39 comparison shopping for a credit card worksheet

Personal Finance: Shopping for a Credit Card - Quizlet When shopping for a credit card, it is important to compare fees and terms of different cards. T, The lower the __________, the less interest you will pay. a. credit limit. c. APR. b. incentive. d. grace period. C. APR, An advantage of a co-branded card over a general purpose card is that, a. they can be used anywhere. c. they have special status. Credit Card Worksheet - Ms. Scharf's Website Credit Card Worksheet. Go to . . to compare credit cards (bankrate.com>credit cards>find the best card for you). Fill out the chart below to help you decide which credit card is best for you. Credit Card #1 Credit Card #2 Credit Card #3 Name & Type of Card. Phone Number. Category (student, low rate, no fee, etc.) Introductory ...

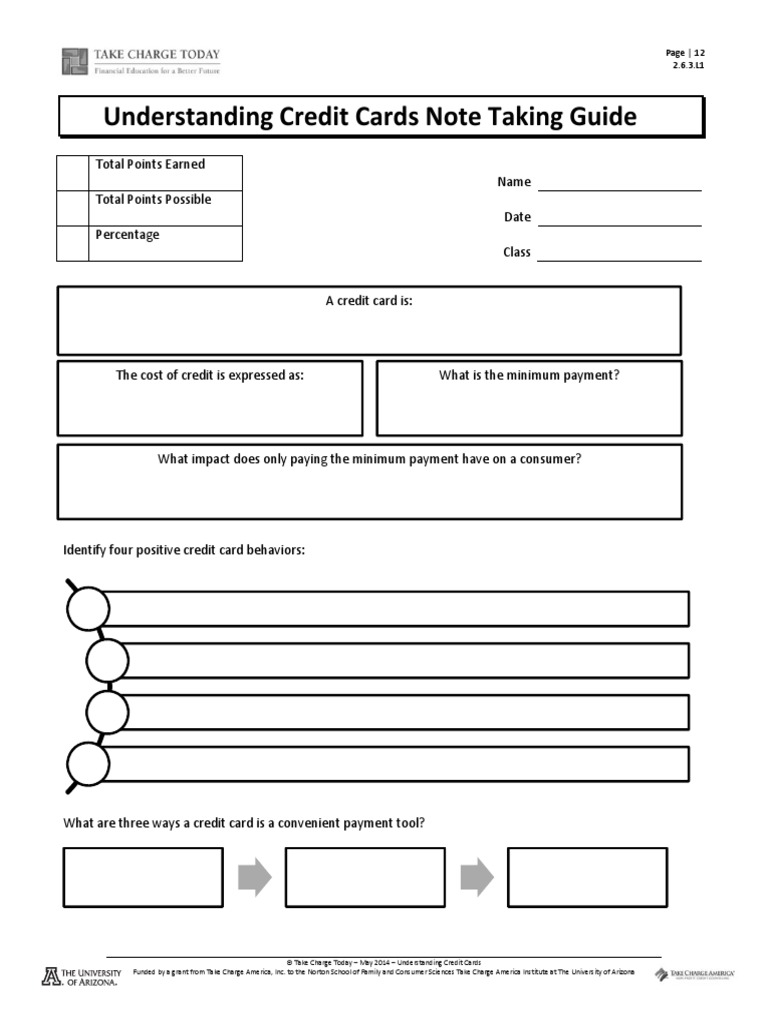

Credit and Credit Card Lesson Plans, Consumer Credit, Teaching Worksheets CREDIT AND Credit Cards. This section includes lessons on consumer credit cards, credit, and paying interest. Learn about credit with an introduction to credit cards, reading a credit card statement, and advanced lessons regarding incorrect credit card transactions. Also, see our spending money category for more consumer related material.

Comparison shopping for a credit card worksheet

NYLearns.org - Shopping for A Credit Card by Consumer Jungle Students will compare and contrast credit card fees and rates by reviewing at least three credit card offers. Duration, 50 minutes: Entire activity, Description, Individually or in teams, students evaluate credit card offers by completing a worksheet that contrasts credit card fees and features. Types of Credit Unit - NGPF Free Types of Credit Lessons, Projects and more for Grades 9-12. Help students compare student debt, auto loans, credit cards, and everything in between. Arcade; Curriculum ... students will take on the role of a peer financial counselor to analyze credit card promotions and comparison shop for a card. They will also learn about alternatives to ... Compare Credit Cards - Credit Card Comparison Calculator - Financial Mentor 0% APR Credit Cards. Balance Transfer Credit Cards. Cash Back Credit Cards. Travel Rewards Credit Cards. For Business Credit Cards. For Fair/Average Credit Credit Cards. Browse All Cards. Once you've narrowed down your top choices, you'll want to compare their long-term costs - quickly and easily. The Credit Card Comparison Calculator does ...

