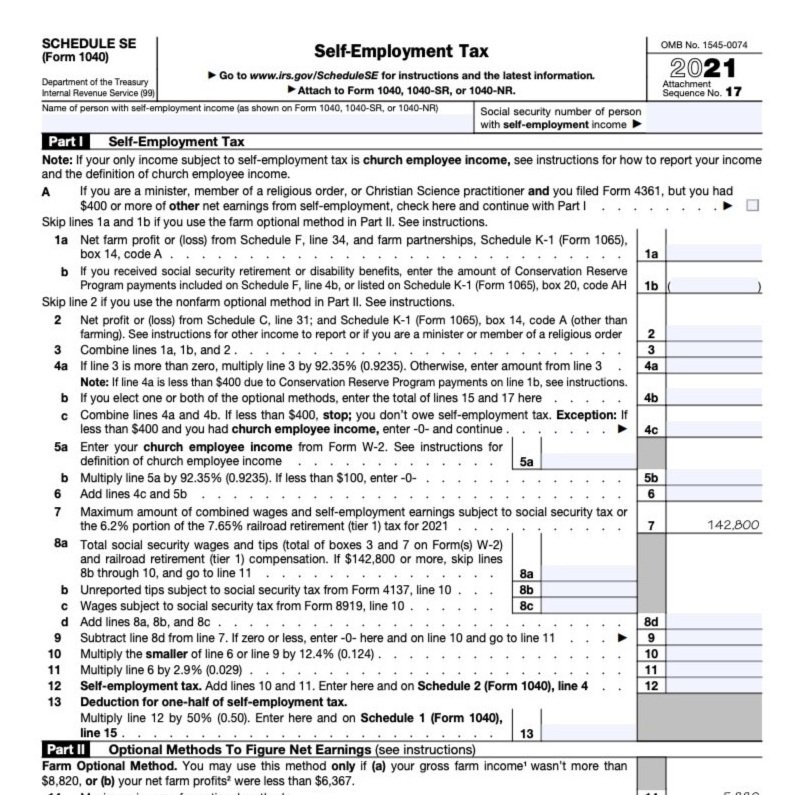

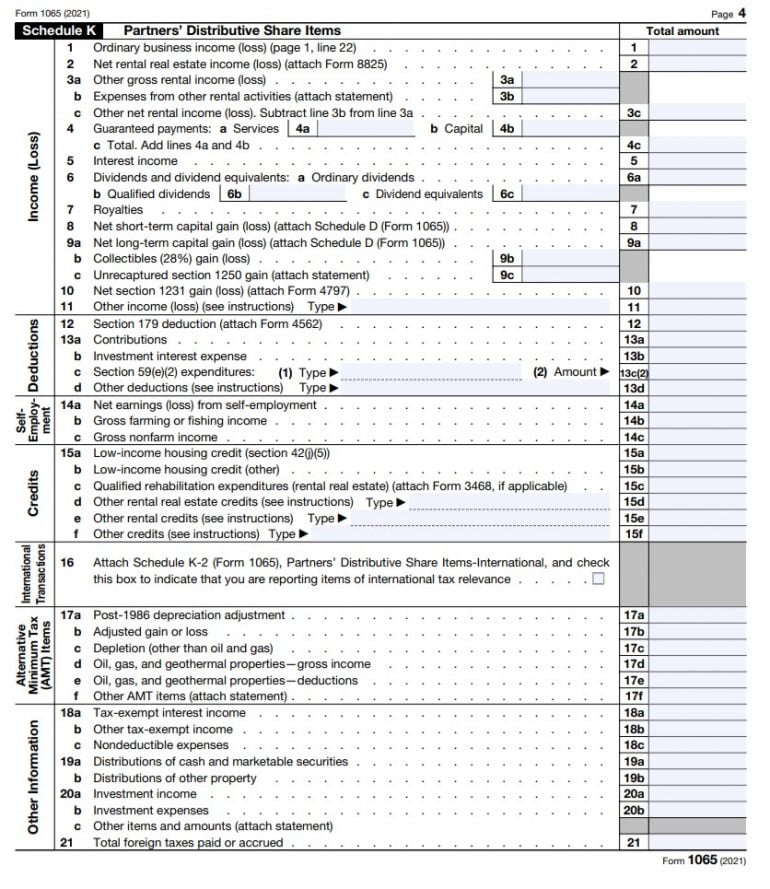

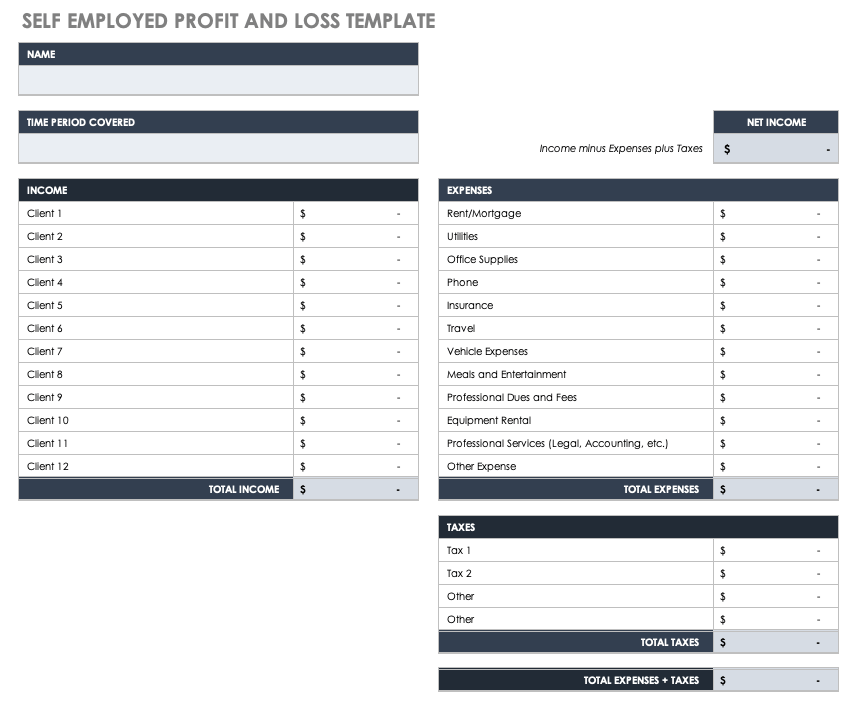

44 worksheet for figuring net earnings loss from self employment

Publication 587 (2021), Business Use of Your Home If you are claiming an increased standard deduction instead of itemizing your deductions, only use a net qualified disaster loss on line 15 of the worksheet version of Form 4684 for this Step 2. See the instructions for line 33, later, for the business use of the home casualty losses that you must include in Section B of the separate Form 4684 ... Publication 970 (2021), Tax Benefits for Education | Internal ... When figuring an education credit or tuition and fees deduction, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses. In most cases, the student should receive Form 1098-T from the eligible educational institution by January 31, 2022.

Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions.

