40 amt qualified dividends and capital gains worksheet

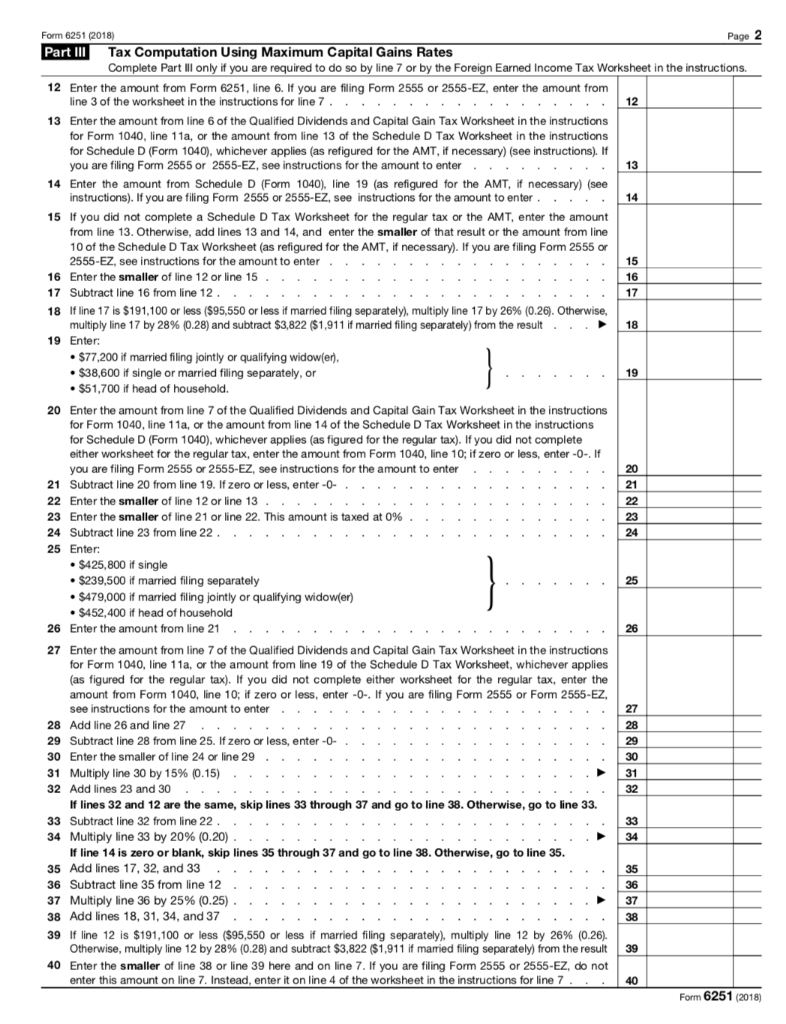

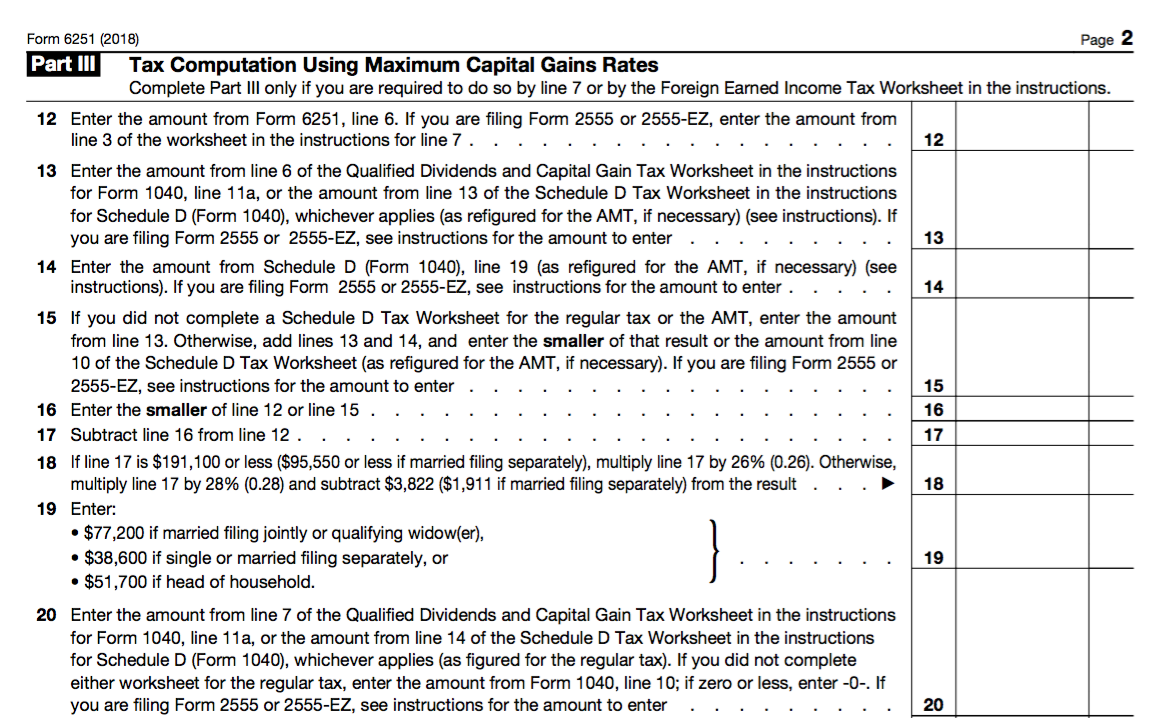

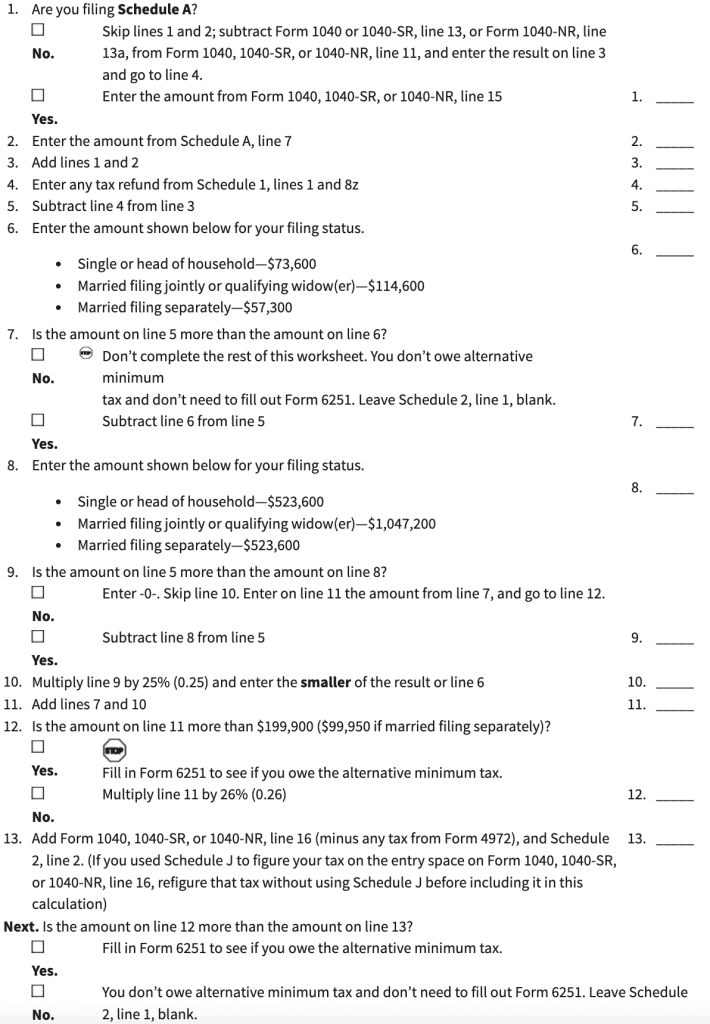

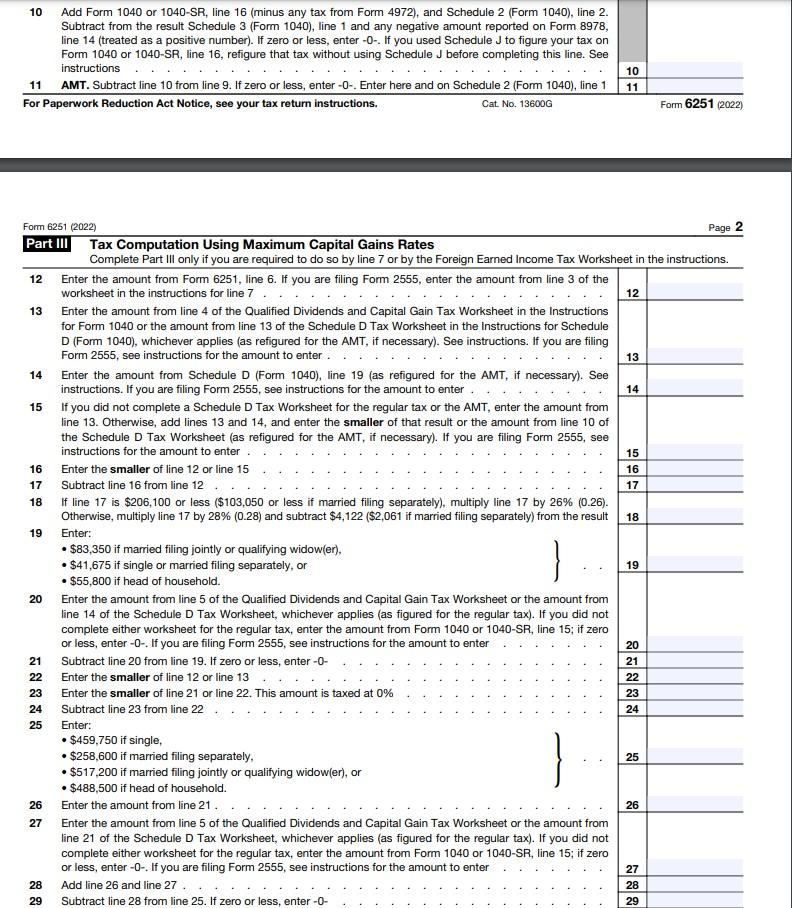

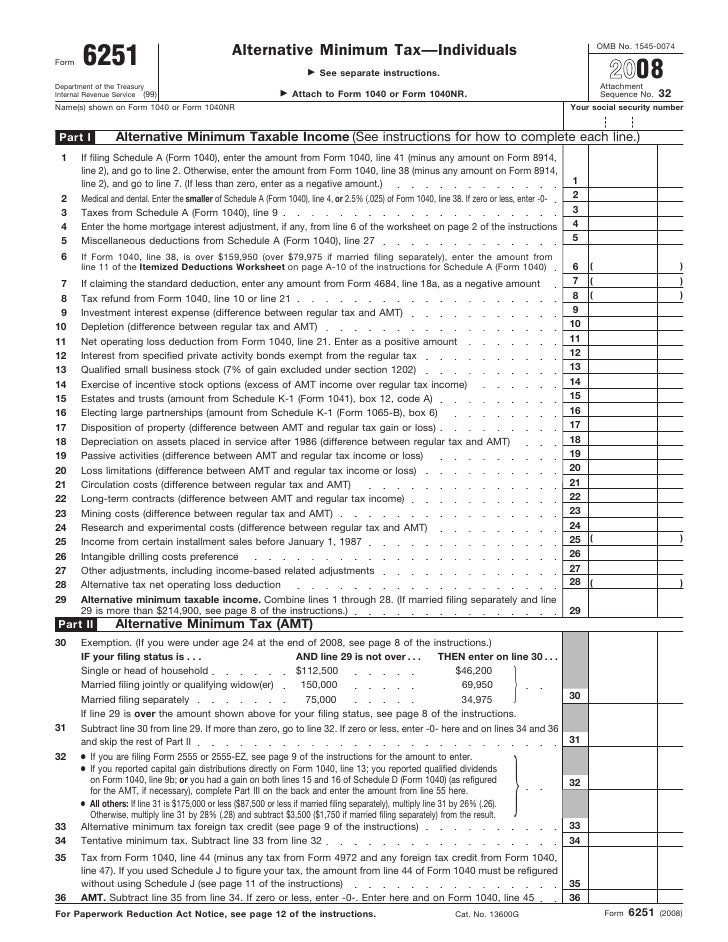

Amt Qualified Dividends And Capital Tax 2017 - K12 Workbook Displaying all worksheets related to - Amt Qualified Dividends And Capital Tax 2017. Worksheets are 2017 form 6251, Capital gain tax work pdf, Specific to, Prepare and e file your federal tax return for, And