42 colorado pension and annuity exclusion worksheet

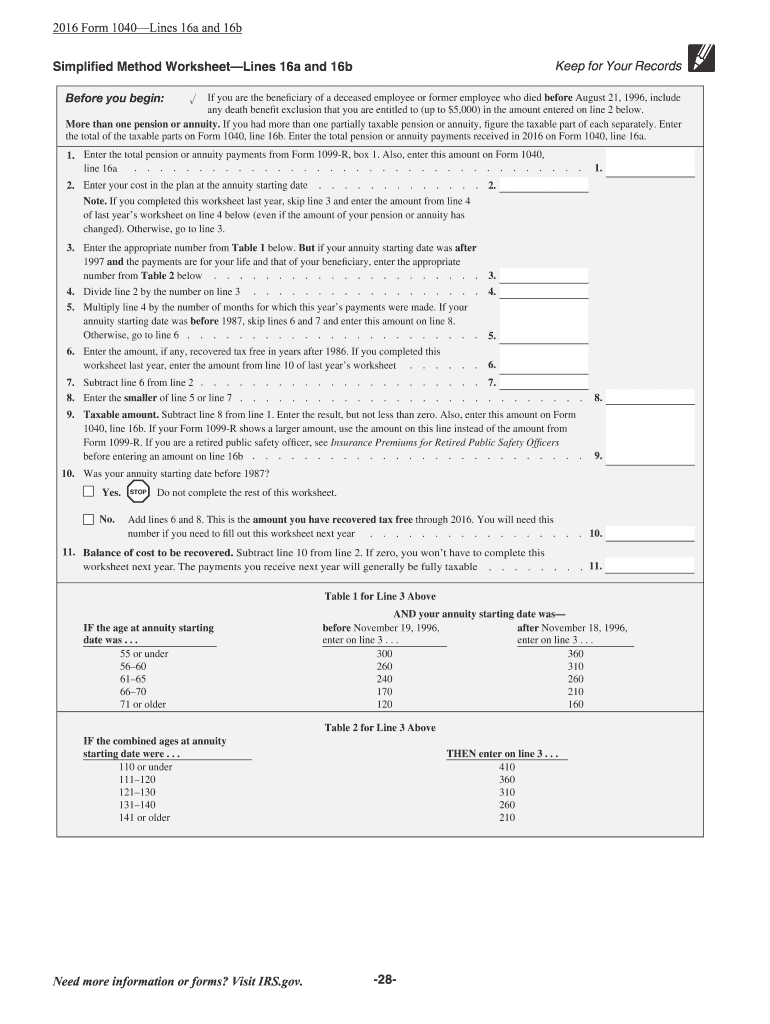

Publication 575 (2021), Pension and Annuity Income John repaid $45,000 on November 10, 2020. He makes no other repayments during the allowable 3-year period. John reported $0 in income on his 2020 return and carried the $15,000 excess repayment ($45,000 - $30,000) to 2021 and reduces the amount he reports to $15,000. John will report $30,000 on his 2022 tax return. Course Help Online - Have your academic paper written by a … Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment.

Publication 939 (12/2018), General Rule for Pensions and Annuities Worksheet I For Determining Taxable Annuity Under Regulations Section 1.72-6(d)(6) Election for Single Annuitant With No Survivor Annuity ... Guidance on submitting a ruling request for help with determining an issue with your pension or annuity, other than the exclusion ratio, is provided in Revenue Procedure 2018‐1, section 5.15(.01) and ...

Colorado pension and annuity exclusion worksheet

Pension Tax By State - Retired Public Employees Association 2/24/2022 · Exclusion reduced to $31,110 for pension and annuity. Tax info: 502-564-4581 or revenue.ky.gov: Louisiana: Yes: Yes: Yes: No: Over 65 retirement income exclusion up to $6,000 (single). Visit revenue.louisiana.gov: Maine: Yes: Yes: Yes: No: Deduct up to $10,000 of pension and annuity income; reduced by social security received. Tax info: 207-626 ... pension worksheet template excel - Microsoft 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet dotpound.blogspot.com. annuity exclusion mediation. Financial Planning Template: Sample Financial Plan freefincal.com. financial template plan excel planning sample integrated own planner personal retirement business create finance insurance chart cash flow need which Pension Exclusion Calculator - cotaxaide.org Annuity/Pension Exclusion Calculator. Clear and reset calculator. ... no pension exclusion but, exclude 0 Public Safety Officer insurance #2: as pension income (Form 1040 line ... Enter Taxable Amount directly or use the worksheet: Form RRB-1099-R: 3 Total employee contributions : 0: 7 Total Gross Paid 0: 7a Taxable Amount: 0: Enter Taxable ...

