45 gross pay vs net pay worksheet

Gross And Net Pay Teaching Resources | Teachers Pay Teachers Net and Gross Pay (Workbook- 4 Worksheets) by. Sophie's Stuff. 4.9. (9) $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. Employee Pay & Benefits Review Worksheet 1. Explain the ... Employee Pay & Benefits Review Worksheet. 1. Explain the difference between Gross Pay and Net Pay. • Gross Pay is the amount you make before any deductions.

Lesson Plan: Calculating Gross and Net Pay - Scholastic Use the example of a $740 laptop computer in a state with 5% sales tax. First, show how 5% is converted to the decimal .05 and multiplied by $740 to arrive at a sales tax of $37. Adding the price of the laptop ($740) and the sales tax ($37) results in the total cost of $777. Step 3: While sales tax is added to the starting amount of a purchase ...

Gross pay vs net pay worksheet

Gross Pay Calculator Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. Your gross income or pay is usually not the same as your net pay especially if you must pay for taxes and other benefits such as health insurance. Some people refer to this calculation as a unit rate conversion. Gross Pay vs. Net Pay: Explanation and Examples Gross monthly income is all of the pay an employee receives as compensation for their work. Net pay is the total income minus any deductions. As stated above, apart from some very unusual circumstances, net pay is lower than gross pay. Deductions from gross pay fall into two categories: voluntary and involuntary deductions. What Is Net Pay? | Definition, Net Pay vs. Gross Pay, & More What is net pay vs. gross pay. ... Thus, you can follow this very general formula for how to calculate net pay from gross pay: Gross Pay - Payroll Deductions = Net Pay. ... That usually means they want to know your gross rather than your net pay. IRS Form W-4 includes a worksheet for computing amounts to be withheld. In many cases, the ...

Gross pay vs net pay worksheet. Gross and Net Income: What's the Difference? - Ticket to Work For example, if you are working in a job in which you're paid an hourly wage, your gross income is the hourly rate you're paid multiplied by the number of hours you've worked during a pay period. For instance, if your pay period is one week and you worked 20 hours at $12.00 per hour: $12.00 x 20 = $240.00. Gross vs. Net Income: What's the Difference? - The Balance The difference between gross and net income is important for many reasons, especially during tax season. Find out what you should know about both to understand your own. ... You can adjust your withholdings with your payroll manager using a W-4 form. Social Security and Medicare taxes, however, are fixed at 6.2% and 1.45%, respectively. Gross Pay And Net Pay Teaching Resources | Teachers Pay Teachers Net and Gross Pay (Workbook- 4 Worksheets) by. Sophie's Stuff. 4.9. (9) $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. My Paycheck - CTECS making calculations related to personal finance (e.g., wage rates, paycheck deductions, taxes). Vocabulary. Gross pay. Commission. Salaried. Net pay.

