39 foreign earned income tax worksheet

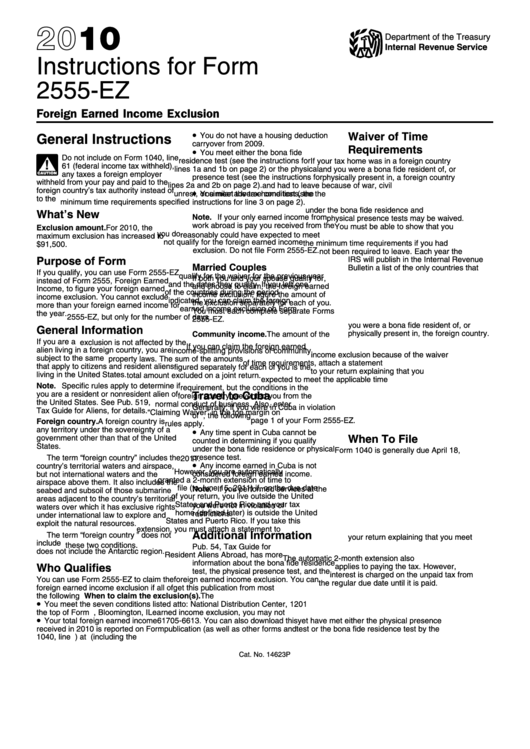

Demystifying IRS Form 1116- Calculating Foreign Tax Credits Similarly, an overall foreign loss reduces taxable U.S. source income in the year generated and thus the U.S. tax on U.S. source income earned in that year. Section 904(f) recaptures the loss, however, by re-sourcing foreign source income earned in a later year as domestic source. Federal Foreign Earned Income Exclusion - TaxFormFinder More about the Federal Form 2555-EZ Individual Income Tax Tax Credit TY 2021 We last updated the Foreign Earned Income Exclusion in January 2022, so this is the latest version of Form 2555-EZ , fully updated for tax year 2021.

1040-US: Form 2555 Foreign Earned Income Allocation Worksheet and Form ... The worksheets provide support for amounts reported on Form 2555 and Form 1116. All worksheets are designed to be submitted with the return. Form 2555 Foreign Earned Income Allocation Worksheet. The Form 2555 Foreign Earned Income Allocation Worksheet is designed to report the allocation between U.S. and foreign earned income.

