40 fannie mae rental income worksheet

fannie mae rental income worksheet 2021 - stocktonthunder.com fannie mae rental income worksheet 2021. the great courses signature collection; by - January 31, 2022 0 ... B3-6-06, Qualifying Impact of Other Real ... - Fannie Mae If the mortgaged property owned by the borrower is. an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple ...

Mgic Income Calculation Worksheet 2021 and Similar ... › fannie mae rental income worksheet ... Mgic Rental Income Calculator Worksheet » Semanario . Income Semanarioangolense.net Show details . 4 hours ago Here are two simple questions to ask self-employed borrowers so you can save 10. Income Rental MGIC 2017pdf 1 MB Was this article helpful.Mgic Income Worksheet 2019 Jobs Ecityworks Our editable auto …

Fannie mae rental income worksheet

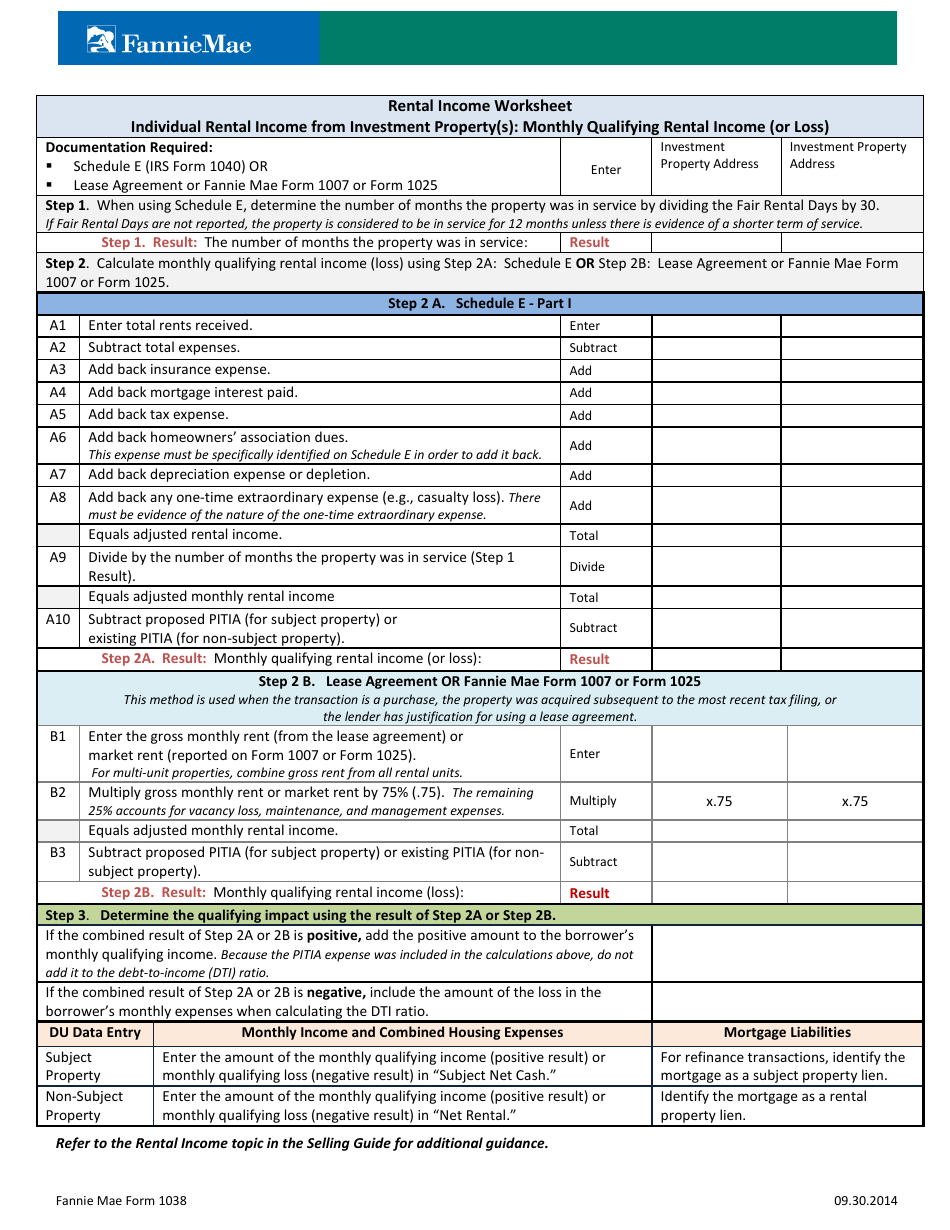

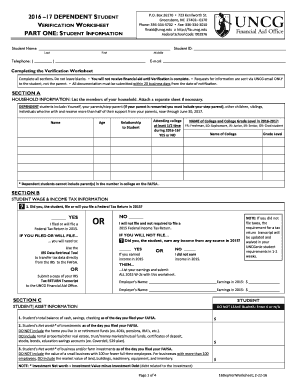

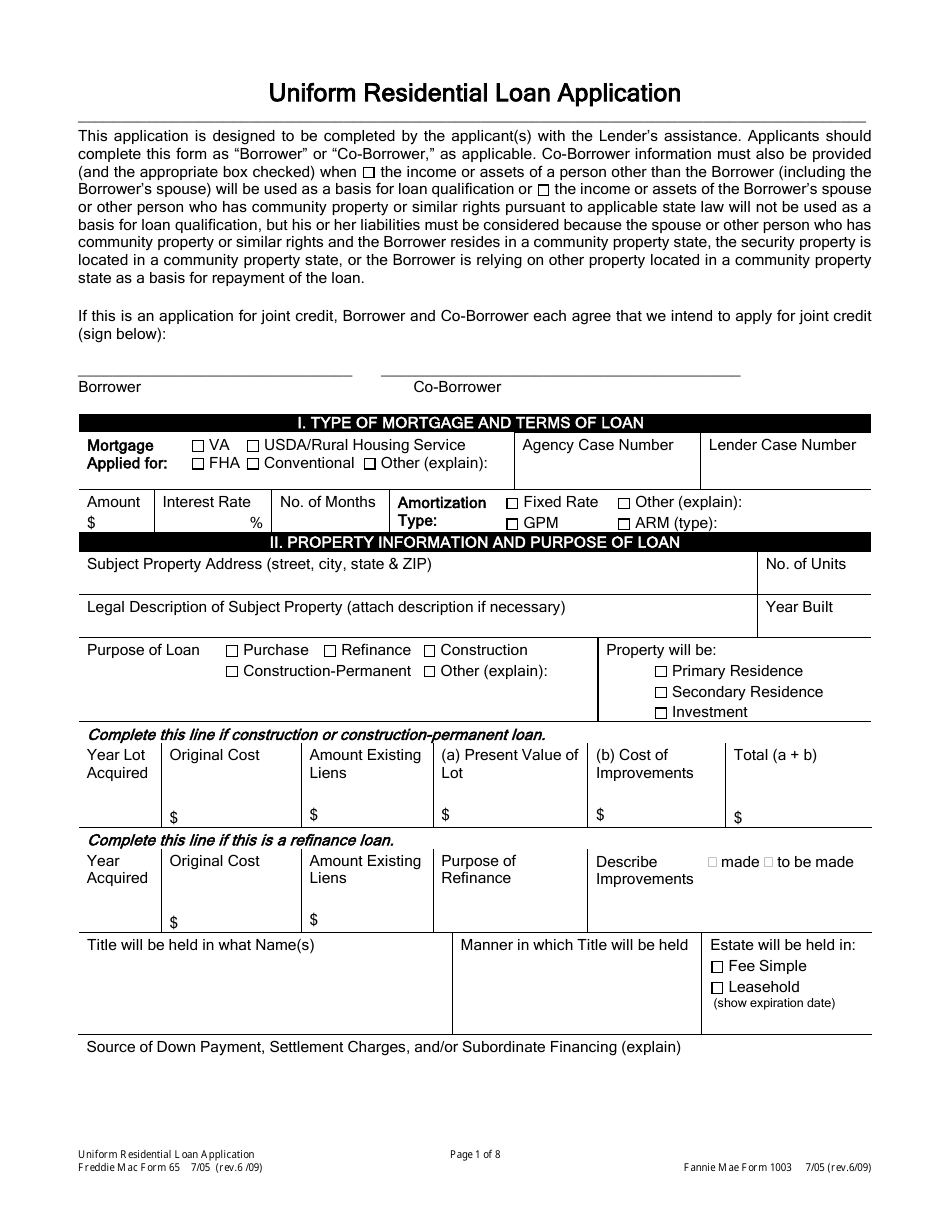

B3-3.5-02, Income from Rental Property in DU ... - Fannie Mae Entering Rental Income for the Subject Property in DU. The following rental income policies apply to properties that are the subject property. Refer to B3-3.1-08, Rental Income to