38 va residual income worksheet

PDF LOAN ANALYSIS - Veterans Affairs section e - monthly income and deductions. 44. items. 31. 40. 41. 42. spouse borrower. 43. total. approve application reject application $ $ $ gross salary or earnings from employment. deductions € pension, compensation or other net income€ (specify) € total€ (sum of lines 37 and 38) net take-home pay va calculation worksheet KS2 Assessments and Scaled Scores - For Schools Education Services. 10 Pics about KS2 Assessments and Scaled Scores - For Schools Education Services : Va Residual Income Calculation Worksheet - Worksheet List, 29 Va Loan Comparison Worksheet - Worksheet Resource Plans and also Va Residual Income Calculation Worksheet - Worksheet List.

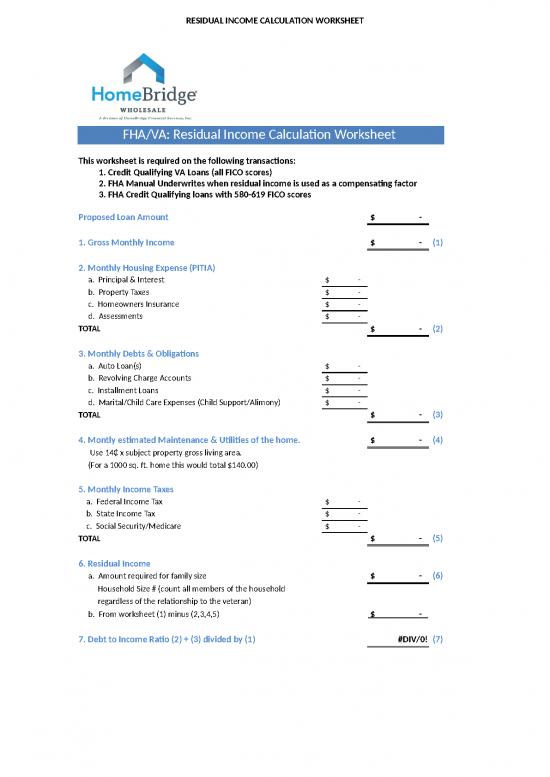

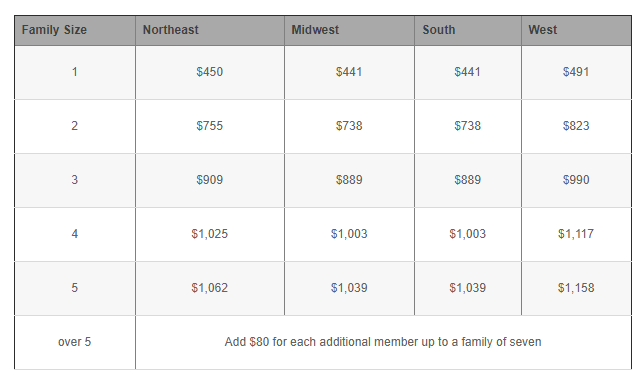

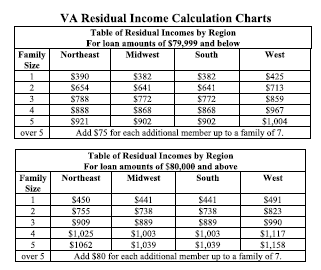

VA Residual Income Charts and Loan Requirements for 2022 VA Residual Income Needed Chart for Loan Amounts of $80,000 and Above For families over 5, add $80 for each additional family member up to seven. How to Calculate Your Residual Income The first step to calculate your residual income is to sum up your total gross monthly income. Remember to include your co-borrower's income if you plan to have one.

