and annuity exclusion worksheet

Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year; Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension; Subtraction Amounts . Qualified taxpayers who are under age 65 as of the last day of … Exclusions of these pensions from New York income are reported on Line 26 of Form IT-201. Unlike the regular Pension and Annuity Income Exclusion, the exclusion of pensions from the Federal government or New York State and/or local governments are NOT limited to $20,000. You may take the exclusion up to the amount the pension or other ...

As I understand the Colorado Pension & Annuity Exclusion, each individual can exempt up to $24,000 per year on his/her Colorado State return for retirement income such as IRA distributions and Social Security benefits. For married couples, each can exempt up to $24,000, for a total of $48,000 per couple.

Colorado pension and annuity exclusion worksheet

I'm also wondering if I could just report the foreign pension on the "Other pension and annuities qualifying for Colorado exclusion" line 4 of the Pension and Annuity Exclusion Worksheet. However, my concern is that the CO instructions for the pension exclusion states that the pension has to be reported on line 4b or 5b on the federal 1040. Use to indicate an early (but not premature) IRA distribution qualifies for exclusion. When using this code, the distribution is used on the Colorado Pension-Annuity Subtraction Worksheet, line f, federal qualified IRA distributions line. The distribution code entered in the federal 1099R screen, box 7 is ignored if "1" or "2" is used. Connecticut Colorado is one of the states that allows a pension/annuity subtraction for taxpayers who are at least 55 years of age and beneficiaries of any age who are ...

Colorado pension and annuity exclusion worksheet. Colorado Pension Annuity Exclusion GENERAL INFORMATION Colorado allows a pension/annuity subtraction for: taxpayers who are at least 55 years of age as of the last day of the tax year; beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the … CO-60 (11/18) (page 4 of 4) Rollovers Q: If a qualifying pension is rolled over into an annuity, will the distribution from the annuity qualify for the $20,000 pension and annuity income exclusion? A: Yes, if the income was included in FAGI and provided all other requirements are met (over 59½, periodic payments, attributable to personal services performed before retirement and an employer- 27.03.2017 · Colorado pension and annuity exclusion worksheet. How to figure the tax free part of periodic payments under a pension or annuity plan including using a simple worksheet for payments under a qualified plan. As pension income. For taxpayers who are at least 65 years of age colorado allows a 24000 pensionannuity subtraction. For your particular situation … For joint filers, the age of the oldest spouse determines the age category. Recipients born before 1946: For 2020 you may subtract all qualifying retirement and pension benefits received from public sources, and may subtract private retirement and pension benefits up to $53,759 if single or married filing separately or up to $107,517 if married filing jointly.

Jun 04, 2019 · What qualifies as Colorado pension and annuity exclusions? Retirees ages 55 through 64 are able to exclude pension income up to $20,000 per year per person. Retirees who are age 65 and over can exclude up to $24,000 per year per person. Anyone receiving a survivor benefit, regardless of their age, can also qualify for the pension exclusion. Jun 01, 2019 · (Item 6 of the Colorado Pension and Annuity Exclusion Worksheet limits amount to exclude as a non-resident) Income 25: Pension and Annuity Subtraction If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104). You must be at least 55 years of age unless you receive pension and annuity income as a death benefit. You can claim the subtraction only for pension and annuity … If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for Maryland's maximum pension exclusion of $31,100 under the conditions described in Instruction 13 of the Maryland resident tax booklet. If you're eligible, you may be able to subtract some of your taxable pension and retirement annuity income from your federal adjusted gross income.

For additional information on how to report pension or annuity payments on your federal income tax return, be sure to review the instructions on the back of Copies B, C, and 2 of the Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. that you received and the Instructions for ... Any qualifying spouse pension/annuity income should be reported on line 8. TIP: Submit copies of all 1099R and SSA-1099 statements with your return. Submit using Revenue Online or attach to your paper return. Line 8 Spouse Pension and Annuity Subtraction. If the secondary taxpayer listed on a jointly filed return is eligible for the pension and ... Jan 07, 2022 · 43 colorado pension and annuity exclusion worksheet. Use to indicate an early (but not premature) IRA distribution qualifies for exclusion. When using this code, the distribution is used on the Colorado Pension-Annuity Subtraction Worksheet, line f, federal qualified IRA distributions line. The distribution code entered in the federal 1099R ... Annuity worksheets. ... Guidance on submitting a ruling request for help with determining an issue with your pension or annuity, other than the exclusion ratio, is provided in Revenue Procedure 2018‐1, section 5.15(.01) and section 7.04 (or subsequent revenue procedure), ...