Foreign earned income tax worksheet

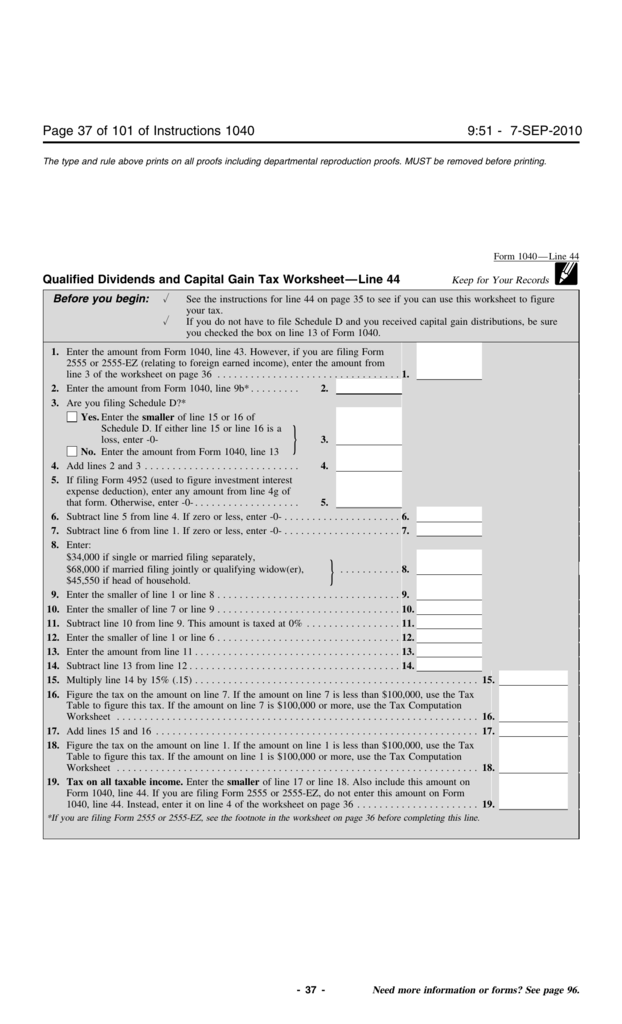

Demystifying IRS Form 1116- Calculating Foreign Tax Credits Similarly, an overall foreign loss reduces taxable U.S. source income in the year generated and thus the U.S. tax on U.S. source income earned in that year. Section 904(f) recaptures the loss, however, by re-sourcing foreign source income earned in a later year as domestic source. Re-sourcing applies to an amount of foreign source income equal ... Foreign earned income tax worksheet HELP | Expat Forum For People ... Fundamentally, it changes the calculation of tax you pay on your income to reflect your AGI + excluded income but then only applies that tax rate on only your non-excluded income. Say you had an income of 110,000 and excluded 100,000. Before they introduced this change you would have looked up 10,000 in the tax tables. Qualified Dividends and Capital Gains Worksheet Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet ..... 26. 27. Tax on all taxable income. Enter the smaller of line 25 or 26. Also include this amount on the entry space on Form 1040 or 1040 ...

