45 qualified dividends and capital gain tax worksheet calculator

Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... Schedule K-1 (Form 1041) - Deductions, Credits & Other Items Line 12 A – Adjustment for Minimum Tax Purposes – Amount in Box 12, using a code of "A," represents the taxpayer's proportion of total AMT adjustments that are reported by the estate or trust for dividends, capital gains and other gains. Amounts entered on this line will automatically flow to Form 6251, Line 15.

Qualified Dividends And Capital Gain Tax Worksheet 2021 ... Once you’ve finished signing your 2021 qualified dividends and capital gain tax worksheet, decide what you want to do next - download it or share the doc with other people. The signNow extension offers you a selection of features (merging PDFs, adding numerous signers, and many others) for a better signing experience.

Qualified dividends and capital gain tax worksheet calculator

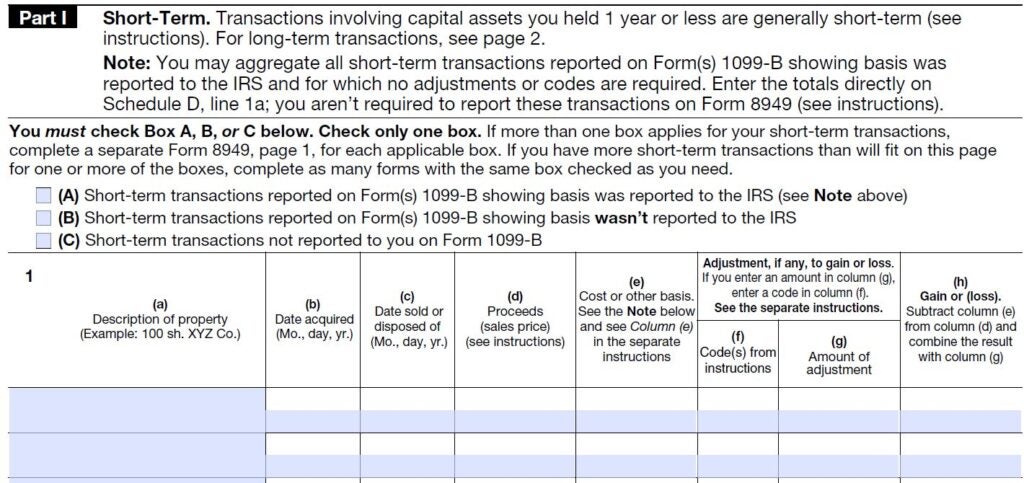

Publication 504 (2021), Divorced or Separated Individuals Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 523 (2021), Selling Your Home | Internal Revenue ... Using the information on Form 8949, report on Schedule D (Form 1040) the gain or loss on your home as a capital gain or loss. Follow the Instructions for Schedule D when completing the form. If you have any taxable gain from the sale of your home, you may have to increase your withholding or make estimated tax payments. 2021-2022 Long-Term Capital Gains Tax Rates | Bankrate Apr 07, 2022 · Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income.

Qualified dividends and capital gain tax worksheet calculator. Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. 2021-2022 Long-Term Capital Gains Tax Rates | Bankrate Apr 07, 2022 · Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. Publication 523 (2021), Selling Your Home | Internal Revenue ... Using the information on Form 8949, report on Schedule D (Form 1040) the gain or loss on your home as a capital gain or loss. Follow the Instructions for Schedule D when completing the form. If you have any taxable gain from the sale of your home, you may have to increase your withholding or make estimated tax payments. Publication 504 (2021), Divorced or Separated Individuals Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

0 Response to "45 qualified dividends and capital gain tax worksheet calculator"

Post a Comment