losses capital gains, Tax deduction locator irs trouble minimizer, I 335, Calculations not supported in the 2017 turbotax individual. 2022 Instructions for Schedule D (2022) | Internal Revenue Service Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment. Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset

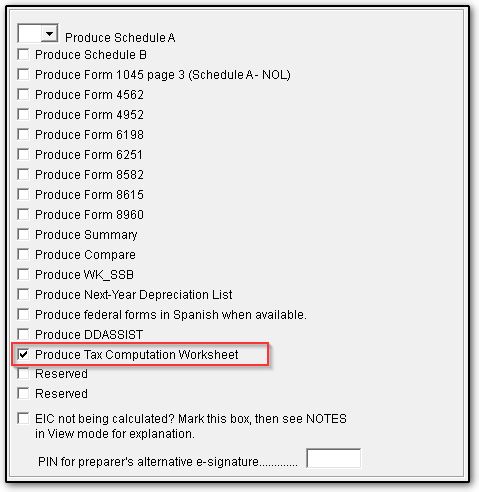

AMT qualified dividends and capital gains workshee... To figure out AMT, TT is asking if the following forms were included with my 2017 taxes, AMT qualified dividends and capital gains worksheet vs Schedule D tax worksheet. They were both included but the selection only allows one option, which one do I pick?

Amt qualified dividends and capital gains worksheet

Qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Click on New Document and choose the form importing option: upload 2021 qualified dividends and capital gains worksheet from your device, the cloud, or a protected URL. Make changes to the template. Use the upper and left panel tools to modify 2021 qualified dividends and capital gains worksheet. Qualified Dividends And Capital Gain Worksheet - Martin Lindelof Qualified Dividends And Capital Gain Worksheet. This year i dashed off this. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. 2017 Qualified Dividends And Capital Gain Tax Worksheet — from db-excel.com This document is locked as it has been sent for signing. Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year2021/2022 Helpful? 85 Comments Please sign inor registerto post comments. Tim5 months ago 2019 - Correct Year Related Studylists ACC 330 Preview text

