40 nol calculation worksheet excel

Net Operating Loss Carryback/Carryover Calculator If you have a NOL you can carry this loss to another year and use it as a deduction to reduce that year's taxable income. This calculator helps you calculate your NOL deduction and any remaining NOL that you may carry to another year. ? Net Operating Loss Carryback/Carryover * indicates required. Net Operating Loss Carryback/Carryover Inputs Net Operating Loss (NOL) - Calculation Worksheet - Thomson Reuters This tax worksheet calculates a personal income tax current year net operating loss and carryover. If a taxpayer's deductions for the year are more than their income for the year, the taxpayer may have an NOL. For further assistance on this topic, click the Tax Forms item group button and view the following tax form:

PDF Nol carryover worksheet excel How to calculate your NOL, Worksheet 1. Finally, use the Redefined Taxable Income (Form 1045, line 15, using the "After Carryover" column) to redefine your total tax liability. Losses for tax years beginning after 31 December 2017 may be carried forward for each tax year following that of the loss.

Nol calculation worksheet excel

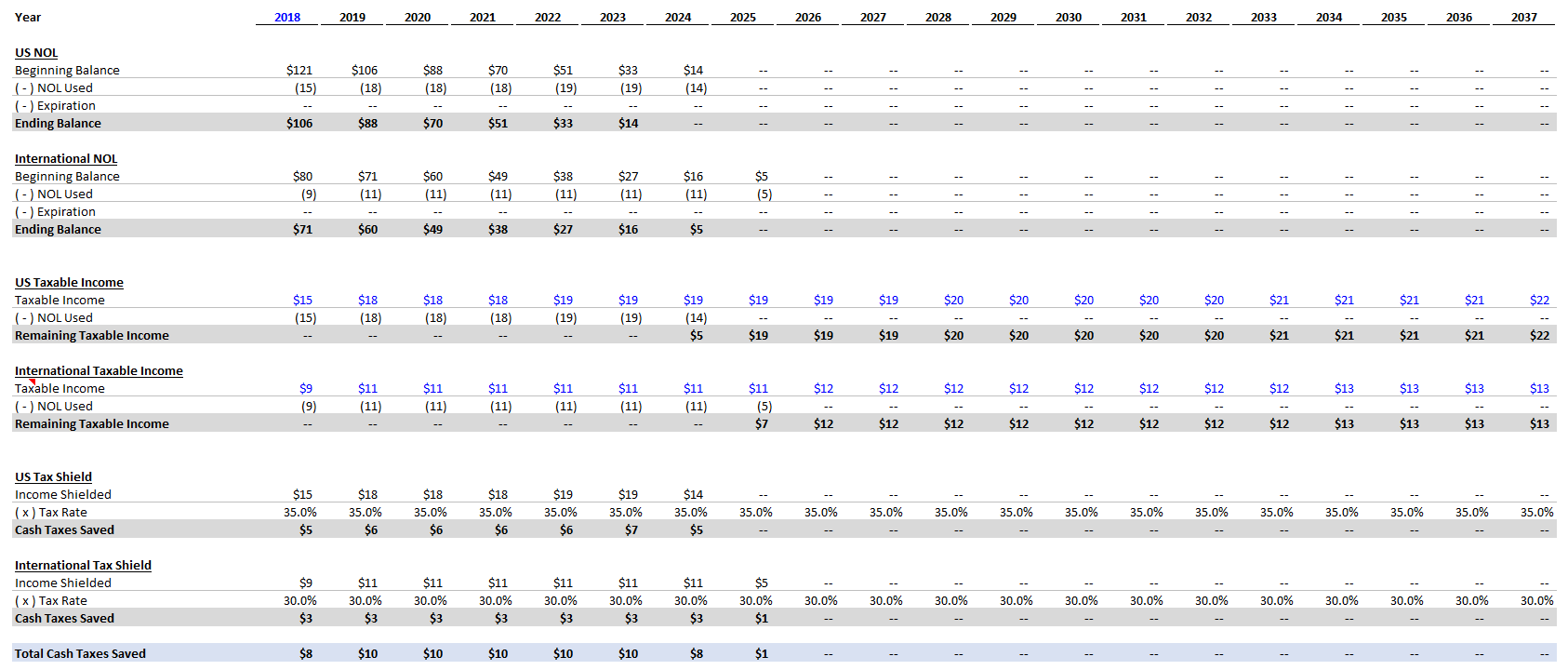

NOL Tax Loss Carryforward - Corporate Finance Institute Steps to create a tax loss carryforward schedule in Excel: Calculate the firm's Earnings Before Tax (EBT) for each year Create a line that's the opening balance to carry forward losses Create a line that's equal to the current period loss, if any Create a subtotal line PDF Final Copyright 2015 Lgutef Net Operating Losses 2 1045) respectively. NOL Worksheet 2 computes the nonbusiness and business capital gains that are reported on lines 3 and 12 of Schedule A (Form 1045) respectively. NOL Worksheet 3 computes the nonbusiness deductions that are entered on line 6 of Schedule A (Form 1045), and NOL Worksheet 4 computes the nonbusiness NJ Division of Taxation - Notice: NOL Conversion Worksheet 500-P - State In updating Form-500 for the 2018 returns, the Division of Taxation created Worksheet 500-P to assist taxpayers calculating the converted net operating loss carryovers for the 2019 returns. The 2018 CBT-100, 2018 CBT-100S, and 2018 BFC-1 are the last tax returns on which the net operating loss subtraction calculation is on a pre-allocation ...

