41 spousal impoverishment income allocation worksheet

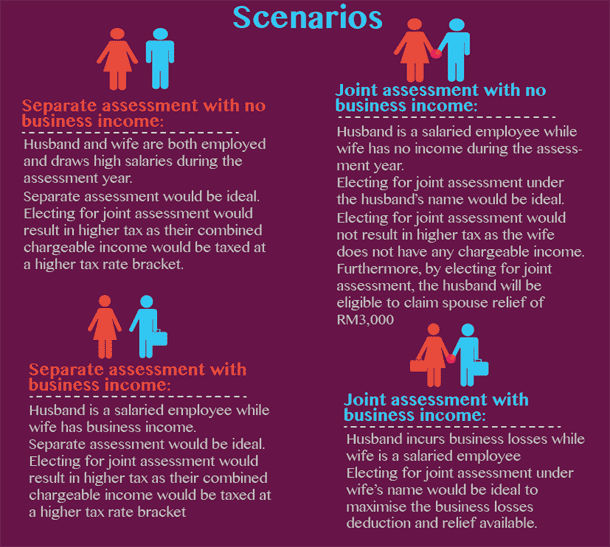

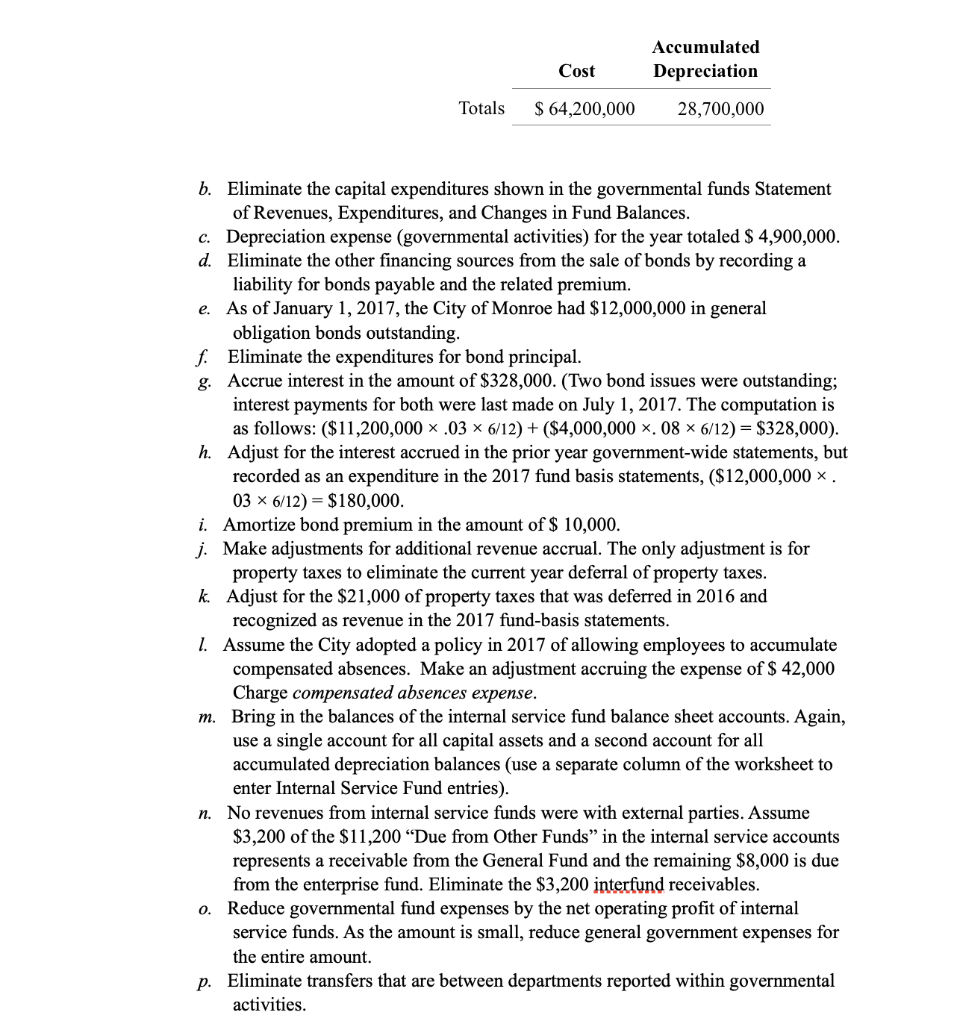

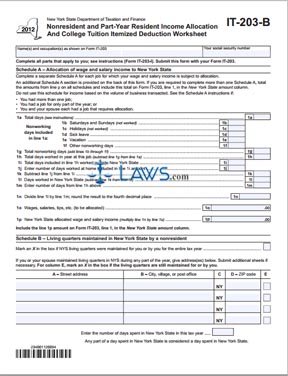

PDF Policy Memo RE: Annual Change in Spousal Impoverishment Programs spouse. $2,114 plus $772.87 = $2,886.87 (the adjusted MMNA for this couple). 1. If the couple's total countable monthly income is $1,800, all income could be allocated to the community spouse. Since the total income was less than the base MMNA of $2,114, the couple does not benefit from the increased MMNA of $2,886.87 and there would be Appendix XXIX, Special Deeming Eligibility Test for Spouse to Spouse ... Determine the non-exempt income of the ineligible children. See MEPD references in Step 2. Deduct from the ineligible spouse's countable income the program-specific living allowance for each ineligible child reduced by the ineligible child's gross amount of income. If the child's own income exceeds the allowance, there is no deduction and the child and their income is disregarded in the budget.

PDF 2019 Spousal Impoverishment Standards Draft - Medicaid.gov Spousal Impoverishment Effective 1-1-21 Unless Otherwise Noted Minimum Monthly Maintenance Needs Allowance (MMMNA): All States (Except Alaska and Hawaii) (Effective 7-1-21) Maximum Monthly Maintenance Needs Allowance: Community Spouse Monthly Housing Allowance: 653.25 All States (Except Alaska and Hawaii) (Effective 7-1-21) 8 16 .38 Alaska 751. ...

Spousal impoverishment income allocation worksheet

MEH 18.6 Spousal Impoverishment Income ... - Wisconsin.gov 18.6.3 Worksheet 7 Section B -- Family Member Income Allowance. Enter $612.92 on Line 1 under the name of each dependent family member who lives with the ... PDF State of California Health and Human Services Agency Department of ... Spousal Income Allocation is income that can be deducted and transferred from the HCBS spouse to the community spouse in order to reduce the HCBS spouse's income and allow the HCBS spouse to qualify for Medi-Cal. Please see Step 1 of the budget steps worksheet included in MEDIL I 21-07. 