Va residual income worksheet

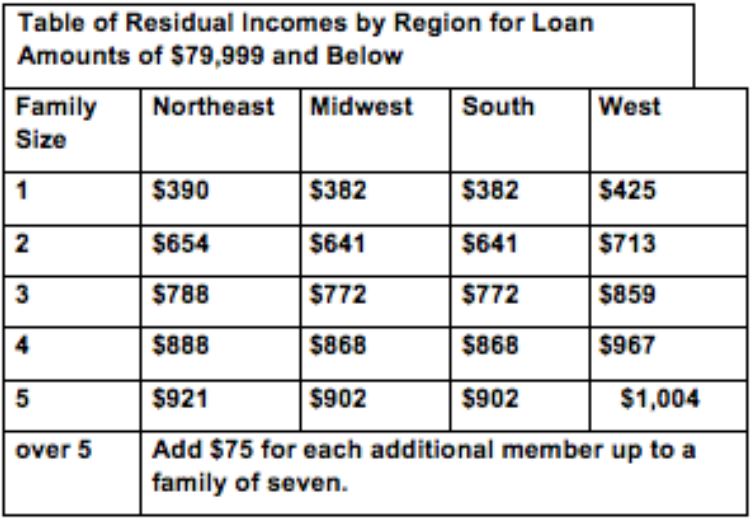

PDF Va Underwriting Checklist VA UNDERWRITING CHECKLIST _____ VA Disclosures ___ VA 26-1880 Request for Certificate of Eligibility ___ VA 26-261a Certificate of Veteran Status ___ VA 26-8937 Verification of VA Benefits ___ VA 26-1802a Application Addendum ___ VA 26-0551 Debt Questionnaire ___ VA 26-0503 Federal Collection Policy ___ VA 26-0592 Counseling Checklist PDF Loan TypeCBC CBC - Chenoa Fund Residual Income Worksheet 1 of 3 01/09/2019 A. LOAN DATA 1. Loan Number 2. Borrower Name 3. Total Loan Amount 4. Total Exceptions (Total Household Size) B. INCOME Borrower Co-Borrower 5. Taxable Gross Monthly Income 6. Federal Deduction 7. State Deduction 8. Social Security Deduction 9. Medicare Deduction 10. Other Deductions 11. VA Residual Income Chart And Requirements | Quicken Loans The chart also illustrates the income conditions that the VA requires, including residual income requirements for loans below $80,000. Table of Residual Income by Region for Loan Amounts of $79,999 and Below Over 5 Add $75 for each addional member up to a family of seven. If you have a loan amount higher than $80,000, things break down as follows.

Va residual income worksheet. How to Become a Paid Caregiver for a Family Member: 6 Steps to ... Caregivers can lose a great deal of income as they care for their loved ones, yet they often have to pay for caregiving expenses out of their own pockets. According to the AARP report, family caregivers spend about 20% of their income on costs associated with caregiving. Family caregivers need to know their options for financial assistance while taking care of their loved … How to Calculate Maintenance & Utilities on a VA Loan | Sapling To calculate monthly maintenance and utilities for a VA loan application, multiply the home's square footage by 14 cents. ... sometimes called DTI -- and the second is residual income. Residual income equals gross income less maintenance and utility expense and other monthly ... you can fill out a loan worksheet like this one from LoanTrainer ... PDF VA Home Loan Prequalification Worksheet - Learning Library VA Home Loan Prequalification Worksheet . Residual Incomes by Region For loan amounts of $79,999 and below Family Size Northeast Midwest South West 1 $390 $382 $382 $425 2 $654 ... adequate by two considerations: residual income and the debt-to-income ratio If a loan analysis VA Residual Income Calculator (2022 Data) - Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense.