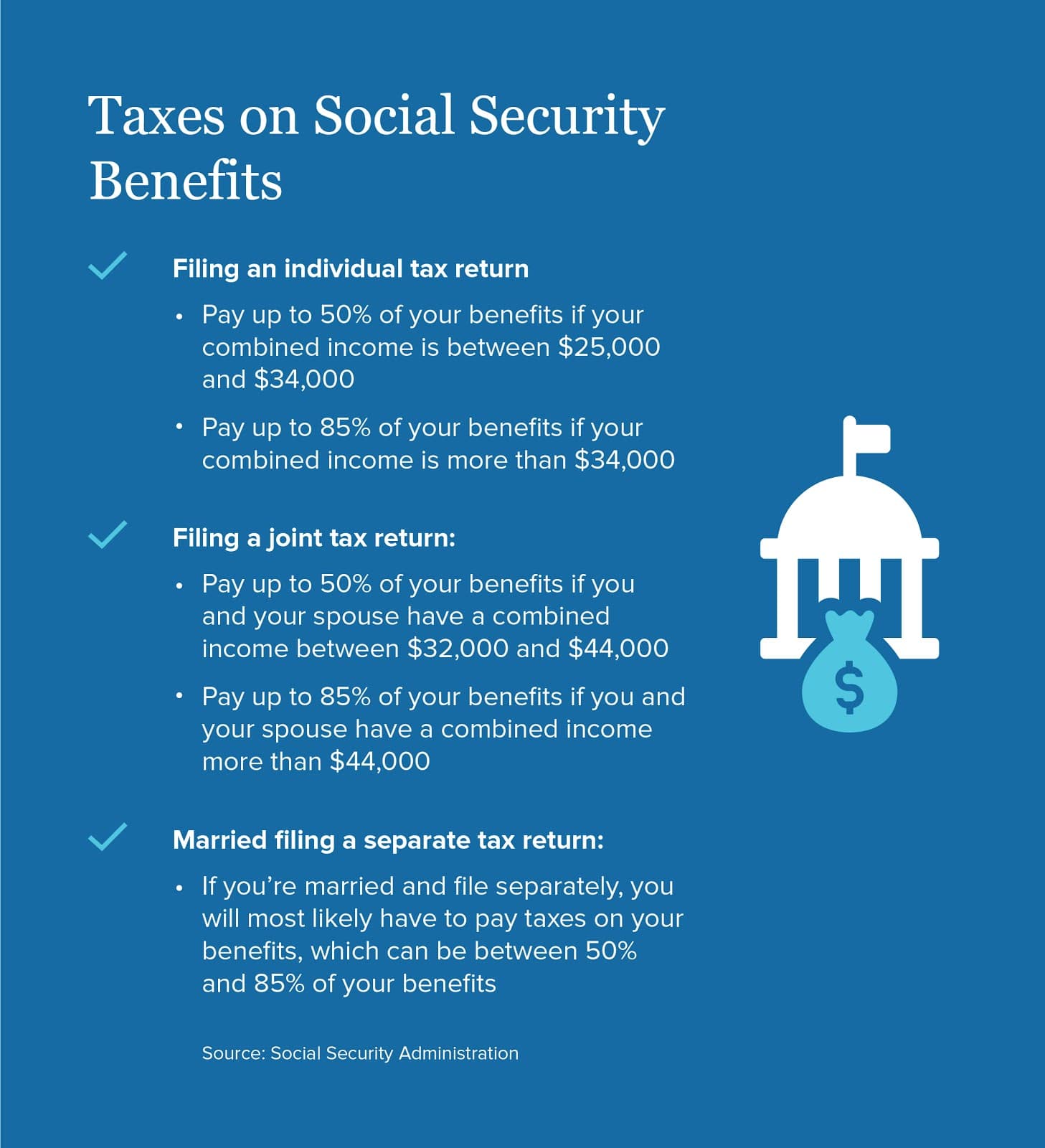

Colorado pension and annuity exclusion worksheet. Railroad Retirement Worksheet - Colorado Tax-Aide Resources The Pension Exclusion Worksheet referenced is printed with the CO return immediately following the CO 104. Other input comes from the taxpayer's documents or their entry in TaxSlayer. The taxable amount of Social Security benefits from Form 1040 is used to determine how much of the 1099-SSA and RRB 1099 Tier I amounts are taxable. Colorado's Pension and Annuity Subtraction - Jim Saulnier, CFP If you are 65 or older you can subtract up to $24,000 of income If you are between 55 and 65 you can subtract up to $20,000 If you are under 55 years old (utilizing the beneficiary exception) you can subtract up to $20,000 Considering the Centennial State has a flat income tax of 4.63% these subtractions often translate to substantial tax savings. View other states' tax treatment of out-of-state government pensions 5/18/2020 · Complete the Pension Exclusion Computation Worksheet shown in Instruction 13 in the Maryland resident tax booklet. Be sure to report all benefits received under the Social Security Act and/or Railroad Retirement Act on line 3 of the pension exclusion worksheet - not just those benefits you included in your federal adjusted gross income. AARP Tax-Aide Tool List This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same.

Achiever Papers - We help students improve their academic standing Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. pension worksheet template excel 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet. 9 Images about 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet : Perfect Storm Prompts Changes in Pension Accounting, FREE 12+ Expense Worksheet Samples & Templates in PSD | PDF and also Mechanical Engineering Spreadsheets Free Download pertaining to 5 Free. Colorado Pension and Annuity Exclusion pre-populates values that ... You are right that on the Colorado Pension Exclusion Worksheet it does show the $20,000 limit (but is that because I put the proper data in the guided interview?). There is just no excuse for displaying a number greater than legally allowed limit as eligible for exclusion. That money is not "eligible" even if it is in the qualifying category. Success Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply.

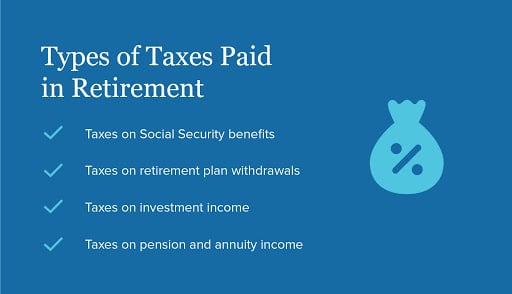