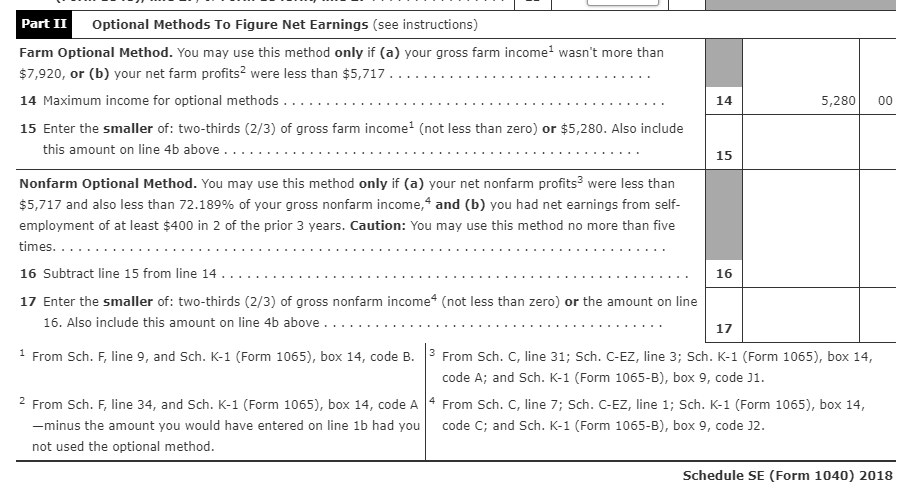

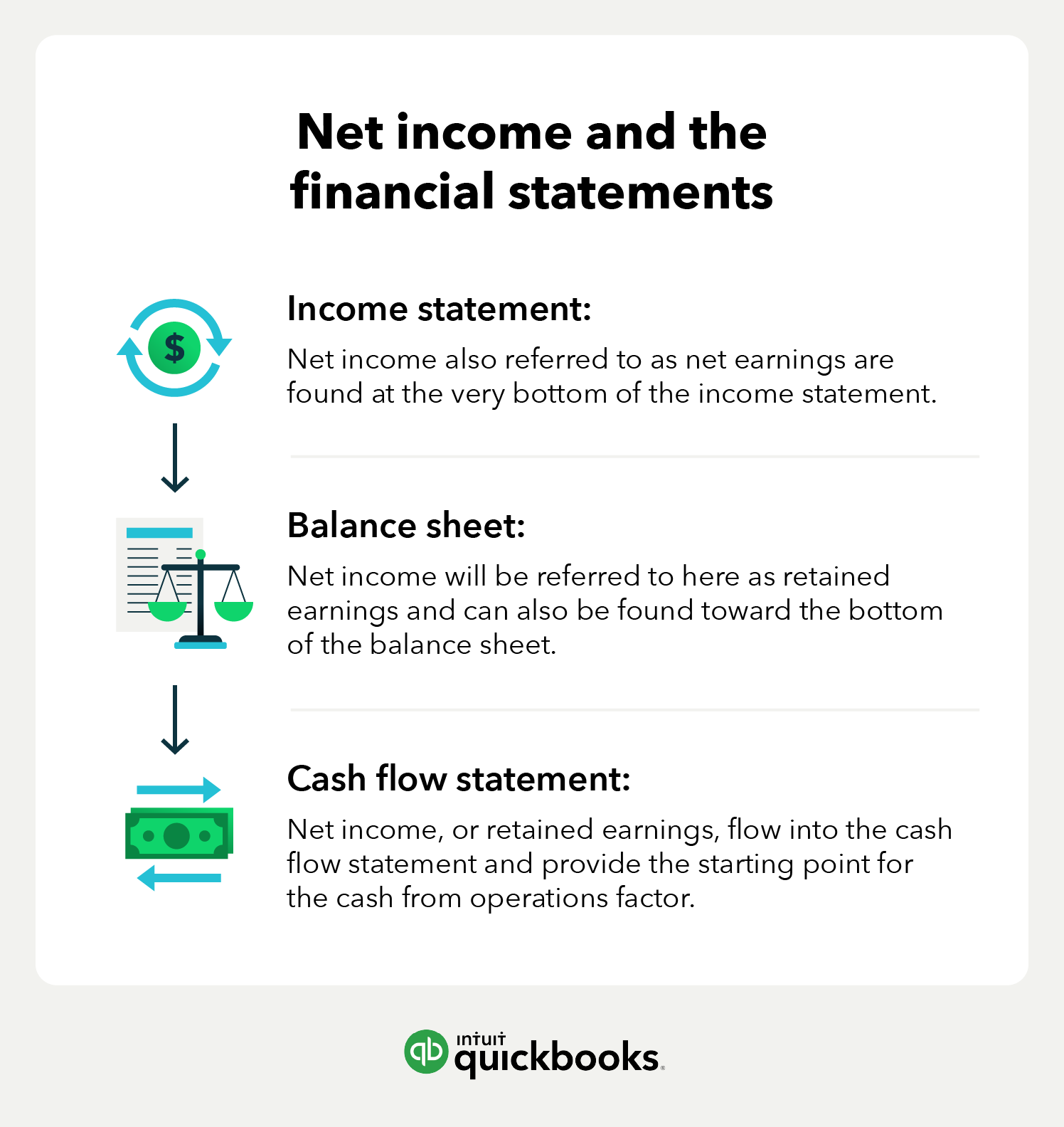

Worksheet for figuring net earnings loss from self employment

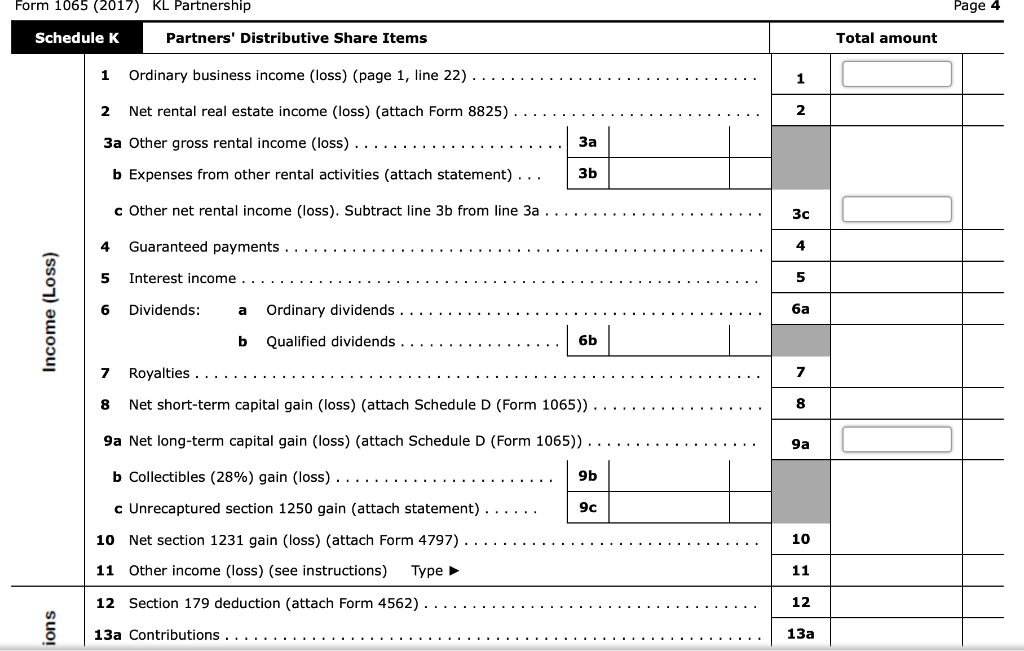

Publication 505 (2022), Tax Withholding and Estimated Tax If self-employed, first complete Worksheet 2-3 to figure your expected deduction for self-employment tax. Subtract the amount from Worksheet 2-3, line 11, to figure the line 1 entry: 1. 2. If you: • Don’t plan to itemize deductions on Schedule A (Form 1040), use Worksheet 2-4 to figure your expected standard deduction. • 2021 Instructions for Schedule C (2021) | Internal Revenue ... Enter your net profit or loss on line 31 and include it on Schedule 1 (Form 1040), line 3. However, do not report this amount on Schedule SE, line 2. If you were a statutory employee and you are required to file Schedule SE because of other self-employment income, see the Instructions for Schedule SE. Publication 560 (2021), Retirement Plans for Small Business Distributions of other income or loss to limited partners aren't net earnings from self-employment. For SIMPLE plans, net earnings from self-employment are the amount on line 4 Schedule SE (Form 1040), Self-Employment Tax, before subtracting any contributions made to the SIMPLE plan for yourself.

