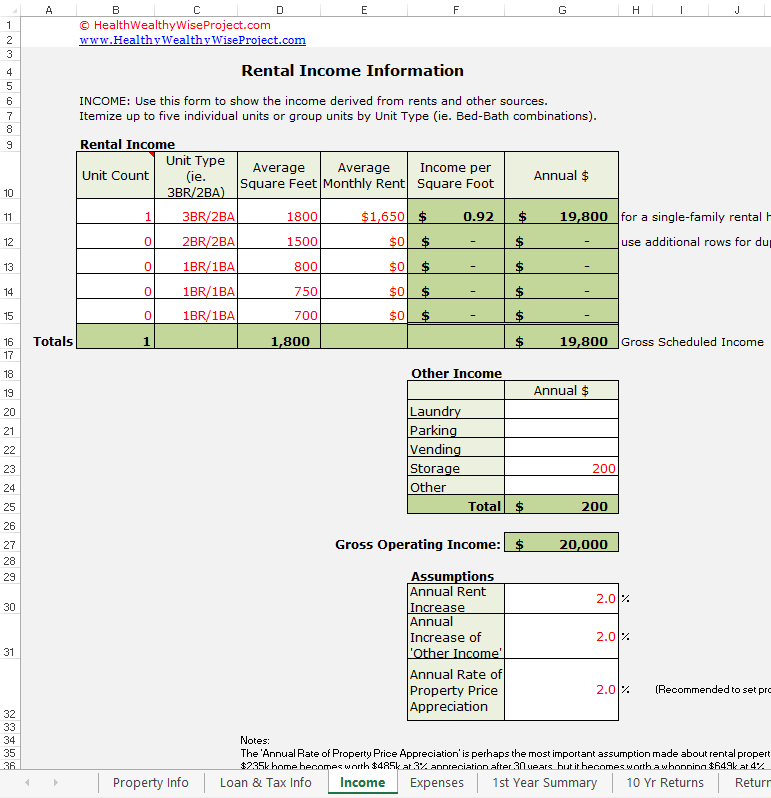

singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below. Rental Income and Expense Worksheet - Google Sheets A l ternating colors. C lear formatting Ctrl+\. S ort sheet . So r t range . Create a f ilter. Filter vie w s . New. Add a slicer ( J) Pr o tect sheets and ranges. Calculating Returns for a Rental Property - Xelplus ... This calculation for loss ( cell D24) is as follows: =C24 * -D22 Because the value in cell D22 is a risk, it needs to be declared as a negative value. The result is $112 for each month ( $1,344 per year ). The Monthly Revenue is the sum of all cells from D22 to D24. We are presented with a value of $1,288 per month for revenue. Monthly Expenses

