42 self employment expenses worksheet

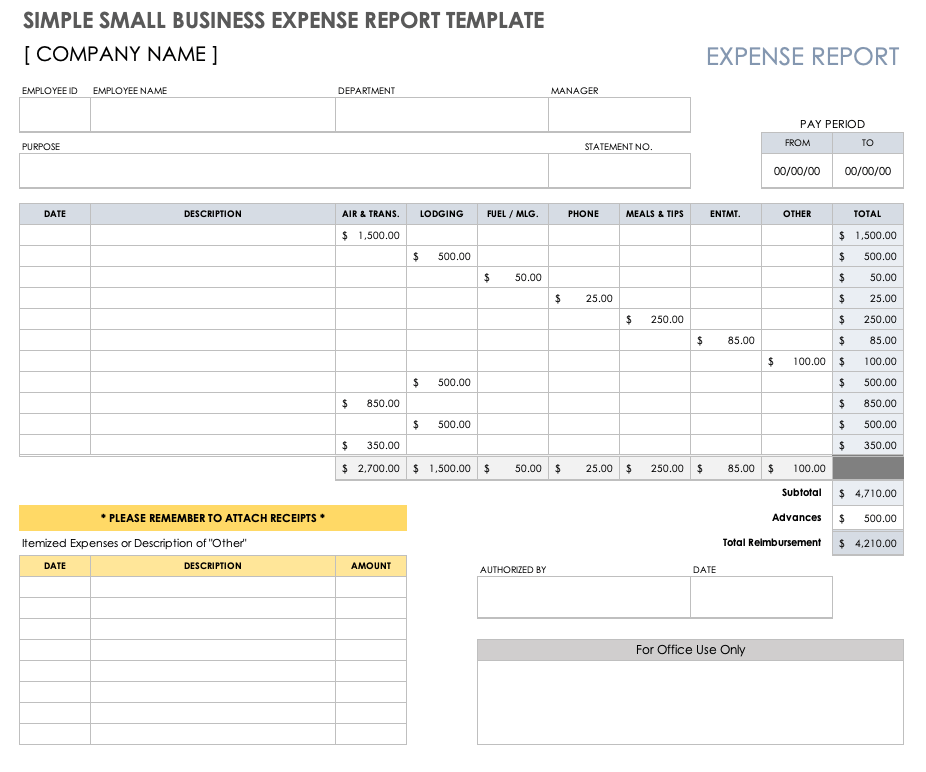

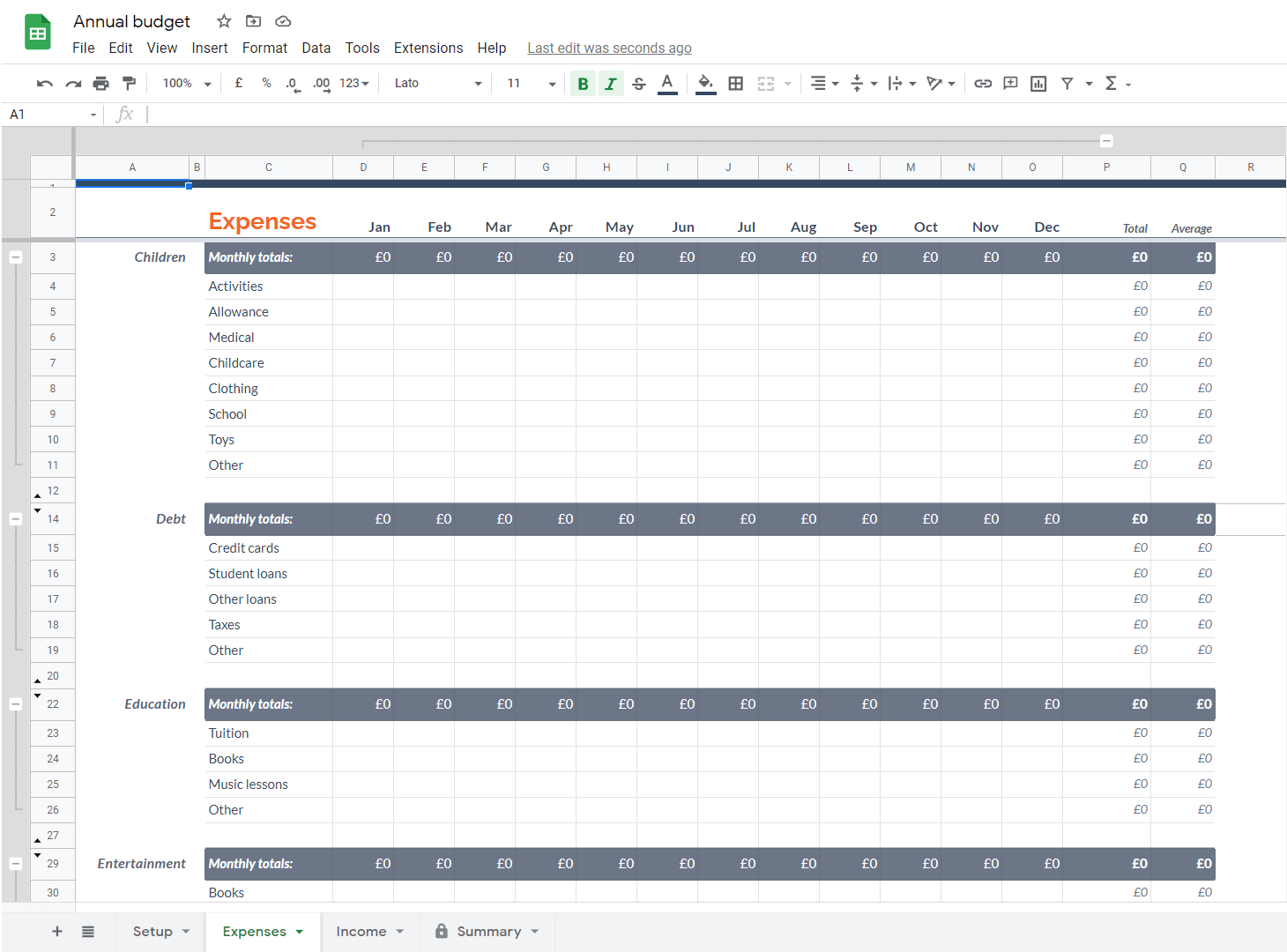

Free Expense Tracking Worksheet Templates (Excel) 4. Expense Report Template. This expense report template is perfect for small businesses and employees — but it can be customized to make the perfect personal budget template as well. Get an accurate breakdown of how you're spending your money when traveling, working for a company, or get an overview of personal expenses. Complete List of Self-Employed Expenses and Tax Deductions You can deduct the costs of your personal health insurance premiums as a self-employed person as long as you meet certain criteria: Your business is claiming a profit. If your business claims a loss for the tax year, you can't claim this deduction. You were not eligible to enroll in an employer's health plan. This also includes your spouse's plan.

