39 self employed expenses worksheet

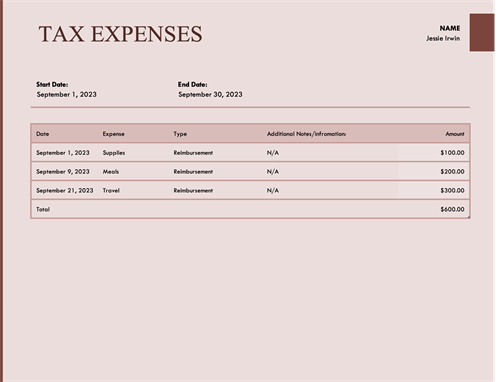

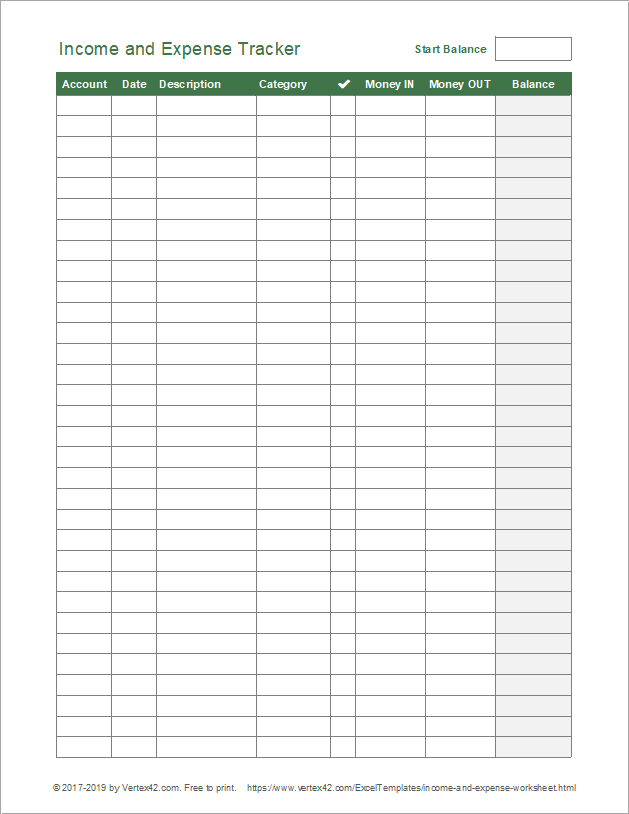

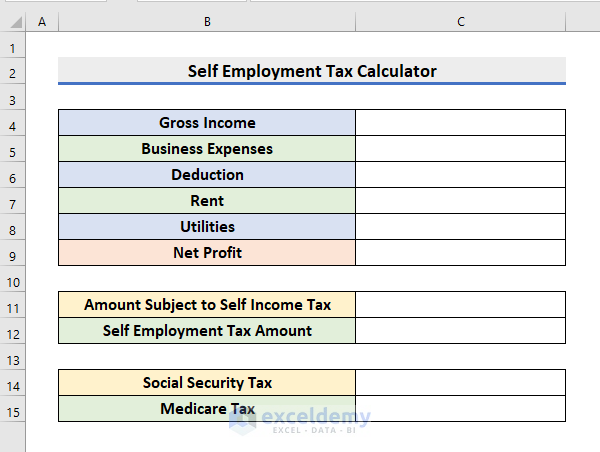

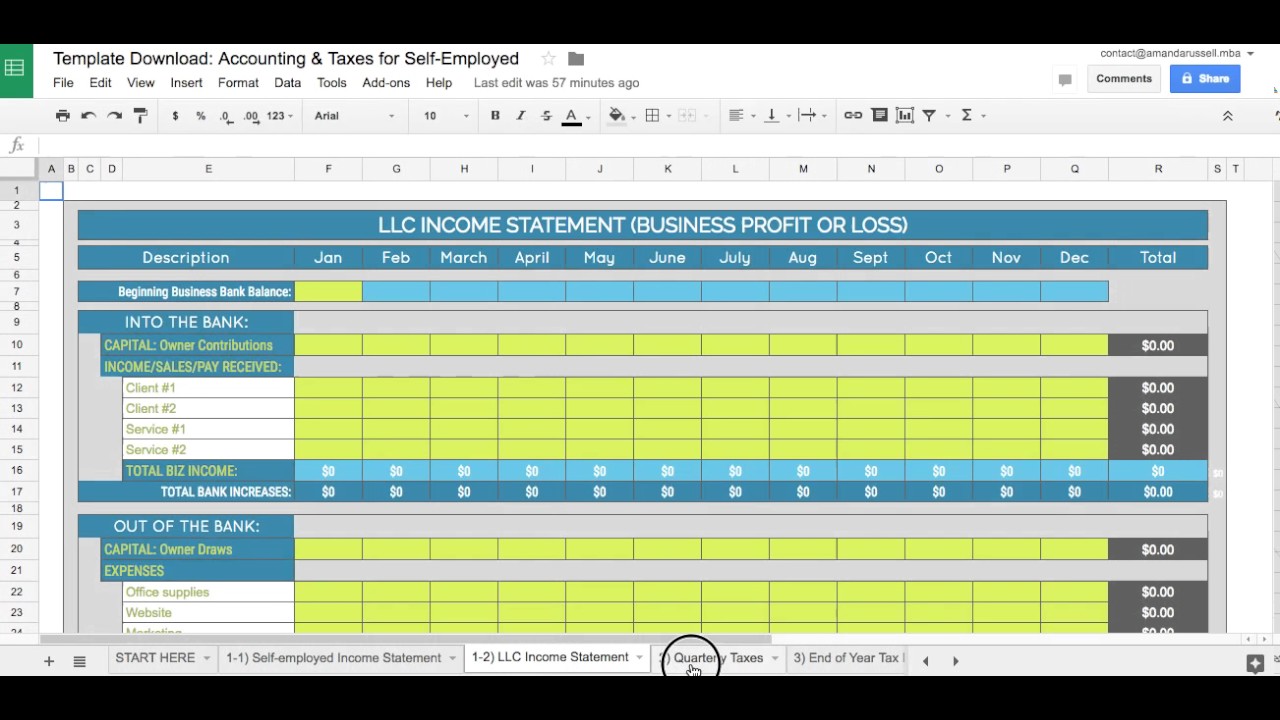

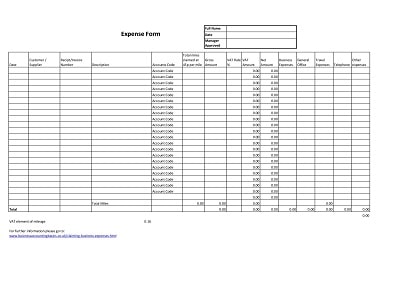

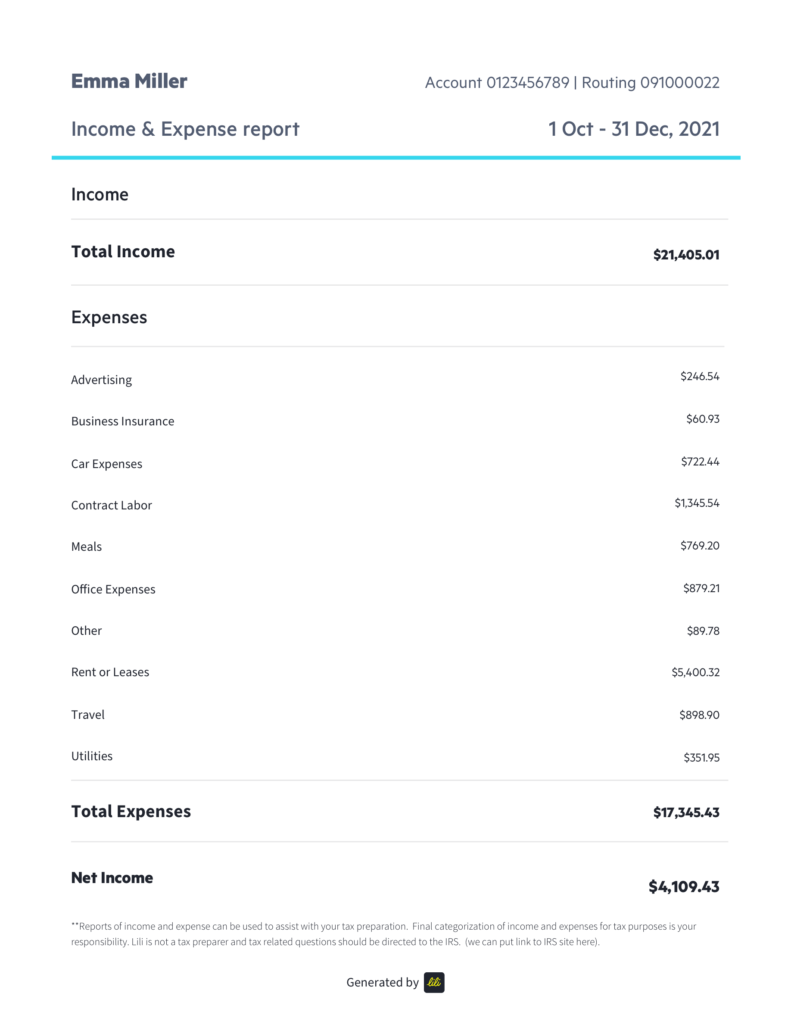

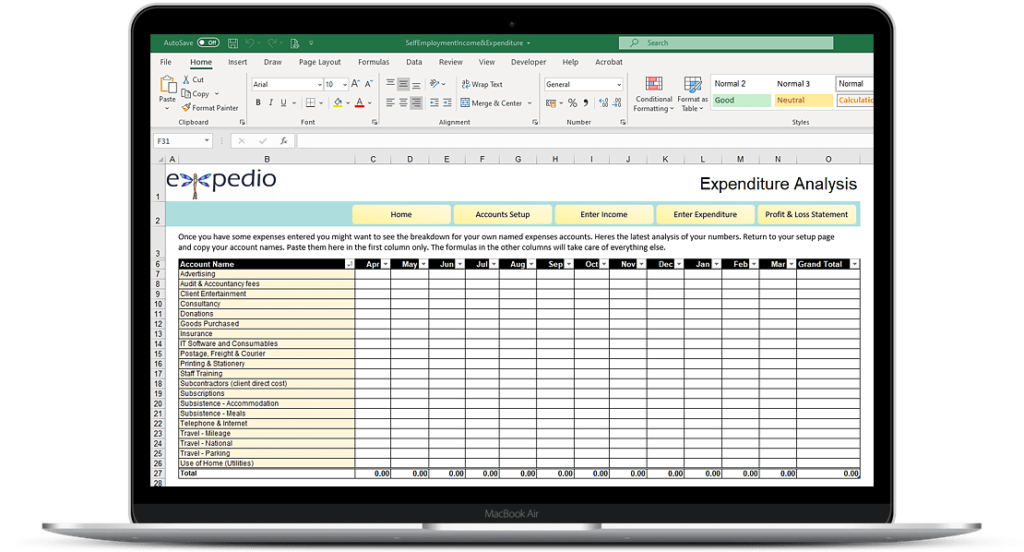

