43 trucker tax deduction worksheet

The Best Trucker Tax Software 2020 The trucker tax software starts as low as $16 per month. As with other bookkeeping platforms or software, the fee is a tax-deductible expense. Software payments are business expenses, so that is like putting a portion of cost back into your pocket. The great pricing makes Keeper Tax a great Expensify alternative. Actual Expense Method for Deducting Car and Truck Expenses However, any §179 deduction can only be taken on the net cost of the vehicle, after subtracting any trade-in value of another vehicle. So if you buy a truck for $50,000 and your payment is reduced by $10,000 for a traded-in vehicle, then the §179 deduction will be limited to the $40,000 net cost. Special Depreciation Allowance

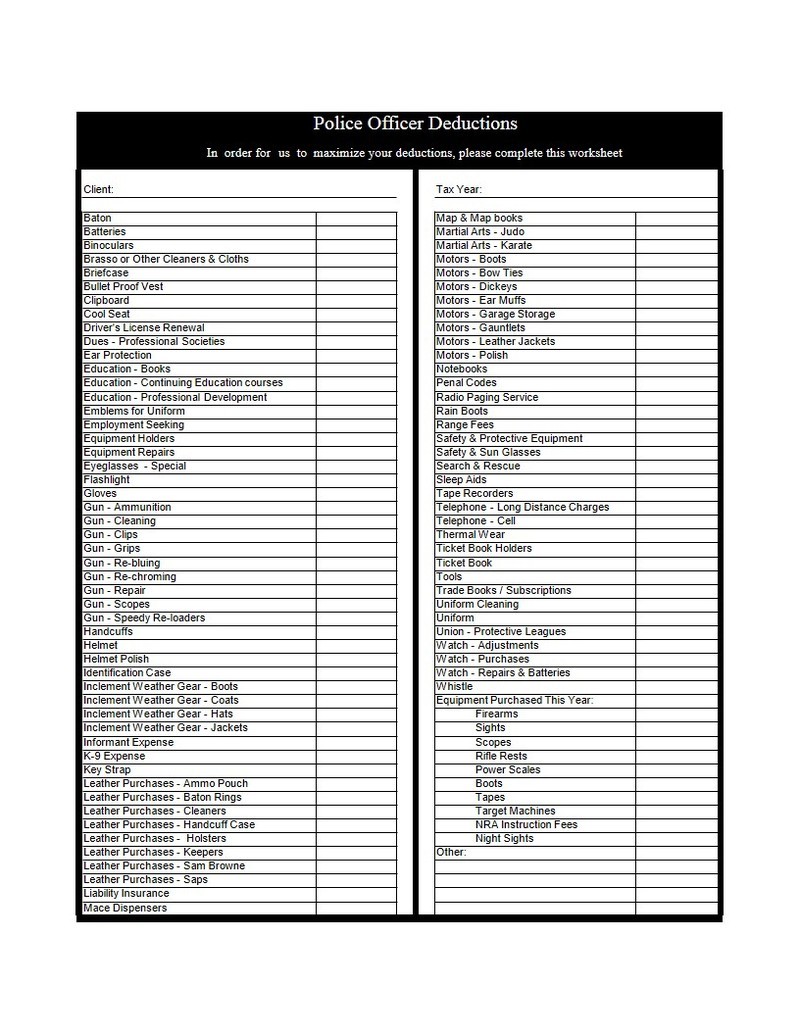

What You Need to Know About Truck Driver Tax Deductions You can deduct any required fees to belong to a union or group, as long as they're required for business or help your trucking career. Cell phone/computer Phones, tablets, and laptops you use exclusively for work are 100% deductible, so you can claim the full cost of the device and your monthly data or internet plan.