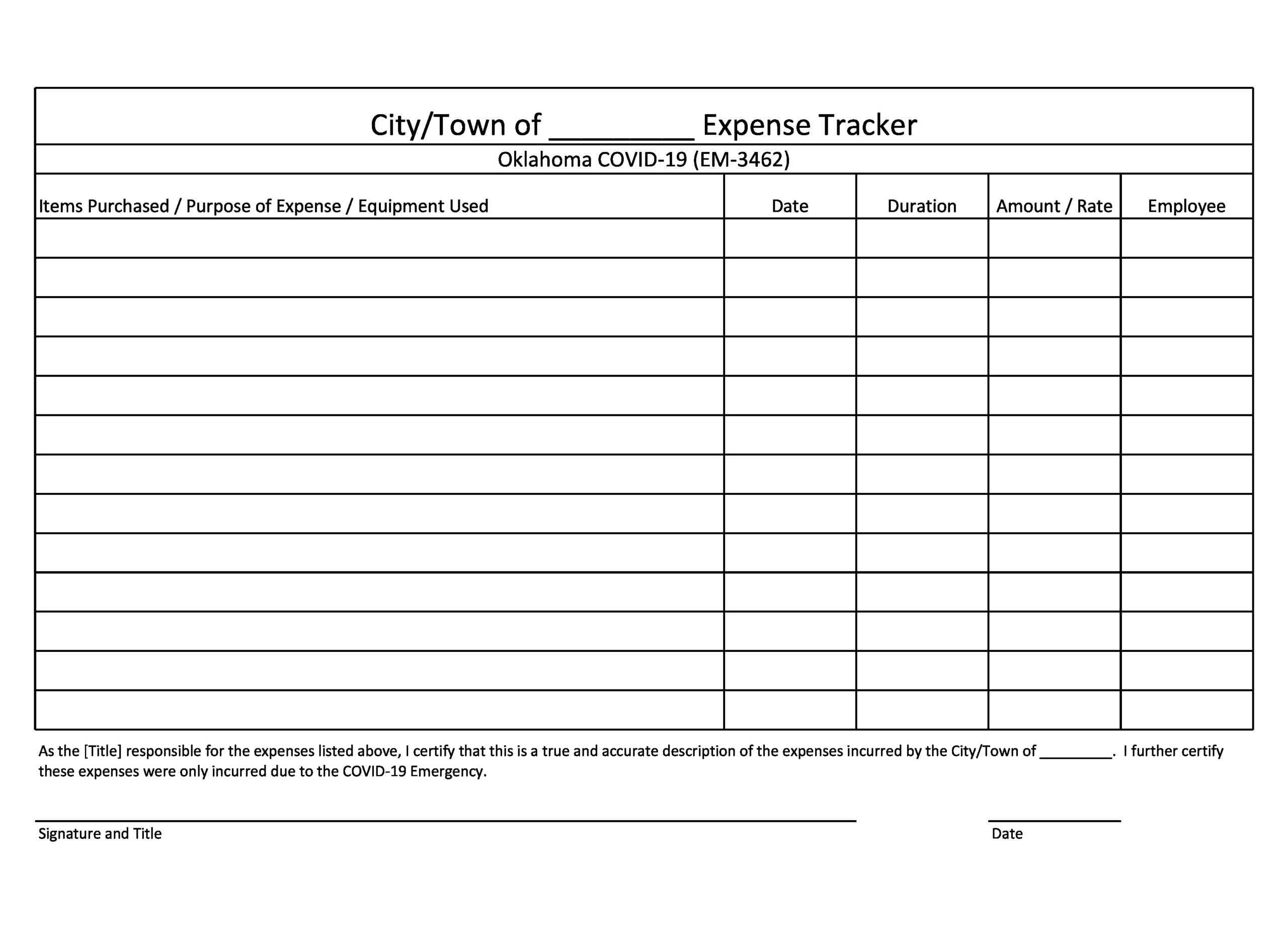

PDF SE Income Worksheet - Kansas Self-Employment Income Worksheet For Agency Use Only: Dear [Primary Applicant Name], You told us that you or someone in your household is self-employed. We need more information from you to process your application. We need proof of your self-employment income. Please fill out the attached worksheet, sign it, and return it to us by the due date.