2. When is it appropriate to calculate the budget ... SR 21-21 Dated 07/21 - dhhs.nh.gov Electronic BFA Form 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals, and the associated New Heights-generated Form AE0017, have been revised to include the maximum income standard and the excess shelter deduction increases as released in this SR.

Spousal impoverishment income allocation worksheet. SR 22-21 Dated 07/22 - dhhs.nh.gov Electronic BFA Form 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals, and the associated New HEIGHTS-generated Form AE0017, have been revised to include the maximum income standard (MIS) and the excess shelter deduction (ESD) increases as released in this SR. PDF I. Spousal Impoverishment - Kansas $2,178 to determine the maximum amount of income which can be allocated to the community spouse. $2,178 plus $755.60 = $2,933.60 (the adjusted MMNA for this couple). 1. If the couple's total countable monthly income is $1,800, all income could be allocated to the community spouse. Since the total income was less than the base MMNA of $2,178, PDF Spousal Impoverishment Income Allocation Worksheet, F-01306 SPOUSAL IMPOVERISHMENT INCOME ALLOCATION WORKSHEET Primary Person Name (Last, First, MI) Social Security Number Section A - Community Spouse Income Allocation Spouse's Name (Last, First, MI) 1. ENTER Maximum Community Spouse Income Allocation 2. SUBTRACT Gross Income of Community Spouse 3. EQUALS Community Spouse Income Allocation Overview of Medi-Cal for Long Term Care -Fact Sheet - CANHR Seth and Logan are registered domestic partners. Seth recently entered a nursing home and was approved for Long Term Care Medi-Cal with Spousal Impoverishment. Seth's monthly income is $3,000. Logan's monthly income is $1,435 which is below the MMMNA, allowing him to receive an allocation from Seth.