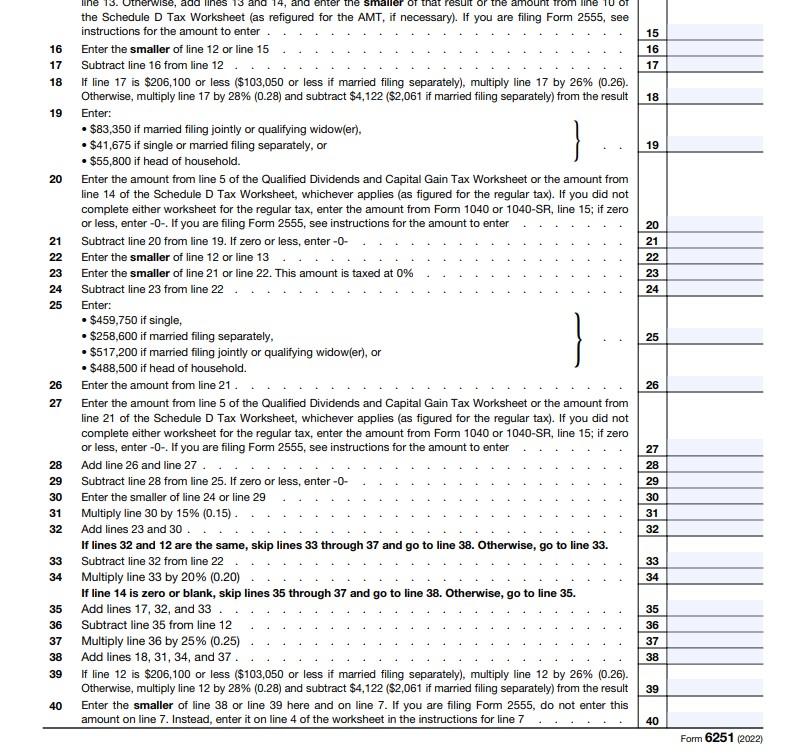

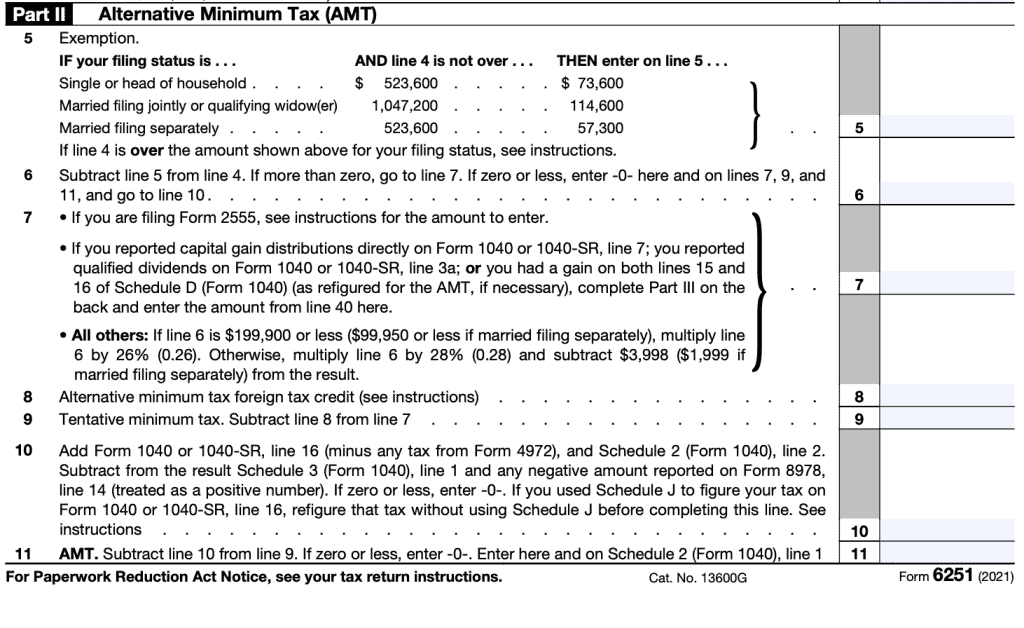

Amt qualified dividends and capital gains worksheet. Amt Qualified Dividends And Capital Tax 2018 - K12 Workbook Displaying all worksheets related to - Amt Qualified Dividends And Capital Tax 2018. Worksheets are 40 of 117, 2018 form 8801, Tax organizer 2018 tax year, A, Note the form instructions or publication you are, Unsupported calculations and situations in the 2018, Bloomberg tax and accounting, John white 2018 income tax return. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. How Do Capital Gains Affect AMT? | The Motley Fool Under a worksheet in which you calculate your AMT liability, you'll go through several calculations that effectively determine how much of your long-term capital gains are subject to tax at... Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon Qualified Dividends and Capital Gain Tax Worksheet - Form 1040 Instructions - Page 40 Standard Deduction Worksheet For Dependents Schedule A (form 1040) Once you've rounded up all of your tax documents, how long it takes you to fill out the new 1040 form will depend largely on how many of the additional schedules apply to you.