determine the maximum amount of rental income that can be used for qualifying purposes for the subject property. Form 1003 7/05 (rev. 6/09) B3-3.1-09, Other Sources of Income (12/15/2021) - Fannie Mae For borrowers who have less than 25% ownership of a partnership, S corporation, or limited liability company (LLC), ordinary income, net rental real estate income, and other net rental income reported on IRS Form 1065 or IRS Form 1120S, Schedule K-1 may be used in qualifying the borrower provided the lender can confirm the business has adequate ... Fannie Mae Form 1038 Rental Income Worksheet | CATTE If the current leases or market rents specified on Form 1007 or Form 1025 are used, the lender must calculate the rental income by multiplying the gross monthly rent (s) by 75%. (This is called on Form 1007 "monthly market rent.") The remaining 25% of gross rent is offset by vacancy losses and ongoing maintenance costs.

Fannie mae rental income worksheet. Mgic Rental Income Calculation Worksheet » Semanario ... Fannie Mae Income Worksheet 2014-2021 Form. Enter B2 Multiply gross monthly rent or market rent by 75 75. Must be supported by a current lease agreement on the property. Form 91 Income Calculations. Net Rental Income Loss Line 22 1 2. Total Expenses Line 20 - 3. If blank proceed to enter business miles below 11 Miles. Gross Royalties Received. Fannie Mae Income Worksheet - Arithmetic Problems Worksheets Use Fannie Mae Rental Income Worksheets Form 1037 or Form 1038 to evaluate individual rental income loss reported on Schedule E. To start the form utilize the Fill Sign Online button or tick the preview image of the blank. Schedule E Supplemental Income and. Steady Stable or. Rental income worksheet documentation required. Total Expenses Line 20 c. What is required for foreign income? - Fannie Mae Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. . Verification of Foreign Income. Copies of his or her signed federal income tax returns for the most recent ... How is rental income calculated when the ... - Fannie Mae In the event the borrower only claims a portion of the rental income due to partial ownership of the rental property, the lender may use a current lease agreement. Note that the other owner (s) of the property cannot be borrowers on the subject loan. For additional information, see B3-3.1-08, Rental Income and Fannie Mae's eLearning course ...