Nol calculation worksheet excel. Net Operating Losses (NOLs): Formula and Calculator [Excel Template] Net Operating Losses (NOLs) Calculator - Excel Template We'll now move to a modeling exercise, which you can access by filling out the form below. Net Operating Losses (NOLs) Example Calculation For our illustrative modeling exercise, our company has the following assumptions. Model Assumptions Taxable Income 2017 to 2018 = $250k Alternative Minimum Tax (AMT) NOL Computation Worksheet - Thomson Reuters This tax worksheet calculates Alternative minimum tax's net operating loss deduction. A net operating loss (NOL) is defined as a taxpayer's excess deductions over a taxpayer's gross income. Similarly, AMT NOL is defined as deductions defined by alternative minimum tax rules over alternative minimum tax income (AMTI). Net Operating Loss (NOL) Carryforward - Excel Model Template 3 Statement Model: Accompanying the NOL model is a Three Statement Model containing an Income Statement, Balance Sheet, and Cash Flow Statement - all fully editable for your own use. The figures already included in the template are for explanatory purposes only and seek to help the user understand the model and where to input their own data. Where do I input an AMT NOL Carryover using Worksheet View? - CCH Where do I input an AMT NOL Carryover using Worksheet View? To input AMT NOL Carryover, complete the following: Select Taxes > AMT Contribution Carryover > Detail. In line 2 - Year input the year. Input information as needed. Calculate the return. Solution Tools Attachments To provide feedback on this solution, please login. Need more help?

nol carryforward worksheet reading response worksheets sheet guided story elements graphic kindergarten activities. Nol Calculation Worksheet Excel - Worksheet List nofisunthi.blogspot.com. nol operating faqs. Results For Worksheets | 1 | Guest - The Mailbox search.theeducationcenter.com. worksheets. Search: RI.3.7 - The Mailbox | Reading Worksheets, Word Skills www ... Net Operating Loss Worksheet / Form 1045 - Support Enter the number of years you wish to carry back the NOL Select the year you want to apply the NOL to first and complete the worksheet for that year. If you wish to forego the carryback period, select IRC Sec 172 (b) (c) Election to Forego the Carryback Period, and select 'YES'. Net Operating Loss Carryover Worksheet - Nol Carryover Worksheet Excel ... Nol carryover from 2020 to 2021. Use this worksheet to compute your nebraska net operating loss (nol) for tax years after 2017 that is available for carryback or carryforward. Enter the tax year a michigan net operating loss (nol) was created. Losses must be applied in the order in which they occurred. PDF 2021 Publication 536 - IRS tax forms NOL Steps Follow Steps 1 through 5 to figure and use your NOL. Step 1. Complete your tax return for the year. You may have an NOL if a negative amount ap- pears in these cases. Individuals—You subtract your standard deduction or itemized deductions from your adjusted gross income (AGI).

How to Calculate Net Operating Loss: A Step-By-Step Guide - FreshBooks Calculate the Net Operating Losses The next step is to determine whether you have a net operating loss and its amount. For example, if your business has a taxable income of $700,000, tax deductions of $900,000 and a corporate tax rate of 40%, its NOL would be: $700,000 - $900,000 = -$200,000. PDF IT NOL - Net Operating Loss Carryback Worksheet - Ohio Department of ... IT NOL - Net Operating Loss Carryback Worksheet (Check the box on the front of Ohio form IT 1040X indicating you are amending for an NOL and attach this form to Ohio form IT 1040X.) If you are carrying back an NOL to more than one previous year, you should complete the Ohio form IT 1040X for the earliest year fi rst. Solved: NOL Carryforward worksheet or statement - Intuit Type 'nol' in the Search area, then click on ' Jump to nol'. You should be able to enter your Net Operating Loss carryover amounts without issue (screenshot). Check your Federal Carryover Worksheet from your 2018 return for the amount. **Say "Thanks" by clicking the thumb icon in a post Publication 536 (2021), Net Operating Losses (NOLs) for Individuals ... Use Worksheet 1 to figure your NOL. The following discussion explains Worksheet 1. See the Instructions for Form 1045. If line 1 is a negative amount, you may have an NOL. Nonbusiness capital losses (line 2). Don't include on this line any section 1202 exclusion amounts (even if entered as a loss on Schedule D (Form 1041)).

NJ Division of Taxation - Notice: NOL Conversion Worksheet 500-P - State In updating Form-500 for the 2018 returns, the Division of Taxation created Worksheet 500-P to assist taxpayers calculating the converted net operating loss carryovers for the 2019 returns. The 2018 CBT-100, 2018 CBT-100S, and 2018 BFC-1 are the last tax returns on which the net operating loss subtraction calculation is on a pre-allocation ...

PDF Final Copyright 2015 Lgutef Net Operating Losses 2 1045) respectively. NOL Worksheet 2 computes the nonbusiness and business capital gains that are reported on lines 3 and 12 of Schedule A (Form 1045) respectively. NOL Worksheet 3 computes the nonbusiness deductions that are entered on line 6 of Schedule A (Form 1045), and NOL Worksheet 4 computes the nonbusiness

NOL Tax Loss Carryforward - Corporate Finance Institute Steps to create a tax loss carryforward schedule in Excel: Calculate the firm's Earnings Before Tax (EBT) for each year Create a line that's the opening balance to carry forward losses Create a line that's equal to the current period loss, if any Create a subtotal line

0 Response to "40 nol calculation worksheet excel"

Post a Comment