43 self employed expense worksheet

Tax Deductions for Self-Employed Workers - FreshBooks Top 10 Tax Deductions for Self-Employed Workers. 1. Self-Employment Tax. As a self-employed person, you have to pay more for Medicare and Social Security taxes, because you don't have an employer splitting the cost with you. If you're self-employed, you are obligated to pay 15.3 percent of your earnings toward the self-employment tax, which ... B3-3.2-01, Underwriting Factors and Documentation for a Self-Employed ... The lender must prepare a written evaluation of its analysis of a self-employed borrower's personal income, including the business income or loss, reported on the borrower's individual income tax returns. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower.

› how-much-can-iHow Much Can I Contribute To My Self-Employed 401k Plan? Mar 22, 2022 · A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. A self-employed 401k plan is also know as a Solo 401k plan. This article will discuss how much you can contribute to your self-employed 401k plan. For 2021, the IRS says you can contribute up to $61,000 in your self-employed 401k plan. The amount should go up by $500 - $1,000 every one or ...

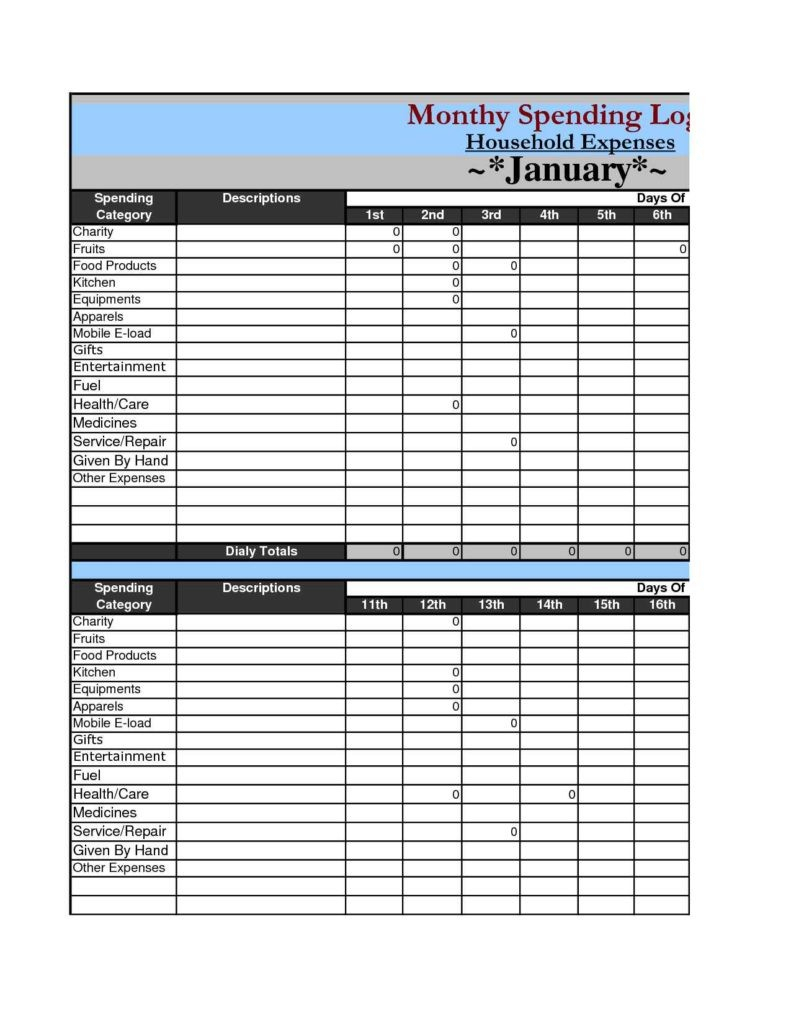

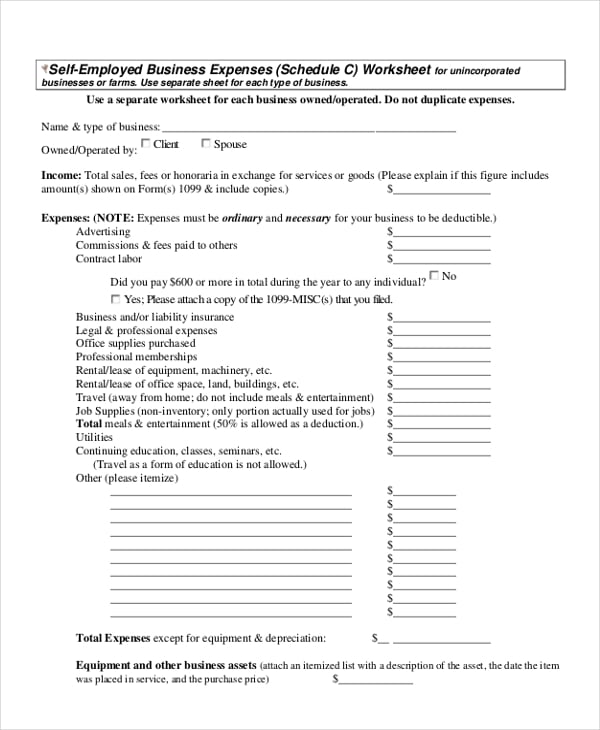

Self employed expense worksheet

LLC Expenses Cheat Sheet - LLC Tax Deductions | TRUiC Above-the-line deductions can be calculated using Schedule 1 of your individual tax return and can include educator expenses, self-employed retirement plans, self-employed health insurance, and early withdrawal penalties. Pay Taxes on Time. Self-employed individuals are mandated by the IRS to pay their designated taxes quarterly. › obamacare › self-employedSelf-employed health insurance deduction | healthinsurance.org For the self-employed, health insurance premiums became 100% deductible in 2003. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. If you have an S-corp, you should be aware of a 2015 notice regarding reimbursement for health premiums. › businesses › small-businesses-selfSimplified Option for Home Office Deduction | Internal ... May 06, 2022 · Beginning in tax year 2013 (returns filed in 2014), taxpayers may use a simplified option when figuring the deduction for business use of their home