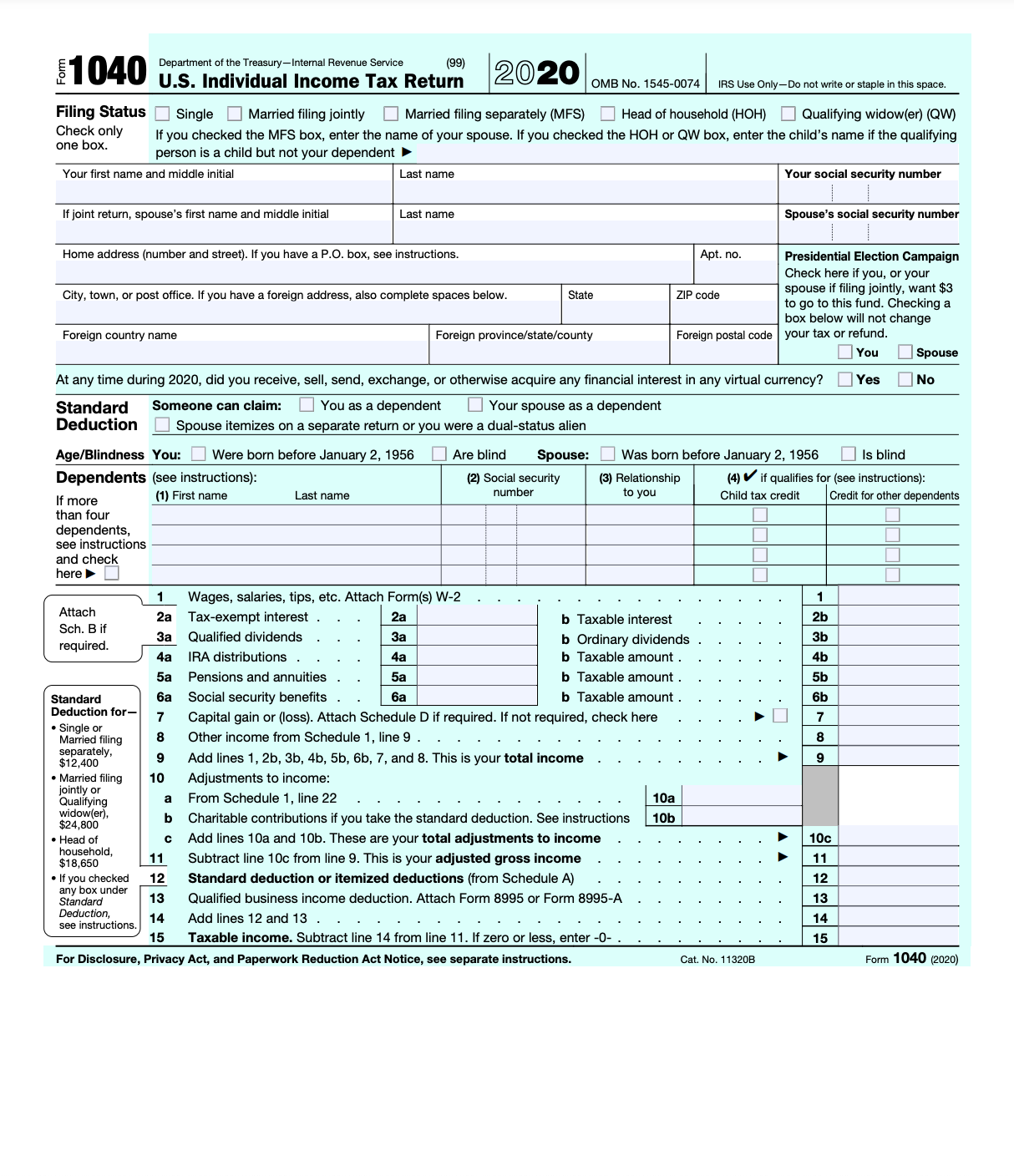

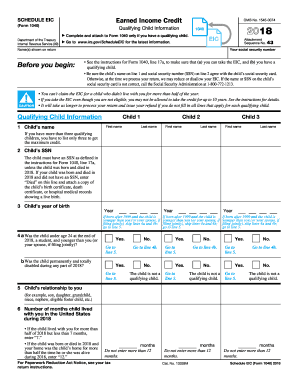

Foreign earned income tax worksheet. I am filling out the foreign earned income tax worksheet and… I am filling out the foreign earned income tax worksheet and am unsure what to put on line 2b. I have filled out the 2555EZ and am using the 1040. Accountant's Assistant: Have you talked to a tax professional about this? I tried calling the irs and was told I needed to speak with their tax lawyers, but I am unable to do so. Credit (EIC) Page 1 of 44 13:39 - 10-Jan-2022 Earned Income 2555 (relating to foreign earned income). 6. Your investment income must be $10,000 or less. 7.You must have earned income. 8. Your child must meet the relationship, age, residency, and joint return tests. 9. Your qualifying child can’t be used by more than one person to claim the EIC. 10. You can’t be a qualifying child of another person ... Expat Tax Services, Preparation, & Consultation - WCG CPAs But, if you earn wages as an employee or have self-employment income while working in a foreign country as an ex-patriate or expat, you might be able to use the foreign earned income exclusion to exclude up to $107,600 (for the 2021 tax year) as tax-free income (or 2 x $108,700 or $217,400 if married to another foreign income earner). Claiming the Foreign Tax Credit with Form 1116 - TurboTax 08/11/2021 · Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when: You paid the tax on your …

Foreign Earned Income Tax Worksheet - US Legal Forms The following tips will allow you to fill out Foreign Earned Income Tax Worksheet quickly and easily: Open the document in the full-fledged online editor by clicking Get form. Fill in the necessary boxes that are marked in yellow. Press the arrow with the inscription Next to jump from field to field. Use the e-signature solution to add an ... Foreign Earned Income Tax Worksheet Confusion Assuming 162k income, single with 12k standard deduction and 110k income exclusion (using approximates for simplicity). Line 1 = 40k. Line 2a and 2c = 110k. Line 3 = 150k. Line 4 = 27k (or 30K from tax computation worksheet) Line 5 = 17.4k (20.4 from tax computation worksheet) Line 6 (tax) = 9.6k. Tax on 162 - 110 = 52 is 4.5k. Fillable Foreign Earned Income Tax Worksheet—Line 11a (IRS) Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Foreign Earned Income Tax Worksheet—Line 11a of Form 1040 (IRS) On average this form takes 2 minutes to complete. The Foreign Earned Income Tax Worksheet—Line 11a (IRS) form ... Credit (EIC) Page 1 of 44 13:39 - 10-Jan-2022 Earned Income 2555 (relating to foreign earned income). 6. Your investment income must be $10,000 or less. 7.You must have earned income. 8. Your child must meet the relationship, age, residency, and joint return tests. 9. Your qualifying child can’t be used by more than one person to claim the EIC. 10. You can’t be a qualifying child of another person. 11.

