45 1031 like kind exchange worksheet

Section 1031 Exchange Worksheet And Like Kind Exchange Formula We always attempt to show a picture with high resolution or with perfect images. Section 1031 Exchange Worksheet And Like Kind Exchange Formula can be valuable inspiration for people who seek an image according specific categories, you will find it in this website. Finally all pictures we've been displayed in this website will inspire you all. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

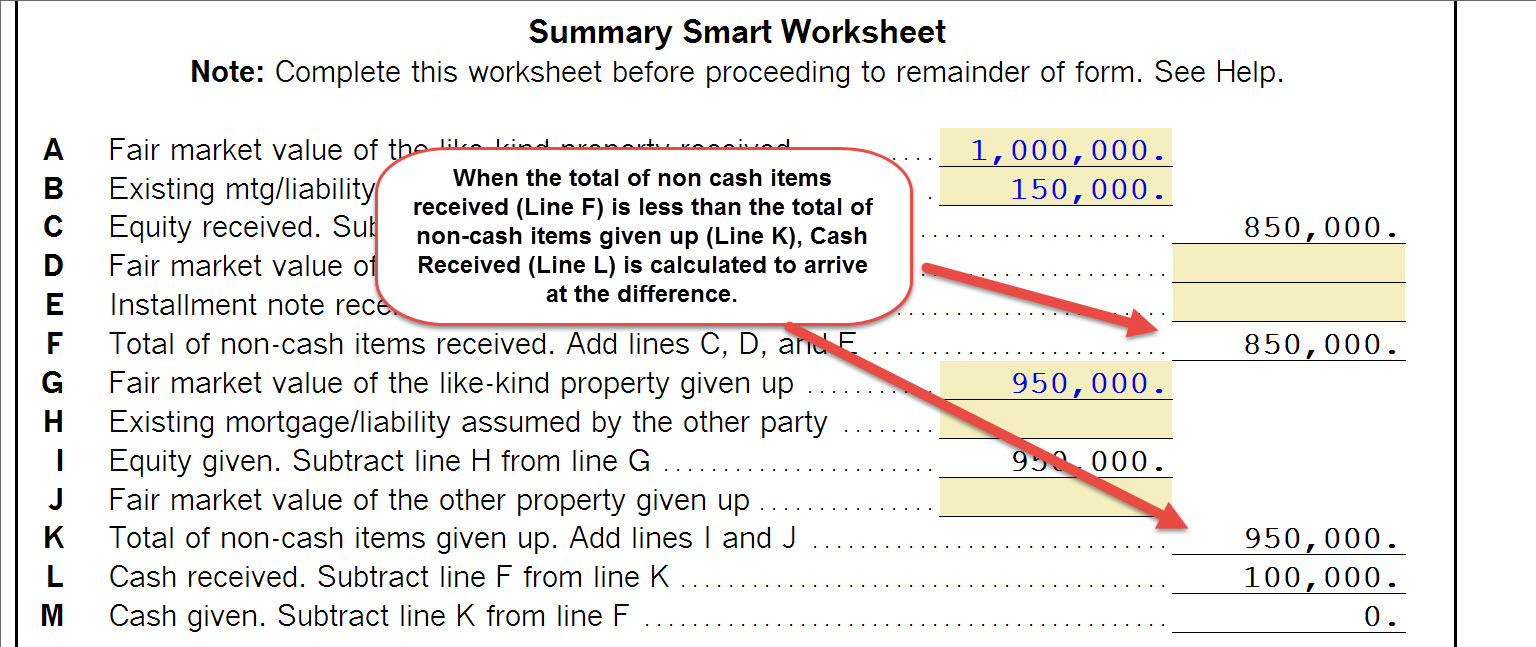

1031 Exchange Examples: Like-Kind Examples to Study & Learn From A cash boot is a financial gain resulting from a like-kind exchange. Cash boots, like all other boots resultant from like-kind exchanges, are taxable. The 1031 exchange real estate examples below are great for understanding a cash boot. Example 1. You own a $3,000,000 investment property with a tax basis of $2,600,000 — meaning that you have ...

