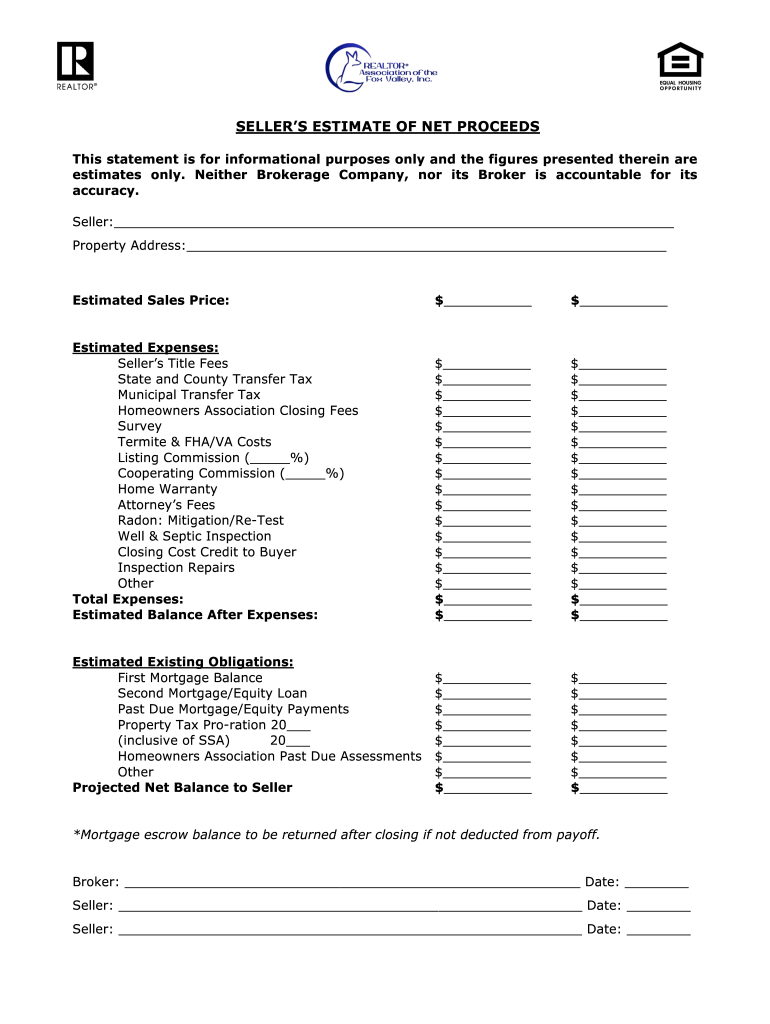

40 seller closing cost worksheet

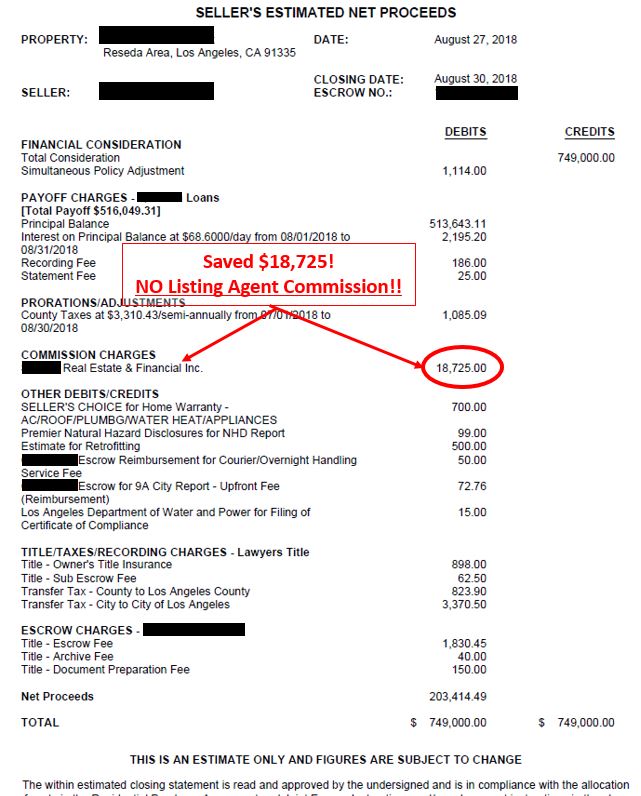

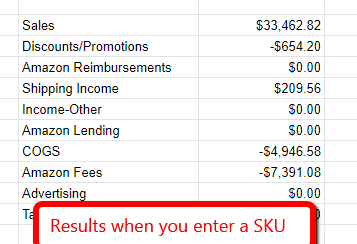

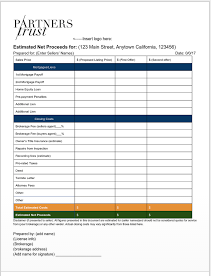

What Paperwork Is Needed to Sell a House Without a Realtor? 15.09.2021 · A seller’s net sheet is an organizational worksheet that will show you how much you’ll pocket from your home sale after factoring in expenses like taxes, your real estate agent’s commission (if you work with one), your remaining mortgage, and escrow fees. Typically, a home’s listing agent prepares the seller’s net sheet. It can also ... Mortgages | Understanding Seller Credits To Closing Costs ... The seller has agreed to give you a 3% credit to your closing costs ($7,500), but your closing costs total only $5,500. You don’t want to lose the extra $2,000 that the seller has agreed to credit you at closing. In this case you could approach your lender and ask them to give you a lower interest rate. In this particular case you have $2,000, which equals 1% of the loan …

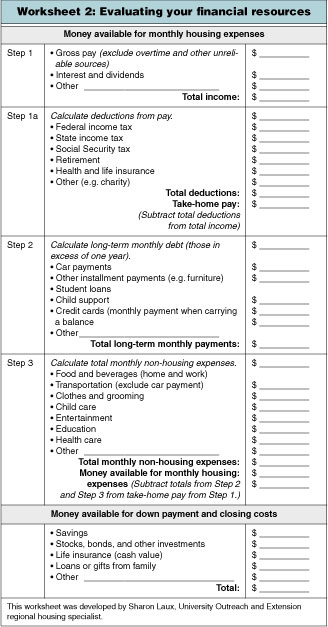

Mortgage Down Payment Center - Bank of America Down payment and/or closing cost assistance programs may not be available in your area. Down payment and/or closing cost assistance amount may be due upon