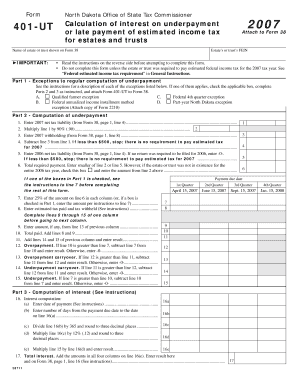

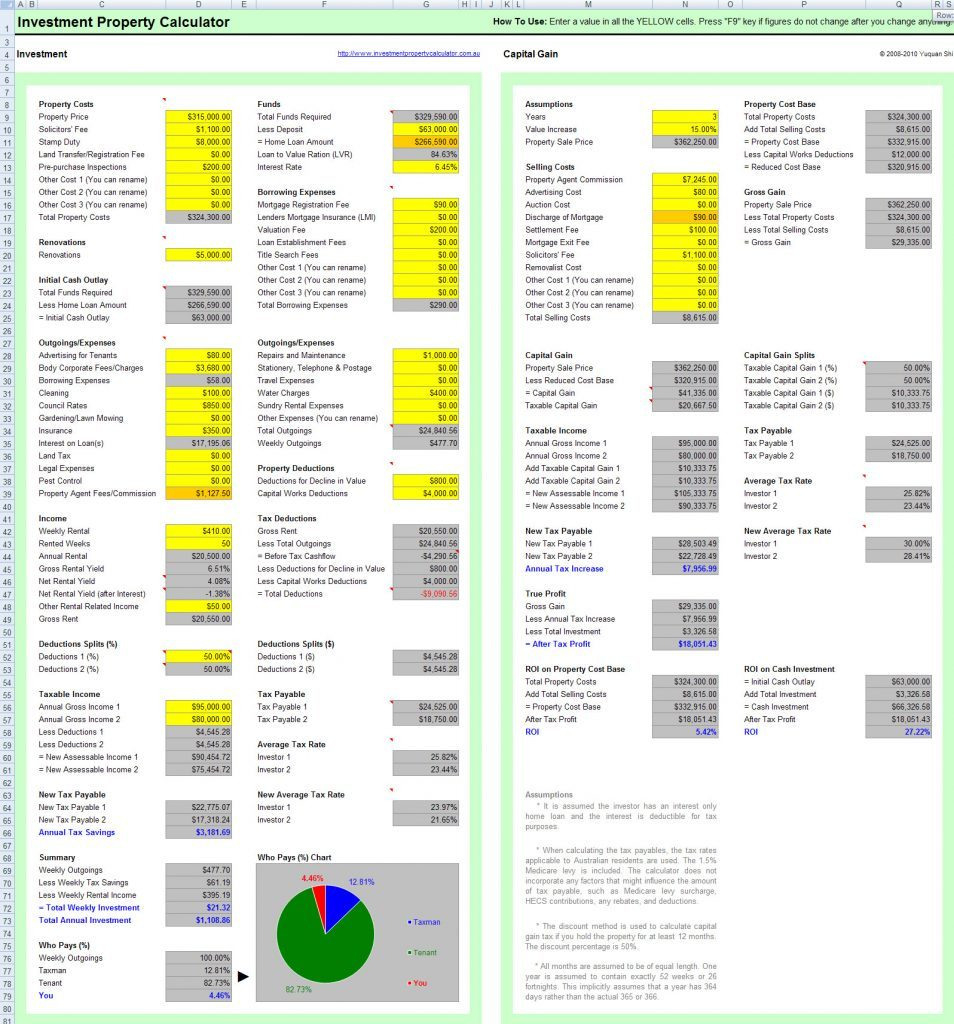

Rental income calculation worksheet. 2022 Rental Property Analysis Spreadsheet [Free Template] Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value. PDF Rental Income Calculator - Genworth Financial Rental Income Calculation 2019 2018 NOTES 1 Gross Rents (Line 3) *Check applicable guidelines if not using 12 months. **Net rental losses are typically included with liabilities when calculating 5 the debt ratio. 2 Expenses (Line 20) - 3 Depreciation (Line 18) + 4 Amortization/Casualty Loss/Nonrecurring Expenses (Line 19) + Insurance (Line 9) › ExcelTemplates › rental-cash-flowCash Flow Analysis Worksheet for Rental Property Aug 18, 2021 · This spreadsheet is for people who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return. fannie-mae-income-worksheet.pdffiller.comFannie Mae Income Calculation Worksheet - Fill Online ... Rental Income Worksheet Individual Rental Income from Investment Property s Monthly Qualifying Rental Income or Loss Investment Investment Property Documentation Required Property Address Address Schedule E IRS Form 1040 OR Enter Lease Agreement or Fannie Mae Form 1007 or Form 1025 Step 1.

PDF Chapter 5. Determining Income and Calculating Rent 5-1 ... records of her income other than a copy of the IRS Form 1040 she files each year. With no other information available, the owner will use the income reflected on Mary's copy of her form 1040 as her annual income. 5-6 Calculating Income—Elements of Annual Income A. Income of Adults and Dependents 1. Figure 5-2 summarizes whose income is ... singlefamily.fanniemae.com › media › 15601Single-Family Homepage | Fannie Mae Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. A1 Enter total rents received. A2 Subtract A3 Add A4 A5 A6 This expense must be specifically identified on Schedule E in order to add it back. A7 A8 Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 Work out your rental income when you let property - GOV.UK Your profit is the amount left once you've added together your rental income and taken away the expenses or allowances you can claim. If you rent out more than one property, the profits and losses... PDF Net Rental Income Calculations - Schedule E Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2. This expense, if added back, must be included in the monthly payment amount being used to establish the DTI ratio . 3