1031 like kind exchange worksheet

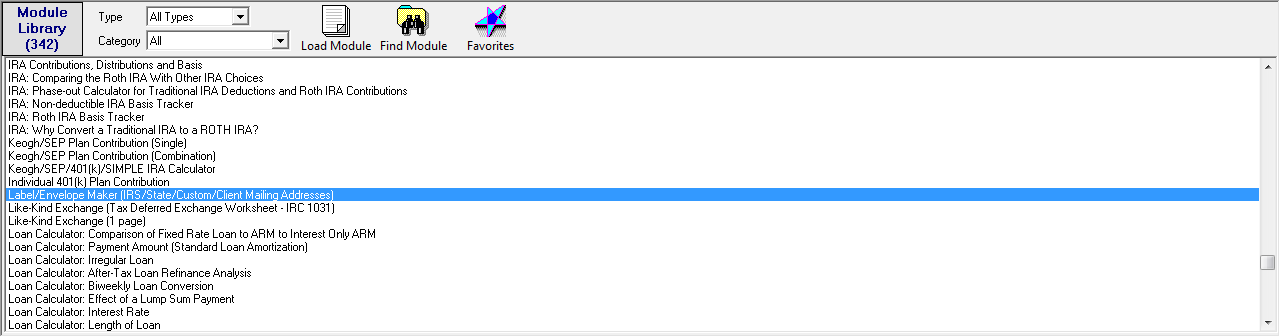

IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn Worksheet April 17, 2018 We tried to get some great references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource which we like it. We hope you can find what you need here. We constantly attempt to show a picture with high resolution or with perfect images. Knowledge Base Solution - How do I complete a like-kind exchange in a ... Go to Income/Deductions > Like-Kind Exchanges (Form 8824). Select section 1 - General. Line 3 - Property Code, select the type of property. Line4 - Classification Code, select theclassification code. Select section 3 - Basis and Value Information. Lines 1 through5input the applicable information for the sale. 2020 Corporation Tax Booklet 100 | FTB.ca.gov - California The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. California conforms to this change under the TCJA for exchanges initiated after January 10, 2019. ... complete the form FTB 3539 worksheet for its records. Do not mail the payment voucher ...