18.6 Spousal Impoverishment Income Allocation - Wisconsin The community spouse maximum income allocation is one of the following: $ 2,903.34 plus excess shelter allowance (see Section 39.4.2 Elderly, Blind, or Disabled Deductions and Allowances) up to a maximum of $ 3,259.50. "Excess shelter allowance" means shelter expenses above $871.00. Subtract $871.00 from the community spouse's shelter costs. PDF Updated 07/11/2022 FACT SHEET Using California's Spousal Impoverishment ... The well spouse may retain all income in her own name and, if that income is less than $3,260 (the Minimum Monthly Maintenance Needs Allowance, or MMMNA, for 2021), he/she may receive an allocation from the Medi-Cal spouse's income to reach $3,260. Example:John receives a pension of $2,500 per month. Mary receives a pension of $500 per month. University of South Carolina on Instagram: “Do you know a future ... 13/10/2020 · Do you know a future Gamecock thinking about #GoingGarnet? 🎉 ••• Tag them to make sure they apply by Oct. 15 and have a completed application file by Nov. 2 to get an answer from @uofscadmissions by mid-December. 👀 // #UofSC WAC 182-512-0960 SSI-related medical -- Allocating income ... The institutionalized spouse is receiving home and community-based waiver services under WAC 182-515-1505 or institutional hospice services under WAC 182-513-1240; and; The institutionalized spouse has gross income under the MNIL. The allocation in (c) of this subsection cannot exceed the one-person effective MNIL minus the institutionalized ...

PDF Spousal Impoverishment - North Dakota spousal impoverishment, the spouse receiving long-term care may have up to $3,000 in countable assets and the community spouse may keep up to half of the couples' countable assets based on federal limits. Also, under spousal impoverishment, the spouse receiving long-term care may be able to give excess income to the community spouse. Spousal Impoverishment | Medicaid A personal needs allowance of at least $30; If there is a community spouse and the spousal impoverishment rules discussed above apply, a community spouse's monthly income allowance (at least $2,002.50 but not exceeding $2,980 for 2016), as long as the income is actually made available to the community spouse; MEH 18.6 Spousal Impoverishment Income ... - Wisconsin.gov 1 Spousal Impoverishment Income Allocation Introduction. 18.6. · 2 Worksheet 7 Section A -- Community Spouse Income Allocation. 18.6. · 3 Worksheet 7 Section B -- ... Get Burial Authorization Letter - US Legal Forms Spousal Impoverishment Income Allocation Worksheet The Multiple Sleep Latency Test (MSLT) Is A Nap Study Get This Form Now! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. Keywords relevant to ...

MIT - Massachusetts Institute of Technology a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ...

MEH 18.6 Spousal Impoverishment Income ... - Wisconsin.gov 18.6.3 Worksheet 7 Section B -- Family Member Income Allowance. Enter $607.08 on Line 1 under the name of each dependent family member who lives with the ...

MEH 18.6 Spousal Impoverishment Income ... - Wisconsin.gov 18.6.1 Spousal Impoverishment Income Allocation Introduction. 18.6.2 Worksheet 7 Section A -- Community Spouse Income Allocation. 18.6.3 Worksheet 7 Section ...

PDF Spousal Impoverishment Income Provisions KEESM 8144 & 8244 If the couple's combined gross nonexempt income is more than $1822 per month, the institutionalized spouse can allocate a portion of his/her income to increase community spouse's monthly income to $1822. The monthly income standard can further be increased up to a maximum of $2739if there is an excess shelter expense.

Alabama Medicaid Eligibility: 2022 Income & Asset Limits This is a spousal impoverishment rule , and in 2022, the MMMNA in AL is $2,288.75 / month (effective 7/1/22 - 6/30/23). If a non-applicant spouse has monthly income under this amount, income can be transferred from the applicant spouse to the non-applicant spouse to bring their monthly income up to this level.

Worksheets for Determining Eligibility Under the Aged & Disabled ... These limits on how much income and resources can be allocated to spouses goes up every year based on cost of living increases. In 2021, the community spouse's Maximum Monthly Maintenance Needs Allowance (monthly income limit) is $3,260.00 and the community spouse's Maximum Resource Allowance (resource limit) is $130,380.00. 6

Spousal Impoverishment Law or Division of Assets - KDADS The Spousal Impoverishment Law, sometimes called Division of Assets, changes the Medicaid eligibility requirement for couples in situations in which only one spouse needs nursing home care. It allows the spouse remaining at home to protect a portion of income and resources. The spouse needing care can receive Medicaid sooner and without the ...

