38 clergy housing allowance worksheet

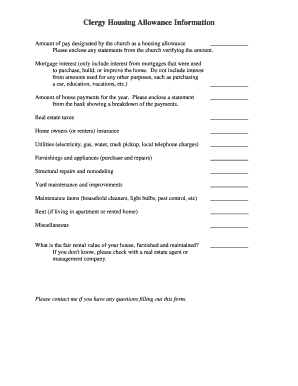

PDF CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year: Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet Downloadable .PDF Document 2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. Downloadable Excel Spreadsheet

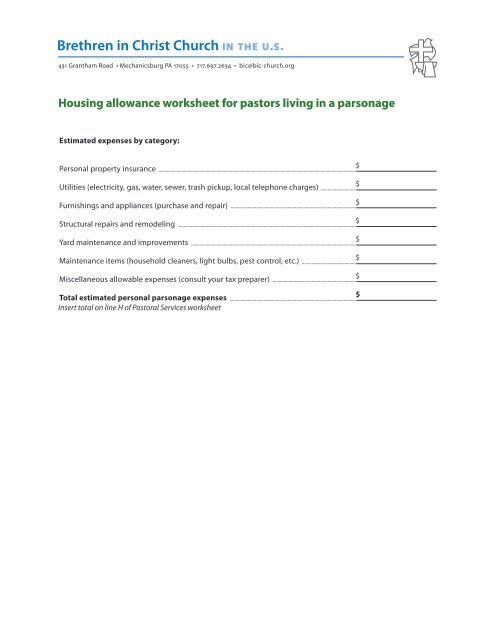

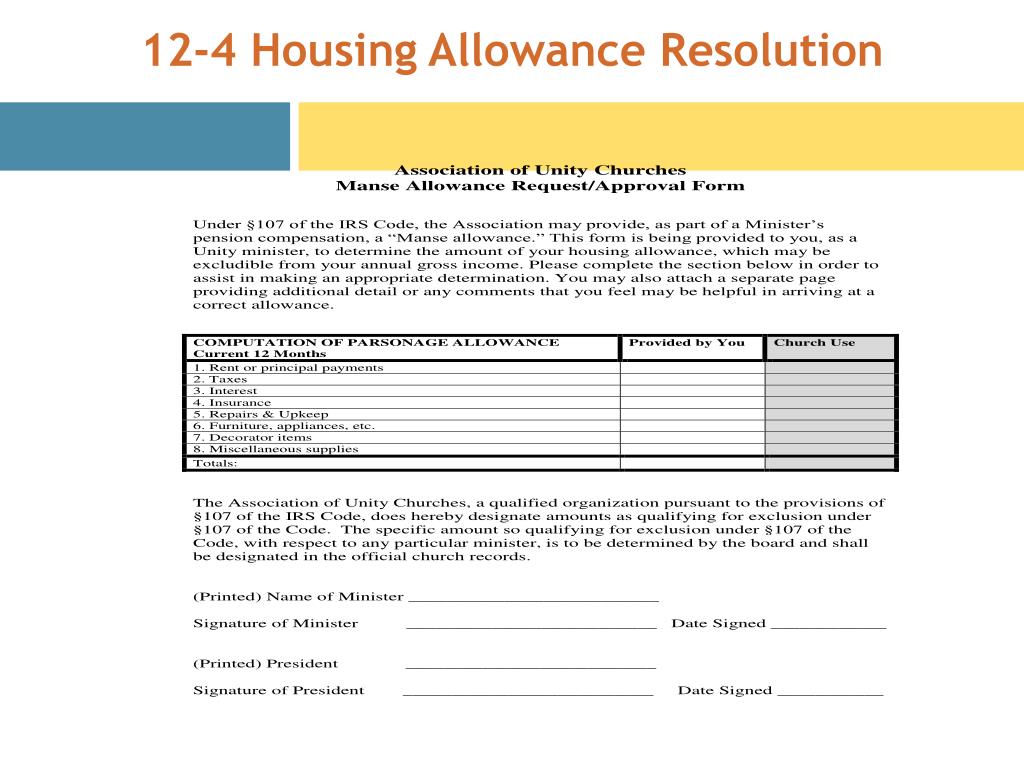

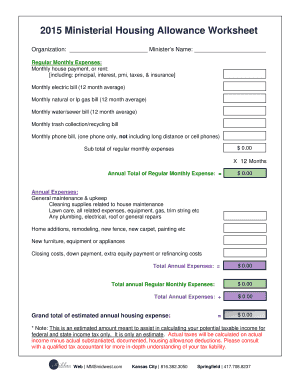

PDF Ministerial Housing Allowance Worksheet - Miller Management A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister's federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that:

