41 1120s other deductions worksheet

› privacy-disclosure › privacy-impactPrivacy Impact Assessments - PIA | Internal Revenue Service Jan 24, 2022 · POPULAR FORMS & INSTRUCTIONS; Form 1040; Individual Tax Return Form 1040 Instructions; Instructions for Form 1040 Form W-9; Request for Taxpayer Identification Number (TIN) and Certification turbotax.intuit.com › personal-taxes › cd-downloadTurboTax® Basic CD/Download 2022-2023 Tax Software Oct 20, 2022 · TurboTax Basic CD/Download is tax software for straight forward tax returns. It's the easy way to prepare and e-file your taxes. Easily e-file taxes or print your IRS tax forms with step-by-step guidance that coaches you along the entire way, so you don't miss a thing

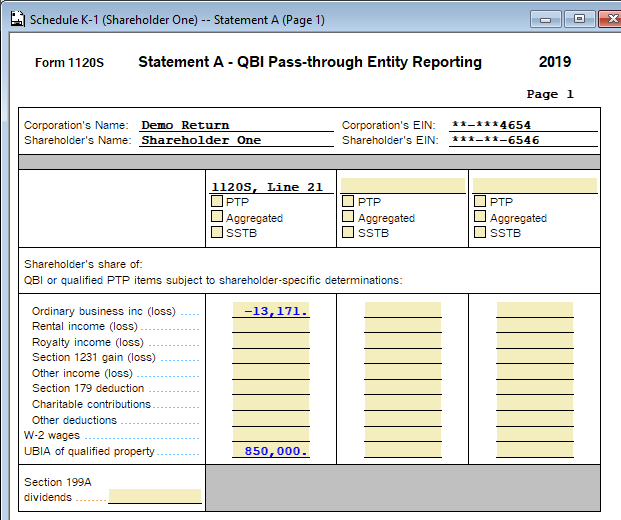

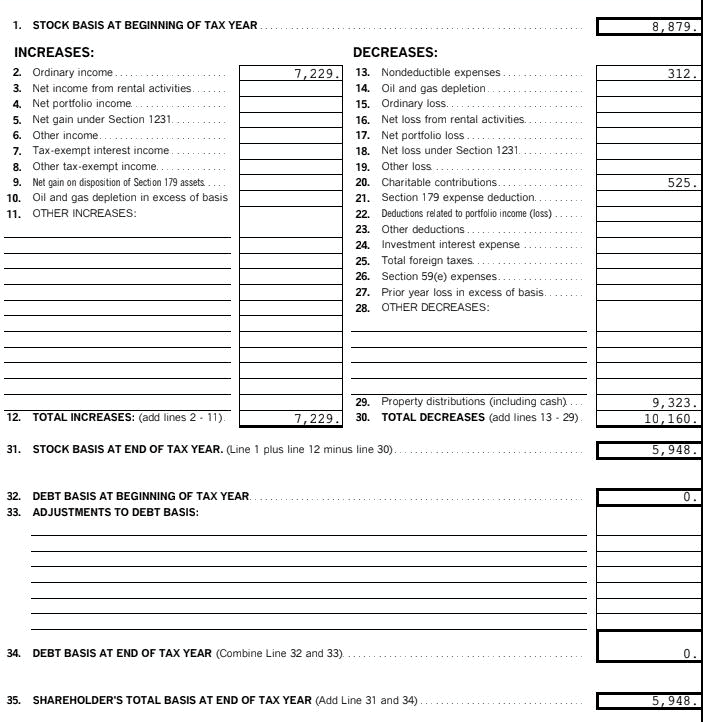

ttlc.intuit.com › community › tax-credits-deductionsSolved: K1 Box 17 V * STMT - Intuit Feb 13, 2020 · When entering the multiple box 17v entries, TT generates the Statement A section of the K-1. This requires re-entry of your business income (loss), section 179 deductions, etc. In other words, you have to re-enter some or all of the entries you previously entered for the K-1 into the section 199A QBI worksheet.