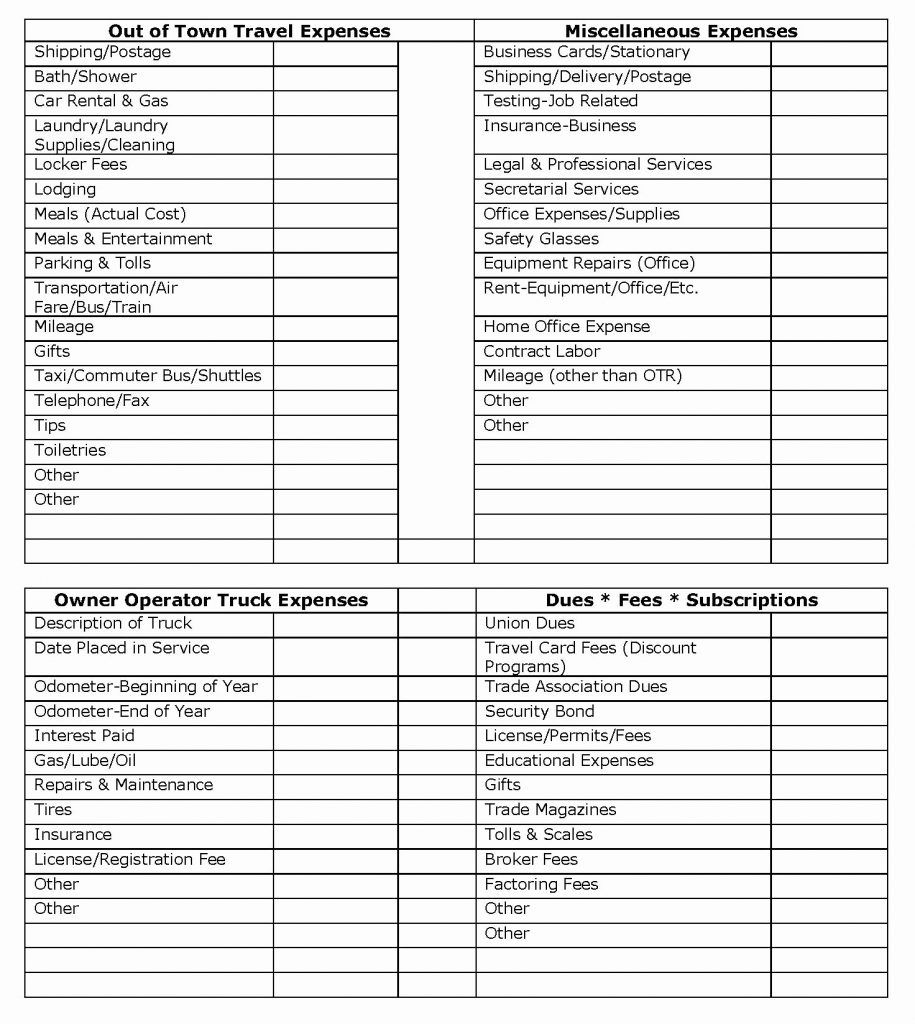

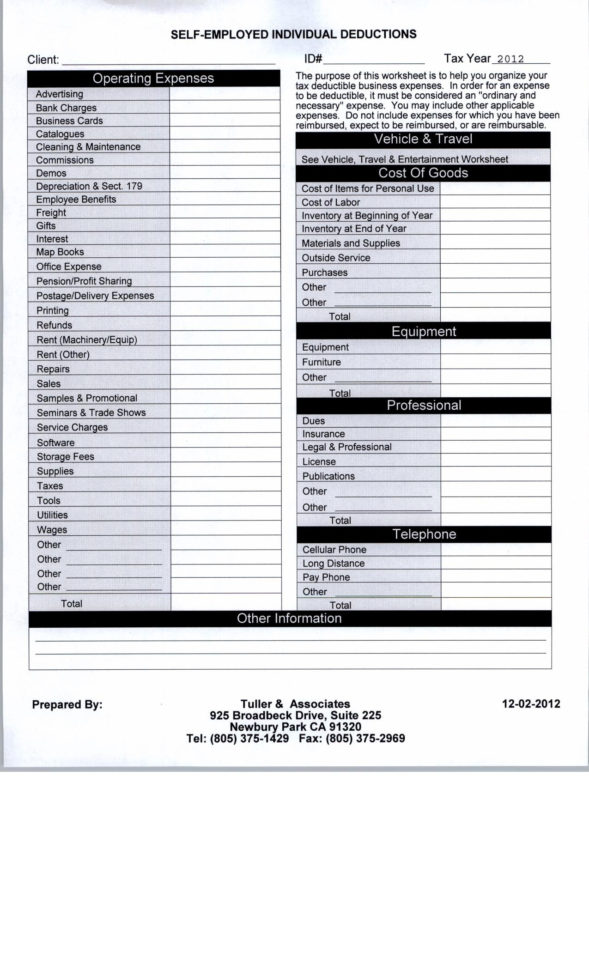

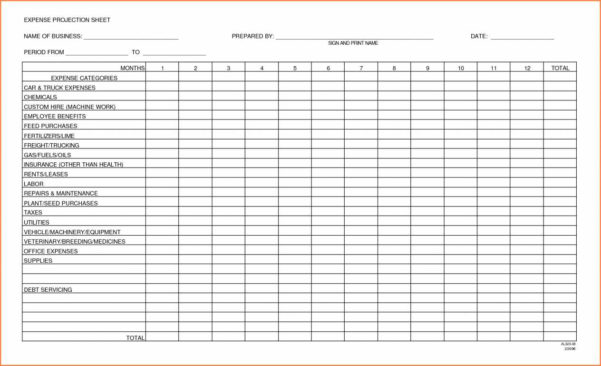

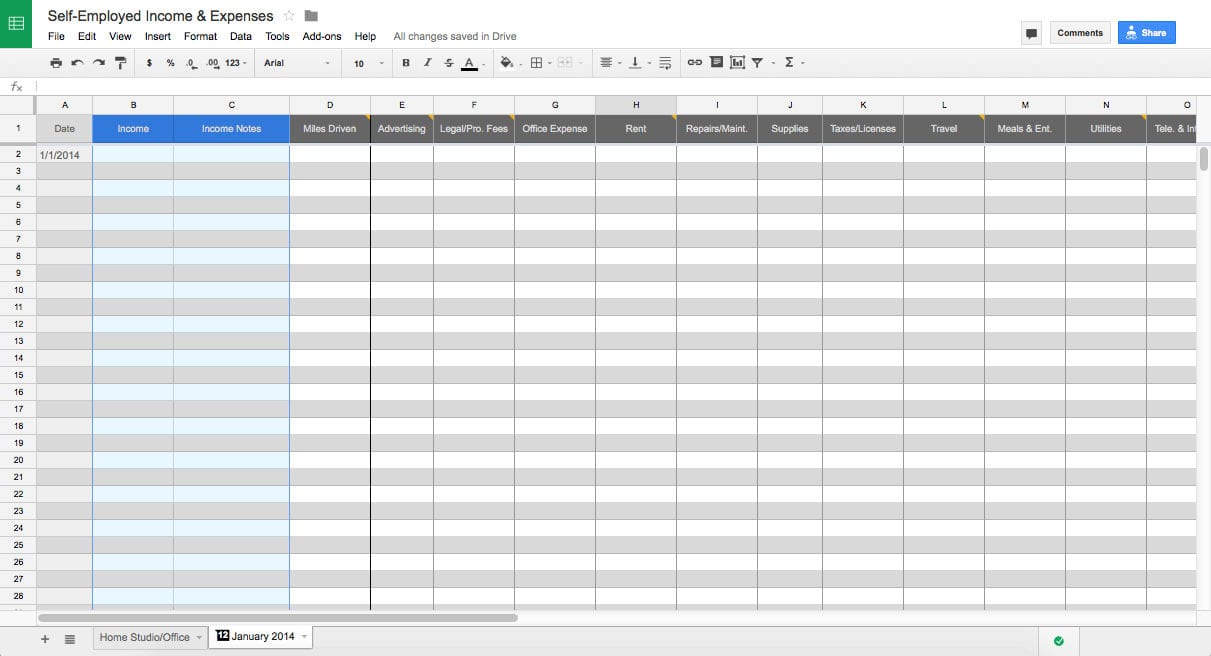

Self employed expense worksheet. Self-employed expenses: which allowable expenses can I claim? Self-employed allowable expenses list. Here is a list of the most common allowable expenses that you can claim against your income tax: 1. Office supplies. You can claim for office supplies such as. Stationery. Printing costs / ink. Postage. Phone and internet bills. Reporting Self-Employment Business Income and Deductions office expenses. You can also deduct: 1. Car and truck expenses: You can report these costs in one of two ways: Enter your actual expenses—for gas, oil changes, repairs, insurance, etc.—if you have supporting documentation, or take the IRS standard mileage rate. The rate for 2021 is 56 cents per mile. turbotax.intuit.com › tax-tips › health-careThe Ultimate Medical Expense Deductions Checklist - TurboTax ... Oct 16, 2018 · Self-Employed defined as a return with a Schedule C/C-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA ... Budget Spreadsheet: Financial Tool to Manage Your Money Generally, you have 4 possible ways to set up your financial tracking spreadsheet. You can use: a free app. a spreadsheet (Google Docs or Excel) a paid tool. a pen and a paper. And when it comes to the budget worksheets, you want to get the best of the best solutions possible to customize it to your needs.