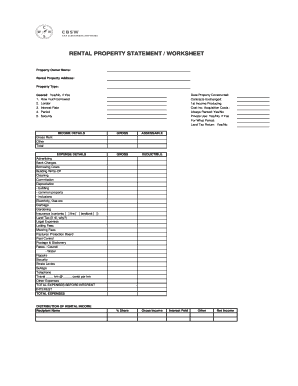

Rental Income and Expense Worksheet - PropertyManagement.com 1 Income and expenses are an essential part of effectively managing your rental. 2 Personalize your expenses with this worksheet. 3 Totals are automatically calculated as you enter data. 4 This sheet will also track late fees and any maintenance costs. › rental-property-worksheet18+ Rental Property Worksheet Templates in PDF | Free ... The expenditure is made on your property like paying off the electricity, Gas, Heat, a bill needs to be mentioned by you in the template of the Sample Rental Property Worksheet. This is a type of property inventory where you can write the income and expense both in a systematic manner. 9. Rental Property Calculation Worksheet Template PDF Rental Income Schedule E Calculation Worksheet 2018 2019. 2015 federal income tax forms form 1040. child support guidelines worksheet case no. alabama form 40 instructions esmart tax. rental income schedule e calculation worksheet. child support guidelines judiciary of virginia. general income tax and benefit guide federal tax and. rental income canada ca. irs forms instructions and ... › resource › 1835HOPWA Income Resident Rent Calculation - HUD Exchange With the exception of persons in short-term supported housing, persons receiving rental assistance under the HOPWA program must pay rent. According to the HOPWA regulations, tenants must pay the higher of: (1) 30 percent of the family's monthly adjusted income; (2) 10 percent of the family's monthly gross income; or (3) The portion of any ...

rental income calculation worksheet excel - Edit Online, Fill Out & Download Business Forms in ...

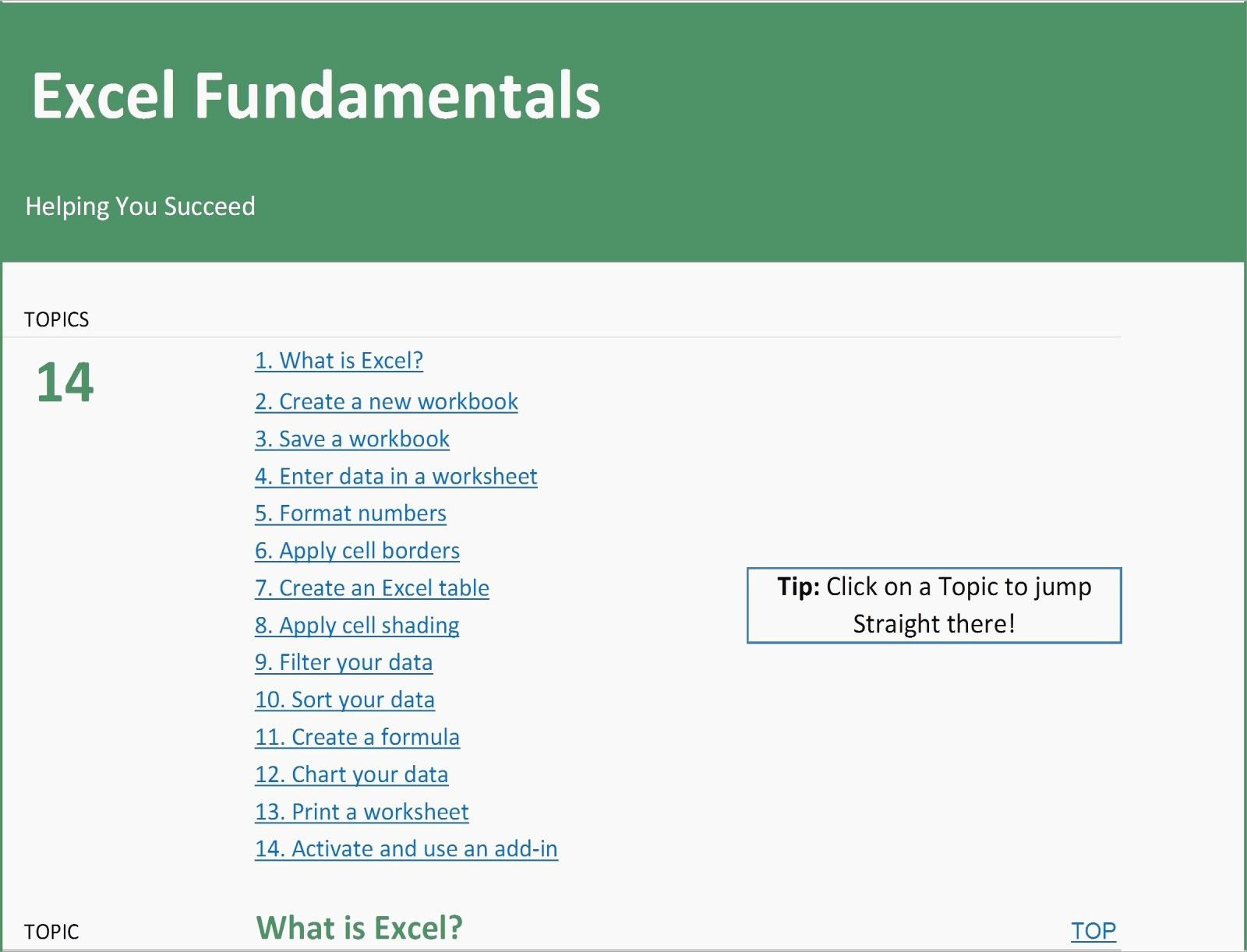

Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment (Schedule E) Determine the average monthly income/loss for a non-owner occupied investment property. Download Worksheet (PDF)