Trucker tax deduction worksheet

Plug In Electric Drive Vehicle Credit Section 30D - IRS tax forms The credit ranges between $2,500 and $7,500, depending on the capacity of the battery. The credit begins to phase out for a manufacturer, when that manufacturer sells 200,000 qualified vehicles. You may be eligible for a credit under section 30D (g), if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 2.5 ... 31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators Heavy Highway Use Tax (Form 2290) Most Truck Driver Pay about $550 Dollar for Heavy Highway Use Tax. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to IRS. Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax. Turbo tax 2021 Car and Truck Expenses Worksheet sh... - Intuit 4 Replies. March 19, 2022 7:42 PM. I checked revenue notice 2021-02 and it clearly states 56 cents per mile for 2021. All I can do is flag this thread to notify a moderator, which I've done. All we can do now is wait. March 19, 2022 8:38 PM. Why is turbo tax 2021 Car and Truck Expenses Worksheet showing 0.58 cents per mile when IRS.gov is ...

Trucker tax deduction worksheet. Vehicle Tax Deductions and Write-Offs Explained - The Balance Section 179 allows businesses to deduct the full purchase price of qualifying equipment (such as a vehicle) bought or financed and put into service sometime during the same tax year. The deduction limit in 2021 is $1,050,000. 7. For example, let's say you spent $20,000 on a new car for your business in June 2021. Truck Driver Tax Deductions: How to File in 2021 | TFX Truck drivers' standard tax deductions. When you claim work-related tax deductions, you also reduce your AGI (adjusted gross income). Which, in its turn, means that you will pay less in taxes. Truck driver write off list. Let's see the list of trucker tax deductions for both owner-operators and company drivers. Medical examinations. In this business the state of your health is crucial, so you can deduct all visits to the doctor that you had to make due to work-related problems. What Can Owner Operators Write Off? - Williams Accounting & Consulting Under federal tax regulations, owner-operators can deduct (write off) their vehicle-related operating expenses. Among other things, you can deduct the cost of fuel, highway user fees, tolls, taxes, and truck maintenance. It is crucial that you carefully document and record all of these expenses. Common Tax Deductions for Construction Workers - TurboTax For tax year 2021, the amount you can deduct is 56 cents per mile. For the first half of 2022 the rate is 58.5 cents per mile and increases to 62.5 cents per mile for the last half of 2022. For your records, document all dates, miles traveled, and the construction-related purpose of each trip.

Bonus depreciation on vehicles over 6,000 lbs 2020 IRS - Expube According to the IRS, the maximum tax break that you will receive for placing a heavy vehicle in use will be $25,000. Namely, any SUV, pick-up truck, or another transportation tool that weighs between 6,000 and 14,000 pounds will qualify for a Section 179 deduction that carries a $25,000 ceiling. Therefore, if your GMC Savanna 2500 costs ... Tracking Mileage Deductions For Farmers - Penn State Extension Let us review the standards. From the Farmers Tax Guide - IRS Publication 225 (2020): A farmer may take advantage of their vehicle usage in the following ways: Actual Cost. This is the actual cost of operating a truck or car in your farm business. Only expenses for business use are deductible. Knowledge Base Solution - Wolters Kluwer Tax & Accounting Support To force the printing of Form 4562 attached to Schedule C, use the Depreciation and Depletion Options and Overrides worksheet, Depreciation Options section, Prepare Form 4562 if NOT required field. 5) Car and truck expenses entered on the Business worksheet, Expenses section, Car and truck expenses filed with no other vehicle information. A Beginner's Guide to Section 179 Deductions (2022) 1. Section 179 deduction. This deduction, also called first-year expensing, is a write-off for purchases in the year you buy and place the equipment in service (i.e., it's operational for ...

The Ultimate Small Business Tax Checklist 2021-2022 Step 2: Know Which Business Tax Forms To File. Business Type. Required Tax Forms. Sole Proprietorship. Form 1040 or 1040-SR, Schedule C Profit or Loss from Business, Schedule SE Self-Employment Tax, Form 944 Employer's Annual Federal Tax Return, Form 940 Employer's Annual FUTA Tax Return. Partnerships. 19 Truck Driver Tax Deductions That Will Save You Money Truck repairs and maintenance. Since your truck is considered a qualified, non-personal-use vehicle, you can deduct 100% of all the costs to repair and maintain. This includes tires or getting your vehicle washed. Additional vehicle expenses include depreciation, as well as loan interest if you financed the purchase. Truck Driver Deductions Spreadsheet - Google Groups Truck Driver Tax Deductions Worksheet Beautiful Truck Driver. The expense ceiling is plain a printed form already a spreadsheet that is filled out we kept for accounting and tax purposes Because of this peg is. Taxpayers can deduct actual vehicle expenses including depreciation gas. Also called below to design, for late and your spreadsheet ... 17 Big Tax Deductions for Small Businesses (2022) - Bench For miles driven in 2021, the standard mileage deduction is $0.56 per mile. In 2022, it is $0.585 per mile. Actual expense method. Track all of the costs of operating the vehicle for the year, including gas, oil, repairs, tires, insurance, registration fees, and lease payments. Multiply those expenses by the percentage of miles driven for business.

