45 1040 qualified dividends and capital gains worksheet

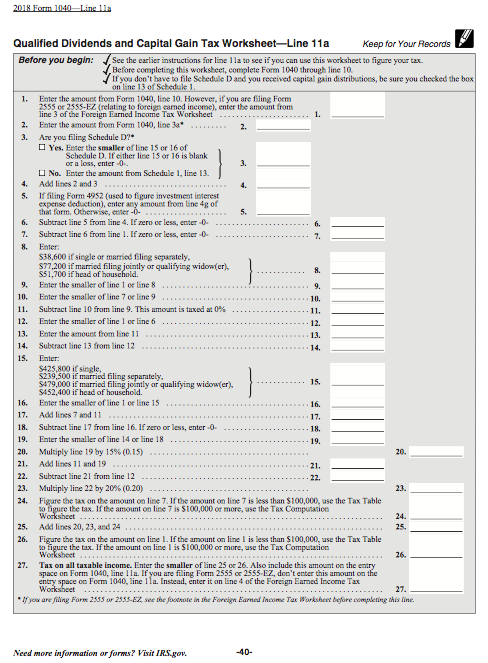

Irs Capital Gains Worksheet - Worksheet Genius Irs Form 1040 Capital Gains Worksheet Form Resume from . As noted in my question, the flaw occurs on line 18 where you subtract line 17 (effectively taxable income that is not qualified dividends or capital gains ) from the 15%. Irs schedule d is a worksheet that helps taxpayers figure capital gains and losses from ... › en-us › documentQualified Dividends and Capital Gains Worksheet - StuDocu Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. Before you begin: 1. Enter the amount from Form 1040 or 1040-SR, line 11b.

1040 Capital Gains Worksheet 2021 - tpdevpro.com SCHEDULE D Capital Gains and Losses - IRS tax forms 2 days ago Capital Gains and Losses ... Schedule D (Form 1040) 2021 : Schedule D (Form 1040) 2021: Page : 2 Part III : Summary: 16 : ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the … Show more View Detail

1040 qualified dividends and capital gains worksheet

2012 Qualified Dividend And Capital Gain Tax Worksheets - K12 Workbook Worksheets are Capital gain tax work pdf, Capital gains and losses, Foreign earned income tax work pdf, Line 44 the tax computation work on if you are filing, 2021 form 1041 es, Individual items to note 1040, Ask anyone to tell you about an experience they had with, Net operating losses. *Click on Open button to open and print to worksheet. 1. apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a, Qualified Dividends and Capital Gain Tax Worksheet—Line 11a, Keep for Your Records, Before you begin: See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 10. Qualified Dividends and Capital Gains Worksheet.docx View Qualified Dividends and Capital Gains Worksheet.docx from ACC 330 at Southern New Hampshire University. Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records Before. ... Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

1040 qualified dividends and capital gains worksheet. Get Qualified Dividends And Capital Gain Tax Worksheet 2019 Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue. Type all necessary information in the necessary fillable fields. The easy-to-use drag&drop graphical user interface makes it easy to add or relocate fields. Qualified Dividends and Capital Gain Tax Worksheet. - CCH According to the IRS Form 1040 instructions for line 44: Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.If you don't have to file Schedule D and you received capital gain distributions, be s...

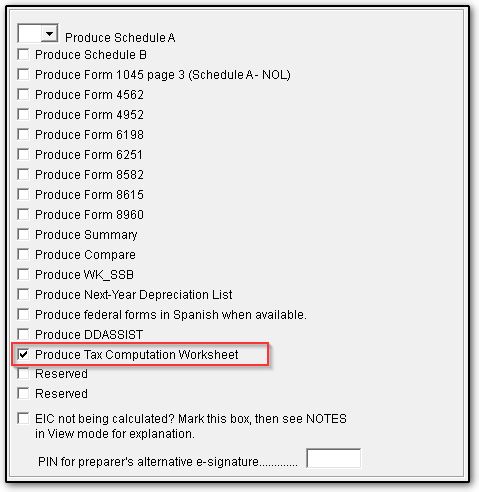

› download-qualifiedHow to Download Qualified Dividends and Capital Gain Tax ... Qualified Dividends and Capital Gain Tax Worksheet, The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... For several years, the IRS has provided a tax computation worksheet in the Form 1040 and 1040A instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete Schedule D. Taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use Sche... 2019 Qualified Dividends And Capital Gains Worksheets - K12 Workbook Displaying all worksheets related to - 2019 Qualified Dividends And Capital Gains. Worksheets are 2019 form 1041 es, 44 of 107, Fo if 2019, 2018 form 1041 es, Table of contents, 2018 form 1040 es, Tax strategies, 2017 qualified dividends and capital gain tax work. *Click on Open button to open and print to worksheet. 1. 2019 Form 1041-ES, 2. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