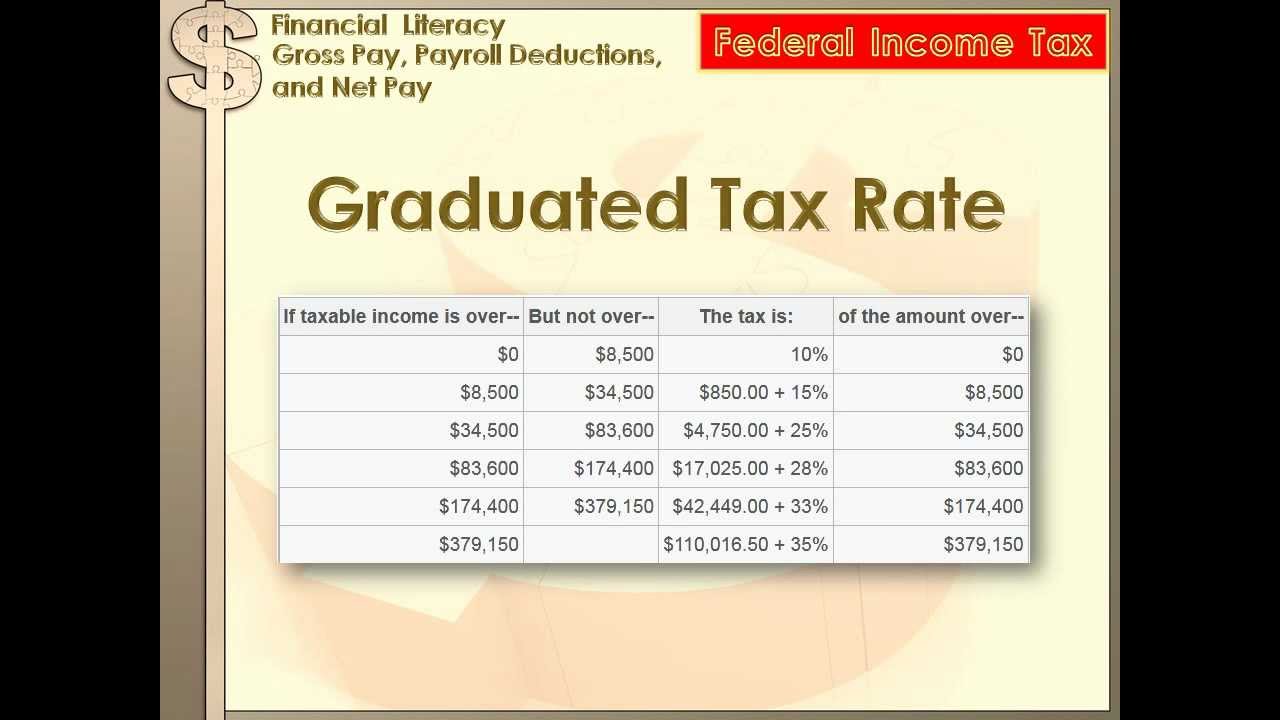

PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income ... Net Pay Worksheet - eNetLearning 1) Sandra earns $13.50/hour and works 32 hours. Determine gross pay_______________________________. (hint hourly rate x hours worked). Gross Pay: Deductions:. Calculating the numbers in your paycheck | Consumer Financial ... Understand what types of taxes are deducted from a paycheck; Calculate the difference between gross income and net income; What students will do. Review information on how to read a pay stub and answer questions about earnings and deductions. Calculate tax withholdings, deductions, and the difference between gross income and net income. Gross Payroll vs. Reportable Payroll - Blog - TSIB, Inc. Gross Payroll. Gross payroll is the unburdened "straight time" portion of any "overtime" payroll (except in the states of Pennsylvania, Nevada, Utah, Delaware and applicable Workers' compensation monopolistic states. These states require the entire unburdened "overtime" payroll to be reported) for all CIP qualified employees ...

Quiz & Worksheet - Gross & Net Income | Study.com Gross income is the total income after subtracting COGS, but before subtracting the cost of running the business; net income is the profit left after subtracting the cost of running the business.... Gross-Up Worksheet - Finance & Accounting Gross-Up Worksheet. * Gross Up Amount: This is an estimated amount that the department needs to pay that will show on the employee's check before withholdings. NOTE: The gross-up calculation is an estimate using the IRS supplemental tax rate of 22 percent, the employee is normally taxed according to the information provided on their IRS Form W-4. Gross Pay vs. Net Pay: Definitions and Examples | Indeed.com For example, if your employer agreed to pay you $15 per hour and you work for 30 hours during a pay period, your gross pay will be $450. Net pay is the final amount of money that you will receive after all taxes and deductions have been subtracted. Net pay is the amount that's actually deposited into your bank account or the value of your paycheck. The Difference Between Gross Pay and Net Pay Net Pay. Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and voluntary deductions are made. 2 To determine net pay, gross pay is computed based on how an employee is classified by the organization. An hourly or nonexempt employee is paid by the hours worked times the agreed-upon ...

How to Calculate Gross Pay to Net Pay - Workest When an employee accepts a new job offer, the negotiated salary is typically a figure determined before tax, which is known as the gross pay. The first paycheck received includes the net pay amount after tax. Gross wages equal the amount before tax whereas net pay is the sum after tax. Net pay is also commonly referred to as "take-home" pay.

paychecks math worksheet answers Paycheck Insurance / Paycheck To Budget Worksheet Spreadsheet Template fortheloveofhealth2011.blogspot.com. paycheck. Gross Pay Vs Net Pay Worksheet - Ivuyteq ivuyteq.blogspot.com. worksheet assume earns. Civics/Econ - HHSResourceProgram sites.google.com. economics guided reading activity civics history econ k12 hilmar week. Gross pay vs net ...

Gross vs Net Income - Difference, Definition, Formulas, Examples Now, using the relation of gross vs net income, Net income = Gross income - Deductions. Net income = $6200 - $632 = $5568 Therefore, his net income is $5568. Example 3: Using the concept of gross vs net income, find the gross income of Sam if his net income is $54500 and he paid taxes of $10500.

Gross vs. Net Income | Examples | Study.com Gross pay is the amount of money that a worker receives before taxes are taken out. Net pay is the amount of money that a worker actually gets after taxes are taken out. The difference between...

PDF Calculating Gross and Weekly Wages Worksheet - Scholastic What is his gross weekly wage? B. Hourly: A regular work week is 40 hours. Overtime pay is time and one-half. 1. Isabel drives truck for $8.75 an hour. If she worked 40 hours, what would her gross earnings be for one week? 2. Manual is a word-processor operator. He makes $11.50 an hour. Determine his gross earnings for a week if he worked 52 hours.

Gross Pay vs Net Pay: How to Calculate the Difference Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the amount left over after deductions have been taken from an employee's gross pay. Net pay is sometimes called take-home pay.

