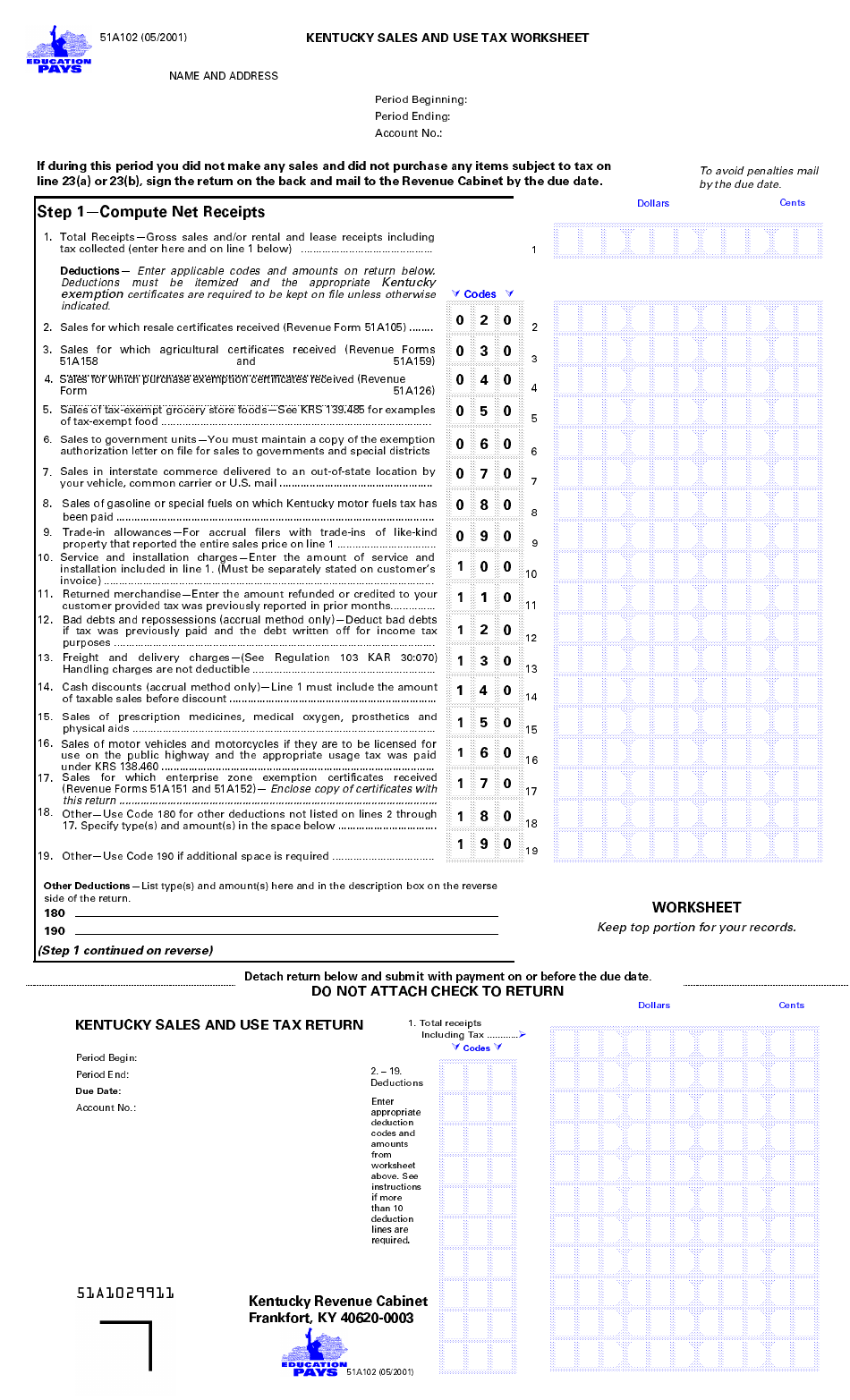

45 kentucky sales and use tax worksheet

Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Consumer Use Tax - Department of Revenue - Kentucky For example, if Georgia state sales tax of 4 percent is paid, only the additional 2 percent is due to Kentucky, or if Illinois state sales tax of 6.25 percent is paid, no additional Kentucky use tax is due. - Sales tax paid to a city, county or country cannot be used as a credit against the Kentucky use tax due.

