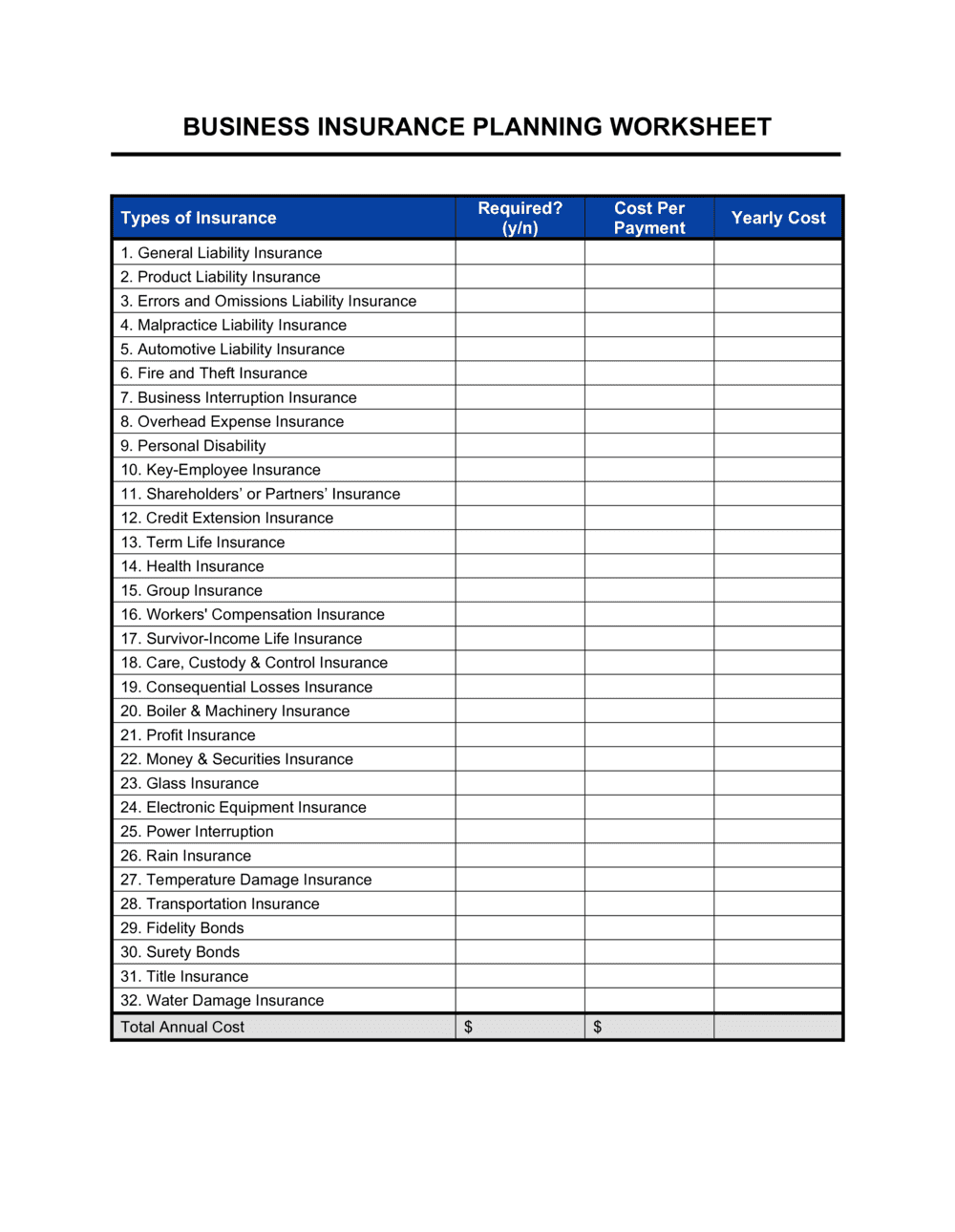

42 business income insurance worksheet

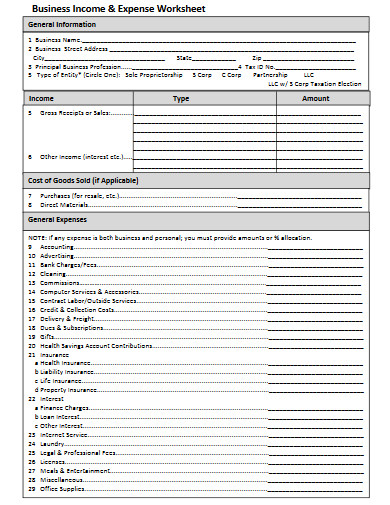

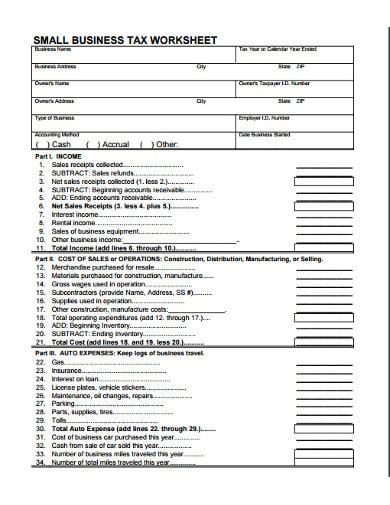

Publication 541 (03/2022), Partnerships | Internal Revenue Service WebIntroduction. This publication provides supplemental federal income tax information for partnerships and partners. It supplements the information provided in the Instructions for Form 1065, U. S. Return of Partnership Income; the Partner's Instructions for Schedule K-1 (Form 1065); and Instructions for Schedule K-2 and Schedule K-3 (Form 1065). Form 4506-T (Rev. 11-2021) - IRS tax forms Web(shows basic data such as return type, marital status, AGI, taxable income and all payment types), Record of Account Transcript (combines the tax return and tax account transcripts into one complete transcript), Wage and Income Transcript (shows data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498), and

How to Calculate Business Income for Insurance | The Hartford WebBusiness income insurance can help cover these payroll costs. Utilities. For example, say you need to pay for utilities for the next two months while your business is being repaired. However, you can’t open your operation until after the repairs are finished. Your business income insurance can step in and help pay for your utility bills. Lost ...