sale, refinance, transfer, or repayment of the loan, or if the senior mortgage is assumed during the term of the loan. Some programs require repayment with interest, and borrowers should become fully …

Seller closing cost worksheet

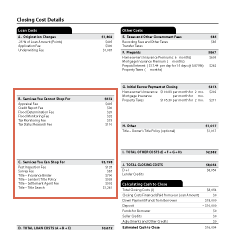

Earnest money check, down payment and closing costs: When ... Feb 28, 2019 · “A buyer can negotiate the seller to pay some or all of these costs,” adds Ailion. Related: Complete guide to mortgage closing costs. Closing costs are due when you sign your final loan documents. › florida-title-insurance-calculatorFlorida Title Insurance Calculator - With 2021 Promulgated ... Title insurance policy premiums in Florida show up as line items within a closing cost worksheet for a buyer and seller such as a Closing Disclosure, Loan Estimate, HUD-1, or an ALTA Settlement Statement. If you're looking to get a preview of what these costs look like, use this free Florida title insurance calculator. Closing Cost Estimator for Seller in NYC | Hauseit New York City Seller closing costs in NYC are between 8% to 10% of the sale price. Closing costs include a traditional 6% broker fee, combined NYC & NYS Transfer Taxes of 1.4 ...How much are seller closing costs in NYC?Is it possible to reduce my seller closing costs in NYC?