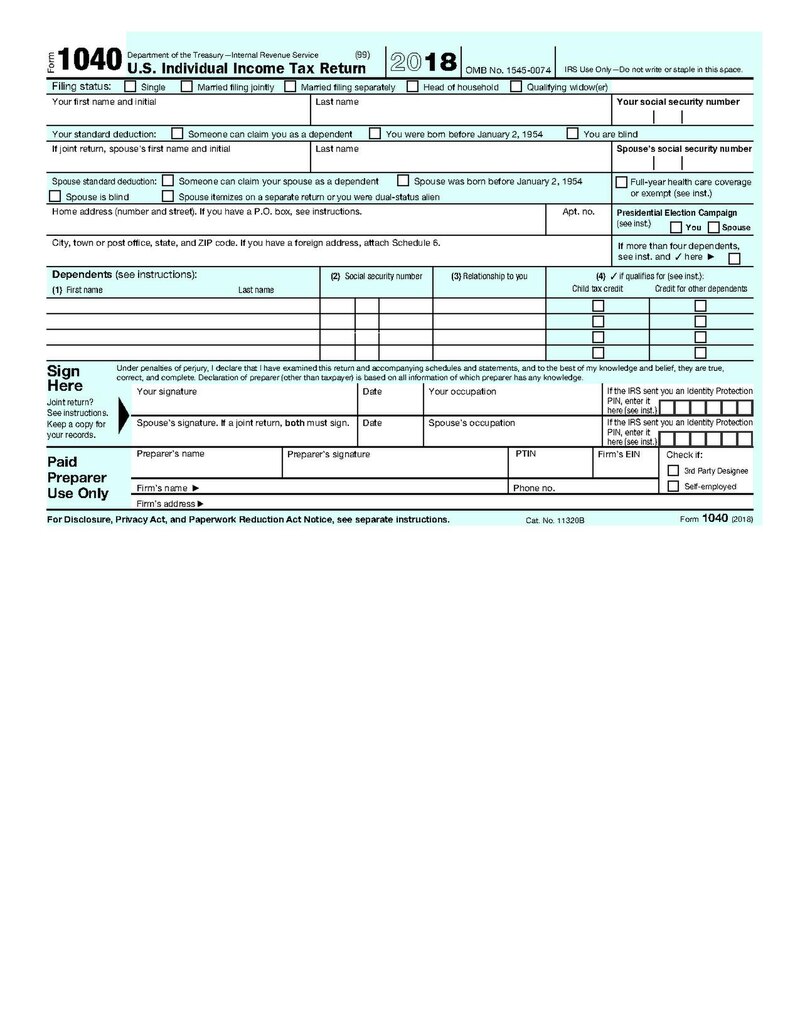

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ... Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. Where Is The Qualified Dividends And Capital Gain Tax Worksheet ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount. › tax-form › 10402021 1040 Form and Instructions (Long Form) - Income Tax Pro Jan 01, 2021 · Standard Deduction Worksheet for Dependents (Line 12a) Student Loan Interest Deduction Worksheet; Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are often published later in January to include any last minute legislative changes. When published, the current year 2021 1040 PDF file will download.

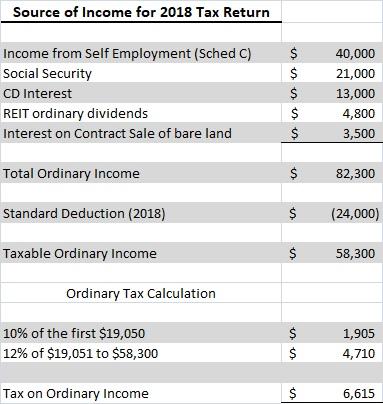

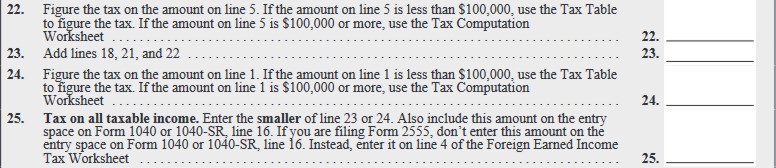

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Instead, 1040 Line 16 "Tax" asks you to "see instructions.", In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

› pub › irs-pdfSCHEDULE D Capital Gains and Losses - IRS tax forms Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes. No. If “Yes,” attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less (see instructions)

Capital Qualified Form And Worksheet Dividends Tax Gain Qualified Dividends And Capital Gain Tax Worksheet Fillable Free from Qualified Dividends And Capital Gain Tax Worksheet, source:comprar-en-internet For most of the history of the income tax, long-term capital gains have been taxed at lower rates than ordinary income (figure 1) Capital gains CAPITAL ALLOWANCES Industrial buildings Plant and ...

smartasset.com › taxes › dividend-tax-rateThe Dividend Tax Rate for 2021 and 2022 - SmartAsset Jan 07, 2022 · So let’s say you’re single and have $150,000 of annual income, with $10,000 of that being dividends. Your dividends would then be taxed at 15%, while the rest of your income would follow the federal income tax rates. The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. For 2021, these rates remain ...