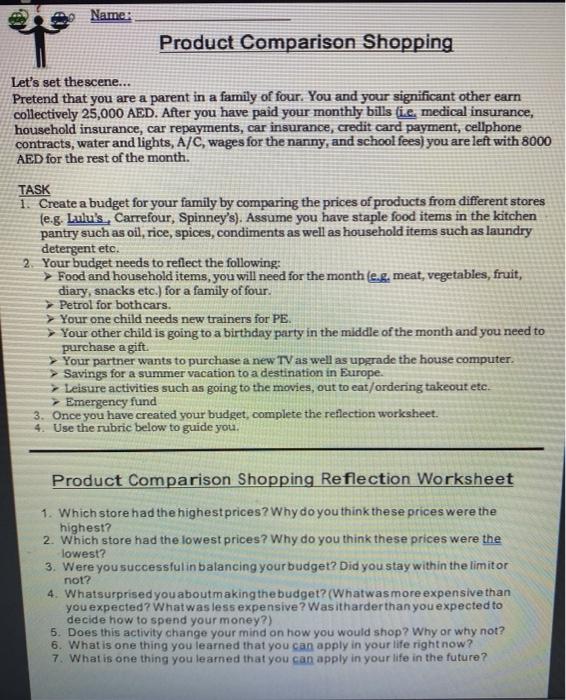

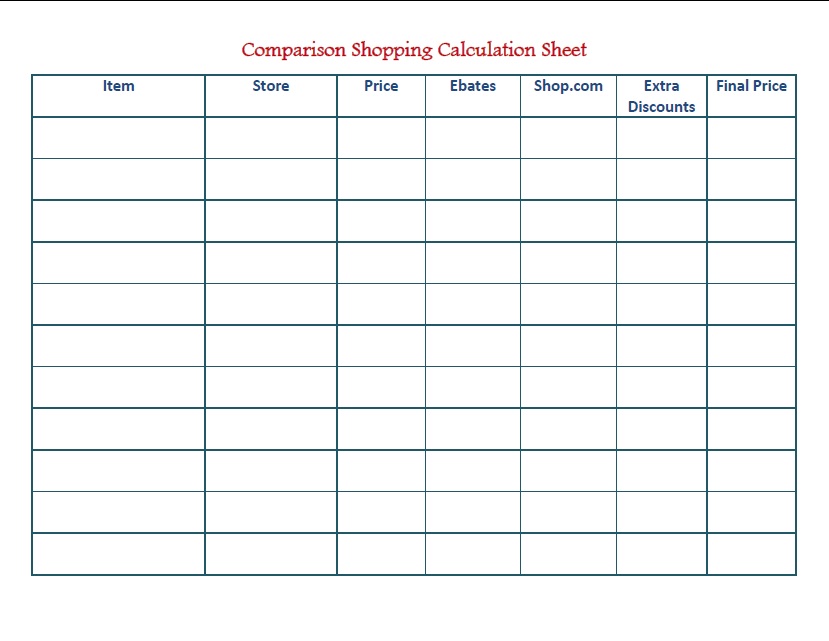

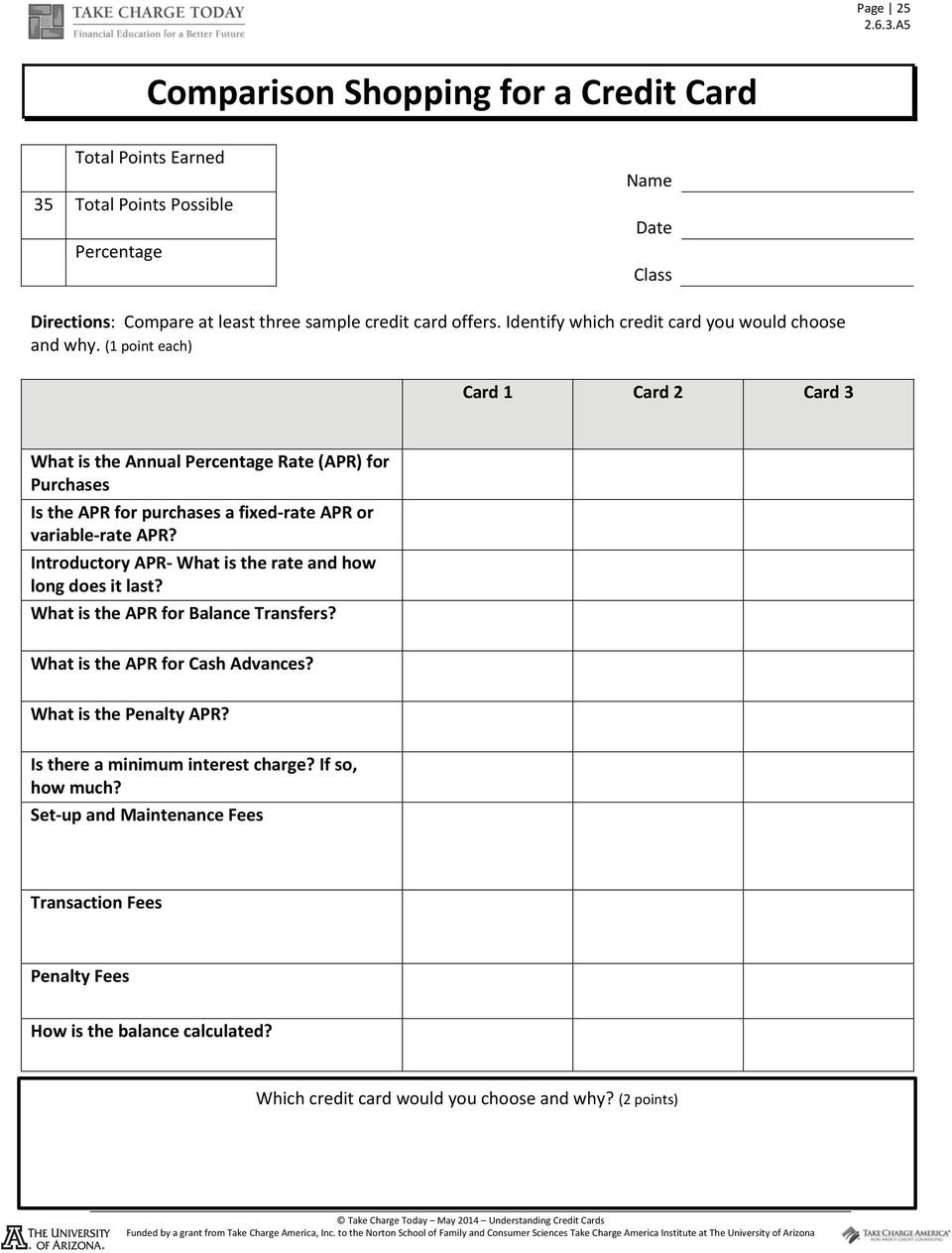

Comparison shopping for a credit card worksheet. PDF Credit Card Comparison Shopping Worksheet Publisher Credit Card Comparison Shopping Worksheet , Things to consider when choosing a credit card: , • If you're going to pay the bill in fullevery month, then the interest rate doesn't really matter to you. Look for a card with no annual fee and a longer grace period so you don't get hit with a finance charge. 4 Credit Card Comparison Charts (Rewards, Fees, Rates & Scores) Capital One Quicksilver Cash Rewards Credit Card, CASH BACK RATING, ★★★★★, 4.8, OVERALL RATING, 4.8/5.0, One-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening, Earn unlimited 1.5% cash back on every purchase, every day, $0 annual fee and no foreign transaction fees, Why A Credit Card Comparison Worksheet Is So Important? A credit card comparison worksheet is a very useful tool for ranking credit cards in the order of their value to you. A credit card is only useful if it can meet your needs. So using this worksheet will eventually save you loads of time as well as money in the long-run. Many credit cards come with great rewards but may attract huge fees. Comparison_Shopping_for_a_Credit Card-1 (1).docx Comparison Shopping for a Credit Card Directions: Complete this table using the Sample Credit Card Offers 1, 2, and 3 handouts. After the comparison table is completed, choose which credit card would be the best choice. Write a one page essay explaining why the credit card is the best choice and why.