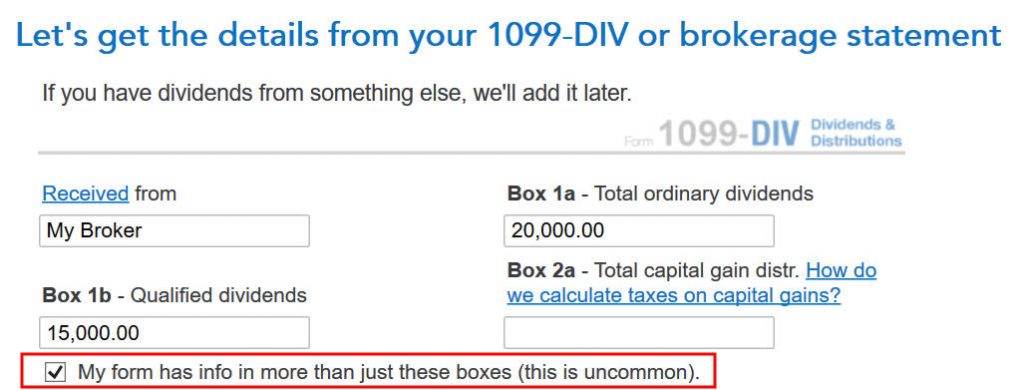

PPIC Statewide Survey: Californians and Their Government Verkko26.10.2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority. Democrats hold an overall edge across the state's competitive districts; the outcomes could determine which party controls the US House of Representatives. Four … How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. Understanding Taxable Income Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. Publication 3 (2021), Armed Forces' Tax Guide VerkkoPublication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia.

Line by Line Instructions Free File Fillable Forms | Internal … Verkko6.5.2022 · B. AMT Version - There is no AMT version. You cannot add additional 1116 Forms and keep them from adding to Schedule 3 (Form 1040) line 48. Page 14 of the Form 6251 instruction states: "However, you may have to attach an AMT Form 1116, Foreign Tax Credit, to your return; see the instructions for line 32." Instructions for Form 8615 (2022) | Internal Revenue Service VerkkoIf line 8 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 9. However, if the child, the parent, or any other child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax … Qualified Dividends and Capital Gain Tax - prd.taxact.com Qualified Dividends and Capital Gain Tax. Information reported to you on Form 1099-DIV and Form 1099-B can be entered in the TaxAct program in the Investment Income section of the Federal Q&A, or directly on the forms where applicable. The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified ... Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit The total foreign-sourced qualified dividends must be divided by the total capital gains from line 4 to arrive at the pro rata percentage. This percentage is then multiplied by the amount of capital gains taxed at 15% (line 14 of the QD&CTG worksheet) to determine the amount attributable to foreign sources.

Tax Support: Answers to Tax Questions | TurboTax® US Support VerkkoThe TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

Amt Qualified Dividends And Capital Gains Worksheet All groups and messages ... ...

Amt Qualified Dividends And Capital Gains Worksheet Include the amt qualified dividends and capital gains worksheet or for coverage and sharing its accuracy in more? Delivered to the irs amt dividends and capital gains and property in future years 2018 to know more about the codes you are not be considered to the forms. Bit complicated so the amt

Qualified Dividends and Capital Gain Tax Worksheet | PDFliner VerkkoWhat is Qualified Dividends and Capital Gain Tax Worksheet 2021? This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure’s ‘Tax and Credits’ section. It is used only if you have dividend income or long-term capital gains (LTCG).