Clergy housing allowance worksheet

Clergy Housing Allowance Worksheet 2010-2022 - US Legal Forms The tips below will allow you to fill out Clergy Housing Allowance Worksheet quickly and easily: Open the form in our feature-rich online editing tool by clicking on Get form. Complete the required fields that are marked in yellow. Hit the arrow with the inscription Next to jump from one field to another. 2022 Housing Allowance Form - Clergy Financial Resources The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. ... Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. This support service is available at a flat rate of $75.00 ... Clergy Housing Allowance | Wespath Benefits & Investments Clearing the Clouds: Clergy Housing Allowance. Wespath Benefits and Investments (Wespath) recognizes the unique and often complex nature of clergy taxes. The following information is designed to help clear some of the gray when thinking about a housing allowance. It pertains to active clergy living in an owned or rented home, active clergy ...

Clergy housing allowance worksheet. PDF Ministers' Housing Allowance Resource Kit Taxes with housing allowance • Salary of $50,000 • Housing Allowance of $28,000 • Reduction of Taxable Income $50,000 - $28,000 = $22,000 • Taxed on $22,000 * 12% = $2,640 • Owed income tax of $2,640 In this illustration there is a $3,360 tax savingswith the Housing Allowance. 2 3. Q. Church Financial Benefits - Kentucky Baptist Convention How to structure financial support for church employees in 4 steps. SBC Compensation Study. Ministers' Financial Support Worksheet. HOUSING: Basics of housing for ministers. HOUSING: Housing Allowance Estimate Form. HOUSING: Sample Housing Allowance Notification Form. RETIREMENT: Retirement contributions for church employees. INSURANCE ... PDF Clergy Housing Allowance Worksheet EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources T1223 Clergy Residence Deduction - Canada.ca If you are a clergy member, use this form to claim the clergy residence deduction. This form will help you calculate the expenses you can deduct.

PDF CLERGY/PASTOR HOUSING ALLOWANCE FAQ's - AccuPay ChurchPay Pros' Housing Allowance Worksheet, is an excellent starting point for determining housing allowance amounts. The worksheet is available at ... A. Ideally, clergy should keep careful housing expense records to determine whether expenses are greater or less than the annual designation. Records are also important for estimating a PDF Retired Clergy Housing Allowance - PBUCC Retired Clergy Housing Allowance • Minister's Housing Allowance exclusion is allowed under Section 107 of the Internal Revenue Code. • When you receive your 1099-R from the Pension Boards, it will indicate the total amount paid to you and any federal taxes withheld for the year. • The 1099-R will not report a taxable amount for clergy. 2 Ministers' Compensation & Housing Allowance - IRS tax forms The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1. Housing Allowance Worksheet 2021 Form - signNow Use this step-by-step instruction to fill out the Clergy Parsonage allowance worksheet worksheet worksheet 2022 worksheet 2021 Worksheet — PCA Retirement Benefits Inc — Carib form promptly and with idEval accuracy. ... Get housing allowance worksheet PCA retirement benefits inc Carib signed right from your smartphone using these six tips:

Clergy housing allowance - Intuit Look at the schedule SE adj sheet in section 2, line 5B. if you are seeing your housing allowance twice what you expect, you need to take additional action. Go to the W2 for that income. On the wks (worksheet) make sure you 0 out the housing allowance (since it already has it) but do enter the amount you spent of qualifying expense. This sorted ... PDF 404 - Benefits & Investments for The United Methodist Church CCP provides long-term retirement security for UMC clergy in the central conferences outside the United States. Learn More. About Wespath. About Wespath . News. Events & Webinars. Careers. Leadership Team. Annual Report. General Conference Resources. Central Conference Pensions (CCP) UMC Connections. Topic No. 417 Earnings for Clergy | Internal Revenue Service Housing Allowance A licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income the fair rental value of a home provided as part of compensation (a parsonage) or a housing allowance provided as compensation if it is used to rent or otherwise provide a home. Housing Allowance Worksheet - Fill Out and Sign Printable PDF Template ... Once you've finished signing your clergy housing allowance worksheet 2022, choose what you wish to do next — save it or share the document with other parties involved. The signNow extension provides you with a selection of features (merging PDFs, adding multiple signers, and many others) for a better signing experience. ...

