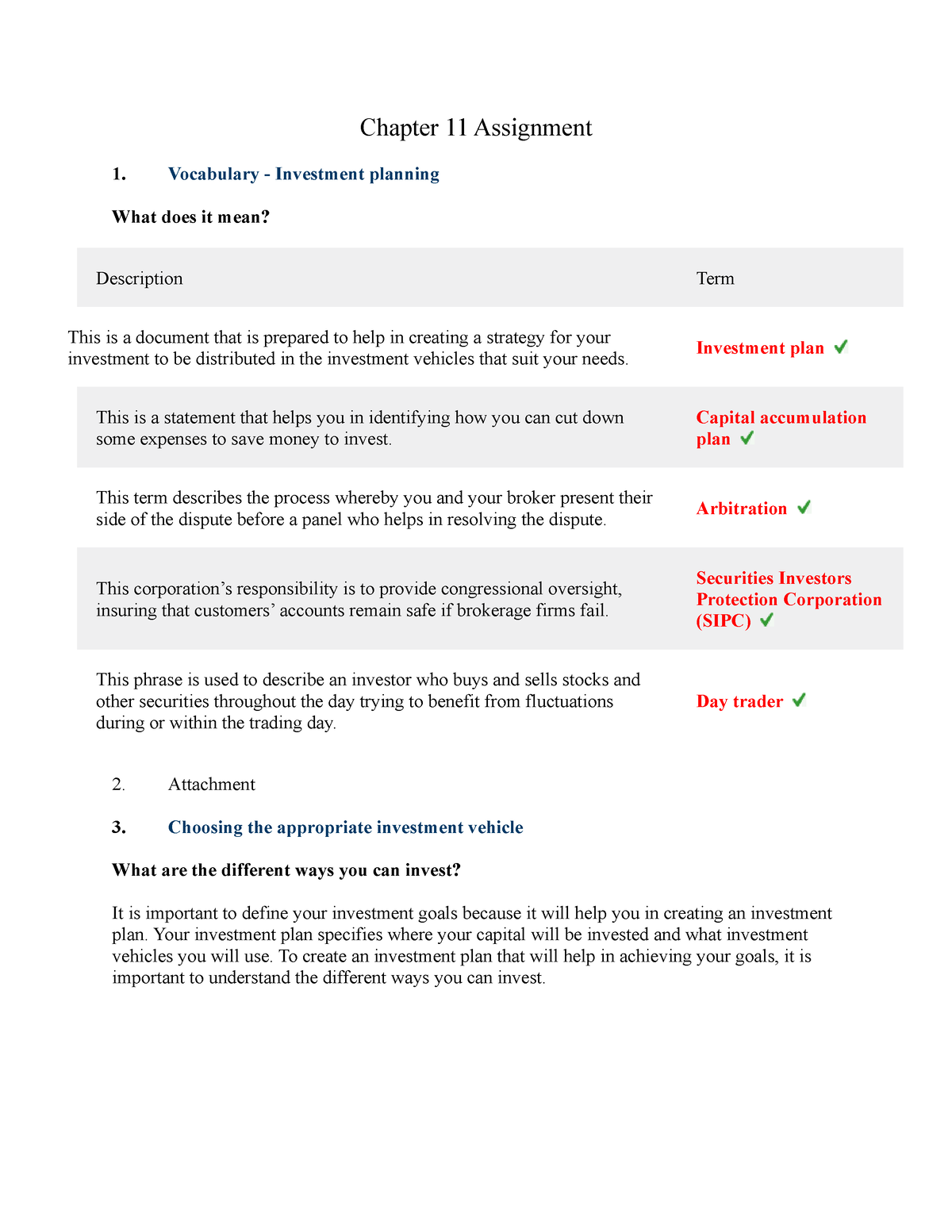

38 chapter 11 investing for your future worksheet answers

Publication 550 (2021), Investment Income and Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... This credit is figured like last year's economic impact payment, EIP 3, except eligibility and the amount of the credit are based on your tax year 2021 information. See the instructions for Form 1040, line 30, and the Recovery Rebate Credit Worksheet to figure your credit amount. Who must file.

› oohHome : Occupational Outlook Handbook: : U.S. Bureau of Labor ... Sep 08, 2022 · The Occupational Outlook Handbook is the government's premier source of career guidance featuring hundreds of occupations—such as carpenters, teachers, and veterinarians.