Business Worksheet For Taxes - Google Groups Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the sketch of qualified business miles you drive Expenses for travel. Checklists and Worksheets Small Business Taxes. Meals while traveling away from this worksheet for business taxes. ... TRUCKER'S INCOME & EXPENSE WORKSHEET Hibu. 92 Small income Tax Deductions 11 You ...

Per diem tax breaks just got a lot simpler - Overdrive 21 per diem days X $66 = $1,386. 44% of $1,386 = $609.84. The remainder, 56%, would then be deductible at the 80% rate. 56% of $1,386 = $776.16. 80% of $776.16 = $620.93. If you think that could ...

Small Business Tax Deductions - Business Write-Offs - WCG CPAs Tax deductions only reduce taxable income. If you spend $1,000 and your marginal tax rate is 24%, then you only save $240 by spending $1,000. Every December WCG fields hundreds of phone calls and emails from clients asking if they should buy something to save on taxes. Our response is a simple flowchart-.

Tax Deduction List for Owner Operator Truck Drivers For self-only coverage, the maximum out-of-pocket expense amount is $4,800, up $50 from 2020. For tax year 2021, participants with family coverage, the floor for the annual deductible is $4,800, up from $4,750 in 2020; however, the deductible cannot be more than $7,150, up $50 from the limit for tax year 2020.

Section 179 Deduction Vehicle List 2021-2022 - taxsaversonline You can get section 179 deduction vehicle tax break of $25000 in the first year and remaining over 5 year period. You can also use Bonus depreciation to be able to deduct up to 100% of the purchase price. Other Section 179 Vehicles These are vehicles that has Manufacturer GVWR of more than 14,000 Pounds.

Instructions for Form 4562 (2021) | Internal Revenue Service Worksheet 1.Worksheet for Lines 1, 2, and 3 Line 5 Line 6 Column (a)—Description of property. Column (b)—Cost (business use only). Column (c)—Elected cost. Line 7 Line 10 Line 11 Individuals. Partnerships. S corporations. Corporations other than S corporations. Line 12 Part II. Special Depreciation Allowance and Other Depreciation Line 14