Self employment expenses worksheet

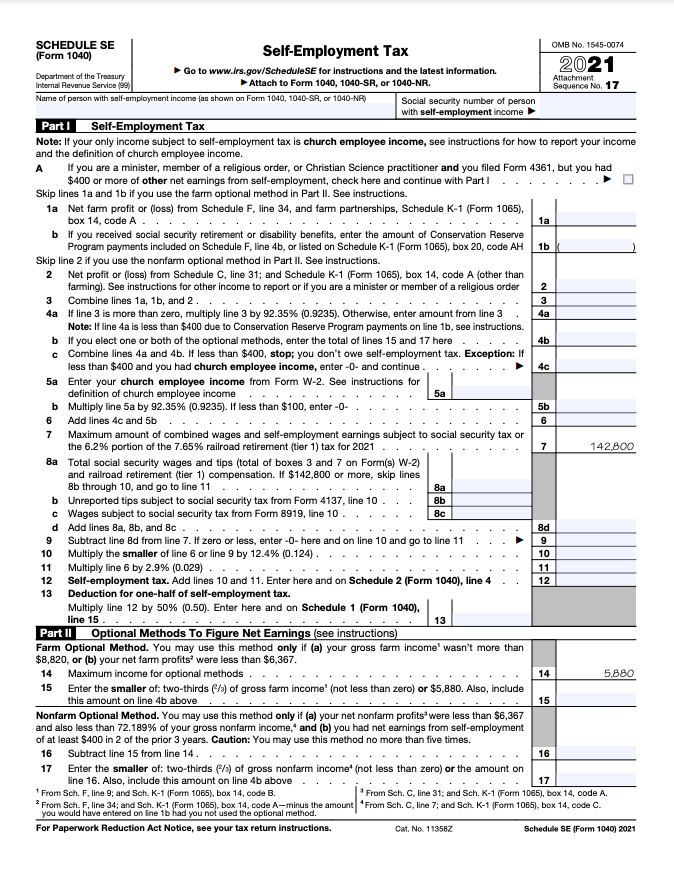

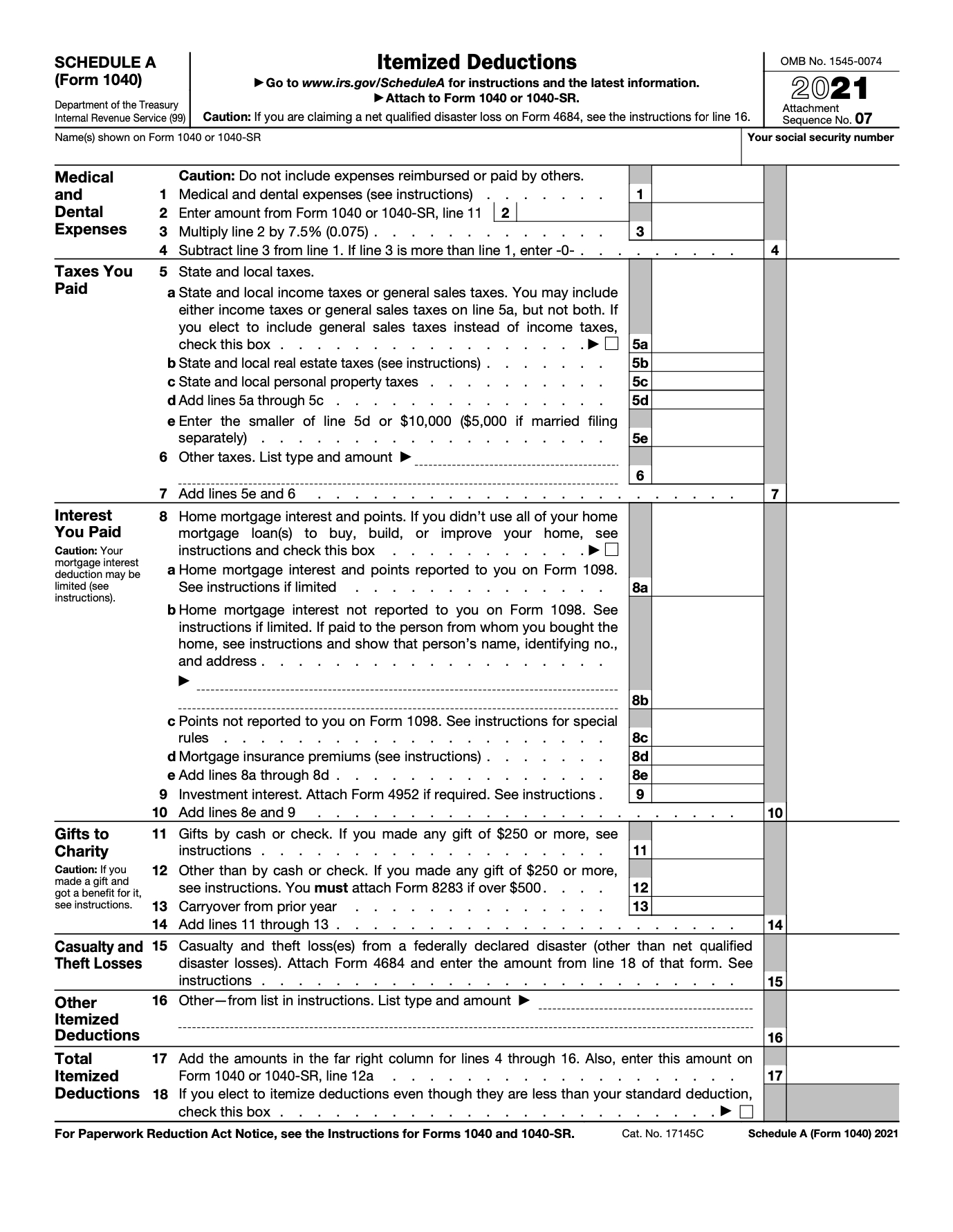

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS). Publications and Forms for the Self-Employed Instructions for Schedule F (Form 1040 or 1040-SR), Profit or Loss from Farming PDF Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Instructions for Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Schedule K-1 (Form 1065), Partner's Share of Income, Credits, Deductions, etc. PDF PDF SELF-EMPLOYMENT WORKSHEET Please provide 3 months of all self ... ELF-EMPLOYMENT WORKSHEET . Please provide 3 months of all self -employment gross monthly income and expenses: Applicant Name (First & Last Name) Date of Birth Type of Work: Month Annual . Gross Income Total $ $ $ $ Deductible Expense: Advertising Car/Truck Expenses Commissions/Fees Contract Labor Depletion Depreciation Employee Benefit Programs

