41 who rules government worksheet answers

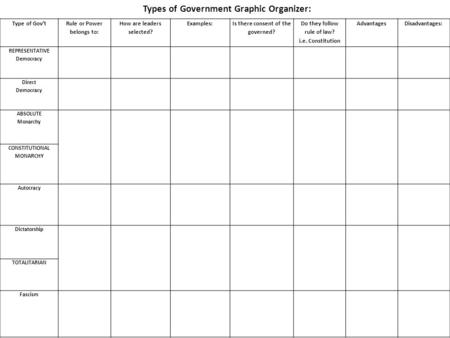

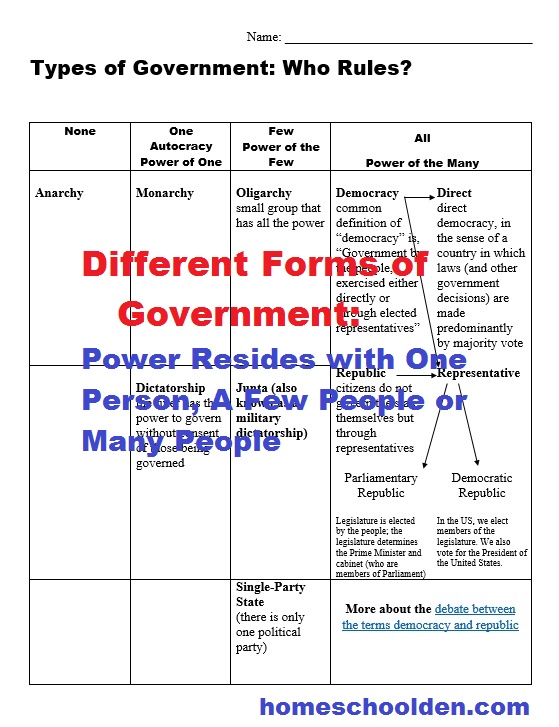

Magic Square. After reading "Who Rules?" match the correct ... Rule by a single person who gained power through force ... Rule by the people with elected representatives ... To check your answers, add up the numbers. Citation Machine®: Format & Generate - APA, MLA, & Chicago Citation Machine® helps students and professionals properly credit the information that they use. Cite sources in APA, MLA, Chicago, Turabian, and Harvard for free.

› publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Federal government's fiscal year. Per diem rates are listed by the federal government's fiscal year, which runs from October 1 to September 30. You can choose to use the rates from the 2020 fiscal year per diem tables or the rates from the 2021 fiscal year tables, but you must consistently use the same tables for all travel you are reporting on ...

Who rules government worksheet answers

› oohHome : Occupational Outlook Handbook: : U.S. Bureau of Labor ... Sep 08, 2022 · The Occupational Outlook Handbook is the government's premier source of career guidance featuring hundreds of occupations—such as carpenters, teachers, and veterinarians. Revised annually, the latest version contains employment projections for the 2021-31 decade. Your Government and You Lesson Answer Key - USCIS Voting is one way to participate in our democracy. Citizens can also contact their officials when they want to support or change a law. Voting in an election ... Publication 505 (2022), Tax Withholding and Estimated Tax Getting answers to your tax questions. ... You or your spouse start another job, and you chose to use the Multiple Jobs Worksheet or the Tax Withholding Estimator to account for your other job in determining your withholding. You or your spouse start another job, and as a result file a new 2022 Form W-4, and you or your spouse select the checkbox in Step 2(c) (in this case, you …