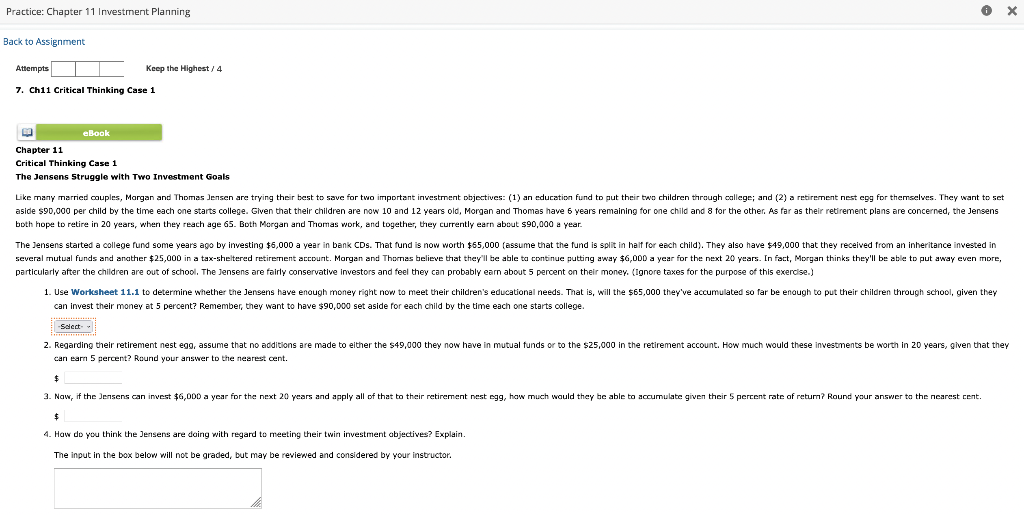

Chapter 11 investing for your future worksheet answers

Publication 541 (03/2022), Partnerships | Internal Revenue Service Similarly, on line 11 of Worksheet B, the owner taxpayer must report the total amount of unrecaptured section 1250 gain for the tax year that the owner taxpayer has with respect to any pass-through interests that it owns. It must also report the amount of unrecaptured section 1250 gain that is recharacterized as short-term capital gain under section 1061 and the amount of … Publication 17 (2021), Your Federal Income Tax - IRS tax forms Getting answers to your tax questions. ... See Form W-2 under Credit for Withholding and Estimated Tax for 2021 in chapter 4. Your employer is required to provide or send Form W-2 to you no later than January 31, 2022. If it is mailed, you should allow adequate time to receive it before contacting your employer. If you still don't get the form by early February, the IRS can … corner.bigblueinteractive.com › indexThe Corner Forum - New York Giants Fans Discussion Board ... Join the discussion about your favorite team! ... 11 pm : 1102: 24: JoeyBigBlue 12/5/2022 10:53 pm: NFT: Phillies sign Trea Turner 11 years 300 million:

Chapter 11 investing for your future worksheet answers. › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... Publication 590-B (2021), Distributions from Individual Retirement ... Getting answers to your tax questions. ... Use Worksheet 1-2 in chapter 1 of Pub. 590-A, or the IRA Deduction Worksheet in the Form 1040 or 1040-SR, or 1040-NR instructions to figure your deductible contributions to traditional IRAs to report on Schedule 1 (Form 1040), line 20. After you complete Worksheet 1-2 in chapter 1 of Pub. 590-A or the IRA Deduction Worksheet in the … U.S. Bureau of Labor Statistics The Bureau of Labor Statistics is the principal fact-finding agency for the Federal Government in the broad field of labor economics and statistics. › free-personality-testFree Personality Test | 16Personalities Free personality test - take it to find out why our readers say that this personality test is so accurate, “it's a little bit creepy.” No registration required!

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions. Home : Occupational Outlook Handbook: : U.S. Bureau of Labor … 08/09/2022 · The Occupational Outlook Handbook is the government's premier source of career guidance featuring hundreds of occupations—such as carpenters, teachers, and veterinarians. Revised annually, the latest version contains employment projections for … American Family News 06/12/2022 · For the latest in Christian news and opinion, download the AFN app to your mobile device. About Us. Whether it's a story about prayer in public schools, workplace restrictions on Christians, or battles for biblical truth within our denominations, the American Family News Network (AFN) is here to tell you what the newsmakers are saying. Learn More. Support Us. If … Free Personality Test | 16Personalities Deepen your relationships, both romantic and otherwise. Career. Kick-start your career or get better at navigating it. Teams; Resources. Articles. Get tips, advice, and deep insights into various topics. Surveys. Explore and participate in hundreds of our studies. Theory. Understand the meaning and impact of personality traits. Country Profiles. Examine our regional and country …

1040 (2021) | Internal Revenue Service - IRS tax forms See the instructions for line 30 and the Recovery Rebate Credit Worksheet to figure your credit amount. ... This prevents delays in processing your return and issuing refunds. It also safeguards your future social security benefits. Address Change. If you plan to move after filing your return, use Form 8822 to notify the IRS of your new address. P.O. Box. Enter your box number only if … The EU Mission for the Support of Palestinian Police and Rule of Law EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ... Excel 2013 Formulas - Page 323 - Google Books Result John Walkenbach · 2013 · ComputersThe example in this section computes the present value of a series of future receipts, sometimes called an annuity. A man gets lucky and wins the $1,000,000 ... performdigi.com › tenses-for-class-7-worksheetTenses for Class 7 Worksheet, Pdf, Exercises with Answers Tenses for Class 7 Worksheet Pdf. If you want to Download the pdf of tenses for class 7 Worksheet, then click on the given link it is free of cost. Tenses for class 7 worksheet pdf Tenses class 7 worksheet Pdf (663 downloads) Hope it is helpful for you, keep learning new things, clear concepts and always support us and suggest your ideas too.

corner.bigblueinteractive.com › indexThe Corner Forum - New York Giants Fans Discussion Board ... Join the discussion about your favorite team! ... 11 pm : 1102: 24: JoeyBigBlue 12/5/2022 10:53 pm: NFT: Phillies sign Trea Turner 11 years 300 million:

Publication 17 (2021), Your Federal Income Tax - IRS tax forms Getting answers to your tax questions. ... See Form W-2 under Credit for Withholding and Estimated Tax for 2021 in chapter 4. Your employer is required to provide or send Form W-2 to you no later than January 31, 2022. If it is mailed, you should allow adequate time to receive it before contacting your employer. If you still don't get the form by early February, the IRS can …

Publication 541 (03/2022), Partnerships | Internal Revenue Service Similarly, on line 11 of Worksheet B, the owner taxpayer must report the total amount of unrecaptured section 1250 gain for the tax year that the owner taxpayer has with respect to any pass-through interests that it owns. It must also report the amount of unrecaptured section 1250 gain that is recharacterized as short-term capital gain under section 1061 and the amount of …

:max_bytes(150000):strip_icc()/journal-4194014-01-FINAL-f49f4adcfab54f858309e375d03a8719.png)

0 Response to "38 chapter 11 investing for your future worksheet answers"

Post a Comment