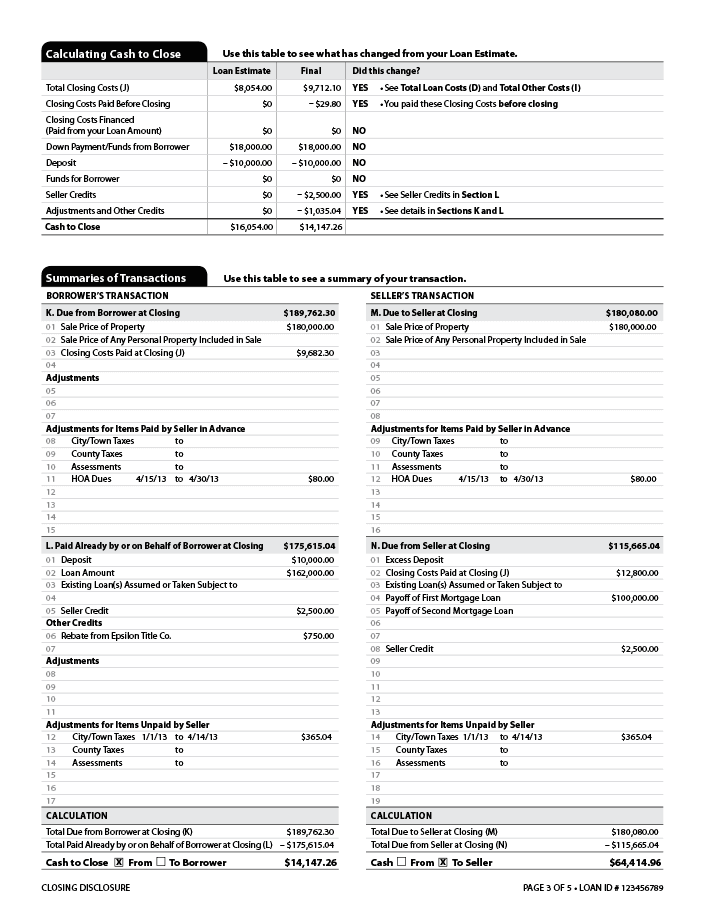

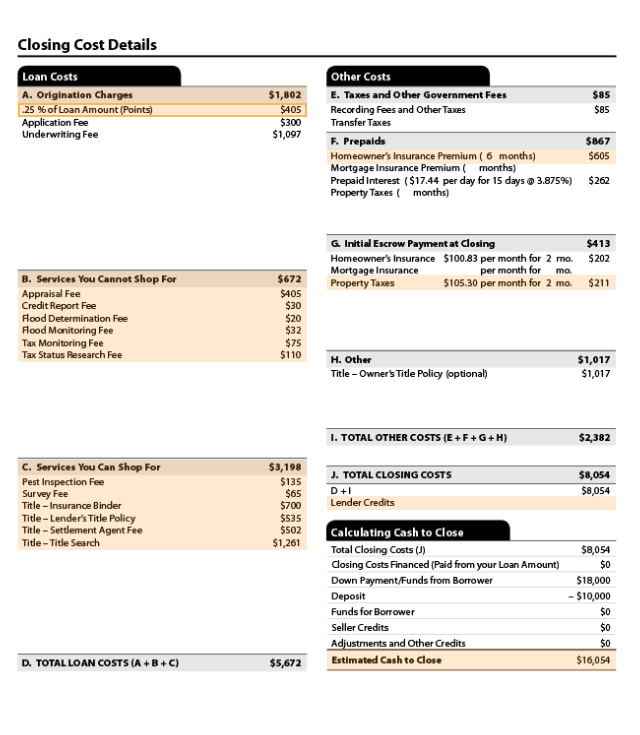

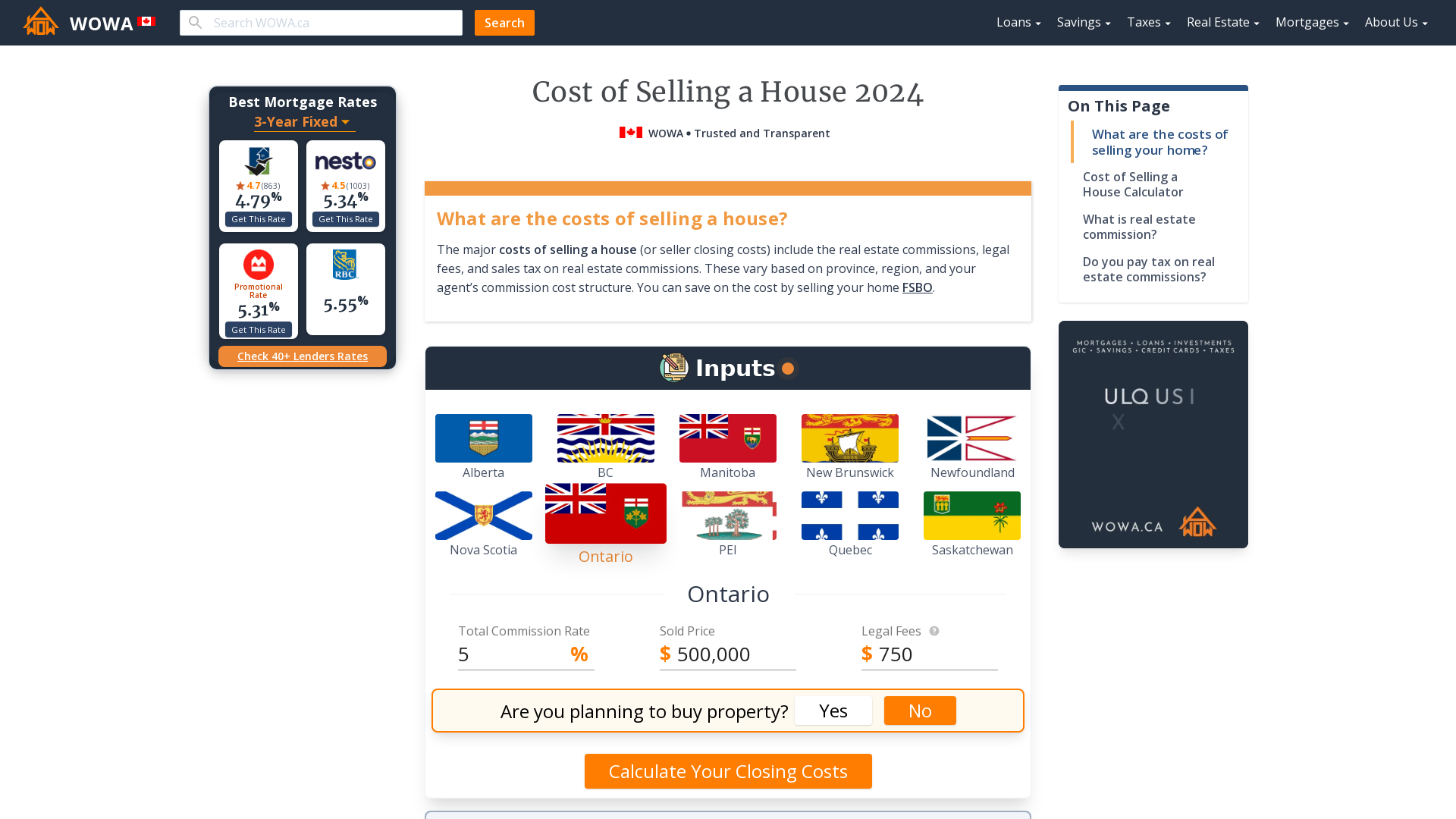

Seller closing cost worksheet. Florida Seller Closing Costs & Net Proceeds Calculator Easily calculate the Florida home seller closing costs and seller "net" proceeds with this online worksheet. In Column A, enter the property sale (or list) price on Line 1, and then enter the various closing costs; including the seller paid closing costs and real estate commission, if applicable. Click on "Print Column A" to print a nice clean closing cost estimate for the Florida … Closing Costs Calculator - SmartAsset One cost to the closing process comes from the amount you have to pay in advance for items you will be paying regularly as a homeowner. Our closing costs calculator accounts for those as well. Some of these pre-payments are placed into an escrow account (a special holding account from which funds can only be accessed in certain circumstances) so that there is a reserve in … From IT-2664 Nonresident Cooperative Unit Estimated Income ... A The transferor/seller is: an individual an estate or trust B ... Part 2 – Estimated tax information (Complete Worksheet for Part 2 on page 2 before completing this part.) 1 Sale price (from Worksheet for Part 2, line 15) ..... 1. 2 Total gain (from Worksheet for Part 2, line 17; if a loss, enter 0)..... 2. 3 Estimated tax due (from Worksheet for Part 2, line 20)..... 3. 00 Part 3 ... Cash To Close: Breaking It Down - Rocket Mortgage 06.07.2020 · If you aren’t sure what “cash to close” means, what your closing cost amounts are or how to pay them, read on to learn more. Cash To Close, Defined Cash to close (also referred to as funds to close) is the total amount of money you’ll need to pay on closing day to finalize the home purchase transaction. Unless you're using a dry closing, you'll need to know ahead of …