coursehelponline.comCourse Help Online - Have your academic paper written by a ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment. Individual Income Tax | Information for Retirees - Colorado Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension Subtraction Amounts successessays.comSuccess Essays - Assisting students with assignments online Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. PDF PENSION OR ANNUITY DEDUCTION - Colorado PENSION OR ANNUITY D EDUCTION. PENSION OR ANNUITY DEDUCTION . EVALUATION RESULTS. WHAT IS THE TAX EXPENDITURE? The Pension or Annuity Deduction [Section 3922-104(4)(f), C.R.S.] - allows individuals who are at least 55 years of age at the end of the taxable year to deduct "amounts received as pensions or annuities from

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Income 25: Pension and Annuity Subtraction - FreeTaxUSA Colorado pension and annuity subtraction. Page 2 of 4 (03/21) HOW TO CALCULATE THE PENSION AND ANNUITY SUBTRACTION The amount of the pension and annuity subtraction is equal to the amount of your qualifying income, except that the subtraction cannot exceed the maximum allowable amount based upon your age. The following table reflects the

New Jersey Form NJ-1040 Instructions - TaxFormFinder Download or print the 2021 New Jersey Individual Tax Instructions (Form NJ-1040 Instructions) for FREE from the New Jersey Division of Revenue.

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income 575 Pension and Annuity Income. 907 Tax Highlights for Persons With Disabilities. 915 Social Security and Equivalent Railroad Retirement Benefits. 970 Tax Benefits for Education. 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments

Pension & Profit Sharing Plans Forms for Colorado Colorado Pension & Profit Sharing Plans - get access to a huge library of legal forms. Professionally drafted and regularly updated online templates. Easily download and print documents with US Legal Forms.

Colorado pension and annuity - Intuit per the state of colorado, if you are younger than 55 years old and you received pension/annuity income as a secondary beneficiary (widow, dependent child, etc.) due to the death of the person who earned the pension/annuity, then you are entitled to subtract $20,000 or the total amount of your secondary beneficiary taxable pension/annuity income, …

Rule 39-22-104(4)(f) - PENSION AND ANNUITY SUBTRACTION, Colo ... - Casetext (c) Pension and annuity benefits, including any lump-sum distributions from sources in paragraph (1) (a) (i) - (iii), paid to an individual who is less than 55 years of age at the close of the tax year if such benefits were received because of the death of the person who was originally entitled to receive such benefits.