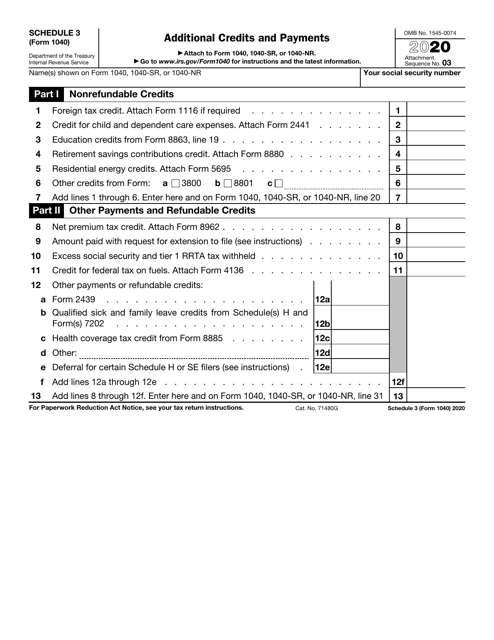

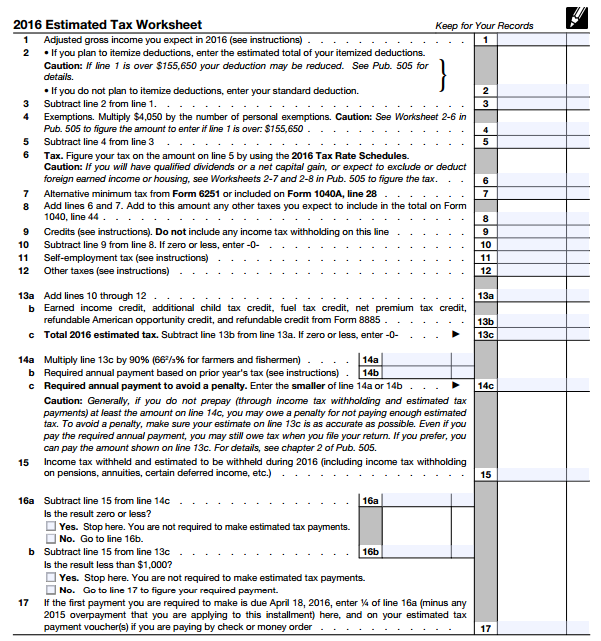

MARYLAND RESIDENT INCOME 2021 FORM TAX RETURN 502 Local tax (See Instruction 19 for tax rates and worksheet.) Multiply line 20 by your local tax rate.0 or use the Local Tax Worksheet..... 28. 29. Local earned income credit (from Local Earned Income Credit Worksheet in Instruction 19.) .. 29. 30. PDF 2020 Tax Computation Worksheet—Line 16 - H&R Block and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter the amount from that form or worksheet in column (a) of the row that applies to the amount you are looking up. Enter the result on the appropriate line of the form or worksheet that you are completing. Section A— MARYLAND RESIDENT INCOME 2021 FORM TAX RETURN 502 Maryland tax (from Tax Table or Computation Worksheet Schedules I or II) ..... 21. 22. Earned income credit (EIC) (See Instruction 18.)..... 22. Check this box if you are claiming the Maryland Earned Income Credit, but do not qualify for the federal Earned Income Credit. Foreign Earned Income Exclusion | Internal Revenue Service 08/12/2021 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions.

Line 44 is higher than amount computed from IRS tax table Foreign Earned Income Tax Worksheet. If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555 or 2555-EZ, you must figure your tax using the Foreign Earned Income Tax Worksheet. The TurboTax program calculates your tax based on the IRS Foreign Earned Income Tax Worksheet—Line 44

Federal Income Tax and Benefit Guide – 2021 - canada.ca Step 2 –Total income. Income you earned that was not reported on an information slip must still be reported on your tax return. Report foreign income and other foreign amounts. Report in Canadian dollars foreign income and other foreign currency amounts (such as expenses and foreign taxes paid).