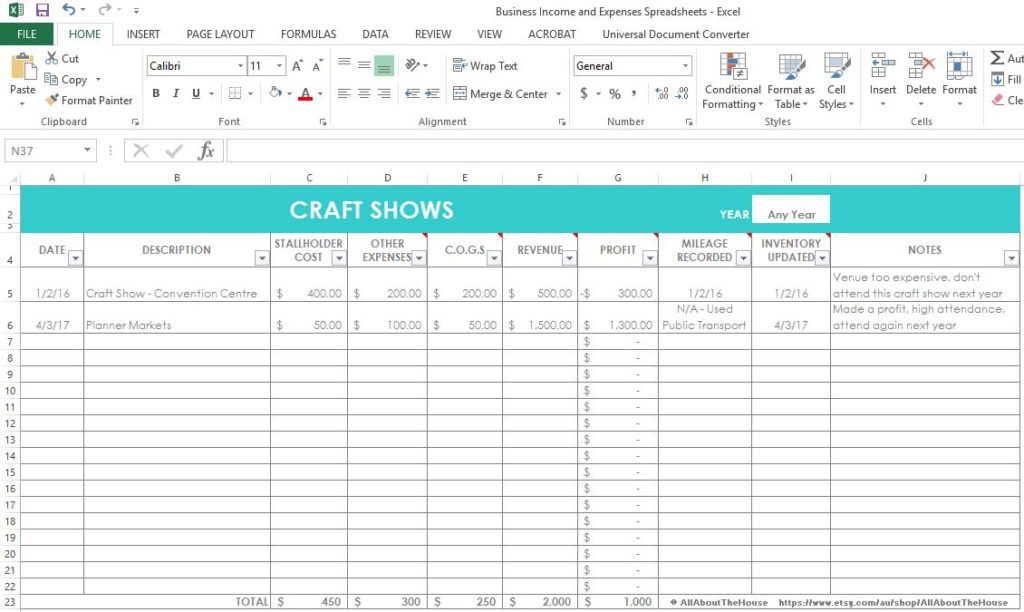

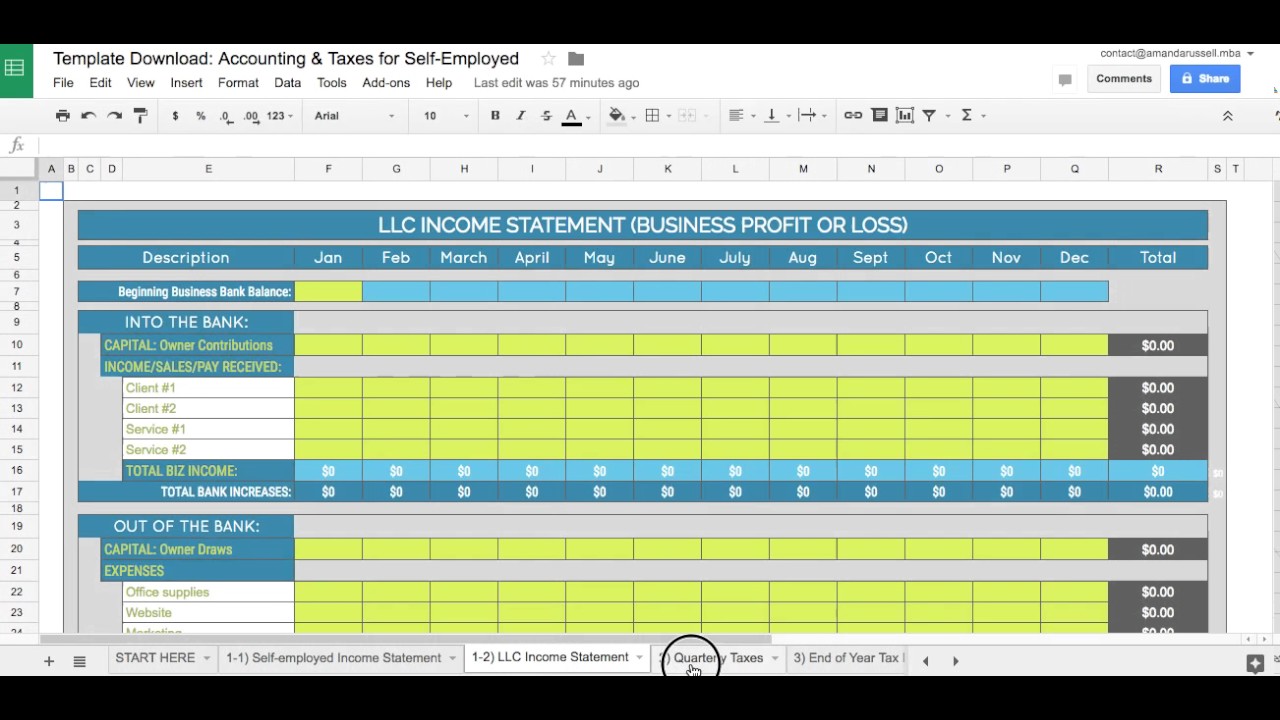

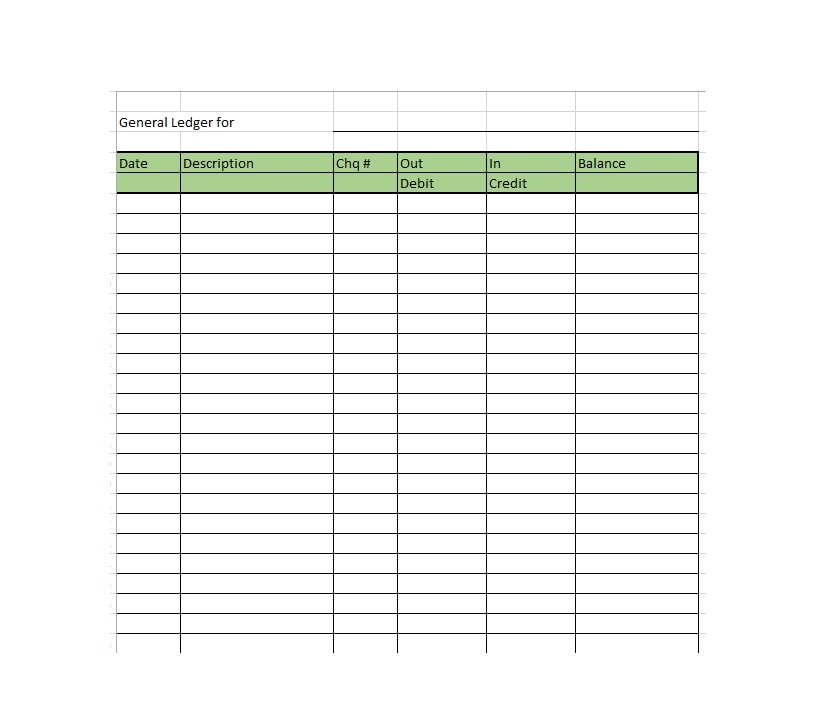

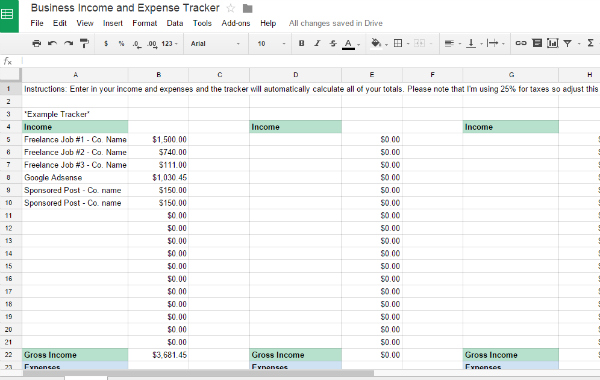

Self employment expenses worksheet. Dpss Self Employed Income Worksheets - K12 Workbook Displaying all worksheets related to - Dpss Self Employed Income. Worksheets are Calfresh work and forms, Income and expenses report form, What is welfare to work why is it important for you to be, 2016 2017 verification work dependent, Base pay only bonusovertime income bonusovertime income, Class purpose, Pa1663 sg 8 18. Free expenses spreadsheet for self-employed - hellobonsai.com Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work. PDF Self Employed Income/Expense Sheet SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other: Self-Employment Ledger: 40 FREE Templates & Examples - TemplateArchive Examples of self-employed individuals are self-sufficient contractors, sole proprietors of businesses and those with partnerships in businesses. A person who is self-employed is entitled to pay self-employment taxes and must be in possession of a self-employment ledger. This is an error-free, detailed record showing self-employment cash returns ...