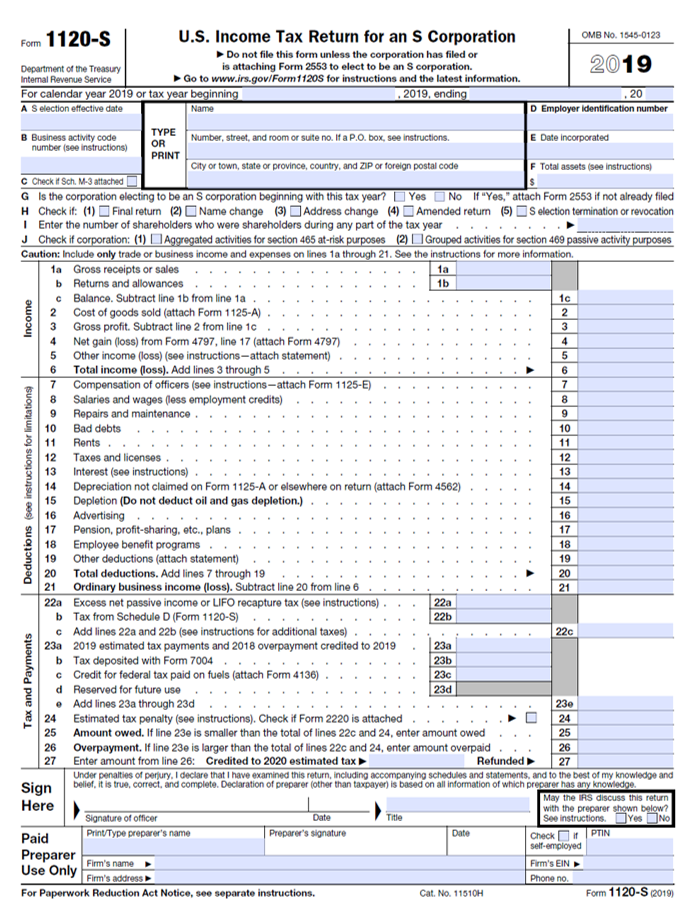

1120s other deductions worksheet

› pub › irs-pdf2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) Box 10. Other Income \(Loss\) Box 11. Section 179 Deduction. Box 12. Other Deductions. Box 13. Credits. Box 14. International Transactions. Box 15. AMT Items. Box 16. Items Affecting Shareholder Basis. Box 17. Other Information. Box 18. More Than One Activity for At-Risk Purposes. Box 19. More Than One Activity for Passive Activity ... › instructions › i1120sskShareholder's Instructions for Schedule K-1 - IRS tax forms Shareholder's Share of Current Year Income, Deductions, Credits, and Other Items. The amounts shown in boxes 1 through 17 reflect your share of income, loss, deductions, credits, and other items, from corporate business or rental activities without reference to limitations on losses, credits, or other items that may have to be adjusted because of: › publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax Other estimated income (Step 4a). Deductions (other than the standard deduction)(Step 4b) you expect to claim. Use the Step 4(b)—Deductions Worksheet in the instructions for Form W-4P to help you determine the amount to enter on line 4b. Any additional amounts you want to withhold from each payment (Step 4c).

1120s other deductions worksheet. ttlc.intuit.com › community › business-taxesShareholder's Basis Computation Worksheet - Intuit Jan 25, 2022 · I have read some other threads on Shareholder Basis and have a follow up question. I understand that TurboTax does not have a way to file the basis worksheet electronically (ridiculous by the way). So according to form 7203 under "who must file" you only need to file this worksheet under certain circumstances. › publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax Other estimated income (Step 4a). Deductions (other than the standard deduction)(Step 4b) you expect to claim. Use the Step 4(b)—Deductions Worksheet in the instructions for Form W-4P to help you determine the amount to enter on line 4b. Any additional amounts you want to withhold from each payment (Step 4c). › instructions › i1120sskShareholder's Instructions for Schedule K-1 - IRS tax forms Shareholder's Share of Current Year Income, Deductions, Credits, and Other Items. The amounts shown in boxes 1 through 17 reflect your share of income, loss, deductions, credits, and other items, from corporate business or rental activities without reference to limitations on losses, credits, or other items that may have to be adjusted because of: › pub › irs-pdf2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) Box 10. Other Income \(Loss\) Box 11. Section 179 Deduction. Box 12. Other Deductions. Box 13. Credits. Box 14. International Transactions. Box 15. AMT Items. Box 16. Items Affecting Shareholder Basis. Box 17. Other Information. Box 18. More Than One Activity for At-Risk Purposes. Box 19. More Than One Activity for Passive Activity ...

0 Response to "41 1120s other deductions worksheet"

Post a Comment