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a*..... 2. 3. Are you filing Schedule D?* Yes.Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. 3.

Foreign earned income tax worksheet - Google Groups The foreign earned income tax worksheet reported the taxable amount then added back in the exclusion of 48,000 then the tax was calculated resulting in much higher tax thus negating the entire exclusion is this normal? I can't find a reasonable explanation on this one. She has no plans to move back to the US so this will be a yearly happening.

FEC Worksheet - Entering Foreign Earned Income in the Program You should instead complete the FEC (Foreign Employer Compensation) worksheet. This income will appear on Form 1040 U.S. Individual Income Tax Return, Line 1 (if entered in the Foreign Employer's Compensation Amount field) or Form 1040, Line 4 (if entered in the Foreign Pension Received or Taxable Amount of Foreign Pension fields).

Why doesn't the tax on my return (line 16) match the Tax Table? If you claimed the Foreign Income Exclusion, housing exclusion or housing deduction on form 2555, you must figure your tax using the Foreign Earned Income Tax Worksheet. 1040 Instructions Line 16 , Foreign Earned Income. The program has already made this calculation for you. Does you return contain capital gains or qualified dividends? When you ...

Foreign Earned Income Tax Worksheet - TaxAct The Foreign Earned Income Tax Worksheet figures the applicable tax rate by combining the amounts (line 3) and subtracting from that tax calculation (line 4) the tax that would have been due on the foreign earned income (line 5). This does not apply tax directly on the FEI, but the exclusion does bump the tax rate up. The FEC worksheet is not an ...

Foreign tax credits and earned income FAQs (1040) UltraTax CS printed a Form 2555 Foreign Earned Income Allocation Worksheet and a Form 2555 Deductions Allocable to Excluded Income Worksheet. What is the purpose of these worksheets? I see force fields in Screen 2555-2 for wages, business income, and partnership income. How can I get the tax application to calculate these amounts?

Federal Form 2555-EZ (Foreign Earned Income Exclusion) We last updated the Foreign Earned Income Exclusion in January 2022, so this is the latest version of Form 2555-EZ, ... Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not …

How to Report Foreign Earned Income on your US Tax Return If you are a U.S. citizen or resident during tax year, you likely have foreign income that you must report on your tax return. Here we help you to understand a few concepts affecting foreign income. The main foreign income concepts (explained below) are: General Rules Regarding Foreign Income; The Foreign Tax Credit; The Foreign Earned Income ...

Foreign Earned Income Exclusion | Internal Revenue Service Dec 08, 2021 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions.

Foreign Earned Income Tax Worksheet - US Legal Forms Fill out each fillable area. Ensure that the info you add to the Foreign Earned Income Tax Worksheet is updated and accurate. Add the date to the sample using the Date option. Select the Sign tool and create an electronic signature. You will find 3 available alternatives; typing, drawing, or uploading one.

PDF Foreign Earned Income Tax Worksheet (PDF) - IRS tax forms Foreign Earned Income Tax Worksheet—Line 11a. Keep for Your Records. CAUTION! If Form 1040, line 10, is zero, don't complete this worksheet. 1. Enter the amount from Form 1040, line 10 ... or line 6 of your Schedule D Tax Worksheet by any of your capital gain excess not used in (1) above. 3. Reduce (but not below zero) the amount on your ...

Foreign Income Worksheet - Capital Group Foreign Income Worksheet 2021 Worksheet instructions For each fund and share class owned, enter the Total Ordinary Dividends reported in Box 1a of Form 1099-DIV next to the fund's name in the worksheet.

1040 (2021) | Internal Revenue Service - IRS tax forms Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments. Line 25 Federal Income Tax Withheld. Line 25a—Form(s) W-2; Line 25b—Form(s) 1099; Line ...

Foreign - Intuit Accountants Community why is the excluded foreign income added back on the foreign earned income tax worksheet? My client worked in US and Switzerland. Her original return only reported the US wages. I am now amending to reflect the Swiss wages also. The 2555 excluded the swiss wages but on the 1040 the tax worksheet adds the income back in and the client owes $.

0 Response to "39 foreign earned income tax worksheet"

Post a Comment