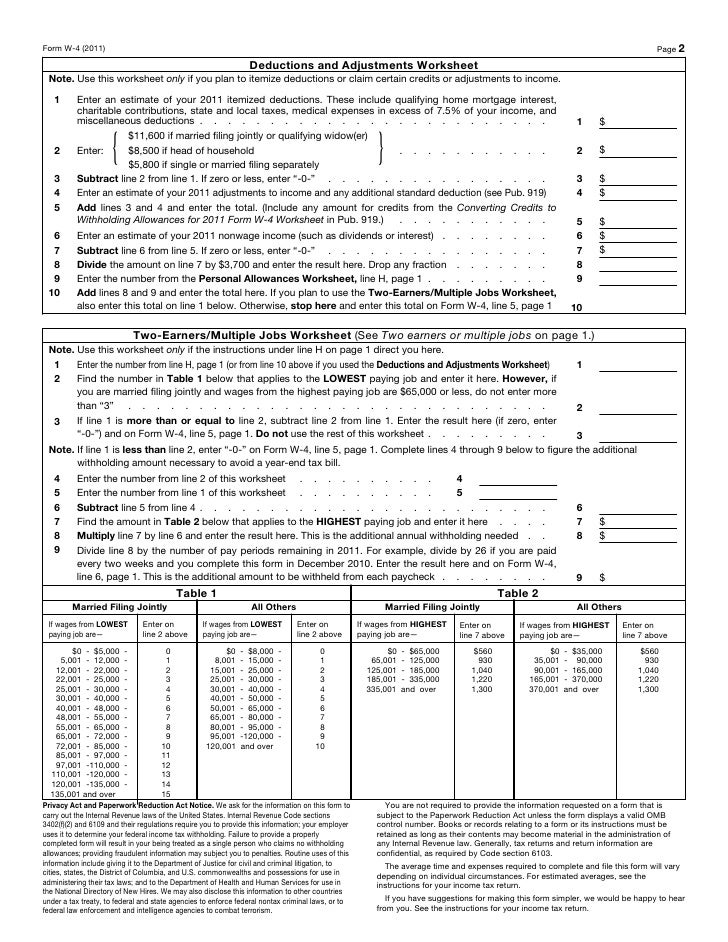

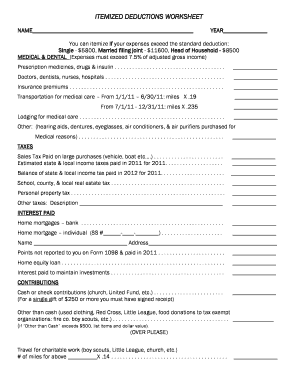

43 itemized deductions worksheet 2015

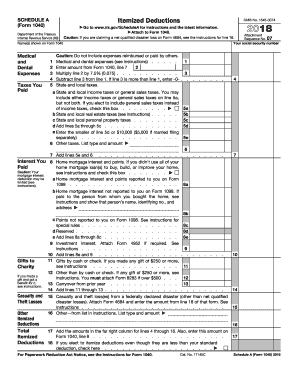

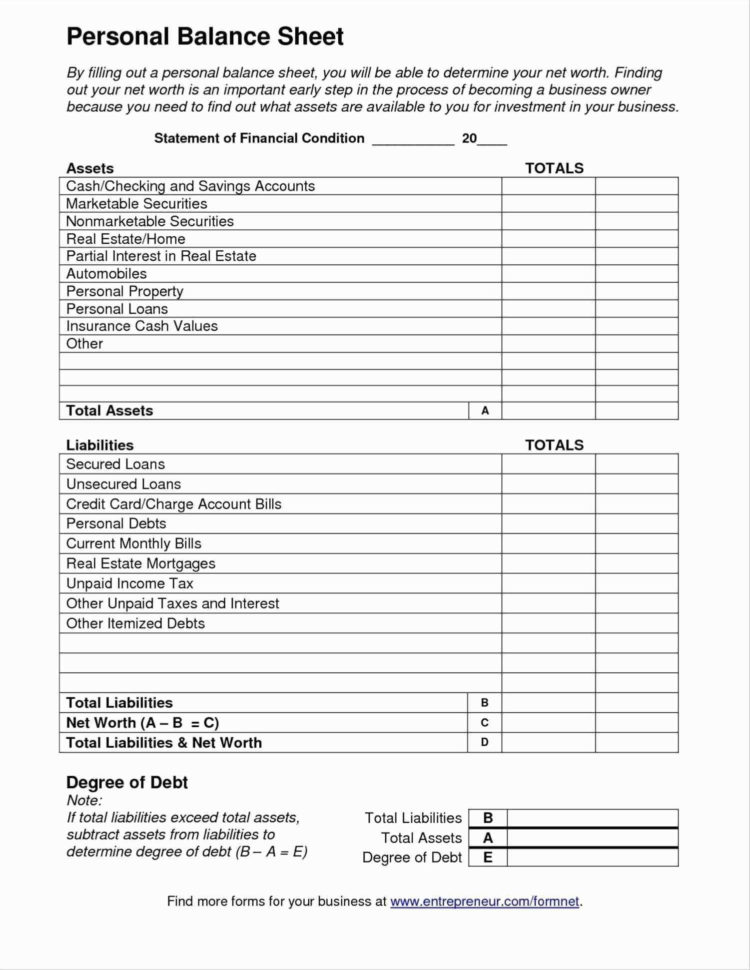

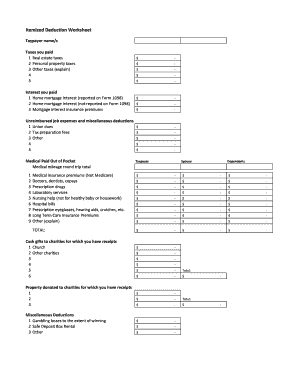

› publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. apps.irs.gov › app › picklistPrior Year Products - IRS tax forms Itemized Deductions 2015 Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040), Itemized Deductions 2014 Form 1040 (Schedule A) Itemized Deductions ...

› instructions › i2106Instructions for Form 2106 (2021) | Internal Revenue Service Form 2106 may be used only by Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses because of the suspension of miscellaneous itemized deductions subject to the 2% floor under section 67(a) by P.L. 115-97, section 11045.

Itemized deductions worksheet 2015

› instructions › i1040sca2021 Instructions for Schedule A (2021) | Internal Revenue ... If you and your spouse paid expenses jointly and are filing separate returns for 2021, see Pub. 504 to figure the portion of joint expenses that you can claim as itemized deductions. Don't include on Schedule A items deducted elsewhere, such as on Form 1040, Form 1040-SR, or Schedule C, E, or F. . › publications › p936Publication 936 (2021), Home Mortgage Interest Deduction Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Deductions for expenses that are deductible in determining adjusted gross income are not suspended. For example, Armed Forces reservists, qualified performing artists, and fee-basis state or local government officials are allowed to deduct unreimbursed employee travel expenses as an adjustment to total income on Schedule 1 (Form 1040), line 12.

Itemized deductions worksheet 2015. › publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Report on Schedule A (Form 1040), Itemized Deductions, any itemized real estate deduction. Reporting Other Income Related to Your Home Sale. Report as ordinary income on Form 1040, 1040-SR, or 1040-NR any amounts received from selling personal property. › publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Deductions for expenses that are deductible in determining adjusted gross income are not suspended. For example, Armed Forces reservists, qualified performing artists, and fee-basis state or local government officials are allowed to deduct unreimbursed employee travel expenses as an adjustment to total income on Schedule 1 (Form 1040), line 12. › publications › p936Publication 936 (2021), Home Mortgage Interest Deduction Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › instructions › i1040sca2021 Instructions for Schedule A (2021) | Internal Revenue ... If you and your spouse paid expenses jointly and are filing separate returns for 2021, see Pub. 504 to figure the portion of joint expenses that you can claim as itemized deductions. Don't include on Schedule A items deducted elsewhere, such as on Form 1040, Form 1040-SR, or Schedule C, E, or F. .

0 Response to "43 itemized deductions worksheet 2015"

Post a Comment