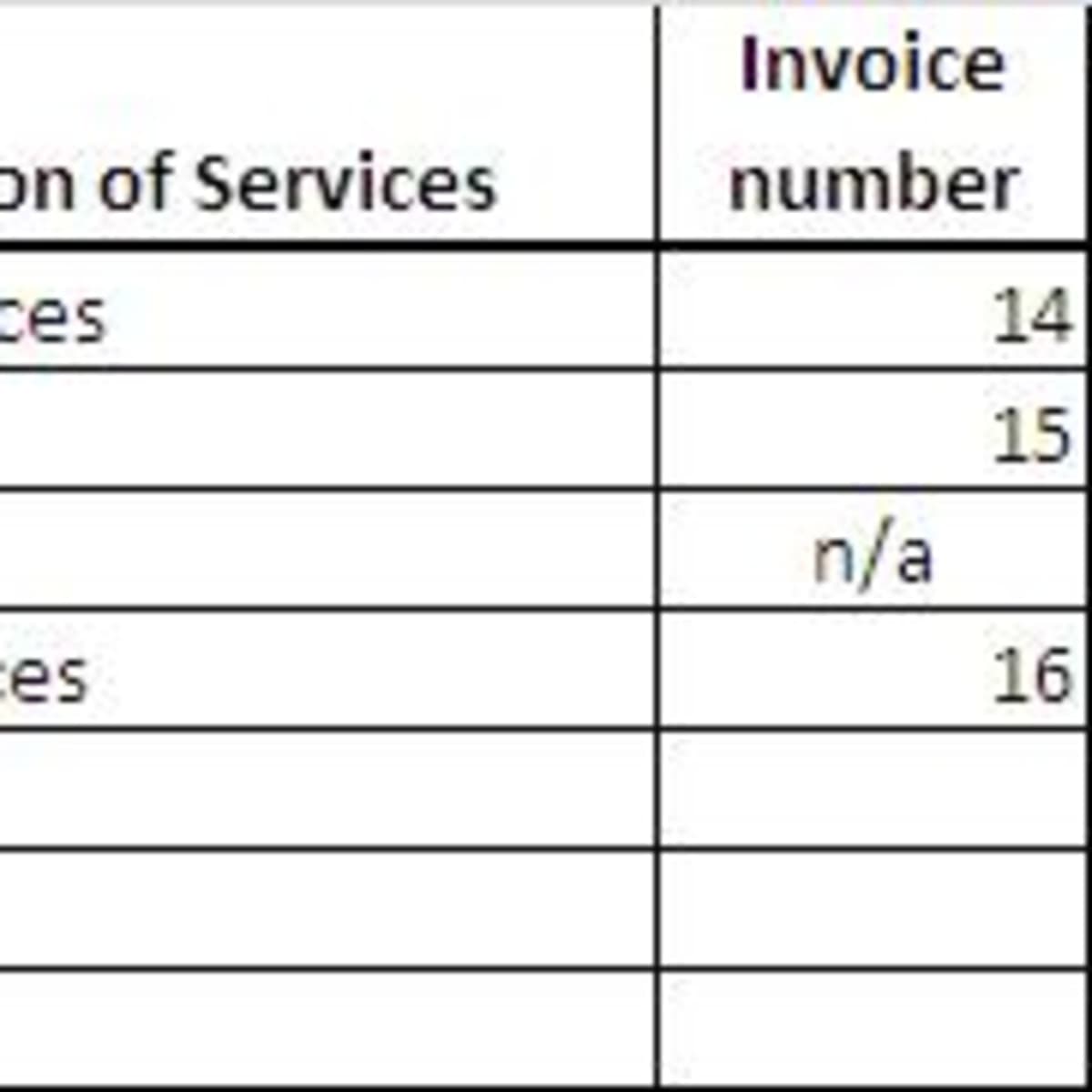

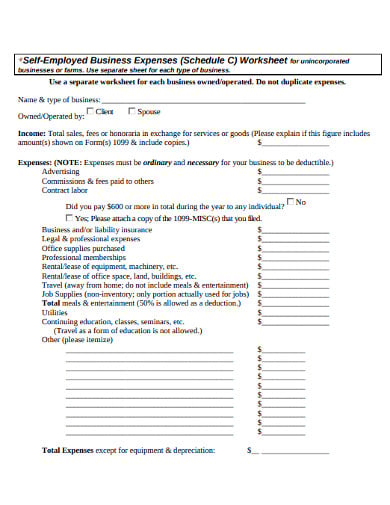

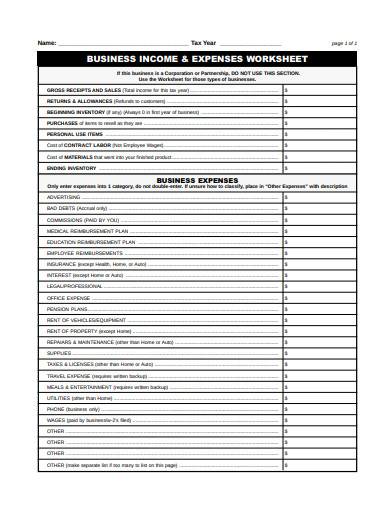

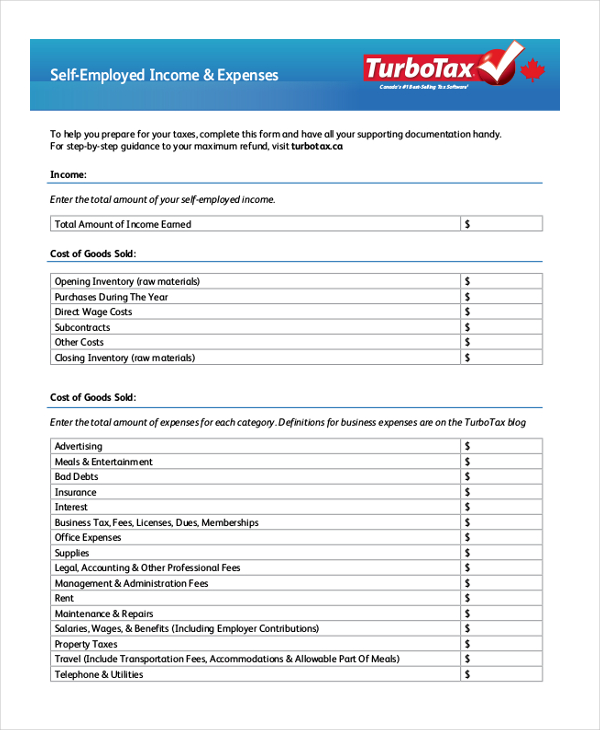

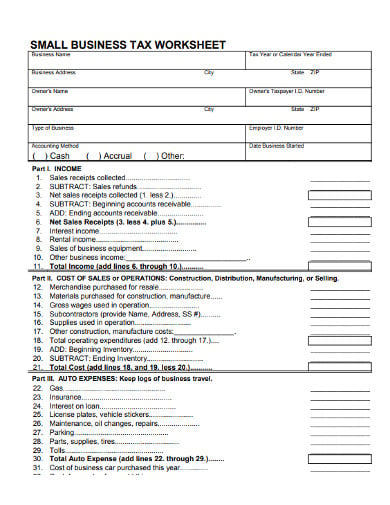

PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $ Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai After all, a self-employed taxpayer will owe 15.3% on their earnings from self-employment or Social Security and Medicare taxes. After you calculate your net earnings from self-employment, multiply it by the self-employed tax rate and you'll see how much you'll owe Uncle Sam. If you are concerned with how much you'll owe, don't worry. PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. ... Employee Benefits such as health insurance, not pension $_____ Equipment, software, computers, tools less than $500,000 $_____ Insurance: Business & liability, not health. ... PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

PDF SE Income Worksheet - Kansas Self-Employment Income Worksheet You told us that you or someone in your household is self-employed. We need more information from you to process ... For more information related to allowable self-employment expenses, please visit the Internal Revenue Service's website at . 2 Business Expenses self employment expense worksheet Spend Less than What You Earn - Money Girl PH. 11 Images about Spend Less than What You Earn - Money Girl PH : 35 Self Employed Expenses Worksheet - Worksheet Resource Plans, Self Employed Tax Deductions Worksheet 2019 | AdiPurwanto.com and also Pin di Worksheet. Spend Less Than What You Earn - Money Girl PH self employed expense worksheet deduction office simplified benefit tax self employment taxpayers does items 15 Best Images Of Identify Types Of Energy Worksheet - Different Forms energy worksheet heat forms types worksheets different grade transfer sources 3rd identify 2nd thermal science light worksheeto via type mailbox PDF SELF-EMPLOYMENT EXPENSE WORKSHEET - cat-team.org SELF-EMPLOYMENT EXPENSE WORKSHEET Applicant's name: _____ Name of self-employed person: _____ ... WAGES (Paid to employee(s)) $ MAINTENANCE REPAIRS ( Business car/ property) $ SUPPLIES $ ADVERTISING/MARKETING $ UTILITIES FOR BUSINESS $ FUEL $

