37 rental property tax deductions worksheet

If you're audited, you will be allowed deductions you have receipts for, so save them carefully. No deduction is allowed for the value of your own labor. DO NOT ...1 page

For more information about the residential property deduction rules, see Part 2 of our guide Rental income - IR264. Which worksheet should I use this year?

Get, Create, Make and Sign rental property tax deductions worksheet ... In general, you can deduct expenses of renting property from your rental ... report ...

Rental property tax deductions worksheet

The rental property deduction worksheet is the worksheet that only includes the particulars that are to be deducted or expenses are made on the property are included in this worksheet. 2 Article 44 of the Massachusetts Constitution requires that the same class of income must be taxed at the same rate. ID TAX YEAR EXPENSES The Purpose of this worksheet is to help you organize Advertising your ...

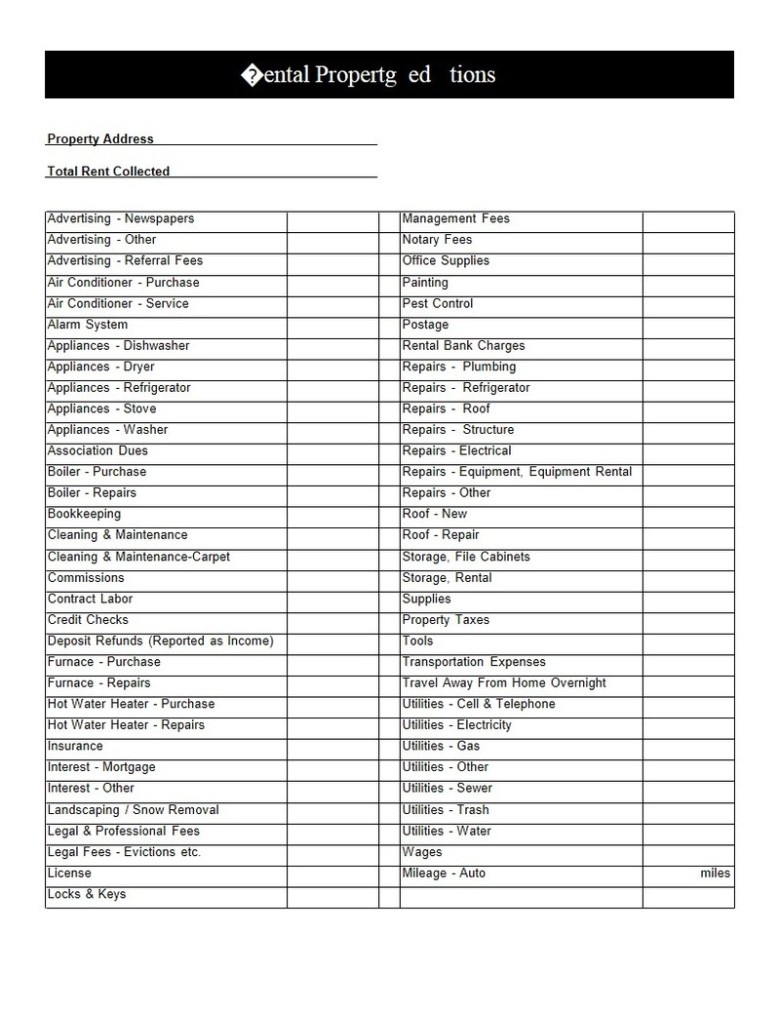

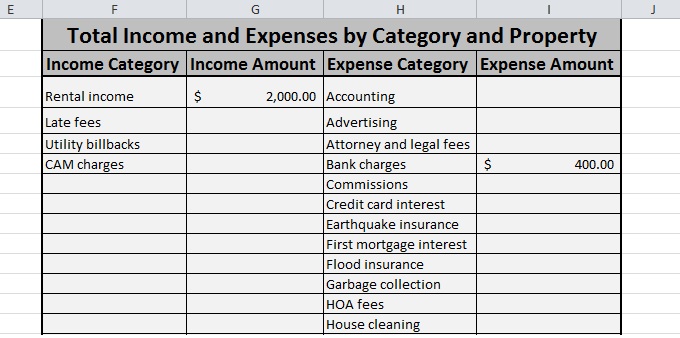

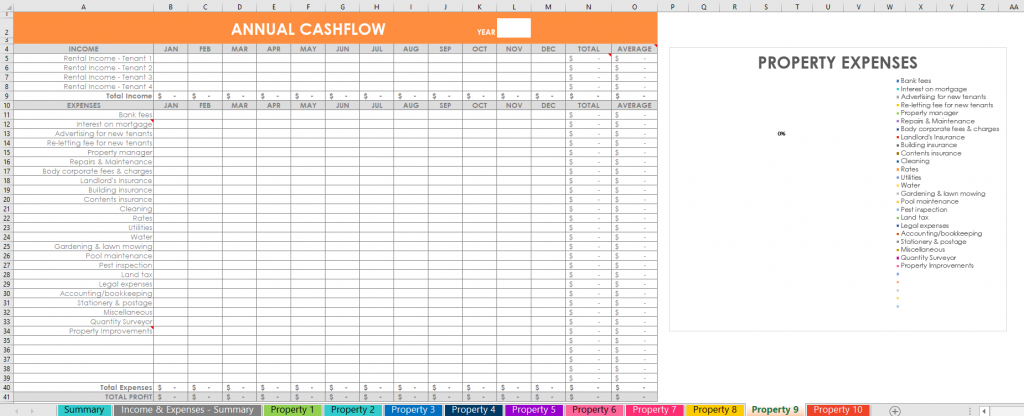

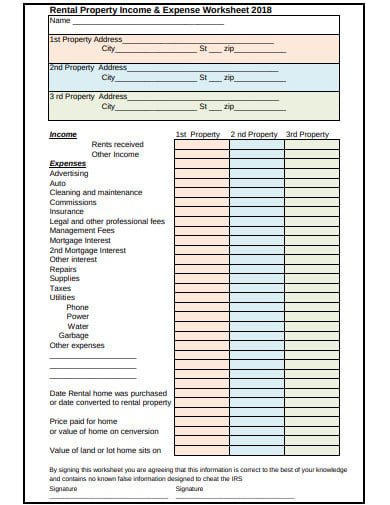

This worksheet, designed for property owners with one to five properties, has a section for each category of income and spending associated with managing a rental property. Appropriate sections are broken down by month and by property. Each section automatically calculates the totals to provide your gross income, net income and total expenses for the year. To download the free rental income ...