Paydays Lesson Plan, Payroll, Gross, Net Pay, Classroom Teaching Worksheet The class treasurer and payroll clerks will learn to fill out payroll paperwork and pay students for both part-time and full-time jobs. Students will differentiate between gross pay and net pay. Students will use purchase orders to buy items from the class store. Some students may begin to purchase items with their MoneyInstructor-Bucks.

Reading a Pay Stub Extension Activity for Managing Money ... understand the difference between gross and net pay. • identify taxes and deductions taken ... Calculating Monthly Gross & Net Pay worksheet (1 per student).

Gross Pay Net Pay Lesson Plans & Worksheets Reviewed by Teachers In this graphing lesson, students explore the concepts of net pay, gross pay, income and expenses. They create a bar graph to designate financial outlay during a specified period. + Lesson Planet: Curated OER Money and Percentage For Teachers 5th Fifth graders examine use of percentages in real world situations.

PDF Bring Home The Gold - National Payroll Week Worksheet 1 9 Exercise 2 Questions 1. What is gross pay? 2. What is net pay? 3. True or False? Your paycheck = total hours worked x rate of pay. 4. Name two mandatory deductions. 5. Name three other deductions. 10 Calculating a Paycheck #1 EMPLOYEE AT A GOURMET COFFEE Employee's name:

Gross vs. Net - Softschools.com Gross estate is the total value of a person's estate before deductions of any costs like for example taxes, living and funeral expenses or any other administration costs. Net is the term opposite to the gross and refers to the amount after we have done any deductions. So, net income is the income we receive after paying taxes.

Gross Income vs. Net Income: What's the Difference? Gross income is the total income a business earns, while net income is the gross income minus expenses. Gross income and net income for tax reporting purposes and financial statements are typically income and expenses from the business's operations Small businesses calculate their gross income and net income on Schedule C.

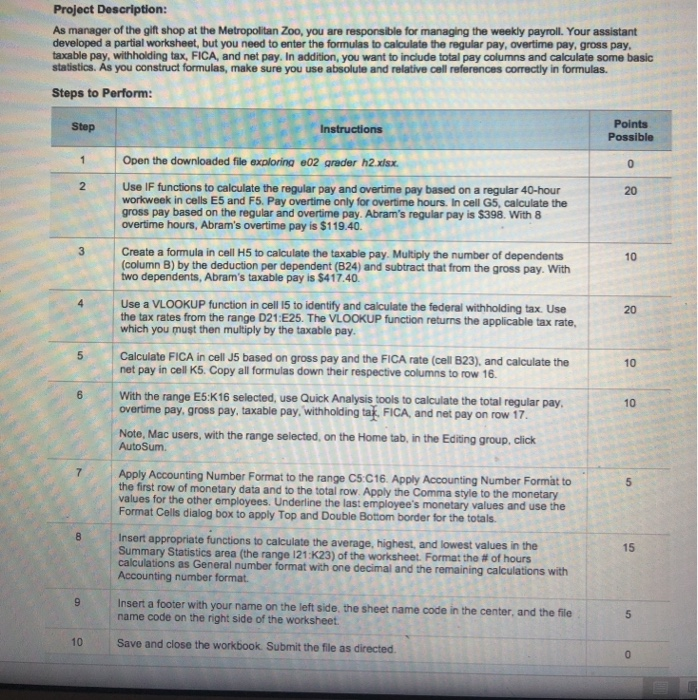

PDF Gross Pay and Net Pay Worksheet - Iwilliamsbusinesseducationclass GROSS PAY AND NET PAY WORKSHEET 1. What job have you chosen? __________________ 2. Who is your employer? ______________________ 3. What is your pay per hour? $__________________ 4. Calculate your gross pay by performing the following step: pay per hour $_________x 16 (number of hours you worked)= $______________

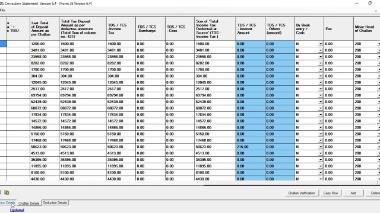

Paycheck Math - Finance in the Classroom Assume that the required income withholdings are 27% of the total. Record the Net Pay below. Hours Worked. Gross Pay. Deductions. Net Pay.

Net Income | Definition, Examples, Formula, Net vs Gross To find the net income of the grocery store, we must first compute the gross income by adding all earnings, 250 000 a n d 8000. Then subtract all expenses for materials, goods, labor, maintenance, operational and administrative costs, 120 000 a n d 70 000. Gross Income = 250 000 + 8000 Gross Income = $ 258 000 Total Deductions = 120 000 + 70 000

:max_bytes(150000):strip_icc()/what-is-gross-pay-and-how-is-it-calculated-398696-v1-5bbd1ae146e0fb0026778399.png)

0 Response to "45 gross pay vs net pay worksheet"

Post a Comment