Incorporation (business) - Wikipedia Lee the court ruled that there could be a corporate tax, essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

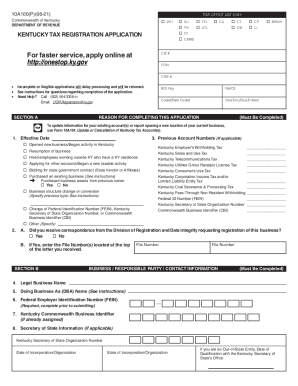

Kentucky sales and use tax worksheet

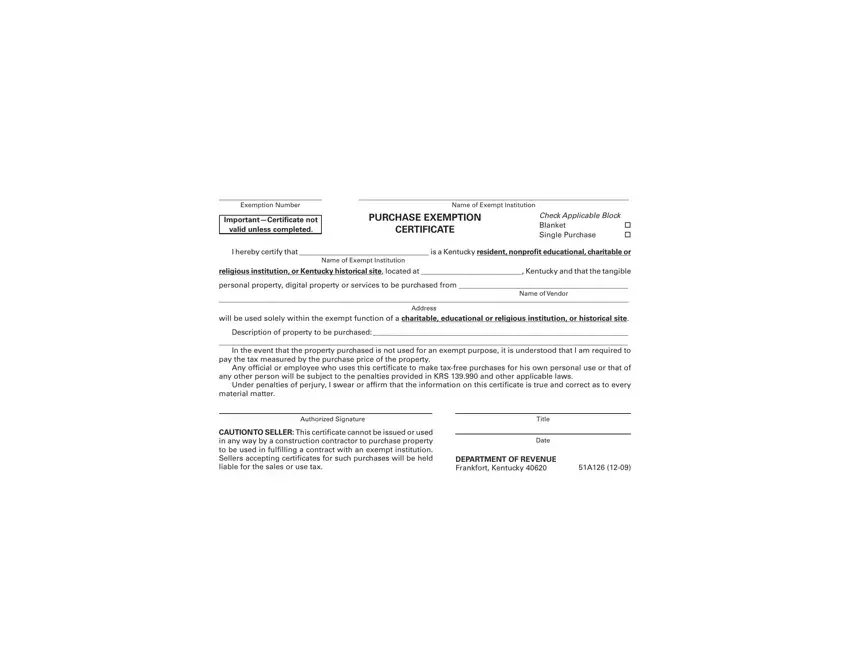

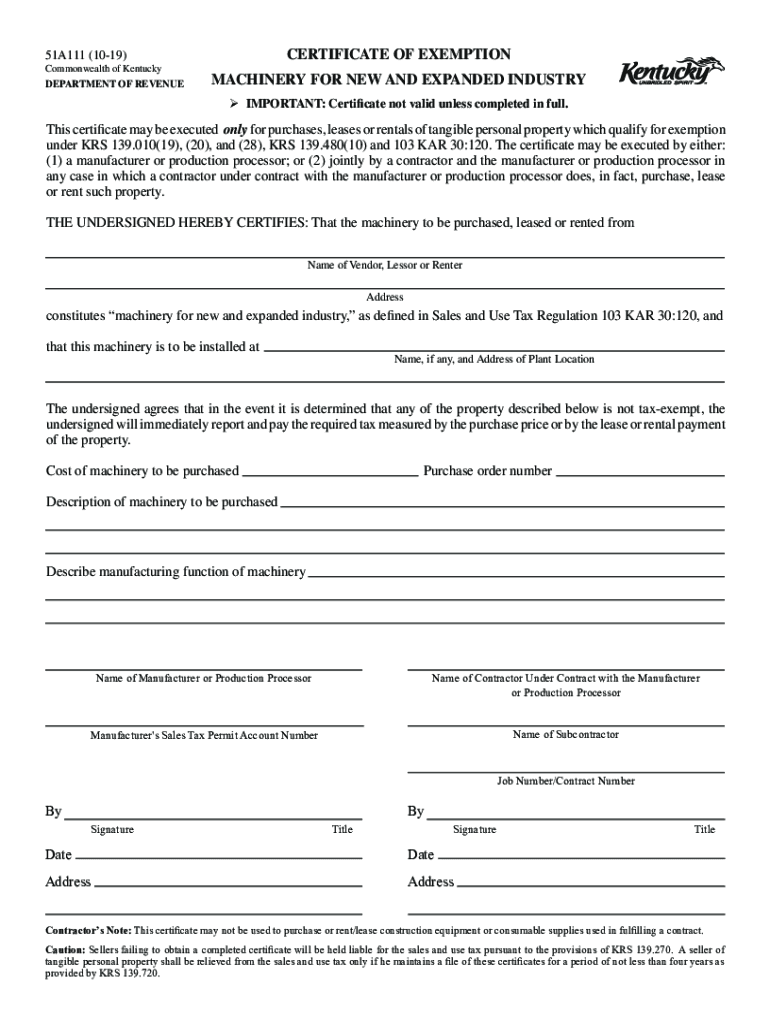

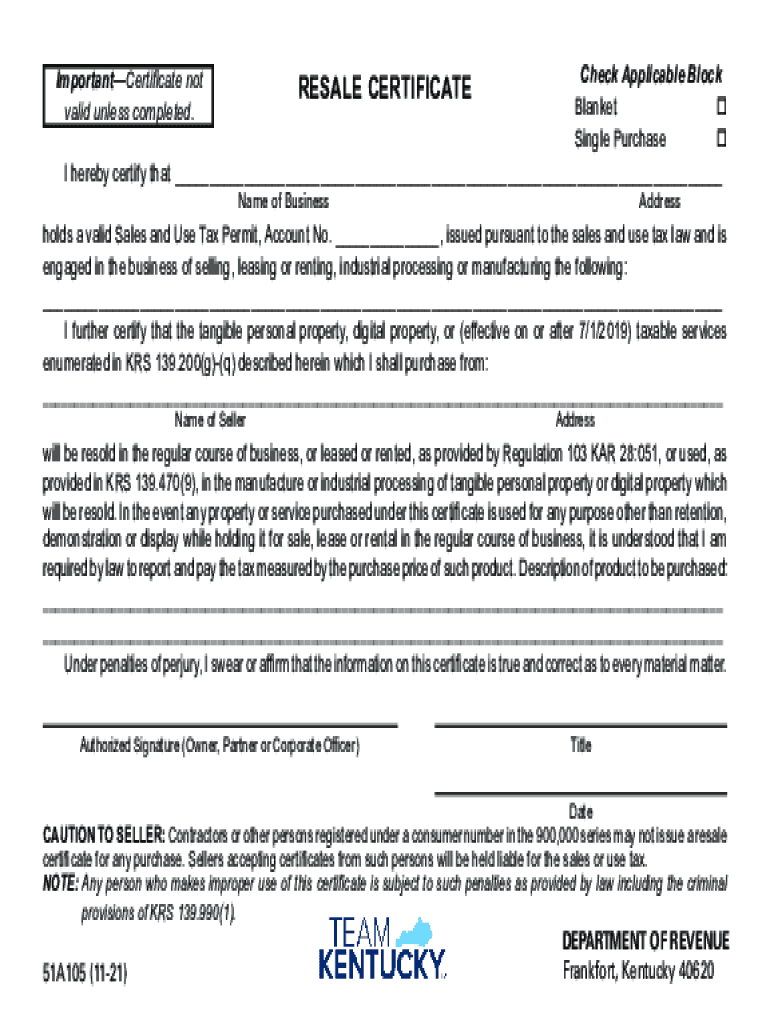

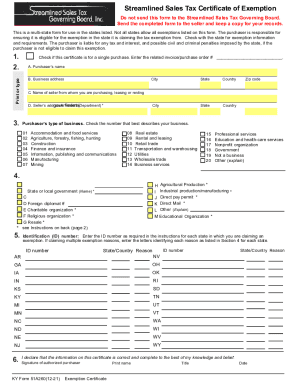

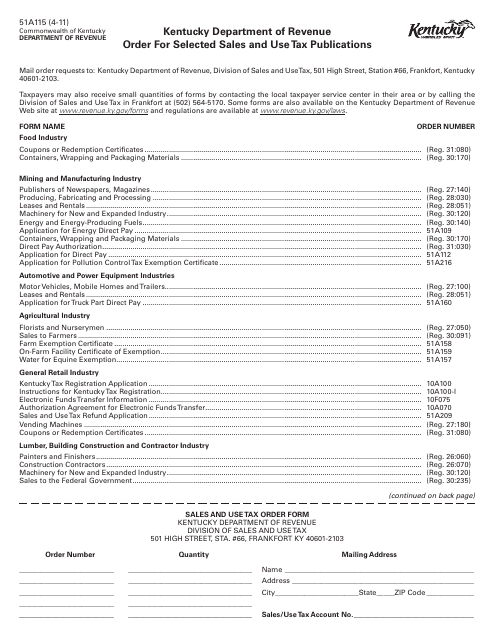

American Family News Aug 02, 2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do. Sales & Use Tax - Department of Revenue - Kentucky Oct 30, 2021 · The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes. U.S. News: Breaking News Photos, & Videos on the United ... Find the latest U.S. news stories, photos, and videos on NBCNews.com. Read breaking headlines covering politics, economics, pop culture, and more.

Kentucky sales and use tax worksheet. Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · In other words, if Microsoft owned Call of Duty and other Activision franchises, the CMA argues the company could use those products to siphon away PlayStation owners to the Xbox ecosystem by making them available on Game Pass, which at $10 to $15 a month can be more attractive than paying $60 to $70 to own a game outright. U.S. News: Breaking News Photos, & Videos on the United ... Find the latest U.S. news stories, photos, and videos on NBCNews.com. Read breaking headlines covering politics, economics, pop culture, and more. Sales & Use Tax - Department of Revenue - Kentucky Oct 30, 2021 · The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes. American Family News Aug 02, 2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do.

0 Response to "45 kentucky sales and use tax worksheet"

Post a Comment