What qualifies for the Colorado pension and annuity exclusion? Retirees ages 55 through 64 are able to exclude pension income up to $20,000 per year per person. Retirees who are age 65 and over can exclude up to $24,000 per year per person. The retirees age as of December 31st determines the amount of the exclusion. …

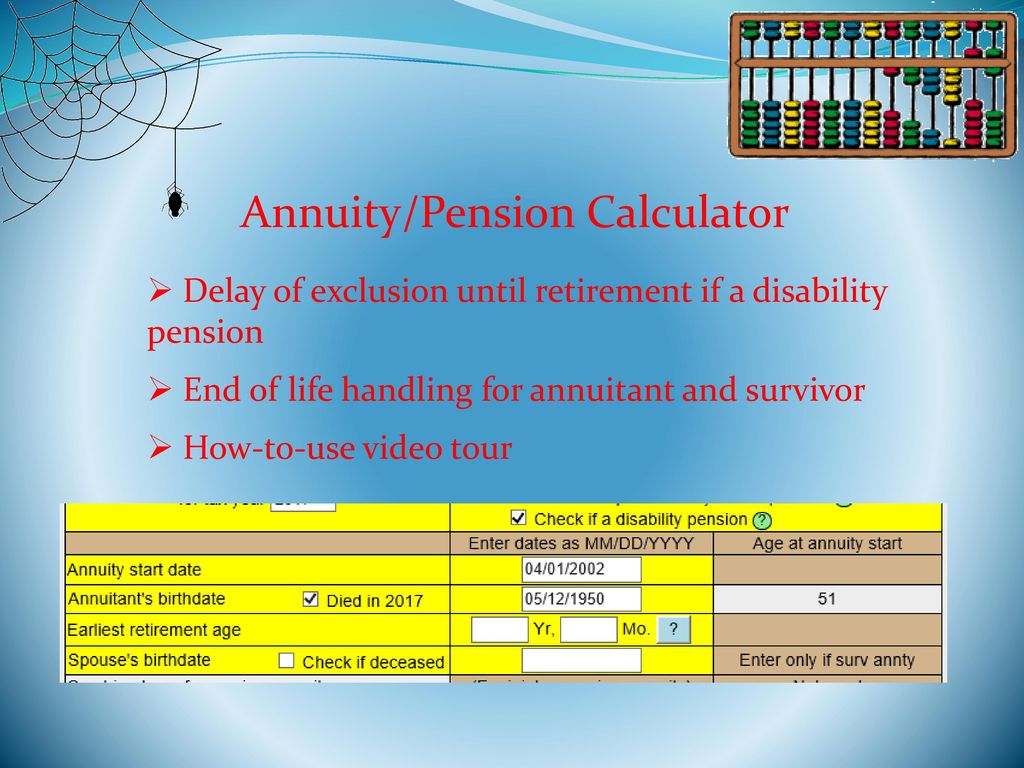

the months prior to minimum retirement age to include as wages income. the months after minimum retirement age to as pension to recover contributions for those months. The calculator will tell you how what to include in each 1099-R. Public safety officers are: Federal and local law enforcement officer. Members of the United States Capitol Police.

Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for ...

Entry of annuities/pensions/Social Security/RR Retirement benefits automatically calculate the correct exclusion amounts for Colorado Subtractions from AGI ...

Considering the Centennial State has a flat income tax of 4.63% these subtractions often translate to substantial tax savings. For instance, if you are over 65 and maxing out the subtraction (you have more than $24,000 of qualifying pension/annuity income) your tax savings is just over $1,100. Additionally, this figure could double if filing ...

This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same. Sales Tax Deduction Worksheet

Total pension income up to $20,000 per year per person for retirees age 55 to 64, or $24,000 for retirees age 65 and beyond, is exempt from Colorado state income tax. The exclusion amount for that year is determined by the retiree’s age on December 31. PERA retirement benefits, Social Security payments, certain other retirement pensions, and payouts from IRAs and tax …

Colorado is one of the states that allows a pension/annuity subtraction for taxpayers who are at least 55 years of age and beneficiaries of any age who are ...

Use to indicate an early (but not premature) IRA distribution qualifies for exclusion. When using this code, the distribution is used on the Colorado Pension-Annuity Subtraction Worksheet, line f, federal qualified IRA distributions line. The distribution code entered in the federal 1099R screen, box 7 is ignored if "1" or "2" is used. Connecticut

I'm also wondering if I could just report the foreign pension on the "Other pension and annuities qualifying for Colorado exclusion" line 4 of the Pension and Annuity Exclusion Worksheet. However, my concern is that the CO instructions for the pension exclusion states that the pension has to be reported on line 4b or 5b on the federal 1040.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/HowAreAnnuitiesTaxedSept.72021-d49cdf24a4c0474ea2ee279b6da44ced.jpg)

0 Response to " and annuity exclusion worksheet"

Post a Comment