Compare Credit Cards: Compare & Apply Online Instantly - WalletHub Below, you'll find a list of notable comparisons, which will hopefully help lead you to the right offer. Capital One VentureOne vs. Quicksilver, Amex Gold vs. Platinum, Capital One Quicksilver vs. QuicksilverOne, Amex EveryDay vs. Blue Cash Everyday, Discover it Cash Back vs. Discover it chrome, Citi Double Cash vs. Capital One Quicksilver, Comparison_Shopping_for_a_Credit_Card (1).doc - Page | 25... Identify which credit card you would choose and why. (1 point each) Card 1 Capital One®VentureOne® Rewards Credit Card Card 2 QuicksilverFrom Capital One Card 3 Discover It What is the Annual Percentage Rate (APR) for Purchases 0% 0% 0% Is the APR for purchases a fxed rate‐ APR or variablerate‐ APR? 11.9%-21.9% 12.9%-22.9% 10.99% -22.99% Introdu... Consumer Math, Spending Money, Worksheets, Lesson Plans, Teaching Life ... With this random worksheet, have your students answer simple questions about spending money. THE VALUE OF MONEY, Lesson Plan: The Value of Money, The Case of the Broken Piggy Bank. Students list the values of a quarter, dime, nickel, and penny in dollar form. credit card statement worksheet answers 36 credit card activity worksheet. 31 understanding a credit card statement worksheet answers. Worksheet. irs form 982 insolvency worksheet. grass fedjp worksheet ... 37 Comparison Shopping For A Credit Card Worksheet - Combining Like chripchirp.blogspot.com. Bank Reconciliation Exercises And Answers Free Downloads .

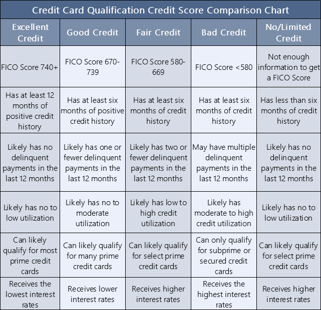

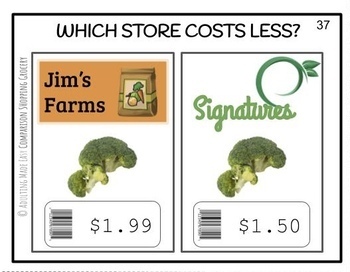

Shopping for a Mortgage FAQs | Consumer Advice Knowing the APR makes it easier to compare "apples to apples" when considering mortgage offers. This Mortgage Shopping Worksheet can help you keep track and compare the costs for each loan quote. How do mortgage brokers work? A mortgage broker is someone who can help you find a deal with a lender and work out the details of the loan. Shopping For A Credit Card Worksheet Answers Shopping for a credit card worksheet answers. Money in the form of coins or notes and not a card is called. The is the place where you pay for things in a supermarket. Calculate the following using the bankrate calculator at. Using a credit calculator on the internet how long would it take to pay off 500000. Use This Grocery Price Comparison Spreadsheet for Big Savings But since everyone's list is different, we created a supermarket comparison template for you to print out and complete yourself. This way, you'll automatically get the most bang for your grocery budget buck — no matter what's on your list. Click for a larger version you can print out. How to Use the Grocery Comparison Worksheet Assignments (Personal Finance) - High School of Business - Google Credit Card Comparison Chart; Credit Scores and Reports WORKSHEET; Carolina Blue Credit Report Activity; CHAPTER 4 EXAM; October 13 - 17: 4.08 and "Credit Wisdom" Worksheet and Discussion; ... Shopping_for_a_Credit_Card_worksheet.xls (31k) Hannah Kasner, Oct 15, 2014, 7:05 AM. v.2.

PDF Lesson Eight Credit Cards - Practical Money Skills Patty took a cash advance of $1,500. Her new credit card charges an Annual Percentage Rate of 21%. The transaction fee for cash advances is 3% of the cash advance, with a maximum fee of $35. This fee is added to the total cash advance, and accrues interest. , If Patty makes monthly payments of $65: ,

PDF Lesson Five Credit Cards - Practical Money Skills Patty took a cash advance of $1,500. Her new credit card charges an Annual Percentage Rate of 21%. The transaction fee for cash advances is 3% of the cash advance, with a maximum fee of $35. This fee is added to the total cash advance, and accrues interest. , If Patty makes monthly payments of $65: ,

PDF Choosing a Credit Card Extension Activity for Credit & Paying for Post ... Shopping for a Credit Card. worksheet (1 per student) • pencil (1 per student) Lesson Plan: 1. Explain to students not all credit cards are the same so it is important to find a card that is ... selector tool to compare credit cards 5. Demonstrate to students how to access the FCAC credit card selector tool: i. access the website by going to ...