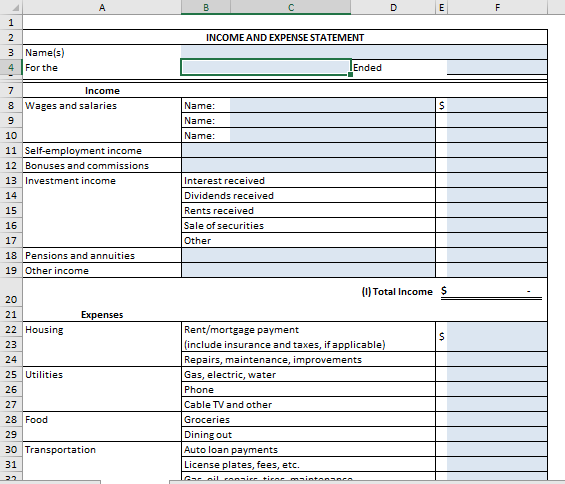

Free expenses spreadsheet for self-employed - hellobonsai.com Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work. Free Expense Tracking Worksheet Templates (Excel) | SoftwareKeep Expense Tracking Sheet This template is perfect for both personal use as well as small business use. It comes with two sheets. The first sheet is dedicated to tracking your expenses in various categories throughout weeks, months or years. The second sheet is a streamlined summary chart of your budget vs. the money you spent in this time period.

Expenses if you're self-employed: Overview - GOV.UK Overview If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses....