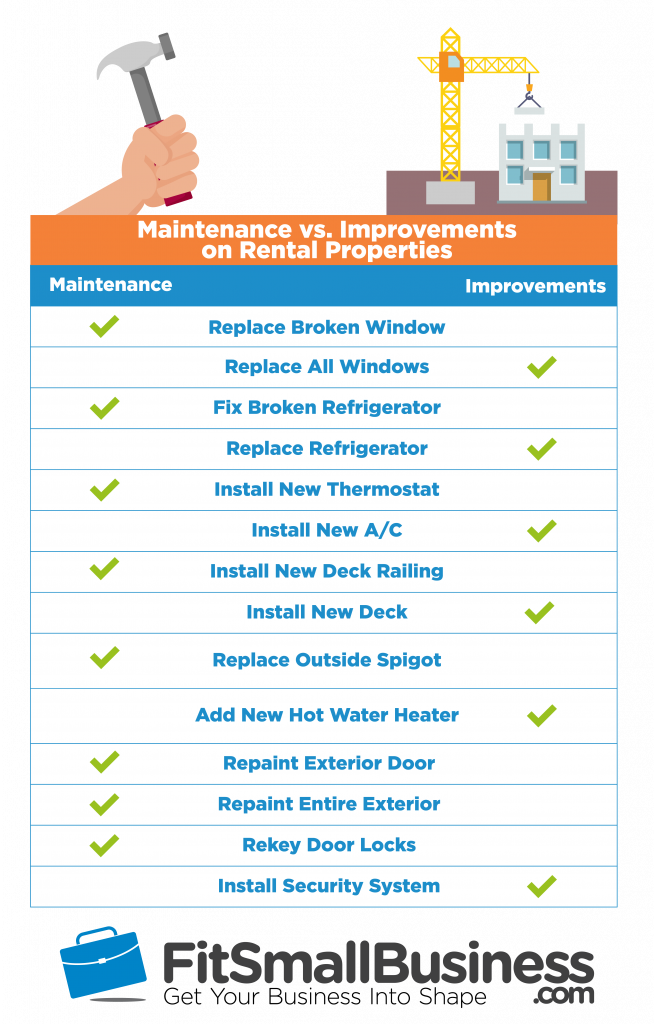

Rental expense categories. There are three rental expense categories, those for which you: can claim a deduction now (in the income year you incur the expense) - for example, interest on loans, council rates, repairs and maintenance and depreciating assets costing $300 or less; can claim a deduction over several years - for example, capital works, borrowing expenses and the decline in ...

Rental property tax deductions worksheet.

When you sell a rental property, you need to pay tax on the profit (or gain) that you realize. The IRS taxes the profit you made selling your rental property two different ways: Capital gains tax rate of 0%, 15%, or 20% depending on filing status and taxable income. Depreciation recapture tax rate of 25%.

Rental property tax deductions worksheet. Residential property deductions worksheets These worksheets can help you to calculate amounts for your income tax return for residential properties that the residential property deduction rules apply to also known as the ring-fencing rules. Sundry rental expenses. Capital works deductions. Do not Include.

27 May 2021 — Note 2: From 1 July 2017, deductions for travel expenses relating to residential rental properties are allowable only if an exception applies.

Download a Rental Property Cash Flow Analysis spreadsheet from from Rental Property Tax Deductions Worksheet, source: pinterest.com. 94 best Taxes images on Pinterest from Rental Property Tax Deductions Worksheet, source: pinterest.com. 30 Awesome Clothing Donation Tax Deduction Worksheet from Rental Property Tax Deductions Worksheet

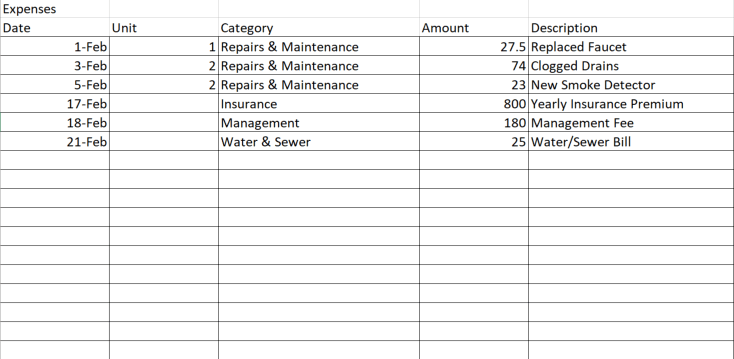

You can deduct the costs of certain materials, supplies, repairs, and maintenance that you make to your rental property to keep your property in good operating condition. You can deduct the expenses paid by the tenant if they are deductible rental expenses.

Even a casual or one-off letting is treated as arising from a property rental business. As with any other business, property income can include payments in kind as well as cash receipts. Profits or losses from overseas properties and furnished holiday lettings need to be treated separately for tax purposes. For further information see PIM1025, PIM4700, and PIM4105. Properties let rent-free or ...

Although there's a new limit on the property tax deduction ($10,000, or $5,000 if married filing separately, for property taxes and either state and local income taxes or sales taxes combined ...