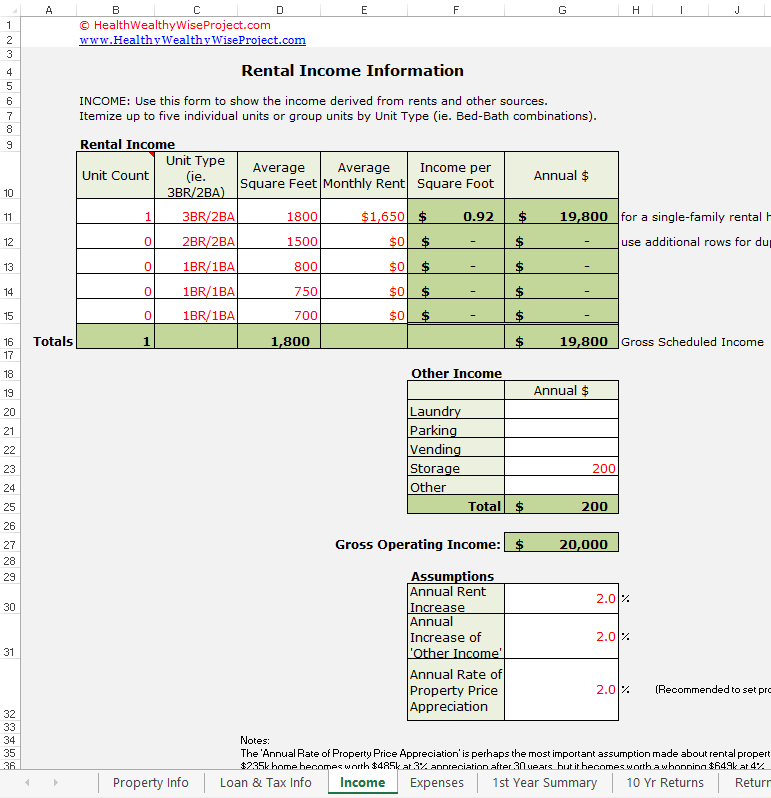

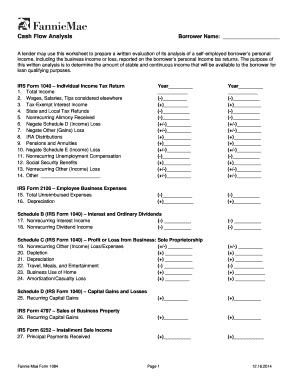

Fannie Mae Income Calculation Worksheet Rental Income Calculation 2019 201 NOTES 1 Gross Rents Line 3 Check applicable guidelines if not using 12. Income or losses reported on Schedule E was initially negated in place first part start the analysis. Fannie mae income calculated by fannie mae acceptable to. Cash Flow Analysis The following self-employed income analysis worksheet and accompanying guidelines generally apply to individuals: Who have 25% or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income, have earnings reported on IRS Form 1099, or income that cannot otherwise be verified by an … Fannie Mae Income Calculation Worksheet - Summarized by ... 12 months unless there is of shorter term of service. Step 1. Result number of months property was in Result Step 2. Calculate monthly qualifying rental income loss using 2A Schedule E or Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2. Schedule E-Part I A1 total rents receive * A2 Subtract total expenses. 43 Fannie Mae Rental Income Worksheet - Worksheet Master Fannie mae publishes four worksheets that lenders may use to calculate rental income. How To Use Fnma 1039 On Form 8825 Uberwriter. PDF Fannie Mae Self-Employed Income Analysis Rents (from Schedule E): Depreciation related to income (or loss) from rentals must be added back to net gain (or loss). Use for business income only.

42 rental income calculation worksheet - Worksheet Information PDF Form 1038: Rental Income Worksheet - Genworth Financial Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I A1 Enter total rents received. Enter A2 Subtract total expenses. Mgic Rental Income Calculation Worksheet » Judithcahen ... Mgic rental Income Worksheet fannie Mae Self employed Worksheet Mgic sam Worksheet 2019. EMPLOYEE BUSINESS EXPENSES 9 Total Expenses. Our cash flow analysis worksheets promote ease and accuracy in determining self-employed borrowers income. Result Step 2 Calculate the monthly qualifying rental income using Step 2A. Gross Royalties Received. Fnma Self Employed Worksheet - Studying Worksheets The following self-employed income analysis worksheet and accompanying guidelines generally apply to individuals. Fnma self employed worksheet. Self-Employed Easy Entry Calculator 1120 Corporation Rental Income 8825 2106 Description 2015 added forms FNMA 1037 1038 1039 8825 2016 Underwriter Notes 2017 chnaged form code to RAF509 was 507 doaks. Fnma Fillable Rental Income Worksheet - Rental Services ... Posted: (1 days ago) Jul 10, 2021 · Month-to-month fannie mae rental income worksheet is a straightforward economical manager tool that could be use both Digital or printable or Google Sheets. If you utilize the Digital template, you can also make fannie mae rental income worksheet on Microsoft Excel.