PDF Income Debt Worksheet - First State Mortgage INCOME AND DEBT WORKSHEET 01/09/14 Posted 08/20/14 Page 1 of 6 Borrower Name: _____ Loan Number: _____ ... Residual Income Evaluation Attestation RE: Date of Evaluation The undersigned hereby affirms and attests that in connection with the mortgage loan for . Borrower name(s) securing the property located at . References - Nan McKay 16.10.2014 · 6/18/14, Section 8 Housing Choice Vouchers: Revised Implementation of the HUD–VA Supportive Housing Program Technical Correction ; 6/25/14, HUD Implementation of Fiscal Year 2014 Appropriations Provisions on Public Housing Agency Consortia, Biennial Inspections, Extremely Low-Income Definition, and Utility Allowances ; 2/17/15, Removal of … The United States Social Security Administration VA-21-4182 Application For Dependency HHS-22 Property Act Requesting Supplemental Officer SSA-23-U5 Delivery Receipt SSA-24 Application For Survivors Benefits Payable Under Title 2 SSA-25 Certificate Of Election For Reduced Spouse’s Benefits SSA-26-PC Magnetic Media Reply Postcard SSA-L26 Wage Report Transmittal SSA-27 Non-Receipt Of Electronic Funds … VA Residual Income Chart Shows How Much You Need to be VA Eligible VA residual income is more important than a debt ratio because it shows how much income is remaining for basic living expenses. Chapter 4: Credit Underwriting of the VA Handbook states, " Residual income is the amount of net income remaining (after deduction of debts and obligations and monthly shelter expenses) to cover family living ...

How to claim your senior property tax exemption Apr 15, 2020 · 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2, 2020 8 Ways To Get A Mortgage Approved (And Not Mess It Up) May 26, 2016 4 ways to keep your ... Calculate Your Debt to Income Ratio - Mortgage Calculator Calculate Your Debt to Income Ratio. Use this to figure your debt to income ratio. A back end debt to income ratio greater than or equal to 40% is generally viewed as an indicator you are a high risk borrower. For your convenience we list current Redmond mortgage rates to help homebuyers estimate their monthly payments & find local lenders. Getting A VA Loan Using Self-Employed Income - Veterans United Network VA Self-Employed Income Calculation. If your business made $100,000 last year, but you wrote off $50,000 in losses or expenses, lenders will only count the remaining $50,000 as effective income toward a mortgage. Needless to say, that can come as a shock to many prospective borrowers. PDF VA LOAN SUMMARY SHEET - Veterans Affairs 50. TOTAL MONTHLY GROSS INCOME (Item 32 + Item 38 from VA Form 26-6393) 52. RESIDUAL INCOME GUIDELINE. 53. DEBT - INCOME RATIO (If Income Ratio is over 41% and Residual Income is not 120% of guideline, statement of justification signed by underwriter's supervisor must be included on or with VA Form 26-6393) % (If "Yes," Complete Item 55) 55.