Tax Deductions for your Rental Luckily you can deduct expenses you incurred during the rental of your property from your taxable rental income, reducing the tax you need to pay. This doesn't include any capital and/or private expenses, as SARS won't allow those as a deduction.

This worksheet helps you submit your rental property information for your tax return. ... If you own the property - You can deduct reasonable motor vehicle ...

that information to compute your deduction for mortgage interest, private mortgage insurance (PMI) and real estate taxes. Some lenders are excellent about printing the property address on the Form 1098. If your lender does not, and you want to be cool, please write down the rental property address on your tax documents.

Convenient and easy to use, this worksheet is designed for property owners with one to five properties. It features sections for each category of income and spending that are associated with rental property finances. You'll start by entering the stats on your properties, and then enter the appropriate dollar amounts into each itemized ...

RENTAL PROPERTIES 2020 ato.gov.au 3 Rental properties 2020 will help you, as an owner of rental property in Australia, determine: n which rental income is assessable for tax purposes n which expenses are allowable deductions n which records you need to keep n what you need to know when you sell your rental property. Many, but not all, of the expenses associated with rental

Rental Property Record-Keeping Checklist With rental properties, your record keeping and management skills are the utmost important factors needed to insure compliance with tax laws, and the best possible financial outcome when taking advantage of tax breaks that can help you lower your end-of-year tax bill.

You can deduct the premiums you pay on your rental property for the current year. If your policy gives coverage for more than one year, deduct only the premiums related to the current year. Deduct the remaining premiums in the year (s) to which they relate. Office expenses You can deduct the cost of office expenses.

How to Claim Rental Property Tax Deductions. Rental property tax deductions worksheet is a document that manages your tax deduction on rental property. Your rental properties have to be located in at least two different sites away from your principal residence. Phone our Publications Distribution Service on 1300 720 092.

As well as the general responsibilities associated with running a rental property, you need to find tenants, pay all your expenses, and ensure you have insurance. In personal tax terms, renting out a property can complicate the situation. There are rental property tax deductions available to help you out with running your business, though.

Residential property deductions worksheets These worksheets can help you to calculate amounts for your income tax return for residential properties that the residential property deduction rules apply to (also known as the ring-fencing rules). Use the worksheet that best suits your situation each year. These worksheets are optional and are for

Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or "ROI," identify opportunities to increase revenues, and make sure they are claiming every tax deduction the IRS allows.

To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

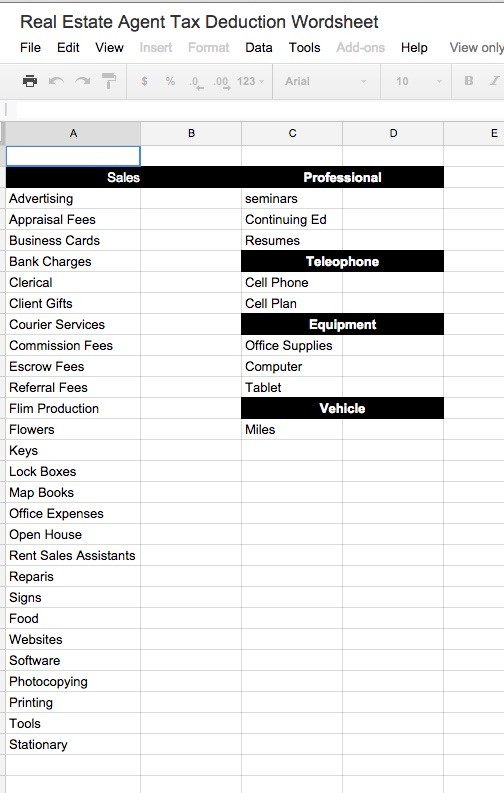

Download Your Free Rental Property Tax Deduction Worksheet. In this article, we will discuss some of the tax benefits of rental property. We will break down each category to help you know what questions to ask your accountant. Keeping track of the items below could save you big at tax time.