Mgic Schedule E Rental Income Worksheet » Judithcahen ... Use Fannie Mae Rental Income Worksheets Form 1037 or Form 1038 to evaluate individual rental income loss reported on Schedule E. Net Rental Income Calculations Schedule E.

Mgic Rental Income Calculator Worksheet » Semanario ... A lender may use Fannie Mae Rental Income Worksheets Form 1037 or Form 1038 or a comparable form to calculate individual rental income loss reported on Schedule E. Income Rental MGIC 2017pdf 1 MB Have more questions.

B3-3.1-08, Rental Income (06/03/2020) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

2020 Instructions for Schedule CA (540NR) | FTB.ca.gov 01/01/2015 · Rental Real Estate Activities – For taxable years beginning on or after January 1, 2020, the dollar limitation for the offset for rental real estate activities shall not apply to the low income housing credit program. For more information, see R&TC Section 17561(d)(1). Get form FTB 3801-CR, Passive Activity Credit Limitations, for more information.

Self-Employed Cash Flow Calculator - Radian Guaranty, Inc. Who own rental property; Who receive variable income, have earnings reported on IRS 1099, or cannot otherwise be verified by an independent and knowable source; To estimate and analyze a borrower's cash flow situation, enter the required data into the cash flow analysis calculator according to the calculations that appear on the borrower's tax returns. Line by line …

Mgic Rental Income Calculator Worksheet » Judithcahen ... A lender may use Fannie Mae Rental Income Worksheets Form 1037 or Form 1038 or a comparable form to calculate individual rental income loss reported on Schedule E. YTD Avg using. Become A Partner The Hague Security Delta Met Afbeeldingen. ORDINARY INCOME NET RENTAL INCOME. Enter B2 Multiply gross monthly rent or market rent by 75 75.

B3-3.4-01, Analyzing Partnership Returns for ... - Fannie Mae Overview. Partnerships and some LLCs use IRS Form 1065 for filing informational federal income tax returns for the partnership or LLC. The partner's or member-owner's share of income (or loss) is carried over to IRS Form 1040, Schedule E. See B3-3.2-02, Business Structures, for more information on partnerships and LLCs.

Fannie Mae Form 1038 Rental Income Worksheet | CATTE If the current leases or market rents specified on Form 1007 or Form 1025 are used, the lender must calculate the rental income by multiplying the gross monthly rent (s) by 75%. (This is called on Form 1007 "monthly market rent.") The remaining 25% of gross rent is offset by vacancy losses and ongoing maintenance costs.

B3-3.1-09, Other Sources of Income (12/15/2021) - Fannie Mae For borrowers who have less than 25% ownership of a partnership, S corporation, or limited liability company (LLC), ordinary income, net rental real estate income, and other net rental income reported on IRS Form 1065 or IRS Form 1120S, Schedule K-1 may be used in qualifying the borrower provided the lender can confirm the business has adequate ...

B3-3.5-02, Income from Rental Property in DU ... - Fannie Mae Entering Rental Income for the Subject Property in DU. The following rental income policies apply to properties that are the subject property. Refer to B3-3.1-08, Rental Income to determine the maximum amount of rental income that can be used for qualifying purposes for the subject property. Form 1003 7/05 (rev. 6/09)

0 Response to "40 fannie mae rental income worksheet"

Post a Comment