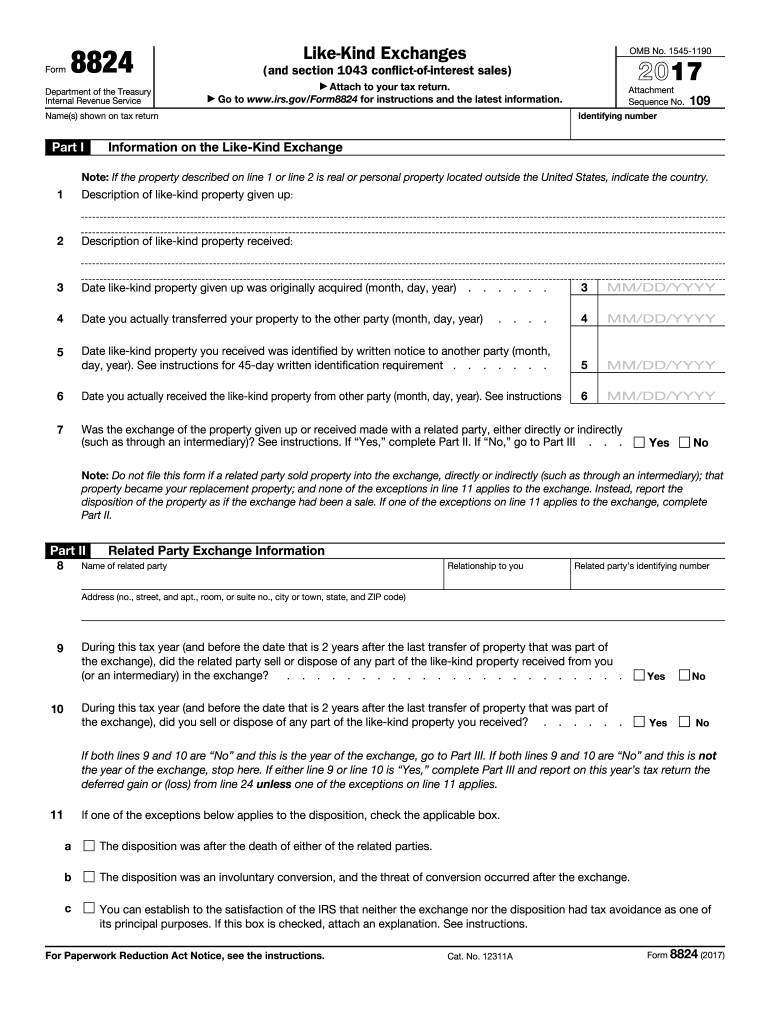

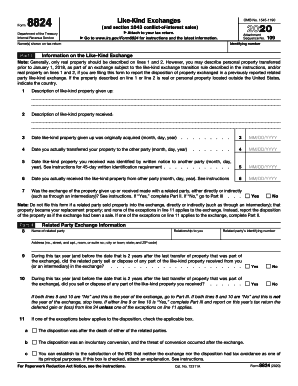

1031 like kind exchange worksheet. 1031 exchange worksheet Section 1031 Like Kind Exchange Rules | 1031 Exchange Rules 2021 1031-exchange-rules.com. Free Spreadsheet To Learn Why Your Clients Should Consider A Tax-Deferred Exchange activerain.com. 1031 exchange worksheet tax spreadsheet kind deferred consider clients should learn why comparison assumptions ones entries shaded simply shown yellow 1031 exchange worksheet excel Sec 1031 exchange worksheet. 1031 lantrip wrote intent. Section 1031 exchange form worksheet function - Using 3 conditions in Excel - Super User. 17 Pictures about worksheet function - Using 3 conditions in Excel - Super User : 1031 Exchange Experts | Section 1031 Like Kind Exchanges, Section 1031 Exchange Form | Universal Network and also Excel61. Net Gains (Losses) from the Sale, Exchange, or Disposition of … Pennsylvania tax law contains no such provision, the difference between the basis of the old property and the current market value of the property received in exchange is the taxable gain and must be reported. Definitions of like-kind properties can be found in IRC Section 1031. Involuntary Conversions Instructions for Form 8824 (2022) | Internal Revenue Service For 2018 and later years, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. ... and partly for business or investment, you will need to use two separate Forms 8824 as worksheets. Use one worksheet for the ...

1031 exchange worksheet Like kind exchange worksheet. 1031 exchange form 8824 worksheet sample irs analysis realdata cont. 1031 exchange 1033 calculate basis cost property following boot kind exercise answered hasn expert question ask yet been involuntary conversions. Random Posts. Unbanked American households hit record low numbers in 2021 Oct 25, 2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ... 1031 exchange worksheet Like Kind Exchange Worksheet. 18 Pictures about Like Kind Exchange Worksheet : 1031 Exchange Analysis Sample Worksheet for IRS Form 8824 (cont, 1031 Exchange Analysis - 1031 Exchange Software and also case 15 40289 rfn11 doc 2668 3 filed 07 08 16 entered 07 08 16 20 29 47. ... 1031 Like Kind Exchange Calculator - Excel Worksheet www ... Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator 1031 exchange worksheet 1031 worksheet. Section 1031 Exchange: The Ultimate Guide To Like-Kind Exchange fitsmallbusiness.com. exchange 1031 kind section steps ultimate guide. 29 Sec 1031 Exchange Worksheet - Notutahituq Worksheet Information notutahituq.blogspot.com. electricity 1031 ch3. 1031 Exchange Analysis Sample Worksheet For IRS Form 8824 (cont ... 1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements Instructions for Form 8824 (2022) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

sec 1031 exchange worksheet 1031 tax. 1031 Like Kind Exchange Worksheet - Ivuyteq ivuyteq.blogspot.com. exchange 1031 kind worksheet entering wizard using. The Weaver CPA Firm, Folsom, CA| Real Estate Tax And Consulting Page | X . estate tax flowchart professional consulting according law.

1031 Exchange Examples | 2022 Like Kind Exchange Example A 1031 Exchange Example What is a 1031 Exchange? eBook The Ron and Maggie Story Let's take an example couple, Ron and Maggie 1, who purchased a small apartment building in California 10 years ago for $1,500,000. They invested $500,000 of their own money and financed the rest with a $1,000,000 mortgage. Purchase Price Step 1 Determine Adjusted Basis

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We always effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be beneficial inspiration for people who seek an image according specific topic, you can find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and IRS ...

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 in Section 1.1031(j)-1 of the regulations. An exchange is only reported as a multi-asset exchange if the exchanger transferred AND received more than one group of like-kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset

