39 kentucky sales and use tax worksheet

Kentucky Sales Tax Guide | Chamber of Commerce To calculate Kentucky's sales and use tax, multiply the purchase price by 6 percent (0.06). For example, an item that costs $100 will have a tax of $6, for a total of $106 (100 times .06 equals 6). If a business sells several items in one transaction, it can figure the tax on each item individually or on the total of the items. How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Step 3. Calculate your tax liability. Once you have calculated your gross receipts and listed your deductions, subtract your deductions from your gross receipts. For example, if you have $1,200 in gross receipts and $200 in deductions, you owe 6 percent of $1,000 in sales taxes. Six percent of $1,000 is $60.

Kentucky Sales And Use Tax Form - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax Form. Some of the worksheets displayed are 51a205 4 14 kentucky sales and department of revenue use, 2018 kentucky individual income tax forms, Sales tax return work instructions, Sales and use tax audit manual, 01 117 texas sales and use tax return, Efo026 idaho business income tax payments work, Application for fueltax ...

Kentucky sales and use tax worksheet

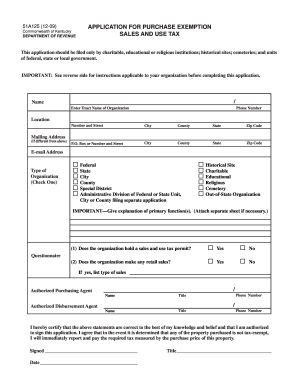

Kentucky Sales And Use Tax Form Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Form. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, 2018 kentucky individual income tax forms, Sales tax return work instructions, Sales and use tax audit manual, 01 117 texas sales and use tax return, Efo026 idaho business income tax payments work, Application for fueltax refund for use of power ... Retail Packet (11/17) - Department of Revenue Form 51A205 is mailed with every sales and use tax return and is also available at . kentucky sales and use tax worksheet 51a102: Fill out & sign online ... Add the kentucky sales and use tax worksheet 51a102 for redacting. Click on the New Document button above, then drag and drop the file to the upload area, import it from the cloud, or using a link. Alter your template. Make any adjustments needed: insert text and photos to your kentucky sales and use tax worksheet 51a102, highlight details that ...

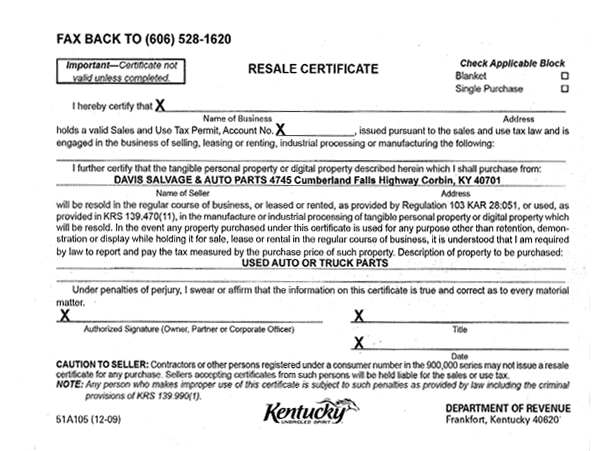

Kentucky sales and use tax worksheet. kentucky sales and use tax worksheet KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars Kentucky Sales Tax Exemptions | Agile Consulting Group - sales and use tax The state of Kentucky levies a 6% state sales tax on the retail sale, lease or rental of most goods and some services. There are no local sales taxes in the state of Kentucky, and as a result, there are no direct Kentucky sales tax exemptions. Use tax is also collected on the consumption, use or storage of goods in Kentucky if sales tax was not ... Sales & Use Tax - Department of Revenue - Kentucky.gov The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes. Sales Tax Facts - Department of Revenue - Kentucky Sales Tax Facts Archive Download; Sales Tax Facts 2022 - Sep.pdf: Sales Tax Facts 2022 - Jun.pdf: Sales Tax Facts 2021 - Dec.pdf: ... The Kentucky Department of Revenue conducts work under the authority of the Finance and Administration Cabinet. Contact; Site Map; Software Developer; Policies; Security;

Form 51A102 "Sales and Use Tax Worksheet" - Kentucky - TemplateRoller Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, United States Tax Forms, Kentucky Legal Forms, Tax And United States Legal Forms. Kentucky Sales And Use Tax - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. Forms - Department of Revenue - Kentucky.gov If you are still unable to access the form you need, please Contact Us for assistance. Main Content. Filter Results. Search within. Forms. Tax Type. Sales and Excise Taxes - TAXANSWERS - Kentucky KRS 138.477 imposes a new excise tax on electric vehicle power distributed by an electric power dealer to charge electric vehicles in the state at the rate of three cents ($0.03) per kilowatt hour. There are also annual electric vehicle owner registration fees established in KRS 138.475. The effective date for the electric vehicle power tax and ...