PDF Self Employment Income Worksheet - Kcr - Personal (non-business) Work-Related Expenses INCOME: 1. Gross Business Revenue - Depreciation, Depletion, and Amortization (for medical plans established under this business) 8. Professional Fees 9. Office Supplies 10. Equipment 4. Cost of Goods Sold 5. Advertising 6. Business Insurance, Licenses, and Permits 7. Medical Insurance Premiums

Self Employed Tax Deductions Worksheet Form - Fill Out and Sign ... The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill camp; Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details.

Tracking your self-employed income and expenses Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software

PDF SELF-EMPLOYMENT WORKSHEET Please provide 3 months of all self ... ELF-EMPLOYMENT WORKSHEET . Please provide 3 months of all self -employment gross monthly income and expenses: Applicant Name (First & Last Name) Date of Birth Type of Work: Month Annual . Gross Income Total $ $ $ $ Deductible Expense: Advertising Car/Truck Expenses Commissions/Fees Contract Labor Depletion Depreciation Employee Benefit Programs

Publications and Forms for the Self-Employed Instructions for Schedule F (Form 1040 or 1040-SR), Profit or Loss from Farming PDF Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Instructions for Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF Schedule K-1 (Form 1065), Partner's Share of Income, Credits, Deductions, etc. PDF

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS).

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fc922f6c345b025c4868_1099-excel-template.png)

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "42 self employment expenses worksheet"

Post a Comment