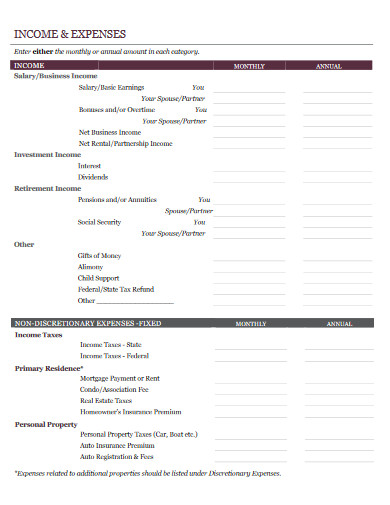

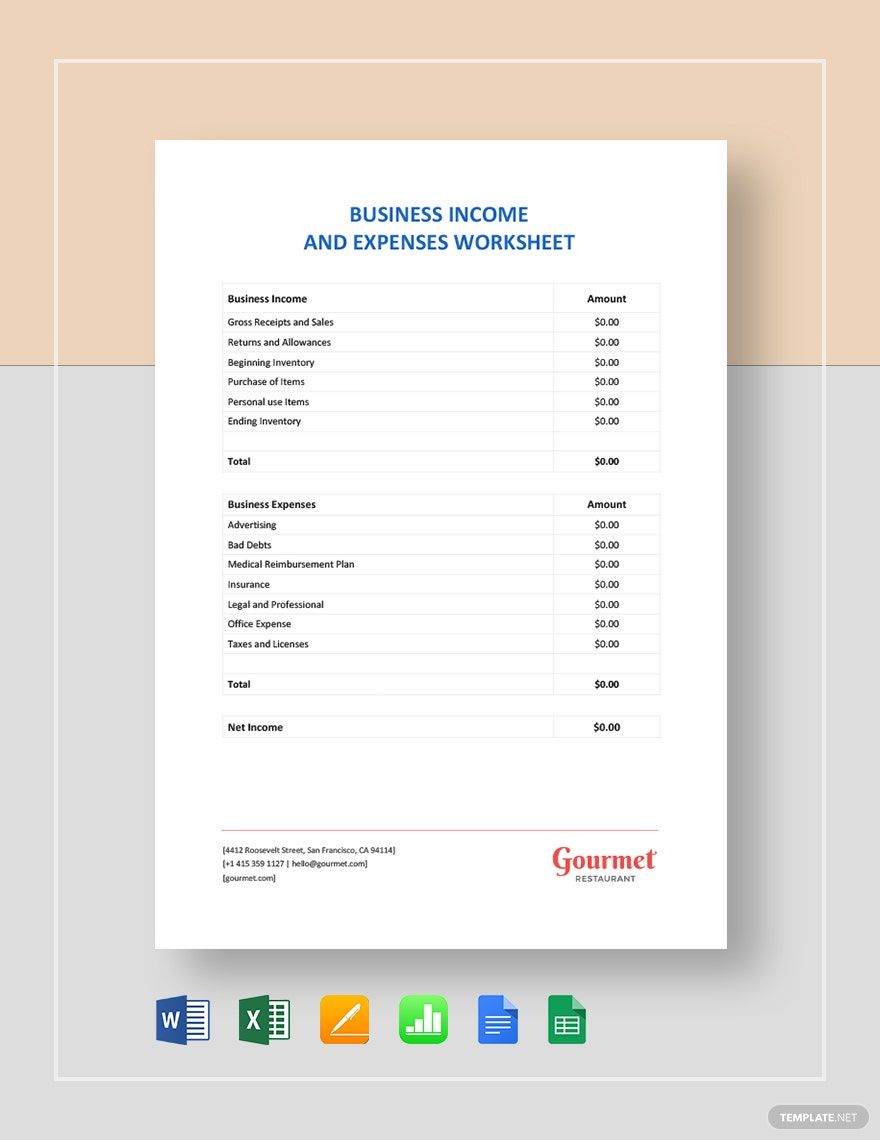

Business income insurance worksheet

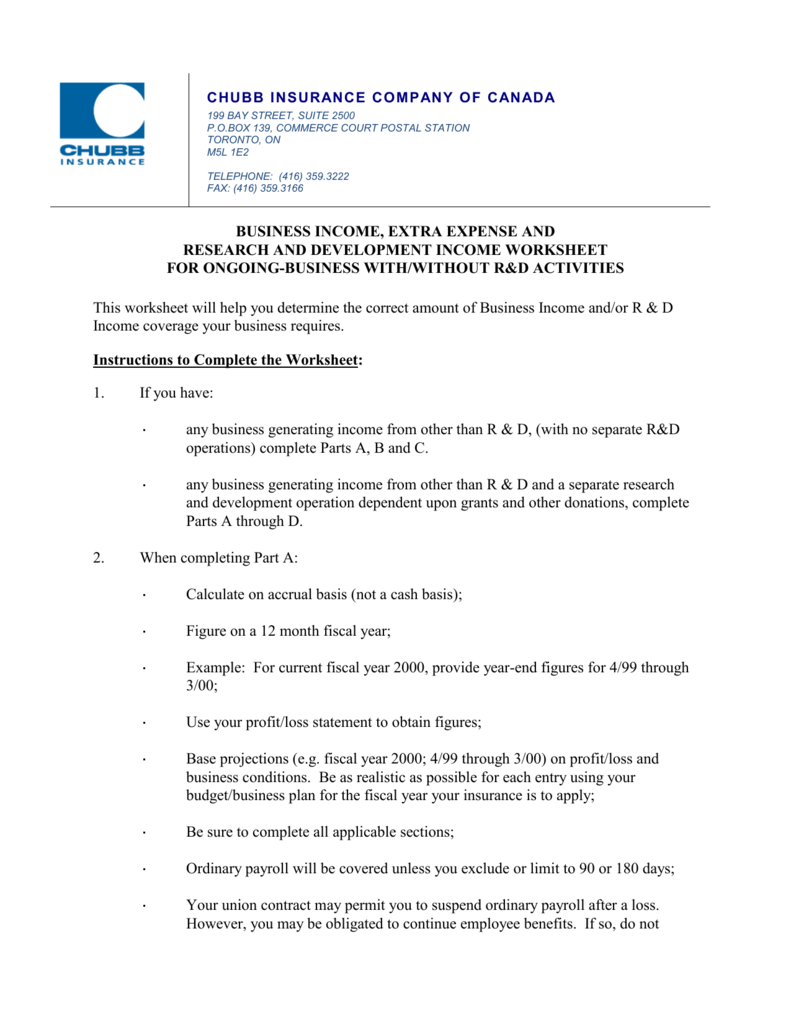

SAM.gov WebThe unique entity identifier used in SAM.gov has changed. On April 4, 2022, the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID (generated by SAM.gov).. The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAM.gov. My Business Income Consultation from Chubb WebIt is offered as a resource to help you establish adequate business income and extra expense values for insurance purposes. This guide is necessarily general in content and is intended as a tool that you can use together with others at your disposal to establish the values you wish to insure. Business Income and Extra Expense Insurance - Travelers WebEven though your business is closed, you may still have financial responsibilities, like payroll, rent, taxes and other bills. Business income and extra expense coverage helps replace your income and expenses while your business is recovering from a covered loss. Some business policies provide additional protection, like extended business ...

Business income insurance worksheet. Publication 590-A (2021), Contributions to Individual Retirement ... WebModified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). A Guide to the Qualified Business Income Deduction (2022) - The Motley Fool WebMay 18, 2022 · Here’s an example: Your taxable income is $150,000, of which $60,000 is QBI. You simply multiply QBI ($60,000) by 20% to figure your deduction ($12,000). Business Income Insurance Coverage: Calculating How Much ... - Travelers WebCompleting a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below: Qualified Business Income Deduction | Internal Revenue Service WebThe qualified business income (QBI) deduction allows you to deduct up to 20 percent of your QBI. Learn more. ... Generally this includes, but is not limited to, the deductible part of self-employment tax, self-employed health insurance, and deductions for contributions to qualified retirement plans (e.g. SEP, SIMPLE and qualified plan deductions).

Business Income and Extra Expense Insurance - Travelers WebEven though your business is closed, you may still have financial responsibilities, like payroll, rent, taxes and other bills. Business income and extra expense coverage helps replace your income and expenses while your business is recovering from a covered loss. Some business policies provide additional protection, like extended business ... My Business Income Consultation from Chubb WebIt is offered as a resource to help you establish adequate business income and extra expense values for insurance purposes. This guide is necessarily general in content and is intended as a tool that you can use together with others at your disposal to establish the values you wish to insure. SAM.gov WebThe unique entity identifier used in SAM.gov has changed. On April 4, 2022, the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID (generated by SAM.gov).. The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAM.gov.

![Business Interruption Insurance Calculation [2 Simple Methods]](https://cdn-acbap.nitrocdn.com/mEpDfFpjnUcMIdkMDwodGakMDqeWdPJo/assets/static/optimized/rev-d49f849/wp-content/uploads/2022/06/2020-05-05-12_44_29-BV-Schedules-Sanderford.xlsx.png)

0 Response to "42 business income insurance worksheet"

Post a Comment