Consumer Use Tax - Department of Revenue - Kentucky.gov The table, along with the Use Tax Calculation Worksheet, is also located in Form 740, line 27, and Form 740 Instructions , page 12. The current year versions of these forms may be found on DOR's Individual Income Tax page. Pay Consumer Use Tax ... The retailer is not required to and does not collect Kentucky sales or use tax; Kentucky Sales And Use Tax Worksheets - Lesson Worksheets Displaying all worksheets related to - Kentucky Sales And Use Tax. Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. PDF Sales and Use Tax K - Kentucky entucky's first entry into the sales tax field occurred in 1934 when the General Assembly enacted a tax of 3 percent on general retail gross receipts. The tax was subsequently re-pealed by the 1936 General Assembly. Kentucky again enacted a sales and use tax effective on July 1, 1960. The sales tax is imposed upon all retailers for the privilege KENTUCKY SALES AND USE TAX INSTRUCTIONS This includes zero. KENTUCKY SALES AND. USE TAX INSTRUCTIONS tax due returns that are filed late after a jeopardy or estimated assessment has been issued.

Kentucky Sales And Use Tax Wooksheet - Printable Worksheets Showing top 3 worksheets in the category - Kentucky Sales And Use Tax Wooksheet. Some of the worksheets displayed are Eftps direct payment work, Deductions form 1040 itemized, Tax computation work. Once you find your worksheet, click on pop-out icon or print icon to worksheet to print or download. Worksheet will open in a new window.

Kentucky Sales & Use Tax Guide - Avalara - Taxrates Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. Kentucky first adopted a general state sales tax in 1960, and since that time, the rate has risen to 6 percent. In many states, localities are able to impose local sales taxes on top of the state sales tax. However, as of June 2019, there are ...

PDF Kentucky Sales and Use Tax Instructions period, please contact the Division of Sales and Use Tax via telephone or e-mail for further instructions. When using the Other Codes 170, 180 or 190, be sure to describe the type of deduction(s) and amount(s) on the worksheet for your own records and in the description box on the reverse side of the return for Department of Revenue verification.

Kentucky Saes And Use Tax Worksheets - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Saes And Use Tax. Some of the worksheets displayed are Retail packet, Matthew bevin office of sales and excise, Building contractors guide to sales and use taxes, 2018 tax organizer, Client tax organizer, Small business work, The salvation army valuation guide for donated items, Manners for the real world.

Kentucky Sales Tax Facts - Department of Revenue For tax periods beginning on or after July 1, 2004, the freight and delivery deduction on line 13 of the sales and use tax worksheet and deduction code 130 on ...

Kentucky Sales and Use Tax - Motor Vehicle Dealers Supplementary Schedule Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181, Station 67 Frankfort, KY 40602-0181

Ky Sales Use Tax Worksheets - Printable Worksheets Showing top 8 worksheets in the category - Ky Sales Use Tax. Some of the worksheets displayed are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Kentucky tax alert, Nebraska and local sales and use tax return form, Sales and use tax audit manual, Work expiration date matrix for sales tax exemption, Department of charitable gaming guide to raffles ...

Kentucky Sales And Use Tax Form - Lesson Worksheets Displaying all worksheets related to - Kentucky Sales And Use Tax Form. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, 2018 kentucky individual income tax forms, Sales tax return work instructions, Sales and use tax audit manual, 01 117 texas sales and use tax return, Efo026 idaho business income tax payments work, Application for fueltax refund for use of power ...