1040 Capital Gains Worksheet 2021 - tpdevpro.com Listing 8 Results 1040 Capital Gains Worksheet 2021, Total 8 Results, Google Api, Bing Api, 1. Users' registration, 2. Select the plan with the price. 3. Go through the API documentation. 4. Use a single token to access all APIs!

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. It's ... How To Download Qualified Dividends and Capital Gain Tax Worksheet? Since the worksheet is part of Form 1040, it can be downloaded from the official ...

Qualified Dividends And Capital Gain Tax Worksheet Irs The Form 1040 Qualified Dividends And Capital Gain Tax. It is very simple & basic. Before completing this worksheet, complete form 1040 through line 10. This guide will provide an overview of the form and instructions on how to complete it. Capital Gains Worksheet 2021 Qualified Dividends And Capital Gain Tax Worksheet 2021?

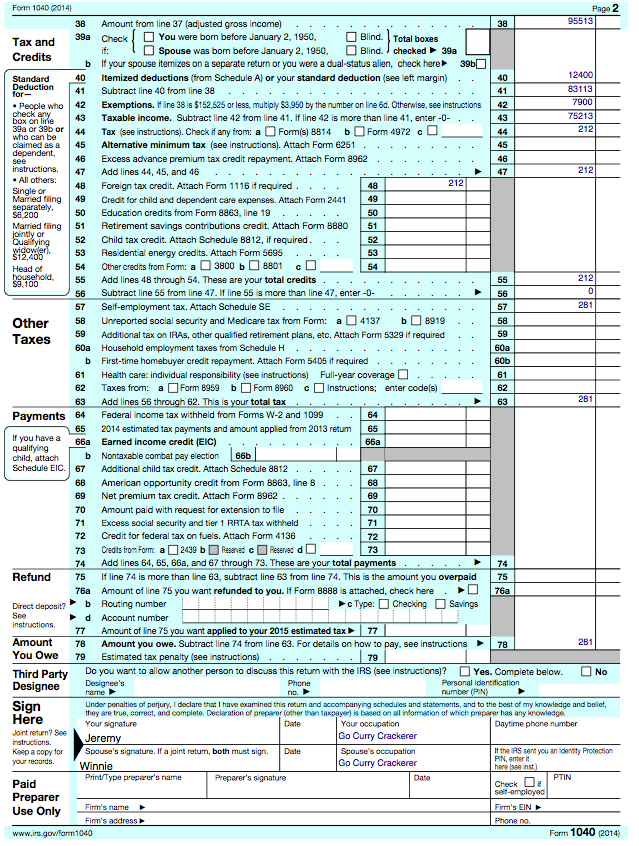

Form Worksheet And Dividends Capital Qualified Gain Tax For tax year 2020, the standard deduction is $24,000 for joint filers and $12,000 for singles Qualified dividend and post-May 5 capital gain income that may be taxable at the reduced rates introduced by the Jobs and Growth Tax Relief Reconciliation Act of 2003 Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2014 Line 44 G Keep for ...

2019 Qualified Dividends Worksheet - Division Worksheets 2019 Qualified Dividends Worksheet. DVD is suitable for 2019 . Complete forms 1040 up to line 10 before completing this sheet. For Mac, click "Forms" in the upper left corner and find the form in the list of returns, and then open the corresponding table of distribution of shares and capital gains tax. See instructions on line 12a to see if you ...

Solved: The Qualified Dividends and Capital Gains Tax worksheet ... The Qualified Dividends and Capital Gains Tax worksheet correctly calculates the 15% tax on these amounts but I cannot see how it is ever reflected on my 1040 return. The amount on line 27 of the Qualified Dividends and Capital Gains Tax worksheet is placed on line 11 of form 1040.

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube Qualified Dividend and Capital Gains Tax Worksheet? 4,129 views Feb 16, 2022 The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term...

Qualified Dividends and Capital Gains Worksheet.docx View Qualified Dividends and Capital Gains Worksheet.docx from ACC 330 at Southern New Hampshire University. Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records Before. ... Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a, Qualified Dividends and Capital Gain Tax Worksheet—Line 11a, Keep for Your Records, Before you begin: See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 10.

2012 Qualified Dividend And Capital Gain Tax Worksheets - K12 Workbook Worksheets are Capital gain tax work pdf, Capital gains and losses, Foreign earned income tax work pdf, Line 44 the tax computation work on if you are filing, 2021 form 1041 es, Individual items to note 1040, Ask anyone to tell you about an experience they had with, Net operating losses. *Click on Open button to open and print to worksheet. 1.

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

0 Response to "45 1040 qualified dividends and capital gains worksheet"

Post a Comment