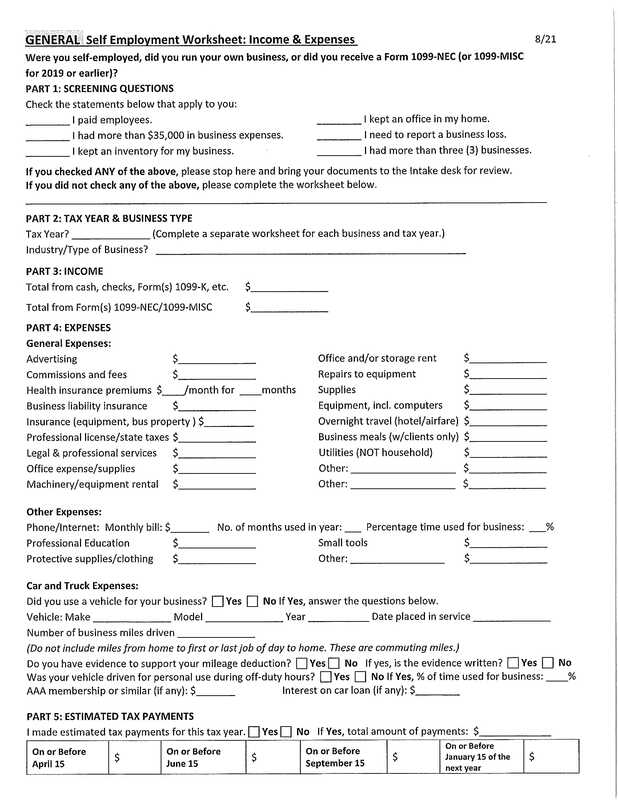

Self employed expenses worksheet

money.usnews.com › money › personal-financeHow to File Taxes When You Are Self-Employed Jan 10, 2022 · Given that a self-employed person's taxes will often be more complex than average, your cost will probably be higher. For instance, if you have an S Corp, you’ll pay an average of $903. Collect ... PDF Self Employment Monthly Sales and Expense Worksheet - Washington If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page. (Sign the back page.) › self-employed-individuals-tax-centerSelf-Employed Individuals Tax Center | Internal Revenue Service What are My Self-Employed Tax Obligations? As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly. Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