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

rpea.org › pension-tax-by-statePension Tax By State - Retired Public Employees Association Feb 24, 2022 · Exclusion reduced to $31,110 for pension and annuity. Tax info: 502-564-4581 or revenue.ky.gov: Louisiana: Yes: Yes: Yes: No: Over 65 retirement income exclusion up to $6,000 (single). Visit revenue.louisiana.gov: Maine: Yes: Yes: Yes: No: Deduct up to $10,000 of pension and annuity income; reduced by social security received. Tax info: 207-626 ...

Legal Forms for Colorado Annuity underwriting | US Legal Forms Colorado Annuity underwriting - get access to a huge library of legal forms. Professionally drafted and regularly updated online templates. Easily download and print documents with US Legal Forms.

eCFR :: 7 CFR Part 273 -- Certification of Eligible Households The Code of Federal Regulations (CFR) is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. The Electronic Code of Federal Regulations (eCFR) is a continuously updated online version of the CFR. It is not an official …

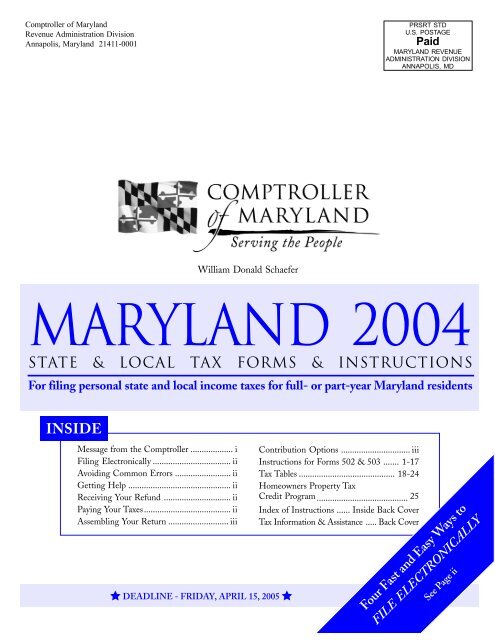

› service-details › view-other-statesView other states' tax treatment of out-of-state government ... May 18, 2020 · Complete the Pension Exclusion Computation Worksheet shown in Instruction 13 in the Maryland resident tax booklet. Be sure to report all benefits received under the Social Security Act and/or Railroad Retirement Act on line 3 of the pension exclusion worksheet - not just those benefits you included in your federal adjusted gross income.

PDF Income 25: Pension and Annuity Subtraction - Colorado If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104). You must be at least 55 years of age unless you receive pension and annuity income as a death benefit. You can claim the subtraction only for pension and annuity income that is included in ...

Publication 525 (2021), Taxable and Nontaxable Income Exclusion of income for volunteer firefighters and emergency medical responders. ... Worksheet 1. Figuring the Cost of Group-Term Life Insurance To Include in Income—Illustrated ... A pension or retirement pay for a member of the clergy is usually treated as any other pension or annuity. It must be reported on lines 5a and 5b of Form 1040 or ...

› newjersey › individual-taxNew Jersey Form NJ-1040 Instructions - TaxFormFinder Download or print the 2021 New Jersey Individual Tax Instructions (Form NJ-1040 Instructions) for FREE from the New Jersey Division of Revenue.

Pension Exclusion Calculator - cotaxaide.org Annuity/Pension Exclusion Calculator. Clear and reset calculator. ... no pension exclusion but, exclude 0 Public Safety Officer insurance #2: as pension income (Form 1040 line ... Enter Taxable Amount directly or use the worksheet: Form RRB-1099-R: 3 Total employee contributions : 0: 7 Total Gross Paid 0: 7a Taxable Amount: 0: Enter Taxable ...

pension worksheet template excel - Microsoft 31 Colorado Pension And Annuity Exclusion Worksheet - Free Worksheet dotpound.blogspot.com. annuity exclusion mediation. Financial Planning Template: Sample Financial Plan freefincal.com. financial template plan excel planning sample integrated own planner personal retirement business create finance insurance chart cash flow need which

Pension Tax By State - Retired Public Employees Association 2/24/2022 · Exclusion reduced to $31,110 for pension and annuity. Tax info: 502-564-4581 or revenue.ky.gov: Louisiana: Yes: Yes: Yes: No: Over 65 retirement income exclusion up to $6,000 (single). Visit revenue.louisiana.gov: Maine: Yes: Yes: Yes: No: Deduct up to $10,000 of pension and annuity income; reduced by social security received. Tax info: 207-626 ...

![[ Offshore Tax ] Today's Thought - What Is Foreign Earned Income Exclusion?](https://i.ytimg.com/vi/gtRwnEyLUrg/maxresdefault.jpg)

0 Response to "42 colorado pension and annuity exclusion worksheet"

Post a Comment