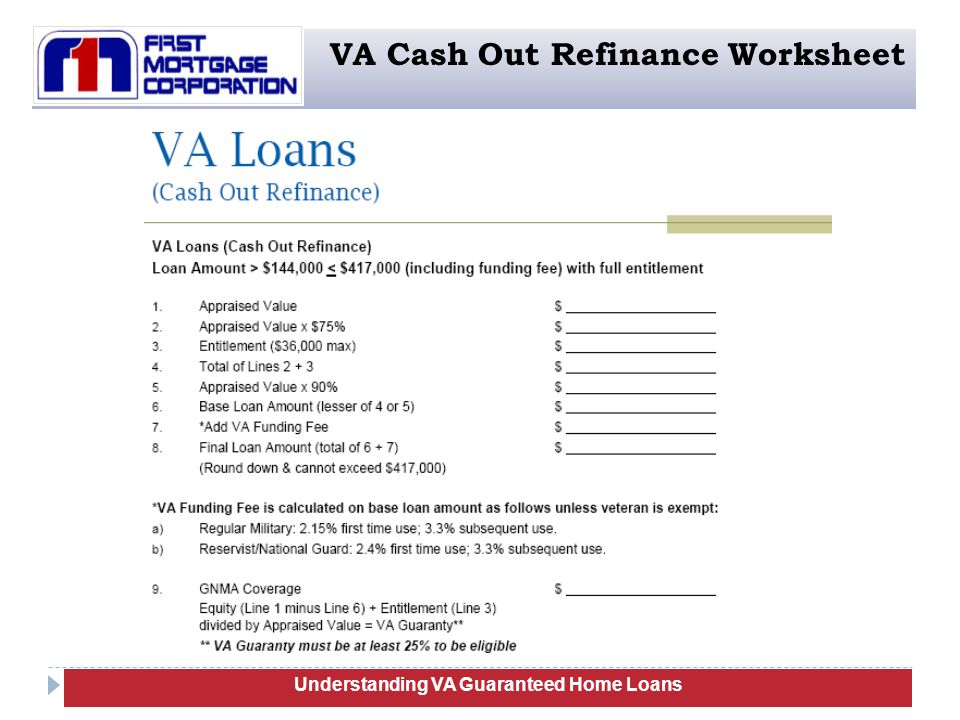

Chapter 3. The VA Loan and Guaranty Overview - Veterans Affairs − residual income (net effective income minus monthly shelter expense) in accordance with regional tables, and − acceptable ratio of total monthly debt payments to gross monthly income (A ratio in excess of 41% requires closer scrutiny and compensating factors.). chapter 4 IRRRLs (Streamline Refinancing Loans) Used to refinance an existing VA loan at a lower interest rate. • …

VA IRRRL Net Tangible Benefit Worksheet - kc.fcmpartners.com VA IRRRL Net Tangible Benefit Worksheet Revised 3.2022 All other VA requirements for guaranteeing an IRRRL are met, including the requirements related to exemption of income verification are satisfied. All VA loans are considered QM, but not all IRRRL loans have safe harbor. To have safe harbor, FCM must verify the VA

Process For Closing Costs, Down Payment, And Earnest Money Aug 31, 2022 · 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2, 2020 8 Ways To Get A Mortgage Approved (And Not Mess It Up) May 26, 2016 4 ways to keep your ...

XLS Veterans Benefits Administration Home Veterans Benefits Administration Home

Lenders Handbook - VA Pamphlet 26-7 - Web Automated Reference Material ... Table of Contents. Chapter 1 Lender Approval Guidelines. Chapter 2 Veteran's Eligibility and Entitlement. Chapter 3 The VA Loan Guaranty. Chapter 4 Credit Underwriting. Chapter 5 How to Process VA Loans and Submit them to VA. Chapter 6 Refinancing Loans. Chapter 7 Loans Requiring Special Underwriting, Guaranty, or Other Consideration.

VA Residual Income Calculator and Chart - Loans101.com Disclaimer Loans101 Interactive Media LLC (Loans101.com) is not a lender, banker or broker. Loans101.com does not offer mortgage loans directly or indirectly. Loans101.com is not a government agency. Loans101.com provides information about home loans and mortgages.

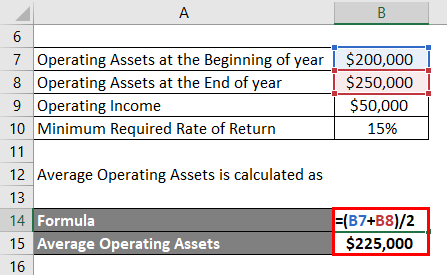

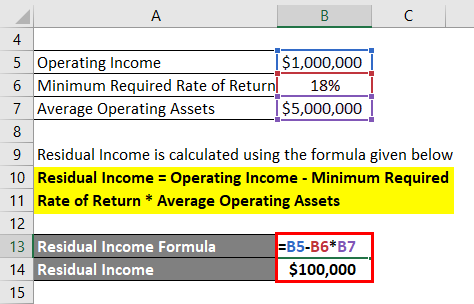

Residual Income Formula | Calculator (Examples With Excel ... - EDUCBA Minimum Required Income = Minimum Required Rate of Return * Average Operating Assets. Step 4: Next, determine the operating income of the company which is an income statement item. Step 5: Finally, the formula for residual income can be derived by deducting the minimum required income (step 3) from the operating income (step 4) as shown below.

VA Mortgage: Residual Income Guidelines For All 50 States 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia January 2, 2020 8 Ways To Get A Mortgage Approved (And Not Mess It Up) May 26, 2016 4 ways to keep your ...