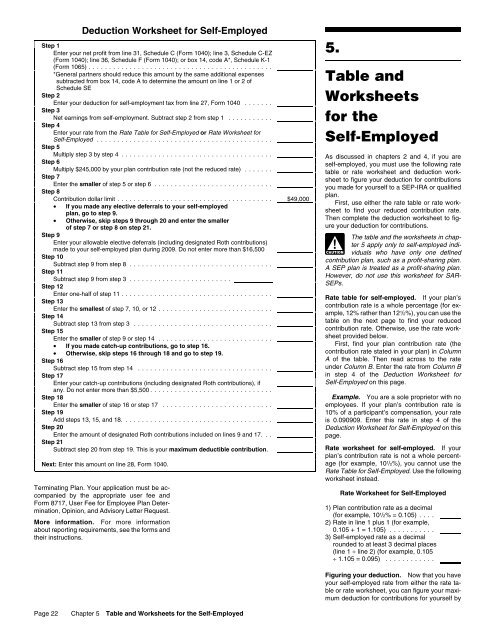

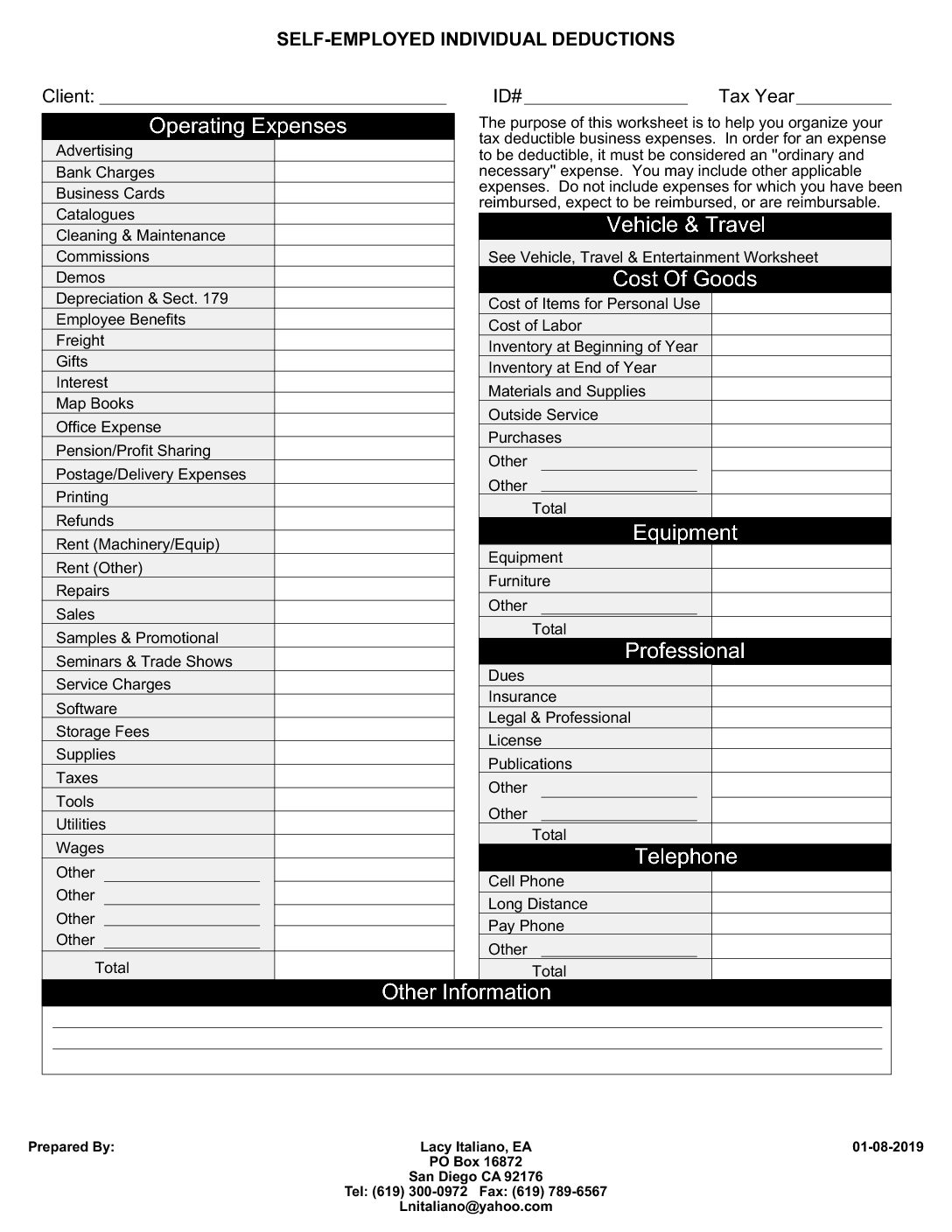

Self employed expenses worksheet. Publication 535 (2021), Business Expenses | Internal Revenue … WebIf you are self-employed, you can also deduct the business part of interest on your car loan, state and local personal property tax on the car, parking fees, and tolls, whether or not you claim the standard mileage rate. For more information on car expenses and the rules for using the standard mileage rate, see Pub. 463. Self-employed health insurance deduction | healthinsurance.org Web25.03.2022 · The deduction – which you’ll find on Line 17 of Schedule 1 (attached to your Form 1040) – allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. You’ll find the deduction on your personal income tax form, and you can file for it if you were self-employed and … Self Employed Expenses Form - Employment Form Self Employed Expenses Form - An employment form is a business document that an employer uses to assess job candidates. It is composed of questions that are considered crucial by the employer to decide who is the most suitable fit for a specific position. Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