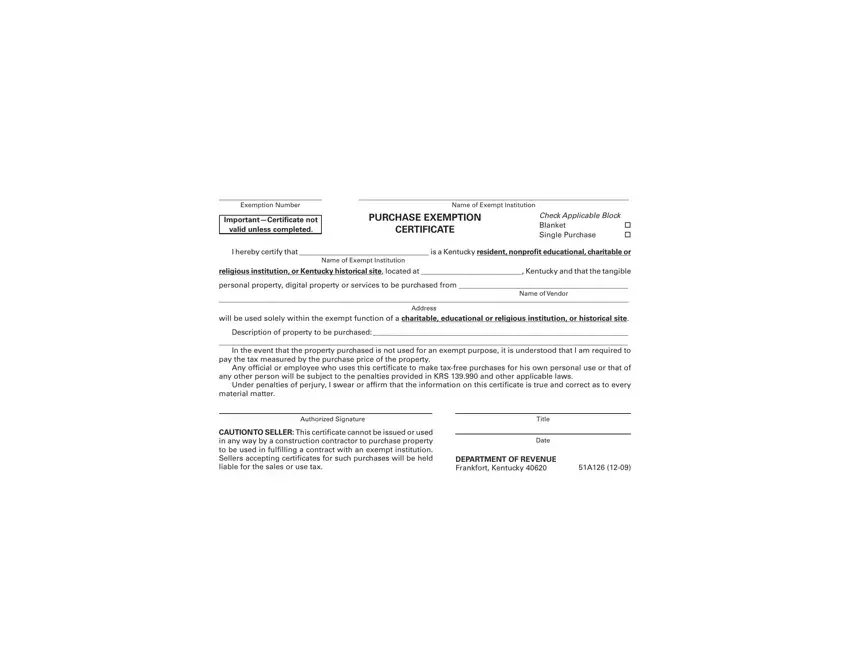

KENTUCKY SALES AND USE TAX WORKSHEET ... the appropriate Kentucky exemption certificates are required to be kept on file unless otherwise indicated. -----. KENTUCKY SALES AND USE TAX WORKSHEET.

Ky Sales Use Tax Worksheets - Lesson Worksheets Displaying all worksheets related to - Ky Sales Use Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Kentucky tax alert, Nebraska and local sales and use tax return form, Sales and use tax audit manual, Work expiration date matrix for sales tax exemption, Department of charitable gaming guide to raffles, Llc s corp small business ...

FAQ Sales and Use Tax - Department of Revenue In lieu of issuing the Kentucky Resale. Certificate (Form 51A105) or a Streamlined Sales Tax Certificate of Exemption (Form. 51A260), an out-of-state entity may ...

Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are Retail packet, Kentucky general information use tax, Kentucky general information use tax contributions, Tax alert, 2020 kentucky individual income tax forms, Kentucky tax alert, Kentucky tax alert, Kentucky tax alert. *Click on Open button to open and print to worksheet.

FAQ Sales and Use Tax - Department of Revenue In lieu of issuing the Kentucky Resale. Certificate (Form 51A105) or a Streamlined Sales Tax Certificate of Exemption (Form. 51A260), an out-of-state entity may ...

Kentucky - Sales Tax Handbook 2022 KY Sales Tax Calculator. Printable PDF Kentucky Sales Tax Datasheet. Kentucky has a statewide sales tax rate of 6%, which has been in place since 1960. Municipal governments in Kentucky are also allowed to collect a local-option sales tax that ranges from 0% to 2.75% across the state, with an average local tax of 0.008% (for a total of 6.008% ...

Sales Tax Worksheets - Math Worksheets 4 Kids Sales Tax Worksheets. There's nothing too taxing about our printable sales tax worksheets! Teeming with exercises like finding the sales tax, calculating the original price, and solving sales tax word problems, our resources have stupendous practice in store for students in grade 6, grade 7, and grade 8. The pdf tools also let them get used to ...

Kentucky Imposes Sales and Use Tax on 35 New Services - Dean Dorton Add services not currently subject to tax. Effective January 1, 2023, 35 more services will be to subject to sales and use tax. Here's the list: Photography and photo finishing services. Marketing services. Telemarketing services. Public opinion and research polling services. Lobbying services.

kentucky sales and use tax worksheet 51a102: Fill out & sign online ... Add the kentucky sales and use tax worksheet 51a102 for redacting. Click on the New Document button above, then drag and drop the file to the upload area, import it from the cloud, or using a link. Alter your template. Make any adjustments needed: insert text and photos to your kentucky sales and use tax worksheet 51a102, highlight details that ...

Retail Packet (11/17) - Department of Revenue Form 51A205 is mailed with every sales and use tax return and is also available at .

Kentucky Sales And Use Tax Form Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Form. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, 2018 kentucky individual income tax forms, Sales tax return work instructions, Sales and use tax audit manual, 01 117 texas sales and use tax return, Efo026 idaho business income tax payments work, Application for fueltax refund for use of power ...

0 Response to "39 kentucky sales and use tax worksheet"

Post a Comment