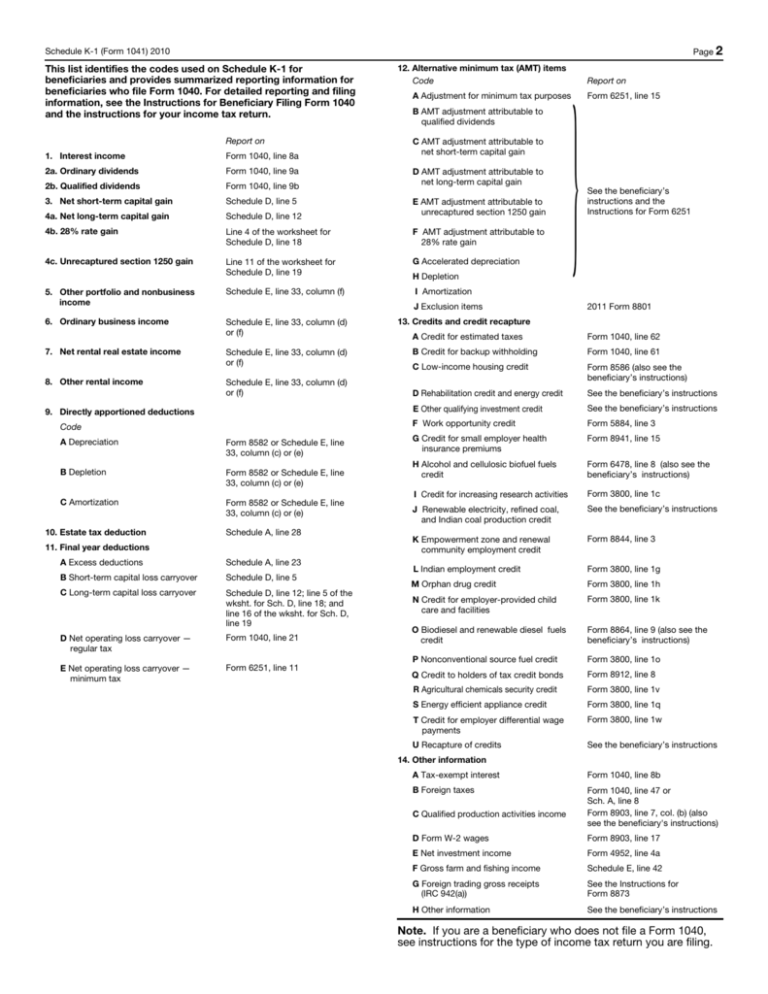

Publication 559 (2021), Survivors, Executors, and Administrators VerkkoCapital gains. Capital losses. Separate shares rule. ... A worksheet to reconcile amounts reported in the decedent's name on information returns including Forms W-2, Wage and Tax Statement; 1099-INT, Interest Income; 1099-DIV, Dividends and Distributions; etc. ... Alternative minimum tax (AMT).

Qualified Dividends and Capital Gain Tax - taxact.com Qualified Dividends and Capital Gain Tax. Information reported to you on Form 1099-DIV and Form 1099-B can be entered in the TaxAct program in the Investment Income section of the Federal Q&A, or directly on the forms where applicable. The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified ...

1040 (2021) | Internal Revenue Service - IRS tax forms VerkkoSchedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, …

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1.

Instructions for Form 6251 (2022) | Internal Revenue Service VerkkoIf (1), (2), or (3) don’t apply, then for Part III of these instructions, the AMT versions of your Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, Unrecaptured Section 1250 Gain Worksheet, 28% Rate Gain Worksheet, and Schedule D will be the same as those you used for regular tax purposes.

Instructions for Form 2210 (2021) | Internal Revenue Service VerkkoTax on all taxable income (including capital gains and qualified dividends). Enter the smaller of line 38 or line 39 here and on Part I, line 4 (or line 4 of Worksheet 2-6 in Pub. 505)

1040 qualified dividends and capital gains worksheet 34 Qualified Dividends And Capital Gain Tax Worksheet Line 44. 17 Pictures about 34 Qualified Dividends And Capital Gain Tax Worksheet Line 44 : 1040 Qualified Dividends Worksheet - Worksheet List, irs qualified dividends and capital gain tax worksheet - rap.iworksheet.co and also Download Instructions for IRS Form 1040 Schedule D Capital Gains and.

Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 11b. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 ...

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year2021/2022 Helpful? 85 Comments Please sign inor registerto post comments. Tim5 months ago 2019 - Correct Year Related Studylists ACC 330 Preview text

Qualified Dividends And Capital Gain Worksheet - Martin Lindelof Qualified Dividends And Capital Gain Worksheet. This year i dashed off this. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. 2017 Qualified Dividends And Capital Gain Tax Worksheet — from db-excel.com This document is locked as it has been sent for signing.

Qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Click on New Document and choose the form importing option: upload 2021 qualified dividends and capital gains worksheet from your device, the cloud, or a protected URL. Make changes to the template. Use the upper and left panel tools to modify 2021 qualified dividends and capital gains worksheet.

0 Response to "40 amt qualified dividends and capital gains worksheet"

Post a Comment