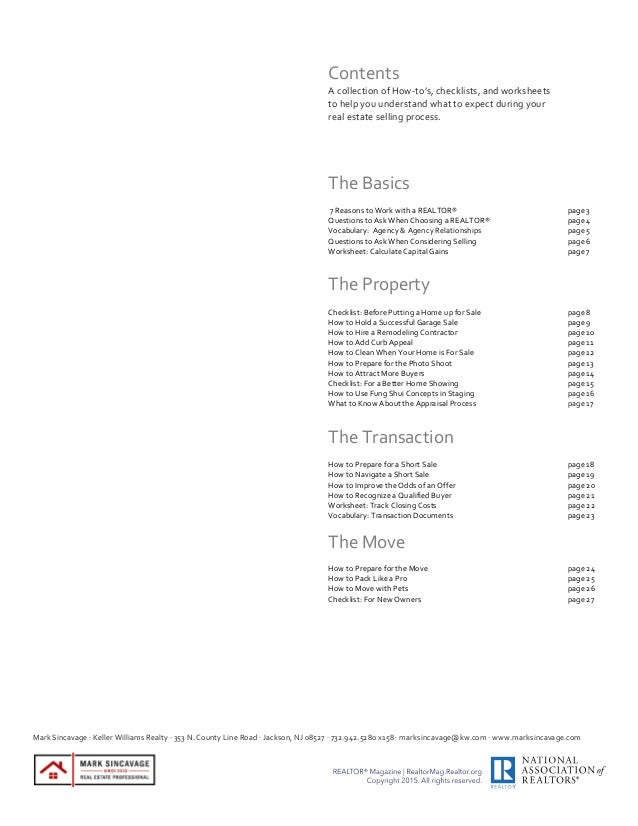

How to Close on a House For Sale By Owner | ForSaleByOwner A home buyer and seller can negotiate who hires a title company and pays associated fees. In most cases, the home seller pays for the owner’s title insurance policy while the buyer pays for the lender’s policy. If you’re the one responsible for ordering title, be sure to have everything sorted out before closing day. When it comes to escrow, you can typically use your title … › article › mortgagesStrategies for Lowering Your Closing Costs - NerdWallet The bill for closing costs is the final hurdle between home buyers and their new homes, and it can represent a surprising chunk of money. Closing fees run between 3% and 6% of the mortgage; that's ... › resources › allstateHome Buyer’s Closing Cost Worksheet - Allstate Cost range is $40 – 60. $ Important: You can use this worksheet to get a rough cost estimate of the typical closing, but please consult an attorney for a comprehensive estimate designed specifically for your situation. Keep in mind that some of the closing costs may be paid to either the seller or added to your mortgage. TOTAL: $ Disclaimer buildingadvisor.com › buying-land › making-an-offerBuying Land: How to Make an Offer That Protects You In general, a seller cannot legally get out of a deal if the buyer has made a reasonable effort to meet the closing deadline, but experienced delays with financing or other due diligence. However, the buyer cannot drag his feet indefinitely, or the seller has the right to cancel the deal.

› homebuying › closing-costsVA Loan Closing Costs - Complete List of Fees to Expect VA buyers can’t just roll their other closing costs and fees on top of their loan. But they can look to build them into the offer and have the seller pay for them at closing. For example, if you’re buying at $200,000 and expecting about $5,000 in closing costs, you can offer the seller $205,000 and ask them to cover your costs and fees. Average closing costs in 2022 | Complete list of closing costs 21.01.2022 · Closing cost calculators can give you a general estimate if you want to know what yours will be. But to find your exact closing costs so … › publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Your cost includes your down payment and any debt such as a first or second mortgage or notes you gave the seller or builder. It also includes certain settlement or closing costs. In addition, you must generally reduce your basis by points the seller paid you. Closing Cost Estimator for Seller in NYC | Hauseit New York City Seller closing costs in NYC are between 8% to 10% of the sale price. Closing costs include a traditional 6% broker fee, combined NYC & NYS Transfer Taxes of 1.4 ...How much are seller closing costs in NYC?Is it possible to reduce my seller closing costs in NYC?

› florida-title-insurance-calculatorFlorida Title Insurance Calculator - With 2021 Promulgated ... Title insurance policy premiums in Florida show up as line items within a closing cost worksheet for a buyer and seller such as a Closing Disclosure, Loan Estimate, HUD-1, or an ALTA Settlement Statement. If you're looking to get a preview of what these costs look like, use this free Florida title insurance calculator.

Earnest money check, down payment and closing costs: When ... Feb 28, 2019 · “A buyer can negotiate the seller to pay some or all of these costs,” adds Ailion. Related: Complete guide to mortgage closing costs. Closing costs are due when you sign your final loan documents.

![Seller Closing Cost Calculator Florida [Interactive] | Hauseit®](https://www.hauseit.com/wp-content/uploads/2021/04/Seller-Closing-Cost-Calculator-Florida.jpg)

![Comprehensive NYC closing Costs Guide [PDF download]](https://kohinalaw.com/wp-content/uploads/2018/05/Flyer-791x1024.jpg)

0 Response to "40 seller closing cost worksheet"

Post a Comment