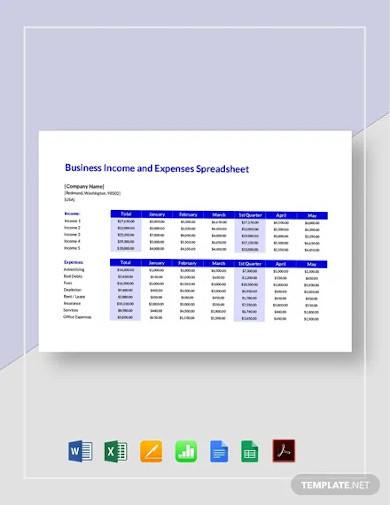

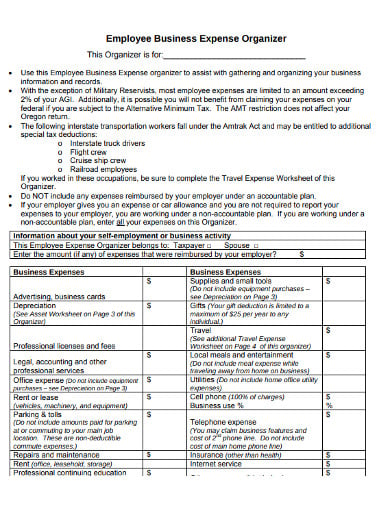

Small Business, Self-Employed, Other Business - IRS tax forms Web07.09.2022 · Generally, if you're an independent contractor you're considered self-employed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship). Most self-employed individuals will need to pay self-employment tax (comprised of social security and … 12+ Business Expenses Worksheet Templates in PDF | DOC 5 Steps to Create a Business Expense Worksheet Step 1: Creating New Workbook You must be creating the new workbook for the business expense worksheet and the spreadshee t. Step 2: Add the Income and Expenses Then add the income and the expenses in the workbook of the business expense worksheet Step 3: Add Formulas Self-Employed Individuals Tax Center | Internal Revenue Service WebIf this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to … PDF Self-Employed Tax Organizer Self-Employed Tax Organizer The Self‐Employed Tax Organizer should be completed by all sole proprietors or single member LLC owners. It has been designed to help collect and organize the information that we will need to prepare the ... Insurance (other than health) Travel (Complete Travel Expense Internet service Worksheet on page 4)

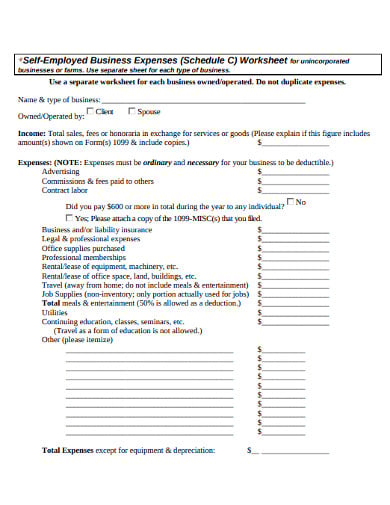

› publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax Self-employment tax. Enter the amount from Worksheet 2-3, line 10. (If you expect to file jointly and both of you are self-employed, figure the self-employment tax for each of you separately and enter the total on line 9.) 9. 10. Enter the total of any other expected taxes * 10. 11. Projected tax for 2022. Add lines 8 through 10. PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ... Fill - Free fillable Tax Worksheet for Self-employed, Independent ... The Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, form is 2 pages long and contains: 0 ... If you also get a W2 for th is same line of work you must split expenses between this form and an Unreimbursed . Employee Expense form. Gig Economy Tax Center | Internal Revenue Service - IRS tax forms Web04.10.2022 · Small Business and Self-Employed; Gig Economy Tax Center Gig Economy Tax Center. English ... Find forms, keep records, deduct expenses, file and pay taxes for your gig work. Manage Taxes for Your Gig Work. Digital Platforms and Businesses. Classify workers, report payments, pay and file taxes for a digital marketplace or …

Self Employed Tax Deductions Worksheet Form - Fill Out and Sign ... The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill camp; Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details.

50+ SAMPLE Expense Worksheets in PDF | MS Word Self-Employment Expense Worksheet download now Auto Expense Worksheet download now Family Expense Worksheet download now Monthly Budget Expense Worksheet download now Food Expense Worksheet download now Educational Expense Worksheet download now Expense Budget Worksheet download now Student Expense Worksheet download now

› obamacare › self-employedSelf-employed health insurance deduction | healthinsurance.org Mar 25, 2022 · HSAs allow the self-employed to pay for medical expenses with pre-tax dollars. For eligible self-employed people, the ACA’s tax credits make individual health insurance significantly more affordable. The self-employed may also be able to deduct some of their medical expenses, including premiums.