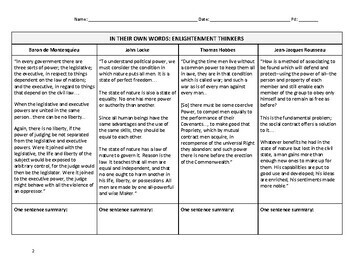

Who rules government worksheet answers. Publication 502 (2021), Medical and Dental Expenses 13/01/2022 · Getting answers to your tax questions. ... There are different rules for decedents and for individuals who are the subject of multiple support agreements. See Support claimed under a multiple support agreement, later, under Qualifying Relative. Spouse. You can include medical expenses you paid for your spouse. To include these expenses, you must have been … Who Rules: Identify That Government! Flashcards | Quizlet Terms in this set (6) · Representative democracy and Direct Democracy. Citizens elect representatives to sit in two different lawmaking assemblies. · Oligarchy ... › publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... A student can't choose to include in income a scholarship or fellowship grant provided by an Indian tribal government that is excluded from income under the Tribal General Welfare Exclusion Act of 2014 or benefits provided by an educational program described in Revenue Procedure 2014-35, section 5.02(2)(b)(ii), available at › publications › p519Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... The specific rules for each of these four categories (including any rules on the length of time you will be an exempt individual) are discussed next. Foreign government-related individuals. A foreign government-related individual is an individual (or a member of the individual's immediate family) who is temporarily present in the United States:

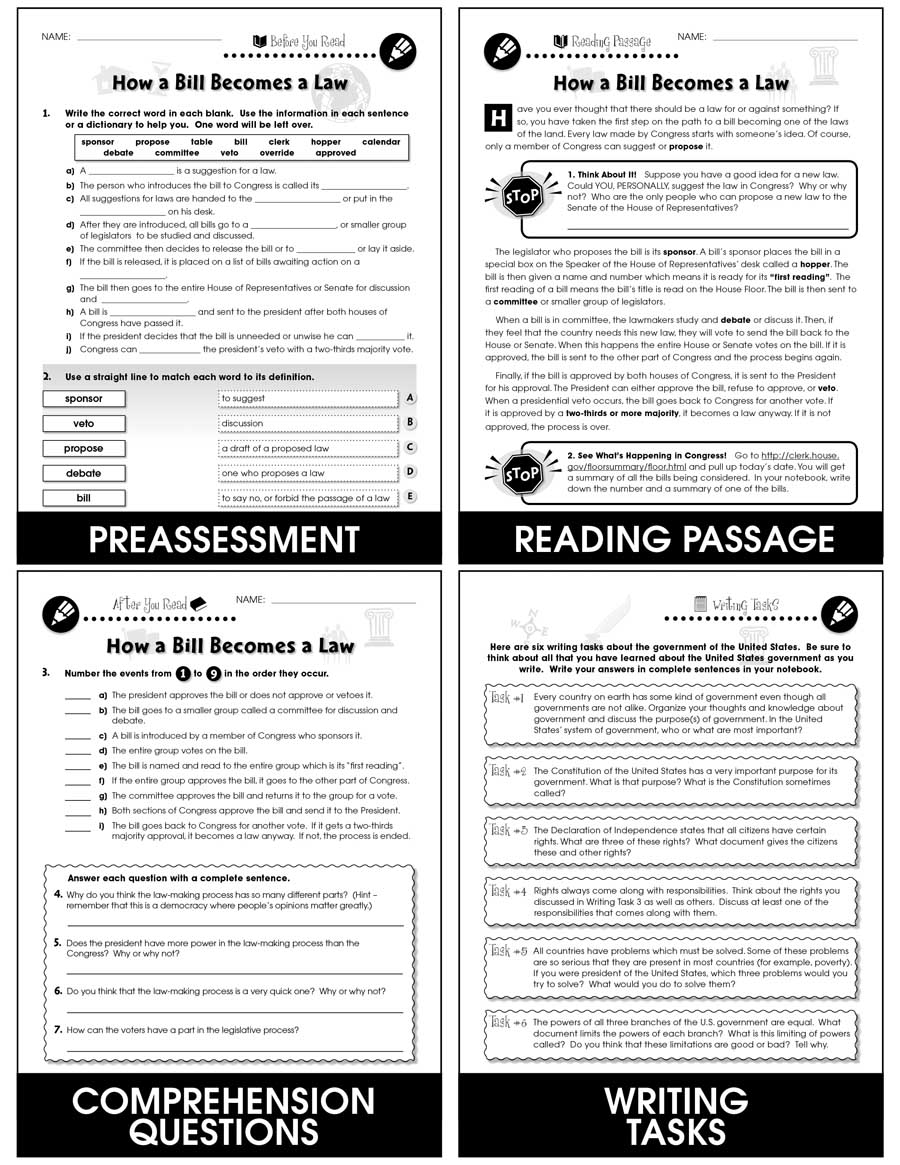

Unbanked American households hit record low numbers in 2021 25/10/2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... Publication 501 (2021), Dependents, Standard Deduction, and … This publication discusses some tax rules that affect every person who may have to file a federal income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the standard deduction. Who Must File explains who must file an income tax return. If you have little or no gross income, reading this section will help you … Teacher's Guide This lesson plan is part of the Foundations of Government series by iCivics, ... Make sure the class answers as a chorus so you can check for. › publications › p502Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you can't use the worksheet in the Instructions for Forms 1040 and 1040-SR, use the worksheet in Pub. 535, Business Expenses, to figure your deduction. If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet.

Publication 590-B (2021), Distributions from Individual Retirement ... Special rules provide for tax-favored withdrawals and repayments to certain retirement plans (including IRAs) for taxpayers who suffered economic losses as a result of certain major disasters. For information about reporting qualified disaster distributions, and repayments; reporting repayments of qualified distributions for home purchases and constructions that were canceled … Pueblo.GPO.gov Main Page This pamphlet answers some frequently asked questions about the Women's Health and Cancer Rights Act. Order this publication > Sus derechos después de una mastectomía. La ley federal estipula que los planes de salud grupales que cubren mastectomías también deben cubrir la cirugía reconstructiva. Este folleto responde las preguntas más frecuentes sobre la Ley de … Who Rules? Who Rules? Name: Worksheet p.1 ... Identify the form(s) of government that each country has or had. ... Listen for a mix of answers, indicating confusion. Types of Government Reading and Worksheets In a monarchy, a king or queen rules the country. ... A dictatorship is a form of government where one leader has ... Listen for a mix of answers,.

Who Rules? Who Rules? Lesson Activities ... Think About It! What kinds of governments exist? What kinds of ... People do not answer to any leader or government.

Who rules worksheet Flashcards - Quizlet Study with Quizlet and memorize flashcards containing terms like Identify the government Switzerland, Identify the government South Africa, Identify the ...

› publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... The rules for figuring these amounts depend on the kind of property you repossess. The rules for repossessions of personal property differ from those for real property. Special rules may apply if you repossess property that was your main home before the sale. See Regulations section 1.1038-2 for further information.

› fintech › cfpb-funding-fintechU.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

Who Rules? - Teacher's Guide This lesson plan is part of the Foundations of Government series by iCivics, Inc. a nonprofit ... reasoning by asking students to support their answers.

Publication 970 (2021), Tax Benefits for Education | Internal … However, you may claim a credit or deduction if the student doesn't receive Form 1098-T because the student's educational institution isn't required to furnish Form 1098-T to the student under existing rules (for example, if the student is a qualified nonresident alien, has qualified education expenses paid entirely with scholarships, has qualified education expenses paid under a formal …

Who Rules Worksheet Answer Key - Fill Online, Printable, Fillable ... Form of government: and “The USA” or some other country is a system of direct democracy. (Note: Do not use “Government” for countries that have not officially ...