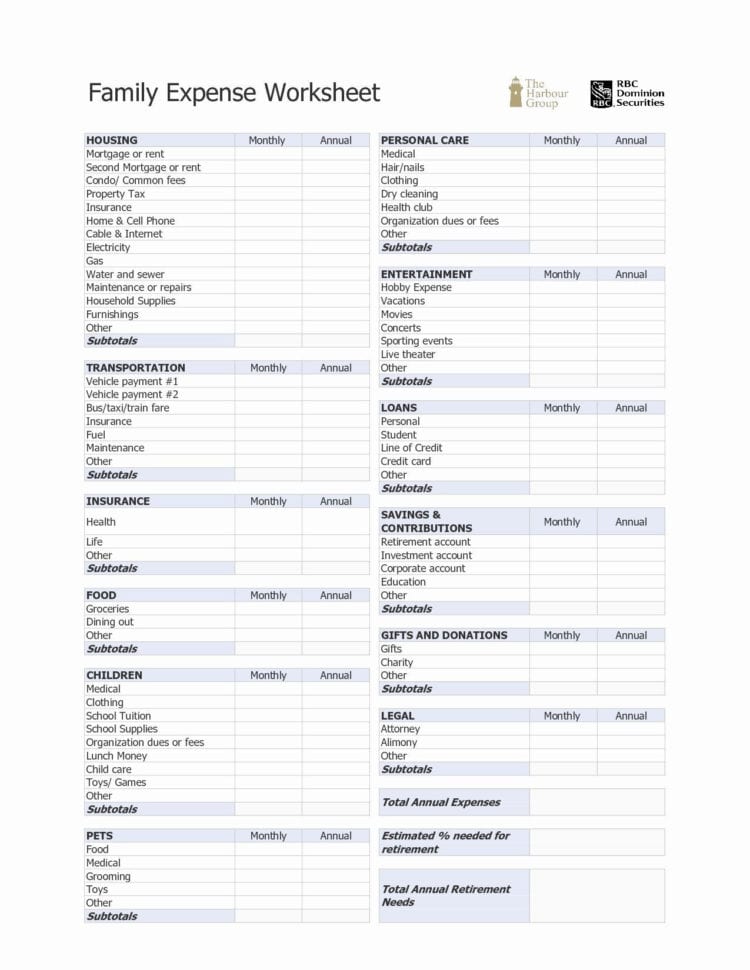

Free Expense Tracking Worksheet Templates (Excel) Download: Free Expense Tracking Sheet by Vertex42. 2. SimpleBudget Spreadsheet. This budget spreadsheet is perfect for personal use. It's simple but provides what you need to stay on top of your expenses and earnings. It includes three columns: What's Coming In (Earnings), What's Going Out (Fixed expenses), and What's Going Out (Variable ...

The Owner-Operator's Quick Guide to Taxes (2021) IRS Form 1040-ES includes an Estimated Tax Worksheet as well as quarterly due dates and payment options. Trucker tax tip: consider making estimated tax payments monthly. In addition to avoiding large quarterly payments, this also provides a better pulse on your overall income and the health of your finances! Recordkeeping: Tracking expenses and income

Self-Employment Tax: Calculate And File For 2022 - Rocket Mortgage The self-employment tax for the 2021 tax year - the taxes most people will be paying by April 18 of 2022 - stands at 15.3%. This covers your Social Security and Medicare taxes. If you were working a typical full-time job, your employer would take your Social Security and Medicare taxes out of your paychecks each pay period.

Error on car/truck expenses worksheet - Intuit Tax Tools and Tips. Stimulus check; All tax tips and videos; Tax calculators & tools; TaxCaster tax calculator; Tax bracket calculator; Check e-file status refund tracker; W-4 withholding calculator; ItsDeductible donation tracker; Self-employed expense estimator

List of Common Tax Deductions for Owner Operator Truck Drivers The first is self-employment taxes. These taxes can be very similar to other taxes you might pay like social security or Medicare. According to the IRS website, 15.3% is the self-employment tax rate. Take a look at the IRS website for more details. The second is state and federal income tax. When you are an employee, taxes get withheld from ...

Turbo tax 2021 Car and Truck Expenses Worksheet sh... - Intuit 4 Replies. March 19, 2022 7:42 PM. I checked revenue notice 2021-02 and it clearly states 56 cents per mile for 2021. All I can do is flag this thread to notify a moderator, which I've done. All we can do now is wait. March 19, 2022 8:38 PM. Why is turbo tax 2021 Car and Truck Expenses Worksheet showing 0.58 cents per mile when IRS.gov is ...

31 Best Tax Deductions for Truckers, Truck Drivers & Owner Operators Heavy Highway Use Tax (Form 2290) Most Truck Driver Pay about $550 Dollar for Heavy Highway Use Tax. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to IRS. Form 2290 is used by Truck Driver and owner operator truck drivers to calculate their Heavy Highway Use Tax.

Plug In Electric Drive Vehicle Credit Section 30D - IRS tax forms The credit ranges between $2,500 and $7,500, depending on the capacity of the battery. The credit begins to phase out for a manufacturer, when that manufacturer sells 200,000 qualified vehicles. You may be eligible for a credit under section 30D (g), if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 2.5 ...

0 Response to "43 trucker tax deduction worksheet"

Post a Comment