Fha Income Residual Worksheet - A-perras CBC Residual Income Worksheet - chenoafund.org - CBCMA secured 90 day stay to Mortgagee Letter 2019-06 while the merits of its case are heard by the courts All case numbers issued before July 23, 2019 are still eligible for FHA insurance. ... . 44 IRRRL Worksheet VA Form 26-8923. N/A. 48 Residual Income Evaluation. Post navigation.

How To Calculate VA Residual Income | 2022 Charts How do I calculate VA residual income? To find your approximate residual income, add up your regular monthly living expenses and subtract the total — along with your debt payments — from your gross monthly income. The money leftover after paying living expenses and debt is your residual income, which is also known as your discretionary income.

VA Loan Residual Income Charts and Requirements - Veterans United Network Here's a look at the VA's residual income charts by loan amount and region. Scroll to the third chart to see which region your state is in. VA Residual Income Chart for Loan Amounts of $79,999 and Below For families over five, add $75 for each additional member up to a family of seven. » MORE: See if you qualify for a $0 down VA loan

How to Qualify for a VA Loan Using Rental Income - OVM Financial While qualifying for a VA loan with rental income is possible, the process can be confusing. Make sure you're working with a lender who has experience using rental income for VA loans. As an OVM customer, you get access to a dedicated loan officer who can help you navigate the process. Contact OVM Financial at 757-296-2148 for a free ...

Residual Income - Blueprint Residual Income Calculator. Name. Date: 10/03/2022. Loan Number: Subject Property State: AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR. Family Size:

VA Residual Income Guidelines - Military Benefits The VA might also refer to your residual income as your "balance available for family support." VA Residual Income Charts Here are the residual income charts for VA loans under $80,000 and VA loans over $80,000. We've further broken each chart down by family size and location. Check Official Requirements for a VA Loan

PDF VA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American Notes for VA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows.

Get Va Residual Income Calculator - US Legal Forms Now, creating a Va Residual Income Calculator takes at most 5 minutes. Our state online blanks and clear guidelines eliminate human-prone errors. Adhere to our simple steps to have your Va Residual Income Calculator prepared rapidly: Find the web sample from the library. Type all necessary information in the required fillable areas.

PDF Working with Ability-to-Repay (ATR/QM) and HOEPA Regulations of the debt to income ratio. • Small Creditor category of QMs - If you have less than two billion dollars in assets and originate 500 or fewer mortgages per year, loans you make and hold in portfolio are Qualified Mortgages as long as you have considered and verified a consumer's debt-to-income ratio (though no specific debt-to-income ratio ...

VA Residual Income Chart And Requirements | Quicken Loans The chart also illustrates the income conditions that the VA requires, including residual income requirements for loans below $80,000. Table of Residual Income by Region for Loan Amounts of $79,999 and Below Over 5 Add $75 for each addional member up to a family of seven. If you have a loan amount higher than $80,000, things break down as follows.

PDF Loan TypeCBC CBC - Chenoa Fund Residual Income Worksheet 1 of 3 01/09/2019 A. LOAN DATA 1. Loan Number 2. Borrower Name 3. Total Loan Amount 4. Total Exceptions (Total Household Size) B. INCOME Borrower Co-Borrower 5. Taxable Gross Monthly Income 6. Federal Deduction 7. State Deduction 8. Social Security Deduction 9. Medicare Deduction 10. Other Deductions 11.

PDF Va Underwriting Checklist VA UNDERWRITING CHECKLIST _____ VA Disclosures ___ VA 26-1880 Request for Certificate of Eligibility ___ VA 26-261a Certificate of Veteran Status ___ VA 26-8937 Verification of VA Benefits ___ VA 26-1802a Application Addendum ___ VA 26-0551 Debt Questionnaire ___ VA 26-0503 Federal Collection Policy ___ VA 26-0592 Counseling Checklist

0 Response to "38 va residual income worksheet"

Post a Comment