21 Tax Deductions for Landlords 1. Losses from Theft or Casualty 2. Property Depreciation 3. Repairs & Maintenance 4. Segmented Depreciation 5. Utilities 6. Home Office 7. Real Estate-Related Travel 8. Meals 9. Closing Costs 10. Property Management Fees 11. Rental Property Insurance & Rent Default Insurance 12. Mortgage Interest 13.

Maintaining a rental property requires you to coordinate many different responsibilities, from maintenance and tenant management to paying property taxes. It also requires accurate record-keeping so that you can properly report all income and expenses on your tax return. Landlords have unique opportunities to claim property deductions on their taxes.

The Property Rental Toolkit (2016 to 2017) has been updated with details of new rules that limit the mortgage interest that an individual can deduct as an expense of a property business to the ...

To figure out the depreciation on your rental property: Determine your cost or other tax basis for the property. Allocate that cost to the different types of property included in your rental (such as land, buildings, so on). Calculate depreciation for each property type based on the methods, rates and useful lives specified by the IRS. 1.

If you let out a property on terms that are not commercial, such as to a friend or a relative for a reduced rent, expenses incurred can only be deducted up to the amount of the rent received for ...

In general, you should file rental property tax deductions the same year you pay the expenses using a Schedule E form. The process will be much more manageable if you keep detailed records of all income and costs related to the property as they occur. Plus, if you're ever audited, you'll have to provide proof for every deduction you claim.

The room is 12 × 15 feet, or 180 square feet. Your entire house has 1,800 square feet of floor space. You can deduct as a rental expense 10% of any expense that must be divided between rental use and personal use. If your heating bill for the year for the entire house was $600, $60 ($600 × 0.10) is a rental expense.

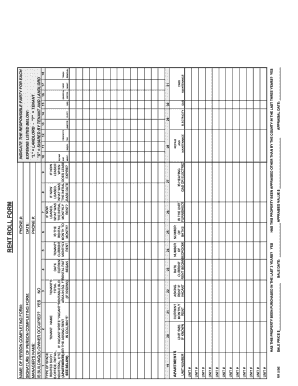

Schedule E Worksheet for Rental Property IRS Requires us to have your information in hand to support all Schedule E's Rental Property #1 - Address_____ If ...

Rental Property Tax Deductions: The Ultimate Tax Guide [2021 Edition] by Team Stessa, posted in Guides , Legal & Taxes If you're like most real estate investors, tax season likely produces sweaty palms, an intimidating "to do" list, and an overwhelming sense of dread.

Sign In. You may be offline or with limited connectivity. Try downloading instead.

Residential property deductions worksheets These worksheets can help you to calculate amounts for your income tax return for residential properties that the residential property deduction rules apply to (also known as the ring-fencing rules). Use the worksheet that best suits your situation each year. These worksheets are optional and are for

RENTAL PROPERTY EXPENSES Client: ID # TAX YEAR EXPENSES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Auto Travel expense to be deductible, it must be considered an Hotel "ordinary and necessary" expense. You may include Food other applicable expenses. Do not Include expenses for Mileage which you have been reimbursed ...

RENTAL PROPERTY EXPENSES Client: ID # TAX YEAR EXPENSES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Auto Travel expense to be deductible, it must be considered an Hotel "ordinary and necessary" expense. You may include Food other applicable expenses. Do not Include ...

The rental property management template is a document in MS Excel in different formats. It keeps the records of your property and rent collection with various reports. With the help of this template, a real estate company can easily handle up to 50 properties. Furthermore, it assists you to enlist the record of properties.

The rental property deduction worksheet is the worksheet that only includes the particulars that are to be deducted or expenses are made on the property are included in this worksheet. The deductions made are the utility bills and the travel expenses etc and when you will to calculate all your deduction then need to take the help of the template of the Rental Property Deduction Worksheet ...

0 Response to "37 rental property tax deductions worksheet"

Post a Comment