Side by Side Credit Card Comparison - NerdWallet Our card comparison tool identifies the things each card is great for, such as rewards, balance transfers or bad credit. In general, there are three types of credit cards: Cards that earn rewards...

credit card vs debit card - TeachersPayTeachers 4. $1.75. PDF. Google Apps™. Credit Card vs. Debit Card Foldable, Economics activity to support an Economics Curriculum or Personal Finance Curriculum. This instruction sheet and grading checklist will walk your students through creating a brochure foldable on Credit Card vs. Debit Card. It is engaging, fun, and relevant.

credit card comparison chart worksheet answer key - luis-hitchko Finance In The Classroom Credit Card Comparison Worksheet Answer Key Fill Online Printable Fillable Blank Pdffiller, Creditcardcomparison Doc Name Maricela Flores Date 4 21 16 Credit Card Comparison Evaluate Different Credit Card Applications Comparing Finance Course Hero, Activity 8 Comparing Credit Card Payments Answers All Card Types,

PDF Comparison Shopping for a Credit Card - Mrs. Quible's 2015-16 Website Write a one page essay explaining why the credit card is the best choice and why. In addition, explain the decision making process used and the possible consequences of the choice (attach Comparison Shopping for a Credit Card worksheet to essay). Card 1 Card 2 Card 3 What is the Annual Percentage Rate (APR) for Purchases ,

How To Make A Credit Card Tracker Spreadsheet In Excel Step 3: Create our Total Spent column. In this step, we will be creating our total spent column for the credit card overview table. This column helps keep track of our overall spending for each card, this is extremely useful if you want to avoid hitting your credit card limit or meet a certain spending mark to get extra credit card points/rewards.

Credit Card Teaching Resources | Teachers Pay Teachers These learning materials focus on teaching students valuable and practical knowledge about credit cards. OBJECTIVES: Students will be able to:· Define credit card and credit lines.·. Explain how a credit card is obtained.·. Identify why credit cards can be dangerous.·. Identify the common fees and costs of credit cards.·.

PDF Comparison Shopping for a Credit Card Directions : Compare at least three sample credit card offers. Identify which credit card you would choose and why. Card 1 Capital One® VentureOne® Rewards Credit Card Card 2 Quicksilver From Capital One , Card 3 Discover It , What is the Annual Percentage Rate (APR) for Purchases 0% 0% 0% ,

PDF Comparison Shopping for a Credit Card - cb001.k12.sd.us 1. Which card is the best choice? 2. Write a one page essay explaining why the credit card is the best choice and why, explain the decision making process used, and the possible consequences of the choice (attach worksheet to essay). Total Points Earned 52 Total Points Possible (, 1 point per card and item) Percentage ,

Compare Credit Cards - Credit Card Comparison Calculator - Financial Mentor 0% APR Credit Cards. Balance Transfer Credit Cards. Cash Back Credit Cards. Travel Rewards Credit Cards. For Business Credit Cards. For Fair/Average Credit Credit Cards. Browse All Cards. Once you've narrowed down your top choices, you'll want to compare their long-term costs - quickly and easily. The Credit Card Comparison Calculator does ...

Types of Credit Unit - NGPF Free Types of Credit Lessons, Projects and more for Grades 9-12. Help students compare student debt, auto loans, credit cards, and everything in between. Arcade; Curriculum ... students will take on the role of a peer financial counselor to analyze credit card promotions and comparison shop for a card. They will also learn about alternatives to ...

NYLearns.org - Shopping for A Credit Card by Consumer Jungle Students will compare and contrast credit card fees and rates by reviewing at least three credit card offers. Duration, 50 minutes: Entire activity, Description, Individually or in teams, students evaluate credit card offers by completing a worksheet that contrasts credit card fees and features.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

0 Response to "39 comparison shopping for a credit card worksheet"

Post a Comment