Self-Employment Income (T2125) | TaxCycle Self-Employment Income (T2125) Updated: 2021-11-17. The Prepare sidebar has a group for income statements. It includes statements for: T776 Rental income. T1163/T1273 AgriStability. T2042 Farming income. T2121 Fishing income. T2125 Business and professional income. Self-Employment Tax: Calculate And File For 2022 - Rocket Mortgage The self-employment tax for the 2021 tax year - the taxes most people will be paying by April 18 of 2022 - stands at 15.3%. This covers your Social Security and Medicare taxes. If you were working a typical full-time job, your employer would take your Social Security and Medicare taxes out of your paychecks each pay period. Schedule C and expense categories in QuickBooks Self-Employed Learn about Schedule C categories and how to categorize transactions in QuickBooks. If you're self-employed, you use a Schedule C form to report your self-employed income and expenses. It's also known as Form 1040. Each time you categorize a transaction, QuickBooks Self-Employed matches it to a line on your Schedule C. Income and Expense Tracking Worksheet - Vertex42.com Description. This version was created specifically for printing and completing by hand. This worksheet can be the first step in your journey to control your personal finances. Step 1: Track your Income and Expenses. Step 2: Use that information to create a budget. Step 3: Continue tracking to help you stick to your budget.

Self Employed Expense Sheet - 15 images - self employed business ... [Self Employed Expense Sheet] - 15 images - self employed expense spreadsheet spreadsheet download self employed, employment expense forms bundle, profit and loss statement template for self employed excel example of, free business expense sheet template in microsoft word excel apple, ... 8 Best Images Of Tax Itemized Deduction Worksheet Irs ... form 1040 schedule 1 line 16 worksheet - Intuit form 1040 schedule 1 line 16 worksheet. I using Turbo Tax Home and Business Windows desktop version, and I have a question about form 1040 schedule 1 line 16 worksheet data entry. I navigate to the the following section: -- Self-employed Retirement screen , click (Start/Update) button. -- I entered Employer Matching (Profit Sharing) Contributions. singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae A self-employed borrower’s share of Partnership or S Corporation earnings can only be considered if the lender obtains documentation, such as Schedule K-1, verifying that the income was actually distributed to the borrower, or the business has adequate liquidity to support the withdrawal of earnings. If the Schedule K-1 provides this Independent Contractor Expenses Spreadsheet: Everything You Need to ... Tax deductions are expenses, often for business, that can be subtracted from your gross taxable income—helping you lower your tax payments and invest in your work. Stay up to date on common independent contractor tax deductions: Self-employment tax: You can deduct half of your Medicare health insurance and Social Security taxes.