PDF Income & Resident Rent Calculation Worksheet HOPWA regulations 24CFR574.310d(1)(2)(3) state: "Resident rent payment. Except for persons in short-term supported housing, each person receiving rental assistance under this program or residing in any rental housing assisted under this program must pay as rent, including utilities, an amount which is the higher of: (1) 30 percent of the family's

Rental Property Income and Expenses Worksheet » The ... The Rental Property Income and Expense template provides you, the business owner, with valuable and timely information. Using it diligently will help you keep aware of your business's financial health and progress, and allow you to better plan for your future. How useful was this template? Click on a star to rate it! Average rating 4.6 / 5.

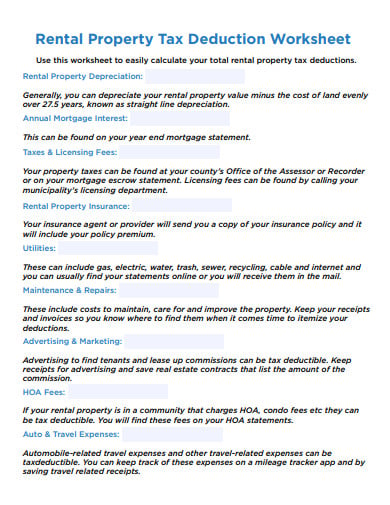

Free Rental Income and Expense Worksheet | Zillow Rental ... To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

PDF Rental Income Schedule E Calculation Worksheet rental income schedule e calculation worksheet each filing individual entity must include copies of all. child support guidelines worksheet case no. general income tax and benefit guide federal tax and. 2017 income tax return form for trusts and ct 1041 estates. b3 3 1 08 rental income 02 28 2017 fannie mae.

PDF Form 1038: Rental Income Worksheet - Genworth Financial Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I A1 Enter total rents received. Enter A2 Subtract total expenses. Subtract A3 Add back insurance expense. Add A4 Add back mortgage interest paid. Add

PDF INCOME CALCULATION WORKSHEET - dudiligence.com INCOME CALCULATION CHECKLIST Page 4 Section 8a: Net Rental Income - Tax Return method Definition: Derived from the Schedule of Real Estate Owned on page 3 of the application.

Rental Income Calculation Worksheet as Well as Investment Property Calculator Excel Spreadsheet ...

PDF INCOME CALCULATION WORKSHEET - LoanSafe.org returns. You can also refer to PMI's Income Analysis Worksheet when calculating rental income from the tax return: Subtotal Total Step 1 Enter year 1 rental income from line 3 on the Schedule E $ Step 2 Enter year 2 rental income from line 3 on the Schedule E $ Step 3 Add steps 1 and 2 for total rental income $

SEB cash flow worksheets Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income Liquidity ratios Rental income Get the worksheets

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 (Individual Rental Income from Investment Property (s) (up to 4 properties) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet

sf.freddiemac.com › content › _assetsIncome Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations ... 1Refer to Form 92 for net rental income calculations using IRS Schedule E 7. Schedule F - Profit or Loss from Farming ...

Rental Income Tax Calculator for Landlords - TaxScouts To calculate the income you're taxed on, you should add your rental income to your wages (if you're employed) and any other income you have. The total amount is your taxable income. The Property Income Allowance is only worth claiming if you've spent less than £1,000 during the tax year on your property business.

PDF Fha Reo Net Rental Income Calculation Worksheet Job Aid FHA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID WHOLESALE LENDING Sheet 2 - Subject Property The second worksheet is specific to rental income calculated from the subject property. This is limited to 2-4 unit property and can be either a Purchase or Refinance of the subject.

Calculating Returns for a Rental Property - Xelplus ... This calculation for loss ( cell D24) is as follows: =C24 * -D22 Because the value in cell D22 is a risk, it needs to be declared as a negative value. The result is $112 for each month ( $1,344 per year ). The Monthly Revenue is the sum of all cells from D22 to D24. We are presented with a value of $1,288 per month for revenue. Monthly Expenses

Rental Income and Expense Worksheet - Google Sheets A l ternating colors. C lear formatting Ctrl+\. S ort sheet . So r t range . Create a f ilter. Filter vie w s . New. Add a slicer ( J) Pr o tect sheets and ranges.

How to calculate rental property | free rental property calculator estimates irr, capitalization

singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

0 Response to "44 rental income calculation worksheet"

Post a Comment