Guide On Self-Employed Bookkeeping With FREE Excel Template You can claim business expenses on your tax return as a self-employed individual. It can help to keep your tax bill low, and it's essential to be aware of what you can claim. Some of the most common business expenses include: Business insurance Equipment and tools used in your work Vehicle expenses Travel expenses Office supplies and stationery

› instructions › i8839Instructions for Form 8839 (2021) | Internal Revenue Service The expenses of re-adoption are qualified adoption expenses in the year in which the expenses are paid, subject to the dollar limitation. Example. Brian and Susan paid qualified adoption expenses of $7,000 in 2018, $8,000 in 2019, and $9,000 in 2020 in connection with the adoption of an eligible foreign child from Country X. Country X is a non ...

What allowable expenses can self employed couriers and delivery drivers ... Class 2 NICs are £3.05 a week, while Class 4 NICs are 9% on profits between £9,569 and £50,270 and 2% on profits over £50,270 (2021/22 tax year for all figures quoted). Vehicle-related allowable expenses Vehicle-related allowable expenses you can claim as a self-employed courier or delivery driver can include: fuel vehicle repair and servicing

PDF Self-Employed/Business Monthly Worksheet - mirtocpa.com Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

16 Tax Deductions and Benefits for the Self-Employed Web15.11.2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

› publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... If you are self-employed, you can also deduct the business part of interest on your car loan, state and local personal property tax on the car, parking fees, and tolls, whether or not you claim the standard mileage rate. For more information on car expenses and the rules for using the standard mileage rate, see Pub. 463.

PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

Business expenses - Canada.ca When you claim the GST/HST you paid or owe on your business expenses as an input tax credit, reduce the amounts of the business expenses by the amount of the input tax credit. Do this when the GST/HST for which you are claiming the input tax credit was paid or became payable, whichever is earlier.. Similarly, subtract any other rebate, grant or assistance from the expense to which it applies.

PDF Self Employed Income/Expense Sheet SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other: Title: Self Employed Income & Expense Sheet.xlsx ...

Complete List of Self-Employed Expenses and Tax Deductions You can deduct the costs of your personal health insurance premiums as a self-employed person as long as you meet certain criteria: Your business is claiming a profit. If your business claims a loss for the tax year, you can't claim this deduction. You were not eligible to enroll in an employer's health plan. This also includes your spouse's plan.

Self-Employed 401k Plan from Fidelity - Fidelity Investments WebComplete a Self-Employed 401(k) Account Application for yourself and each participating owner (including the business owner's spouse, if applicable). Fidelity Investments PO Box 770001 Cincinnati, OH 45277-0003; Once you have established your Self-Employed 401(k) Plan and any new account(s), the next step is to contribute to your 401(k). 4 ...

PDF Schedule C Worksheet for Self Employed Businesses and/or Independent ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

Publication 502 (2021), Medical and Dental Expenses Web13.01.2022 · This publication also explains how to treat impairment-related work expenses, health insurance premiums if you are self-employed, and the health coverage tax credit that is available to certain individuals. Pub. 502 covers many common medical expenses but not every possible medical expense. If you can't find the expense you are looking for, refer to …

How to File Taxes When You Are Self-Employed - US News Web10.01.2022 · You may also need to pay a self-employment tax if you earned more than $400 working for yourself. The IRS says you have to file an income tax return if your net earnings from self-employment were ...

16 Tax Deductions and Benefits for the Self-Employed - Investopedia Each pays 7.65%. 9 People who are fully self-employed pay for both parts themselves. An additional 0.9% Medicare tax rate applies if income is above a certain threshold. 10 The threshold...

› instructions › i1040sc2021 Instructions for Schedule C (2021) | Internal Revenue ... Small Business and Self-Employed (SB/SE) Tax Center. Do you need help with a tax issue or preparing your return, or do you need a free publication or form? SB/SE serves taxpayers who file Form 1040, 1040-SR, Schedules C, E, F, or Form 2106, as well as small business taxpayers with assets under $10 million.

PDF Self-employed Income and Expense Worksheet self-employed income and expense worksheet taxpayer name ssn principal business or profession business name employer id number business address business entity (circle one) individual spouse joint business city, state, zip code income expenses $ gross receipts or sales $ advertising $ returns & allowances auto & travel $ $

Publications and Forms for the Self-Employed Publication 15-A, Employer's Supplemental Tax Guide PDF. Publication 225, Farmer's Tax Guide. Publication 334, Tax Guide for Small Business (For Individuals Who Use Schedule C) Publication 463, Travel, Gift, and Car Expenses. Publication 505, Tax Withholding and Estimated Tax. Publication 535, Business Expenses.

PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

Self Employment Worksheets - K12 Workbook Displaying all worksheets related to - Self Employment. Worksheets are Self employment work attachment v, Work for self employed, Self employment income work, Self employment monthly sales and expense work, Self employedbusiness monthly work, 2018 publication 517, Self employed tax work, Cash flow analysis form 1084.

Publication 587 (2021), Business Use of Your Home WebWhere you deduct these expenses on the form depends on whether you are a self-employed person or a partner. Self-Employed Persons If you use your home in your trade or business and file Schedule C (Form 1040), report the entire deduction for business use of your home on line 30 of Schedule C (Form 1040).

Self Employed Expense Sheet Template - Excel, Word, Apple Numbers ... This document allows the self employed worker to keep track of their expenses. This Self Employed Expense Sheet Template is compatible on all versions of MS Excel, MS Word, Mac Numbers, and Mac Pages. Free to download now, just edit the content and texts available before printing. Daily Expense Sheet Template Blank Expense Sheet Template

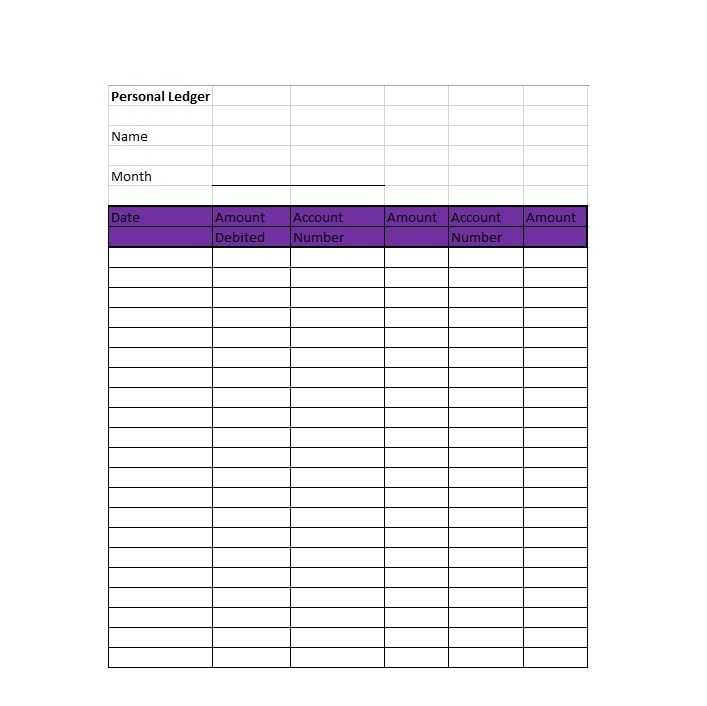

Self-Employment Ledger: 40 FREE Templates & Examples - TemplateArchive Examples of self-employed individuals are self-sufficient contractors, sole proprietors of businesses and those with partnerships in businesses. A person who is self-employed is entitled to pay self-employment taxes and must be in possession of a self-employment ledger. This is an error-free, detailed record showing self-employment cash returns ...

Tracking your self-employed income and expenses Download the appropriate "Self-employed income and expense worksheet" in PDF or Excel format. Add up your self-employed income and enter in the income section of the worksheet. Add up your expenses using the categories in the worksheet and enter the amounts in the appropriate section of the worksheet. Spreadsheet Software

› self-employed-individuals-tax-centerSelf-Employed Individuals Tax Center | Internal Revenue Service What are My Self-Employed Tax Obligations? As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly. Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

PDF Self Employment Monthly Sales and Expense Worksheet - Washington If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. (WAC 388-450-0085, 182-512-0840) For cash and food only: I choose to take the 50% standard deduction instead of listing my expenses on the next page. (Sign the back page.)

money.usnews.com › money › personal-financeHow to File Taxes When You Are Self-Employed Jan 10, 2022 · Given that a self-employed person's taxes will often be more complex than average, your cost will probably be higher. For instance, if you have an S Corp, you’ll pay an average of $903. Collect ...

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

0 Response to "39 self employed expenses worksheet"

Post a Comment