15 Self-Employment Tax Deductions in 2022 - NerdWallet The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Self-employment tax is not the same as income ...

Bookkeeping Templates For Self Employed - 5 Useful Templates Cash Book - Free Bookkeeping Templates for Self Employed. Our cash book is simple to use and has some good features. Set-up takes under 5 minutes. You can change the names of the sales and expenditure categories to suit your business. All the figures for the year are calculated on an annual profit and loss report.

What Is the Self-Employed Health Insurance Deduction? The self-employed health insurance deduction is an adjustment to income, also known as an "above-the-line deduction" because you don't need to itemize to claim it. Instead, you claim the deduction in Part II of Schedule 1, Additional Income and Adjustments to Income. The IRS Instructions for Form 1040 include a worksheet to help you calculate ...

Free Expense Tracking Worksheet Templates (Excel) This budget spreadsheet is perfect for personal use. It's simple but provides what you need to stay on top of your expenses and earnings. It includes three columns: What's Coming In (Earnings), What's Going Out (Fixed expenses), and What's Going Out (Variable expenses). On top of the columns, you can see a total counter for both earnings and ...

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it's usually better to just track your actual home expenses. Hopefully, this free worksheet — and the Keeper Tax app — can take the hassle out of expense tracking. {filing_upsell_block}

Self-Employment Tax: Everything You Need to Know - SmartAsset Self-employed workers pay self-employment tax. This 15.3% tax covers Medicare and Social Security taxes. ... use Schedule C of Form 1040 to calculate your net self-employment income. If your business expenses come out to $5,000 or less, you may be able to file Schedule C-EZ instead of Schedule C. ... Filling out the form's worksheet will ...

Calculation of SE Health Insurance Deduction when claiming the Premium ... The Simplified Calculation Method. Step 1: Figure your adjusted gross income (AGI), modified AGI, and household income using the total of Worksheet X, line 15 as your self-employed health insurance deduction on line 29 of the printed copy of Form 1040 or Form 1040NR . Use Worksheets 1-1 and 1-2 in the Form 8962 instructions to figure modified ...

› files › 109128408Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate.

› publications › p560Publication 560 (2021), Retirement Plans for Small Business Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in chapter 5. Carryover of Excess SEP Contributions If you made SEP contributions that are more than the deduction limit (nondeductible contributions), you can carry over and deduct the difference in later years.

Tax Preparation Worksheets by Lake Stevens Tax Service - LSTAX.com Self-Employed Income & Expense Worksheet. This worksheet helps self-employed clients prepare both their income and expense information. Organizing this information, along with receipts prior to our appointment ensures the best tax outcome possible. Download HERE.

Independent Contractor Expenses Spreadsheet - Pruneyardinn Contractor Expense Spreadsheet. The spreadsheet will allow you to do cost versus value analysis. This means that you can find out how much you should be charging for your services and the amount of money that you should be charging per person or per day. In order to calculate this for yourself, you will have to input the prices of some of the ...

Free Small Business Bookkeeping Templates | Smartsheet Keep track of business expenses with this simple spreadsheet template. Columns include Payment Date, Method, Description, and Amount. If you're self-employed, include home office expenses and other deductibles to help save time during tax season. The template keeps a running subtotal of expenses, adjusting the total sum with each new entry.

15 Tax Deductions and Benefits for the Self-Employed IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

Self-Employed? Everything You Need to Know About Taxes How to calculate your self-employment tax. The self-employment tax rate for 2019 is 15.3%, which encompasses the 12.4% Social Security tax and the 2.9% Medicare tax. Self-employment tax applies to ...

Self Employment Worksheet - 17 images - english worksheets jobs ... self employed expense spreadsheet with regard to self employed hair. Self Employment Worksheet. Here are a number of highest rated Self Employment Worksheet pictures upon internet. ... We give a positive response this kind of Self Employment Worksheet graphic could possibly be the most trending subject taking into account we portion it in ...

T777 Statement of Employment Expenses - Canada.ca T777 Statement of Employment Expenses. For best results, download and open this form in Adobe Reader. See General information for details. You can view this form in: PDF t777-21e.pdf; PDF fillable/saveable t777-fill-21e.pdf; For people with visual impairments, the following alternate formats are also available:

What Is a Schedule E IRS Form? - TurboTax Tax Tips & Videos One of the more common reasons you may find yourself filling out a Schedule E is if you own real estate that you rent out to tenants. This also includes the rental income you receive when renting out space in the same home you reside in. In most cases, the IRS doesn't consider you self-employed, so you won't have to prepare a Schedule C.

0 Response to "43 self employed expense worksheet"

Post a Comment