Worksheet for figuring net earnings loss from self employment. Publication 17 (2021), Your Federal Income Tax | Internal ... You must include income from services you performed as a minister when figuring your net earnings from self-employment, unless you have an exemption from self-employment tax. This also applies to Christian Science practitioners and members of a religious order who have not taken a vow of poverty. For more information, see Pub. 517. Publication 560 (2021), Retirement Plans for Small Business Distributions of other income or loss to limited partners aren't net earnings from self-employment. For SIMPLE plans, net earnings from self-employment are the amount on line 4 Schedule SE (Form 1040), Self-Employment Tax, before subtracting any contributions made to the SIMPLE plan for yourself. 2021 Instructions for Schedule C (2021) | Internal Revenue ... Enter your net profit or loss on line 31 and include it on Schedule 1 (Form 1040), line 3. However, do not report this amount on Schedule SE, line 2. If you were a statutory employee and you are required to file Schedule SE because of other self-employment income, see the Instructions for Schedule SE. Publication 505 (2022), Tax Withholding and Estimated Tax If self-employed, first complete Worksheet 2-3 to figure your expected deduction for self-employment tax. Subtract the amount from Worksheet 2-3, line 11, to figure the line 1 entry: 1. 2. If you: • Don’t plan to itemize deductions on Schedule A (Form 1040), use Worksheet 2-4 to figure your expected standard deduction. •

0 Response to "44 worksheet for figuring net earnings loss from self employment"

Post a Comment