PDF STATE OF WISCONSIN Division of Hearings and Appeals The Personal Maintenance Allowance is an income deduction used primarily when calculating a cost share for a Group B waiver member. However, it is also used in the cost share calculation of a Group C waiver member when completing Section C of the Spousal Impoverishment Income Allocation Worksheet (18.6.4).

PDF Spousal Impoverishment Resource Provisions (Ltc/Hcbs) I-1660 I-1661 ... Community spouse's monthly income is $500 below the spousal maintenance needs. Before the community spouse would be allowed to allocate additional assets to income-producing assets, the institutionalized spouse would have to transfer as much of the $500 from their income as possible to the communtiy spouse.

MEH 18.6 Spousal Impoverishment Income ... - Wisconsin.gov 18.6.3 Worksheet 7 Section B -- Family Member Income Allowance. Enter $612.92 on Line 1 under the name of each dependent family member who lives with the ...

Get Spousal Impoverishment Income Allocation Worksheet - US Legal Forms Fill out Spousal Impoverishment Income Allocation Worksheet in several clicks by simply following the instructions listed below: Find the template you need from the library of legal forms. Select the Get form key to open the document and move to editing. Complete all of the necessary boxes (these are yellowish).

PDF RESOURCE ASSESSMENT Legal Authority: 1. - Tennessee the institutionalized spouse, a calculated amount of the couple's assets is allocated to the community spouse to be used for his own needs. The Medicaid rules that govern the special treatment of a community spouse's income and resource allocation are referred to as spousal impoverishment policy.

Spousal Impoverishment Income Allocation Worksheet | Wisconsin ... Spousal Impoverishment Income Allocation Worksheet . Assigned Number Title Version Date Publication Type Other Location Language ; F-01306: Spousal Impoverishment Income Allocation Worksheet : July 1, 2014: PDF . None: English : Last Revised: February 7, 2018. Follow us ...

MEH 18.6 Spousal Impoverishment Income ... - Wisconsin.gov 1 Spousal Impoverishment Income Allocation Introduction. 18.6. · 2 Worksheet 7 Section A -- Community Spouse Income Allocation. 18.6. · 3 Worksheet 7 Section B -- ...

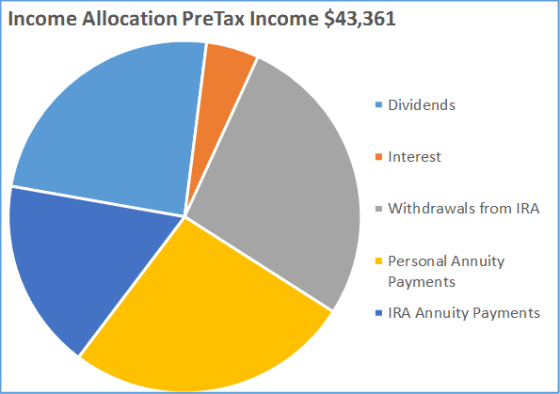

Spousal IRA Contribution and Deduction Limits - The Balance Just like with other traditional IRAs, a couple can deduct the full contribution to a traditional spousal IRA from federal income taxes in tax years 2021 and 2022 if neither is covered by a defined-contribution plan, such as a 401(k) or an IRA, or a defined-benefit plan, such as a pension plan that's provided by an employer.

18.6 Spousal Impoverishment Income Allocation - Wisconsin Use the Spousal Impoverishment Income Allocation Worksheet (See WKST 07) to determine how much of the institutionalized spouse's income: May be allocated to his/her spouse ( Section A ). Will be deducted, regardless of whether or not s/he actually allocated it to other dependent family members ( Section B ).

MEH 18.6 Spousal Impoverishment Income ... - Wisconsin.gov 18.6.1 Spousal Impoverishment Income Allocation Introduction. 18.6.2 Worksheet 7 Section A -- Community Spouse Income Allocation. 18.6.3 Worksheet 7 Section ...

PDF State of California Health and Human Services Agency Department of ... updated budget steps worksheet for completing Spousal Impoverishment (SI) evaluations for those who request In-Home Support Services (IHSS), Home and Community Based Services (HCBS) applicants and beneficiaries who are HCBS Spouses at annual redetermination or change in circumstance. The updated budget steps worksheet is attached to this letter.

0 Response to "41 spousal impoverishment income allocation worksheet"

Post a Comment