PDF 2021 Minister's Housing Allowance Worksheet - MinistryCPA 2021 Minister's Housing Allowance Worksheet Amount Portion of cash compensation designated as housing allowance Homeowner's or renter's insurance (if not already included in mortgage payments) Real estate taxes (if not already included in mortgage payments) Furnishings, appliances, carpeting, etc. Utilities

Housing Allowance for Pastors - Clergy Housing Allowance | MMBB How It Works Example: If a clergy's annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000. They must pay Social Security/Medicare tax on the entire compensation of $65,000.

PDF MMBB's Housing Allowance Worksheet Example Remember the tax code limits the nontaxable portion of housing compensation designated as. housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Ministers who own their homes should take the following expenses into account in. computing their housing allowance exclusion.

Minister's Housing Expenses Worksheet - AGFinancial Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Minister's Housing Expenses Worksheet Download the free resource now. Did you know we have a wide array of products and services to help you on your financial journey?

PDF HOUSING ALLOWANCE GUIDE - CBF Church Benefits Housing Allowance of $28,000 Reduction of Taxable Income $50,000 - $28,000 = $22,000 Taxed on $22,000 * 12% = $2,640 Owed income tax of $2,640 A: The main advantage of declaring a housing allowance is that it helps the minister save in paying income tax (see the illustration below). That savings on taxes can be used for

PDF CLERGY INCOME & EXPENSE WORKSHEET YEAR - Cameron Tax Services Housing Allowance Weddings & Funerals (see below) Speaking engagements Business Expense Reimbursement Liturgical work Direct reimbursement Auto Barter Set Amount Other Other Sales of Equipment and/or Machinery Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost

Everything Ministers/ Clergy Should Know About Their Housing Allowance A housing allowance may include expenses related to renting, purchasing (which may consist of down payments or mortgage payments) and/or maintaining a clergy member's current home. (It may not encompass expenses incurred as the result of commercial properties or vacation homes.) Any items for inclusion must be personal in nature for the ...

What is the Clergy Housing Allowance? In order to determine how much of the Clergy Housing Allowance can be excluded from income taxes, three categories must be considered: The amount designated as a housing allowance 2. The amount actually spent on housing expenses for their primary home 3. The fair rental value of the home, including utilities and furnishings for the year

PDF 2020 Minister Housing Allowance Worksheet - The Pastor's Wallet 2020 Minister Housing Allowance Worksheet Mortgage Payment *Real Estate Taxes *Homeowners Insurance Mortgage Down Payment & Closing Costs Rent Renter's Insurance HOA Dues/Condo Fees Home Maintenance & Repairs Utilities Furniture & Appliances Household Items Home Supplies Yard Service Yard Care Tools & Supplies Miscellaneous Other: Other: Other:

PDF MINISTER'S HOUSING EXPENSES WORKSHEET - AGFinancial MINISTER'S HOUSING EXPENSES WORKSHEET ANNUAL HOUSING EXPENSES Rent (if a primary residence was ented for all or part of the year)$ Down payment on a home $ Remodeling and improvements $ Installment payments on a mortgage loan to purchase or improve your home $ (include both principal and interest)

Clergy Housing Allowance | Wespath Benefits & Investments Clearing the Clouds: Clergy Housing Allowance. Wespath Benefits and Investments (Wespath) recognizes the unique and often complex nature of clergy taxes. The following information is designed to help clear some of the gray when thinking about a housing allowance. It pertains to active clergy living in an owned or rented home, active clergy ...

2022 Housing Allowance Form - Clergy Financial Resources The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. ... Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. This support service is available at a flat rate of $75.00 ...

Clergy Housing Allowance Worksheet 2010-2022 - US Legal Forms The tips below will allow you to fill out Clergy Housing Allowance Worksheet quickly and easily: Open the form in our feature-rich online editing tool by clicking on Get form. Complete the required fields that are marked in yellow. Hit the arrow with the inscription Next to jump from one field to another.

0 Response to "38 clergy housing allowance worksheet"

Post a Comment