About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

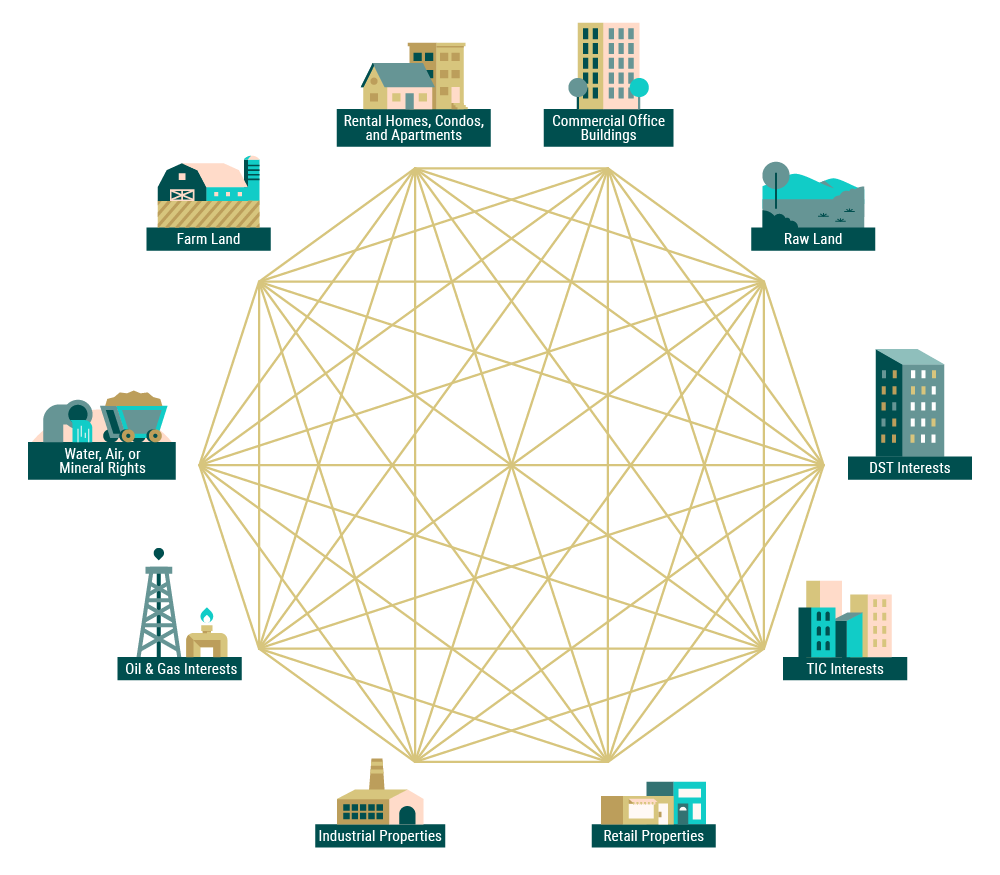

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or

️1031 Exchange Worksheet Excel Free Download| Qstion.co Section 1031 exchange worksheet and like kind exchange formula. The 1031 exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. Depreciation taken in prior years from worksheet #1 (line d)$ _____ b.

PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and …

Get 1031 Exchange Worksheet 2019 2020-2022 - US Legal Forms It takes only a couple of minutes. Follow these simple steps to get 1031 Exchange Worksheet 2019 prepared for sending: Select the form you want in our collection of legal templates. Open the template in the online editing tool. Read the guidelines to determine which details you have to provide. Select the fillable fields and put the required ...

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

Like Kind 1031 Exchange/Form 8824 - Intuit I've always found with 1031's I create my own worksheet for the gain deferral and basis of replacement real estate and then make sure the bottom line numbers match the IRS form. Most people do so few that they're rarely confident in the form preparation. ... I understand conceptually how a 1031 Like Kind Exchange works. My challenge is to know ...

1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

Replacement Property Basis Worksheet - efirstbank1031.com Replacement Property Basis Worksheet. ... Like-Kind Exchange Replacement Property Analysis of Tax Basis for Depreciation (pdf). Contact Us. Mail: Phone: Fax: Email: 1031 Corporation 1707 N Main St Longmont, CO 80501. 888-367-1031. 303-684-6899. 1031 Team. Resources. 1031 Exchange Manual; 1031 Exchange Manual; Escrow Services; What is a 1031 ...

like kind exchange worksheet 1031 Like Kind Exchange Worksheet - Promotiontablecovers promotiontablecovers.blogspot.com. 1031. 30 1031 Exchange Worksheet Excel - Worksheet Project List isme-special.blogspot.com. 1031. Like Kind Exchange Forms - Form : Resume Examples #wRYPKmb94a .

2020 Corporation Tax Booklet 100 | FTB.ca.gov - California The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. California conforms to this change under the TCJA for exchanges initiated after January 10, 2019. ... complete the form FTB 3539 worksheet for its records. Do not mail the payment voucher ...

Knowledge Base Solution - How do I complete a like-kind exchange in a ... Go to Income/Deductions > Like-Kind Exchanges (Form 8824). Select section 1 - General. Line 3 - Property Code, select the type of property. Line4 - Classification Code, select theclassification code. Select section 3 - Basis and Value Information. Lines 1 through5input the applicable information for the sale.

IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn Worksheet April 17, 2018 We tried to get some great references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource which we like it. We hope you can find what you need here. We constantly attempt to show a picture with high resolution or with perfect images.

0 Response to "45 1031 like kind exchange worksheet"

Post a Comment