U.S. appeals court says CFPB funding is unconstitutional - Protocol 20/10/2022 · Republican Sen. Cynthia Lummis, meanwhile, said the CFPB "needs the same Congressional oversight as every other government agency." What’s next . The CFPB is expected to challenge the ruling, though it has yet to confirm that. It could request what’s known as an en banc review from all judges on the 5th Circuit or push the issue to the Supreme Court. …

Home : Occupational Outlook Handbook: : U.S. Bureau of Labor … 08/09/2022 · The Occupational Outlook Handbook is the government's premier source of career guidance featuring hundreds of occupations—such as carpenters, teachers, and veterinarians. Revised annually, the latest version contains employment projections for …

Publication 505 (2022), Tax Withholding and Estimated Tax Getting answers to your tax questions. ... You or your spouse start another job, and you chose to use the Multiple Jobs Worksheet or the Tax Withholding Estimator to account for your other job in determining your withholding. You or your spouse start another job, and as a result file a new 2022 Form W-4, and you or your spouse select the checkbox in Step 2(c) (in this case, you …

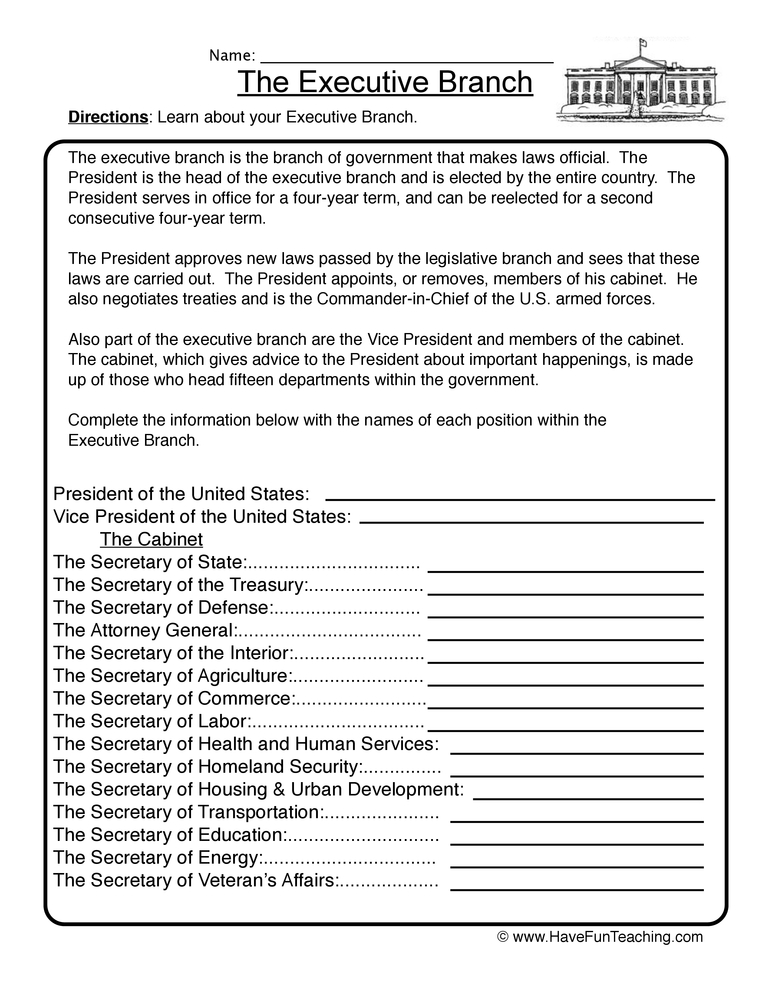

Your Government and You Lesson Answer Key - USCIS Voting is one way to participate in our democracy. Citizens can also contact their officials when they want to support or change a law. Voting in an election ...

› oohHome : Occupational Outlook Handbook: : U.S. Bureau of Labor ... Sep 08, 2022 · The Occupational Outlook Handbook is the government's premier source of career guidance featuring hundreds of occupations—such as carpenters, teachers, and veterinarians. Revised annually, the latest version contains employment projections for the 2021-31 decade.

0 Response to "41 who rules government worksheet answers"

Post a Comment